How People Learn: How Experts Differ from Novices

Fascinating chapter in the book "How People Learn" about How Experts Differ from Novices; It has significant...

Interesting IBD lecture on why Buy & Hold can be so costly, and how to use charts to avoid disaster stocks: -You buy a stock. Soon,...

Interesting IBD lecture on why Buy & Hold can be so costly, and how to use charts to avoid disaster stocks: -You buy a stock. Soon,...

I am working on a column on Stock Tips, and in my research I came across this unbelievable chart. Its from Jason Goepfert of...

I am working on a column on Stock Tips, and in my research I came across this unbelievable chart. Its from Jason Goepfert of...

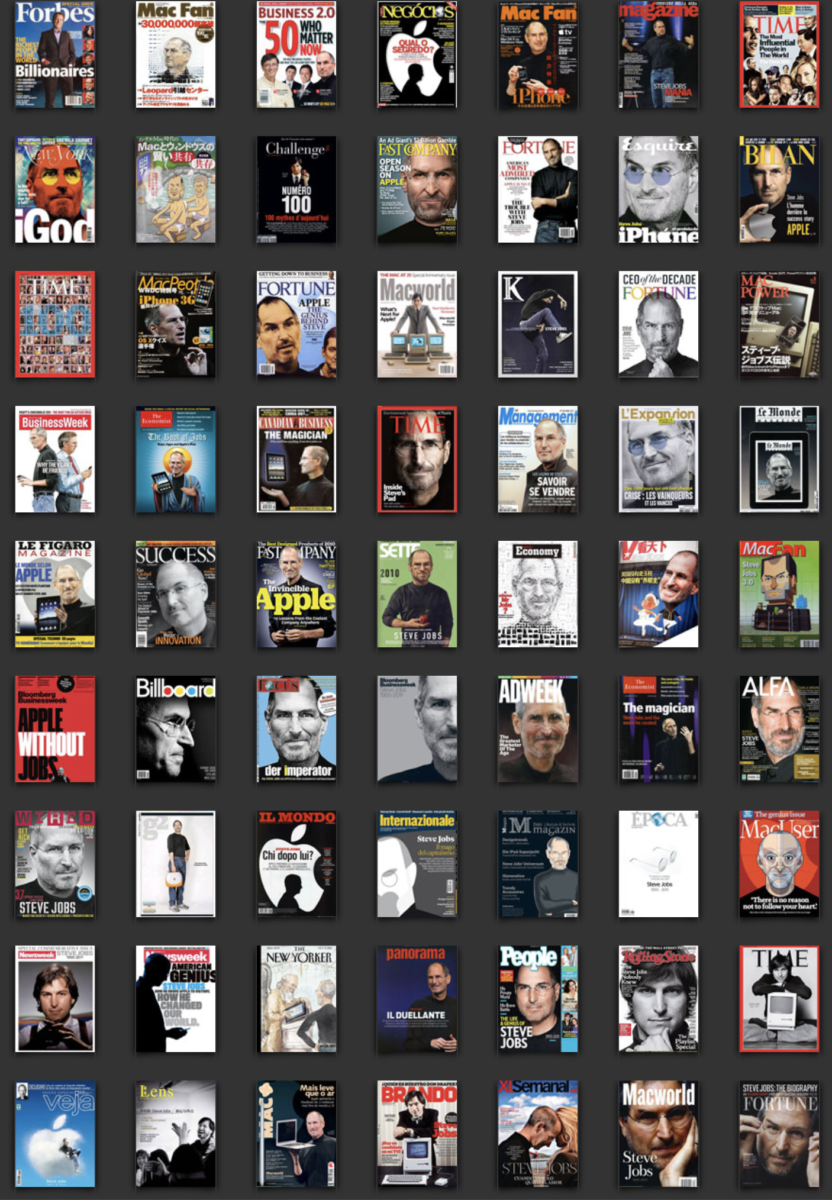

In the past, I have warned against relying on the magazine cover indicator for specific companies. There are some very specific caveats...

In the past, I have warned against relying on the magazine cover indicator for specific companies. There are some very specific caveats...

Get subscriber-only insights and news delivered by Barry every two weeks.