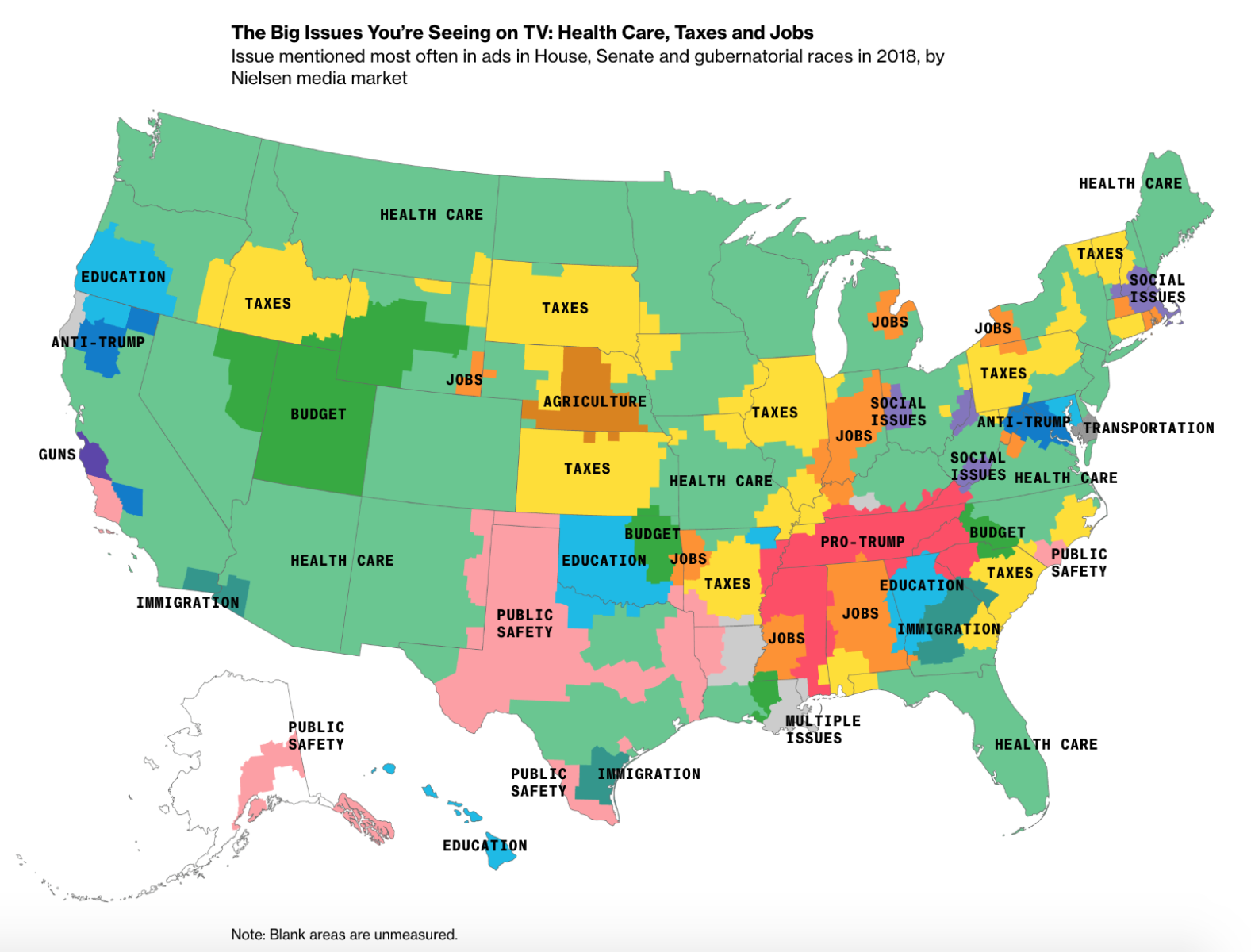

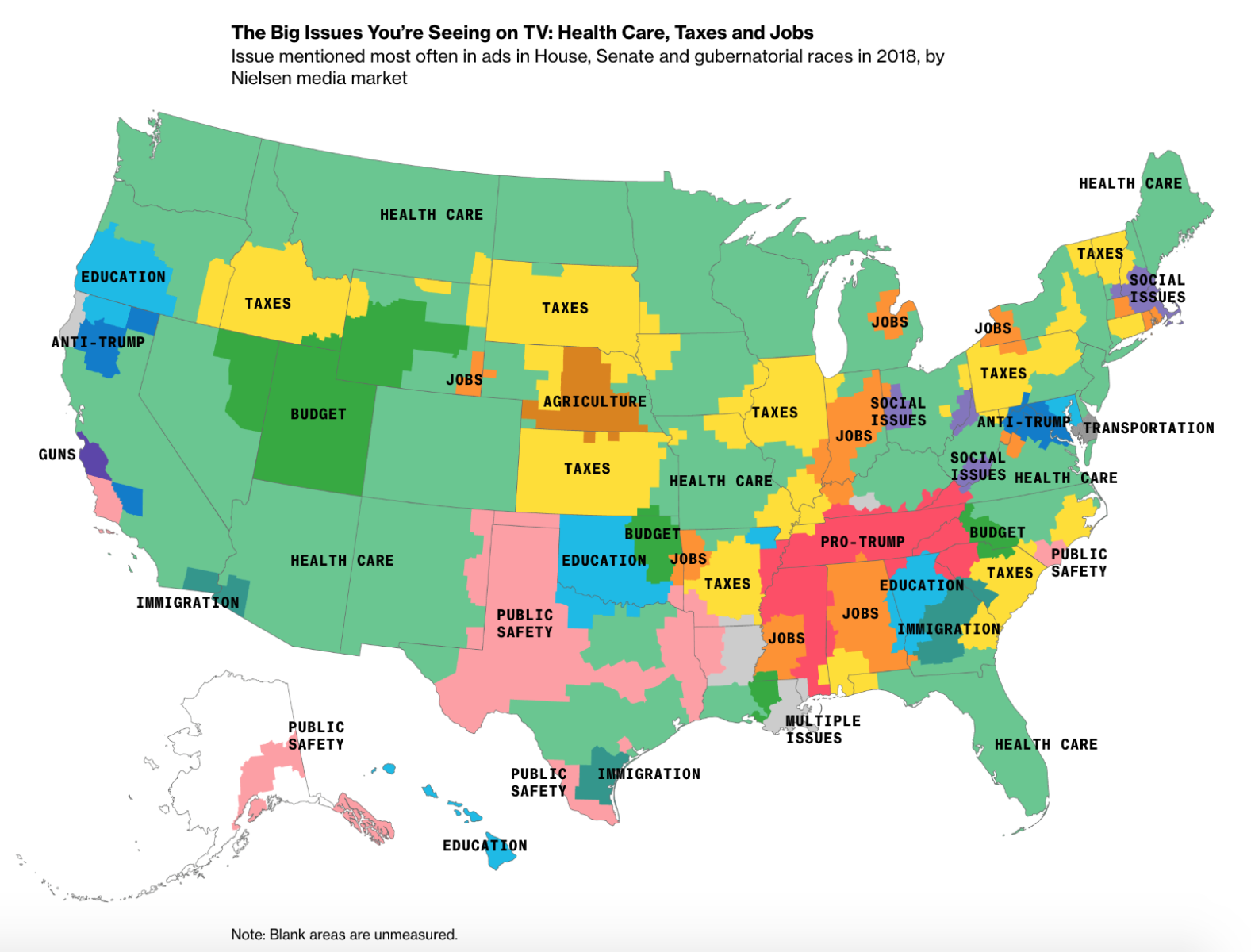

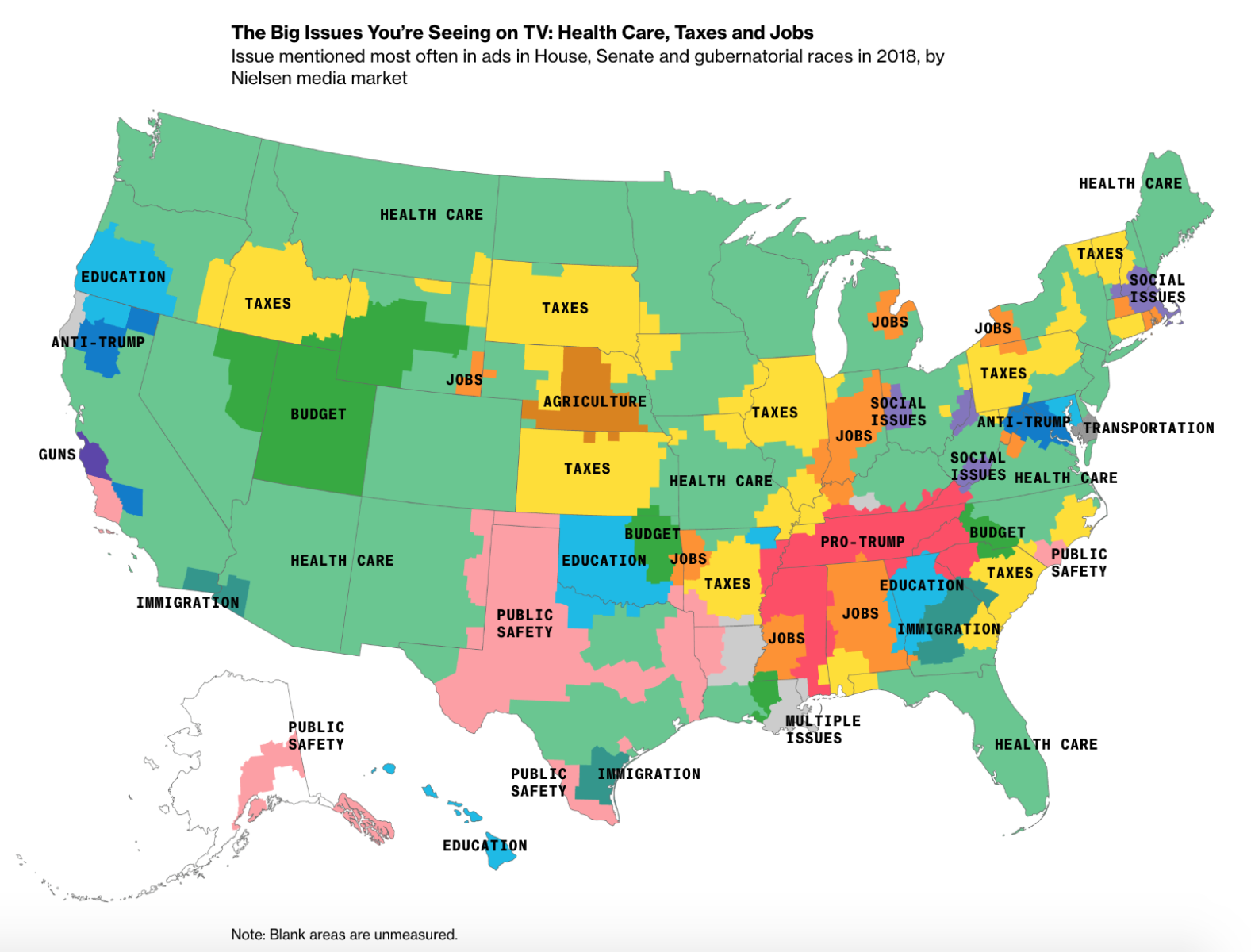

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

Read More

@TBPInvictus here: Dow just crashes through 25,000. Congrats! Big cuts in unnecessary regulations continuing. — Donald J. Trump...

Read More

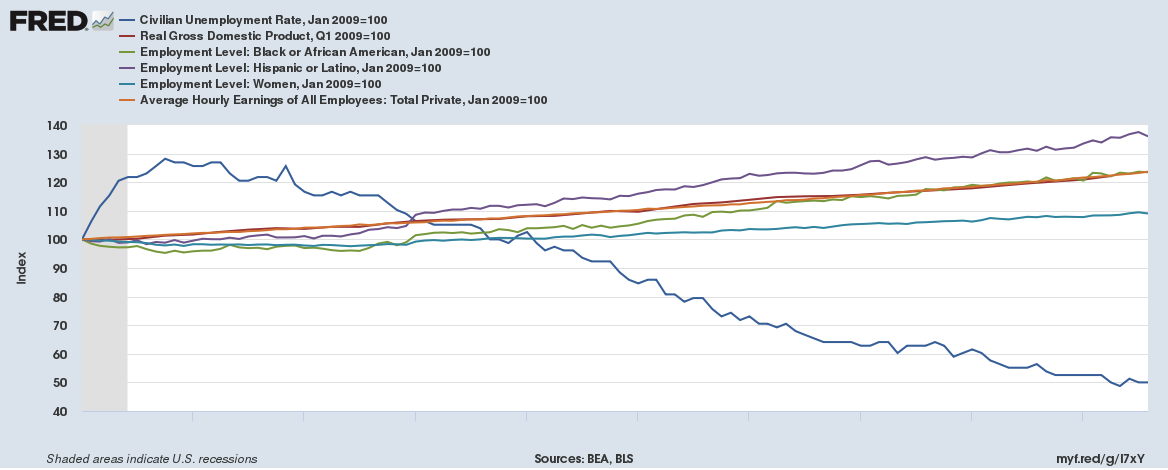

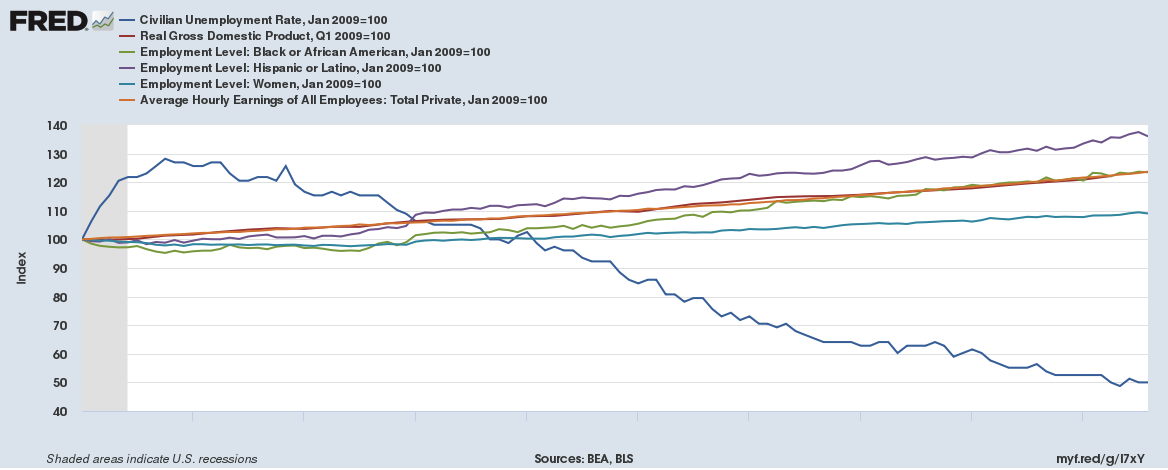

@TBPInvictus here, with a simple question: How much credit does Trump deserve for the current state of the economy? This should be easy...

@TBPInvictus here, with a simple question: How much credit does Trump deserve for the current state of the economy? This should be easy...

Read More

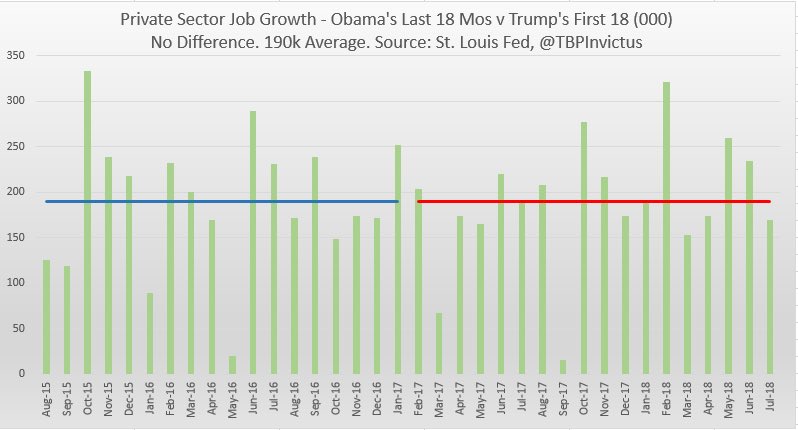

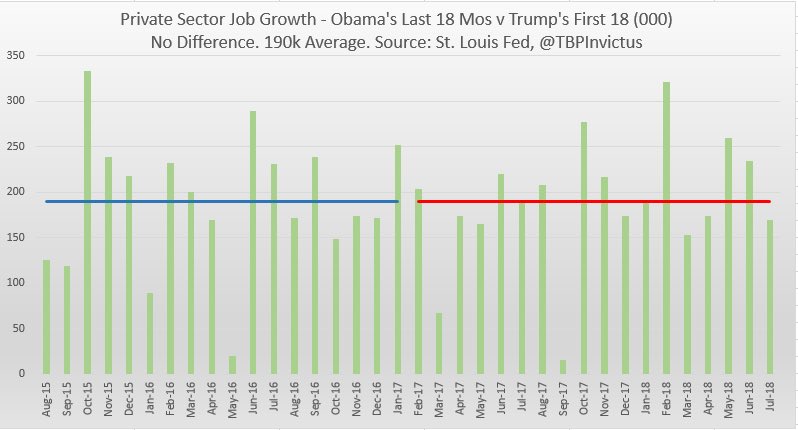

@TBPInvictus here: Trump’s fond of talking about jobs, jobs, jobs, and how they’re “pouring” back into the...

@TBPInvictus here: Trump’s fond of talking about jobs, jobs, jobs, and how they’re “pouring” back into the...

Read More

@TBPInvictus here: The following GOP tweet and accompanying video demonstrate quite clearly the lengths to which the GOP will simply lie...

@TBPInvictus here: The following GOP tweet and accompanying video demonstrate quite clearly the lengths to which the GOP will simply lie...

Read More

@TBPInvictus here: Conservative commentator S.E. Cupp recently made what I thought was a fairly bold claim on Twitter: The firearms...

@TBPInvictus here: Conservative commentator S.E. Cupp recently made what I thought was a fairly bold claim on Twitter: The firearms...

Read More

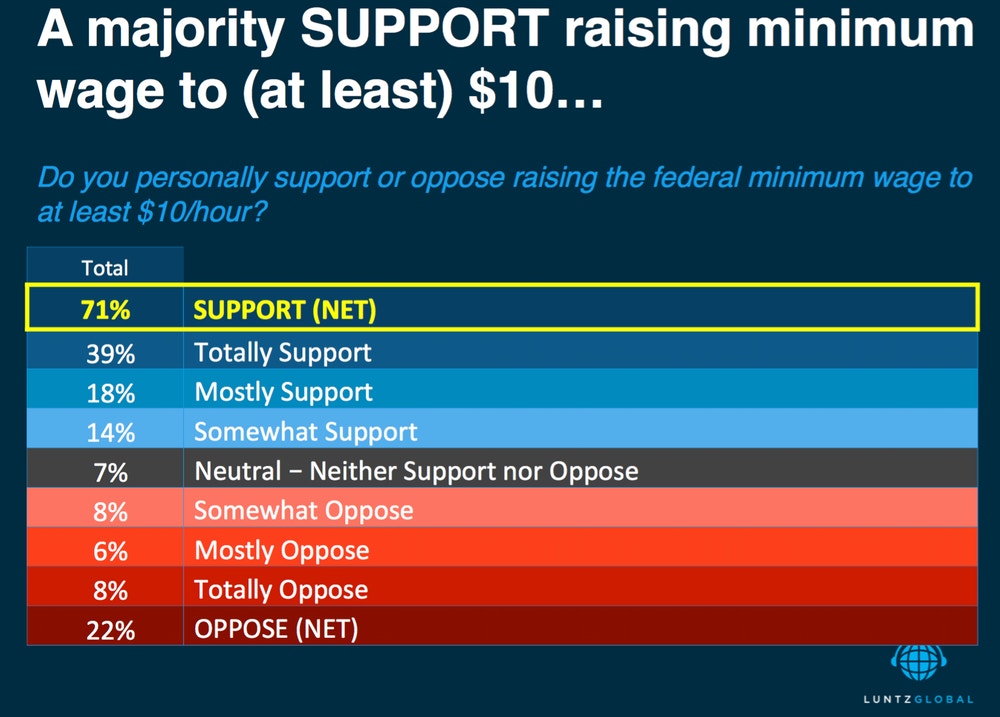

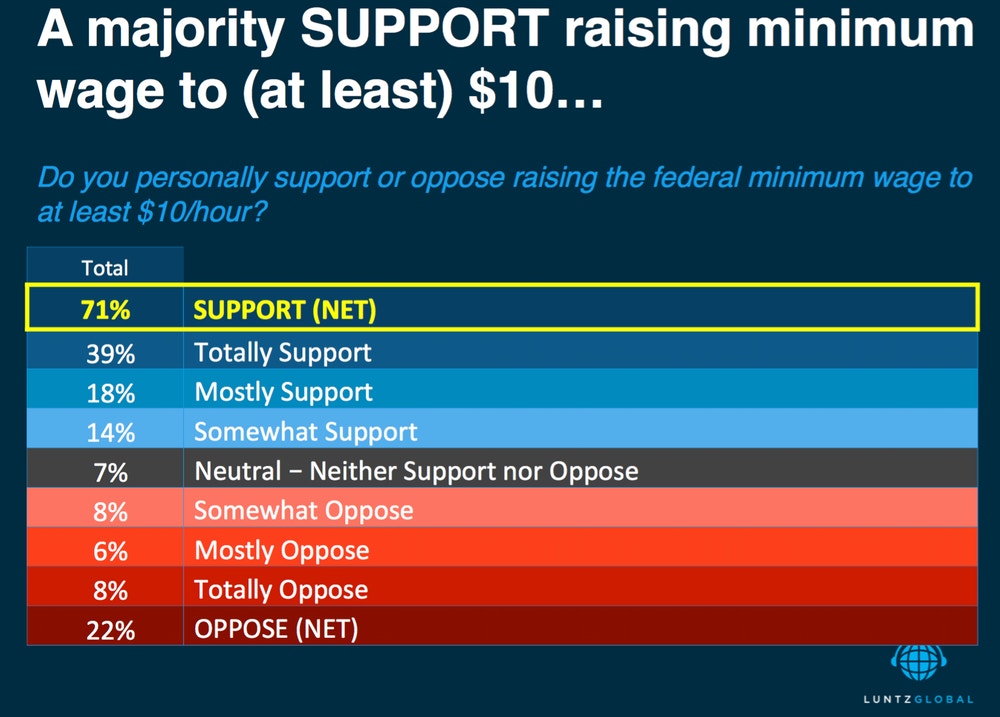

@TBPInvictus here: There have been a few recent minimum wage related developments that I thought I’d memorialize in one quick post....

@TBPInvictus here: There have been a few recent minimum wage related developments that I thought I’d memorialize in one quick post....

Read More

@TBPInvictus here: Last we heard from Jacob Wohl — see original story here for background — Wohl’s attorney appeared at...

Read More

A comprehensive guide to just about every public sexual harassment or assault case, organized by industry or month. click for...

A comprehensive guide to just about every public sexual harassment or assault case, organized by industry or month. click for...

Read More

First came the Panama Papers, which revealed personal financial information about wealthy individuals and public officials that had...

First came the Panama Papers, which revealed personal financial information about wealthy individuals and public officials that had...

Read More

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...