Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...

Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...

Read More

The transcript from this month’s MIB Live with Ray Dalio, is below. You can stream/download the full conversation, including...

Read More

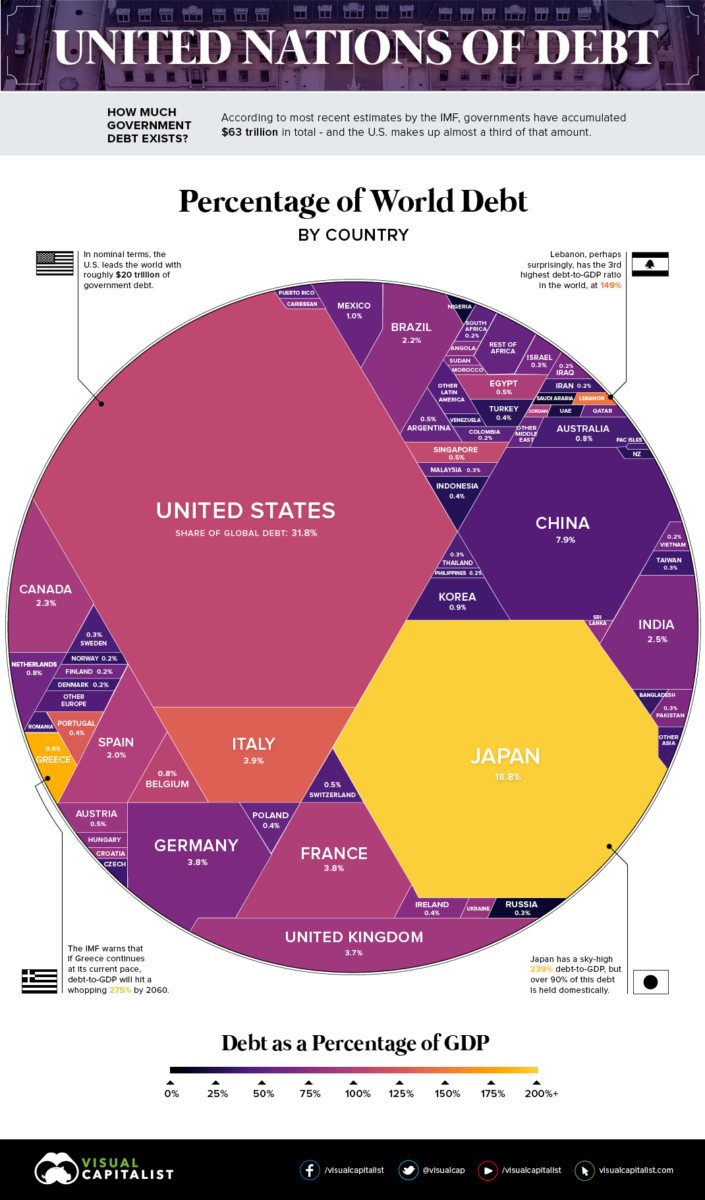

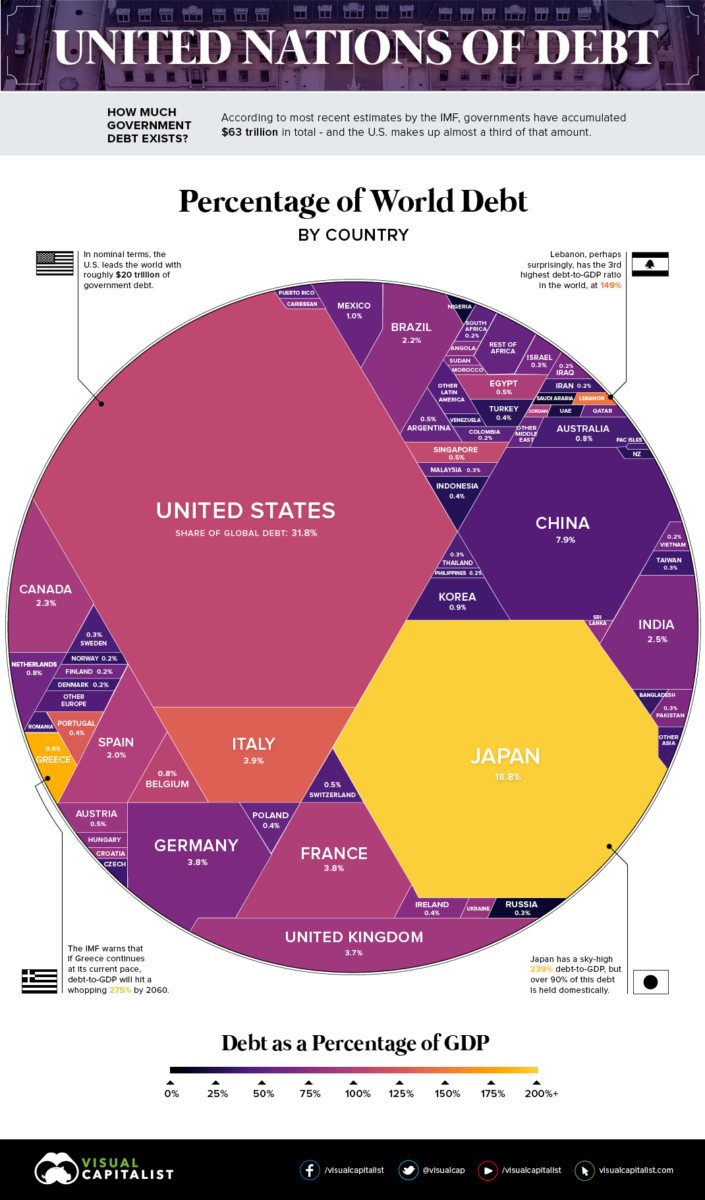

Source: World Economic Forum Interesting discussion from WEF: Historically, the cycle of interest rate hikes by the Federal...

Source: World Economic Forum Interesting discussion from WEF: Historically, the cycle of interest rate hikes by the Federal...

Read More

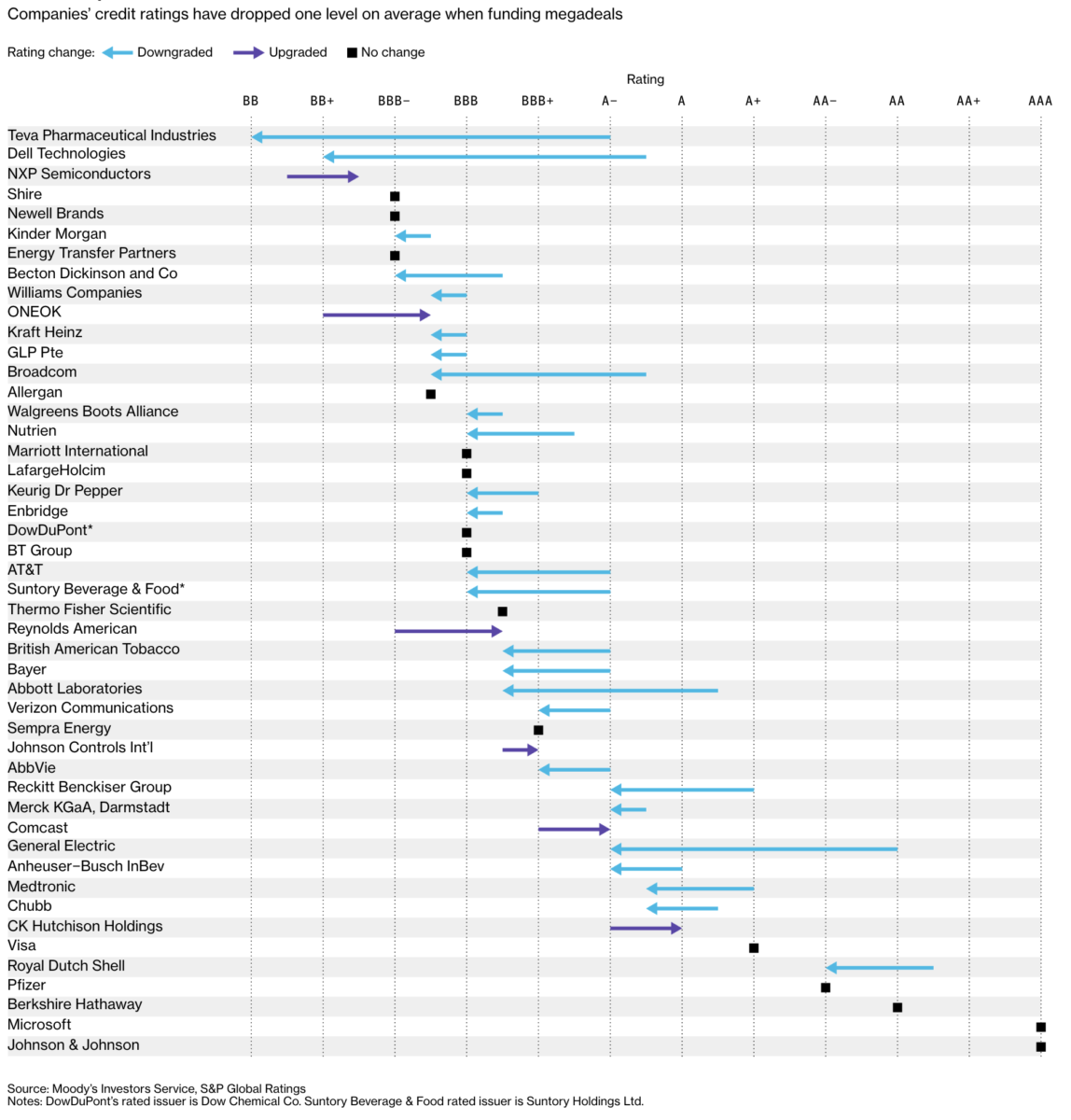

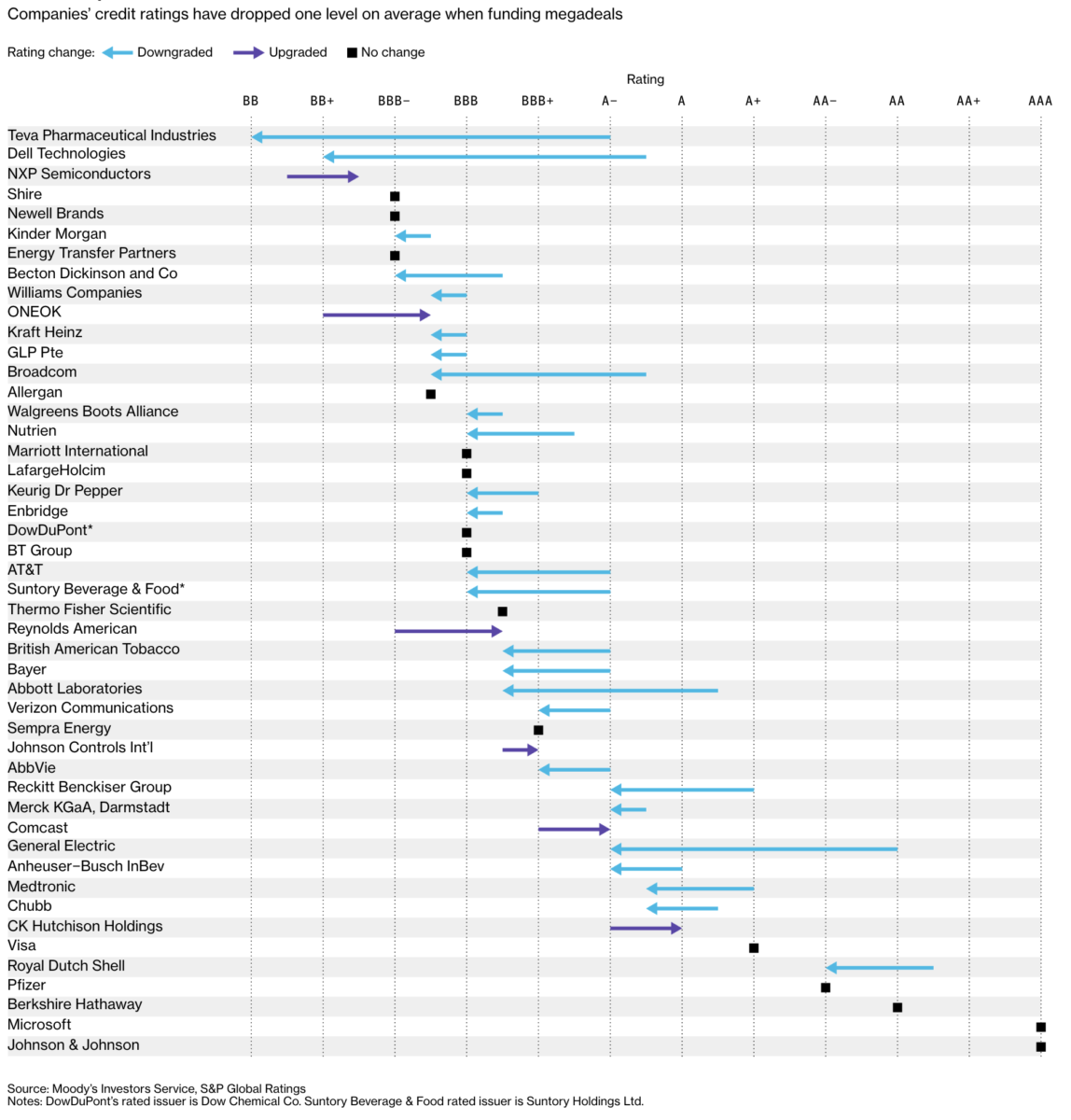

A Bloomberg column I referenced in Thursday’s reads has a few huge graphics; this one in particular I wanted to make sure no one...

A Bloomberg column I referenced in Thursday’s reads has a few huge graphics; this one in particular I wanted to make sure no one...

Read More

Making a killing in a crisis is easy! “All you had to do was have money to spend and the nerve to spend to it. You didn’t need...

Read More

The transcript from this week’s MIB: Howard Marks, Oaktree Capital is below. You can stream/download the full...

Read More

This week on our Masters in Business radio podcast, we speak with our 3 time returning champion Howard Marks of Oaktree Capital. (You...

Read More

Iceland Found Another Way to Clean Up a Financial Crisis Unlike the U.S., the country let its banks fail and bailed out lots of...

Read More

Dalio Says Next Downturn Is ‘Couple of Years’ Away Dalio Says ‘Time to Buy Is When There’s Blood in the...

Read More

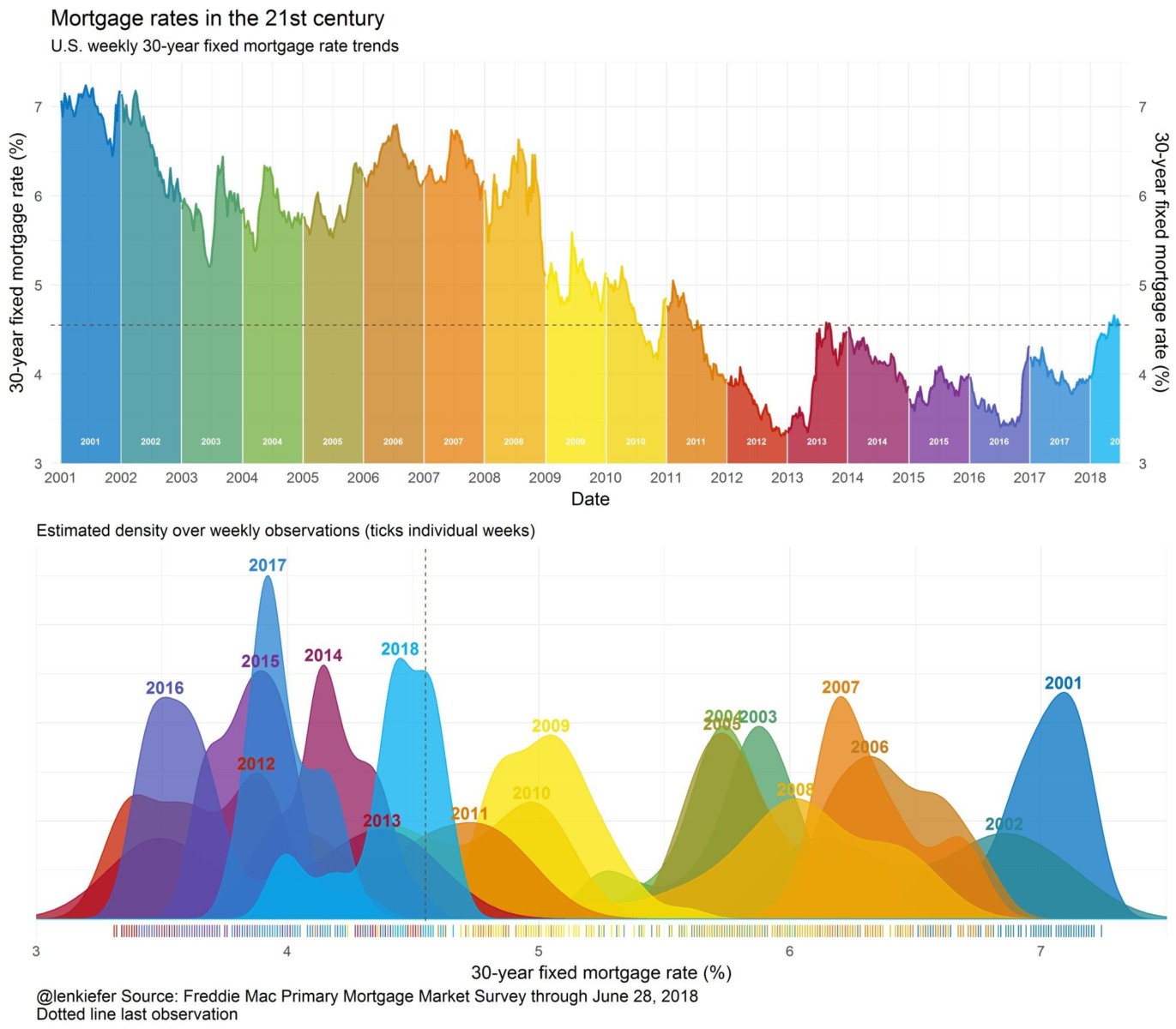

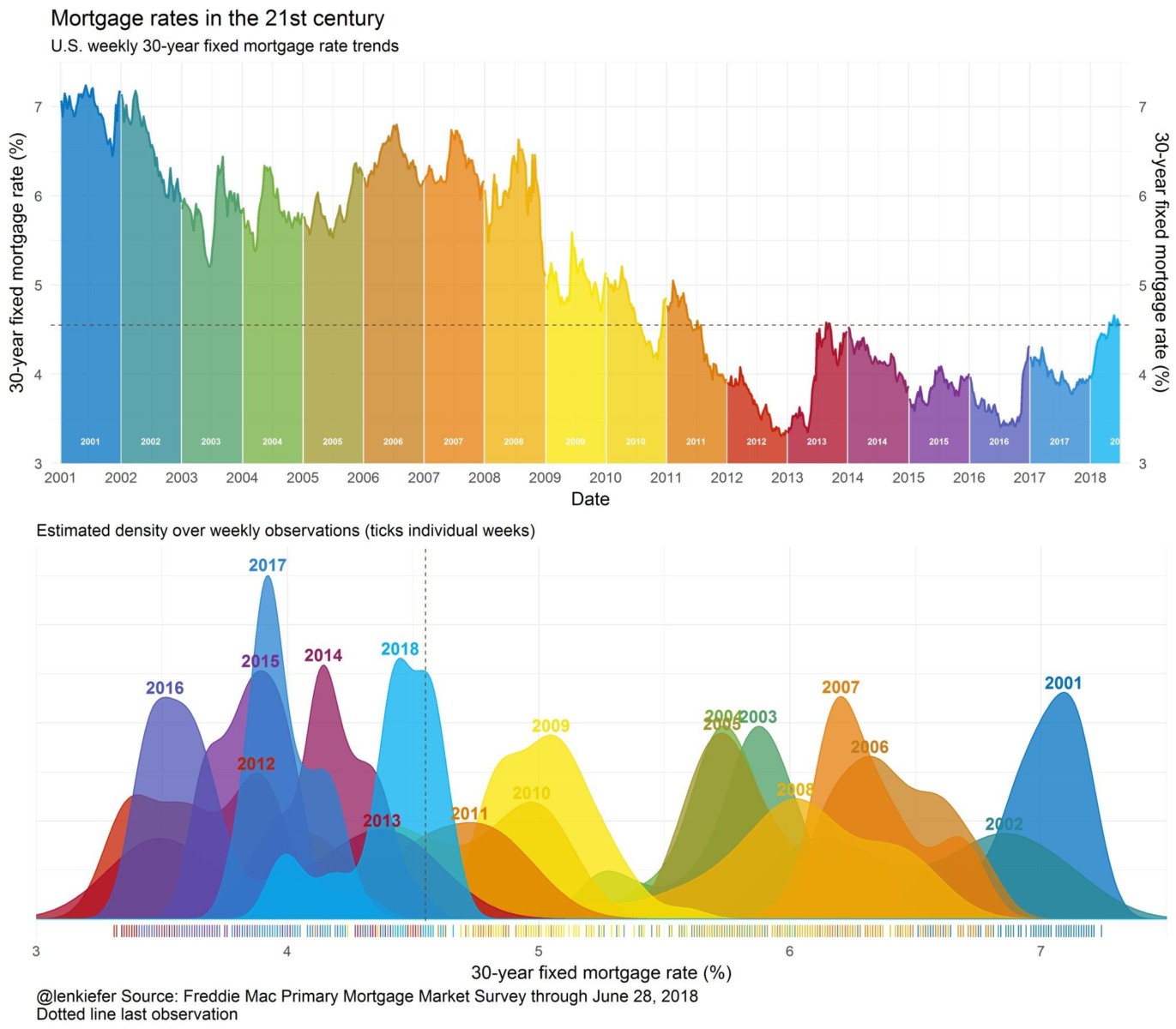

Via Jonathan Miller (Miller Samuel) comes this wonderful chart of mortgage rates per year since 2000: click for ginormous graphic...

Via Jonathan Miller (Miller Samuel) comes this wonderful chart of mortgage rates per year since 2000: click for ginormous graphic...

Read More

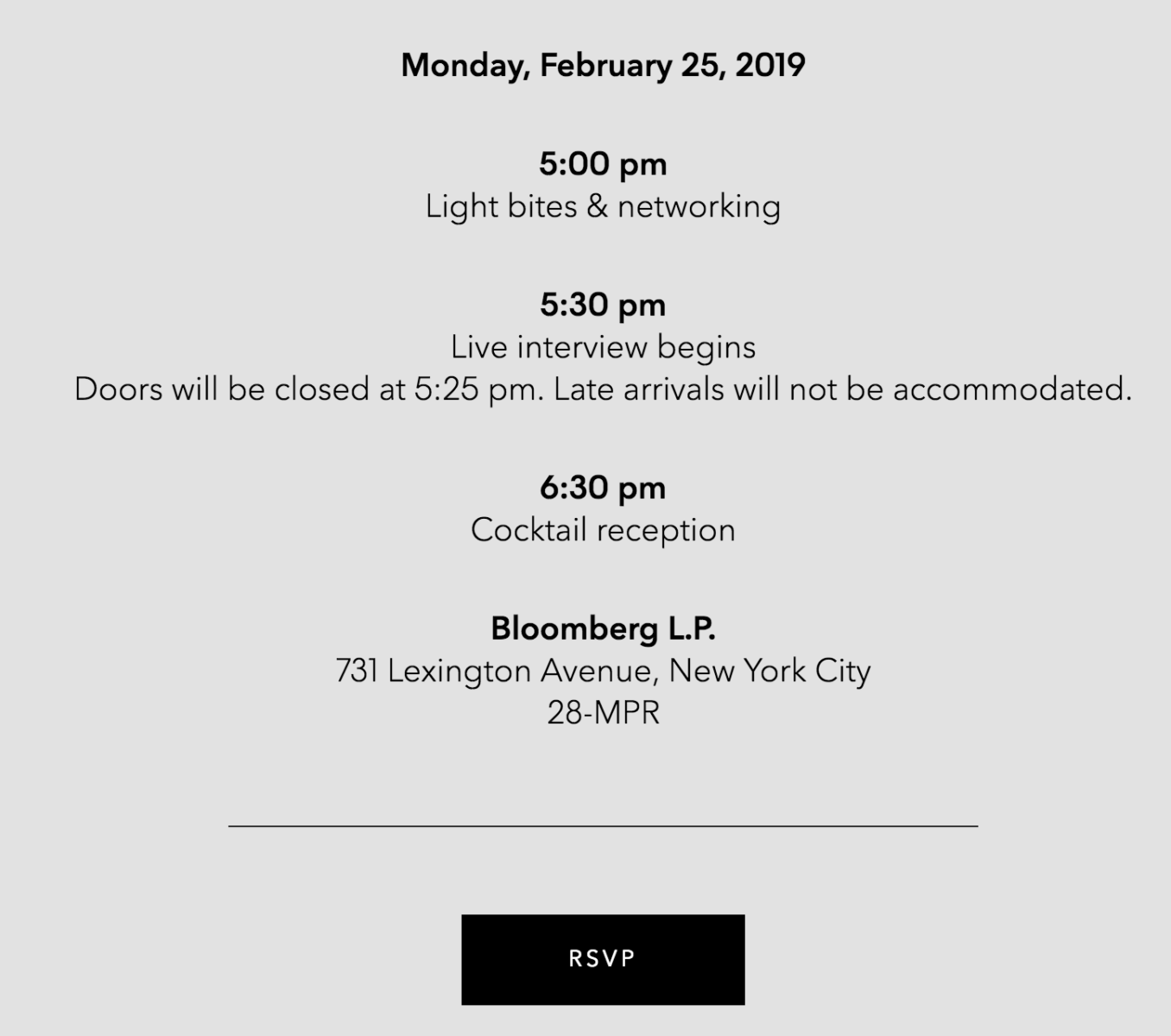

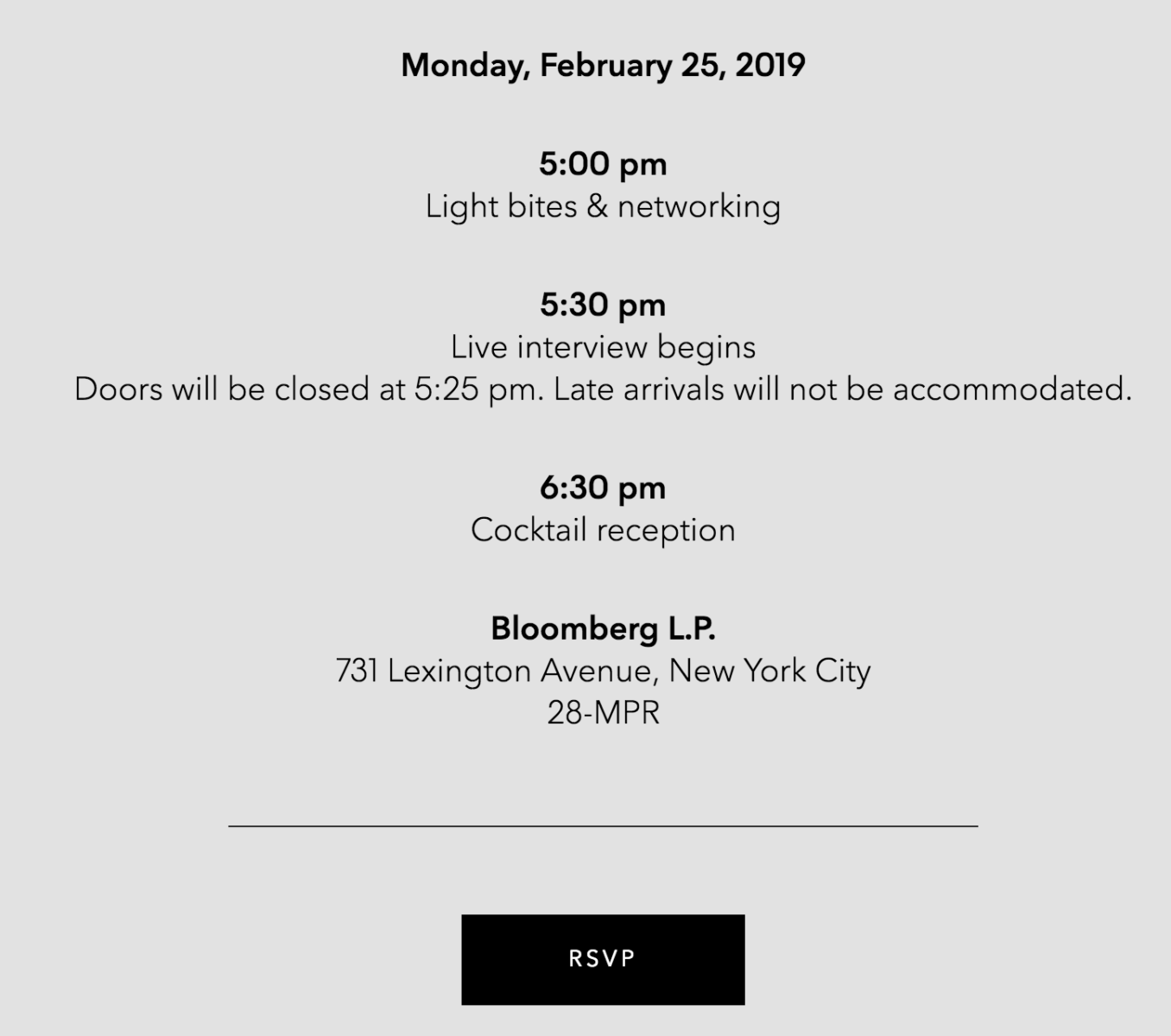

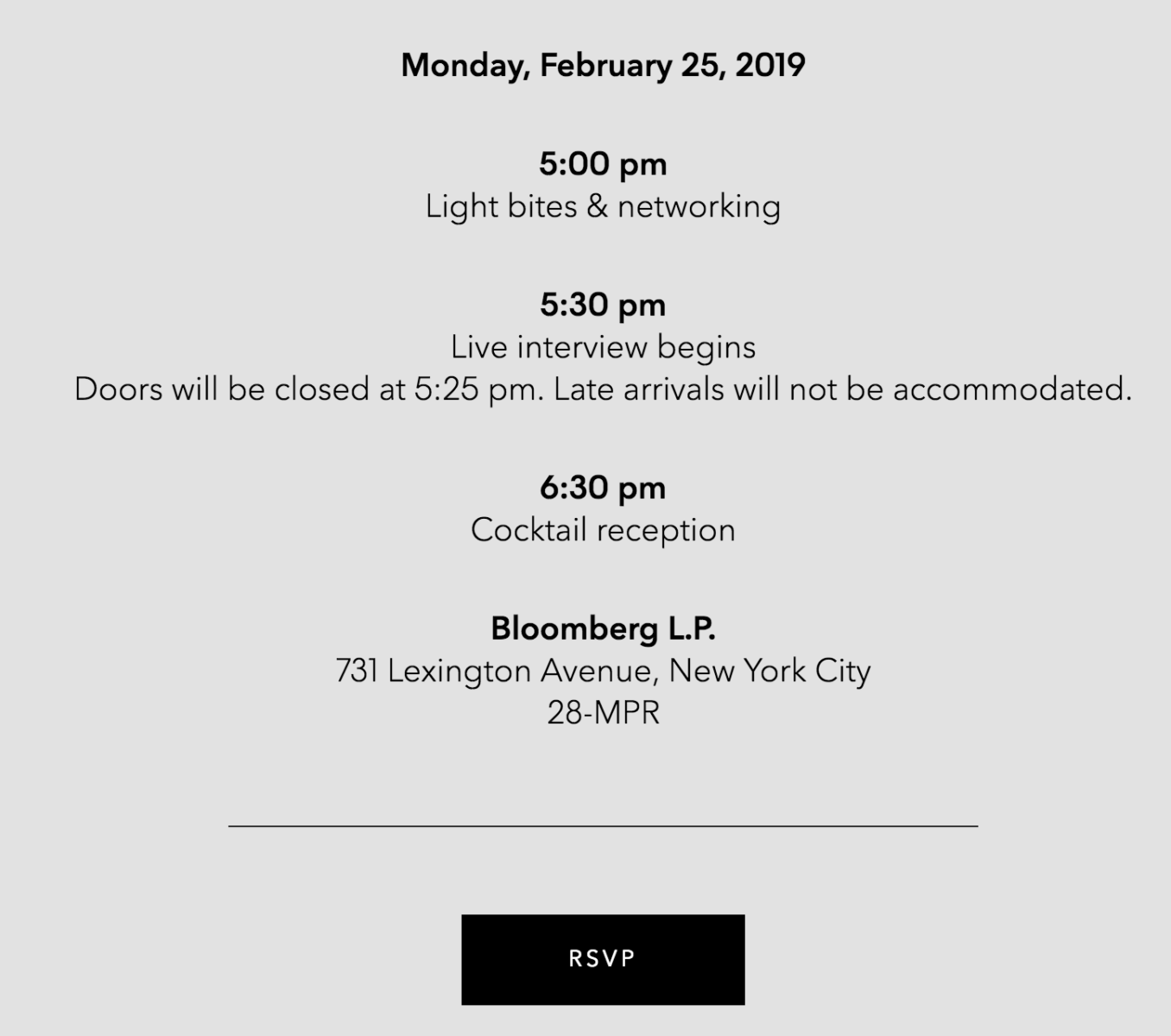

Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...

Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...

Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...

Last month, we hosted the very first Masters in Business Live podcast. It was with Ray Dalio, and it worked out rather well. Ray...