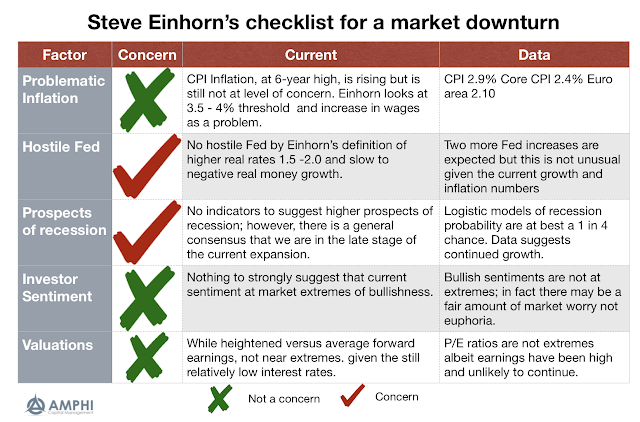

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...

Read More

Old Age Isn’t What Ends a Bull Stock Market The length of the run really doesn’t matter very much. Bloomberg, August 17, 2018 ...

Read More

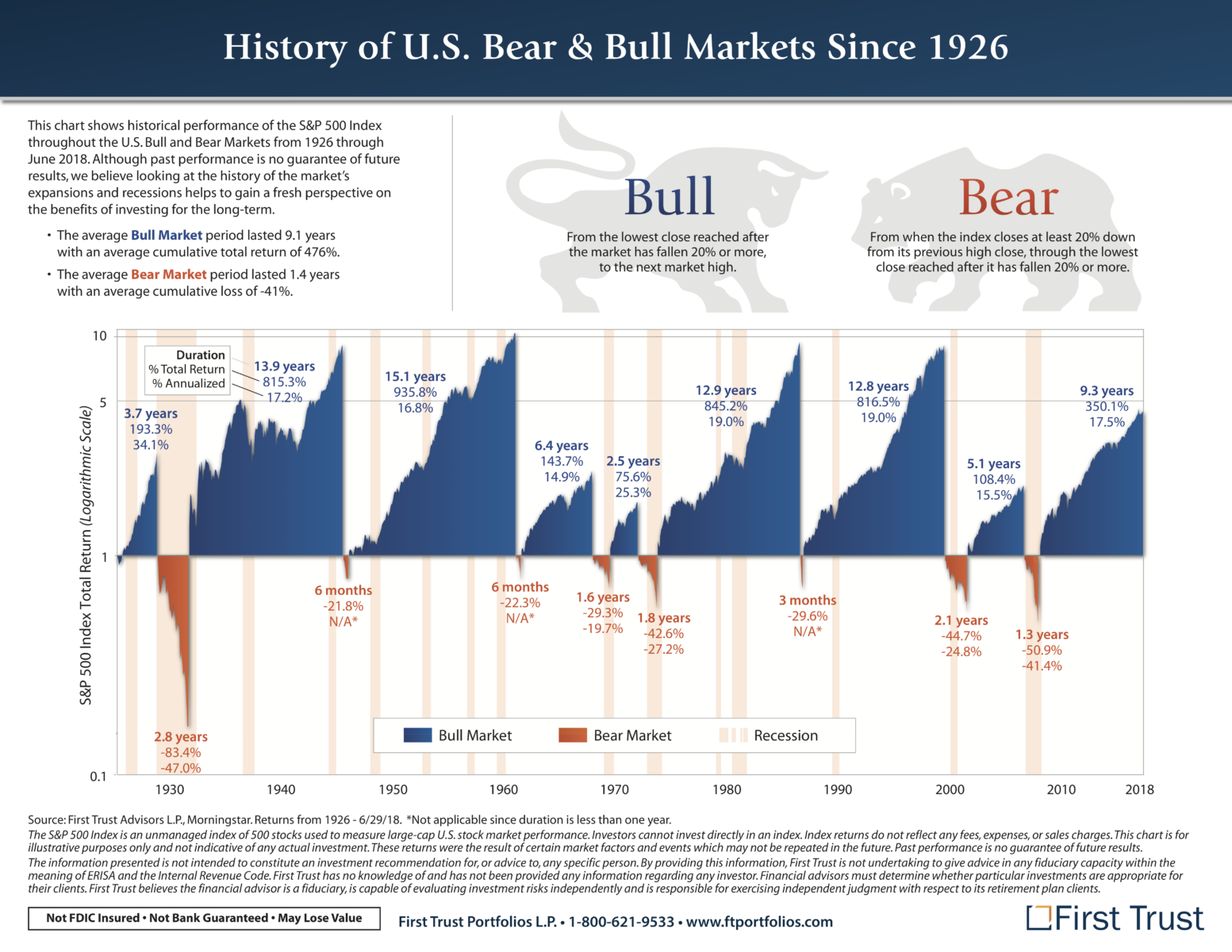

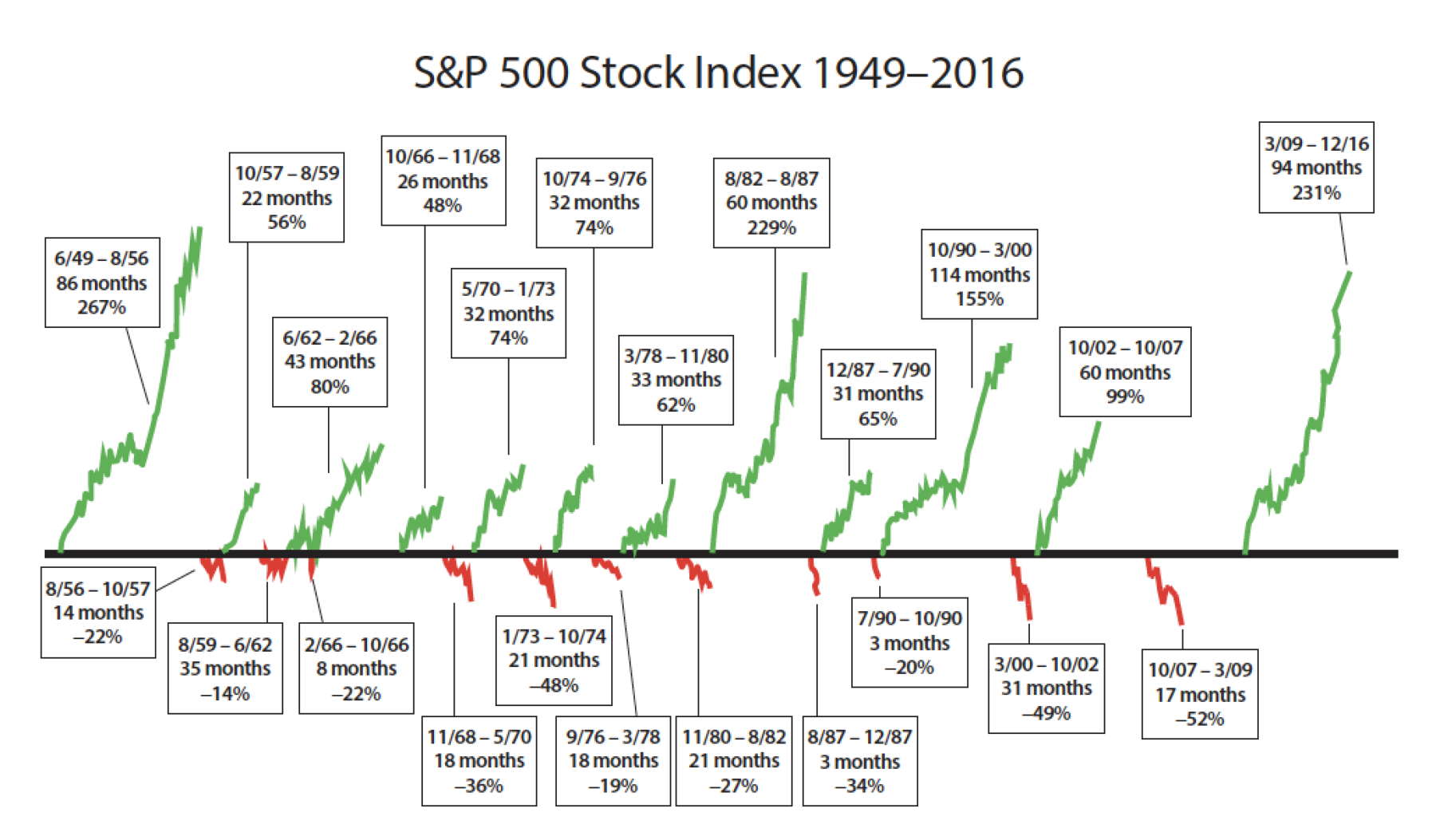

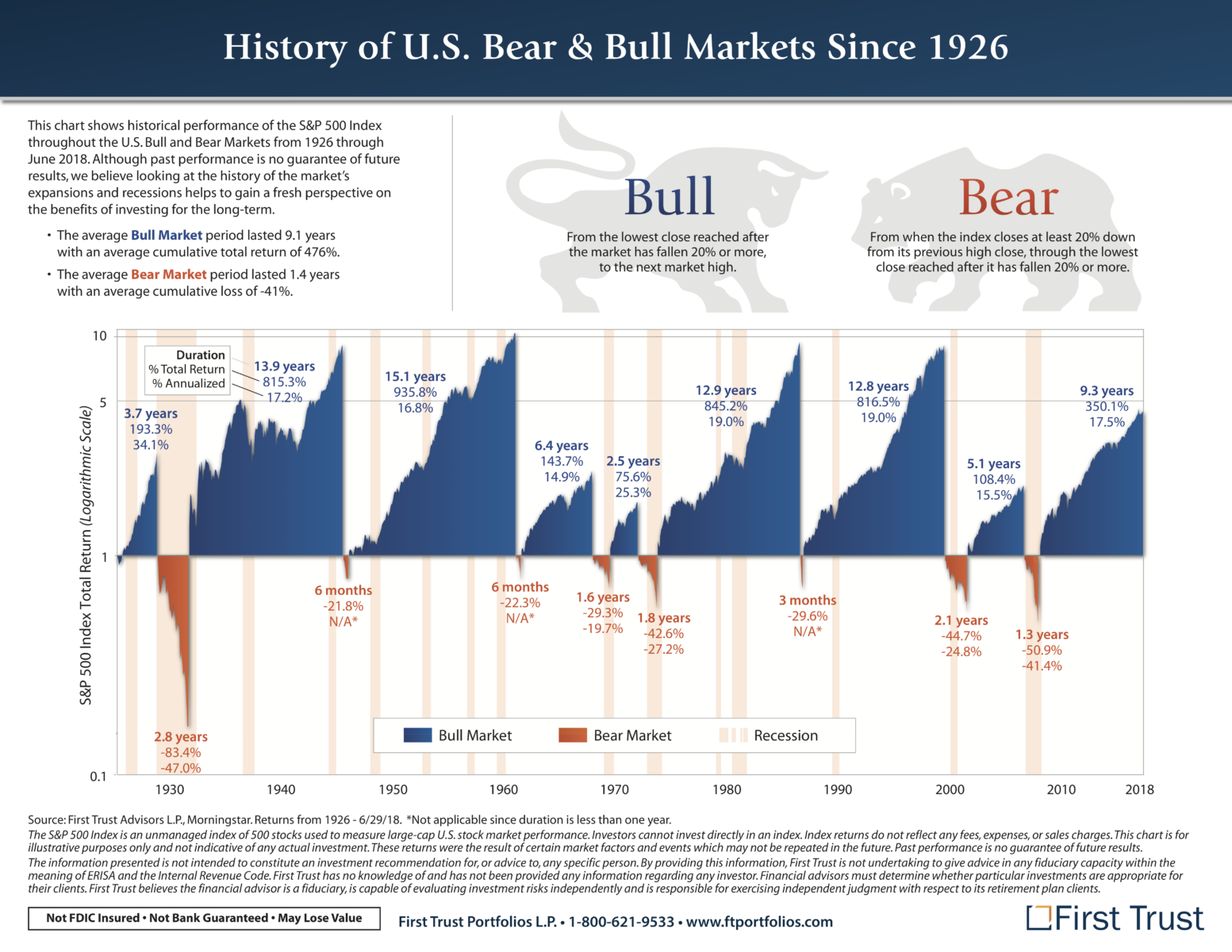

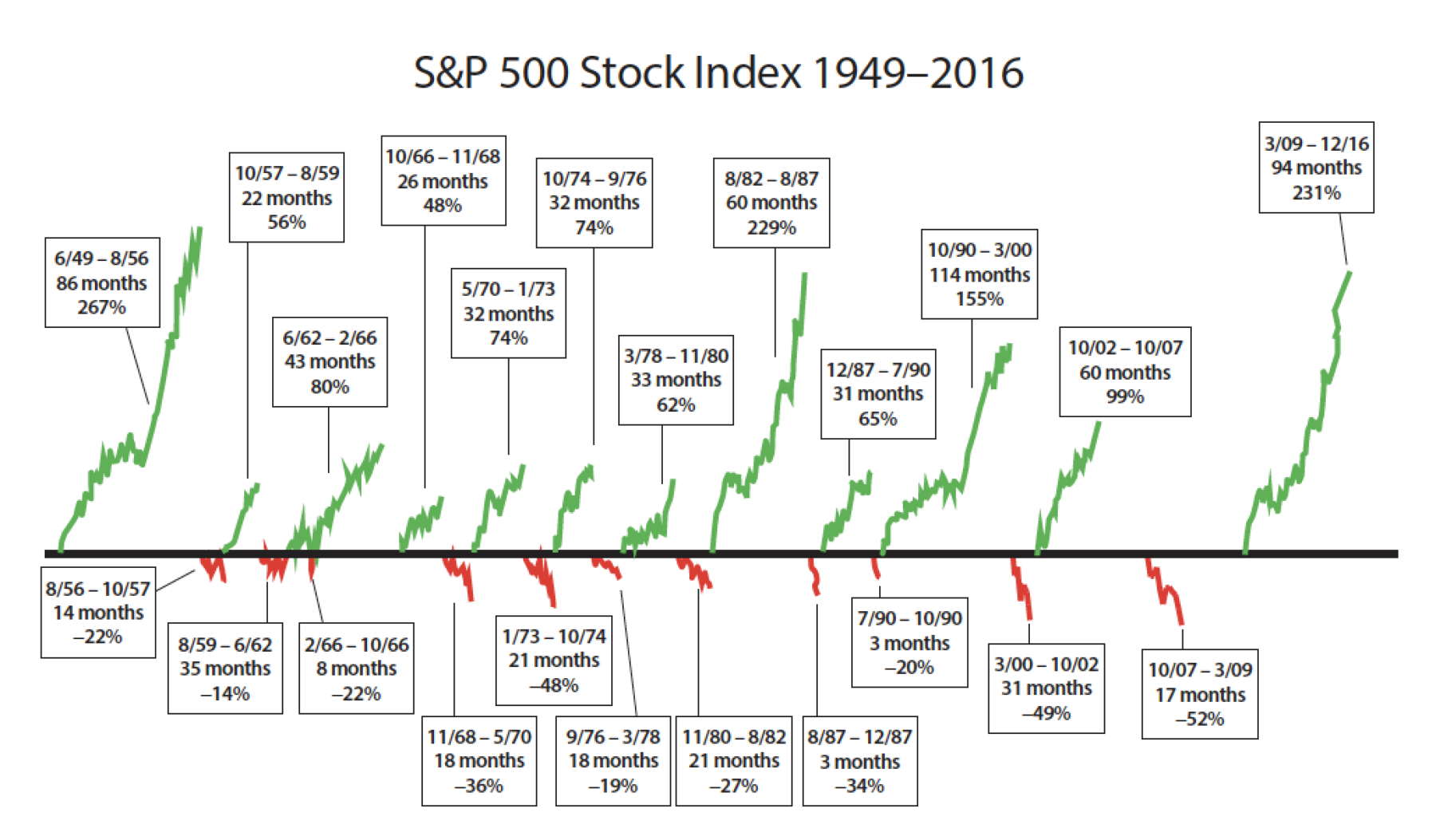

click for ginormous graphic Source: First Trust I really like this graphic, via First Trust, showing the history of bull and bear...

click for ginormous graphic Source: First Trust I really like this graphic, via First Trust, showing the history of bull and bear...

Read More

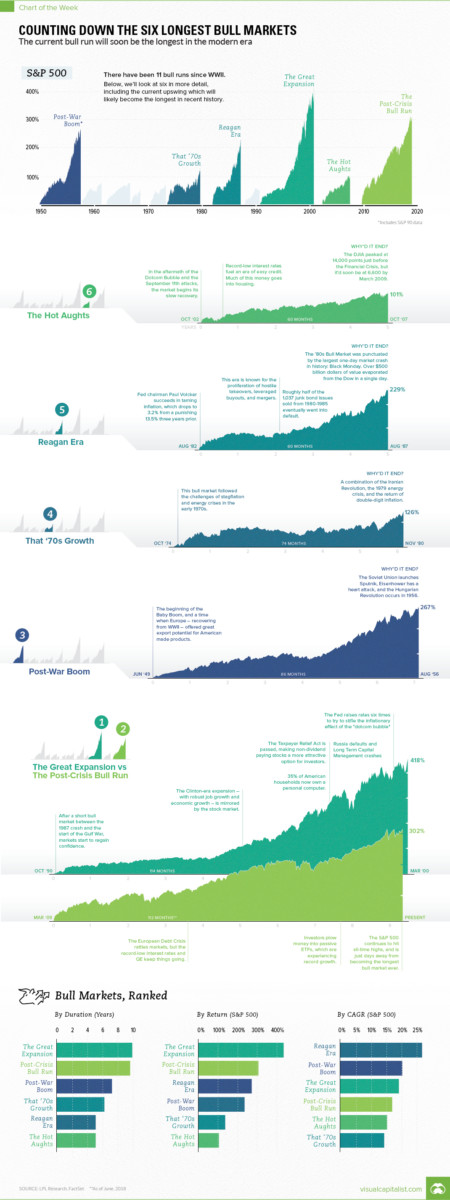

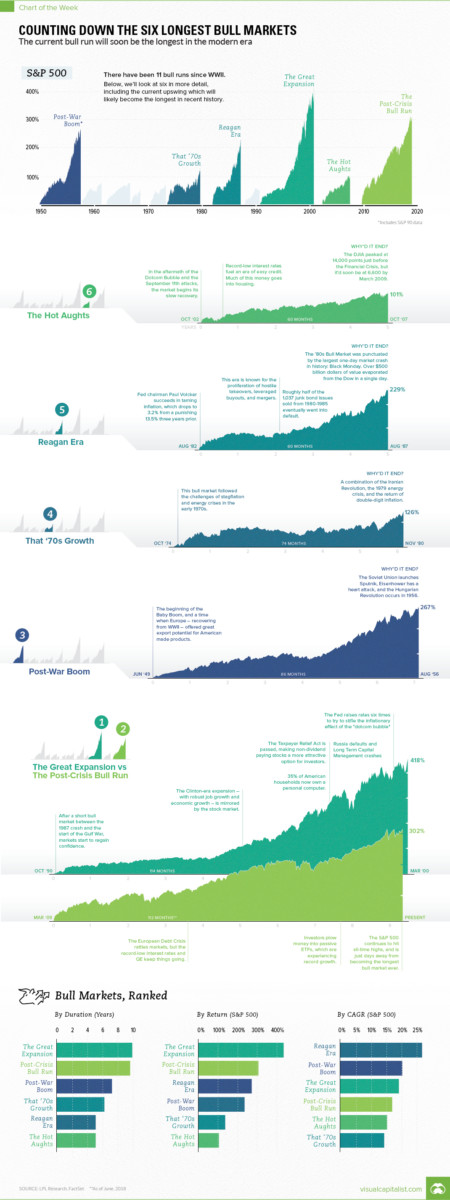

I have modest disagreements about start and stop dates but overall this is an intriguing set of graphics: Source: Visual Capitalist

I have modest disagreements about start and stop dates but overall this is an intriguing set of graphics: Source: Visual Capitalist

Read More

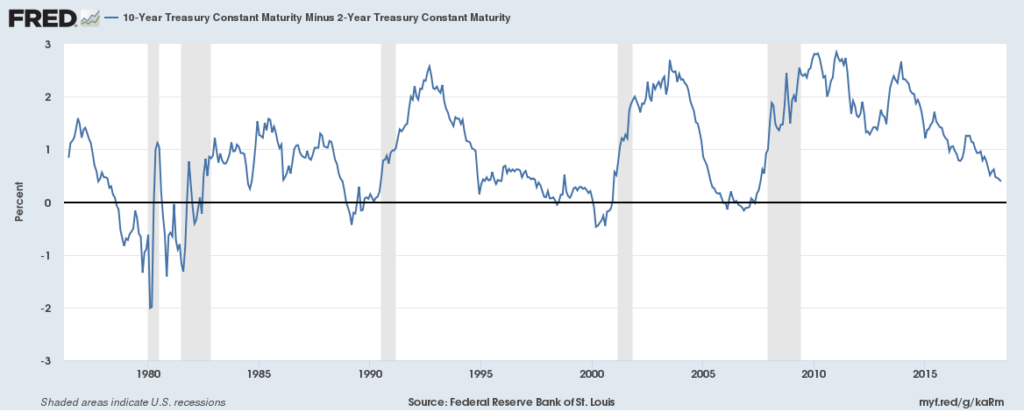

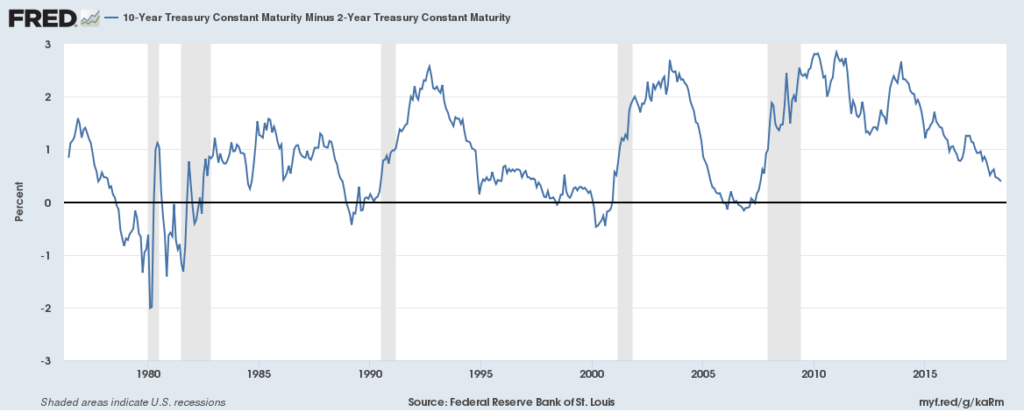

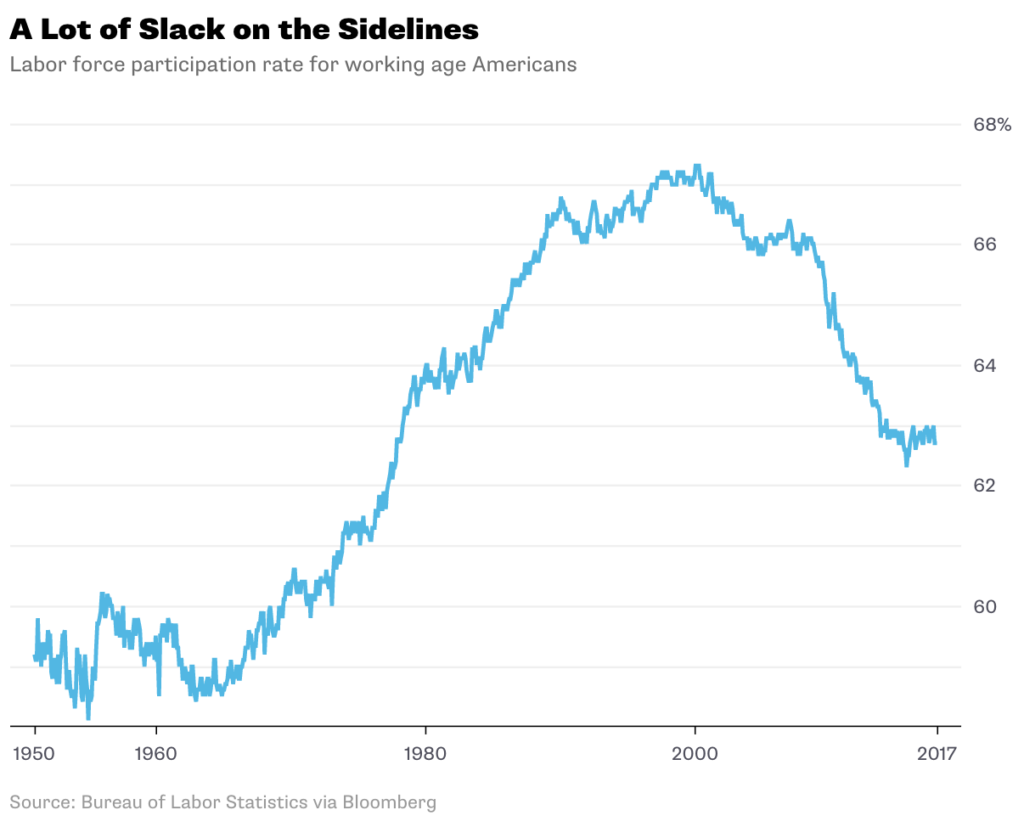

@TBPInvictus here: What inning are we in in this economic cycle? Sixth? Eighth? Are we going to go into extra innings? This parlor game...

@TBPInvictus here: What inning are we in in this economic cycle? Sixth? Eighth? Are we going to go into extra innings? This parlor game...

Read More

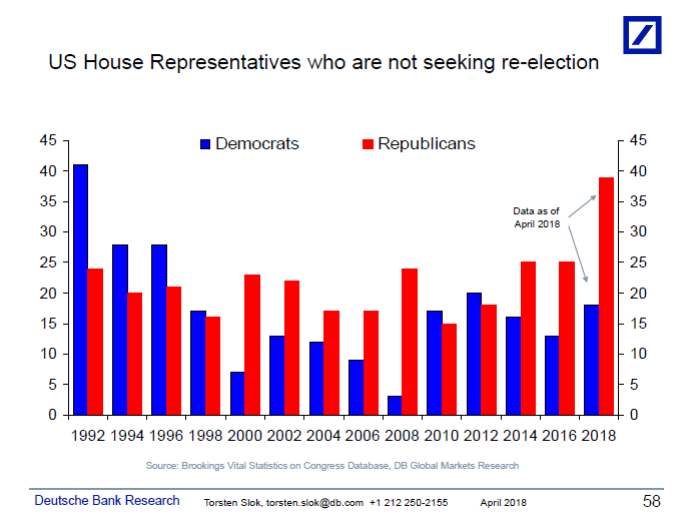

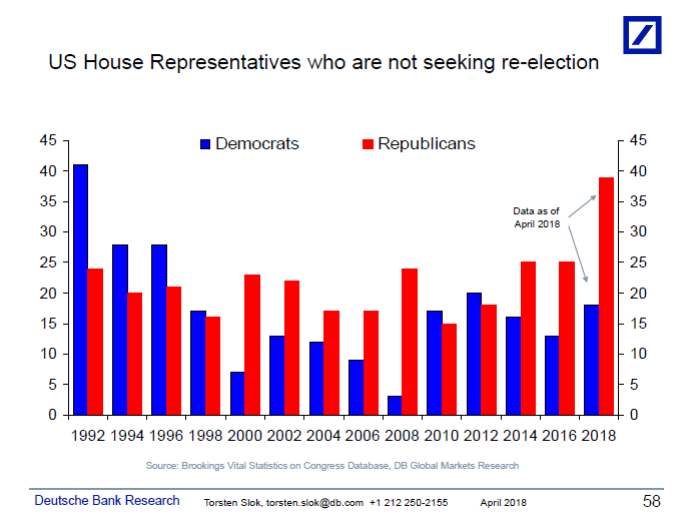

Very interesting discussion, via Torsten Sløk: US midterm elections come up more and more frequently in my client conversations, and the...

Very interesting discussion, via Torsten Sløk: US midterm elections come up more and more frequently in my client conversations, and the...

Read More

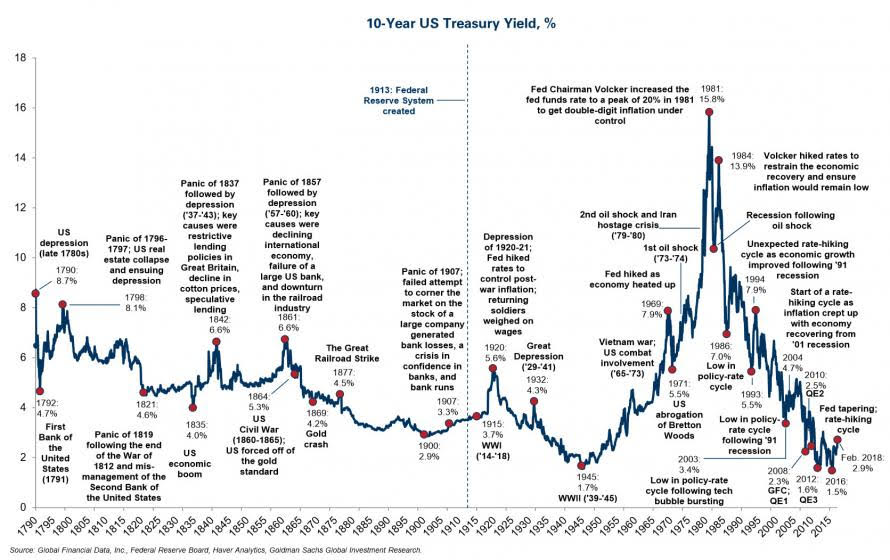

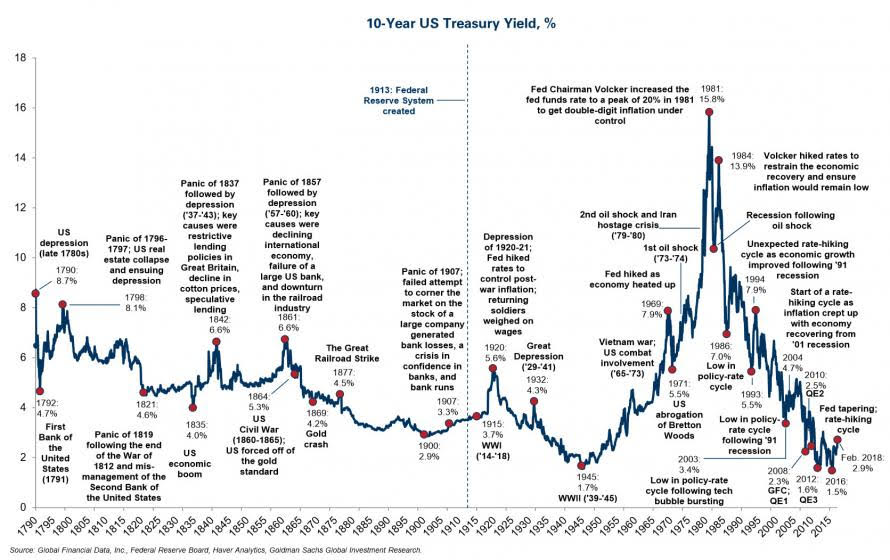

click for ginormous graphic Source: Goldman Sachs via Reformed Broker This is a fabulous chart showing the past two...

click for ginormous graphic Source: Goldman Sachs via Reformed Broker This is a fabulous chart showing the past two...

Read More

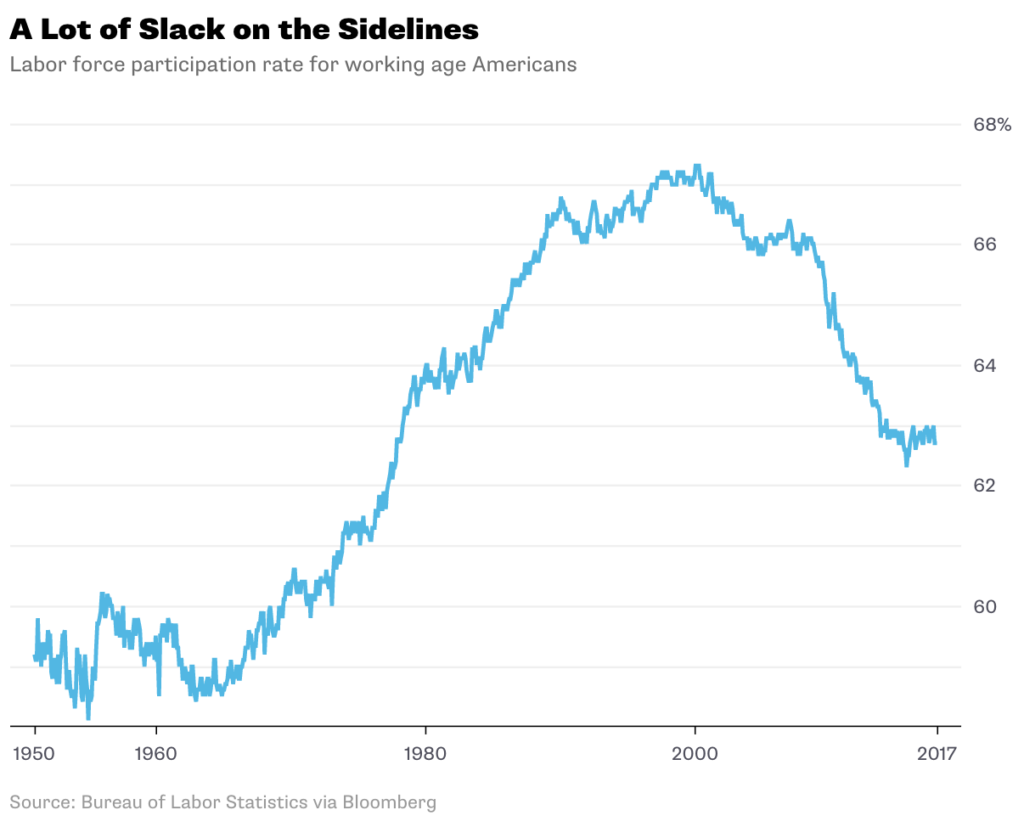

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

Read More

Bigger Raises Might Be Coming in 2018 Thank tightening labor markets, higher minimum wages and steady growth. Bloomberg, January 8, 2018...

Bigger Raises Might Be Coming in 2018 Thank tightening labor markets, higher minimum wages and steady growth. Bloomberg, January 8, 2018...

Read More

Source: Edelman Financial Services This week on Masters in Business, I had a conversation with Ric Edelman. As always, there were...

Source: Edelman Financial Services This week on Masters in Business, I had a conversation with Ric Edelman. As always, there were...

Read More

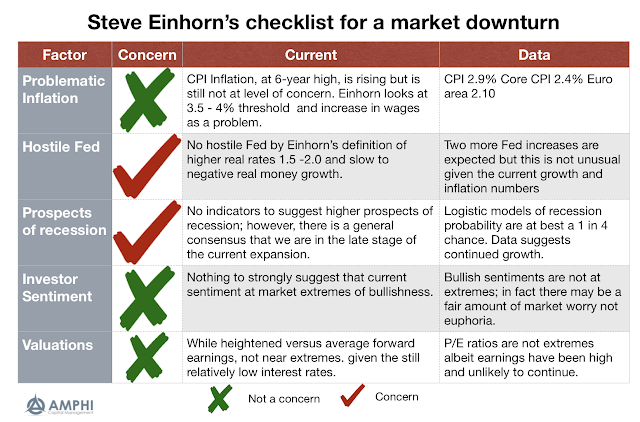

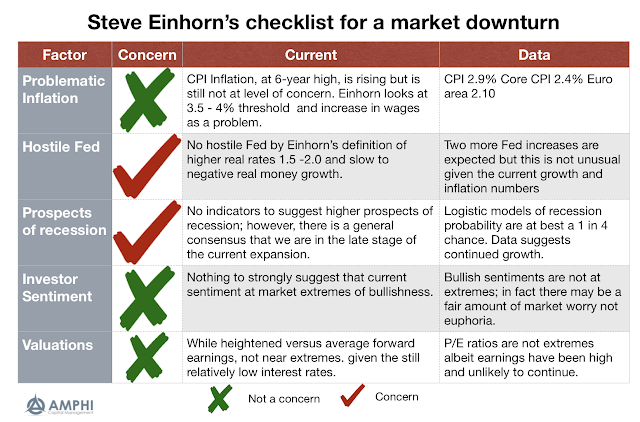

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...

Steve Einhorn is Vice Chairman at Omega Advisors, and Lee Cooperman’s right hand man. I like his checklist (via Disciplined...