Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Read More

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole...

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole...

Read More

I spent some time with my buddy Pete Dominick on Monday talking about all of the things we don’t know about SVB. As...

Read More

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

Read More

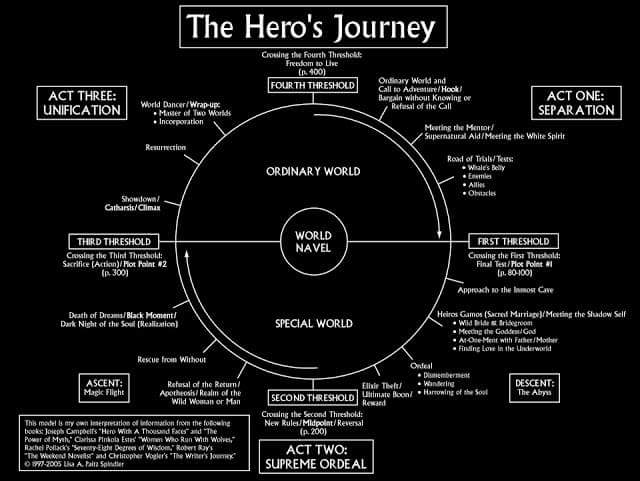

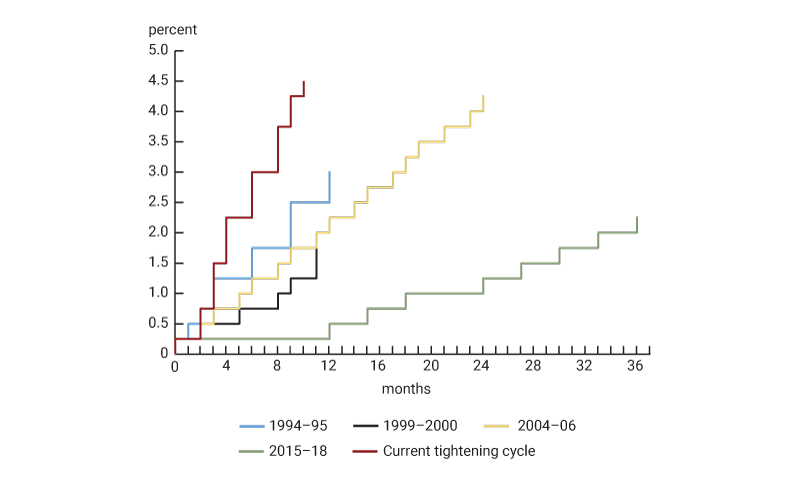

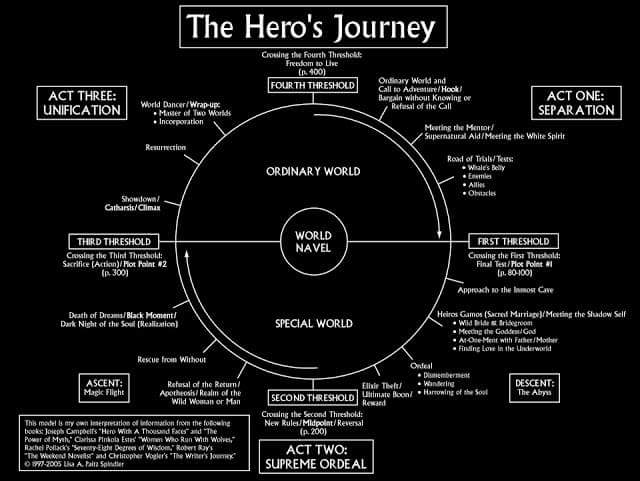

To hear an audio spoken word version of this post, click here. Joseph Campbell’s seminal work1 explores the...

To hear an audio spoken word version of this post, click here. Joseph Campbell’s seminal work1 explores the...

Read More

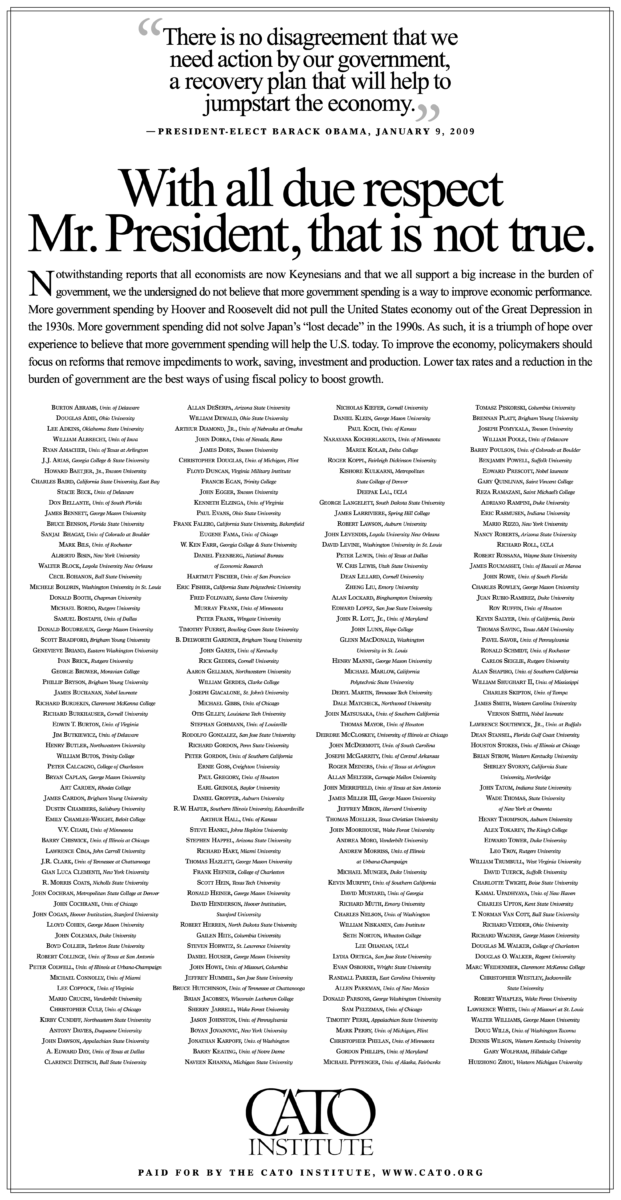

To hear an audio spoken word version of this post, click here. Debates between various schools of economic thought keep...

To hear an audio spoken word version of this post, click here. Debates between various schools of economic thought keep...

Read More

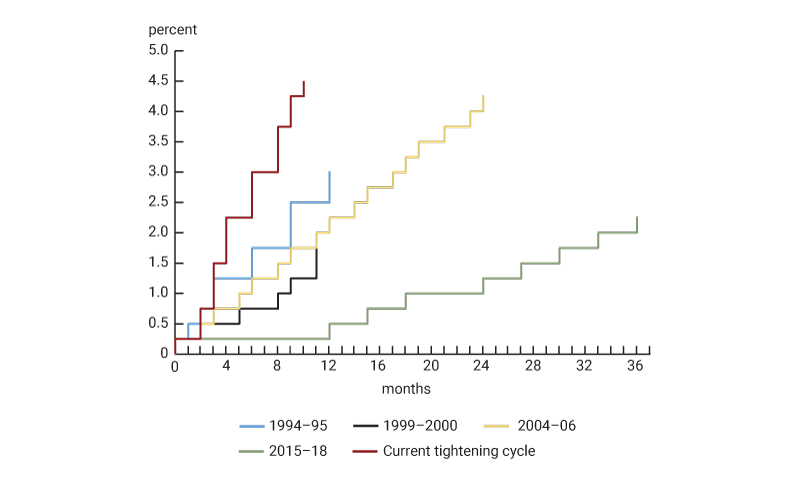

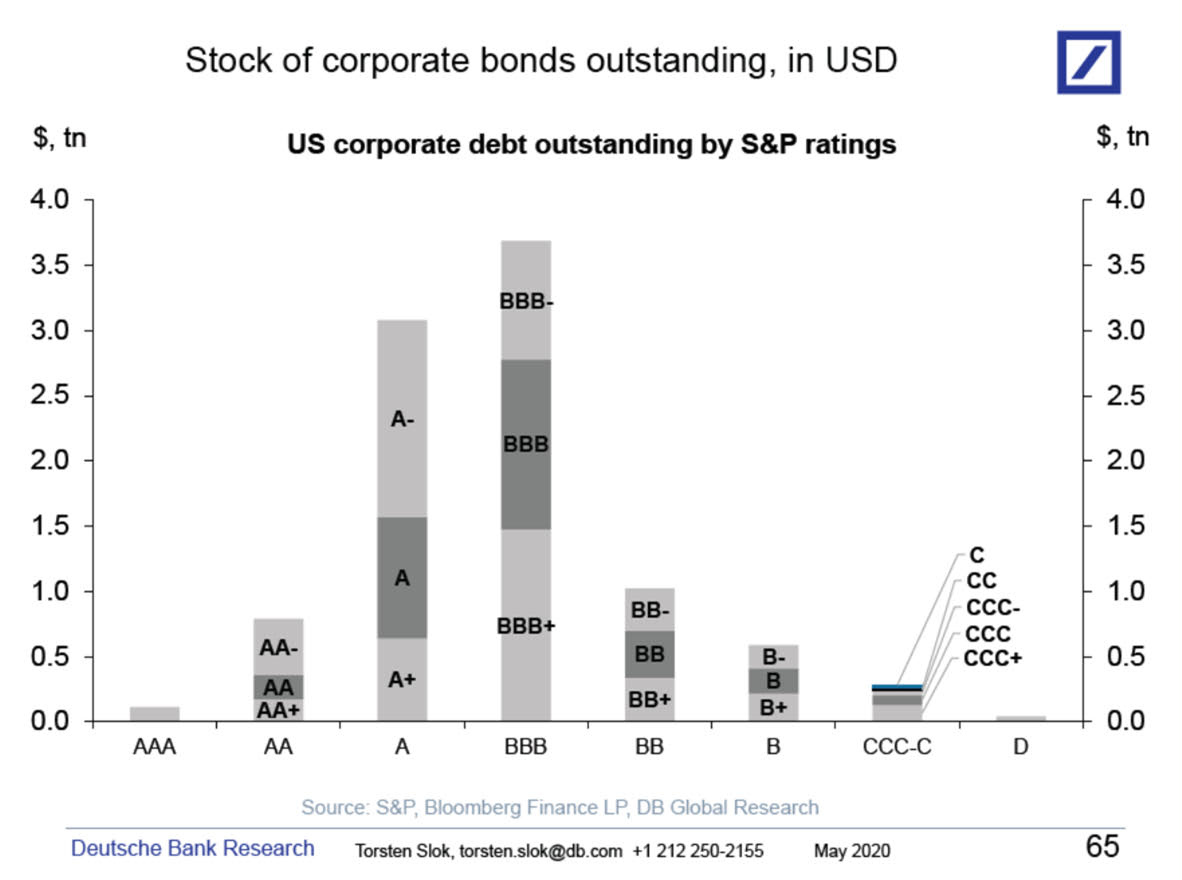

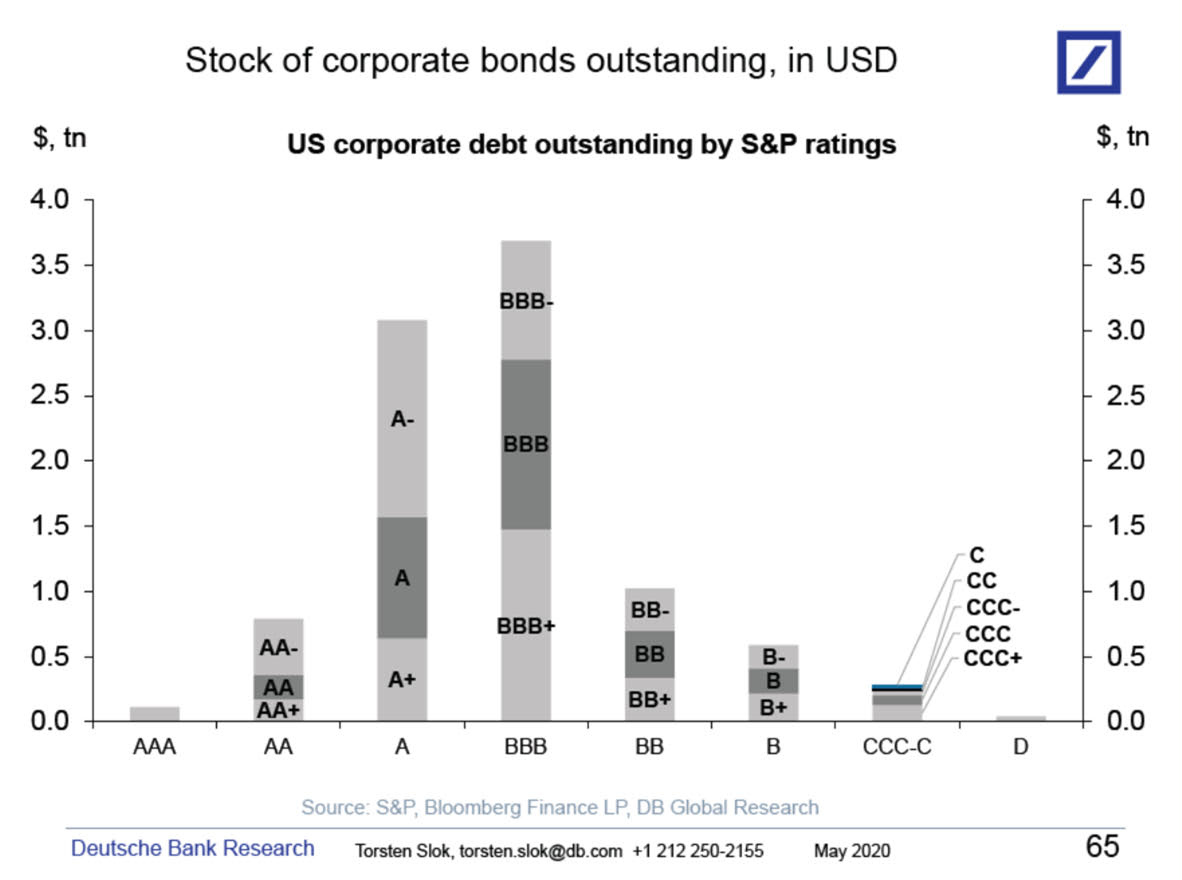

Negative interest rates not the right tool for this shock Source: Torsten Sløk, Deutsche Bank Research Torsten Sløk, chief...

Negative interest rates not the right tool for this shock Source: Torsten Sløk, Deutsche Bank Research Torsten Sløk, chief...

Read More

On Thursday, I mentioned my beastly BusinessWeek piece on economic rescues: It’s Time to Go Big. For those of you who don’t...

On Thursday, I mentioned my beastly BusinessWeek piece on economic rescues: It’s Time to Go Big. For those of you who don’t...

Read More

The U.S Needs Way More Than a Bailout to Recover From Covid-19 Shore up the markets, sure, but don’t stop there. It’s time for...

The U.S Needs Way More Than a Bailout to Recover From Covid-19 Shore up the markets, sure, but don’t stop there. It’s time for...

Read More

This is part III of our Unintended Consequences/Counter-factual series; part one on Chrysler is here; part II on Long Term Capital...

Read More

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...