Before the GFC There was LTCM . . .

We Forget That the Financial Crisis Had a Trial Run The collapse of hedge fund Long-Term Capital Management had the same ingredients:...

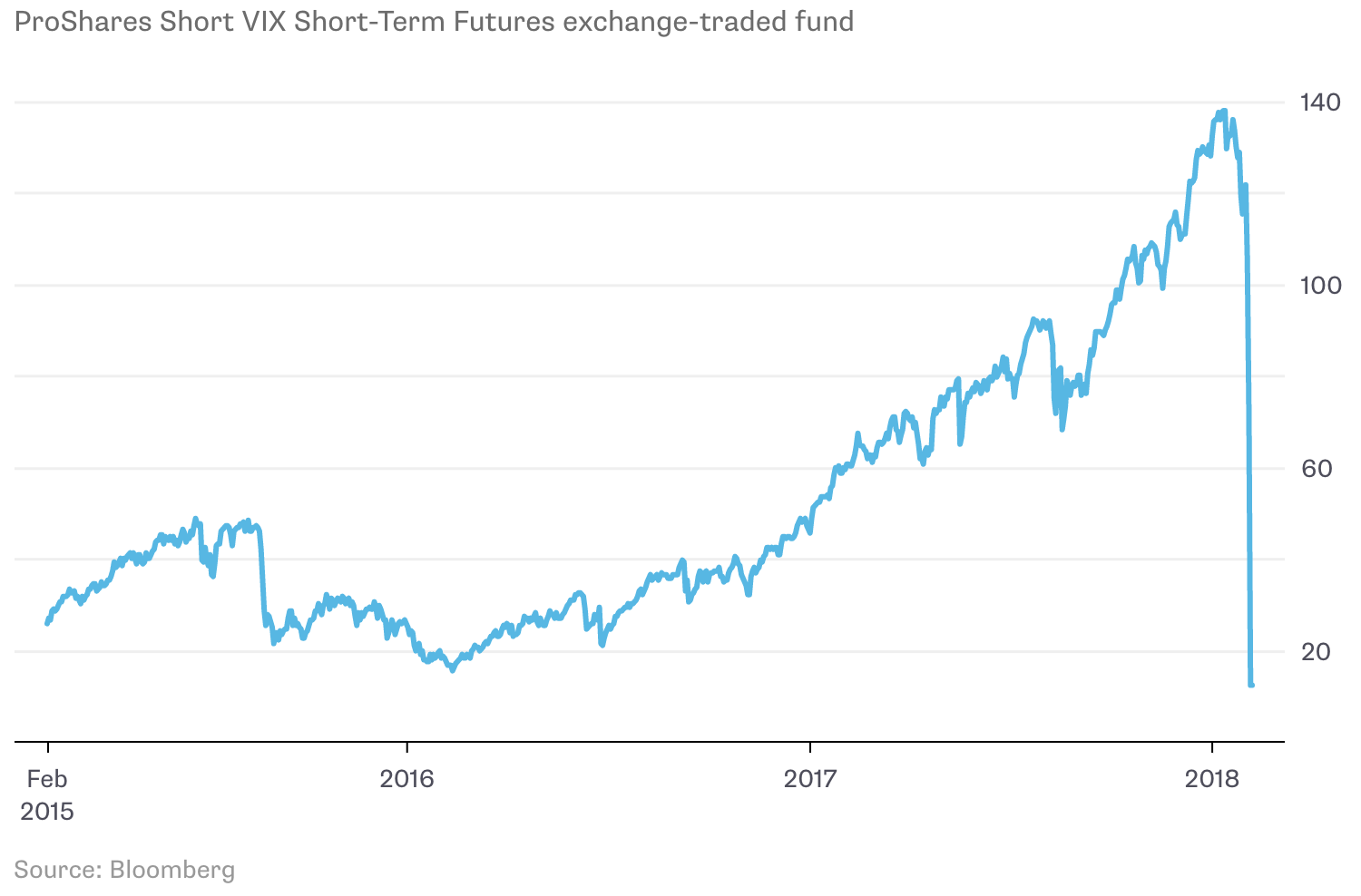

5 Rules to Help Avoid Investing Disaster It’s actually not that hard. Bloomberg, February 8, 2018. A basic rule of...

5 Rules to Help Avoid Investing Disaster It’s actually not that hard. Bloomberg, February 8, 2018. A basic rule of...

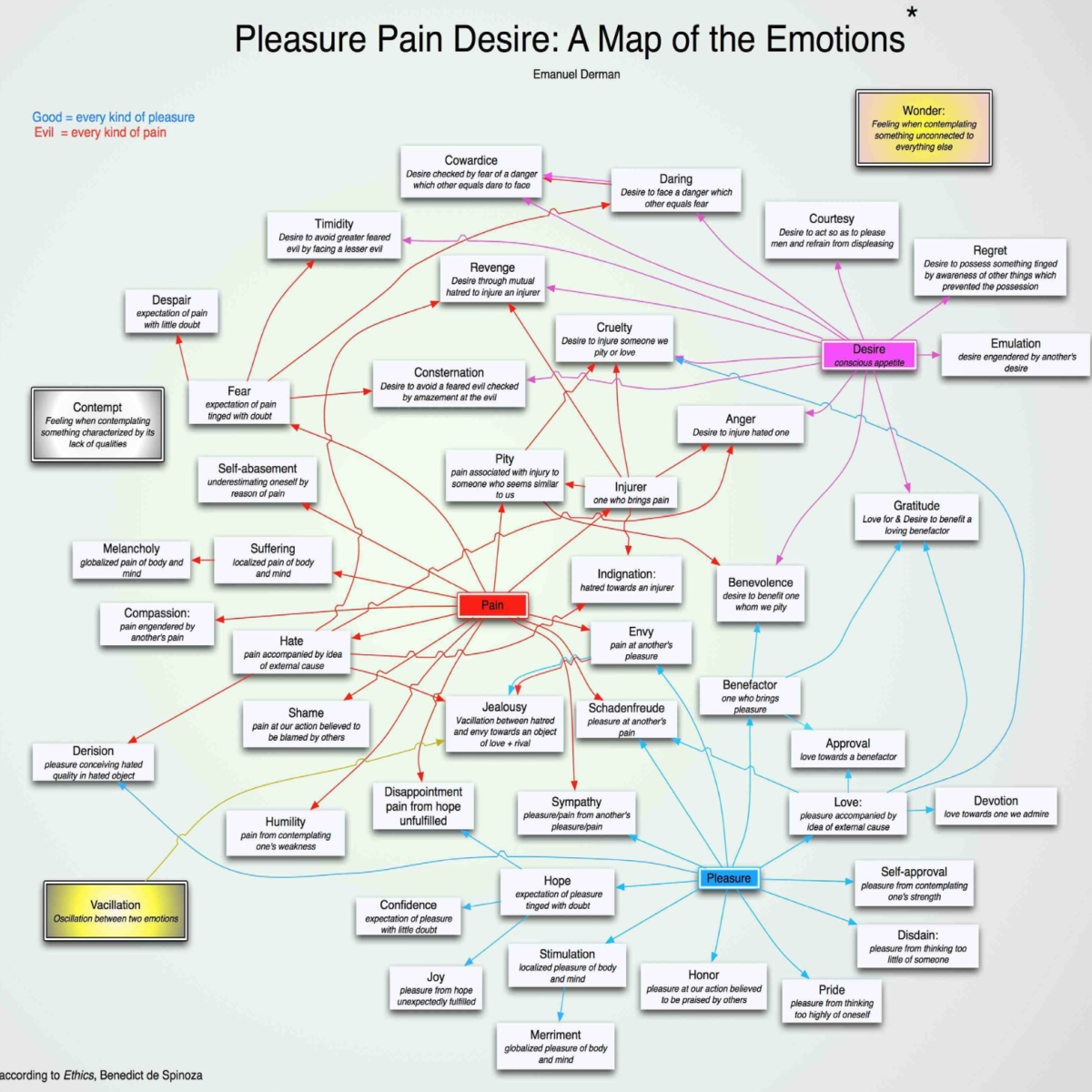

A Stylized History of Quantitative Finance Emanuel Derman The evolution of a quantitative approach to finance has...

A Stylized History of Quantitative Finance Emanuel Derman The evolution of a quantitative approach to finance has...

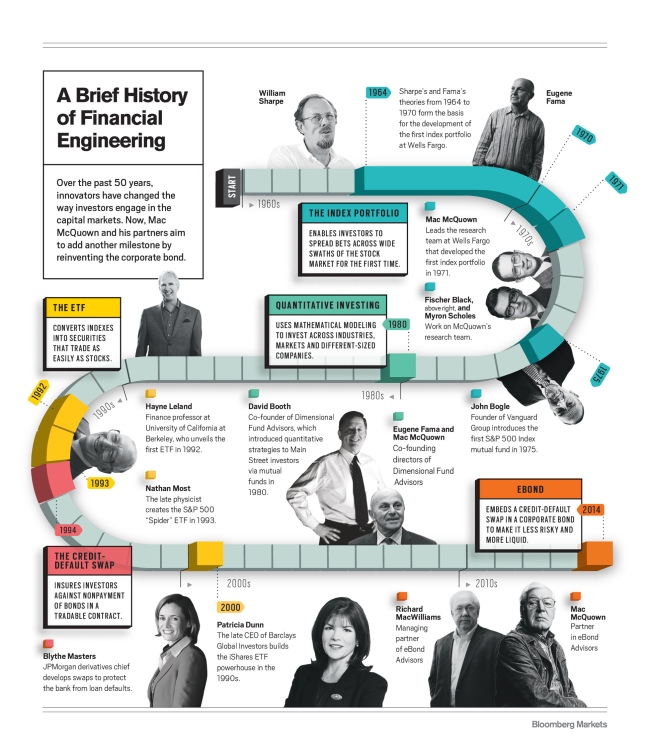

Killer slice of history from Bloomberg Business: click for utterly ginormous infographic Source: Bloomberg Business

Killer slice of history from Bloomberg Business: click for utterly ginormous infographic Source: Bloomberg Business

Get subscriber-only insights and news delivered by Barry every two weeks.