Never Tempt the Market Gods…

@TBPInvictus here: Dow just crashes through 25,000. Congrats! Big cuts in unnecessary regulations continuing. — Donald J. Trump...

I am attending (and presenting) at the Behavioral Summit 2018 (agenda) this week, part of a Conjunction of Conferences, with...

I am attending (and presenting) at the Behavioral Summit 2018 (agenda) this week, part of a Conjunction of Conferences, with...

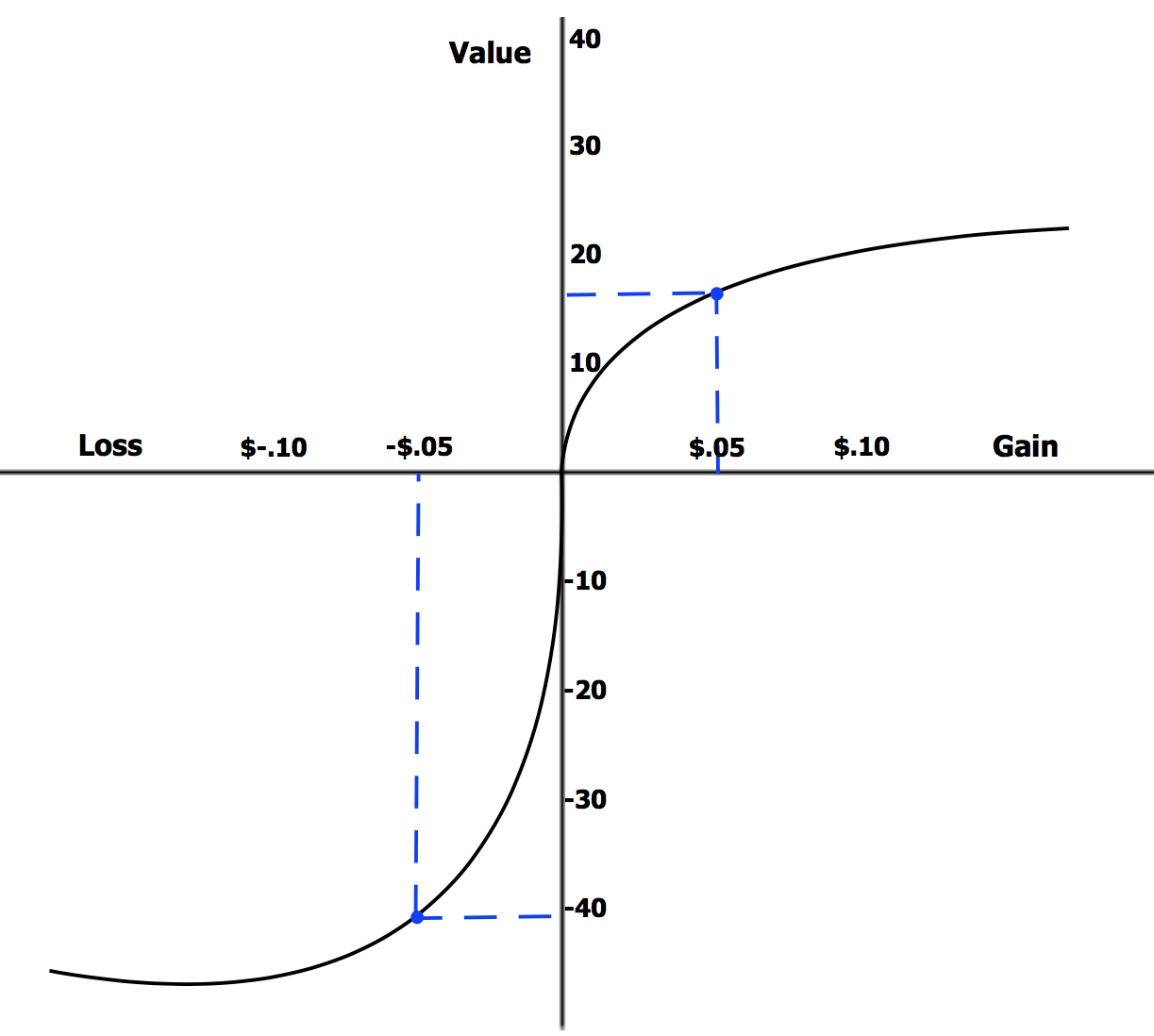

A Challenge to the Biggest Idea in Behavioral Finance Two professors make an interesting argument, but the theory of loss aversion...

A Challenge to the Biggest Idea in Behavioral Finance Two professors make an interesting argument, but the theory of loss aversion...

There is a fascinating discussion in Scientific American: “Why the Most Important Idea in Behavioral Decision-Making Is a Fallacy.”...

There is a fascinating discussion in Scientific American: “Why the Most Important Idea in Behavioral Decision-Making Is a Fallacy.”...

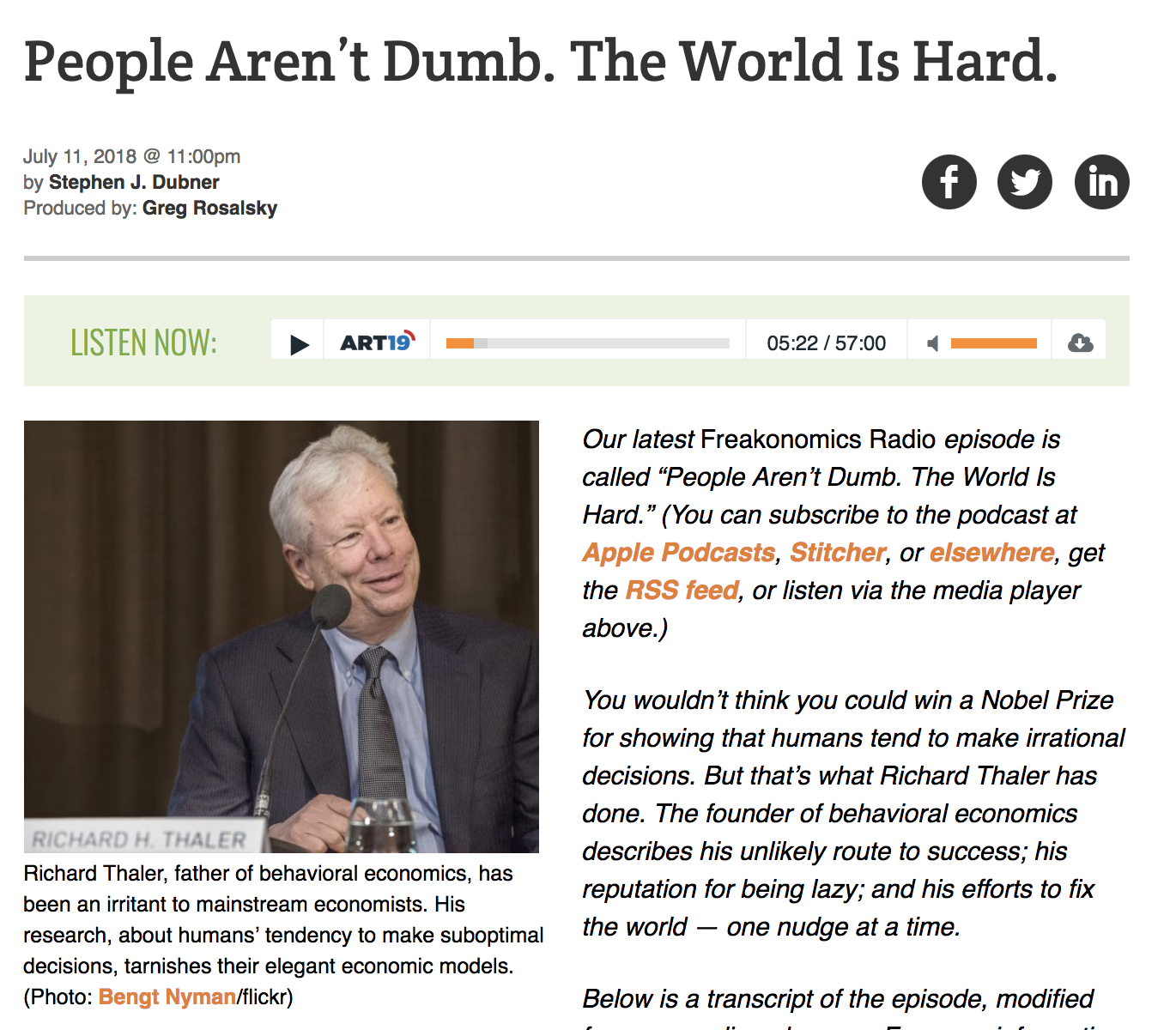

Richard Thaler: “People Aren’t Dumb. The World Is Hard.” Audio All of our prior conversations with Thaler can...

Richard Thaler: “People Aren’t Dumb. The World Is Hard.” Audio All of our prior conversations with Thaler can...

Get subscriber-only insights and news delivered by Barry every two weeks.