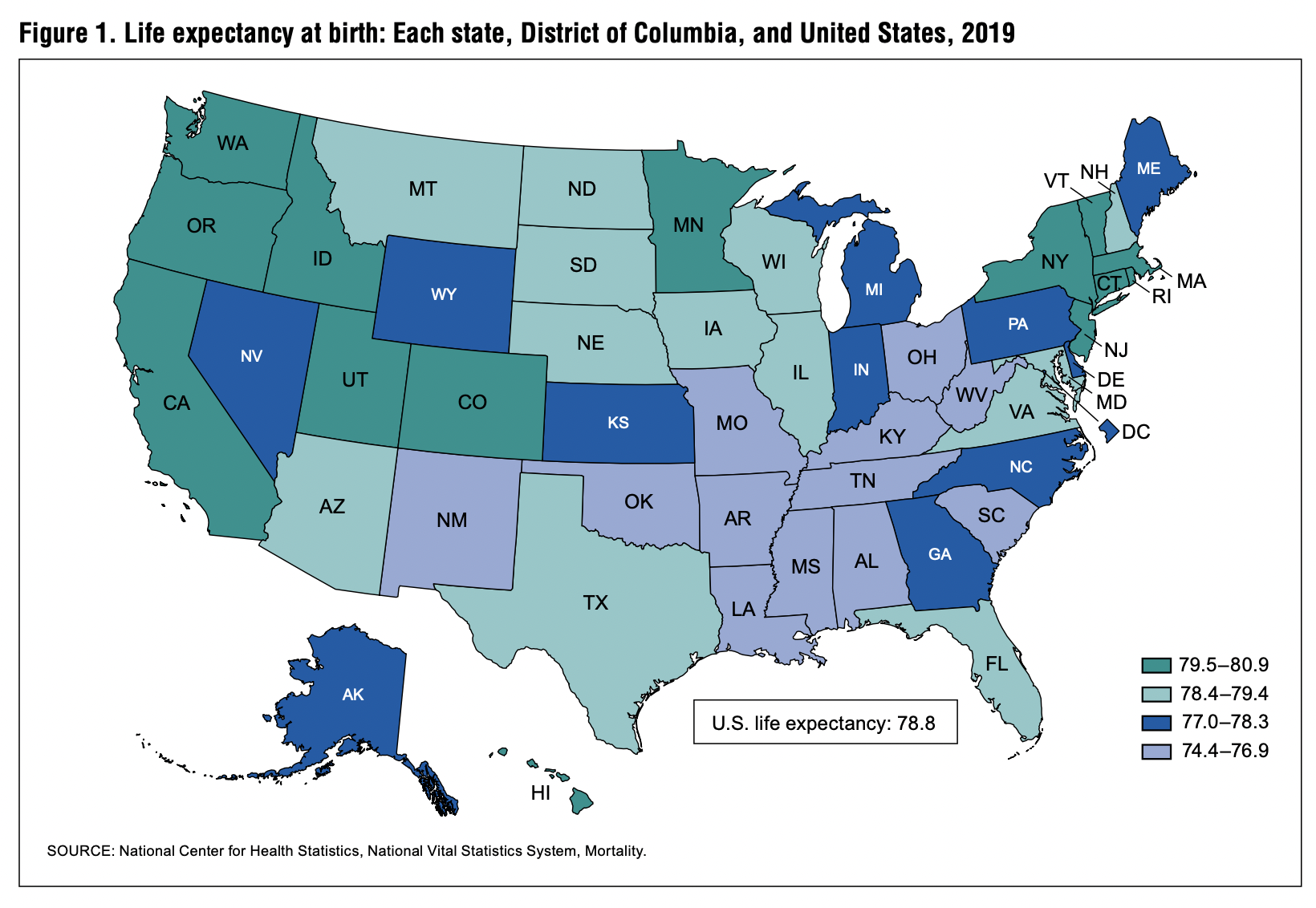

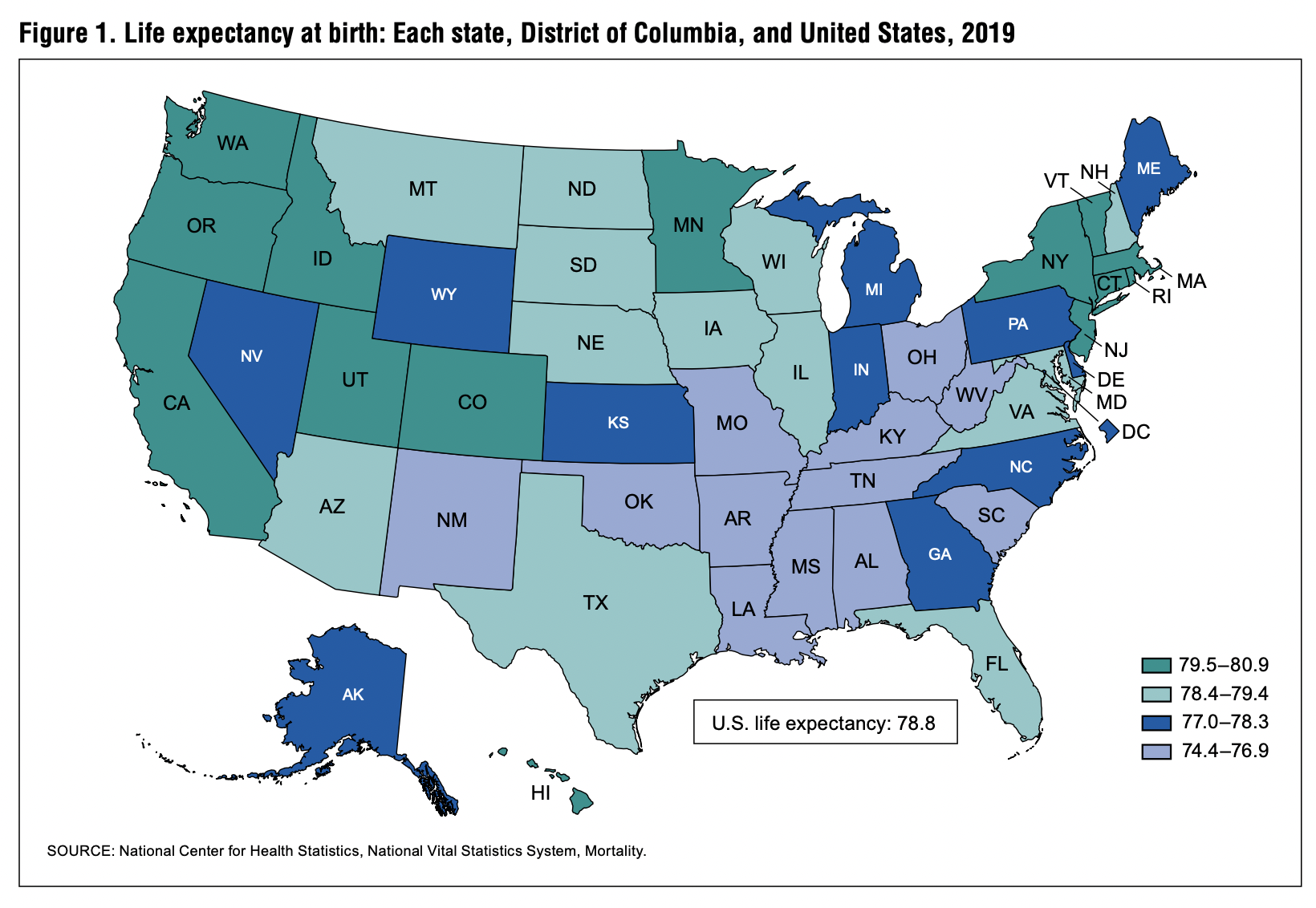

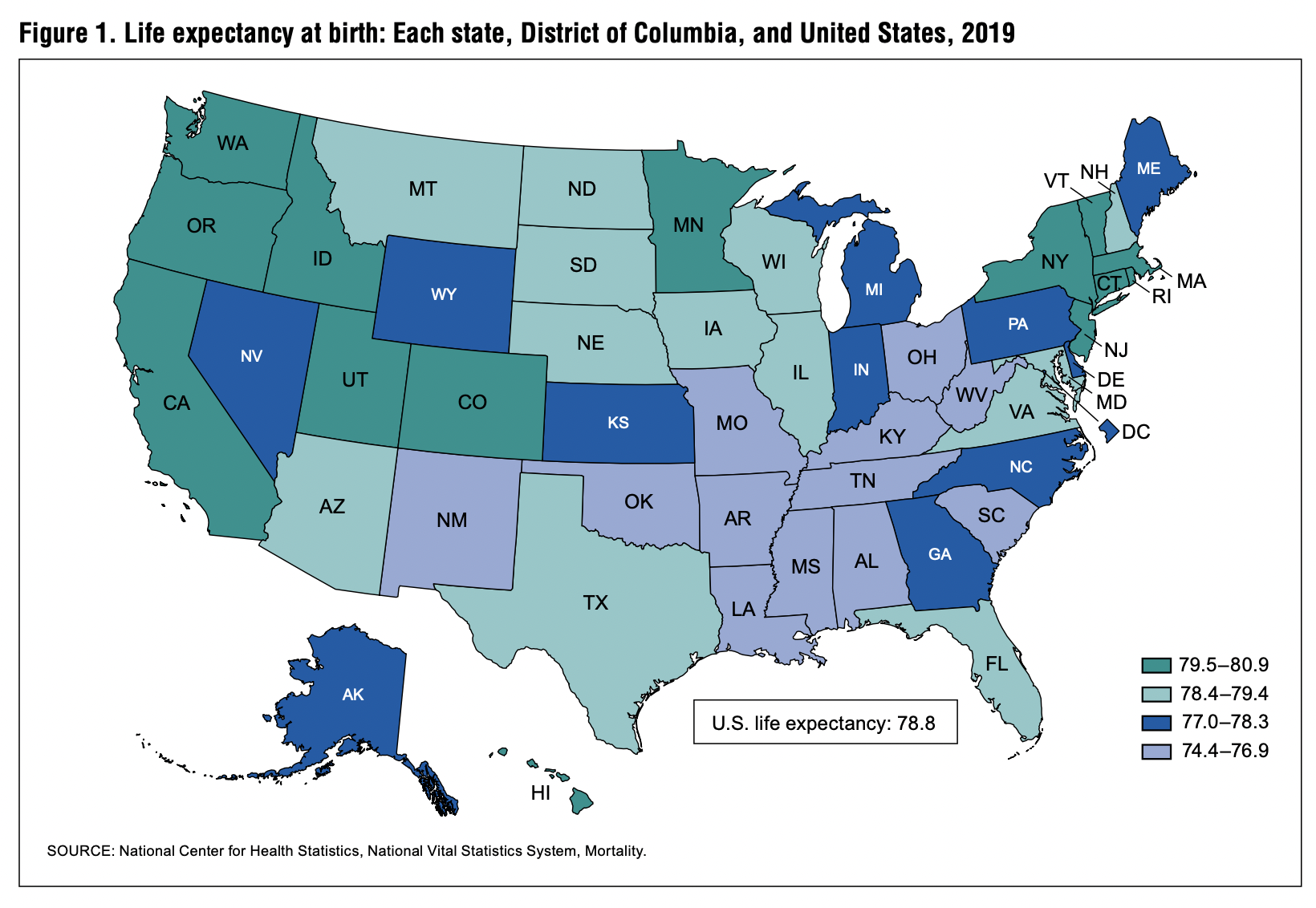

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...

Read More

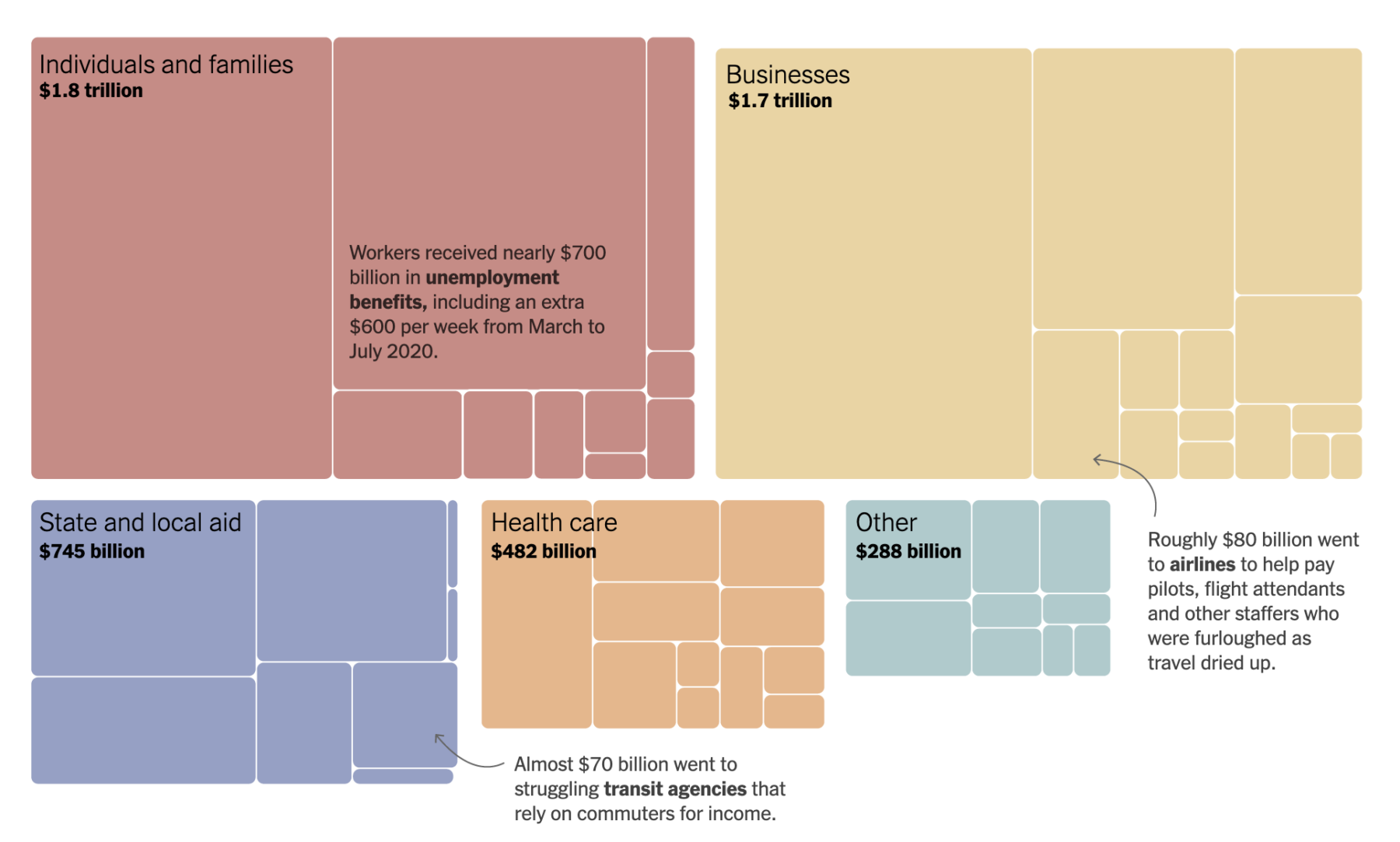

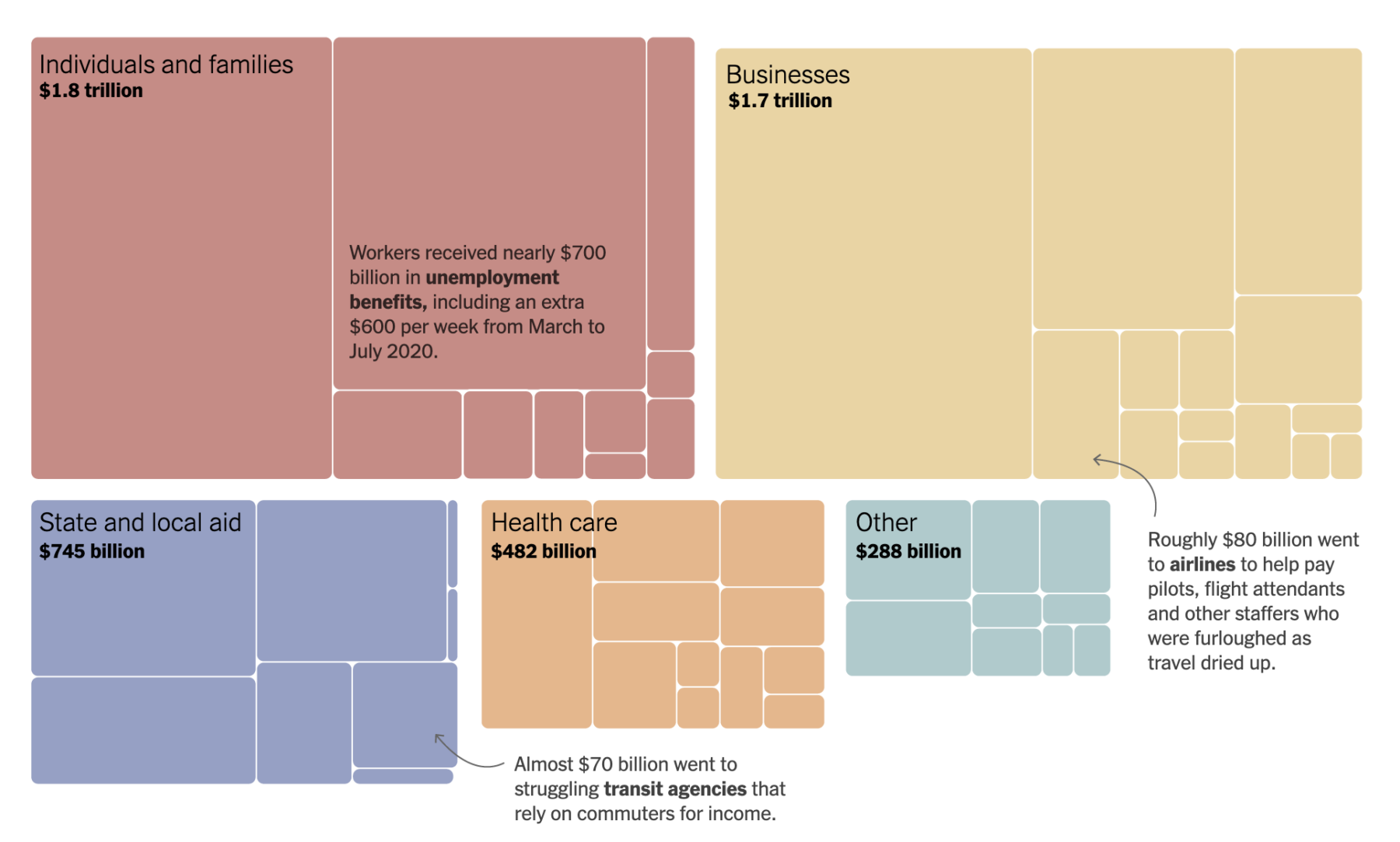

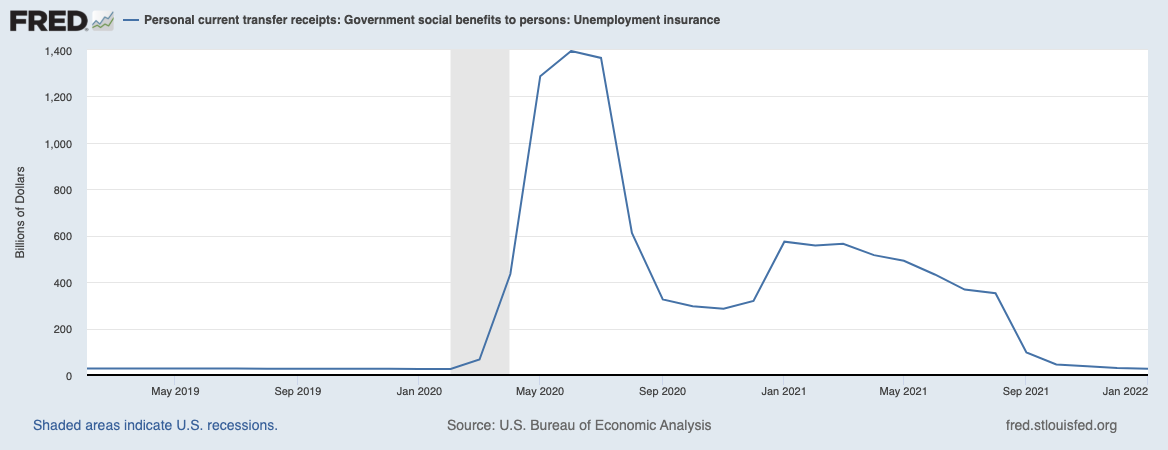

The reactions to the two most recent major economic crises provide a wonderful laboratory to do a compare and contrast...

The reactions to the two most recent major economic crises provide a wonderful laboratory to do a compare and contrast...

Read More

The Nonfarm payroll report today showed strength in hiring, modest wage increases, and a substantial decrease in...

The Nonfarm payroll report today showed strength in hiring, modest wage increases, and a substantial decrease in...

Read More

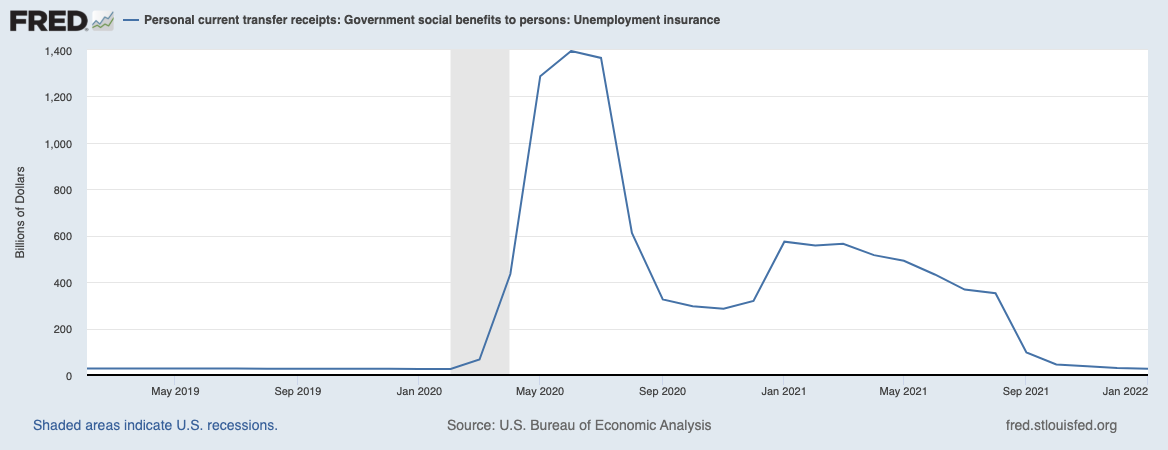

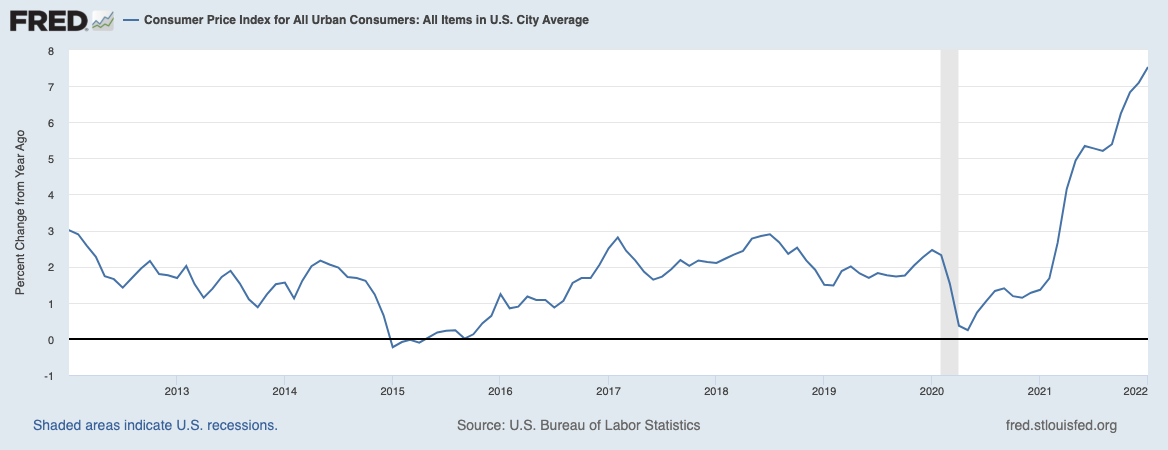

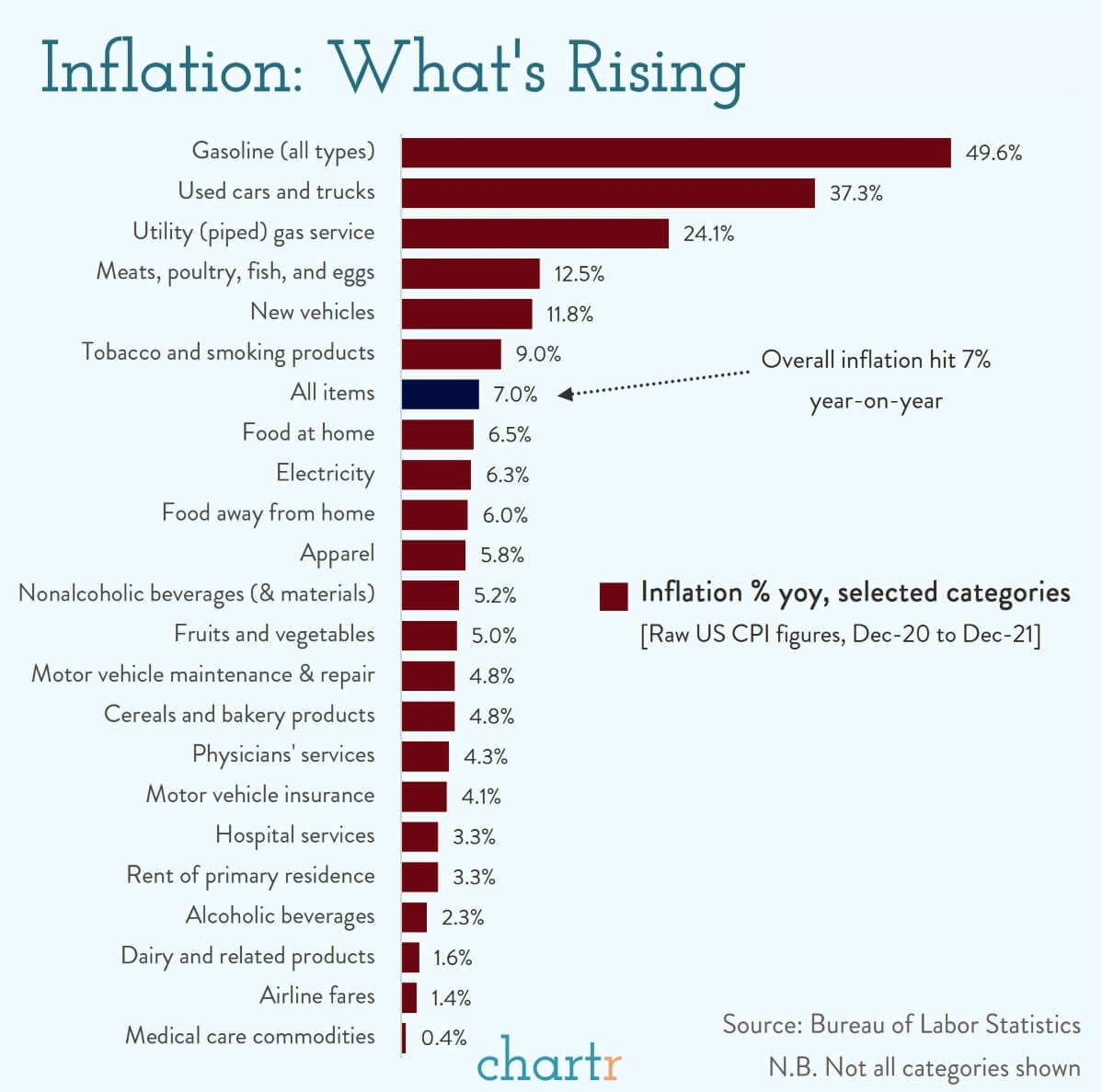

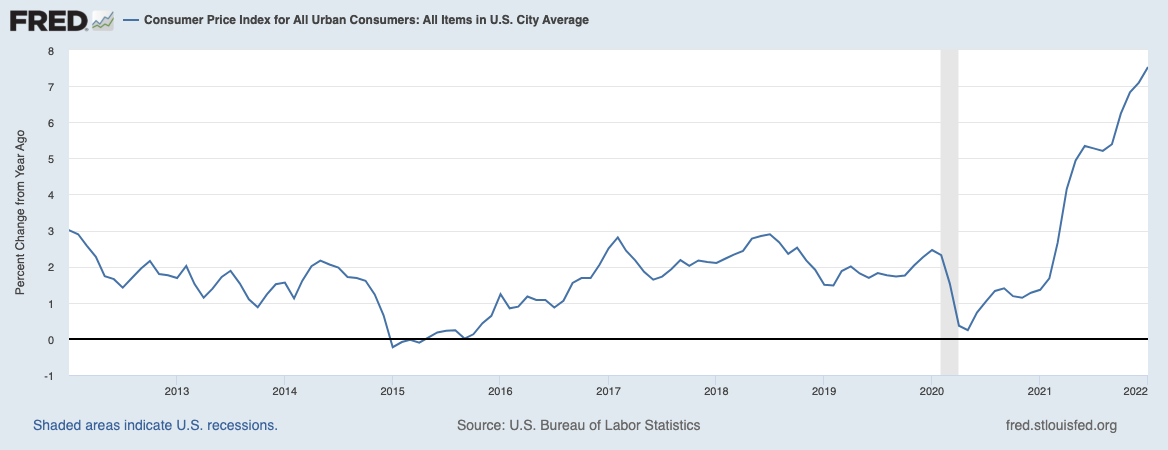

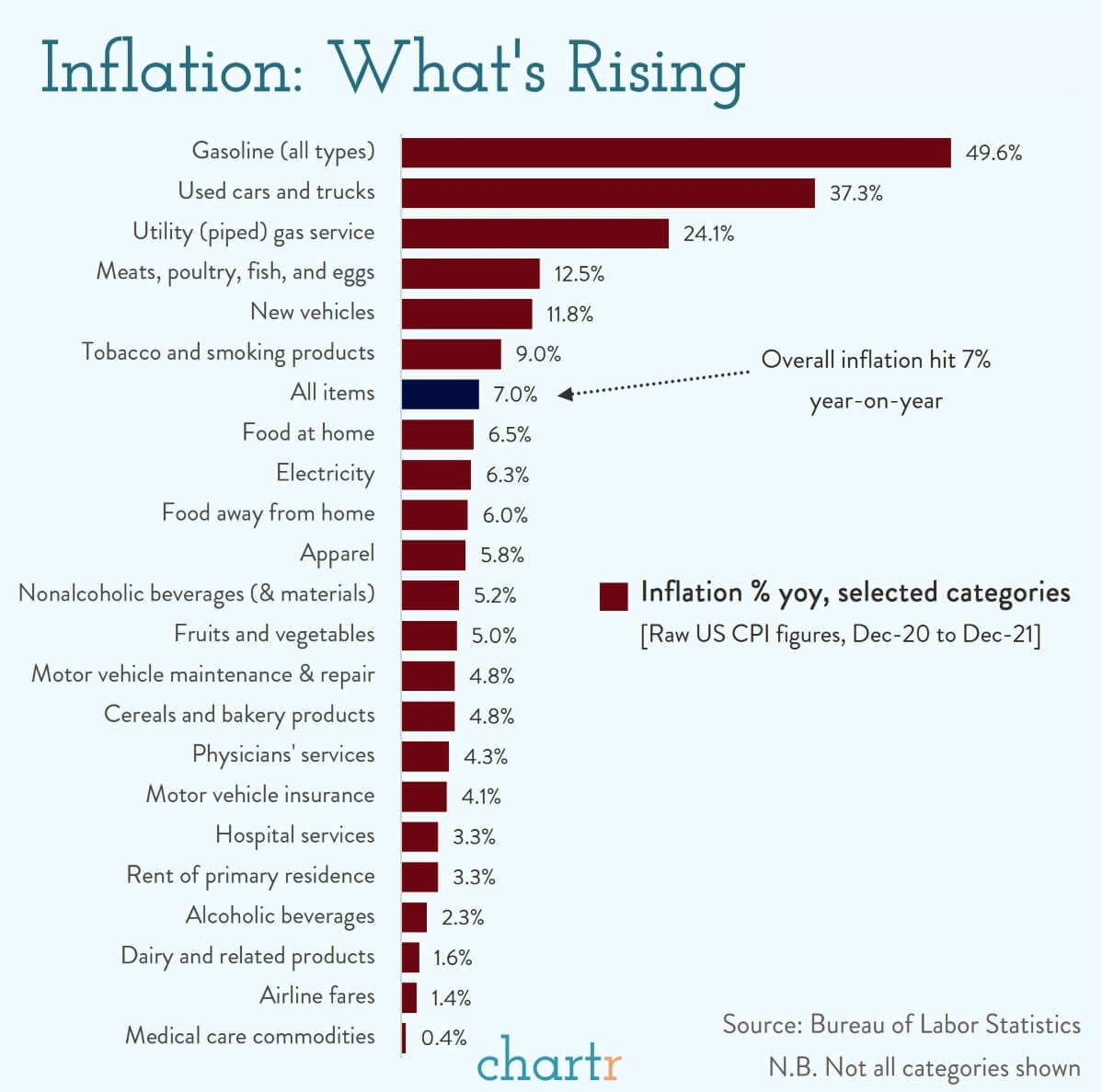

CPI came in hotter than expected today, up 0.6% in January (seasonally adjusted); Year-over-year the increase of 7.5% (no...

CPI came in hotter than expected today, up 0.6% in January (seasonally adjusted); Year-over-year the increase of 7.5% (no...

Read More

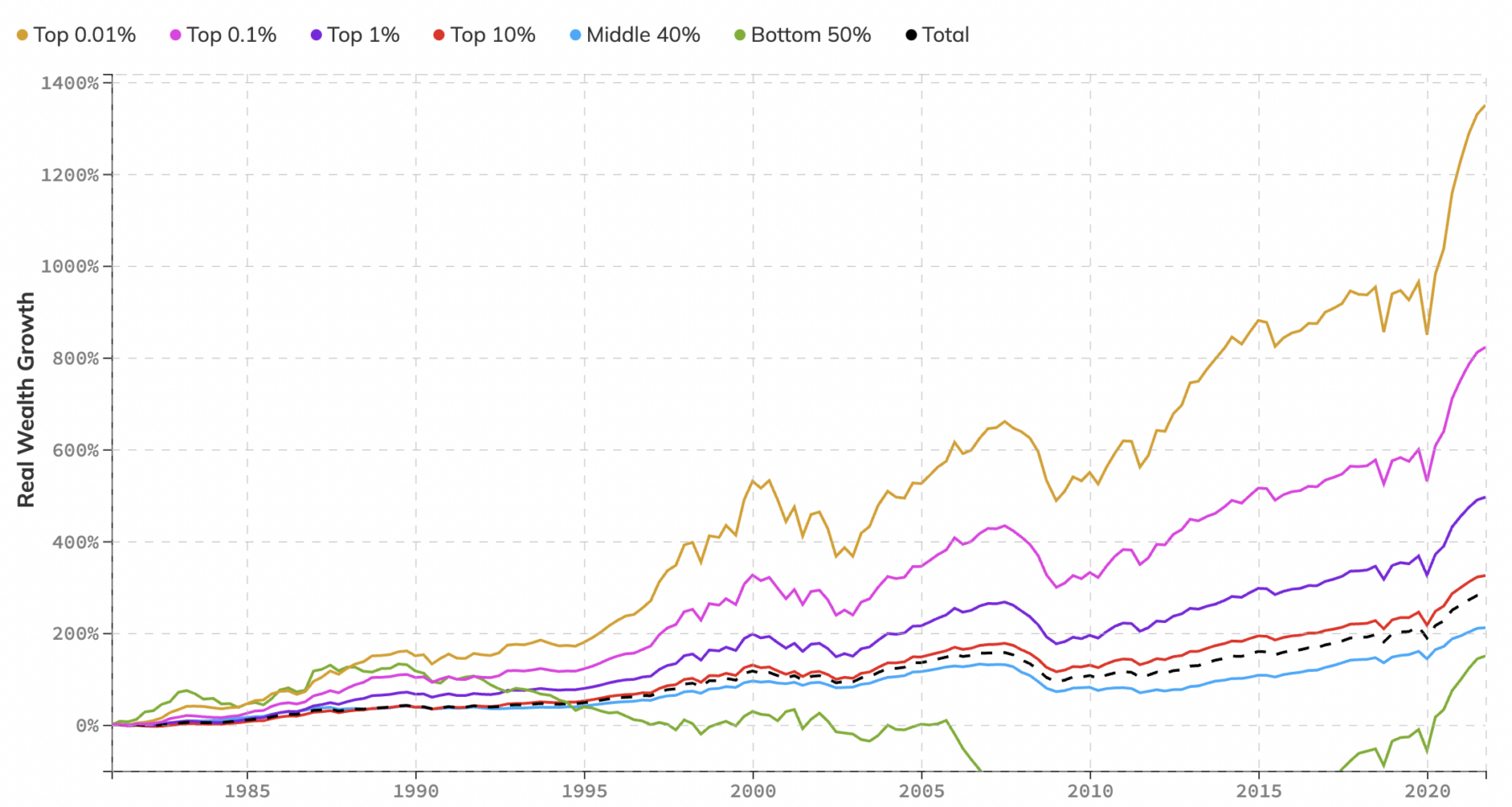

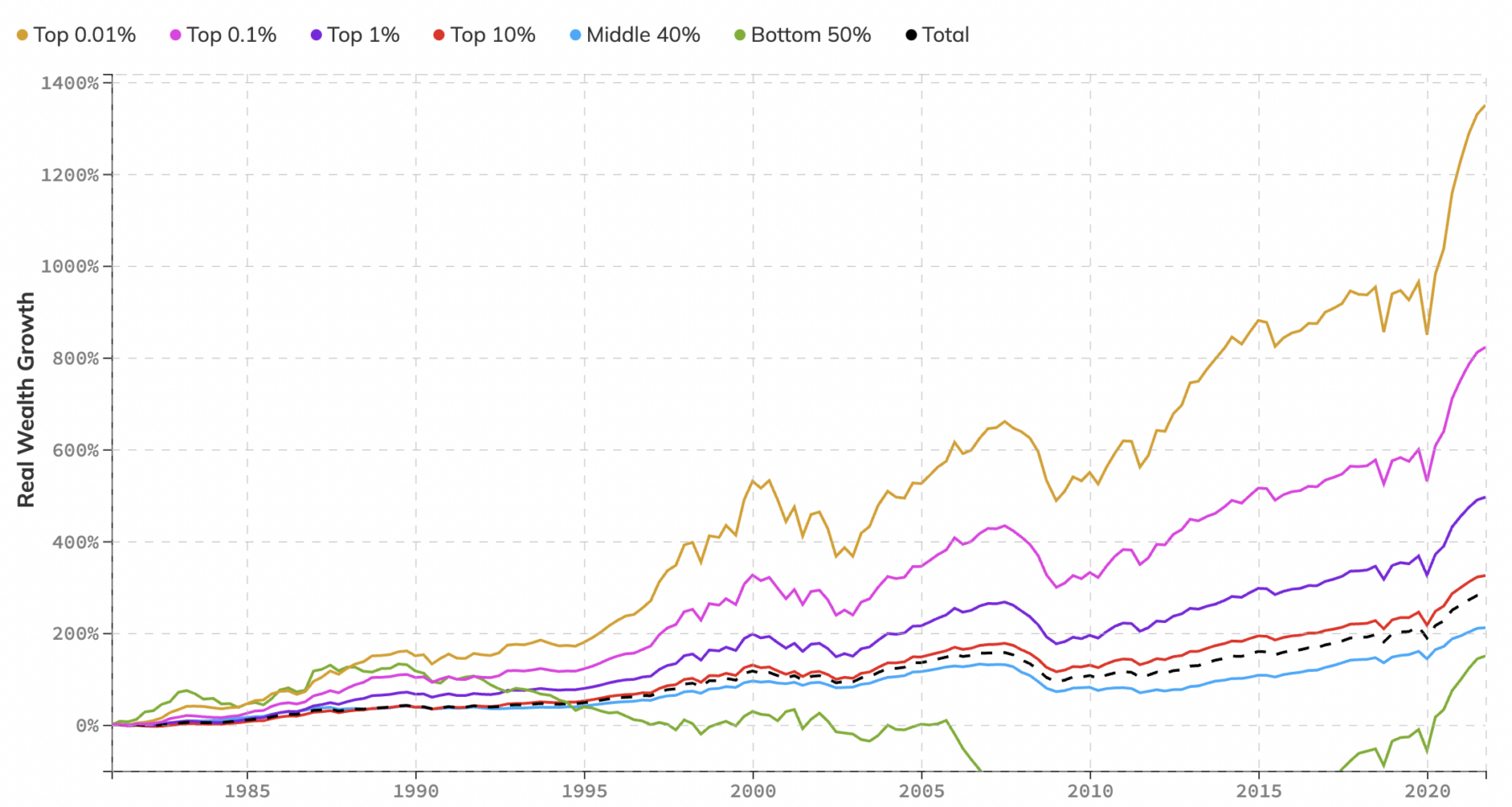

Wealth and wage inequality touch on many of my favorite topics: Saving & Investing, Wealth & Wages, Real Estate...

Wealth and wage inequality touch on many of my favorite topics: Saving & Investing, Wealth & Wages, Real Estate...

Read More

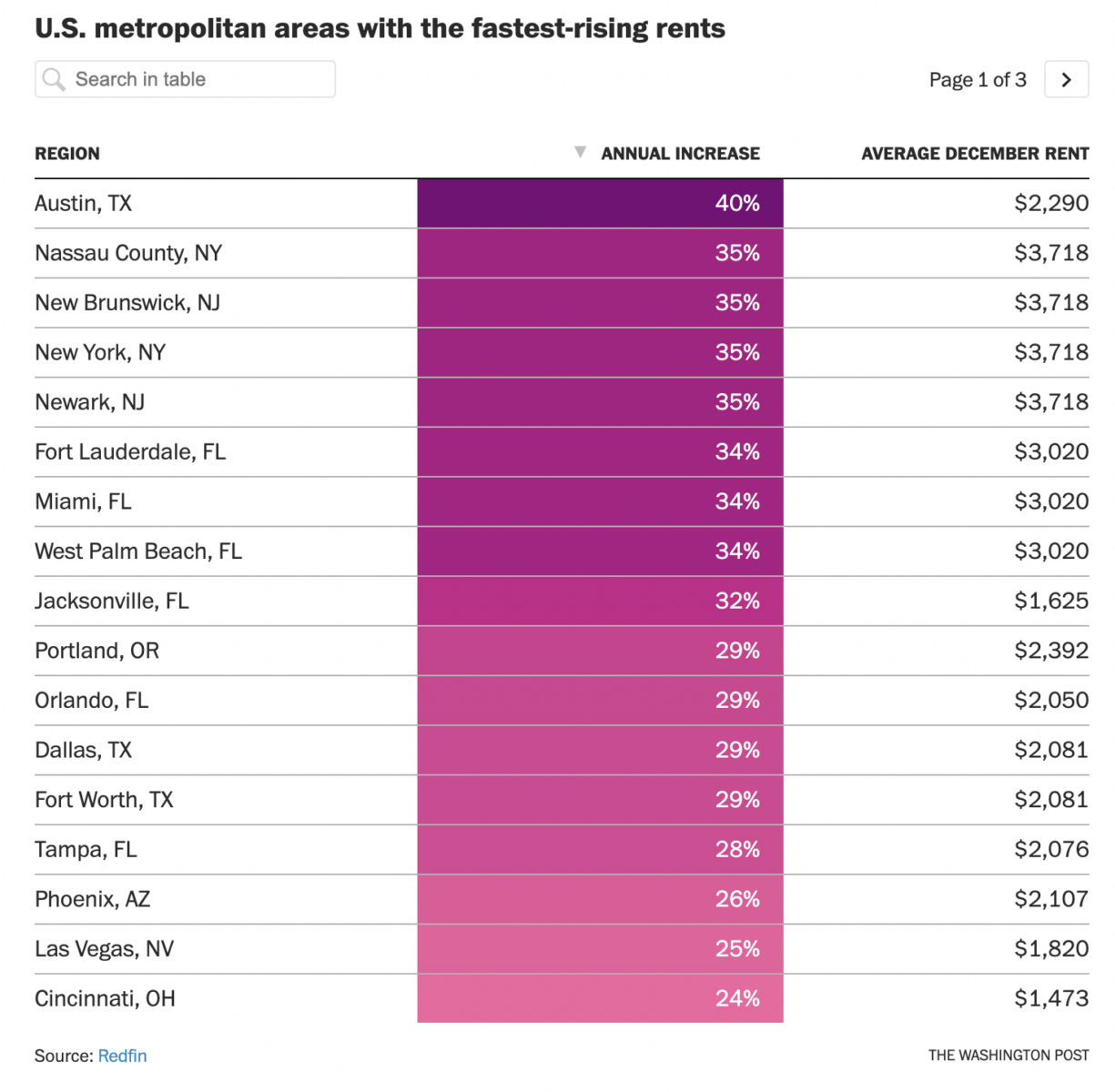

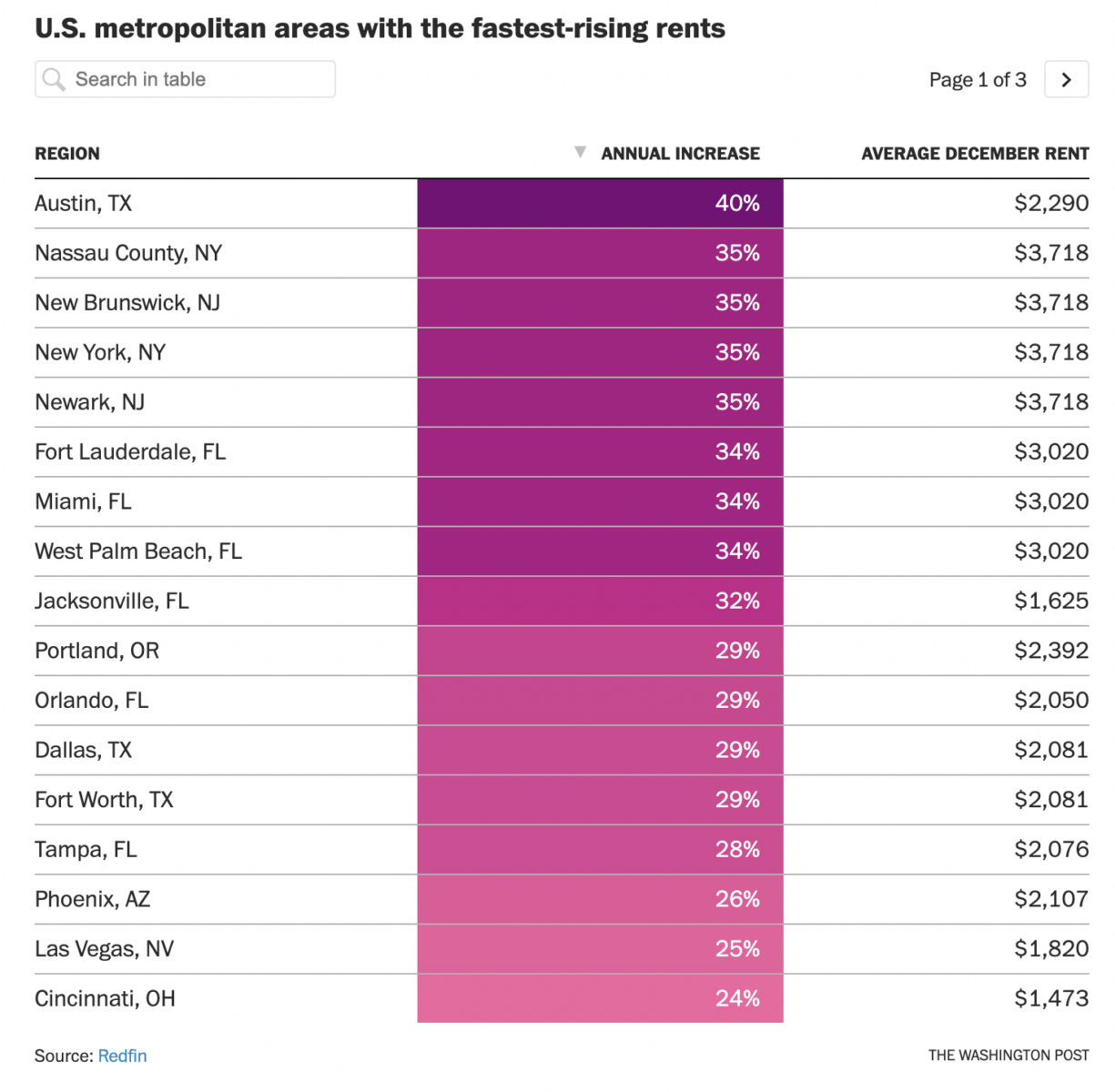

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post...

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post...

Read More

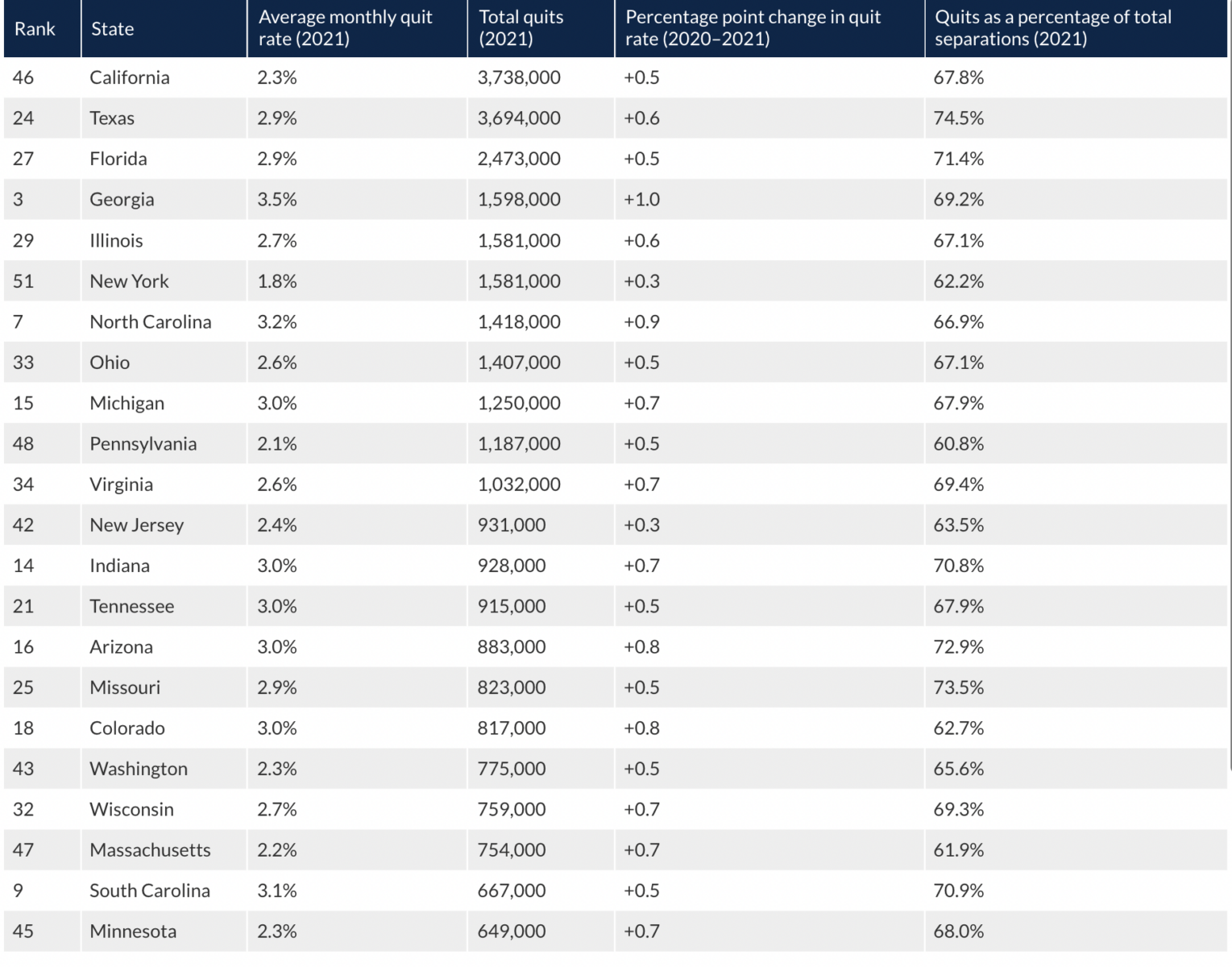

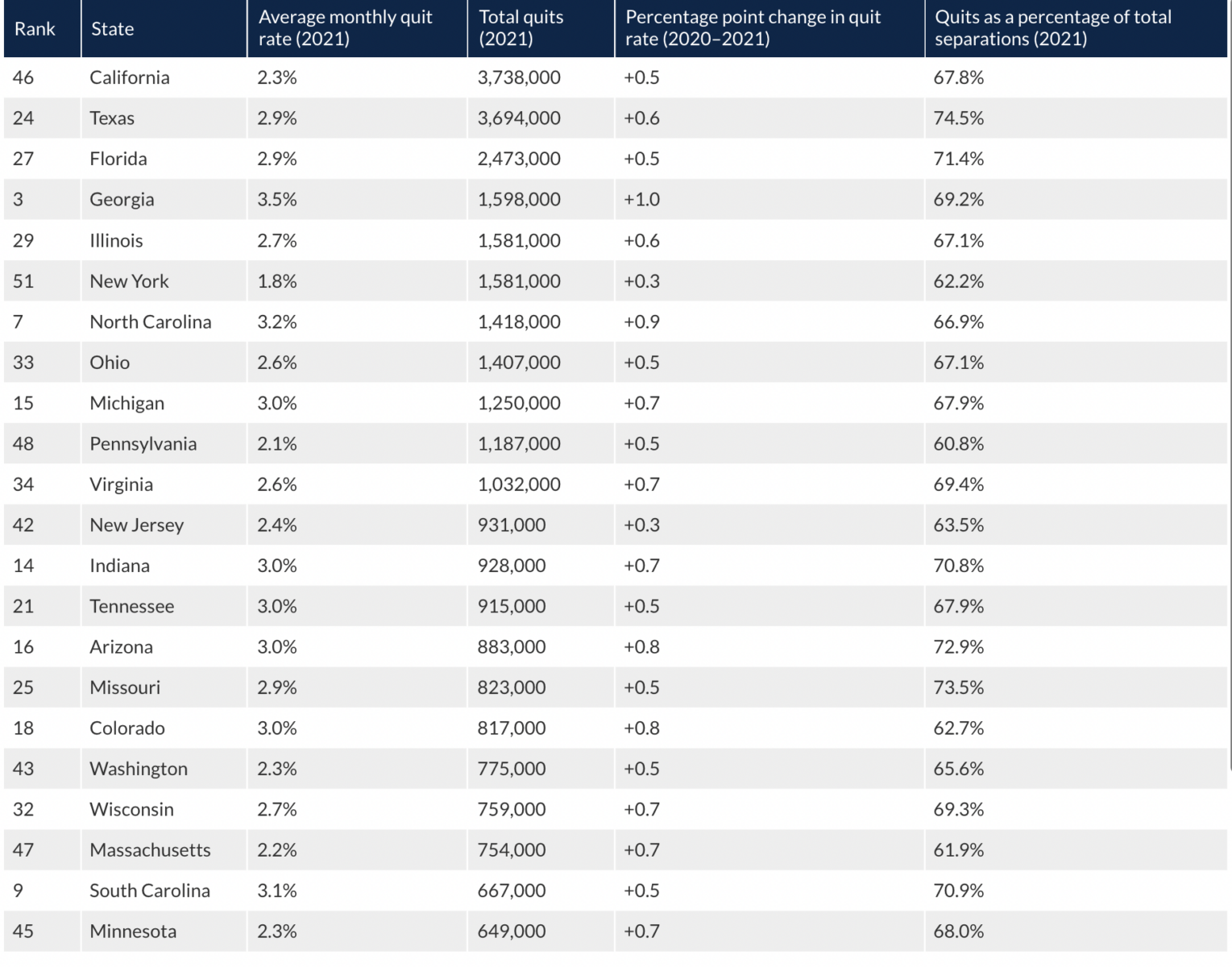

Source: Chamber of Commerce Really interesting data series from the Chamber of Commerce. I would sort this in a rather...

Source: Chamber of Commerce Really interesting data series from the Chamber of Commerce. I would sort this in a rather...

Read More

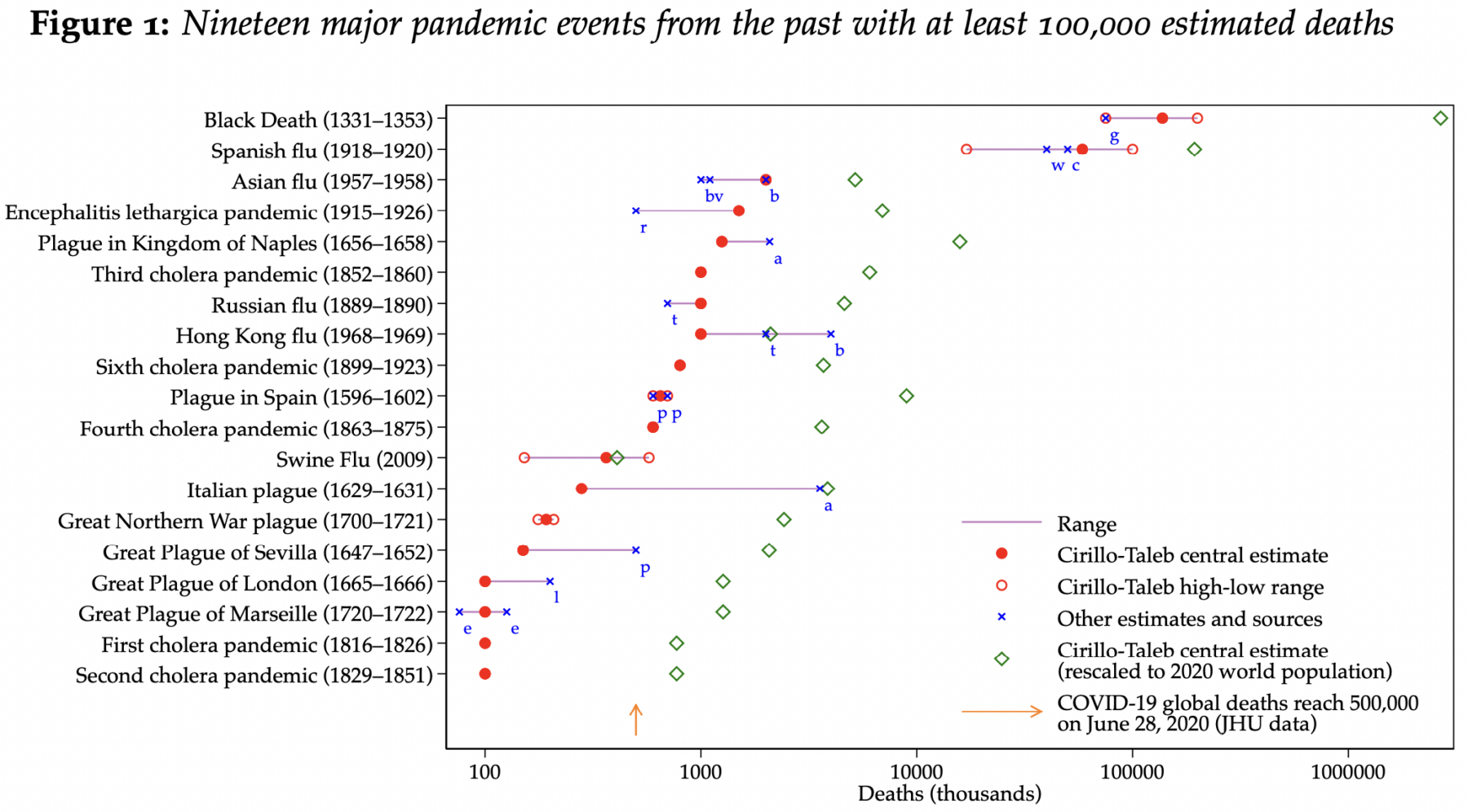

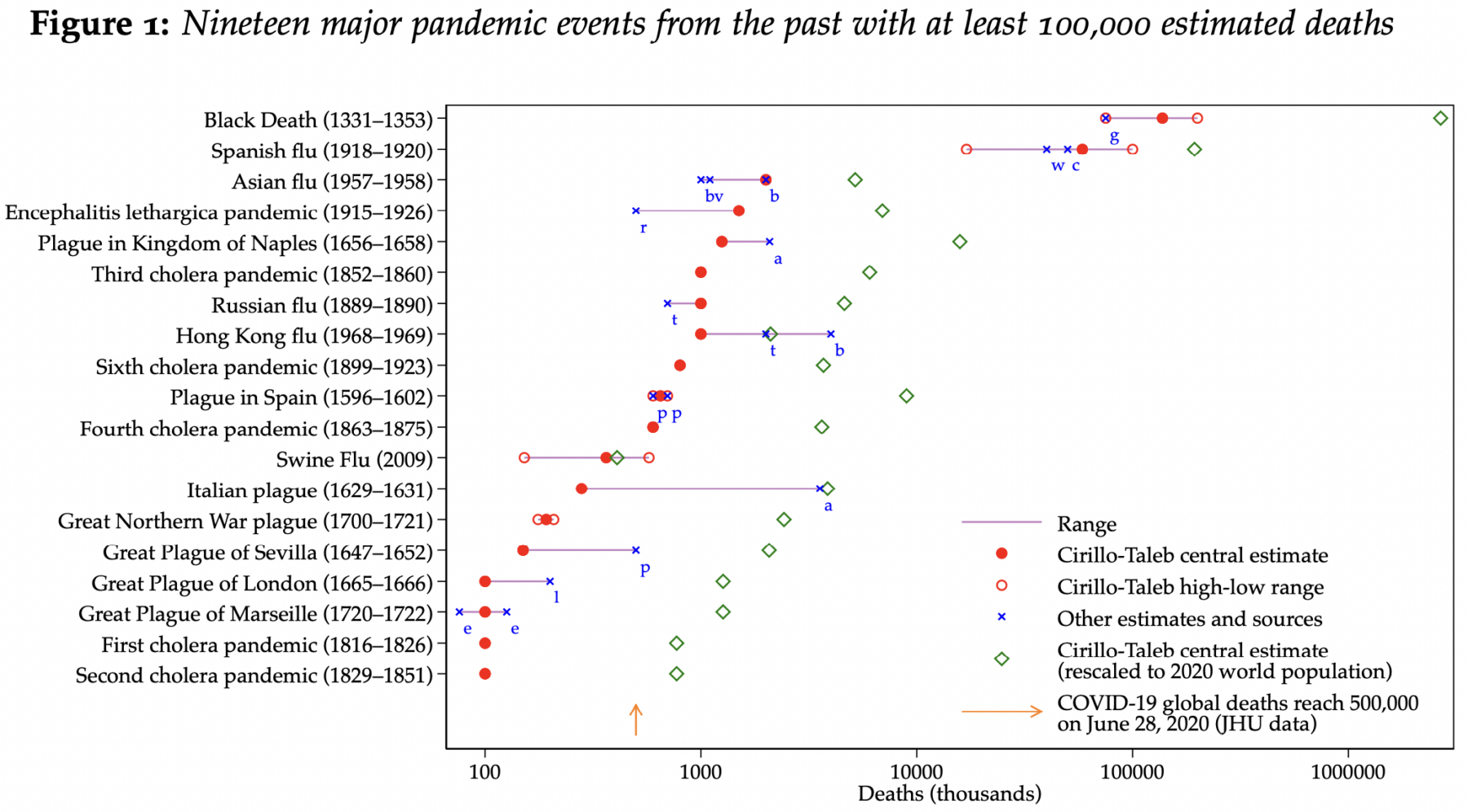

I was speaking with my fishing buddy David Kotok recently about a research project he has been working on: “What are the...

I was speaking with my fishing buddy David Kotok recently about a research project he has been working on: “What are the...

Read More

To hear an audio spoken word version of this post, click here. Every discussion I hear about inflation...

To hear an audio spoken word version of this post, click here. Every discussion I hear about inflation...

Read More

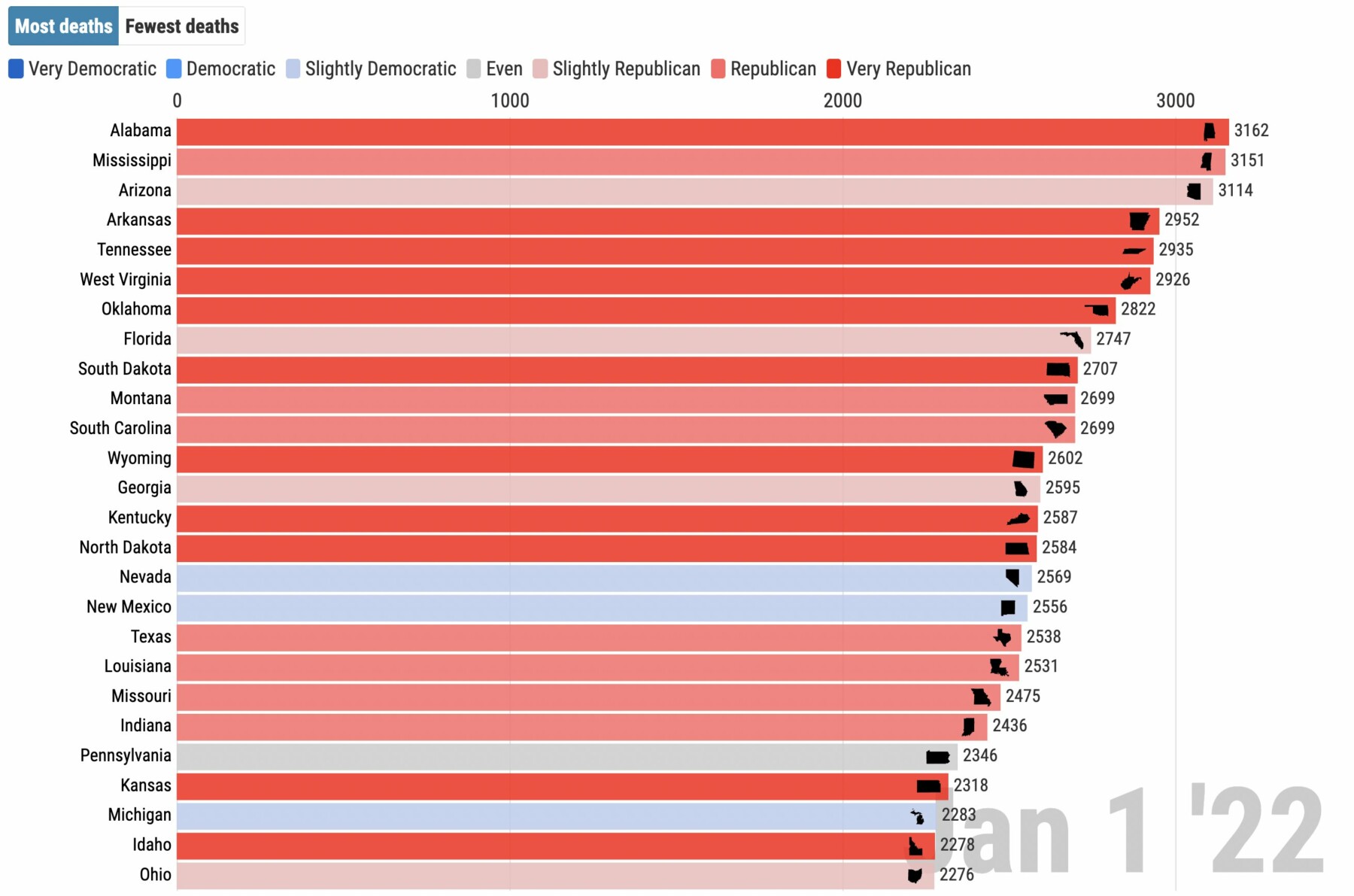

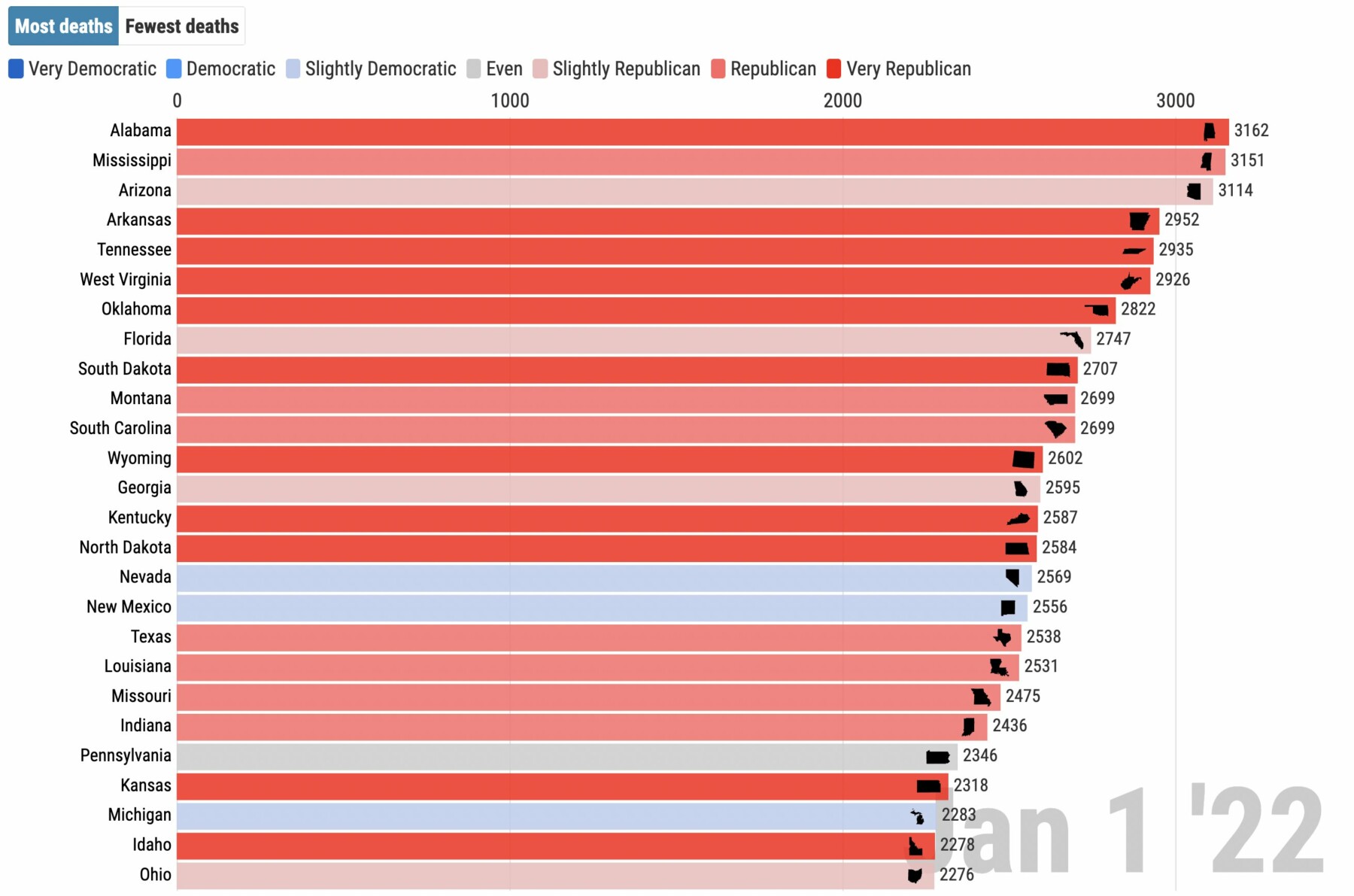

Amazing infographic from Dan Goodspeed showing the state by state relationship between Covid deaths and partisan...

Amazing infographic from Dan Goodspeed showing the state by state relationship between Covid deaths and partisan...

Read More

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...

Source: CDC Before Covid struck the U.S. (and the world), there was a shockingly large range of life expectancy in this...