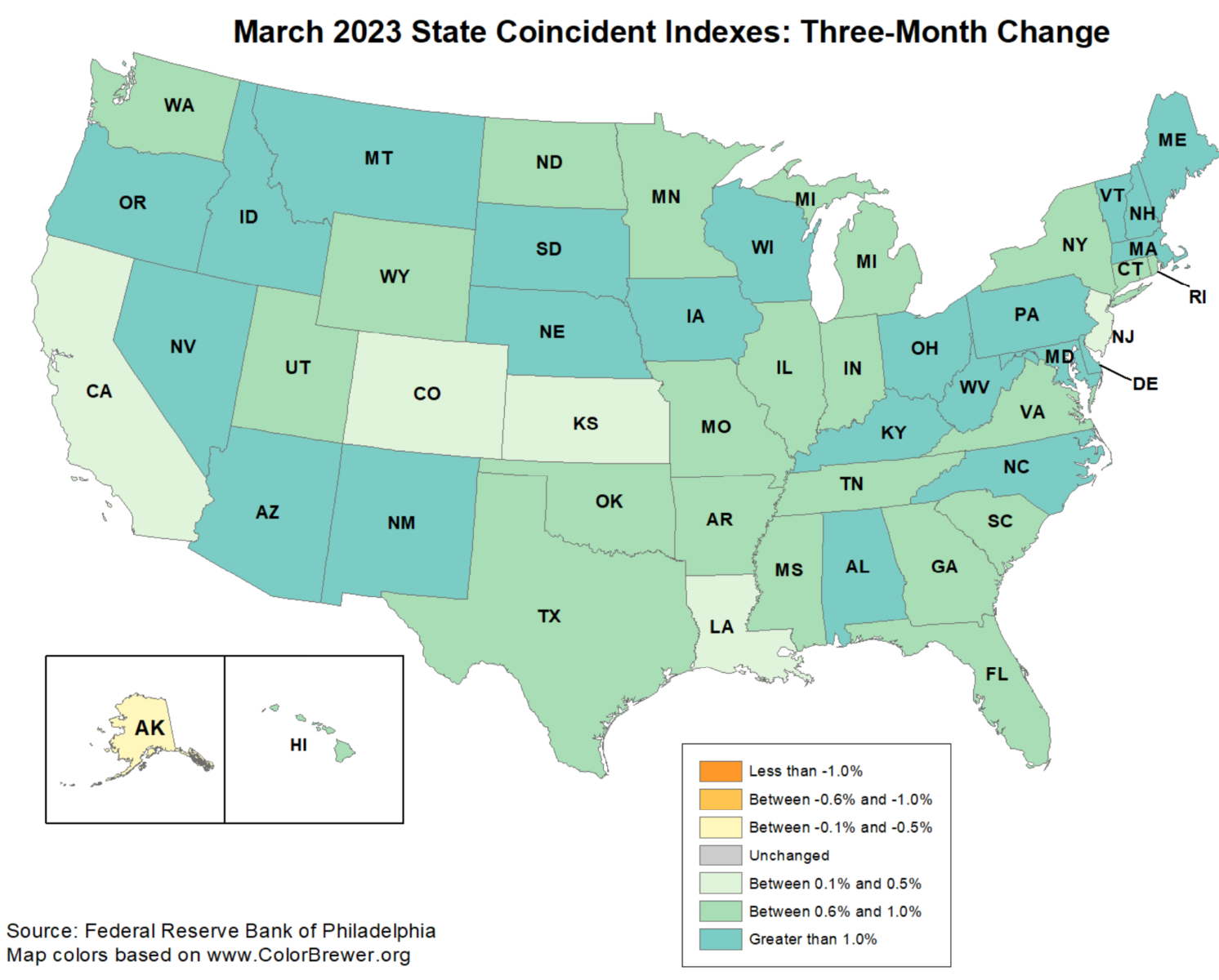

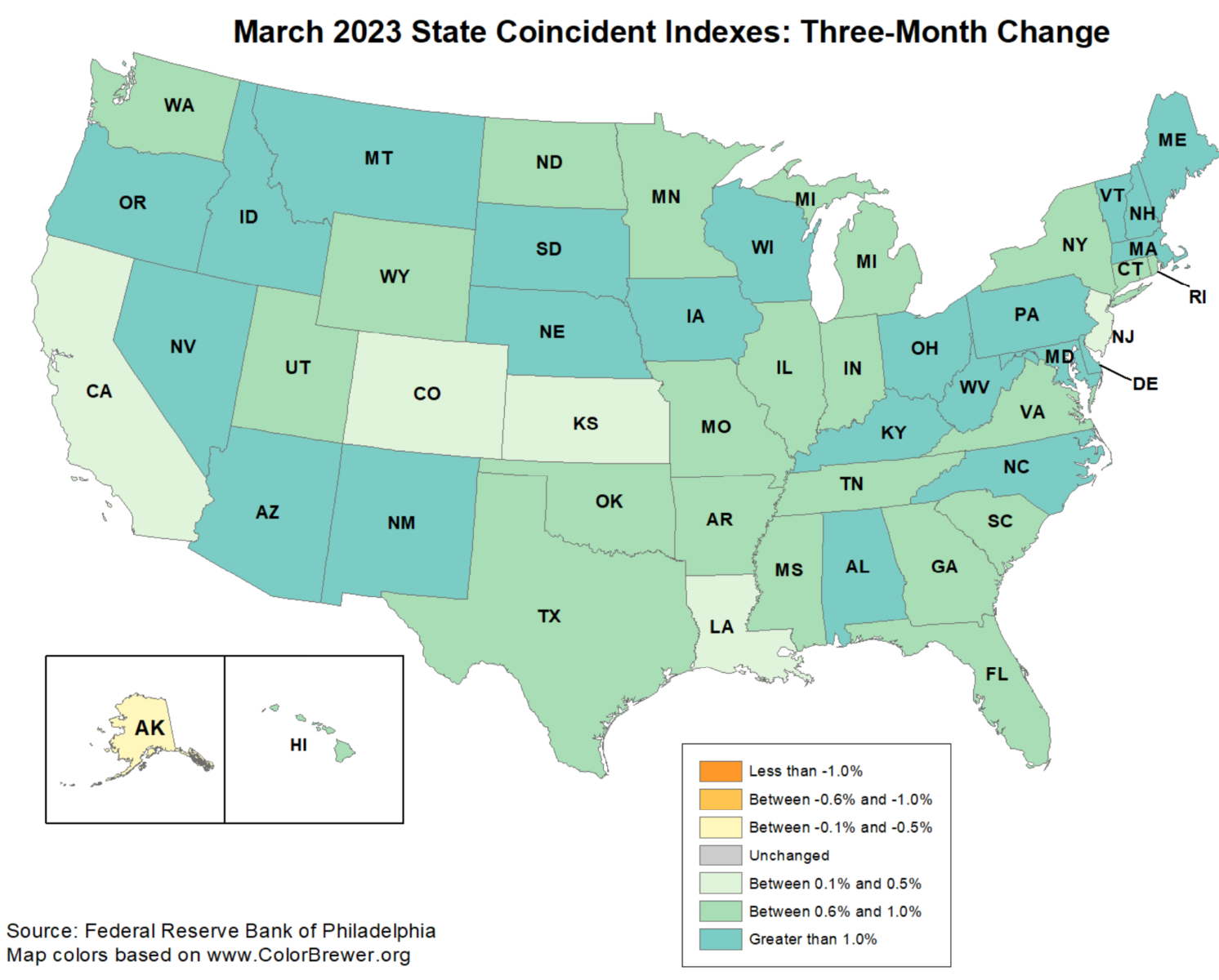

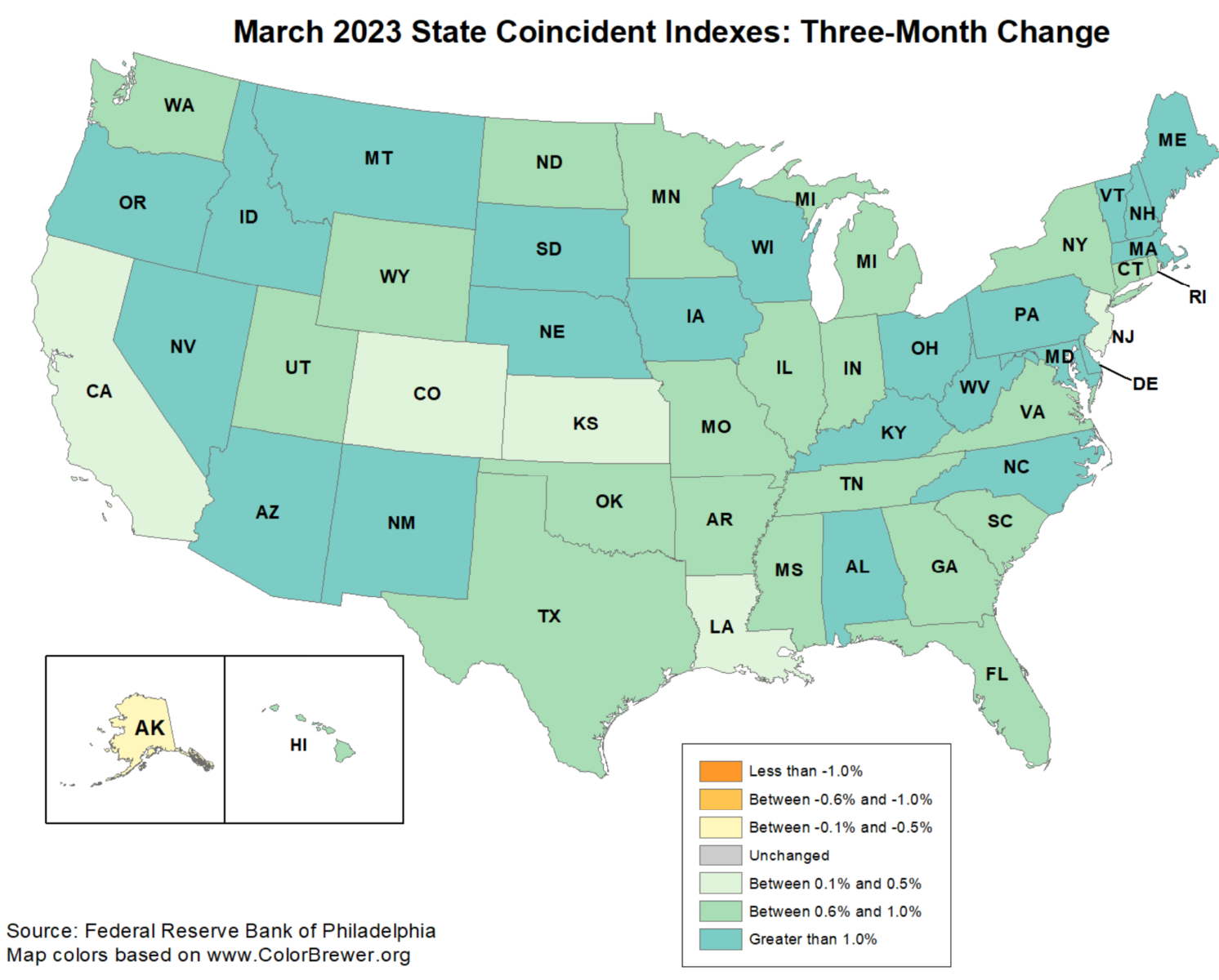

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...

Read More

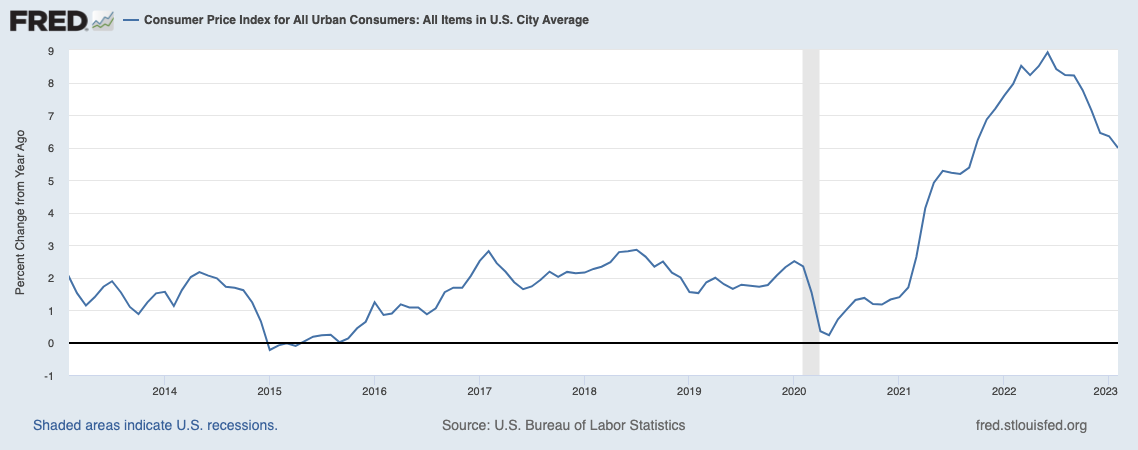

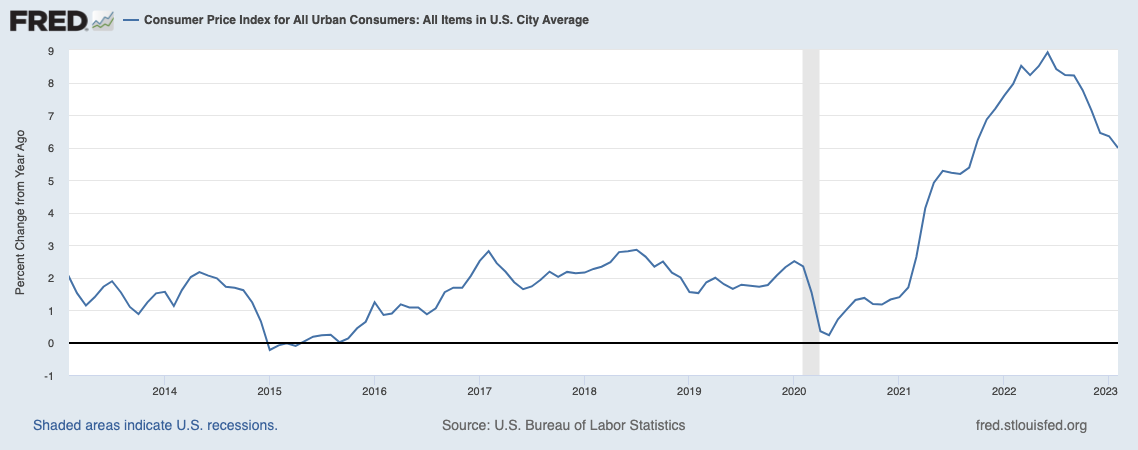

U.S. Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a...

U.S. Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a...

Read More

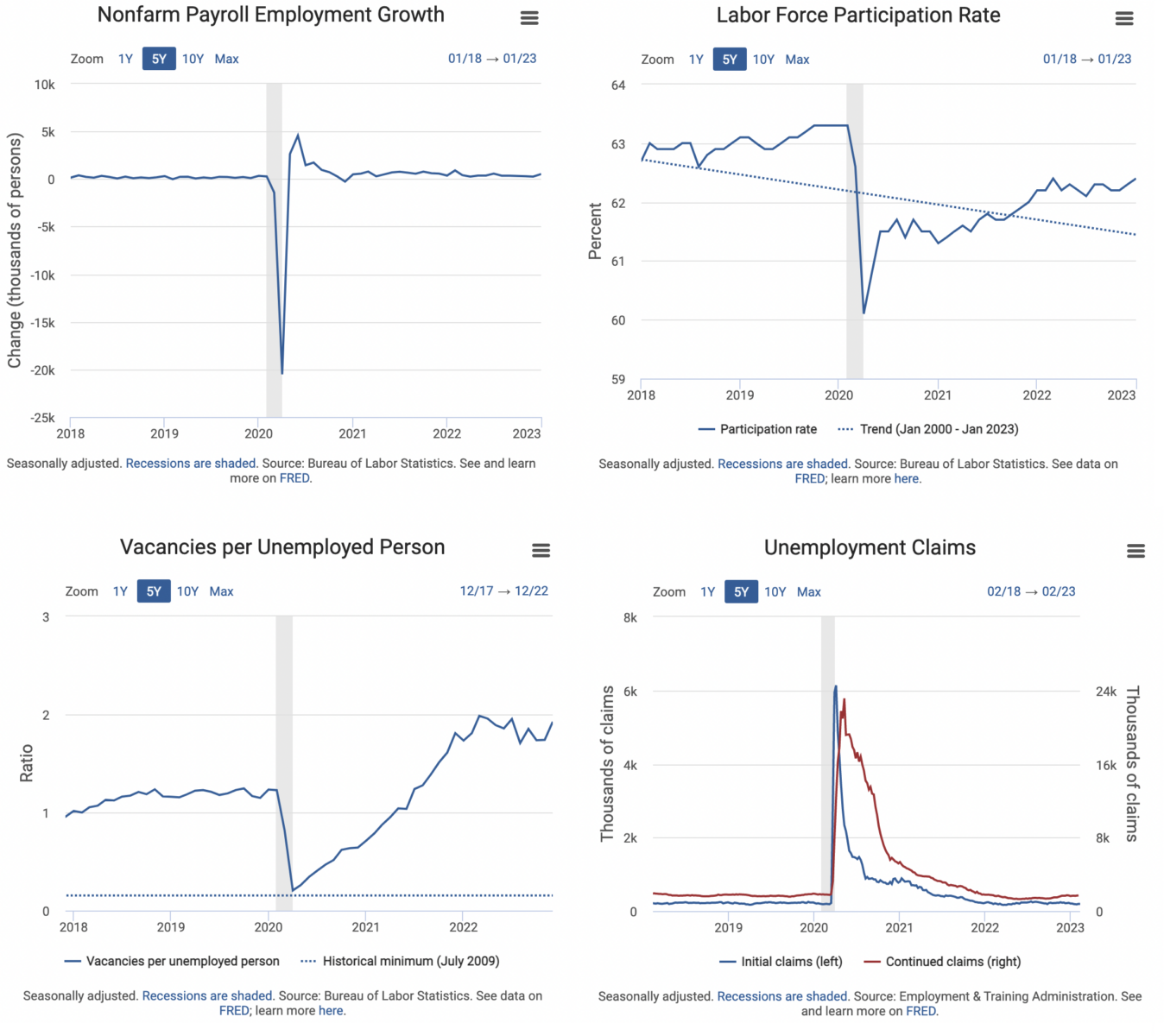

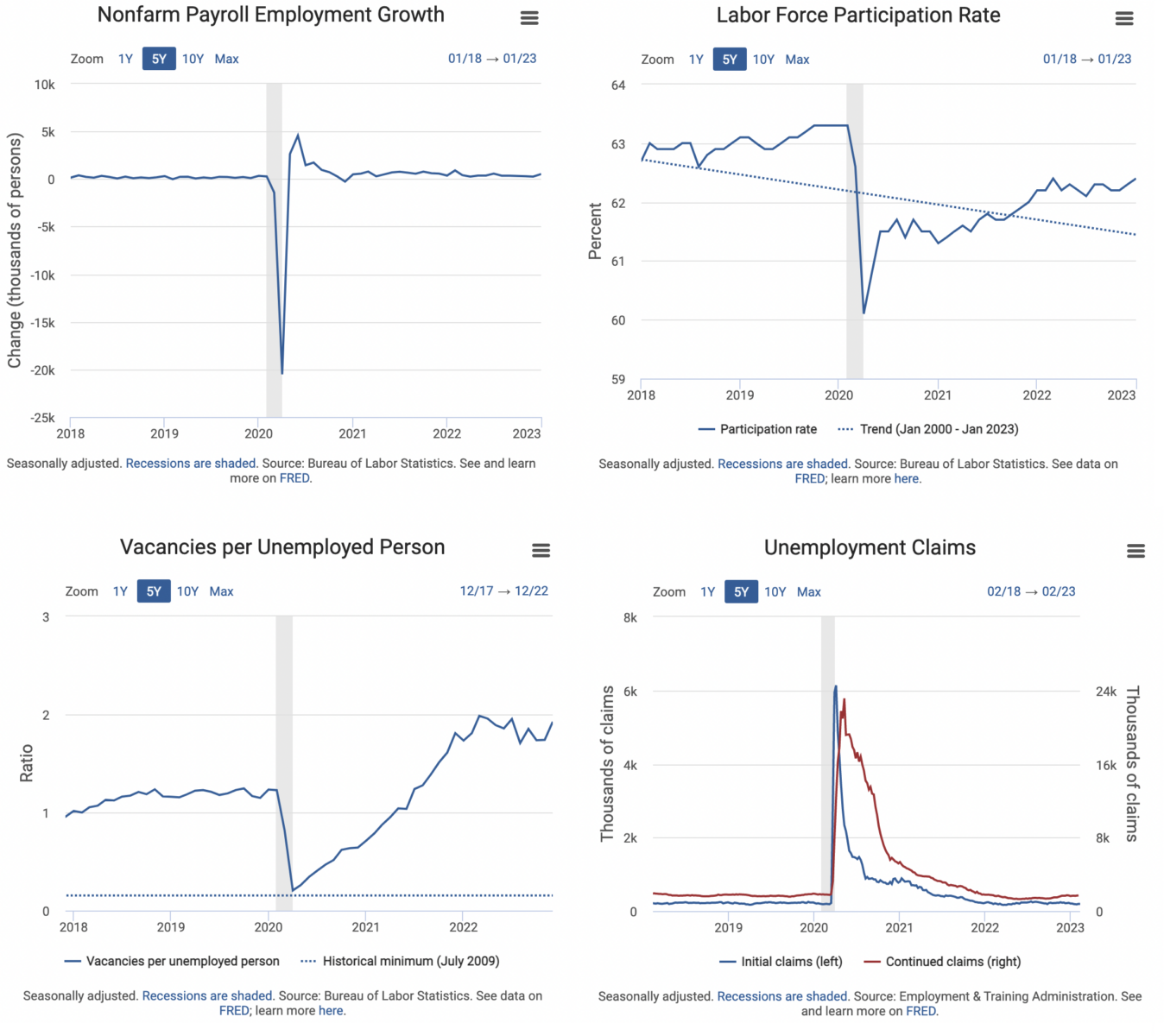

Nonfarm payrolls came out Friday, and once again they impressed with their underlying strength: 236,000 new workers were added in...

Nonfarm payrolls came out Friday, and once again they impressed with their underlying strength: 236,000 new workers were added in...

Read More

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Read More

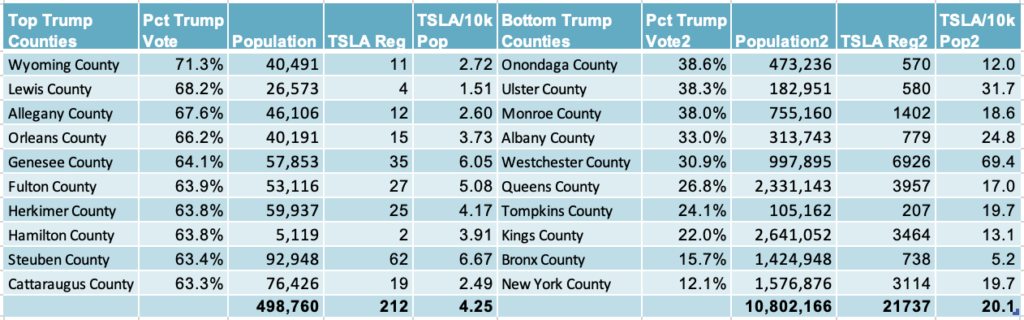

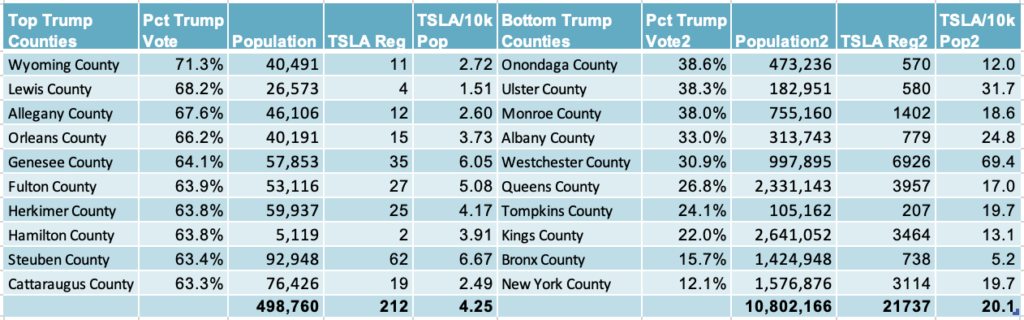

@TBPInvictus here. (Also on Post and Mastodon). Happy holidays to all, and the best for 2023. It’s been a hot minute since...

@TBPInvictus here. (Also on Post and Mastodon). Happy holidays to all, and the best for 2023. It’s been a hot minute since...

Read More

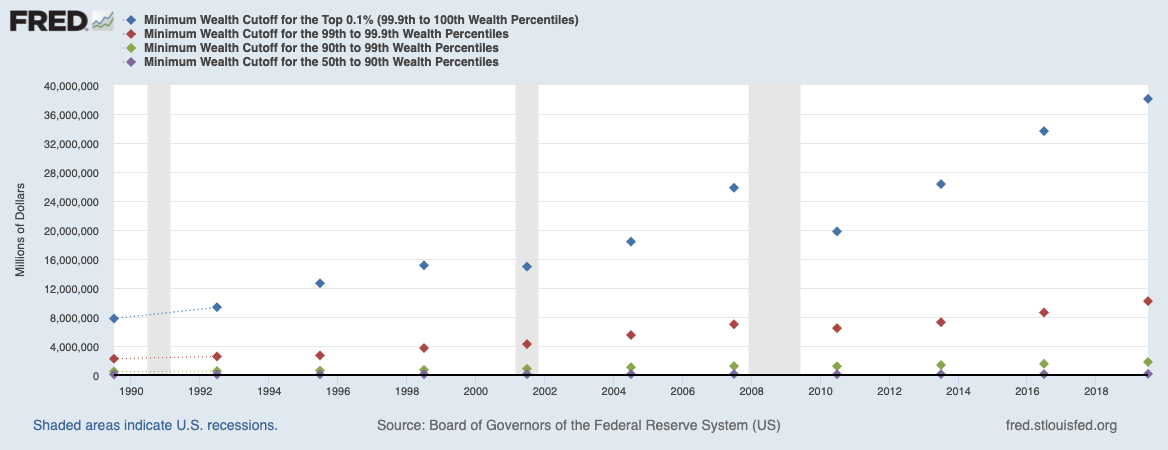

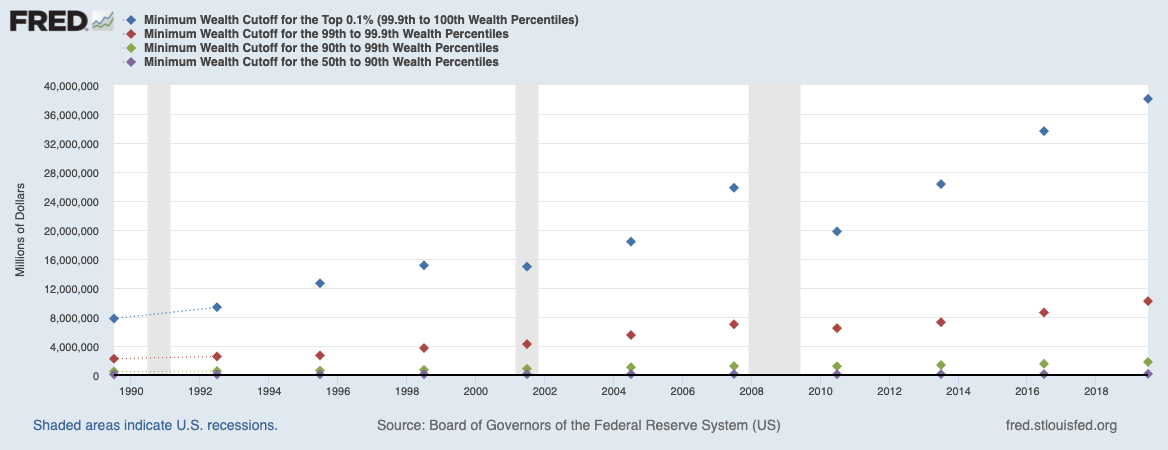

I was working on a longer piece about which economic strata the Fed has the greatest impact on (its more complicated than you...

I was working on a longer piece about which economic strata the Fed has the greatest impact on (its more complicated than you...

Read More

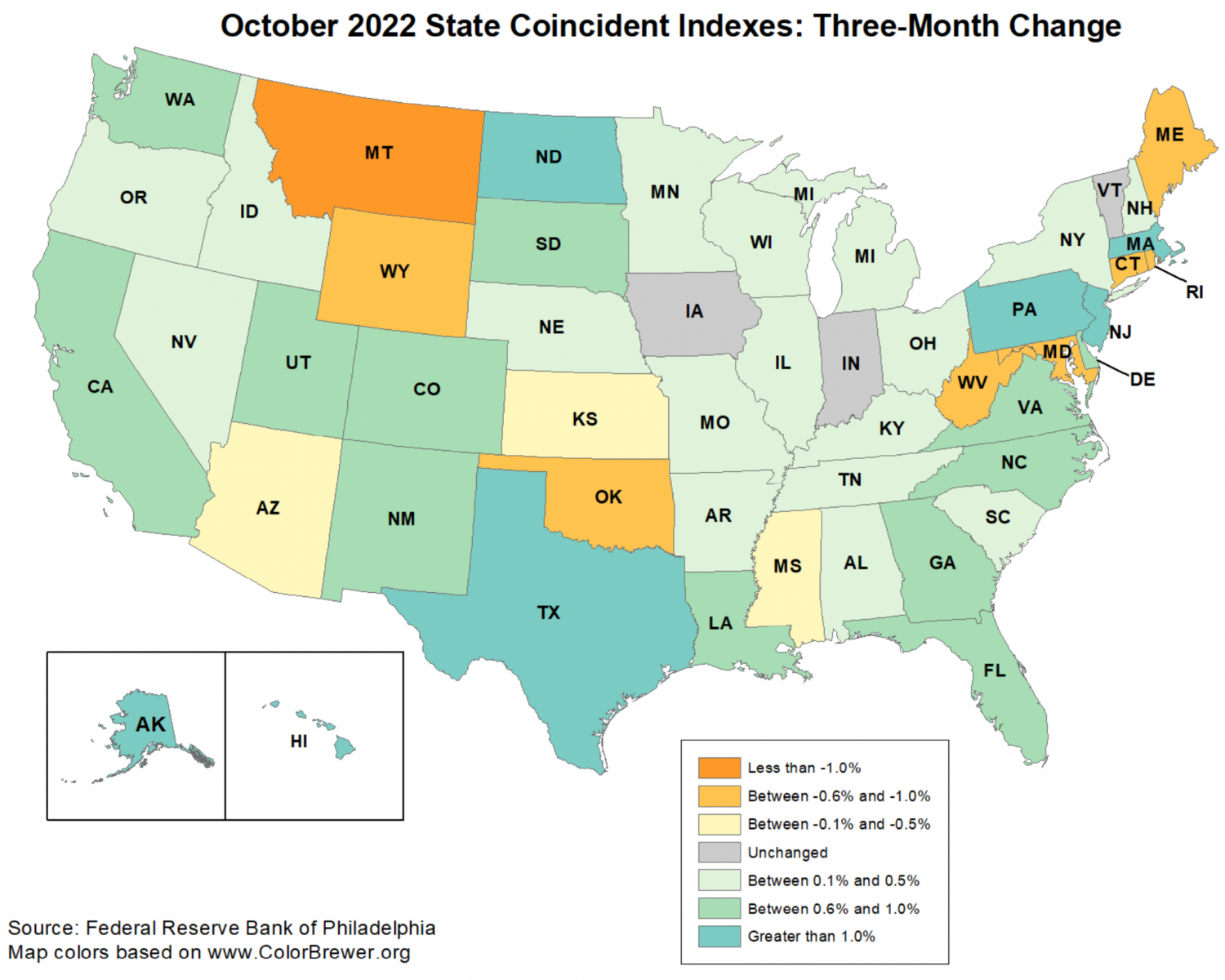

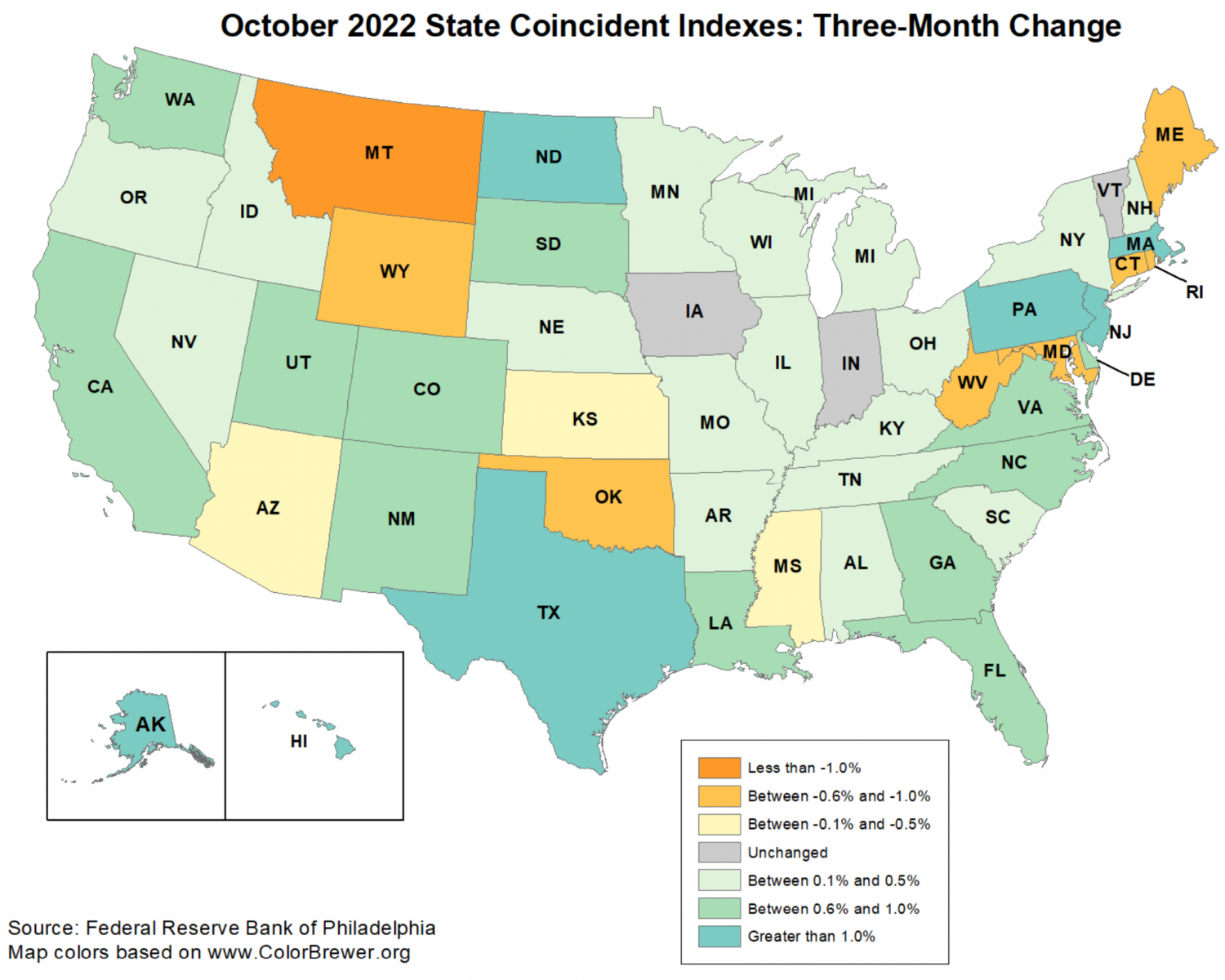

Source: Federal Reserve Bank of Philadelphia The Coincident State Indexes for October 2022 snuck out last week right before...

Source: Federal Reserve Bank of Philadelphia The Coincident State Indexes for October 2022 snuck out last week right before...

Read More

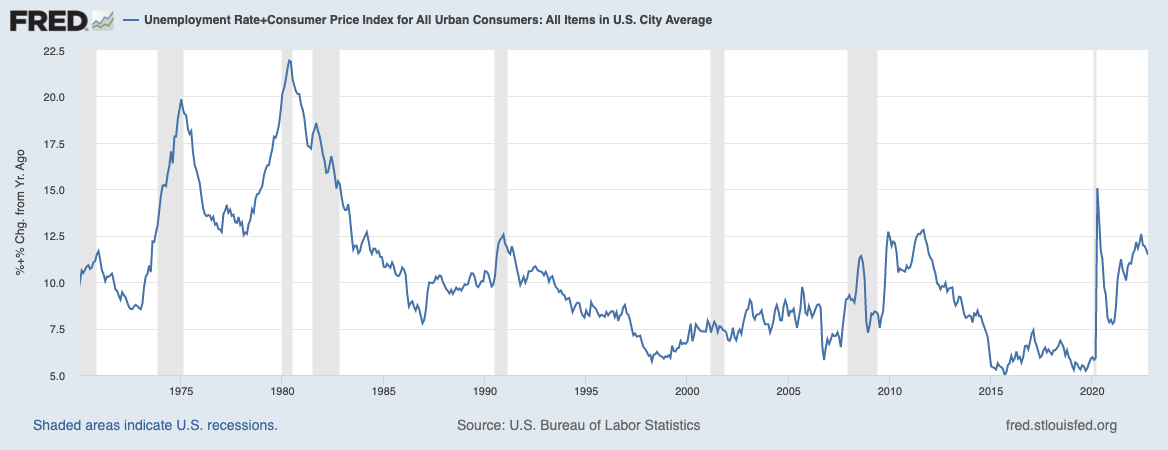

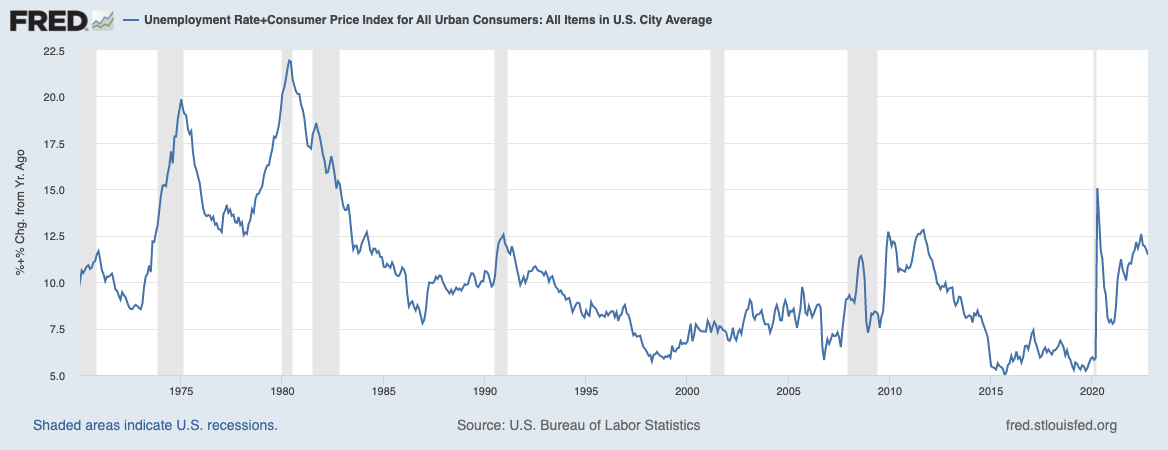

You may have missed this wonderful Josh Zumbrun column in the Wall Street Journal last week: “Inflation and Unemployment Both...

You may have missed this wonderful Josh Zumbrun column in the Wall Street Journal last week: “Inflation and Unemployment Both...

Read More

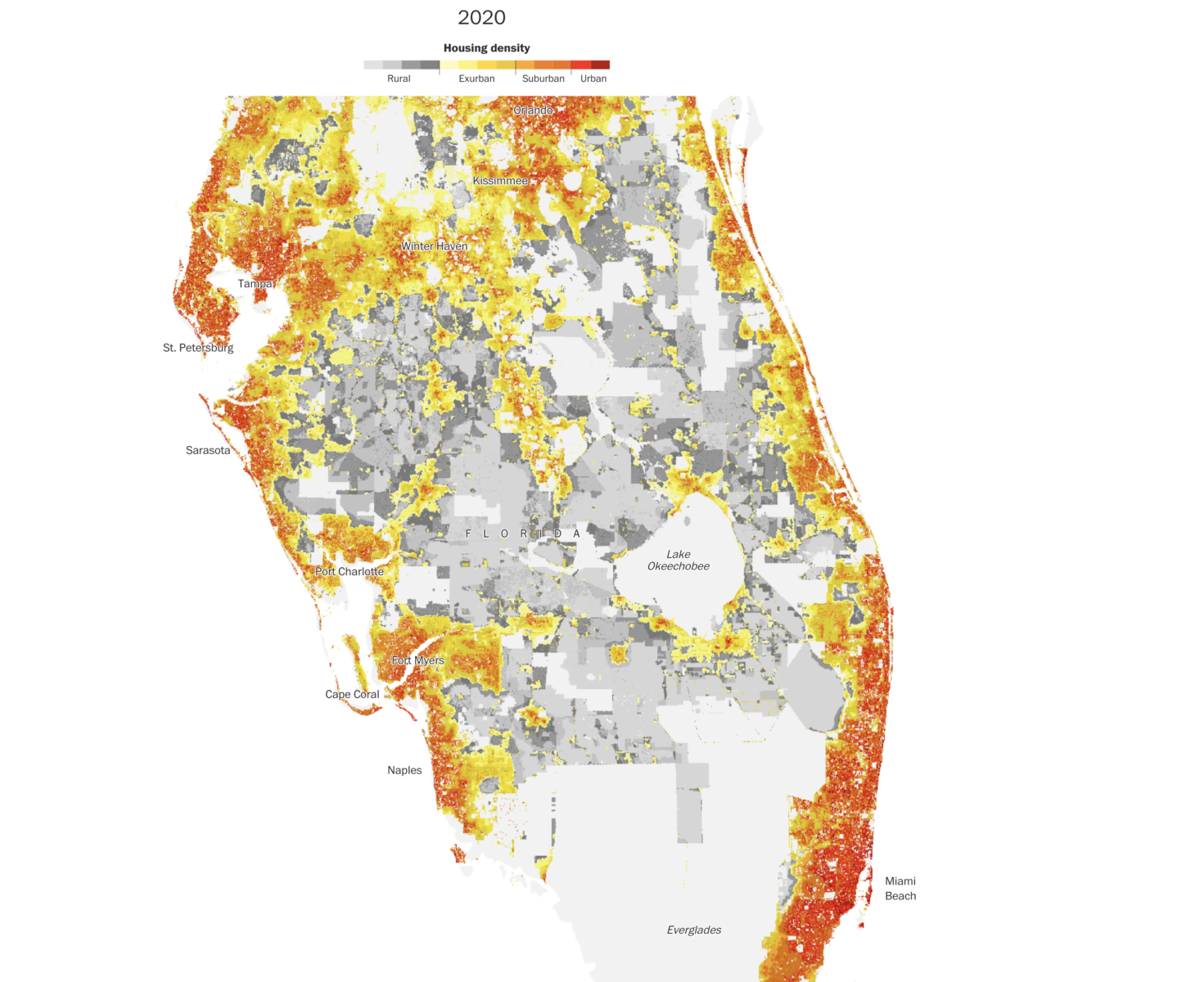

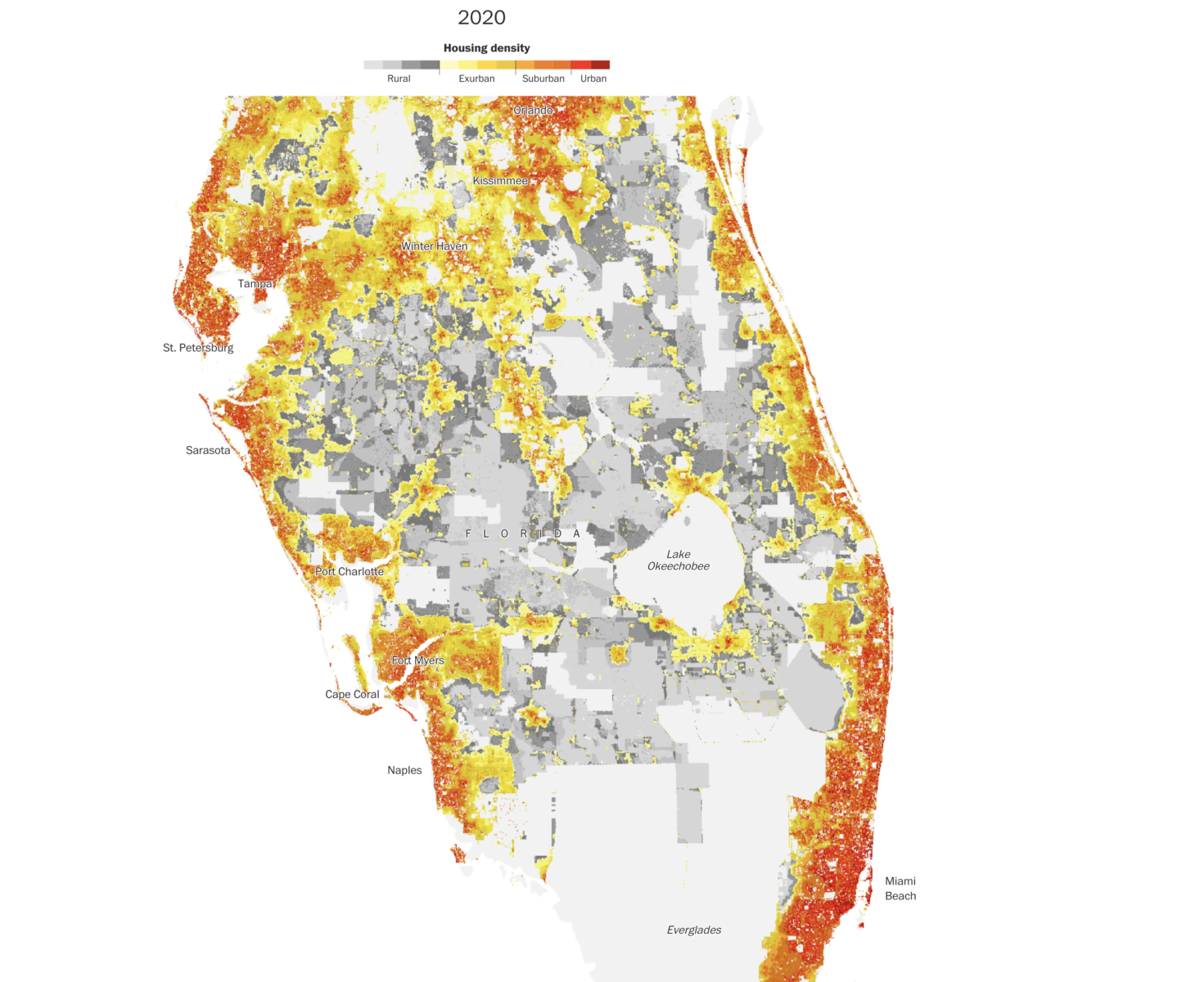

Great interactive from the Washington Post showing the past 50 years. During that time, millions of people have moved into Hurricane...

Great interactive from the Washington Post showing the past 50 years. During that time, millions of people have moved into Hurricane...

Read More

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...

I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State...