I am utterly fascinated by the concept of metacognition — how we evaluate and measure our own skills and abilities. This is the...

Read More

“The market can remain irrational longer than you can remain solvent.” –Not John Maynard Keynes I...

Read More

Have you ever been confronted with the fact that you were in over your head, or that you had no idea what you were doing, or that you...

Read More

“Reality is merely an illusion, albeit a very persistent one.” -Albert Einstein One of my favorite topics is the...

Read More

The film interweaves real personal stories, expert opinions, human behavioral experiments, and archival footage to reveal how and why...

Read More

With his book “Thinking, Fast and Slow,” Daniel Kahneman emerged as one of the most intriguing voices on the complexity of human...

Read More

This is my third and final installment in our look at deploying what we have learned from behavioral economics in the everyday practice...

Read More

Over the decades, I have consumed the entire canon of Behavioral Finance, from Ariely to Kahneman to Thaler to Shiller and back. The...

Read More

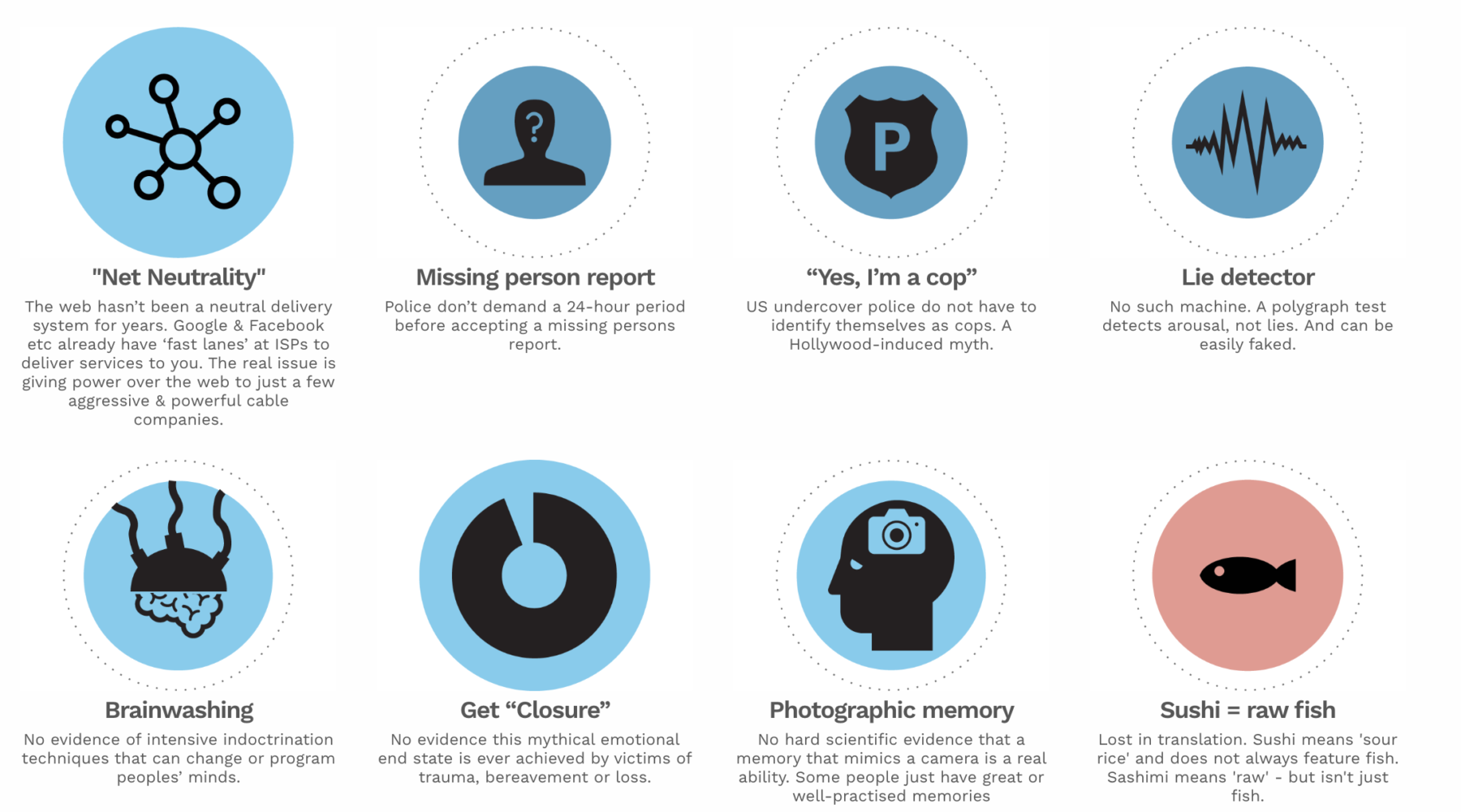

Click for the whole list. Source: Information Is Beautiful

Click for the whole list. Source: Information Is Beautiful

Read More