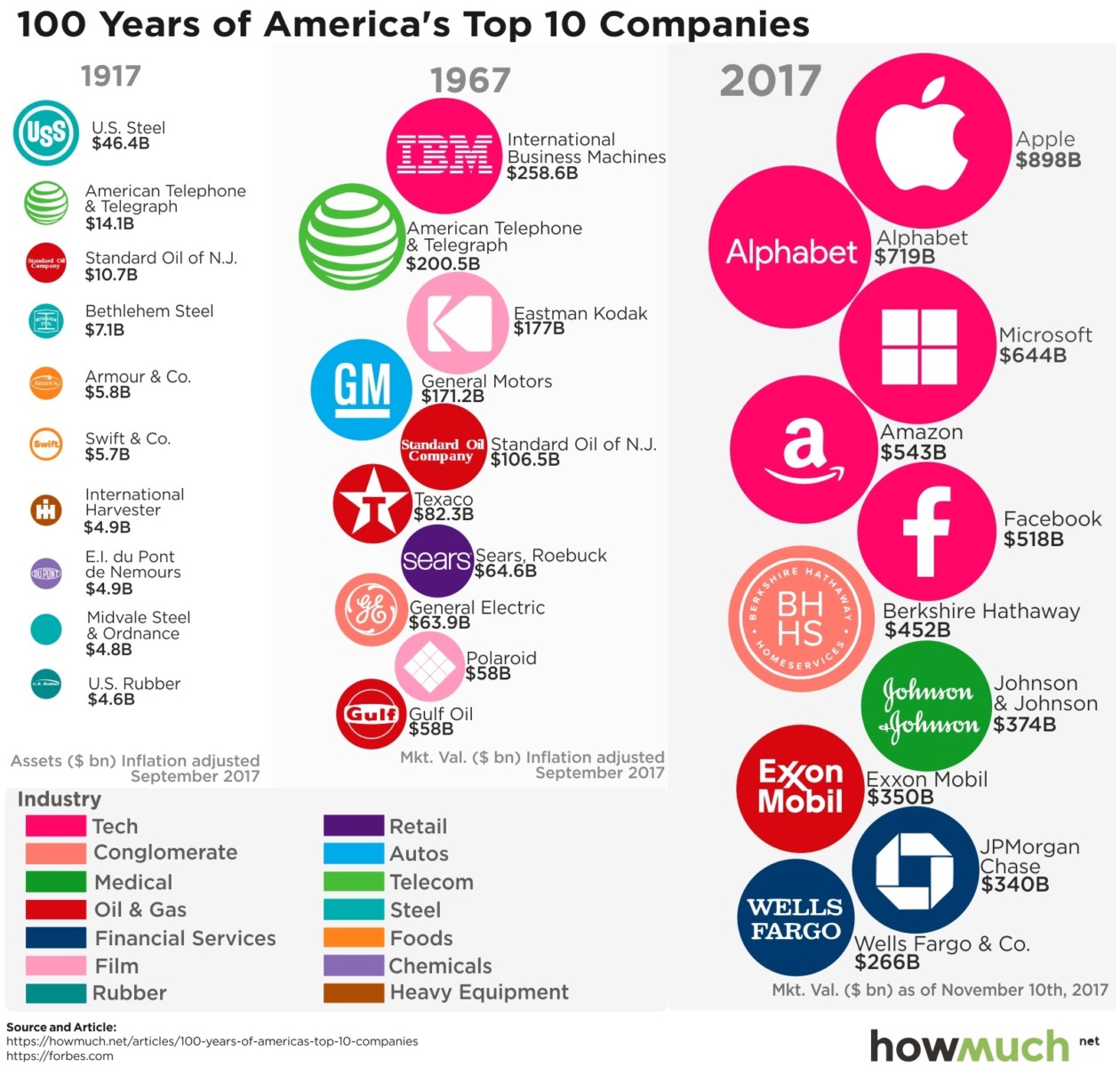

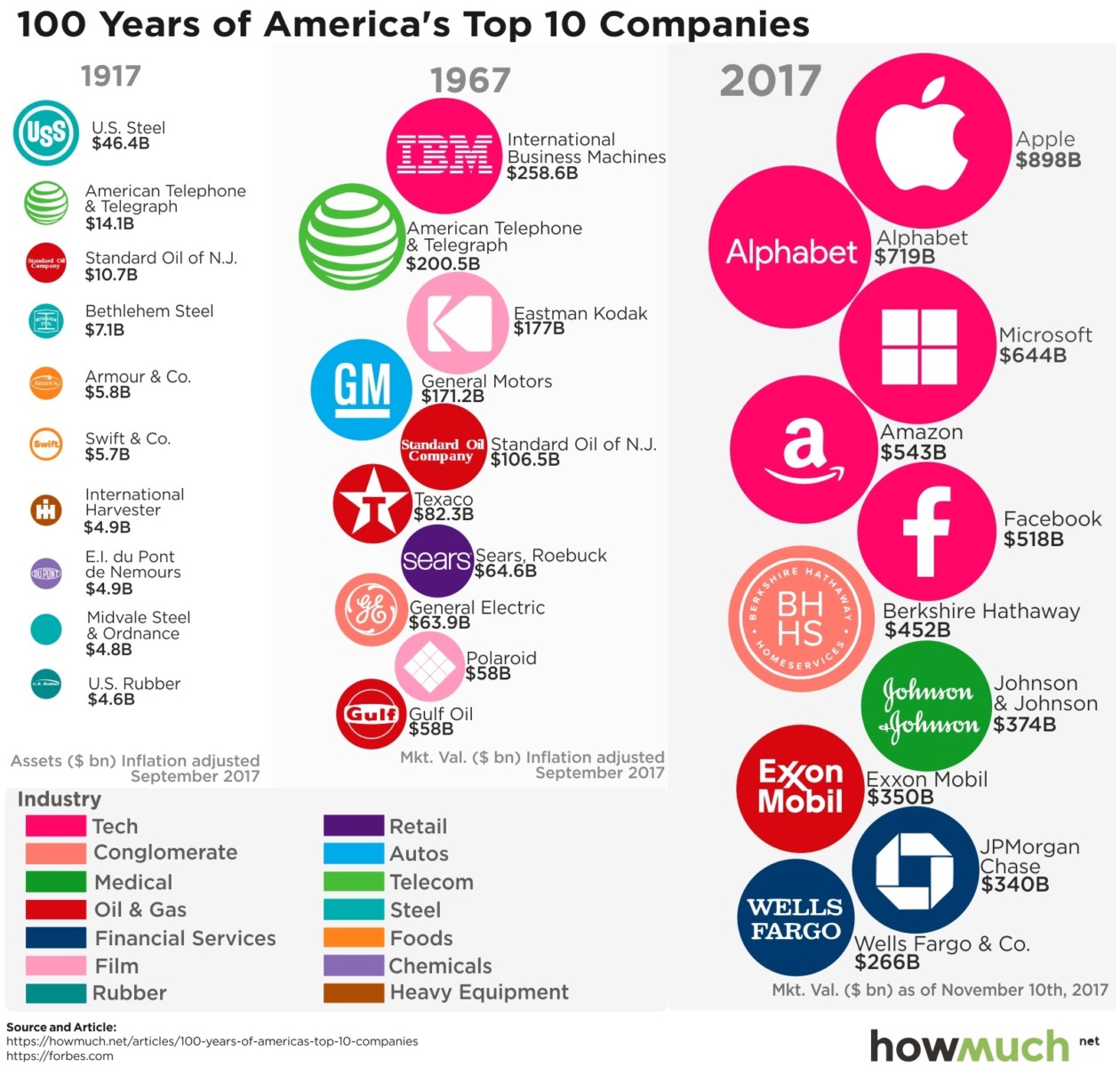

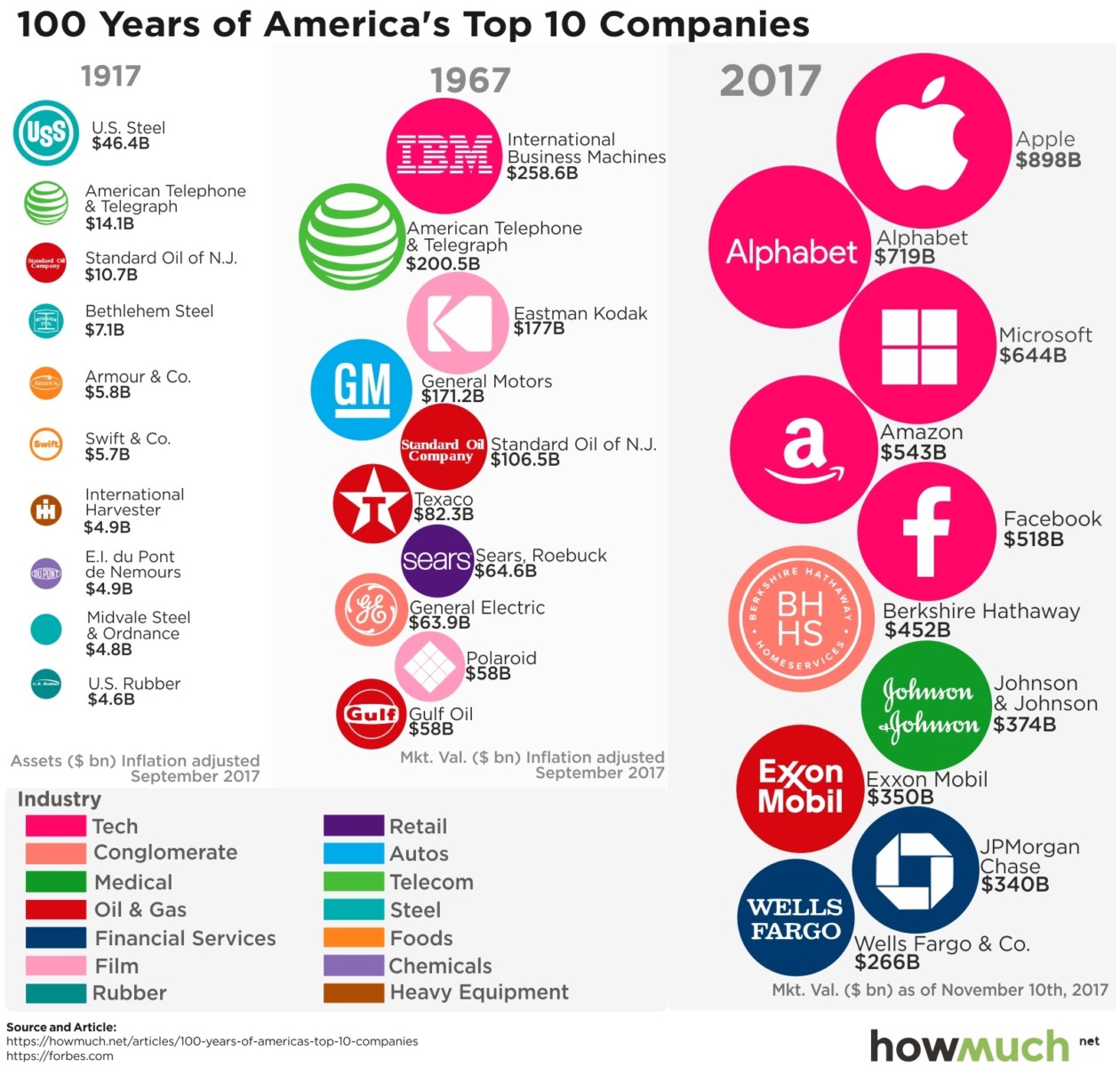

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...

Read More

This week we sit down with legendary investor Felix Zulauf. The Switzerland-based hedge fund manager was former head of...

Read More

This week we sit down with legendary investor Felix Zulauf. In 1990, he founded Zulauf Asset Management, a...

Read More

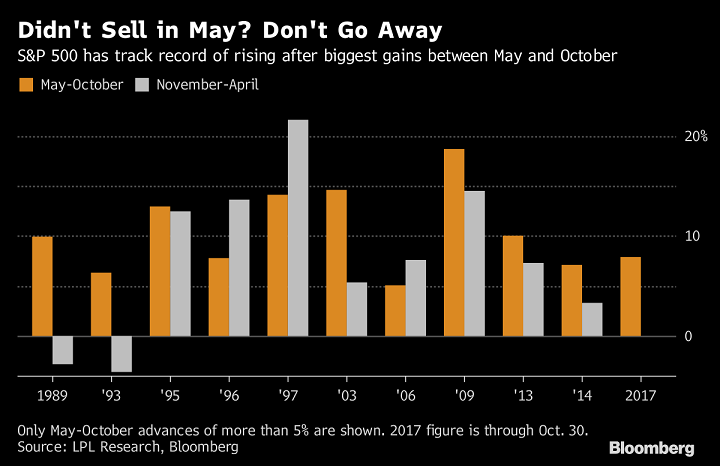

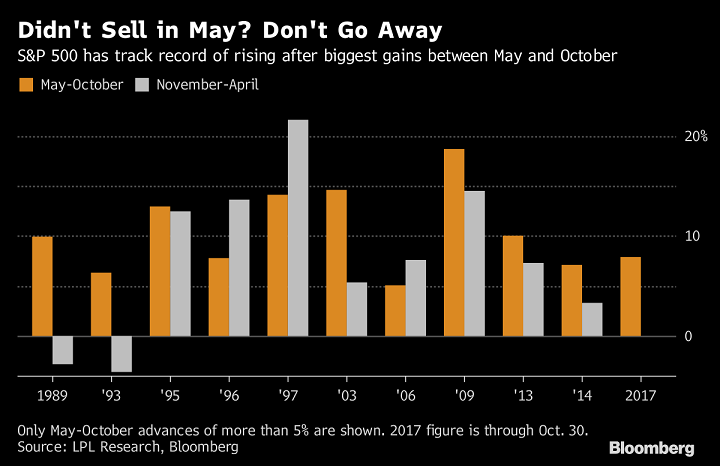

Dave Wilson points us towards the great chart below, which he created via an LPL research note: “Sell in May and go away”...

Dave Wilson points us towards the great chart below, which he created via an LPL research note: “Sell in May and go away”...

Read More

Ed Yardeni, who has been about as right about this market since the 2009 lows as anyone, believes stocks still have some...

Ed Yardeni, who has been about as right about this market since the 2009 lows as anyone, believes stocks still have some...

Read More

If you want to have a better understand why Howard Marks is considered one of the all time greats in investing, have a look at this...

Read More

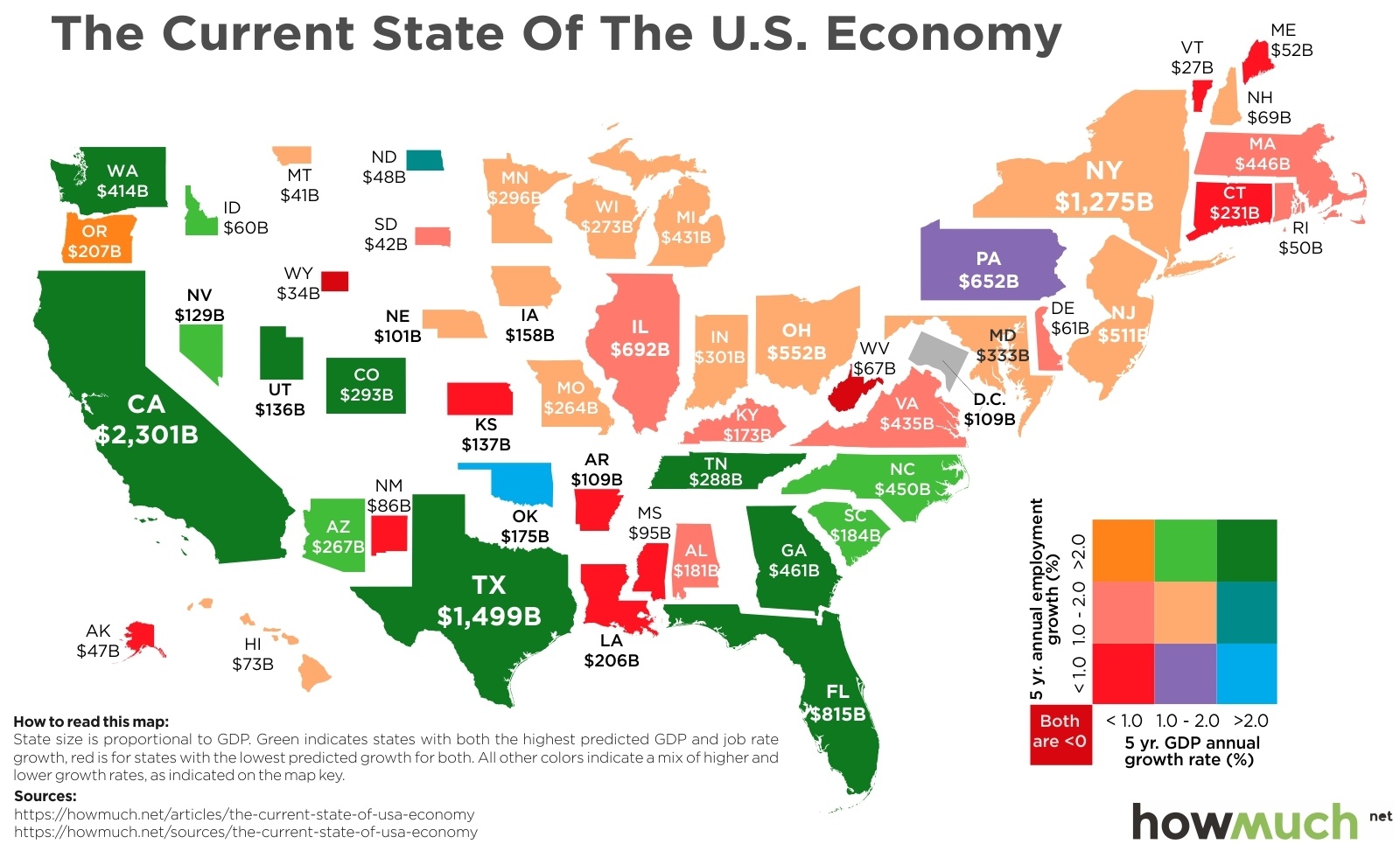

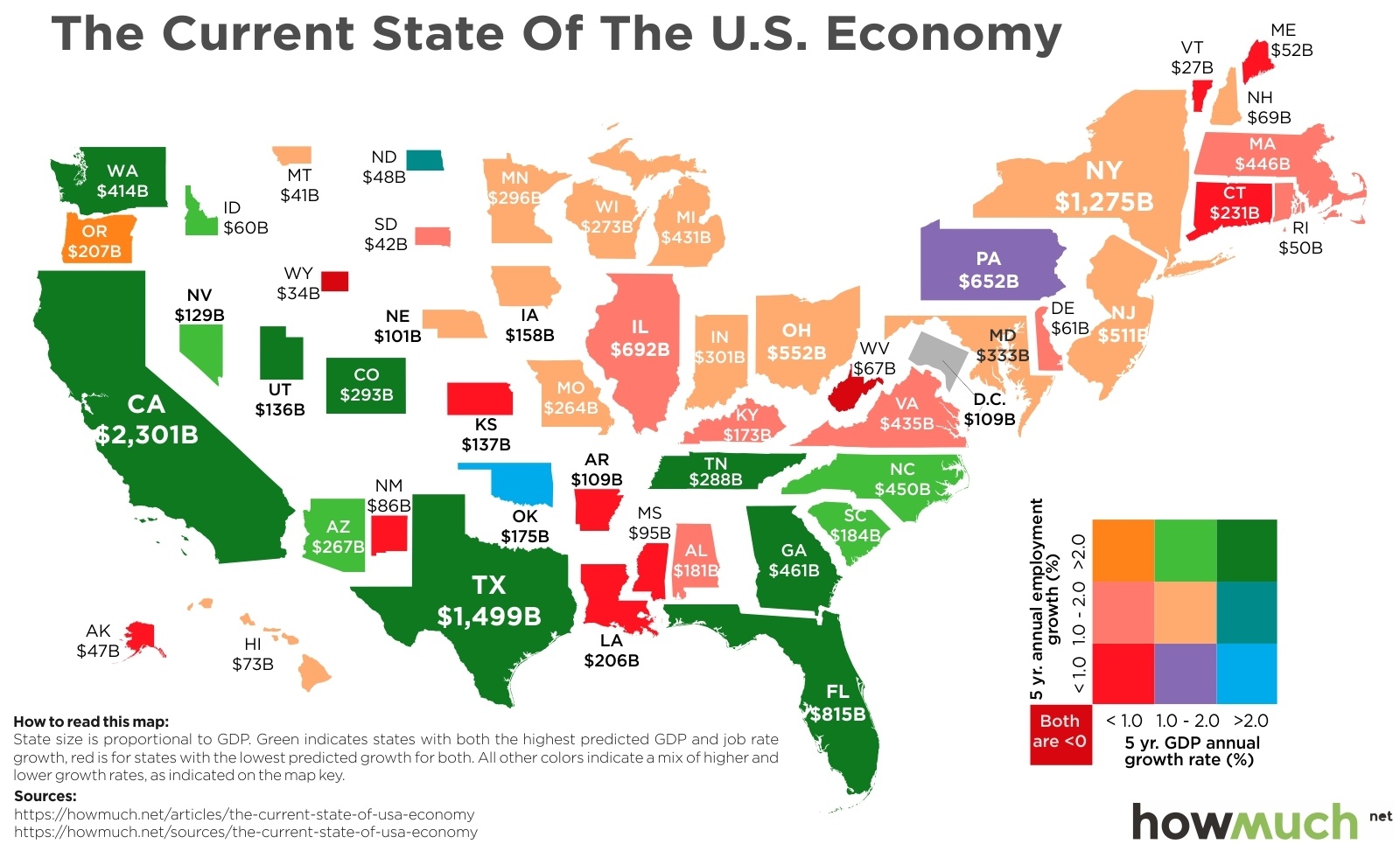

Fascinating: The U.S. economy has finally regained its pre-recession levels of employment and Gross Domestic Product (GDP). What does...

Fascinating: The U.S. economy has finally regained its pre-recession levels of employment and Gross Domestic Product (GDP). What does...

Read More

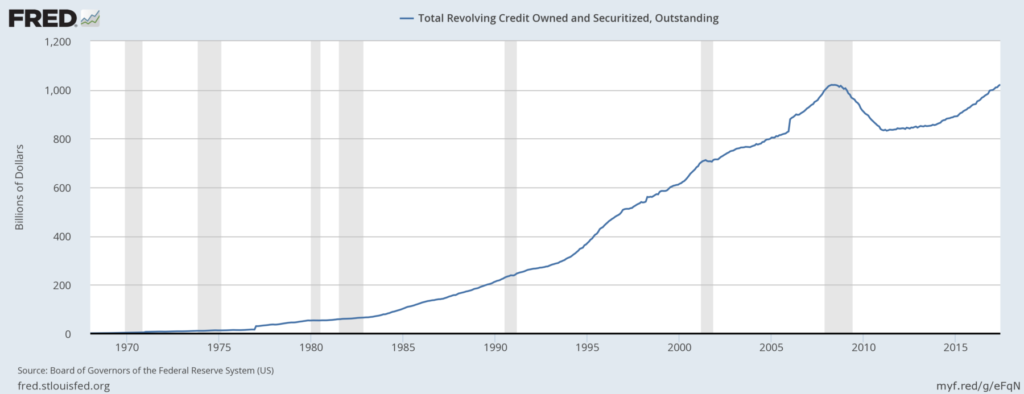

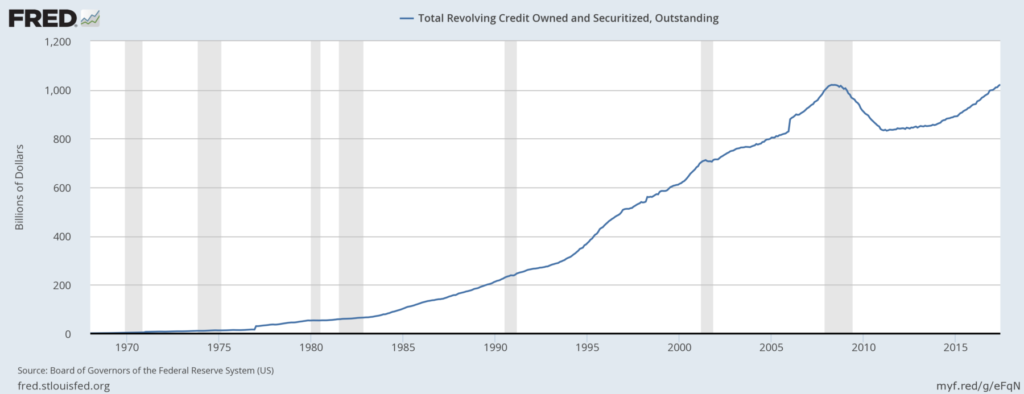

@TBPInvictus here: A recent column in the Washington Post – Consumer debt is at a record high. Haven’t we learned?...

@TBPInvictus here: A recent column in the Washington Post – Consumer debt is at a record high. Haven’t we learned?...

Read More

How to Spot a Bull or Bear Market Defining a market by percentage changes doesn’t offer the insight needed to make...

How to Spot a Bull or Bear Market Defining a market by percentage changes doesn’t offer the insight needed to make...

Read More

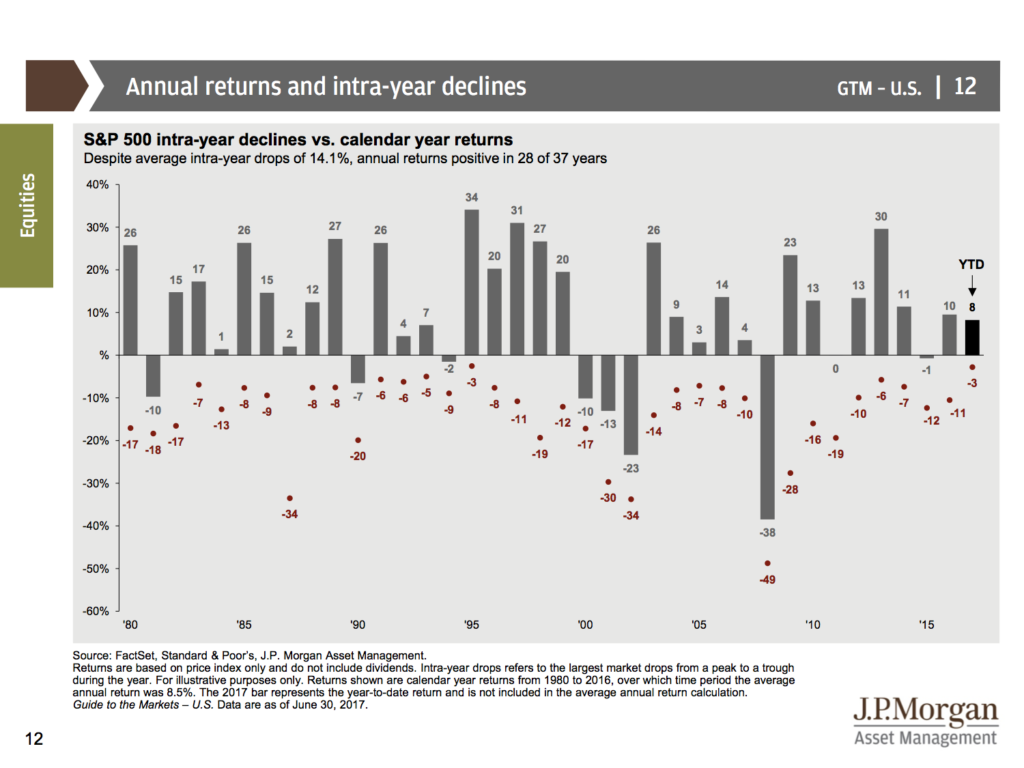

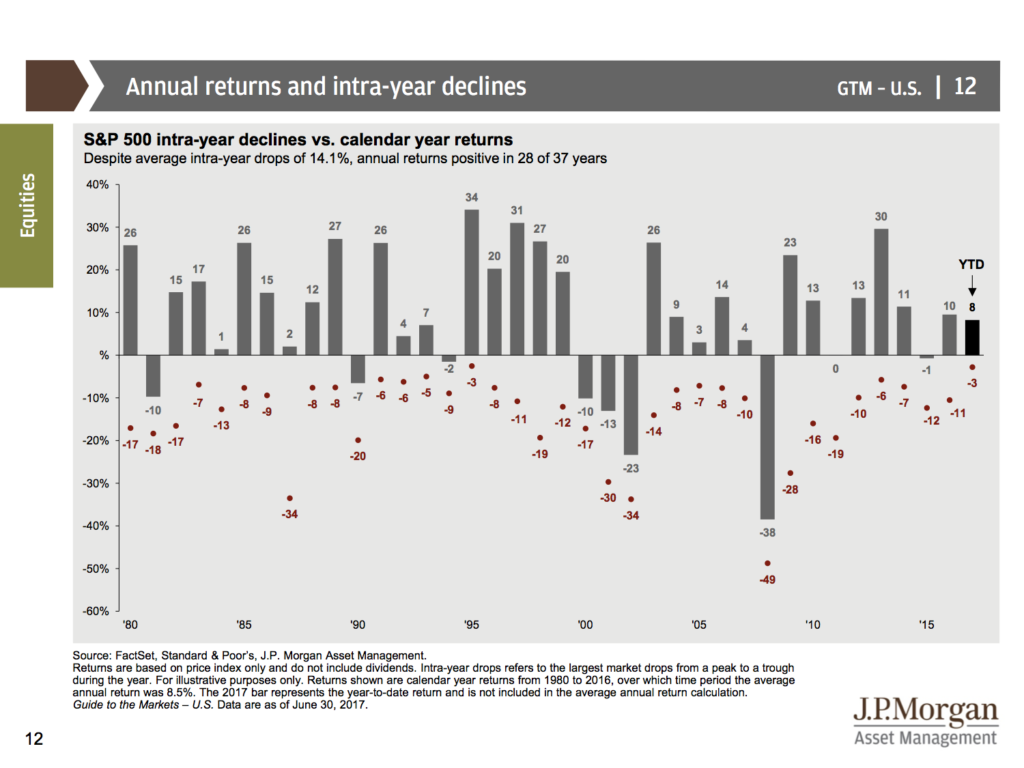

Here are two more favorite charts, via JP Morgan: Source: JP Morgan Chase

Here are two more favorite charts, via JP Morgan: Source: JP Morgan Chase

Read More

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...

Fascinating look at how much things change over 50 to 100 years: “[The] historical sequence for 1917, 1967 and 2017. The size of...