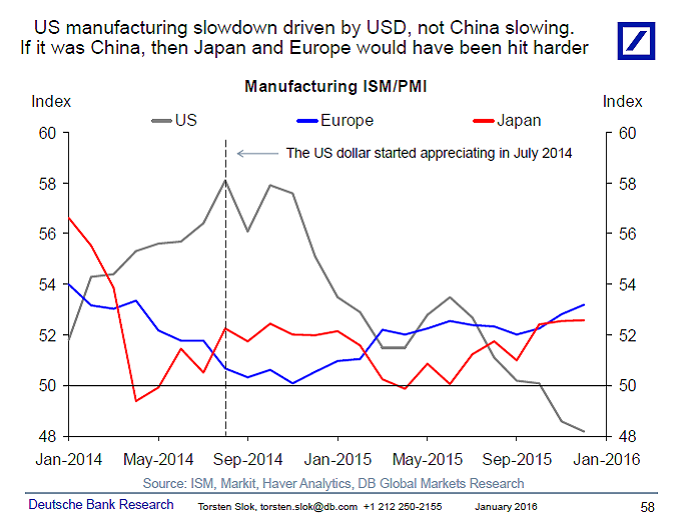

From Torsten Sløk, Ph.D.: In some of my client conversations I have debates as if we are already in a global recession. Yes, ISM below...

From Torsten Sløk, Ph.D.: In some of my client conversations I have debates as if we are already in a global recession. Yes, ISM below...

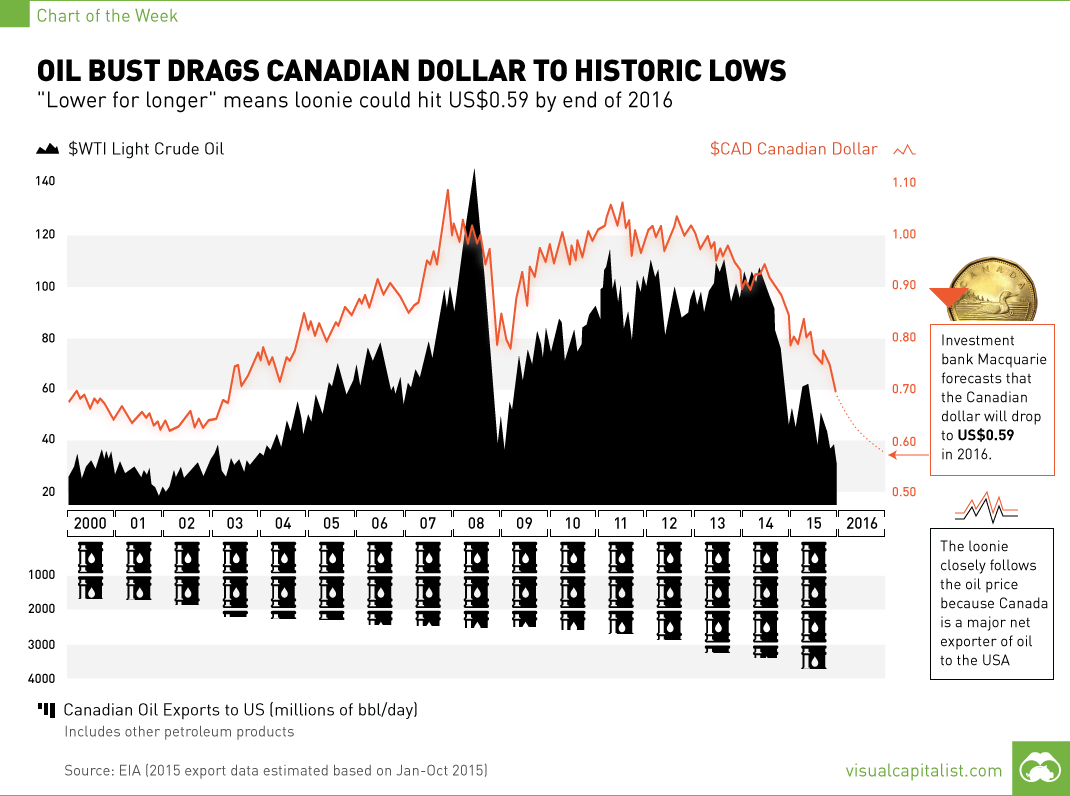

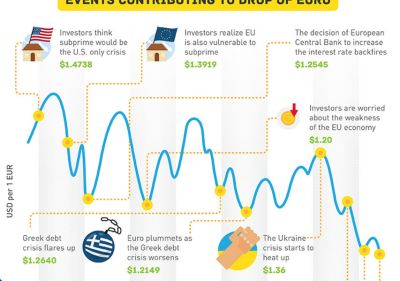

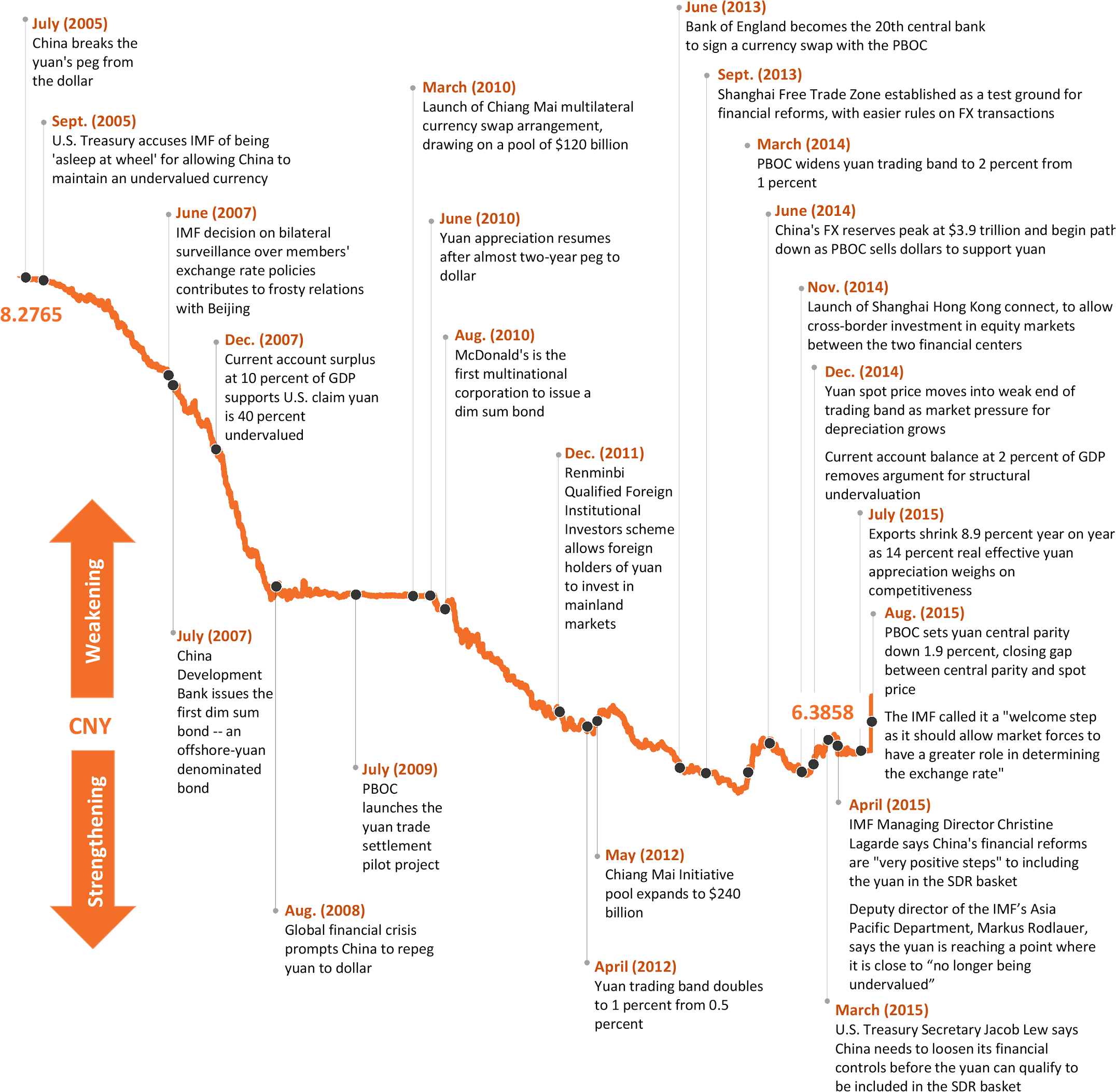

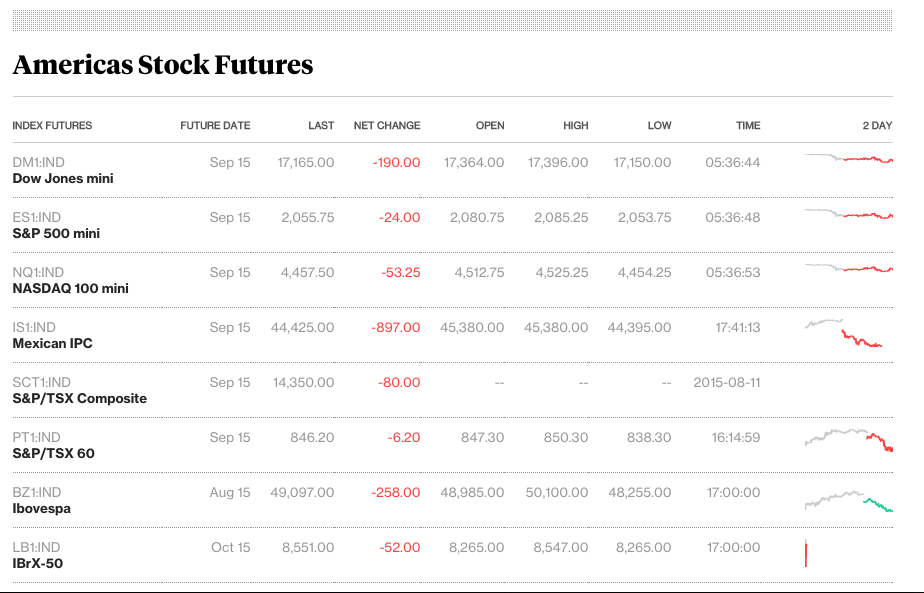

US Dollar or China behind US slowdown?

From Torsten Sløk, Ph.D.: In some of my client conversations I have debates as if we are already in a global recession. Yes, ISM below...

From Torsten Sløk, Ph.D.: In some of my client conversations I have debates as if we are already in a global recession. Yes, ISM below...