MIB: How to recover from a setback

Imagine you are the founders of an early a social-networking website at an Ivy league school. You want top expand the footprint, so you...

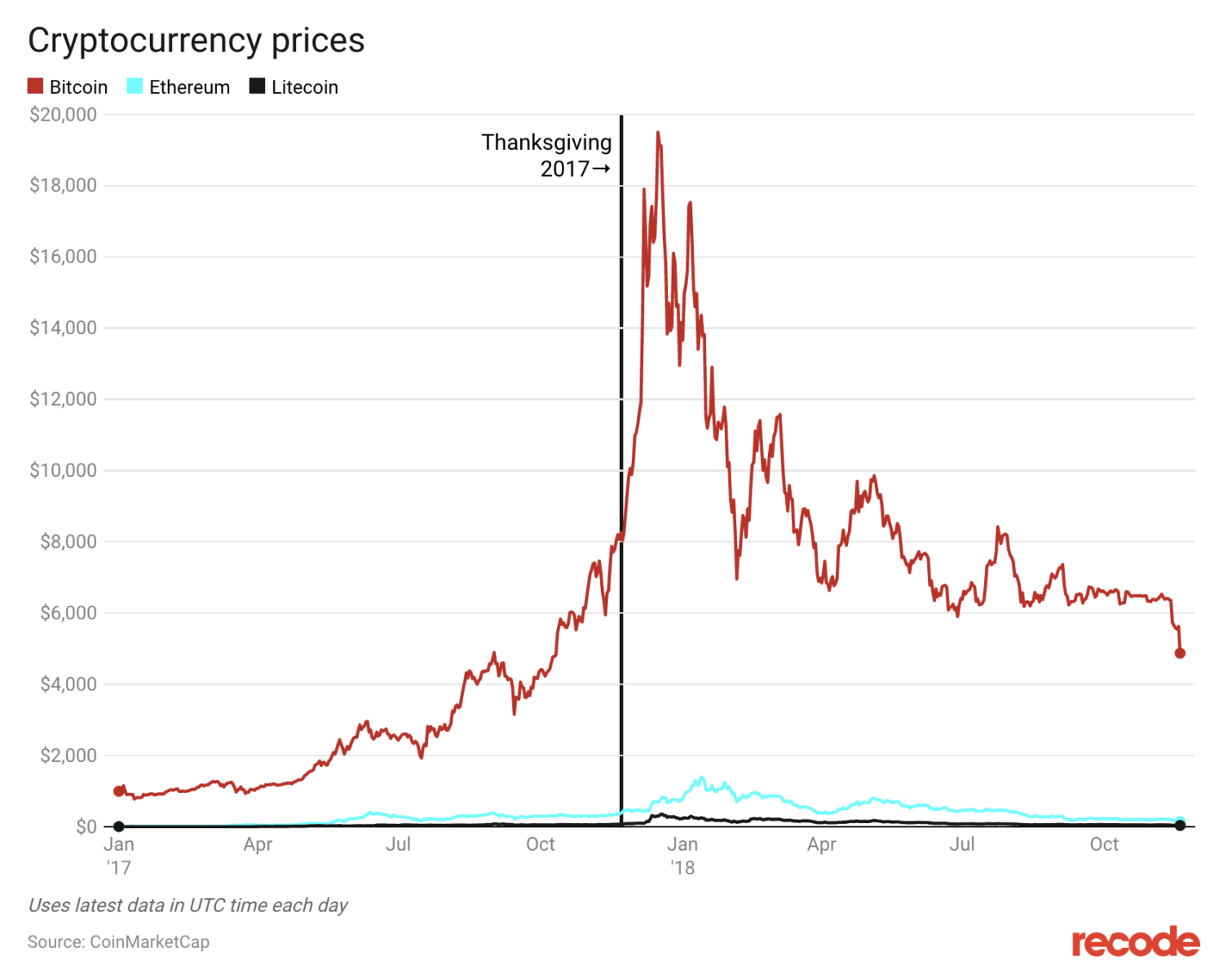

Some good advice from the folks at Recode: “So in case the people around your table bought into crypto last year and didn’t get...

Some good advice from the folks at Recode: “So in case the people around your table bought into crypto last year and didn’t get...

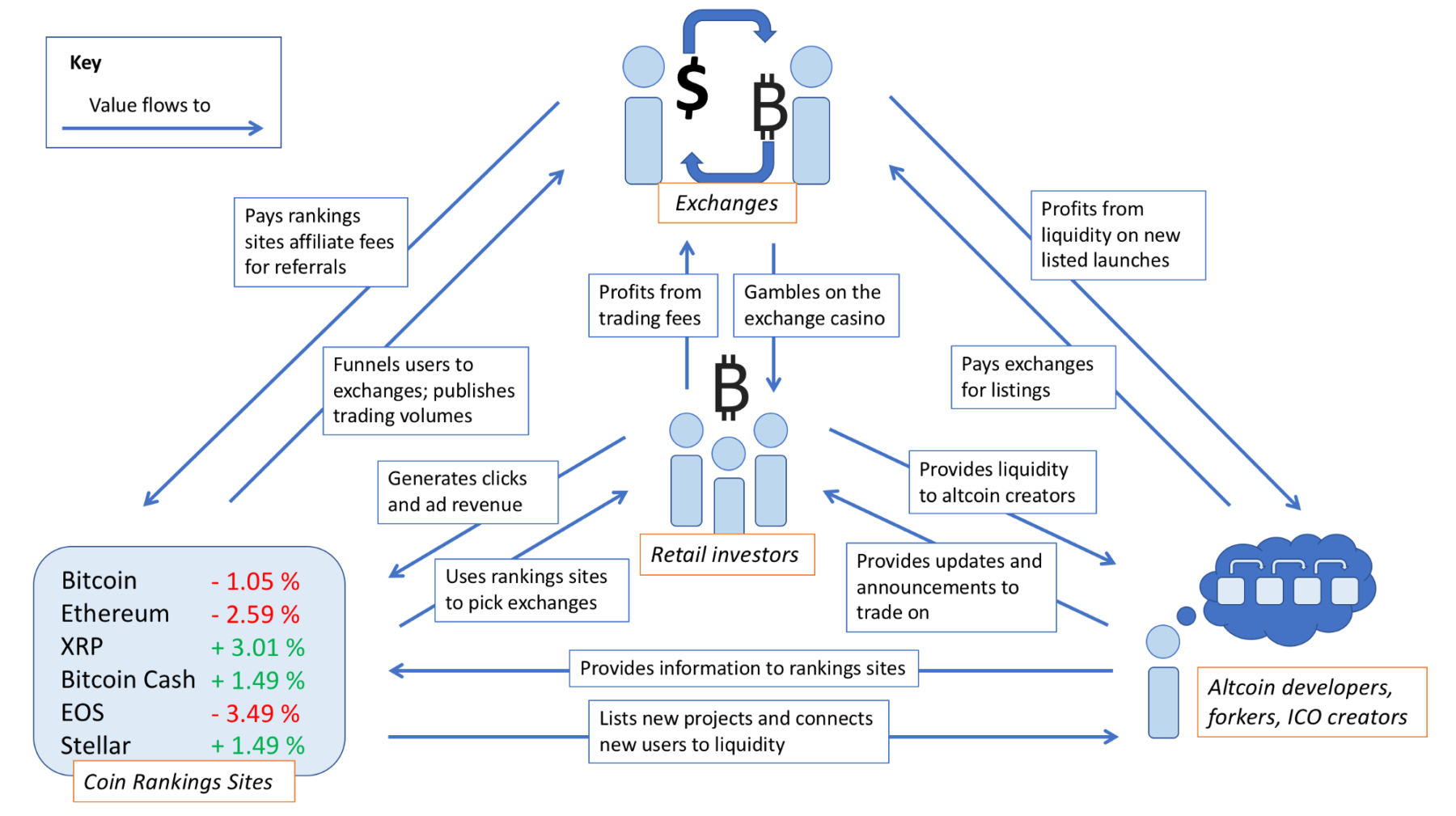

In today’s morning reads, I linked to this Medium column, which is worth reading idf you are interested in this sort of stuff:...

In today’s morning reads, I linked to this Medium column, which is worth reading idf you are interested in this sort of stuff:...

Get subscriber-only insights and news delivered by Barry every two weeks.