If You’re Contrarian, You’re Like Everyone Else

“Romanticizing that you are a contrarian when you are indistinguishable from consensus can’t be good.” The...

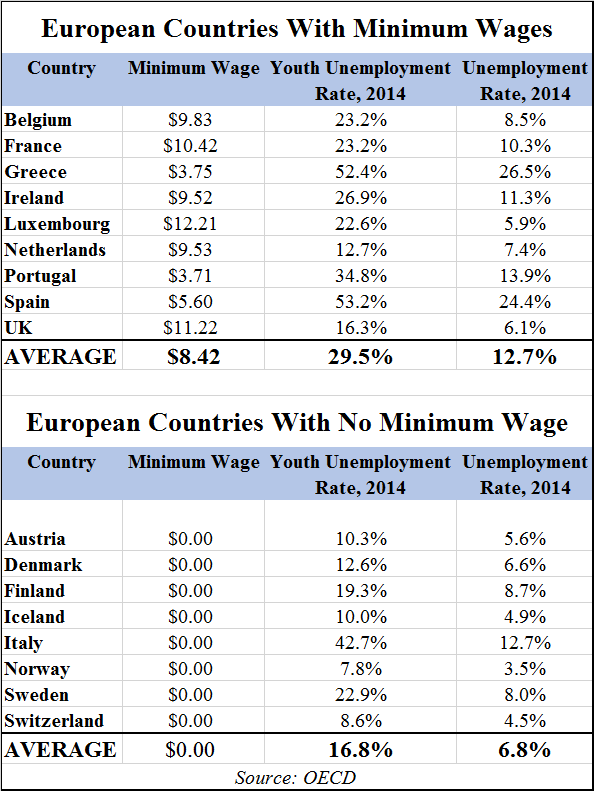

@TBPInvictus In his latest screed against the minimum wage, Mark Perry goes international in an attempt to demonstrate that countries...

@TBPInvictus In his latest screed against the minimum wage, Mark Perry goes international in an attempt to demonstrate that countries...

My Sunday Washington Post Business Section column is out. This morning, we look at what you can do — right now —...

My Sunday Washington Post Business Section column is out. This morning, we look at what you can do — right now —...

Grilled Cheese and $100 Million of Irrational Exuberance Grilled Cheese Truck market valuation may be a sign of excess in financial...

Grilled Cheese and $100 Million of Irrational Exuberance Grilled Cheese Truck market valuation may be a sign of excess in financial...

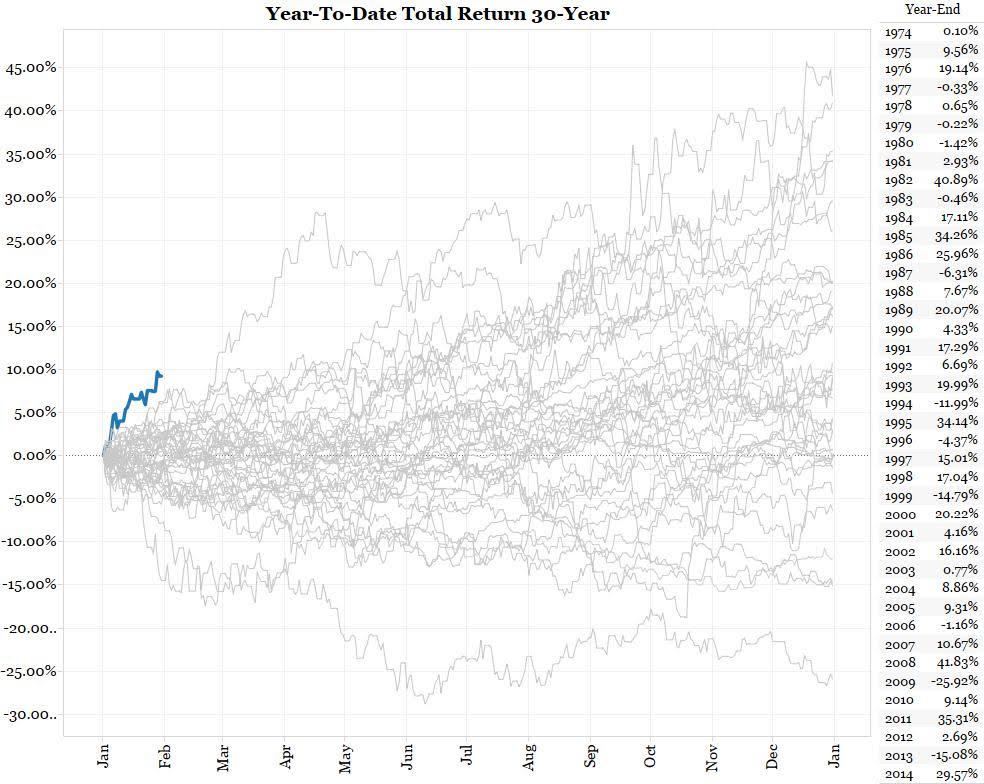

“Some day interest rates will go up. Until then the Treasury bears are missing one of the greatest bond rallies in history.” —...

“Some day interest rates will go up. Until then the Treasury bears are missing one of the greatest bond rallies in history.” —...

Investment Signals in a Magazine Cover The magazine cover story for a general news magazine can serve as a contrary investment indicator....

Investment Signals in a Magazine Cover The magazine cover story for a general news magazine can serve as a contrary investment indicator....

Get subscriber-only insights and news delivered by Barry every two weeks.