Don’t Fear October

October Is the Scariest Month for Investors, Along With All the Others Actually, worry more about September. Bloomberg, October 1, 2018...

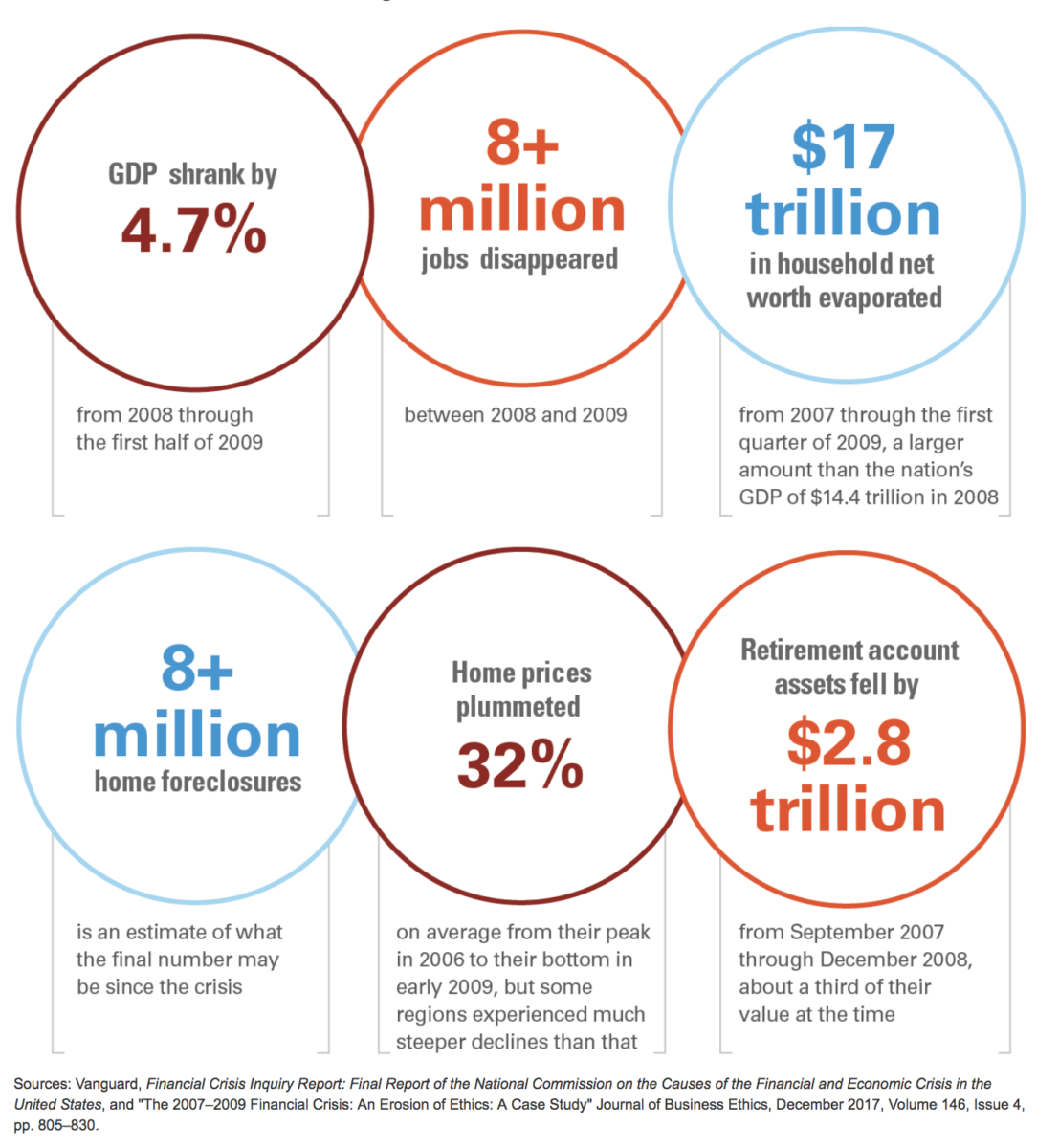

More on this later . . . The fallout from the global financial crisis continues a decade on Source: Vanguard

More on this later . . . The fallout from the global financial crisis continues a decade on Source: Vanguard

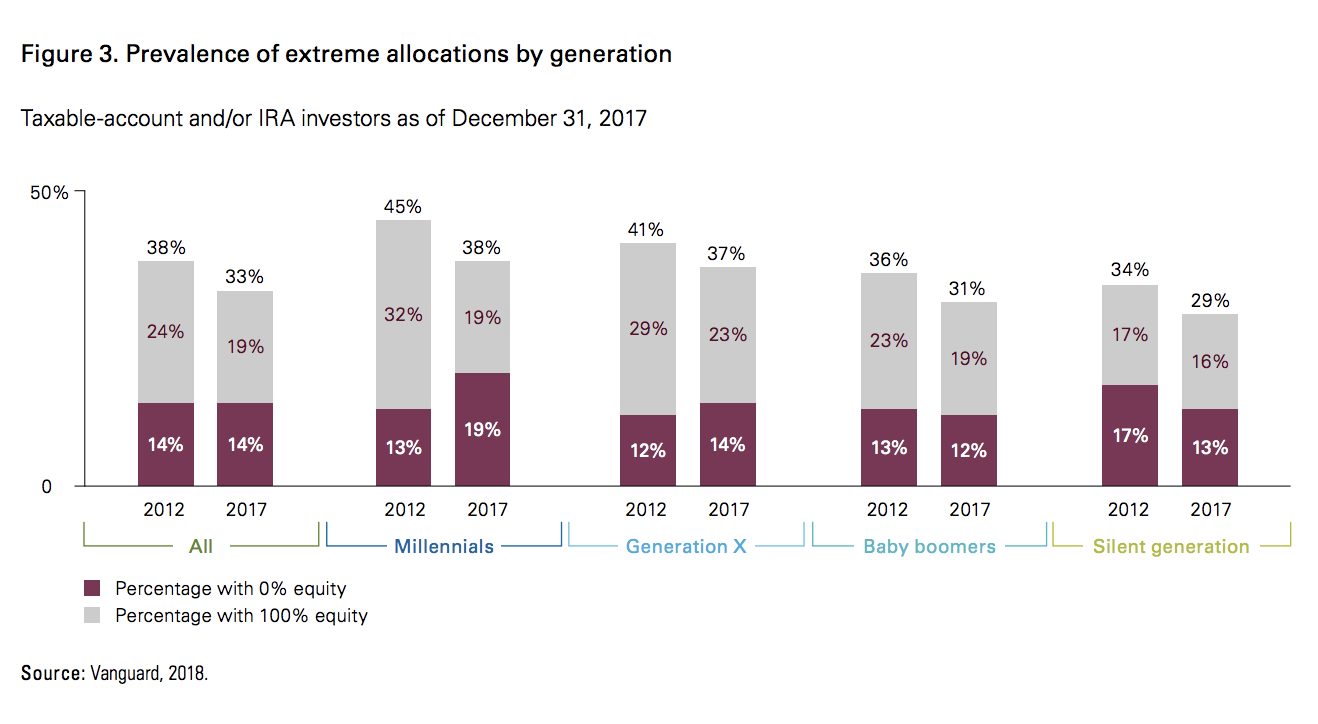

This is fascinating: do Millenials, who came of age right into the teeth of the GFC, have a lower tolerance for risk? From Vanguard:...

This is fascinating: do Millenials, who came of age right into the teeth of the GFC, have a lower tolerance for risk? From Vanguard:...

While everyone is so busy looking at whether or not this bull market is longest ever or not — I say not — let’s...

While everyone is so busy looking at whether or not this bull market is longest ever or not — I say not — let’s...

What Does the Longest Bull Market Mean?: Kaissar vs. Ritholtz The run for stocks is now in the record books. So what? Bloomberg, August...

What Does the Longest Bull Market Mean?: Kaissar vs. Ritholtz The run for stocks is now in the record books. So what? Bloomberg, August...

Get subscriber-only insights and news delivered by Barry every two weeks.