Transcript: Angus Deaton

The transcript from this week’s, MiB: Angus Deaton on America’s Wealth & Inequality, is below. You can stream...

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

Do not buy an iPhone 15. But you might want to buy an iPhone 15 Pro or Pro Max. The war is over. Apple won. It vanquished Android....

Do not buy an iPhone 15. But you might want to buy an iPhone 15 Pro or Pro Max. The war is over. Apple won. It vanquished Android....

It’s Black Friday and you know what that means: Lots of promotional sales and lots of holiday retail spending forecasts. You...

It’s Black Friday and you know what that means: Lots of promotional sales and lots of holiday retail spending forecasts. You...

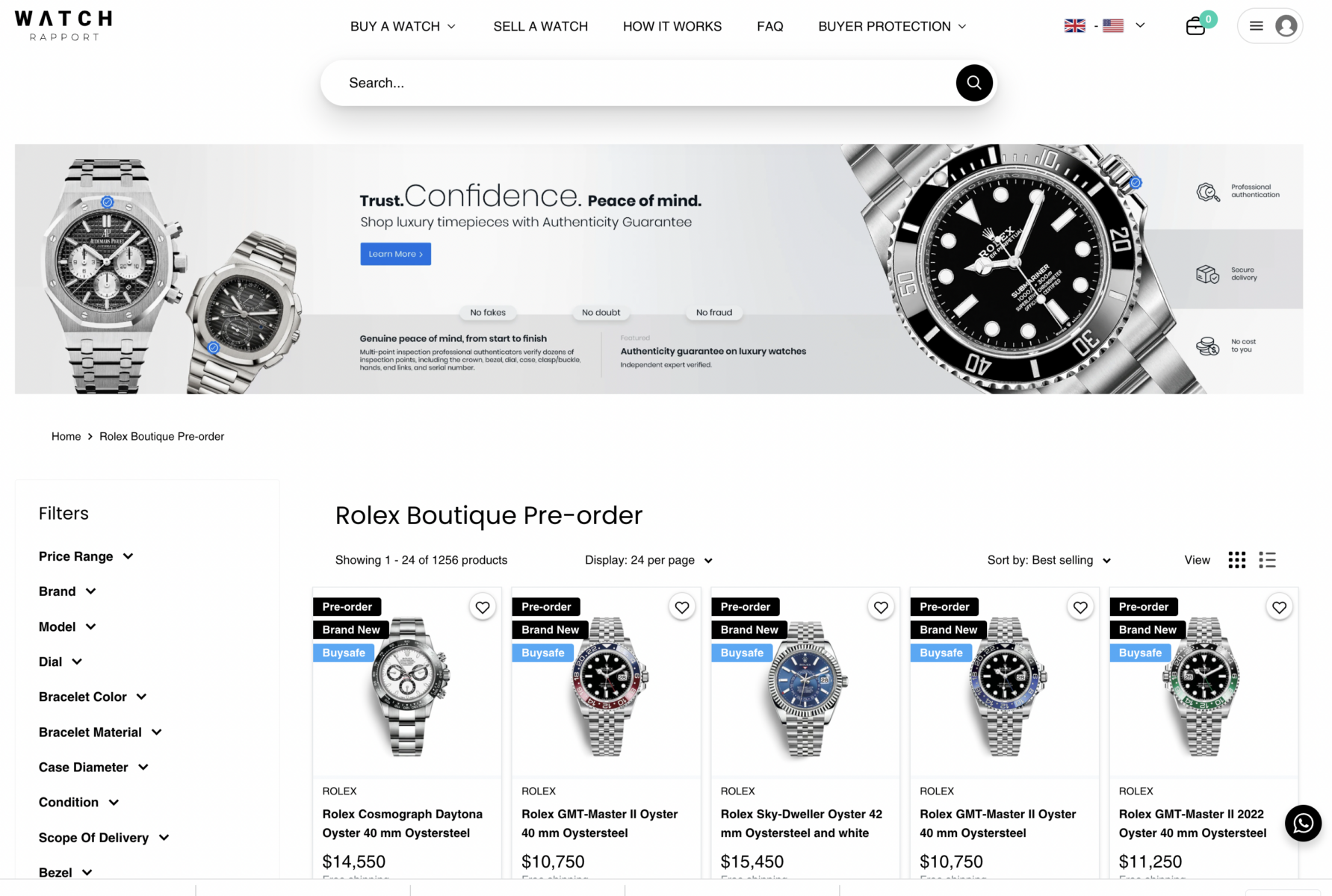

How would you like to buy a Rolex — brand new, with papers and box — for MSRP? Prices have skyrocketed for used timepieces,...

How would you like to buy a Rolex — brand new, with papers and box — for MSRP? Prices have skyrocketed for used timepieces,...

“Buy Yourself a F*^king Latte” was one of the more popular pieces I wrote in 2019. It was a debunking of a...

“Buy Yourself a F*^king Latte” was one of the more popular pieces I wrote in 2019. It was a debunking of a...

Get subscriber-only insights and news delivered by Barry every two weeks.