I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...

I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...

Read More

Whenever I go off on a rant when writing some critical polemic screed, I try not to edit myself. Just get it all out in print, and we can...

Read More

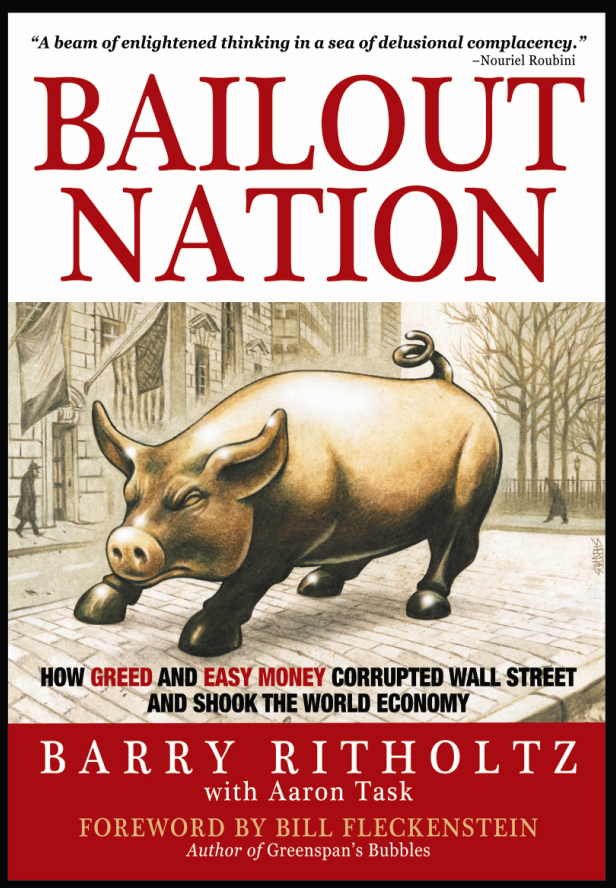

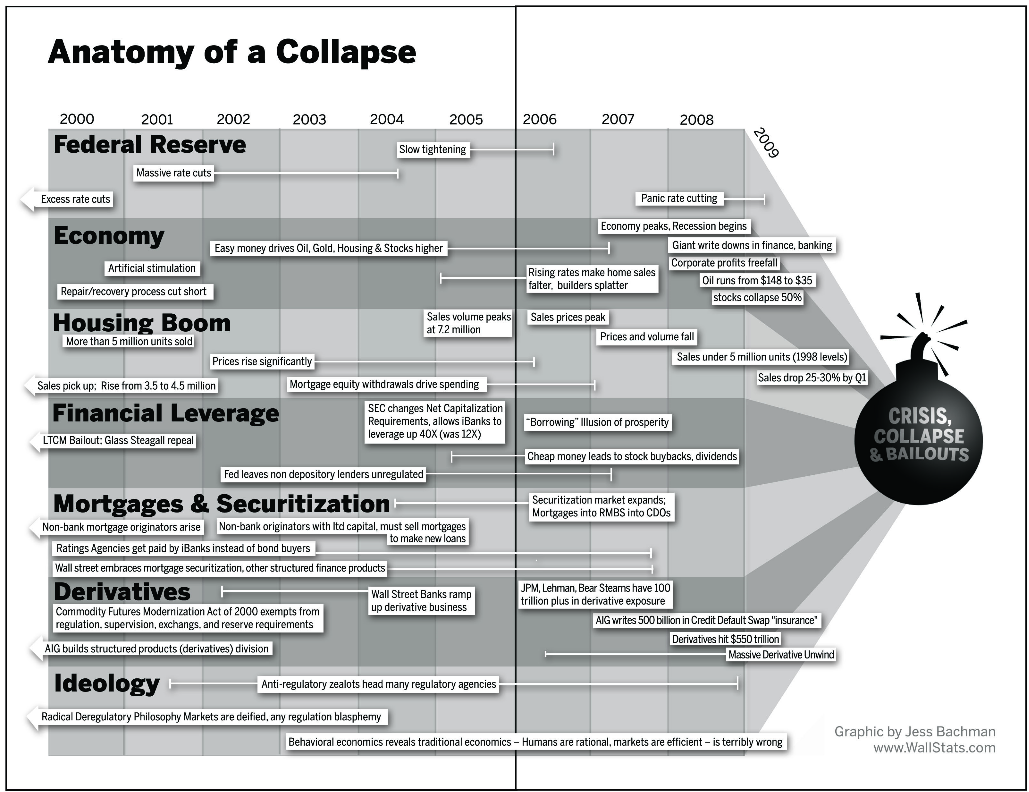

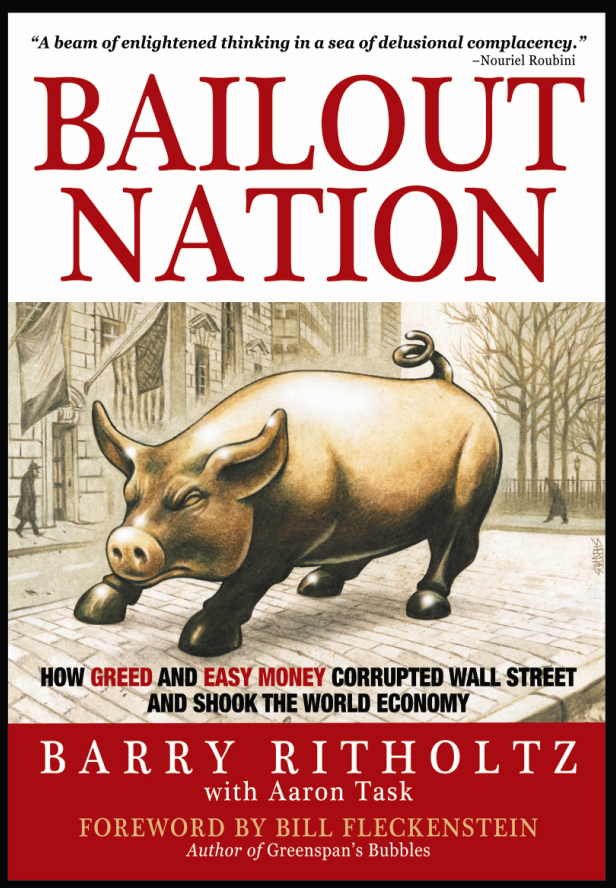

Wow, I almost let this slip by unannounced: The paperback edition of Bailout Nation is here ($11.53 for the paperback, $10.38 for the...

Wow, I almost let this slip by unannounced: The paperback edition of Bailout Nation is here ($11.53 for the paperback, $10.38 for the...

Read More

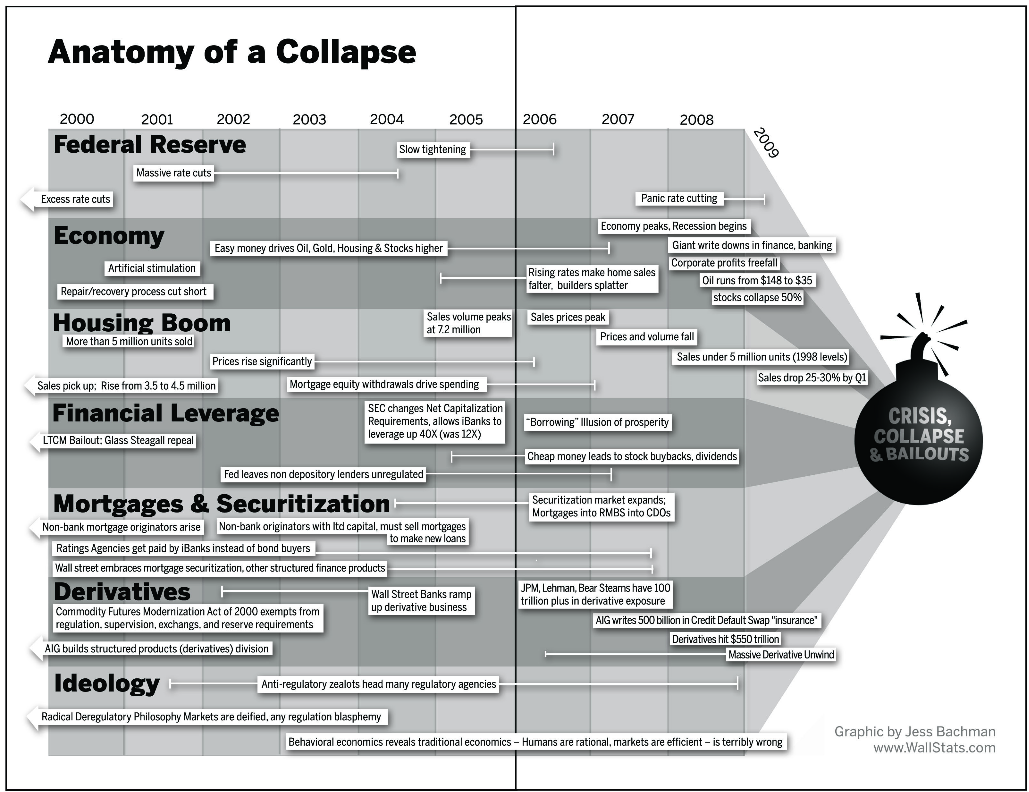

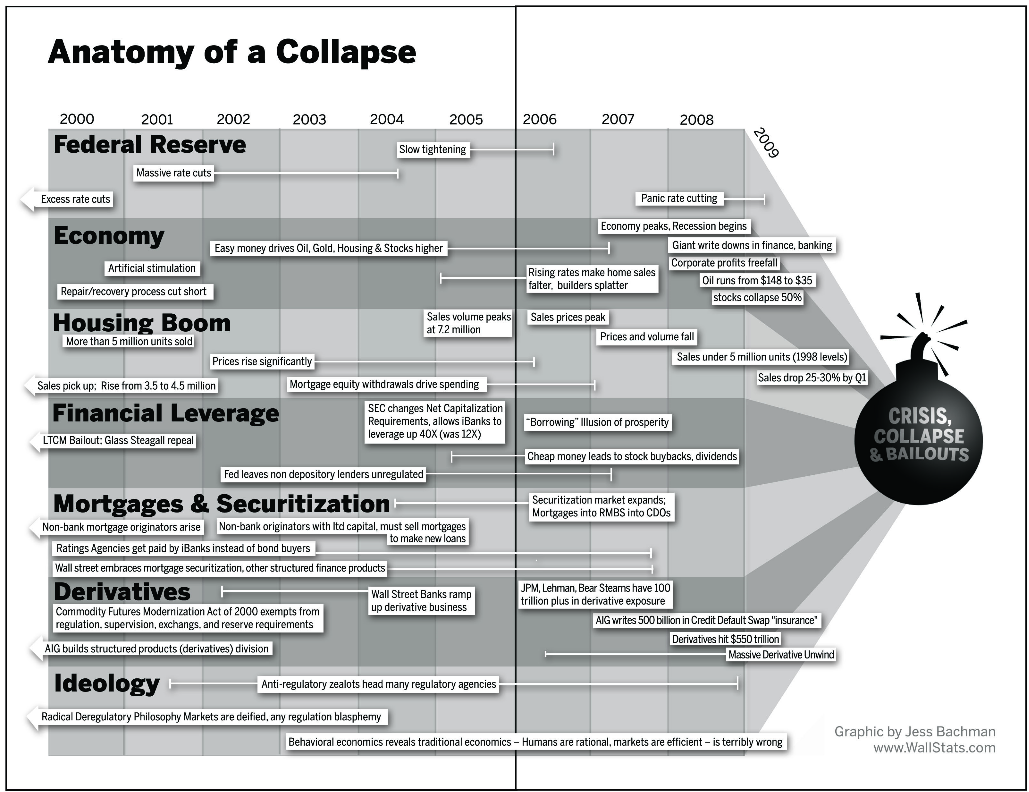

5.0 out of 5 stars Great history lesson on government bailouts Great book on helping me understand how we got to the bailout mess we are...

5.0 out of 5 stars Great history lesson on government bailouts Great book on helping me understand how we got to the bailout mess we are...

Read More

Here are the most up-to-date collection of reviews for Bailout Nation: USA Today: “Best books to make sense of financial crisis of...

Read More

As mentioned Monday, I found The Big Short discussion on 60 Minutes quite interesting. I went over to Amazon to check out the book...

Read More

Here are the full run of reviews of the book: Mainstream Media Reviews New York Times: Rescues Unlimited: Government as Wall Street’s...

Read More

The Sunday New York Times has a nice review of Bailout Nation in the Business Section: Excerpt: “MANY people were outraged when...

The Sunday New York Times has a nice review of Bailout Nation in the Business Section: Excerpt: “MANY people were outraged when...

Read More

The Bailout Nation manuscript has officially been accepted by Wiley. I am told we are on target for a mid-May publication date, with the...

The Bailout Nation manuscript has officially been accepted by Wiley. I am told we are on target for a mid-May publication date, with the...

Read More

I did three segments Tuesday on Yahoo Tech Ticker at the Nasdaq: Here is the last, on Bailouts, Fannie & Freddie: Click for...

Read More

I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...

I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...

I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...

I am please to report that calling out the Big Lie has now gone fully mainstream. Recall last month, I had two Big Lie columns in the...