What makes gas prices go up and down?

David Pogue: “Last week U.S. gas prices hit a record high, which adds to the cost of just about everything we buy. But is the...

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Steel prices are up 40% this year since tariffs were introduced: Source: Torsten Sløk, Deutsche Bank Securities More on...

Steel prices are up 40% this year since tariffs were introduced: Source: Torsten Sløk, Deutsche Bank Securities More on...

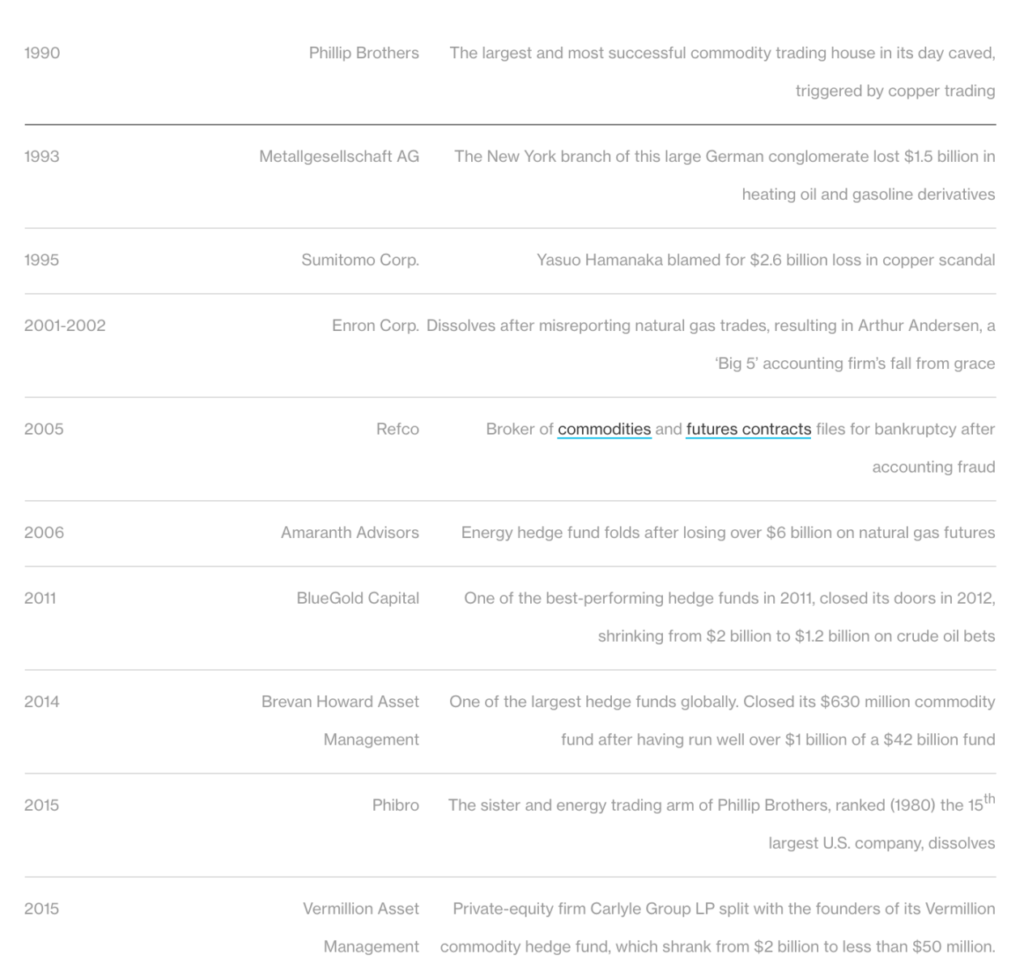

The number of trading houses has dwindled, and the institutional, pure-play commodity hedge funds that remain are few: click for...

The number of trading houses has dwindled, and the institutional, pure-play commodity hedge funds that remain are few: click for...

Get subscriber-only insights and news delivered by Barry every two weeks.