Playboy Bunnies, Mila Kunis and the Myth of the Celebrity...

Kenny G and the Playmate Stock-Pickers Celebrity stock-pickers get lots of attention from the news media, but they probably...

Source: Barron’s If you have been paying any kind of attention to the mainstream media the past few years, you may...

Source: Barron’s If you have been paying any kind of attention to the mainstream media the past few years, you may...

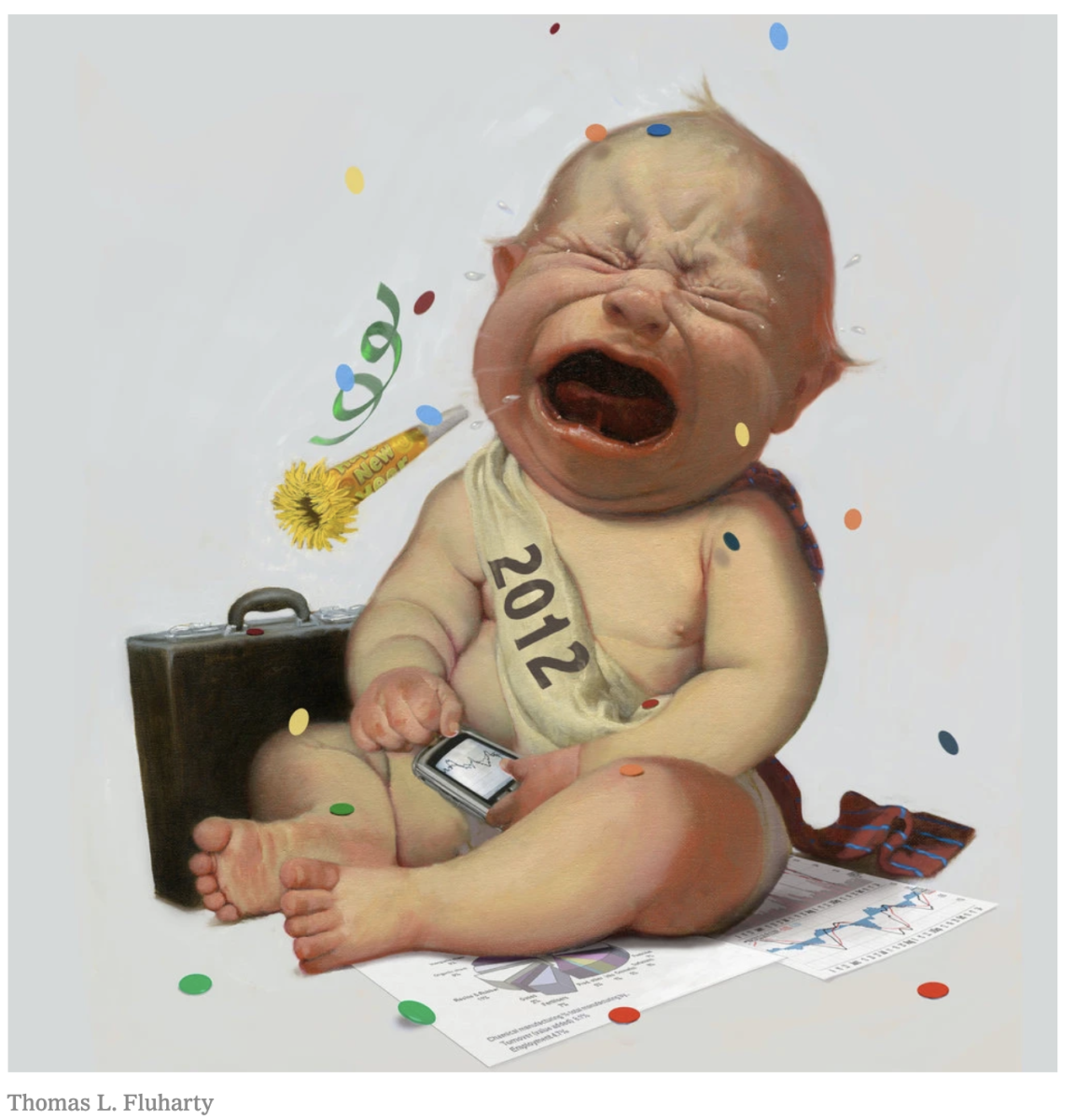

Uh-oh: “I Just Got Here, but I Know Trouble When I See It” > That headline and image is the cover page of the Sunday NYT...

Uh-oh: “I Just Got Here, but I Know Trouble When I See It” > That headline and image is the cover page of the Sunday NYT...

I have a commentary on the Time Magazine article coming this week — I find it is both inaccurate and misleading — but...

I have a commentary on the Time Magazine article coming this week — I find it is both inaccurate and misleading — but...

A few caveats with contrary indicators such as below: First, they are quite imprecise in terms of time. Recall the August 13, 1979...

A few caveats with contrary indicators such as below: First, they are quite imprecise in terms of time. Recall the August 13, 1979...

>"Dude, you owned this story all weekend." >So said one of the many comments we received over our weekend Freddie (FRE)...

>"Dude, you owned this story all weekend." >So said one of the many comments we received over our weekend Freddie (FRE)...

Get subscriber-only insights and news delivered by Barry every two weeks.