MIB: Got Credit Cards? You’re Probably Using the Wrong Ones

If you are an American who uses credit, you walk around with an average of 3.7 credit cards in your wallet. You’re probably using them...

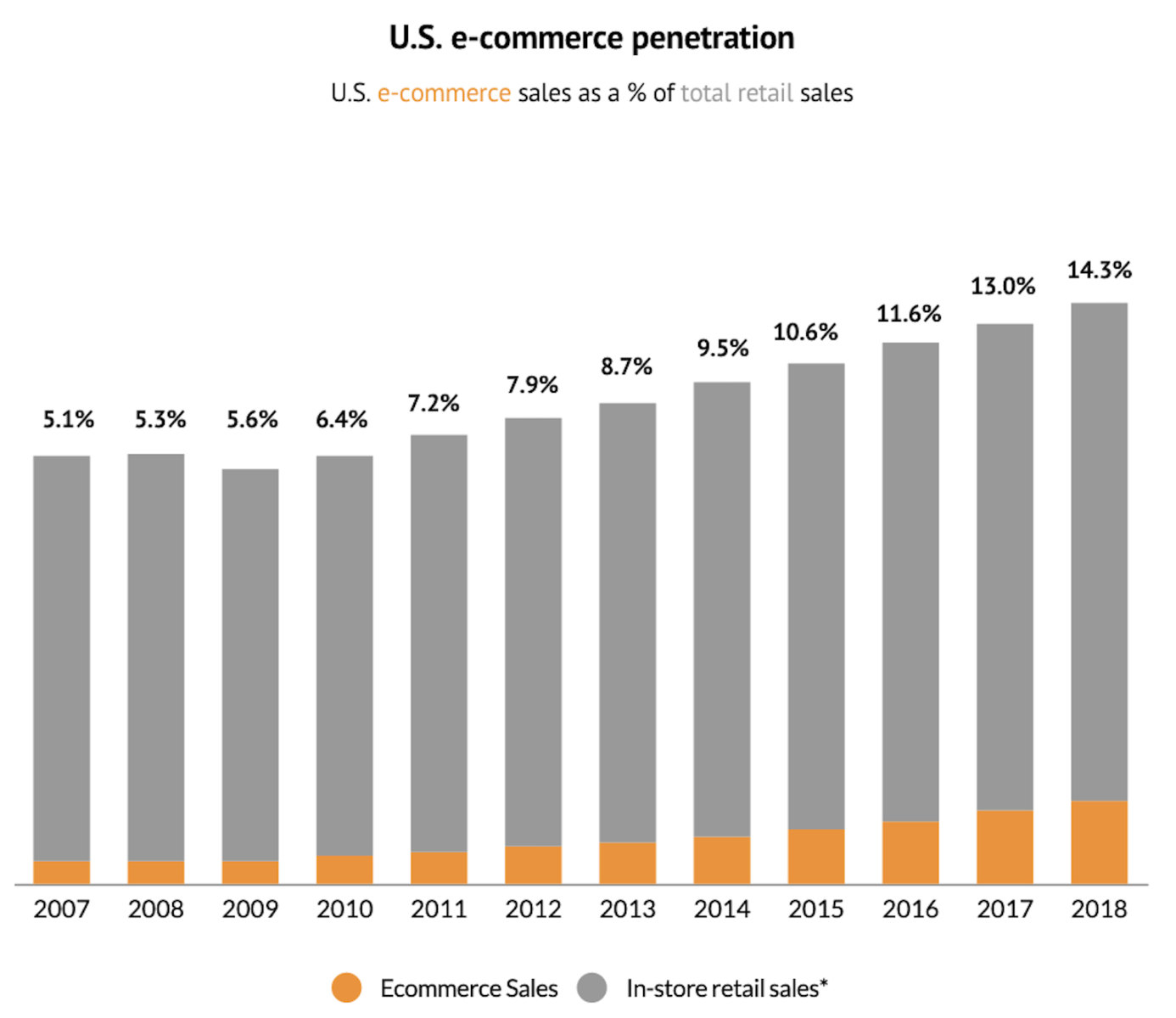

Source: Digitalcommerce360 Now that Shopmas® has arrived, the retailers various trade associations are out spinning...

Source: Digitalcommerce360 Now that Shopmas® has arrived, the retailers various trade associations are out spinning...

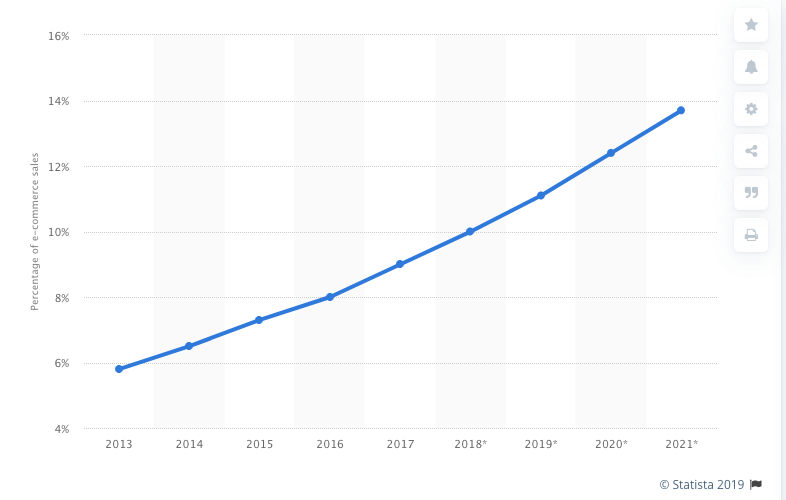

Black Friday, the official kickoff of Shopmas®, is here once again. Whether you are spending time with friends and family or are out...

Black Friday, the official kickoff of Shopmas®, is here once again. Whether you are spending time with friends and family or are out...

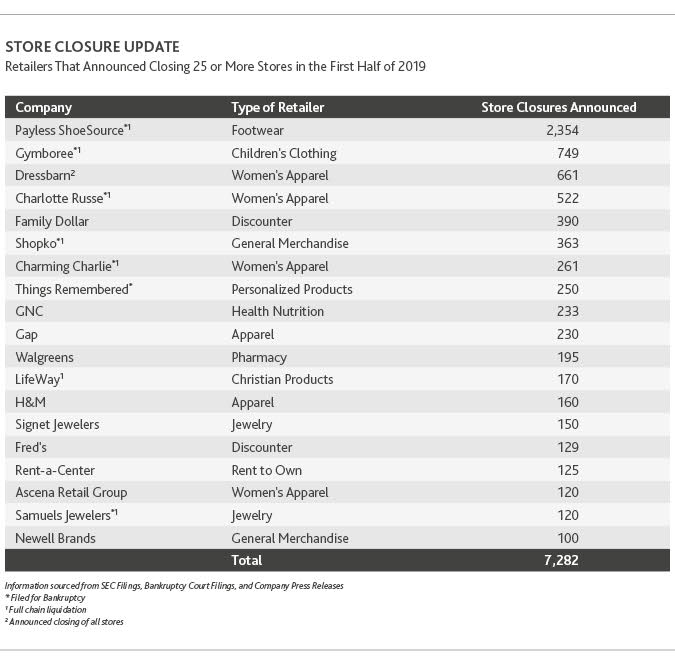

These charts are brutal: Source: BDO This is pretty astonishing: “The pace of retail bankruptcies in 2019 to date is...

These charts are brutal: Source: BDO This is pretty astonishing: “The pace of retail bankruptcies in 2019 to date is...

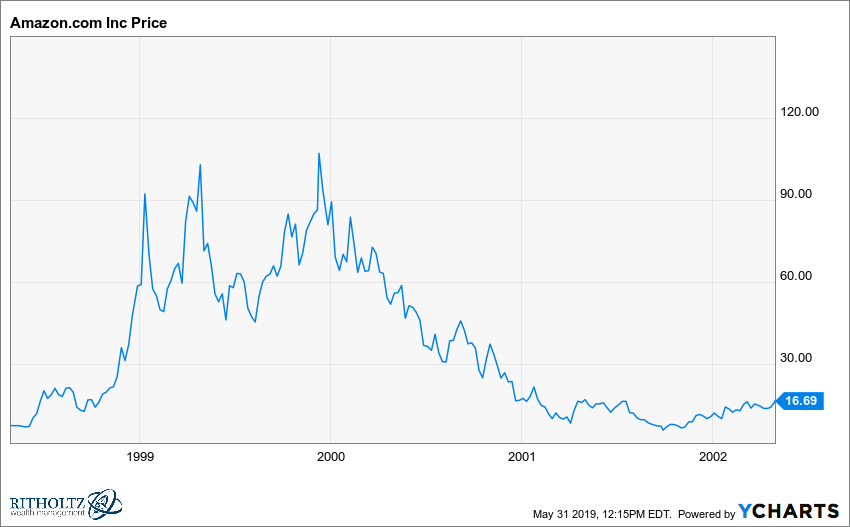

Looking Back at a Bearish Call on Amazon Twenty years ago, how could Barron’s or anyone else know what would become of an internet...

Looking Back at a Bearish Call on Amazon Twenty years ago, how could Barron’s or anyone else know what would become of an internet...

Get subscriber-only insights and news delivered by Barry every two weeks.