MiB: Jeremy Schwartz on How to Hedge Currency Risks

This week we sit down with Jeremy Schwartz, the director of research at WisdomTree. He is responsible for the equity index construction...

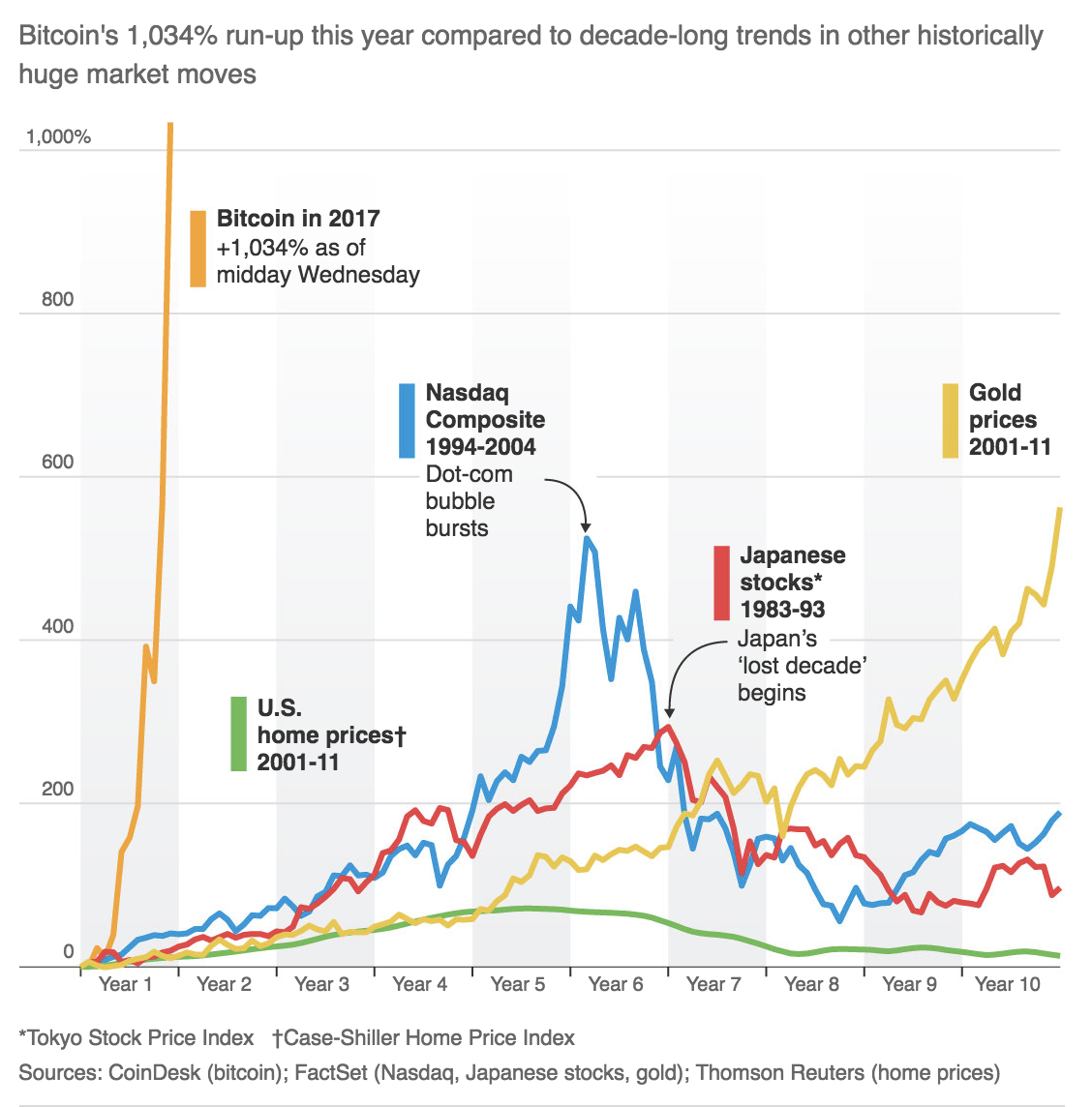

Interesting comparison: Bitcoin has captured the imagination and money of investors Source: Wall Street Journal

Interesting comparison: Bitcoin has captured the imagination and money of investors Source: Wall Street Journal

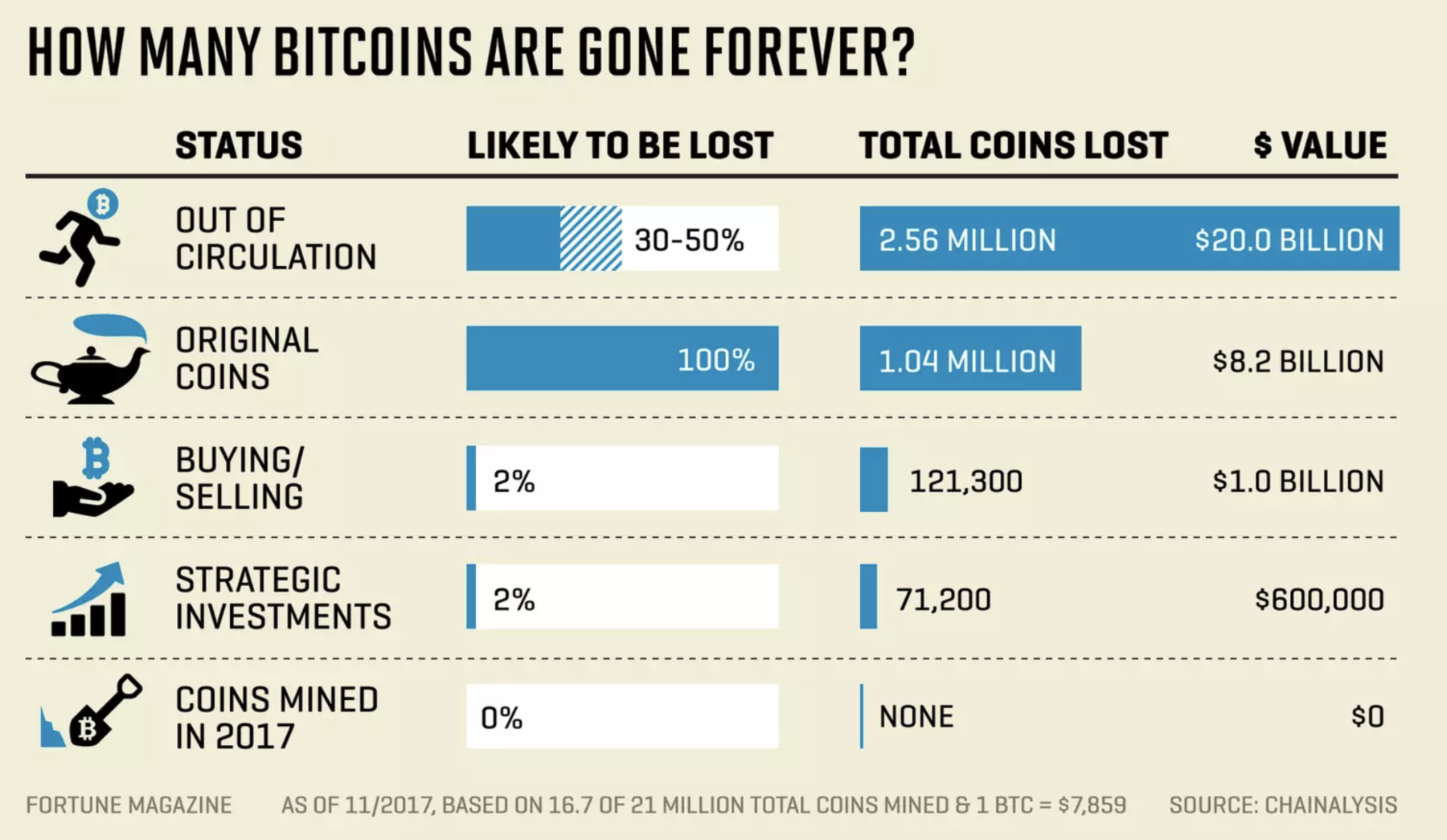

This is fascinating — almost half of all bitcoins will eventually become lost or unrecoverable: “According to new research...

This is fascinating — almost half of all bitcoins will eventually become lost or unrecoverable: “According to new research...

What ancient stones on a tiny Pacific island can teach us about Bitcoin, blockchains and the future of money. Future of Money...

What ancient stones on a tiny Pacific island can teach us about Bitcoin, blockchains and the future of money. Future of Money...

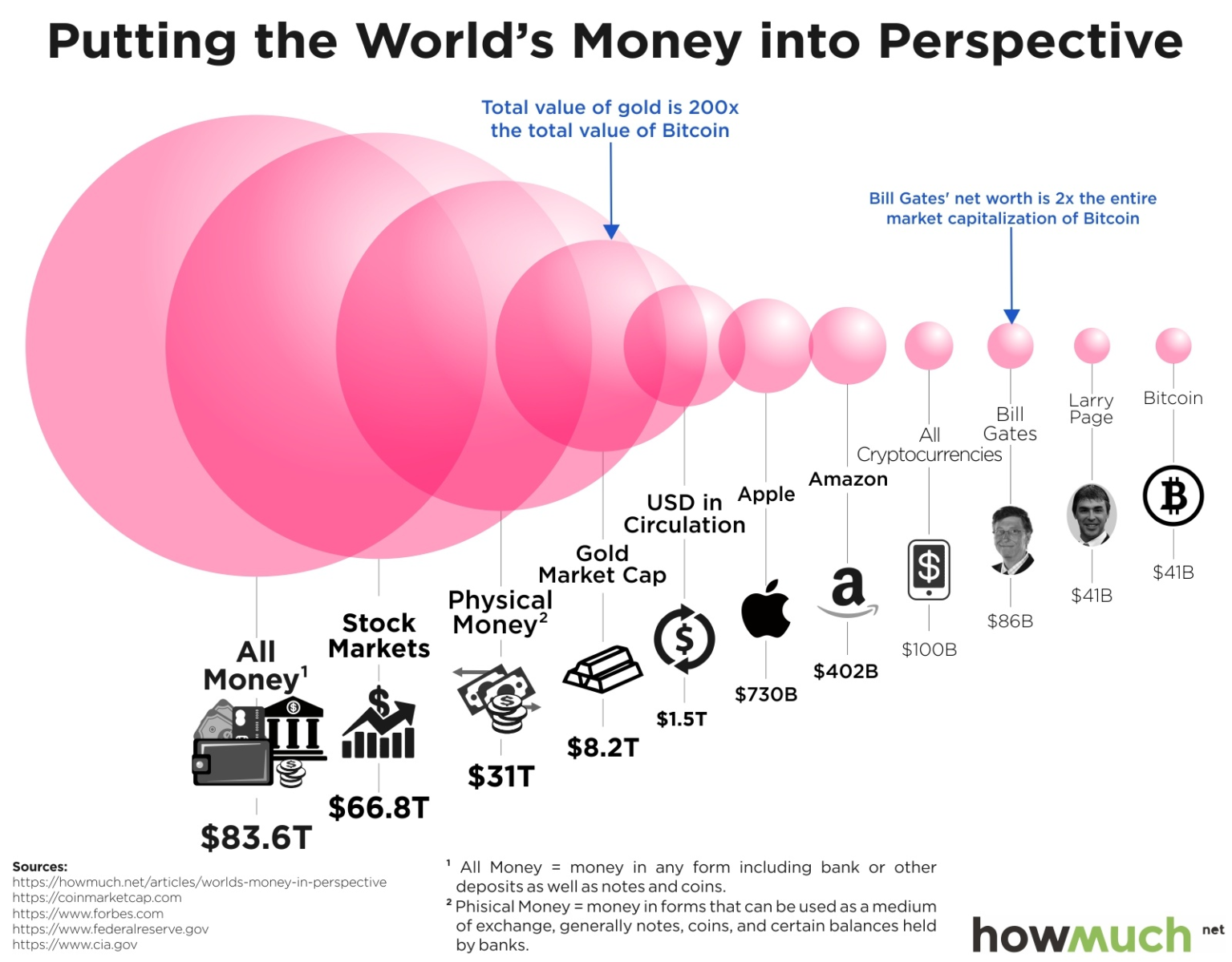

I am not sure what this graphic is trying to demonstrate: Last year, Bitcoin became more stable than gold, and earlier this year, the...

I am not sure what this graphic is trying to demonstrate: Last year, Bitcoin became more stable than gold, and earlier this year, the...

Get subscriber-only insights and news delivered by Barry every two weeks.