“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

Read More

Barry Ritholtz, a Bloomberg Opinion columnist, talks Bitcoin and Banks with Bloomberg’s Tom Keene and Lisa Abramowicz on...

Read More

This week, we speak with Duke University finance professor Campbell Harvey. Since 2014, his Fuqua School of Business...

Read More

A friend accidentally sent me an invite to a metals and mining conference. She knows I was bullish on Gold in the mid-2000s...

A friend accidentally sent me an invite to a metals and mining conference. She knows I was bullish on Gold in the mid-2000s...

Read More

I weigh in on the cryptocurrency debate with Tom Keene and Lisa Abramowicz Bitcoin ‘Lacks Teeth’ of Traditional...

Read More

Source: Trading View To hear an audio spoken word version of this post, click here. What do you get of you...

Source: Trading View To hear an audio spoken word version of this post, click here. What do you get of you...

Read More

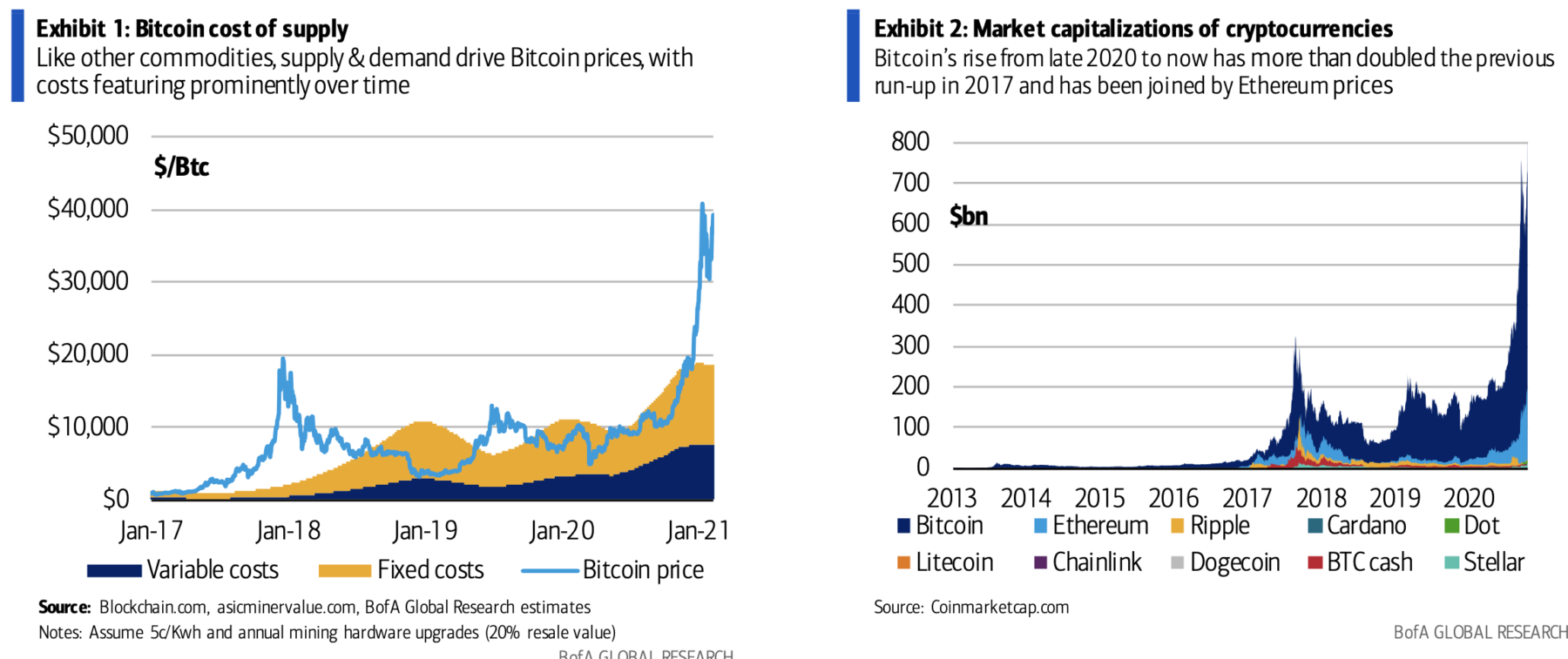

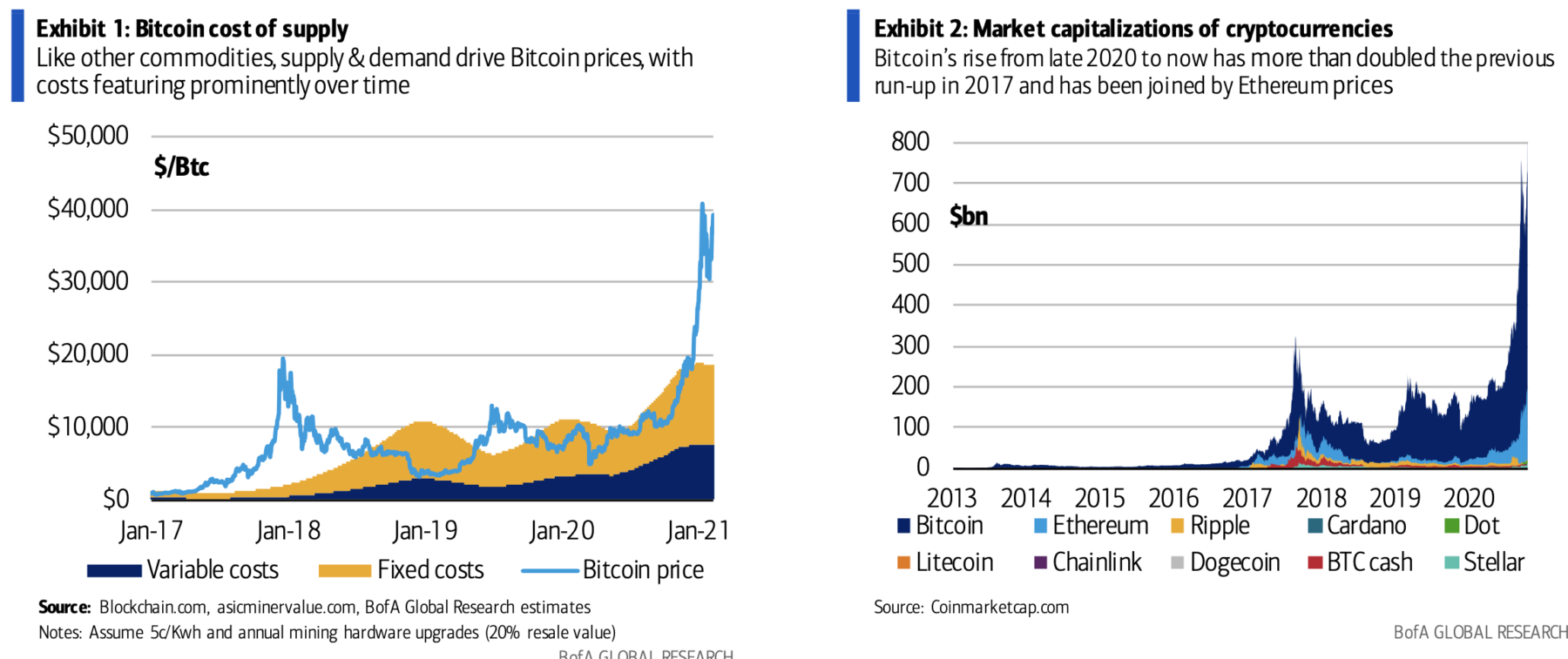

Do you understand Bitcoin and Blockchain? I don’t mean abstractly, I mean specifically, do you grok it as a trader or...

Do you understand Bitcoin and Blockchain? I don’t mean abstractly, I mean specifically, do you grok it as a trader or...

Read More

Nearly 90% of international transactions in 2019 were in U.S. dollars, giving the U.S. extraordinary power over nearly every...

Read More

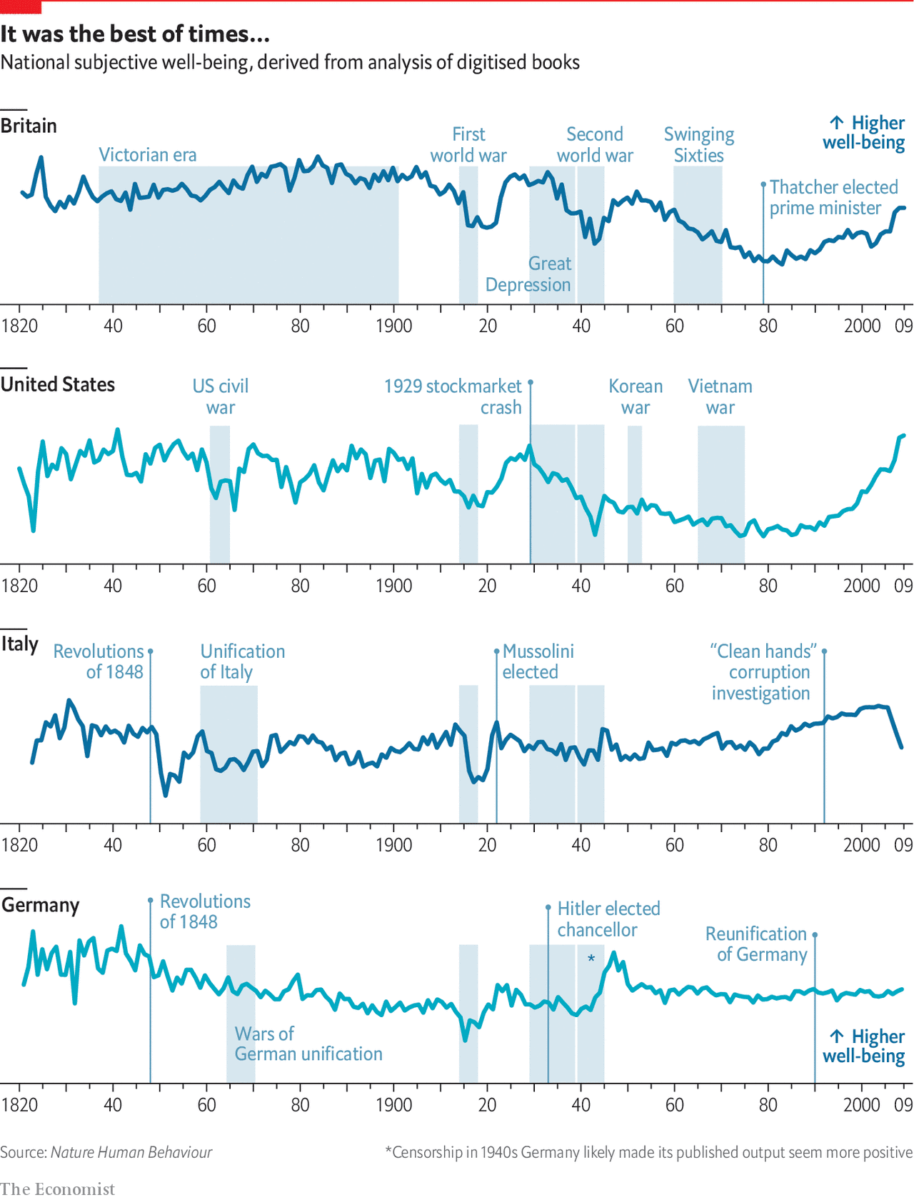

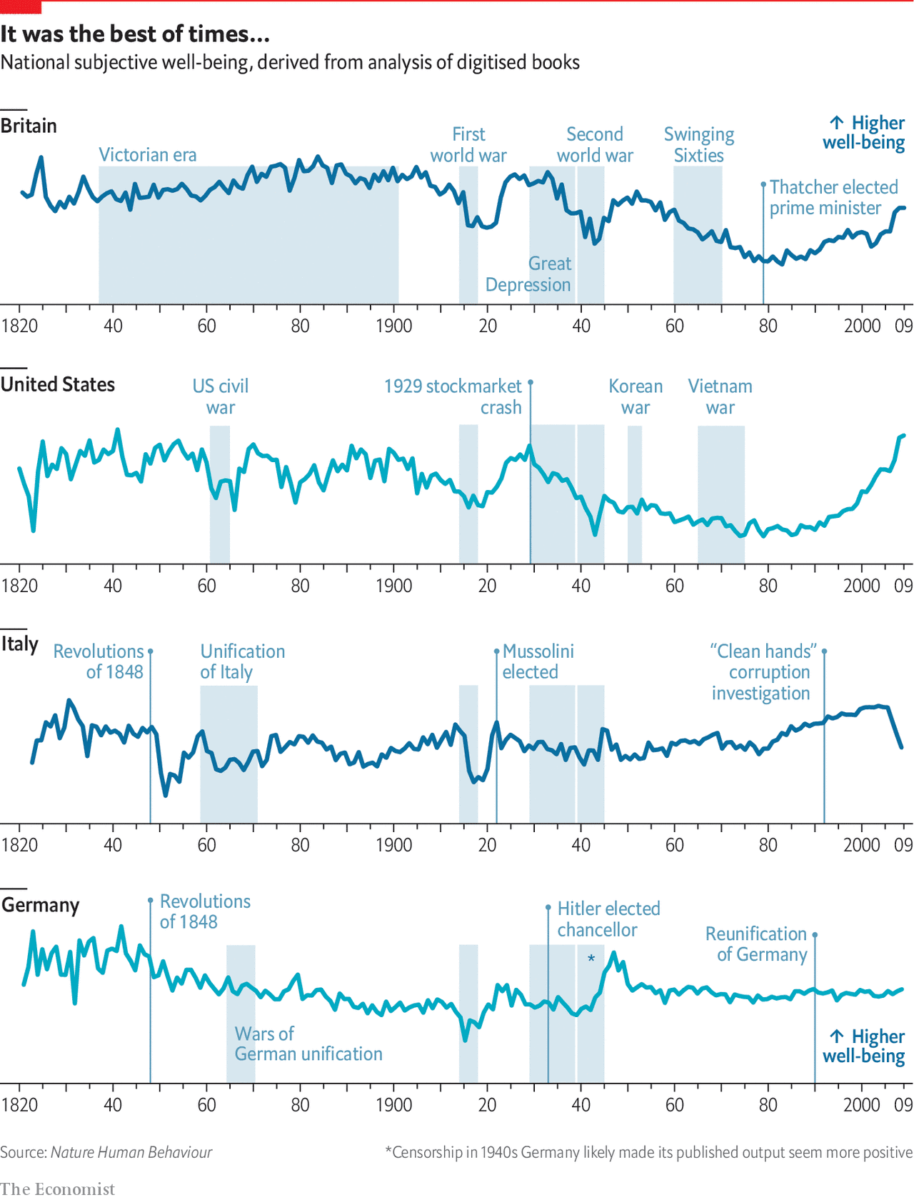

Can money buy happiness? Two centuries’ worth of books suggest it can Source: The Economist This is a fascinating look at...

Can money buy happiness? Two centuries’ worth of books suggest it can Source: The Economist This is a fascinating look at...

Read More

In 1966, Australia switched from pounds to decimal currency. The country’s central bank issued a new range of banknotes with modern...

Read More

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...