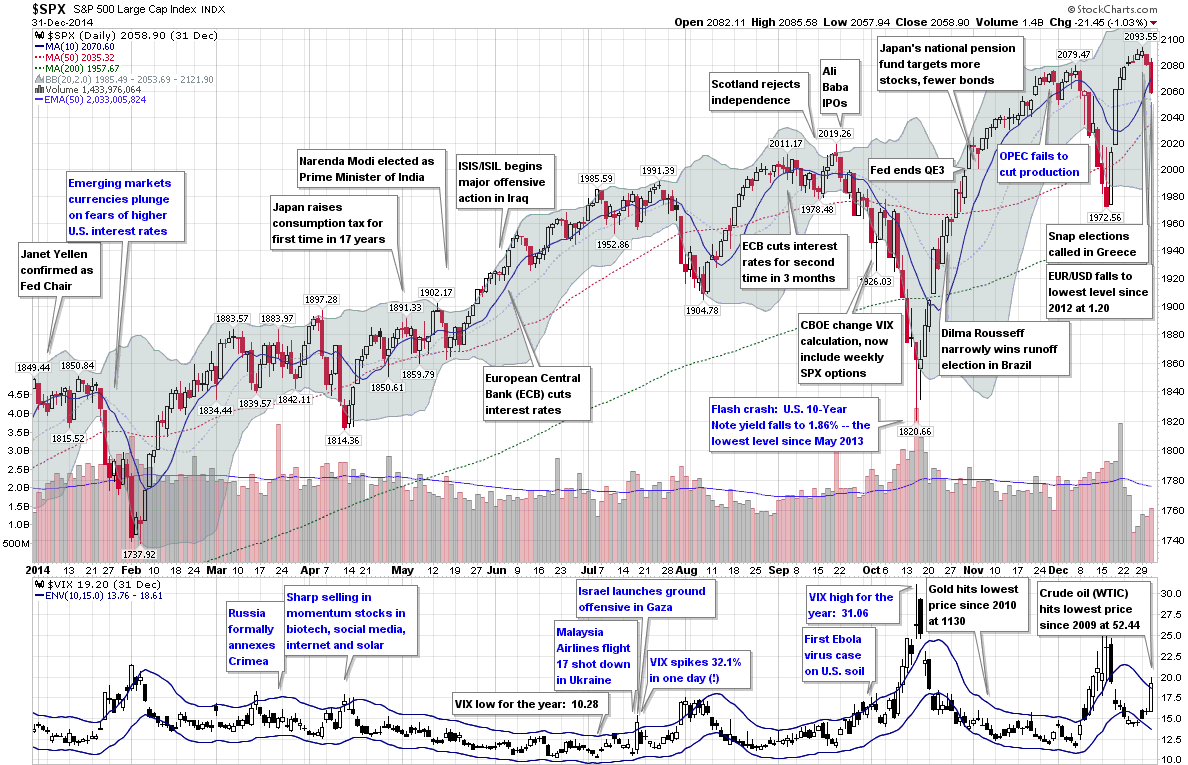

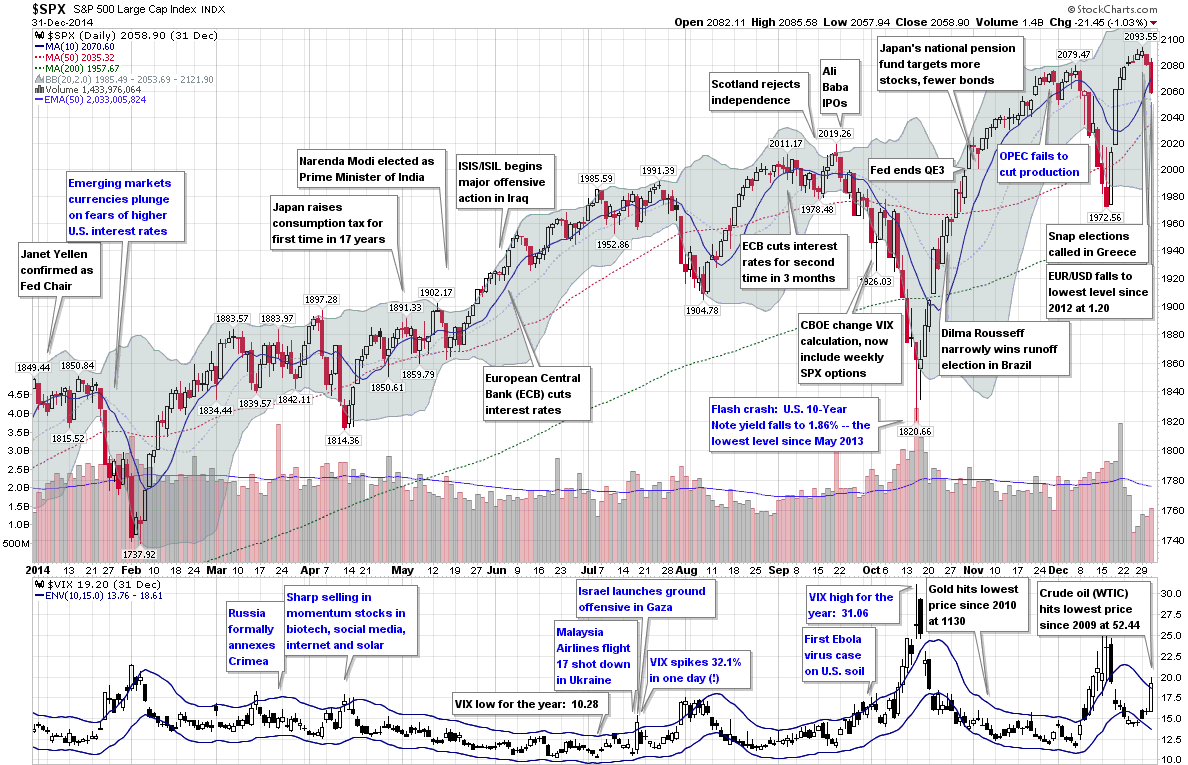

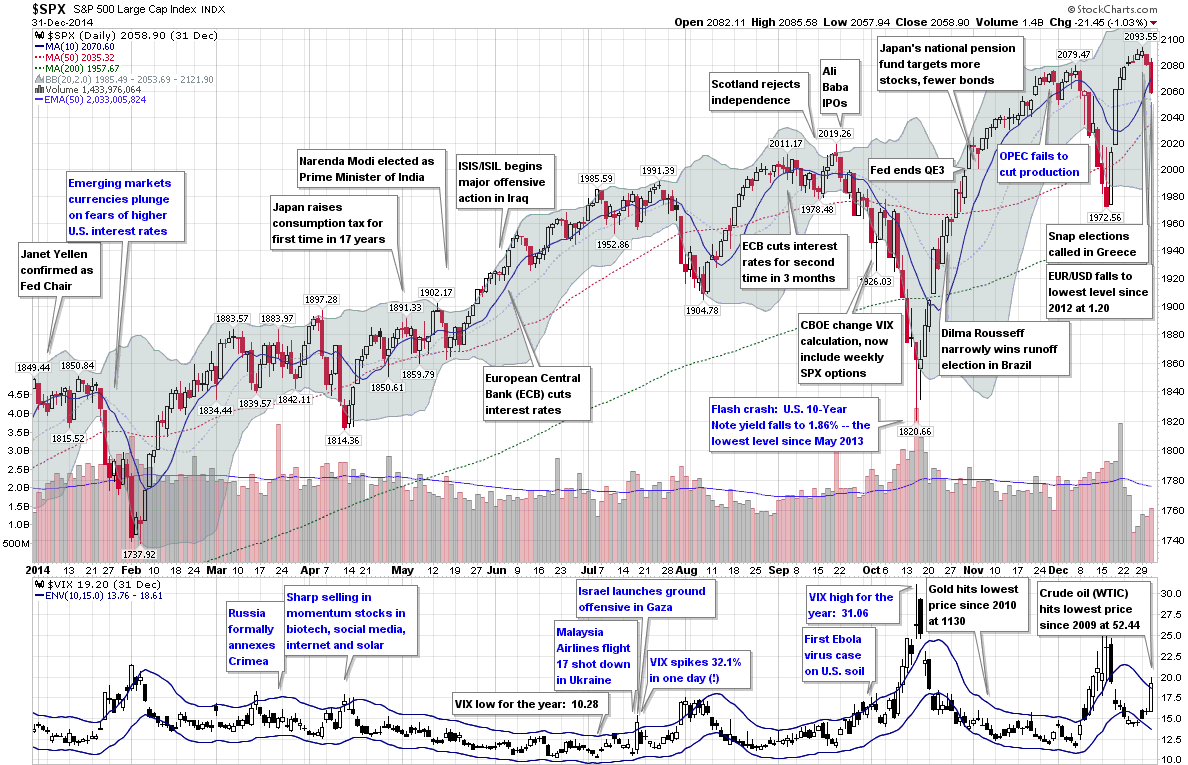

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...

Read More

Last evening, we asked what are the costs and consequences, as well as the market reaction to, the imminent bailout of Fannie Mae (FNM)...

Last evening, we asked what are the costs and consequences, as well as the market reaction to, the imminent bailout of Fannie Mae (FNM)...

Read More

“This bright new system, this practice in the United States, this practice in the United Kingdom and elsewhere, has broken...

Read More

Roger Altman, former deputy secretary of the Treasury, thinks so: "Today, regulatory authority is divided among the Federal Reserve,...

Read More

CNBC’s Steve Liesman on "Unique insights on the credit crisis and the future of the banking system from a stream in...

CNBC’s Steve Liesman on "Unique insights on the credit crisis and the future of the banking system from a stream in...

Read More

This morning’s must read journalism is a Bloomberg piece on credit availability as projected/forecast by money markets and interest...

Read More

Today’s guest post comes to us via Macro Man — a portfolio manager at a London-based hedge fund, he trades global currencies,...

Today’s guest post comes to us via Macro Man — a portfolio manager at a London-based hedge fund, he trades global currencies,...

Read More

> If this is the sort of stuff that floats your boat, then you need to read this full paper; the rest of you should just go about your...

> If this is the sort of stuff that floats your boat, then you need to read this full paper; the rest of you should just go about your...

Read More

This morning’s guest post is from PIMCO Managing Director Paul McCulley. I got to spend some time with Paul at David Kotok’s...

This morning’s guest post is from PIMCO Managing Director Paul McCulley. I got to spend some time with Paul at David Kotok’s...

Read More

Chris Whalen at the Institutional Risk Analyst asks an interesting question: How Much Capital Does a Bank Need? The short answer: Alot....

Chris Whalen at the Institutional Risk Analyst asks an interesting question: How Much Capital Does a Bank Need? The short answer: Alot....

Read More

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...

Terrific graphic from Bill Luby at VIX and More looking at the various potential drivers of volatility: click for monster chart...