At The Money: Contrarian Investing

At The Money: Contrarian Investing. (January 3, 2024) Is contrarian investing a solid strategy, or a fool’s errand?...

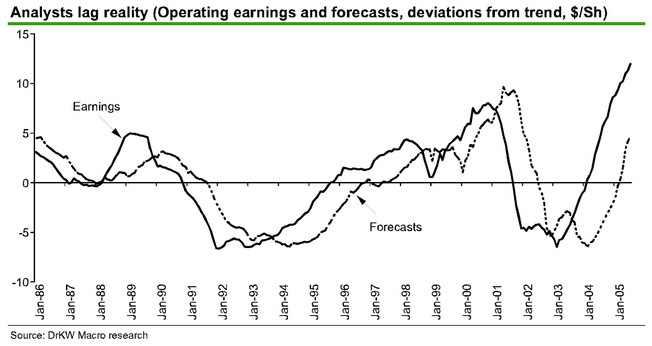

The relevance of perspective to investing is self-evident. When confronted by a problem or challenge, it is useful to change your...

The relevance of perspective to investing is self-evident. When confronted by a problem or challenge, it is useful to change your...

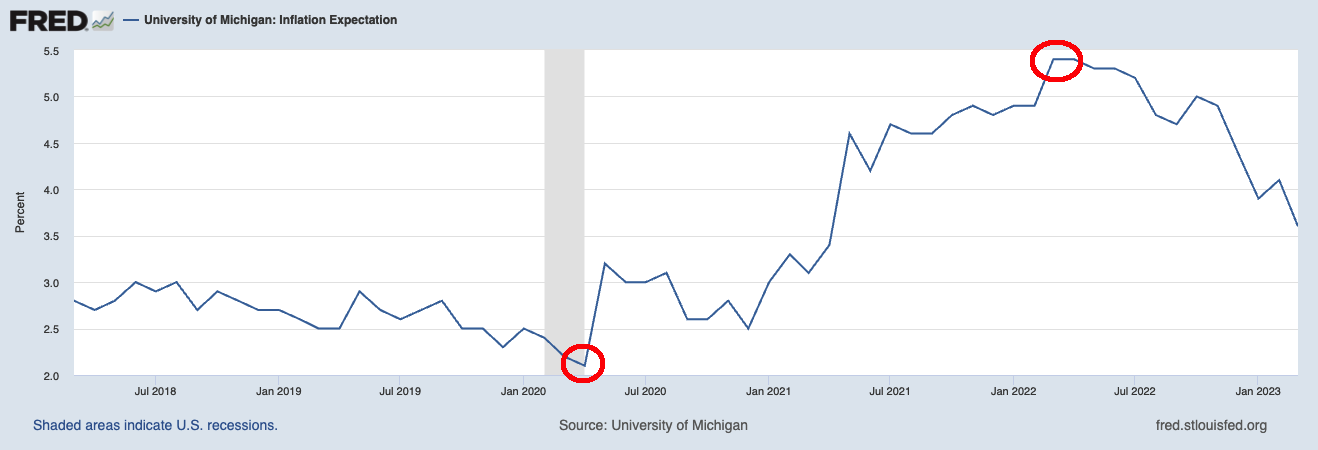

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

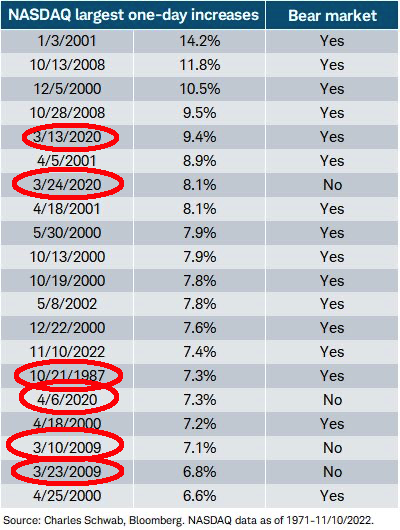

Yesterday’s explosive move higher was exactly the sort of thing traders should have been anticipating. As I wrote last month...

Yesterday’s explosive move higher was exactly the sort of thing traders should have been anticipating. As I wrote last month...

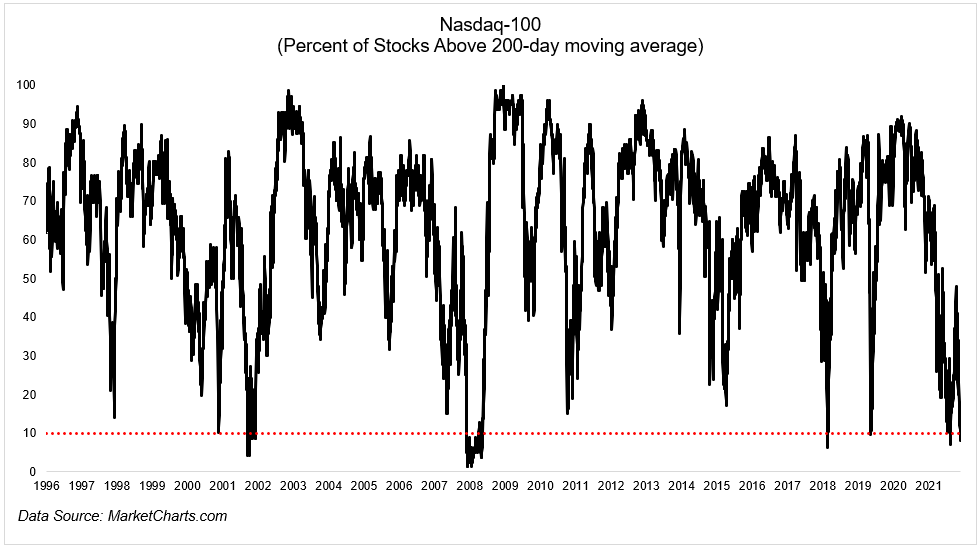

“Are we there yet?” is not just a line from the kids in the back of the car — it’s the question that investors,...

“Are we there yet?” is not just a line from the kids in the back of the car — it’s the question that investors,...

“Magazine covers, especially the Economist, are wonderful contrary indicators.” –@Trendsandtailrisks...

“Magazine covers, especially the Economist, are wonderful contrary indicators.” –@Trendsandtailrisks...

The modern Anti-Vaxxer movement of recent years traces its origins to a paper published in The Lancet in 1998 by (then Dr.)...

The modern Anti-Vaxxer movement of recent years traces its origins to a paper published in The Lancet in 1998 by (then Dr.)...

@TBPInvictus here. With Herman Cain and Stephen Moore apparently on life support for Fed slots, looks like Art Laffer is stepping up his...

@TBPInvictus here. With Herman Cain and Stephen Moore apparently on life support for Fed slots, looks like Art Laffer is stepping up his...

Get subscriber-only insights and news delivered by Barry every two weeks.