Chuck Trafton, EDLY ISA

Every now and again, I come across someone I want to interview but they aren’t quite the right fit for MiB. Either the firm is too...

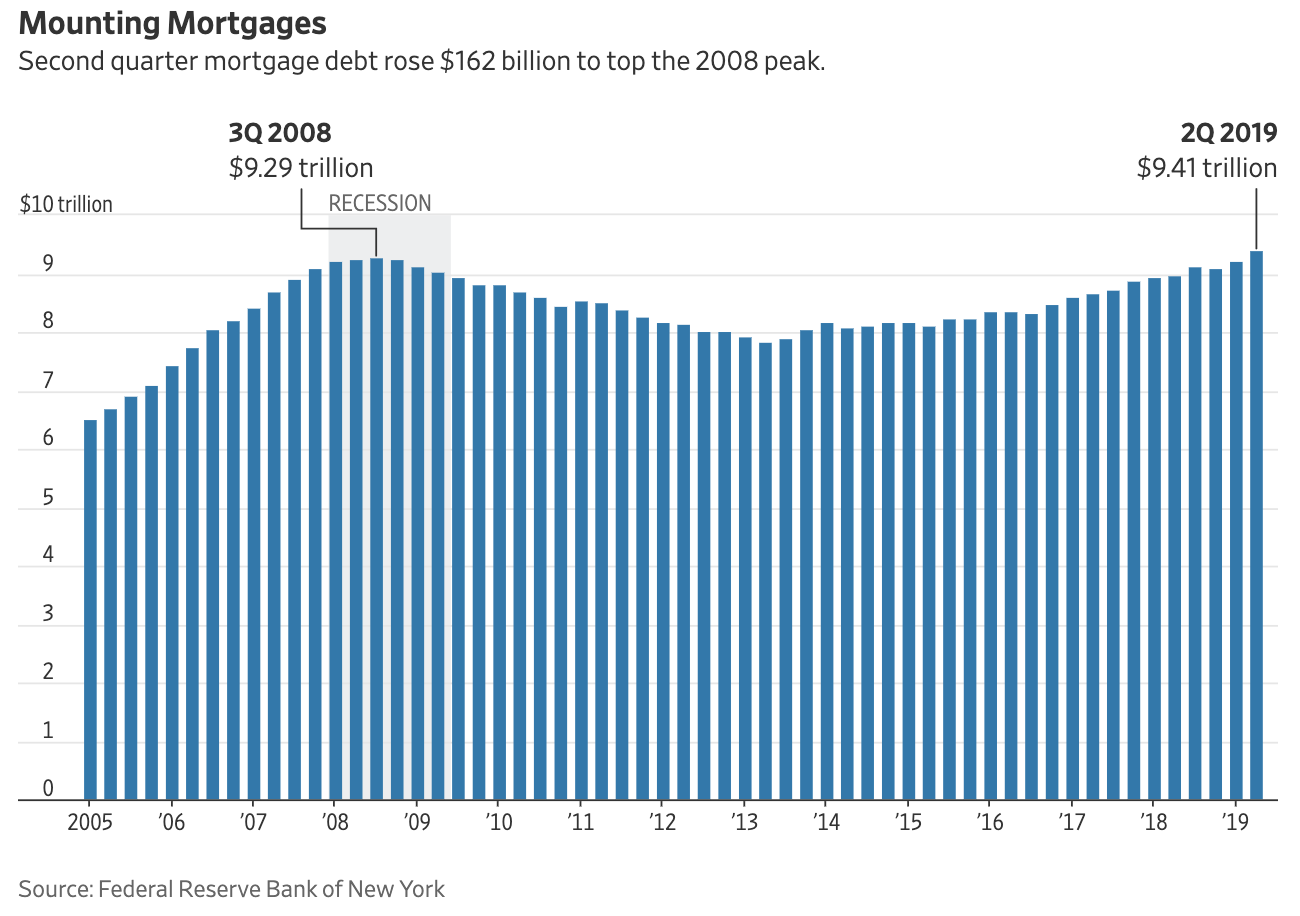

Source: WSJ File this one under more “denominator blindness:” Every now and again, a data point comes along...

Source: WSJ File this one under more “denominator blindness:” Every now and again, a data point comes along...

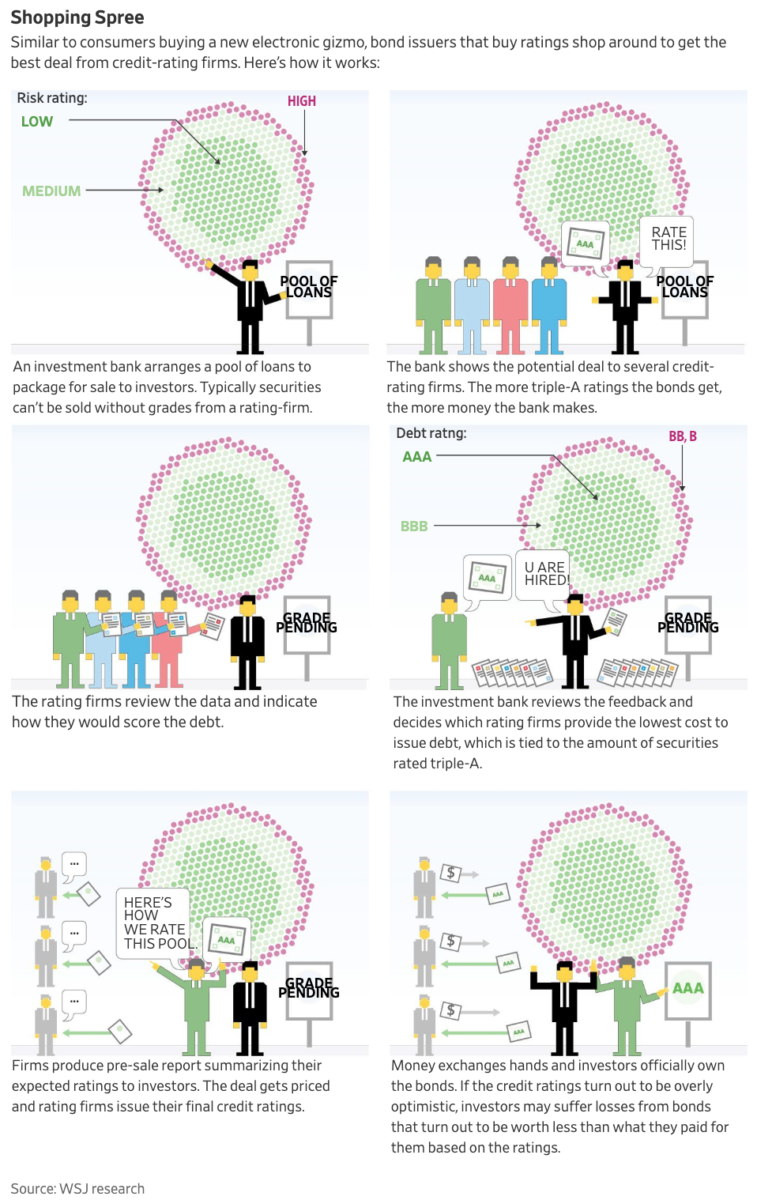

I was away last week when this monster piece came out in the WSJ. This issue has intrigued me since 2007, but for those of you not up to...

I was away last week when this monster piece came out in the WSJ. This issue has intrigued me since 2007, but for those of you not up to...

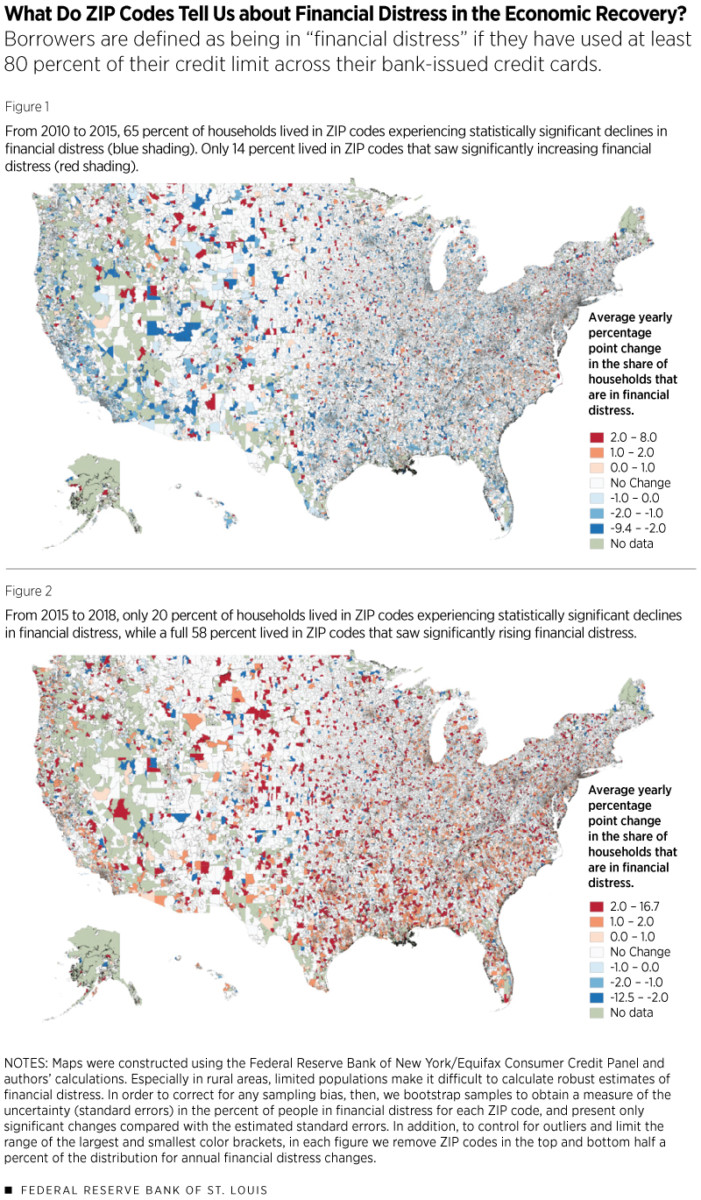

There is a fascinating research piece by the St. Louis Federal Reserve Bank: The Unequal Recovery: Measuring Financial Distress by ZIP...

There is a fascinating research piece by the St. Louis Federal Reserve Bank: The Unequal Recovery: Measuring Financial Distress by ZIP...

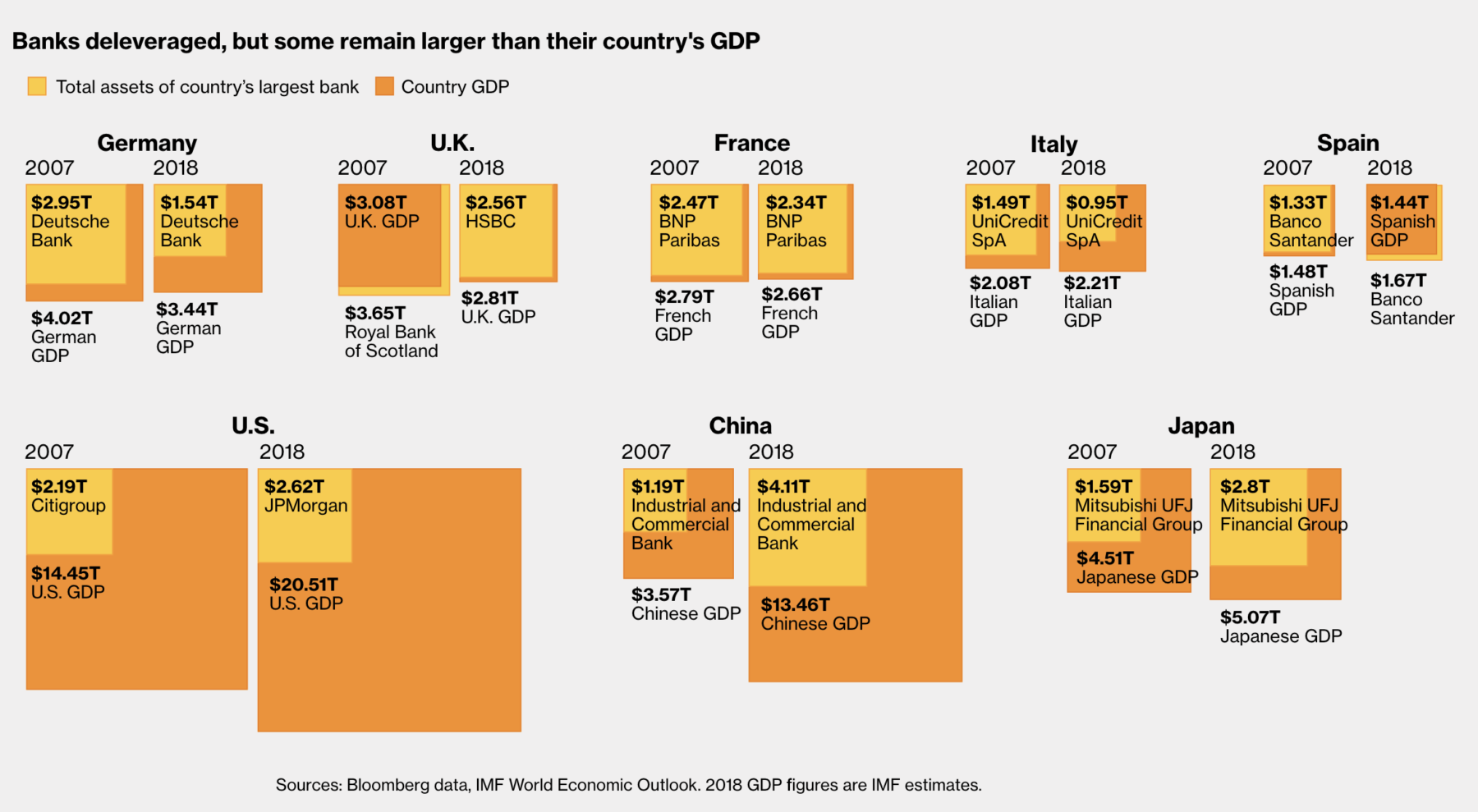

Great collection of charts by John Authers and Lauren Leatherby looking at “The Decade of Deleveraging Didn’t Quite Turn Out That...

Great collection of charts by John Authers and Lauren Leatherby looking at “The Decade of Deleveraging Didn’t Quite Turn Out That...

Get subscriber-only insights and news delivered by Barry every two weeks.