What Do You Wish Someone Told You About Money When You Were...

“What’s the one thing about money you wish someone told you when you were younger?” All About Your Benjamins The Podcast Ep....

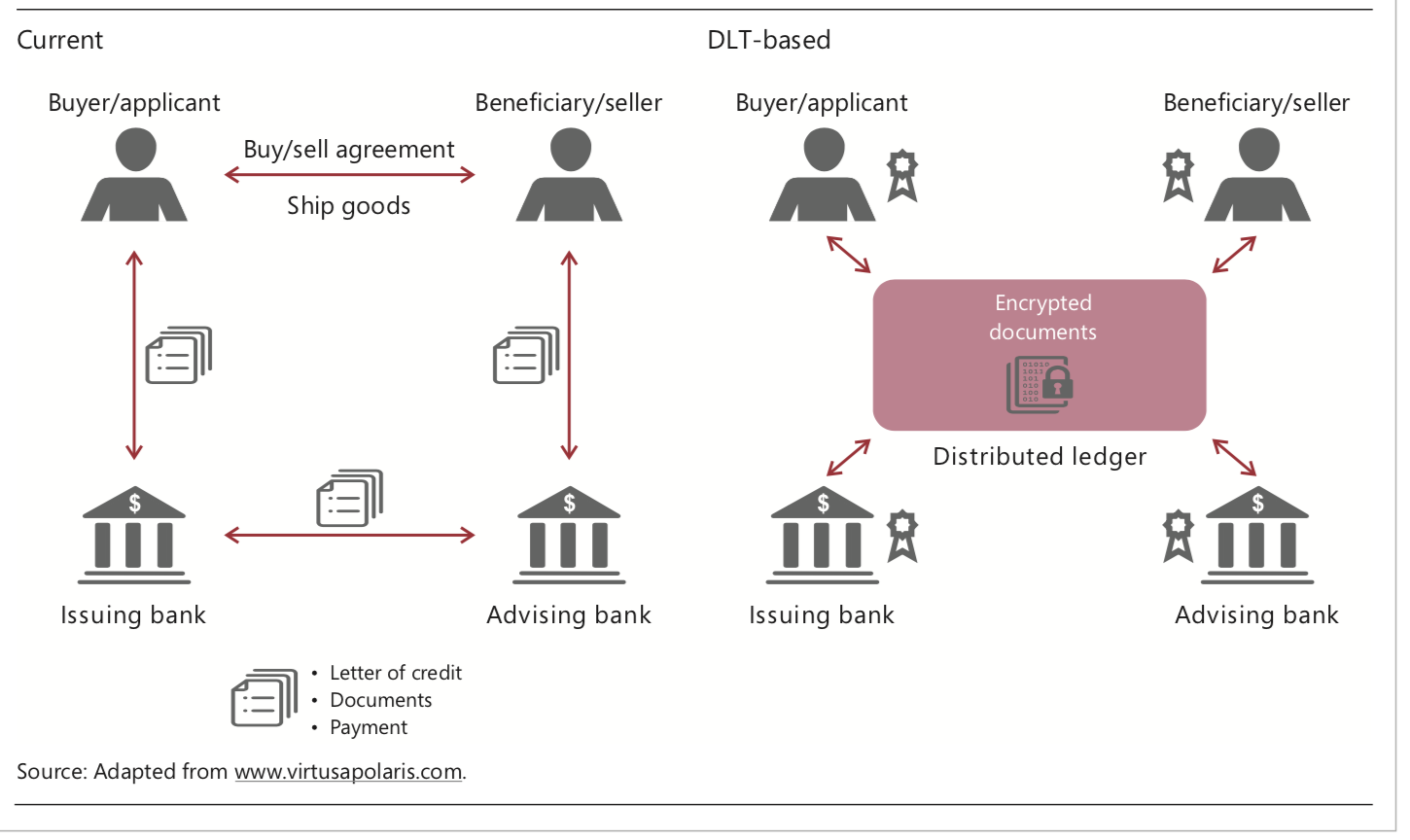

Fascinating discussion from Bank for International Settlements (BIS) about crypto currencies: “Cryptocurrencies promise to replace...

Fascinating discussion from Bank for International Settlements (BIS) about crypto currencies: “Cryptocurrencies promise to replace...

Would a Central Bank Digital Currency disrupt monetary policy? Ben Dyson and Jack Meaning Bank Underground, 30 MAY 2018 ...

Would a Central Bank Digital Currency disrupt monetary policy? Ben Dyson and Jack Meaning Bank Underground, 30 MAY 2018 ...

How Futures Trading Changed Bitcoin Prices Galina Hale, Arvind Krishnamurthy, Marianna Kudlyak, and Patrick Shultz FRBSF Economic Letter,...

How Futures Trading Changed Bitcoin Prices Galina Hale, Arvind Krishnamurthy, Marianna Kudlyak, and Patrick Shultz FRBSF Economic Letter,...

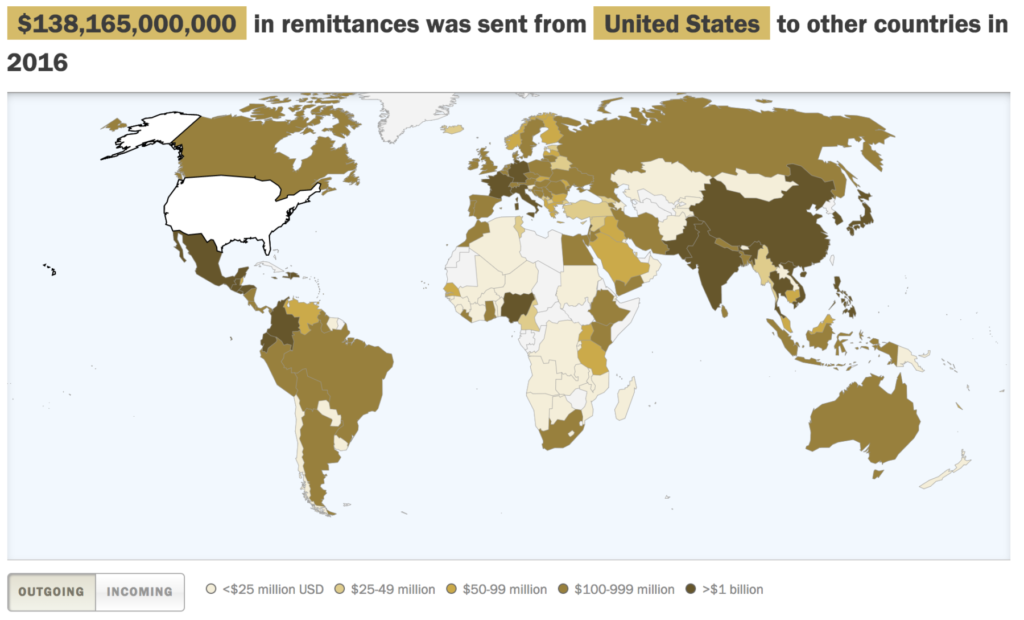

click for ginormous graphic Source: Pew Research Center This is kinda intriguing: You can track the flows of remittances...

click for ginormous graphic Source: Pew Research Center This is kinda intriguing: You can track the flows of remittances...

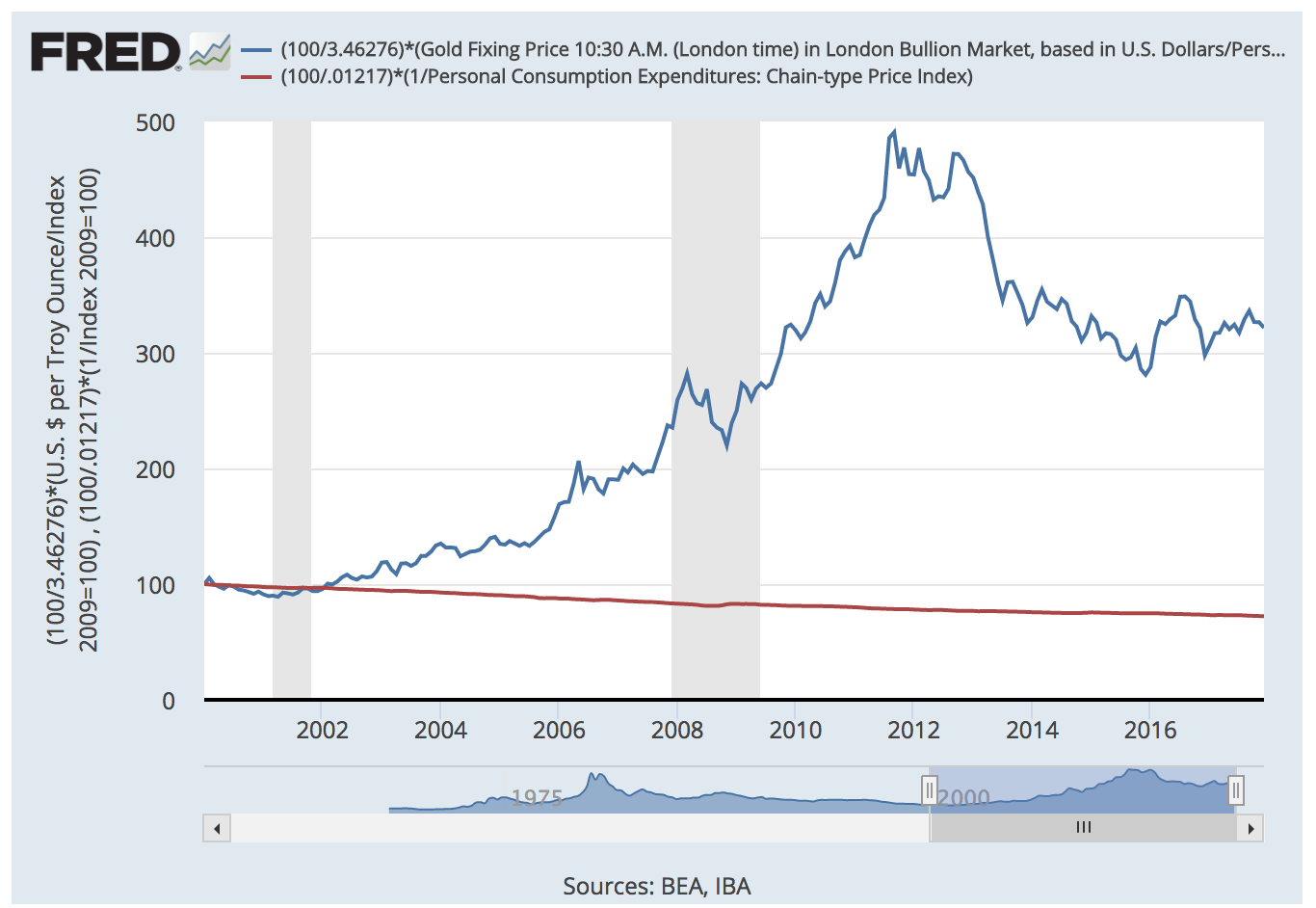

Is Bitcoin a Waste of Resources? Stephen Williamson Federal Reserve Bank of St. Louis, Early Edition 2018 ...

Is Bitcoin a Waste of Resources? Stephen Williamson Federal Reserve Bank of St. Louis, Early Edition 2018 ...

Get subscriber-only insights and news delivered by Barry every two weeks.