How to Use Behavioral Finance in Asset Management, Part II

Yesterday, I laid out the ways we think about and use Behavioral Finance at RWM in the practice of running a wealth management firm....

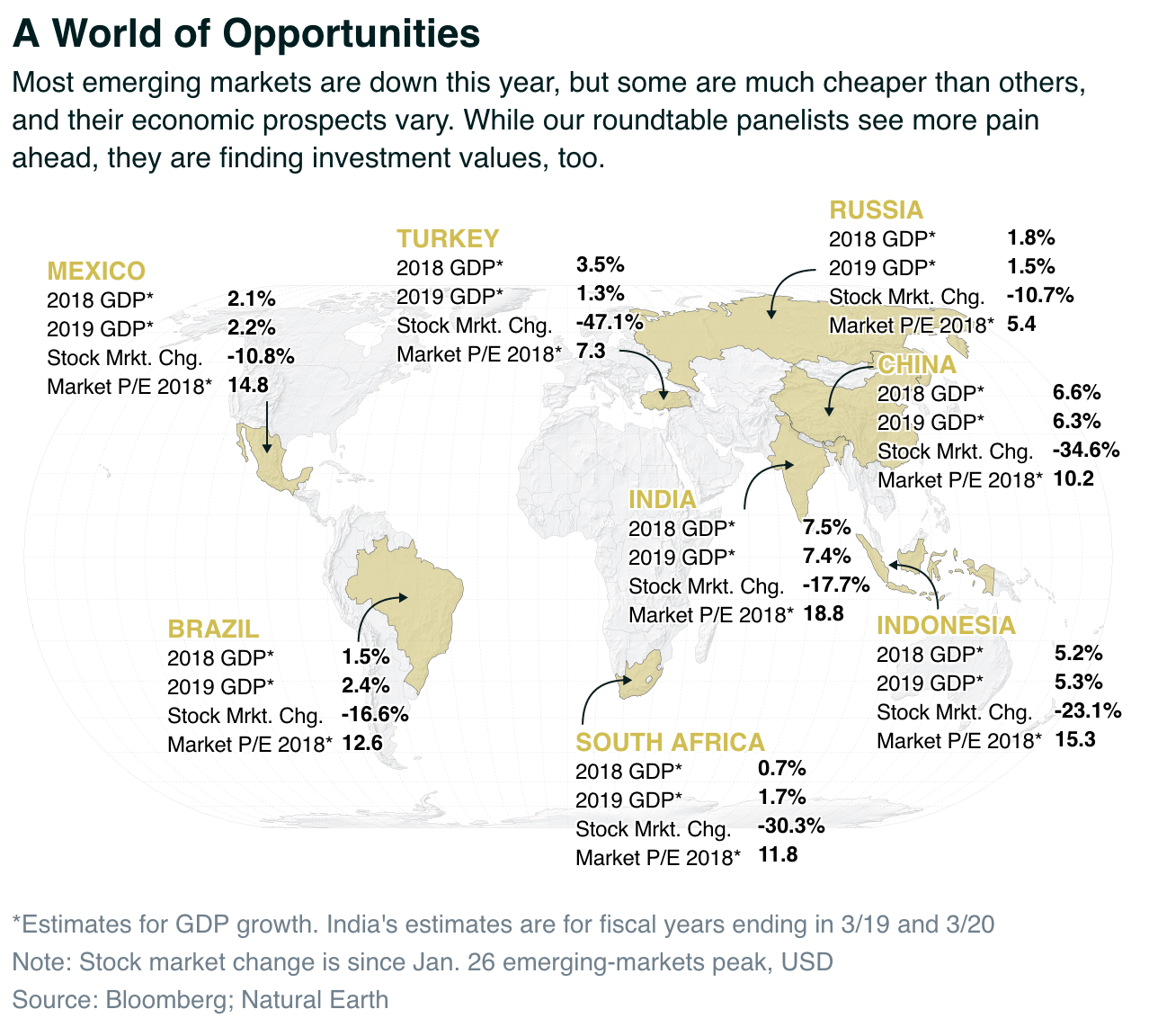

If you think U.S. stocks are volatile, you should see Emerging Markets. EM did well in 2017, but have seen their fortunes slip in 2018....

If you think U.S. stocks are volatile, you should see Emerging Markets. EM did well in 2017, but have seen their fortunes slip in 2018....

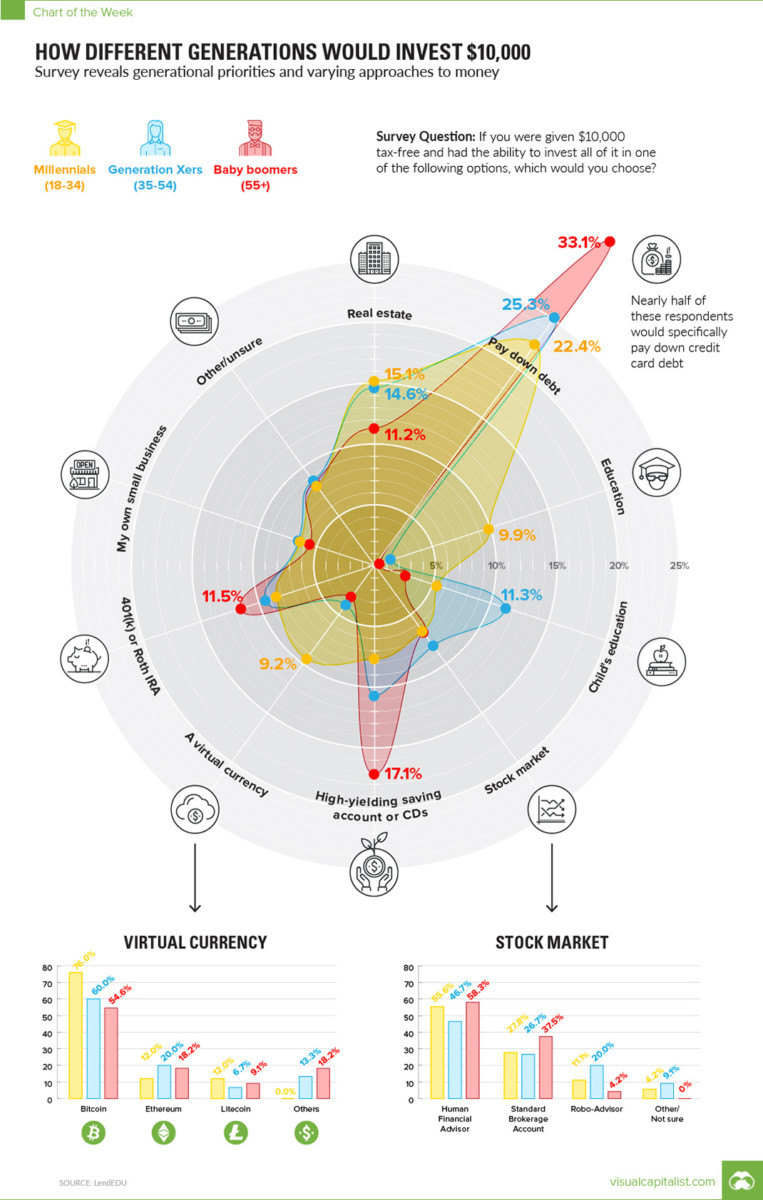

Relative to yesterday’s discussion on the psychology of how millenials invest, this is kind of an interesting overlaid graph:...

Relative to yesterday’s discussion on the psychology of how millenials invest, this is kind of an interesting overlaid graph:...

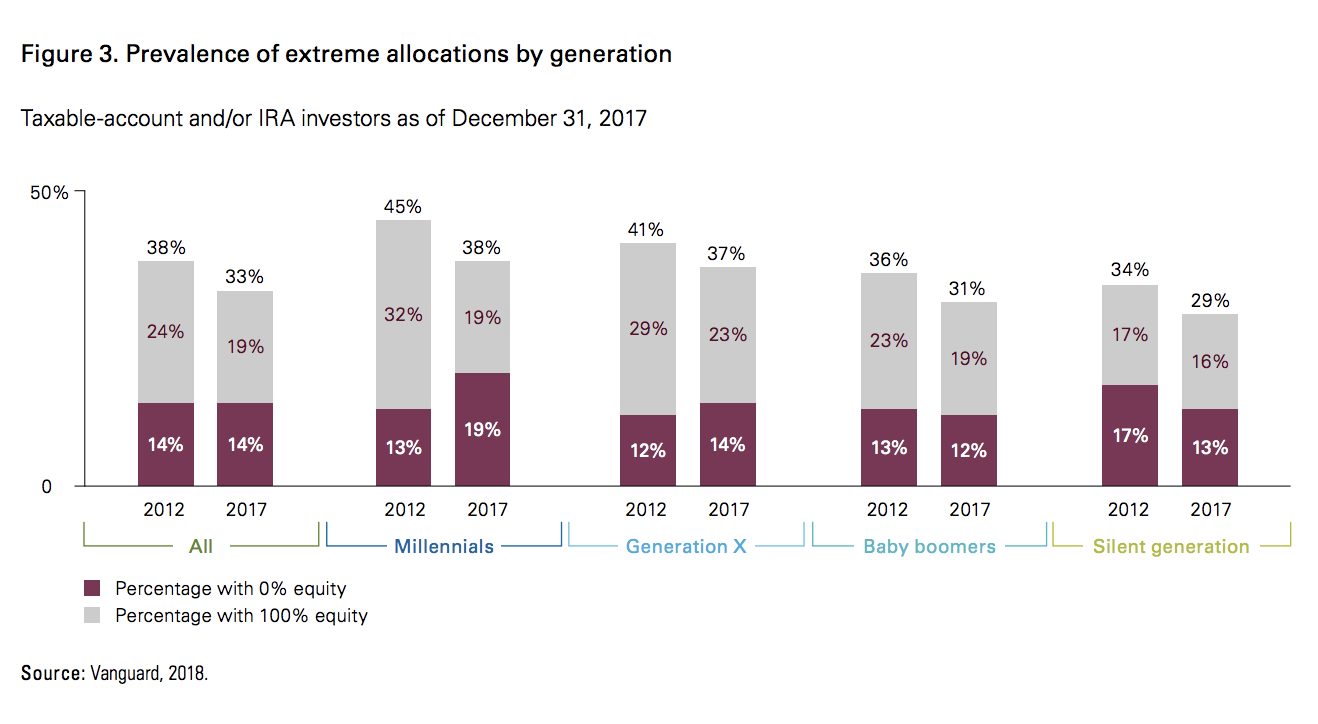

This is fascinating: do Millenials, who came of age right into the teeth of the GFC, have a lower tolerance for risk? From Vanguard:...

This is fascinating: do Millenials, who came of age right into the teeth of the GFC, have a lower tolerance for risk? From Vanguard:...

Get subscriber-only insights and news delivered by Barry every two weeks.