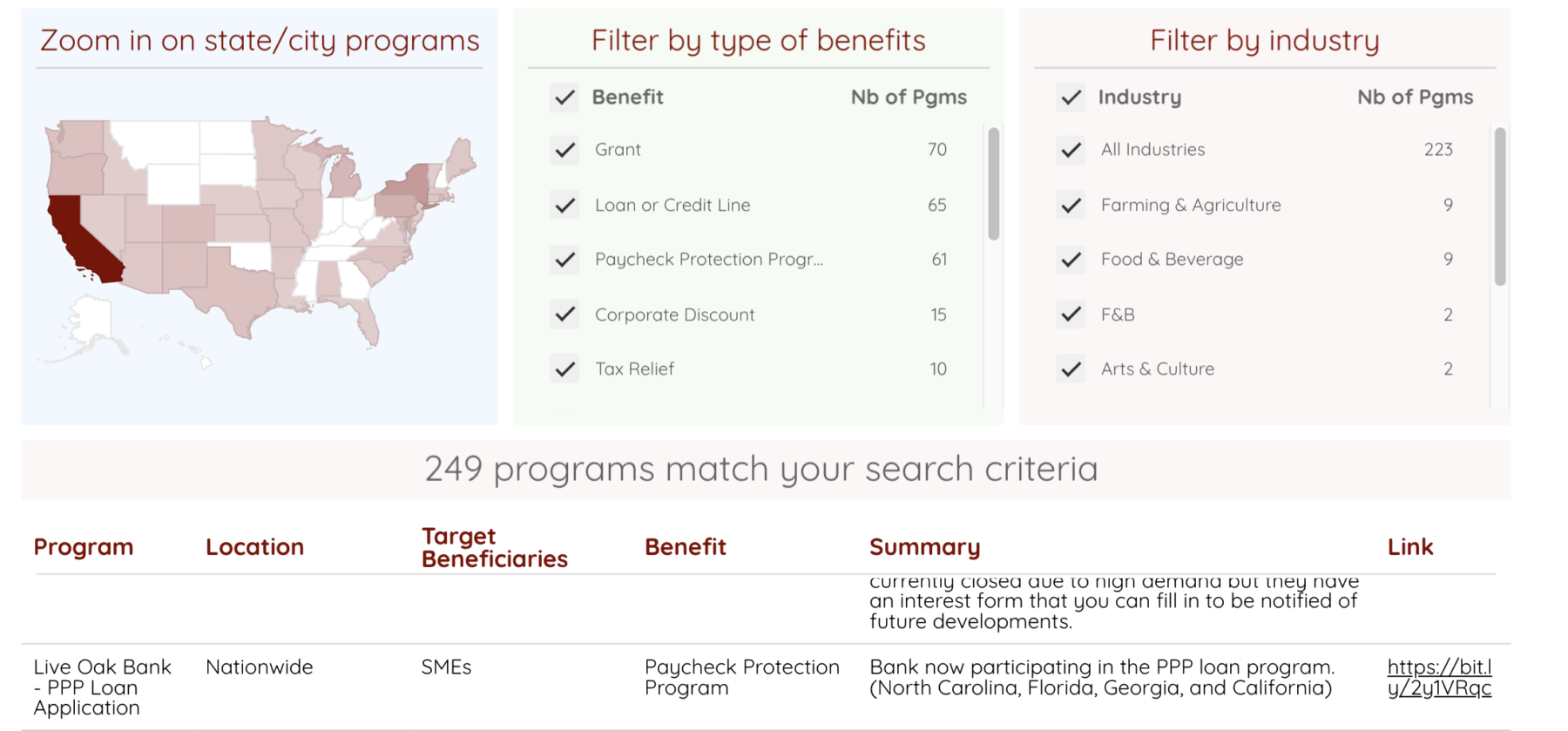

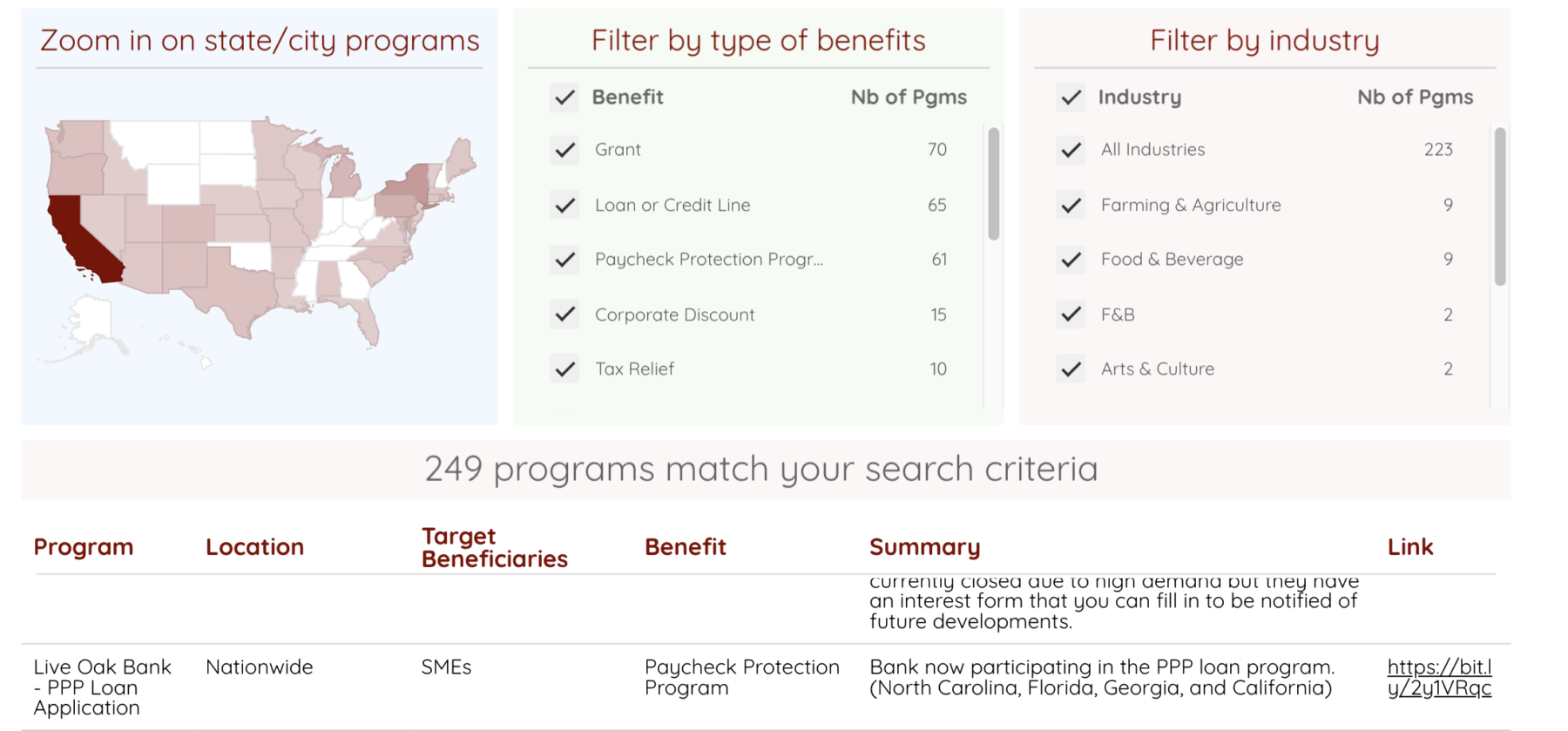

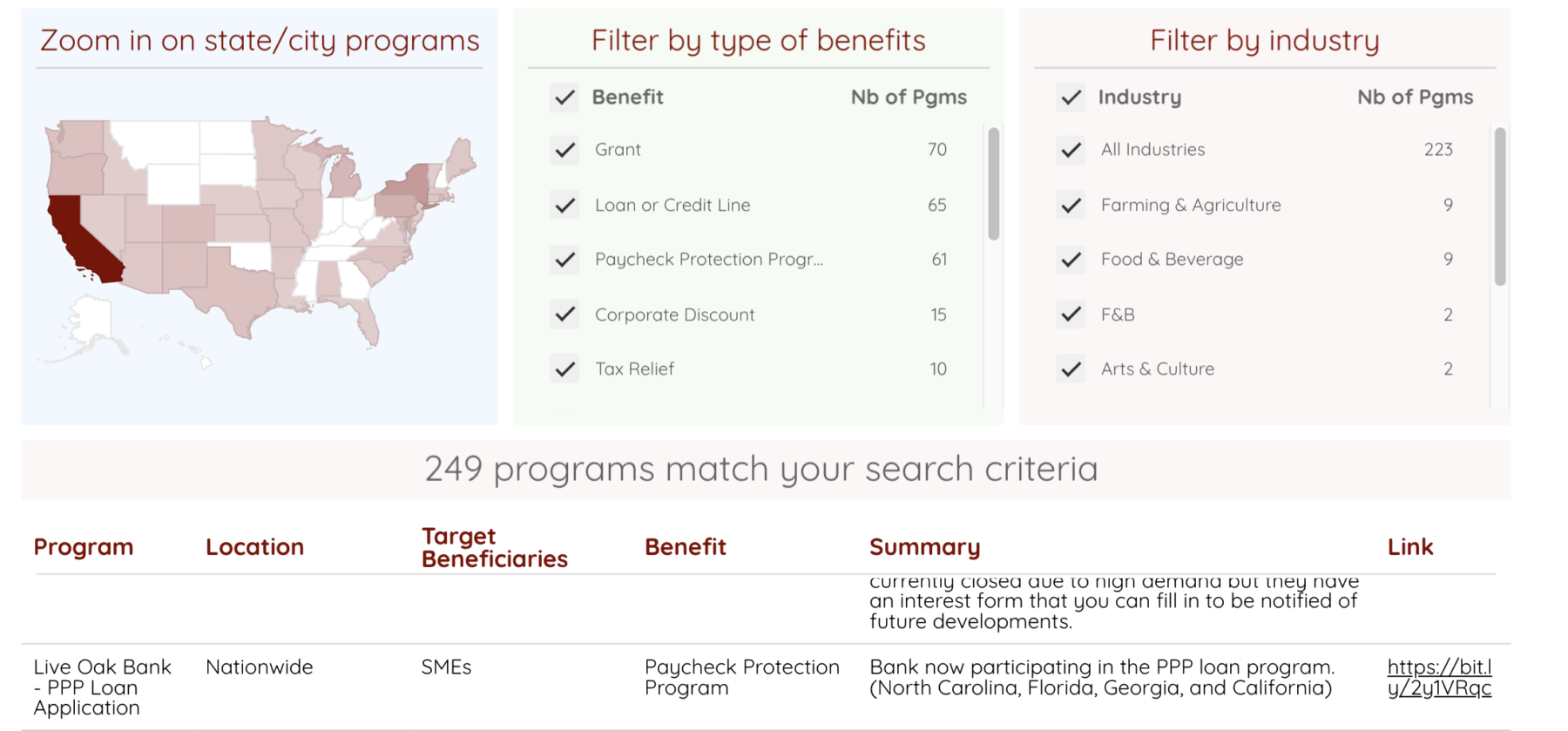

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...

Read More

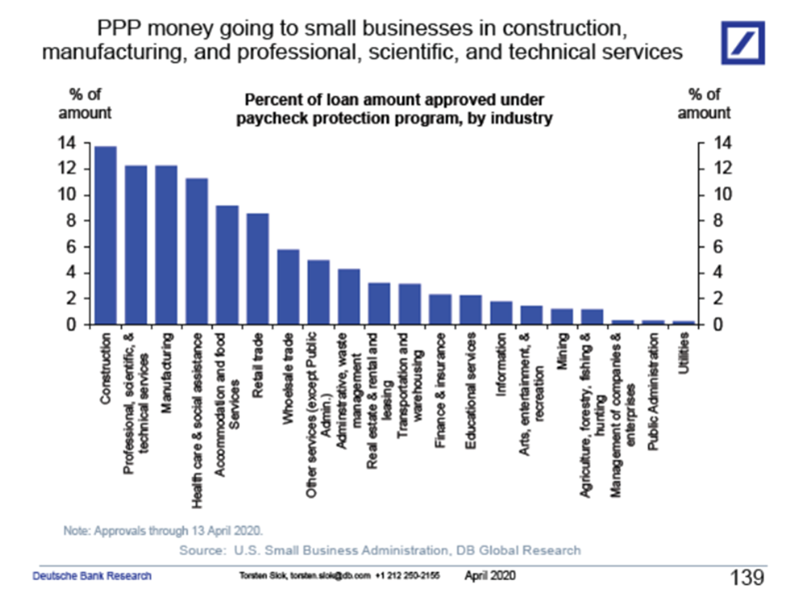

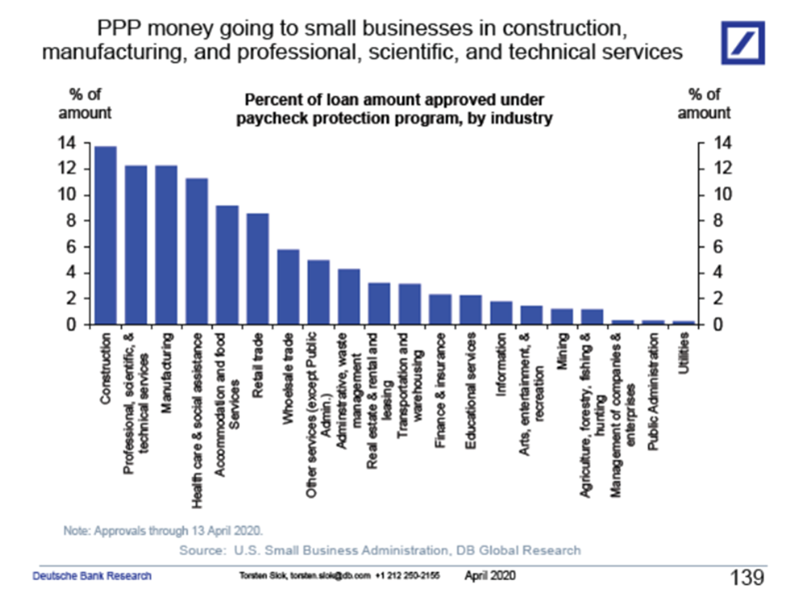

The first $349 billion in Paycheck Protection Program (PPP) monies have been disbursed (another $350 billion in PPP loans is expected to...

The first $349 billion in Paycheck Protection Program (PPP) monies have been disbursed (another $350 billion in PPP loans is expected to...

Read More

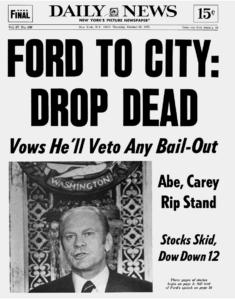

This is part II of our Unintended Consequences/Counter-factual series; part one on Chrysler is here. More to come next week. ~~~ Before...

This is part II of our Unintended Consequences/Counter-factual series; part one on Chrysler is here. More to come next week. ~~~ Before...

Read More

We live in a post-bailout world. It wasn’t always this way. Before the 1970s, America was not a bailout nation. For the first 200 years...

Read More

U.S. Can Get Bailouts Right This Time Terms in the financial crisis were too generous to most companies, but at least one rescue offers a...

Read More

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. ~~~ Before I get into the details of the bill, I...

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. ~~~ Before I get into the details of the bill, I...

Read More

Yesterday’s discussion about bailouts (for airlines and other industries) provoked some interesting feedback from readers. Some were...

Read More

U.S. Can Get Bailouts Right This Time Terms in the financial crisis were too generous to most companies, but at least one rescue offers a...

Read More

The nation has essentially shut down. The 2008-09 financial crisis threw sand into the gears of the economic system: A trifecta of...

The nation has essentially shut down. The 2008-09 financial crisis threw sand into the gears of the economic system: A trifecta of...

Read More

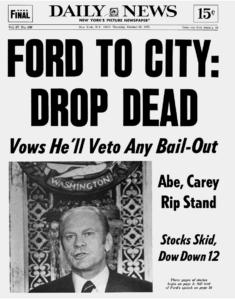

“My Municipal Assistance Corporation (MAC) bonds got called. Find me something to replace them with. They pay 14% tax...

“My Municipal Assistance Corporation (MAC) bonds got called. Find me something to replace them with. They pay 14% tax...

Read More

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...

The Phoenix (as in arising from the ashes of destruction) is an online searchable database of relief programs for small...