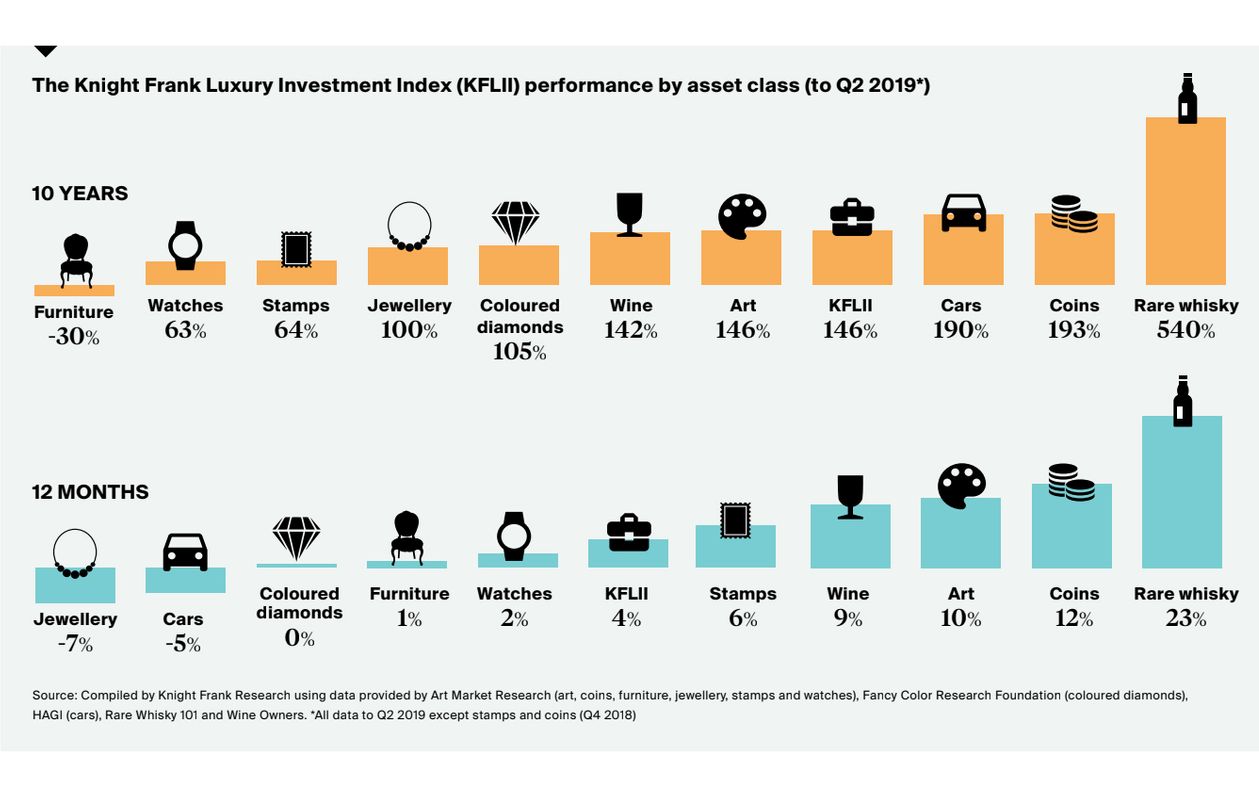

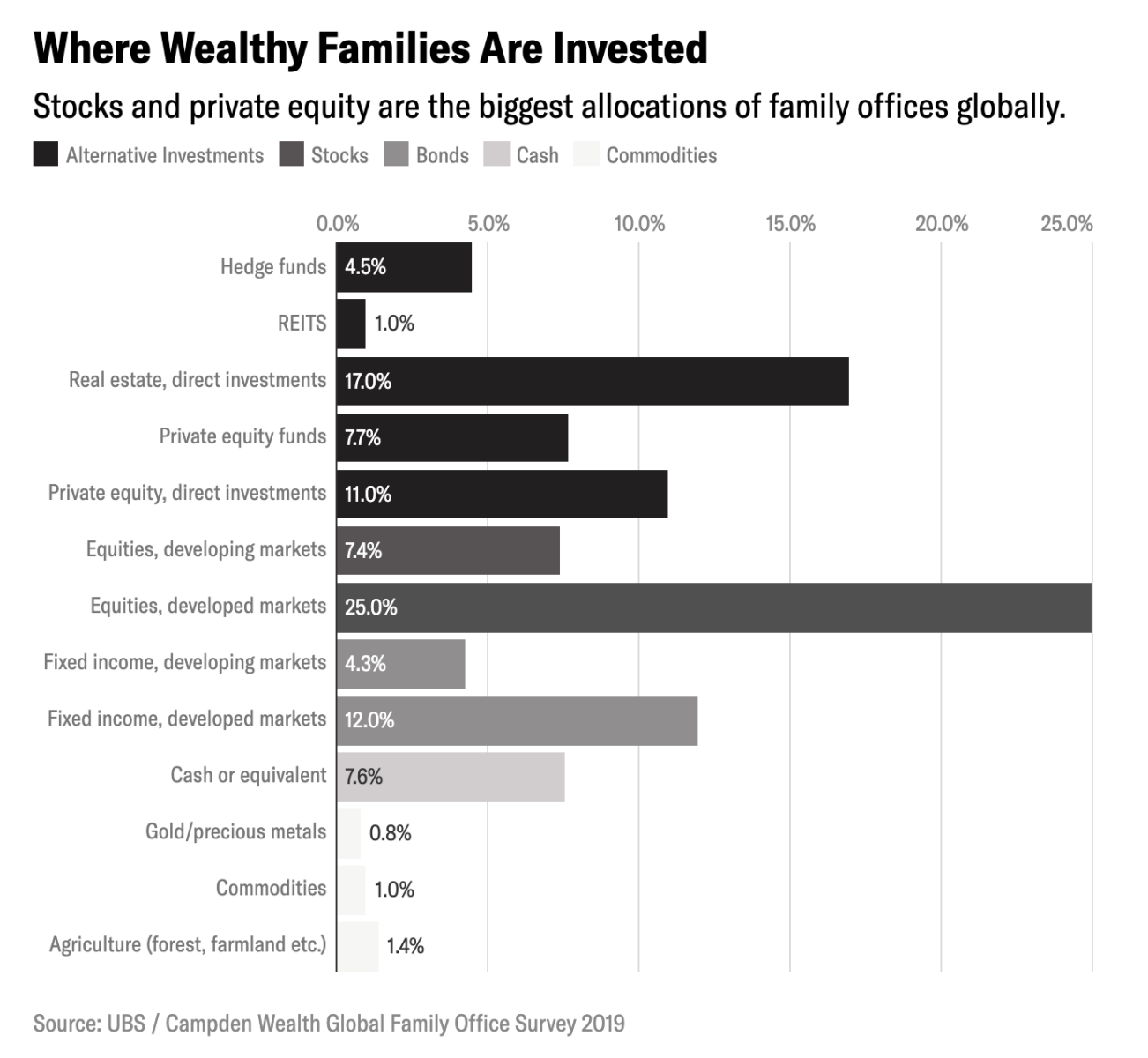

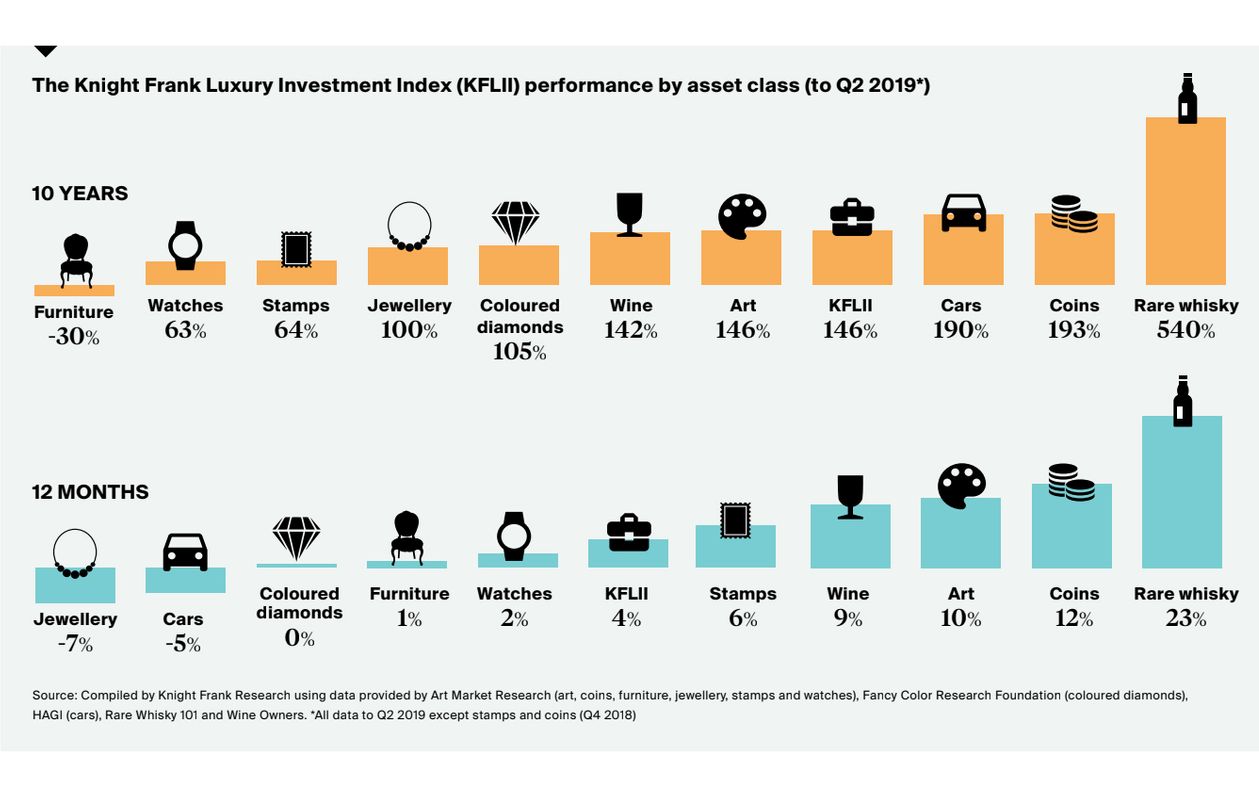

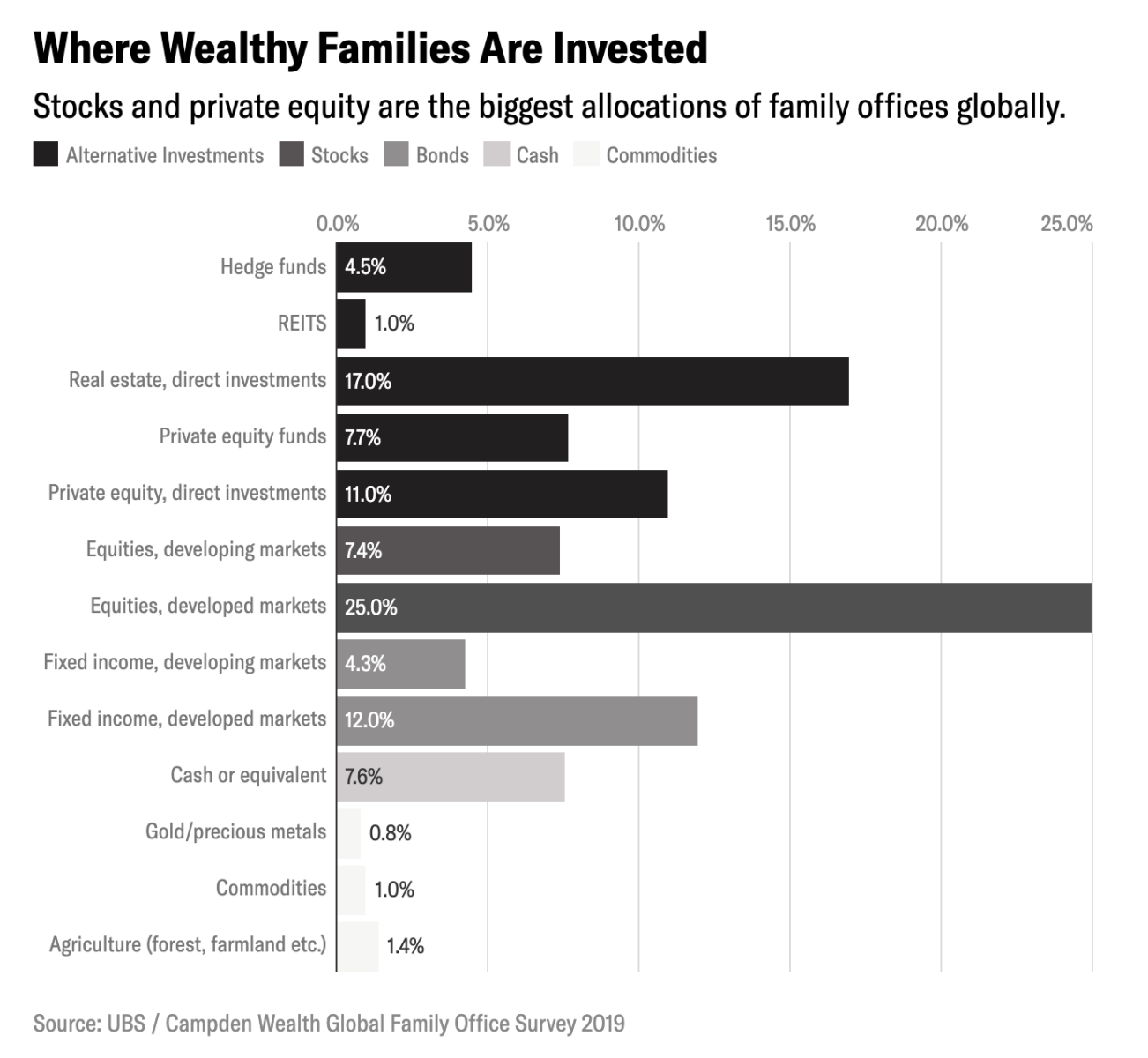

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...

Read More

A short digression about an interesting topic: What is an investable asset class? This seems like an obvious question...

A short digression about an interesting topic: What is an investable asset class? This seems like an obvious question...

Read More

The transcript from this week’s MIB: Vanguard’s Fran Kinniry, Global Head of Portfolio Construction at the...

Read More

Our guest this week is Fran Kinniry, principal in Investment Strategy Group, and Global Head of Portfolio Construction at...

Read More

On this episode of Talk Your Book, I speak with Rick Ferri about the next phase of his career. Rick was one of the pioneers of the low...

Read More

Spoiler alert: it depends on your income and portfolio and interest and time. Longer answer below. Fees for investment...

Read More

This week, we speak with Roger G. Ibbotson, Professor Emeritus of Finance at Yale School of Management. He is also Chairman and CIO of...

Read More

The world’s first financial advisor is Joseph, son of Jacob. He is doing asset management for the Egyptian Pharaoh and he also kind of...

The world’s first financial advisor is Joseph, son of Jacob. He is doing asset management for the Egyptian Pharaoh and he also kind of...

Read More

“Between 2009 and 2016, college and university endowments underperformed market benchmarks by more than twice as much as...

Read More

This is my third and final installment in our look at deploying what we have learned from behavioral economics in the everyday practice...

Read More

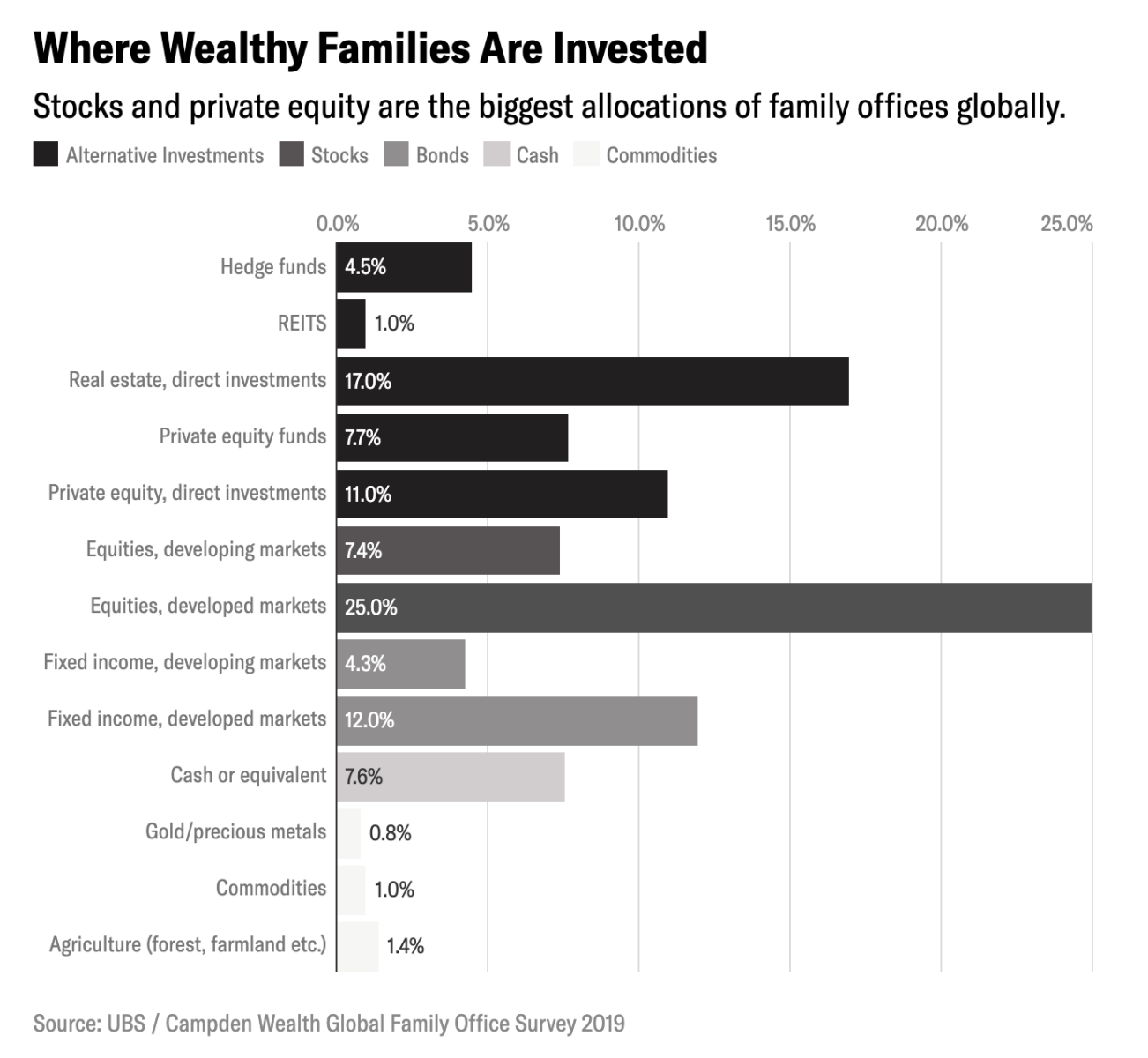

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...

I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family...