Source: Barron’s Barron’s cover showing Apple’s new “golden” headquarters generated a...

Source: Barron’s Barron’s cover showing Apple’s new “golden” headquarters generated a...

MiB: Felix Zulauf on What Drives Markets

This week we sit down with legendary investor Felix Zulauf. In 1990, he founded Zulauf Asset Management, a...

Is Japan the Greatest Bubble of All-Time?

Ben Carlson is a Chartered Financial Analyst and Director of Institutional Asset Management at Ritholtz Wealth Management. He has spent...

Ben Carlson is a Chartered Financial Analyst and Director of Institutional Asset Management at Ritholtz Wealth Management. He has spent...

Time Covers: May 2009 and This Week

You Have to hand it to the editors of Time Magazine: they really do have spectacular timing. To wit: May 2009 This...

You Have to hand it to the editors of Time Magazine: they really do have spectacular timing. To wit: May 2009 This...

Zombie Reagan Jobs Lie Eats Moore’s Brain

@TBPInvictus here: I thought I’d put the “Reagan-created-one-million-jobs-in-one-month” lie to bed a long time ago....

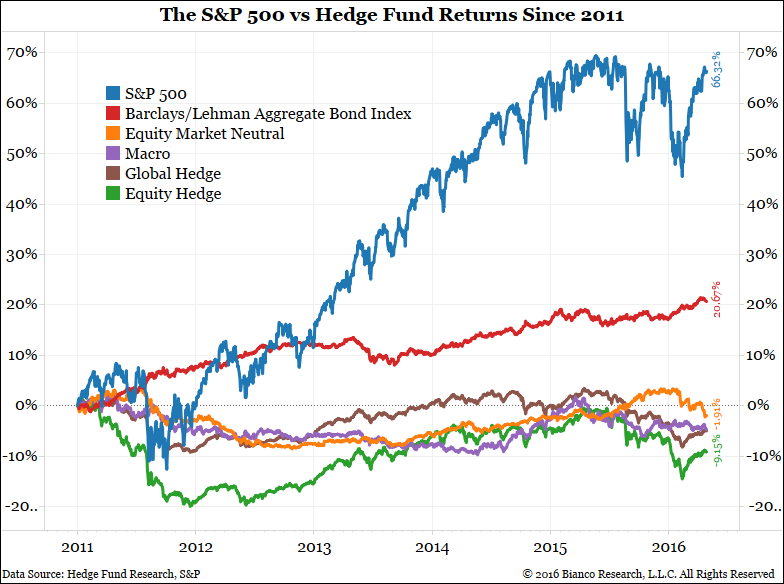

The 10 Things We Fear in Markets

The 10 Things We Fear in Markets They all have one thing in common — they are beyond our control. Bloomberg, October 31, 2016 ...

Wall Street Strategists Are Bearish (and that’s good news!)

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

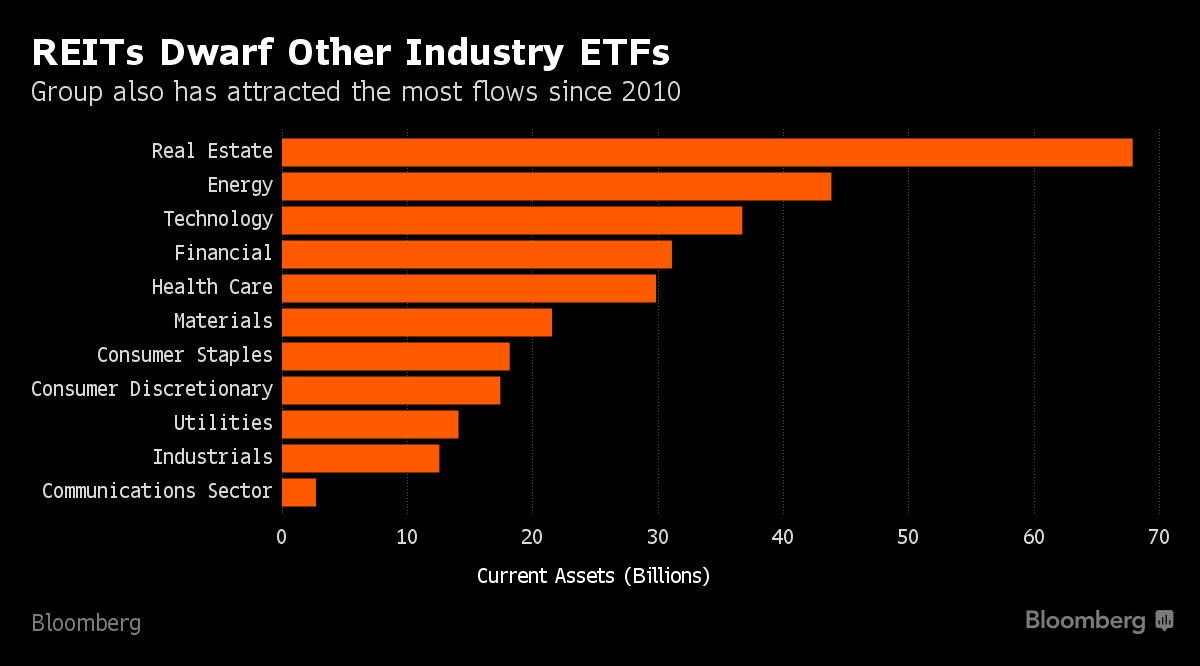

REITs are Awesome !

For the first time since 1999, the Standard & Poor’s 500 Index is being reconfigured. The last time was when technology was...

For the first time since 1999, the Standard & Poor’s 500 Index is being reconfigured. The last time was when technology was...

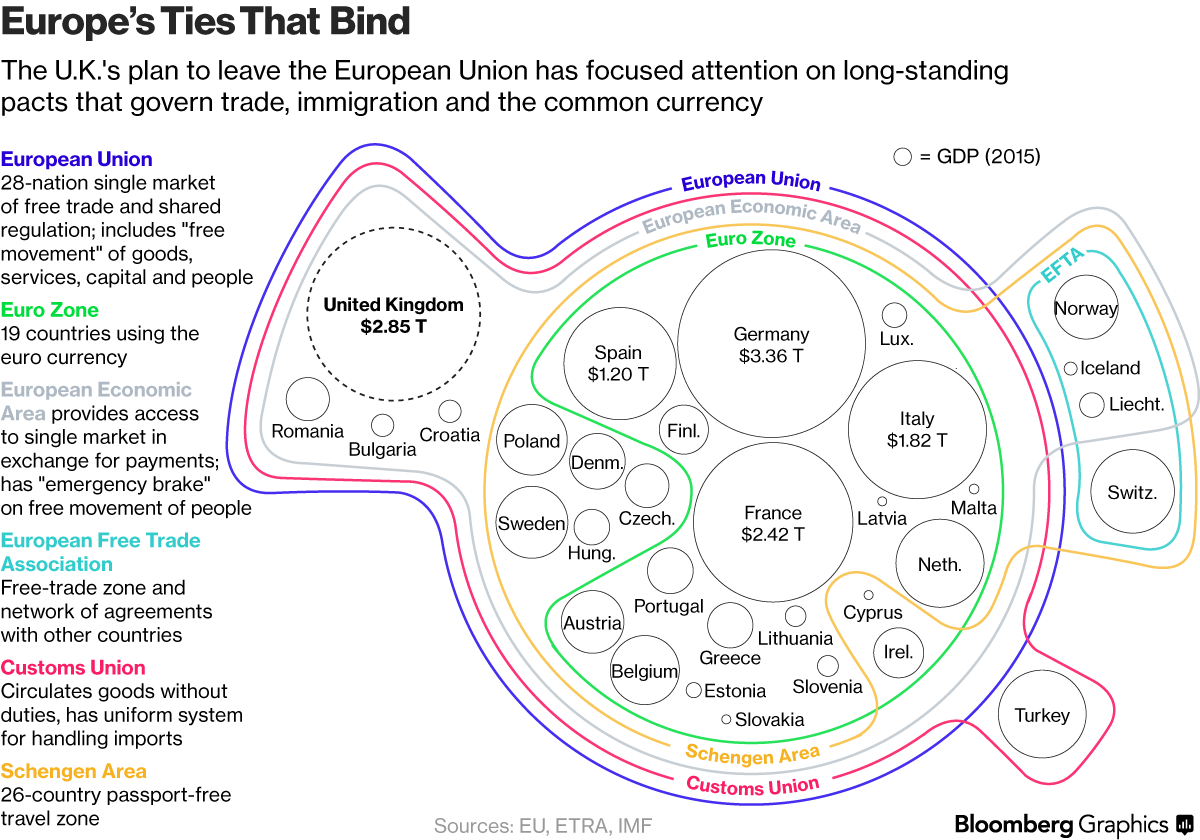

How U.K. and Europe Might Relate After Breakup

The U.K. and Europe can’t exactly go their own ways once their divorce is finalized… Source: Bloomberg

The U.K. and Europe can’t exactly go their own ways once their divorce is finalized… Source: Bloomberg

When “Fringe” Sentiment Dominates Psychology

It is never wise to ignore market, economic or voter sentiment. Discount it, yes. Put it into broader context, for sure. But ignore it at...

It is never wise to ignore market, economic or voter sentiment. Discount it, yes. Put it into broader context, for sure. But ignore it at...