Bloomberg: Active Money Management Isn’t Dead Yet

Active Money Management Isn’t Dead Yet There are five niches that should survive Bloomberg, August 13, 2018 If we are to...

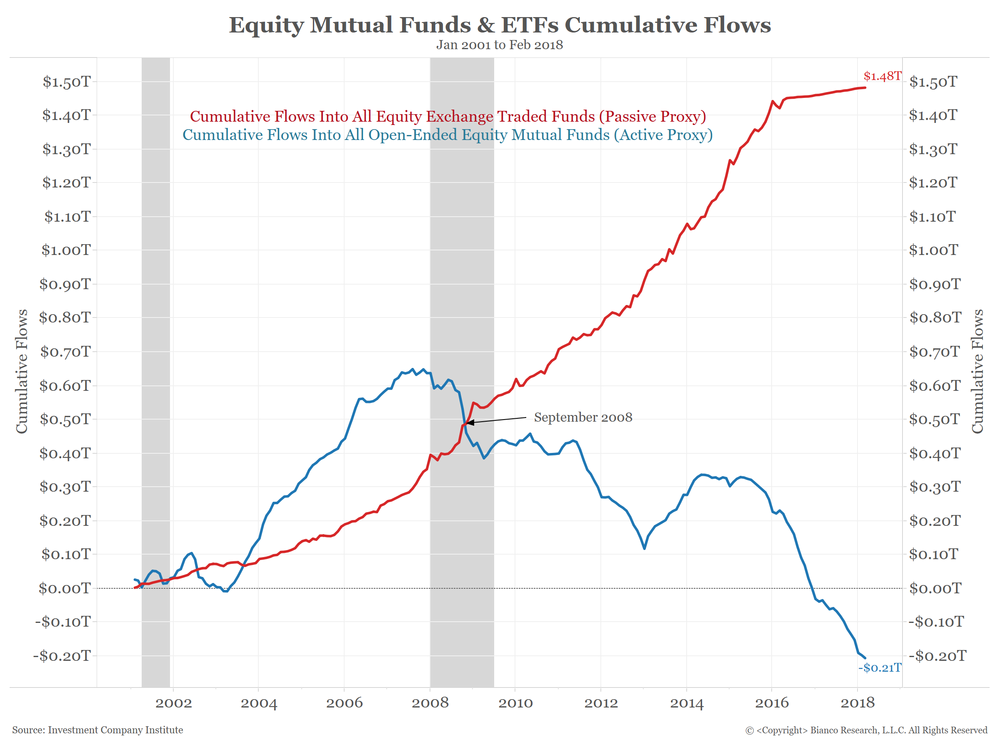

Jim Bianco, one of my favorite market analysts/researchers, points out that the “active money manager model is no longer...

Jim Bianco, one of my favorite market analysts/researchers, points out that the “active money manager model is no longer...

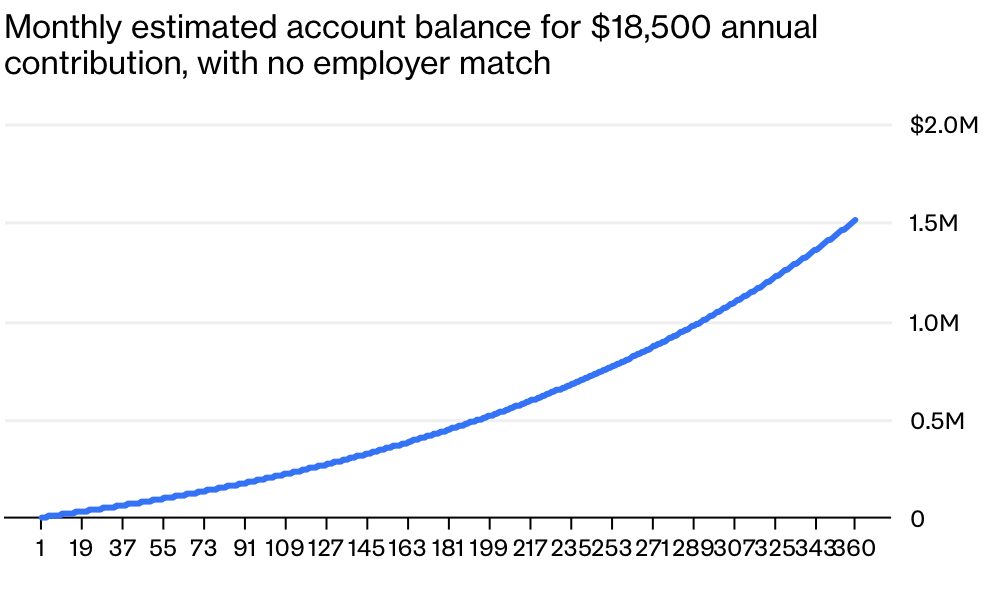

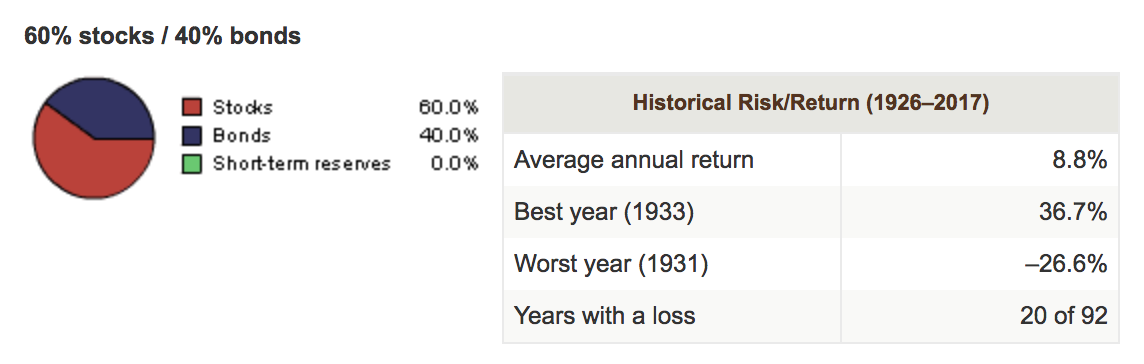

How to Become a 401(k) Millionaire With a little planning and discipline, it’s actually not that hard. Bloomberg, July 23, 2018 ...

How to Become a 401(k) Millionaire With a little planning and discipline, it’s actually not that hard. Bloomberg, July 23, 2018 ...

Last month, I recorded an interview at Vanguard Group where in a bit of role reversal, I was the interviewee (as opposed to the...

Last month, I recorded an interview at Vanguard Group where in a bit of role reversal, I was the interviewee (as opposed to the...

How to Become a 401(k) Millionaire With a little planning and discipline, it’s actually not that hard. Bloomberg, July 23, 2018 ...

How to Become a 401(k) Millionaire With a little planning and discipline, it’s actually not that hard. Bloomberg, July 23, 2018 ...

Get subscriber-only insights and news delivered by Barry every two weeks.