Hierarchy of Portfolio Success

Ranking What Helps or Hurts Investment Returns The key is knowing which ones are subject to human intervention. Bloomberg, June 11. 2018...

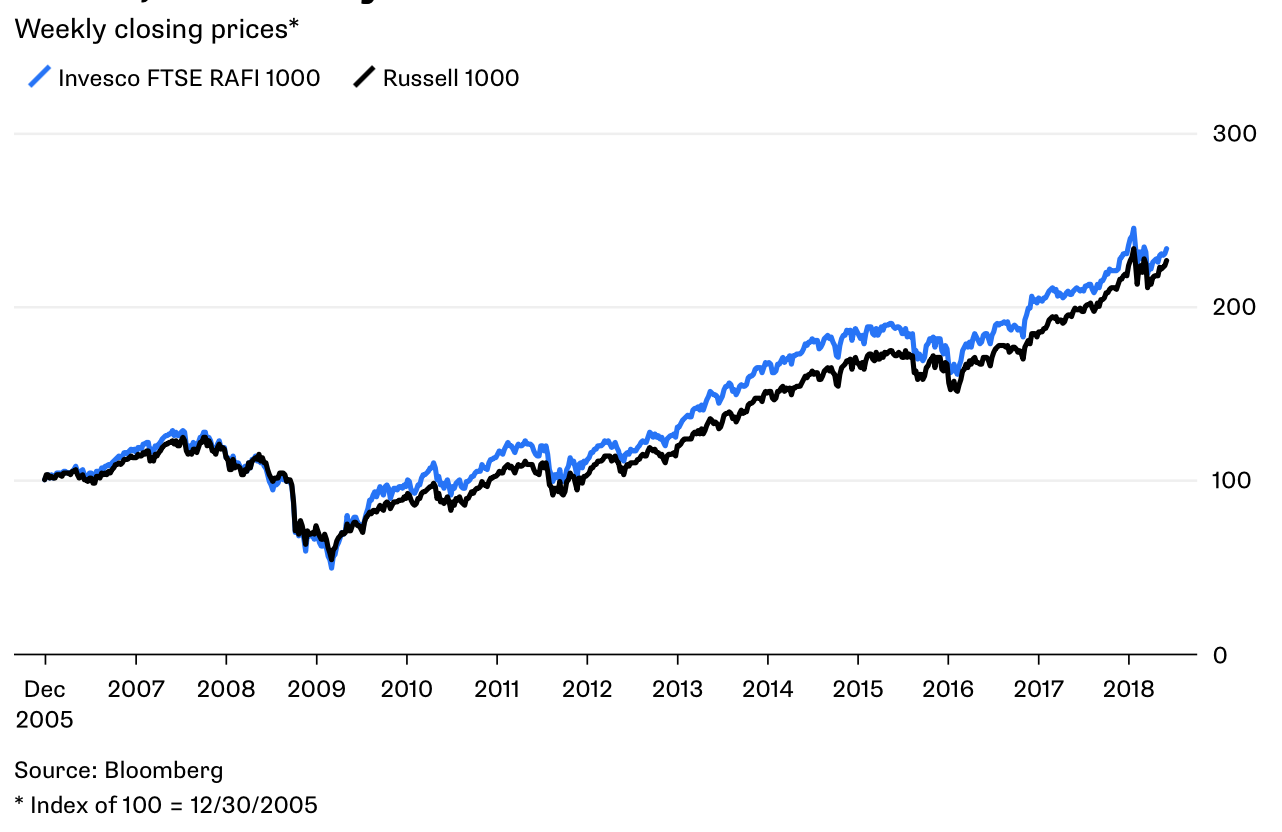

Smart Beta Performance Isn’t Worth the Cost The higher fees offset sporadically better returns. Bloomberg, June 8, 2018 ...

Smart Beta Performance Isn’t Worth the Cost The higher fees offset sporadically better returns. Bloomberg, June 8, 2018 ...

I am thrilled to welcome the latest addition to the RWM team, Blair duQuesnay. I have known Blair for over 15 years (we both worked in...

I am thrilled to welcome the latest addition to the RWM team, Blair duQuesnay. I have known Blair for over 15 years (we both worked in...

Light posting/tweeting today, as I am deep in Pennsylvania at the Vanguard Institutional Advisor’s Alpha in Malvern, discussing...

Light posting/tweeting today, as I am deep in Pennsylvania at the Vanguard Institutional Advisor’s Alpha in Malvern, discussing...

click for more info on our Chicago office We are Chicago bound tomorrow! Me, Kris Venne (our director of financial planning),...

click for more info on our Chicago office We are Chicago bound tomorrow! Me, Kris Venne (our director of financial planning),...

Get subscriber-only insights and news delivered by Barry every two weeks.