The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

Read More

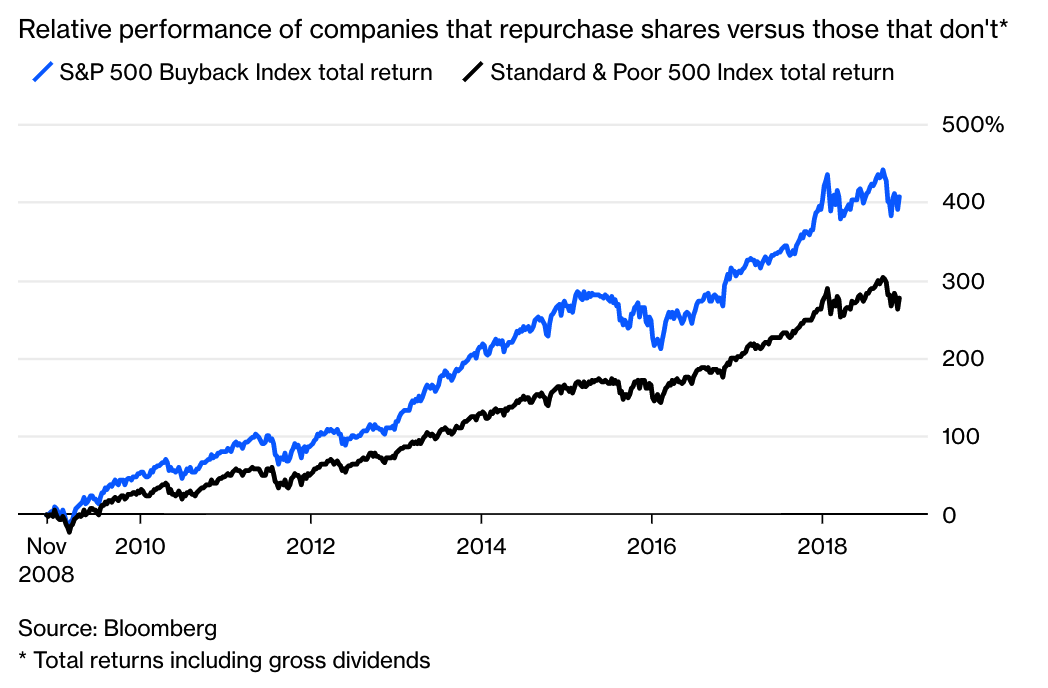

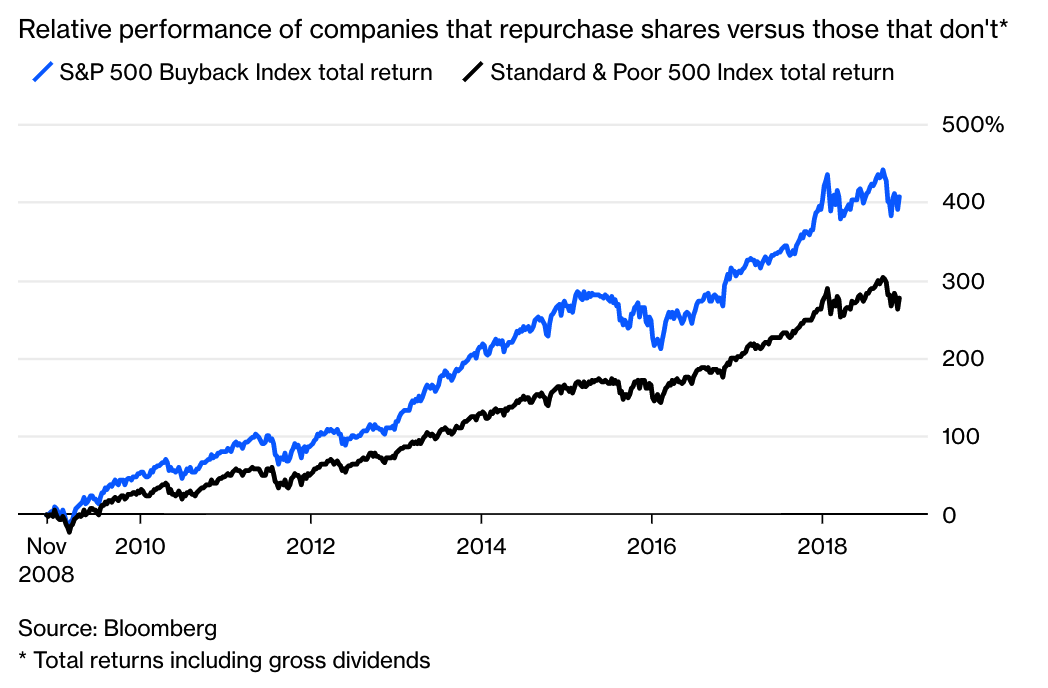

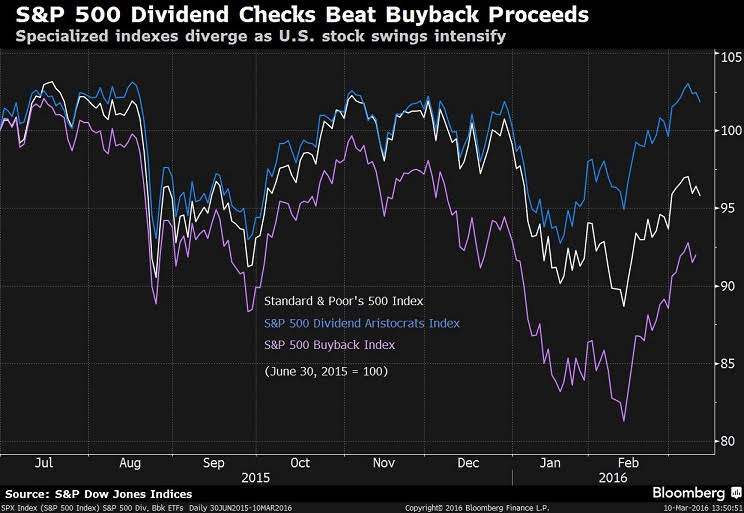

Fans and Foes of Buybacks Aren’t in Disagreement As a group, companies that repurchase shares are good investments even as individual...

Fans and Foes of Buybacks Aren’t in Disagreement As a group, companies that repurchase shares are good investments even as individual...

Read More

Fans and Foes of Buybacks Aren’t in Disagreement As a group, companies that repurchase shares are good investments even as individual...

Read More

I was working on my regular Bloomberg column, taking a closer look at some companies in the news (here and here) — GE, GM, Apple,...

Read More

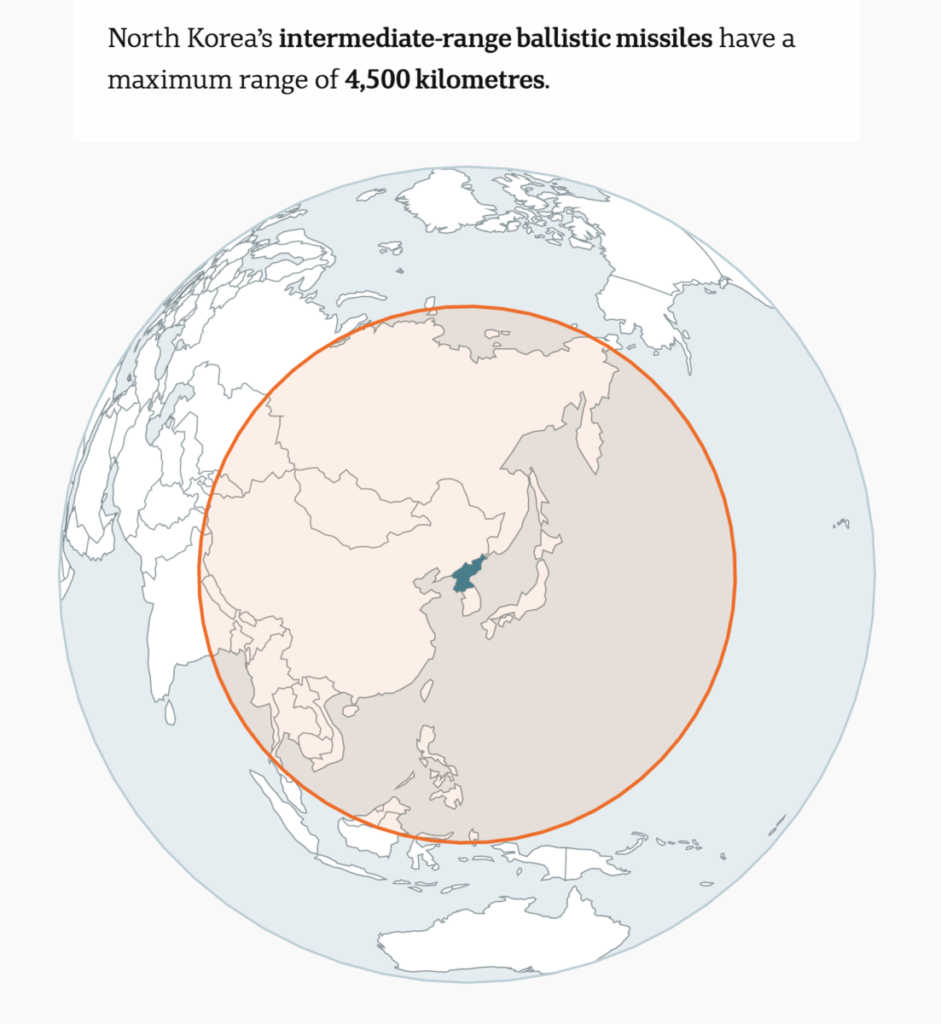

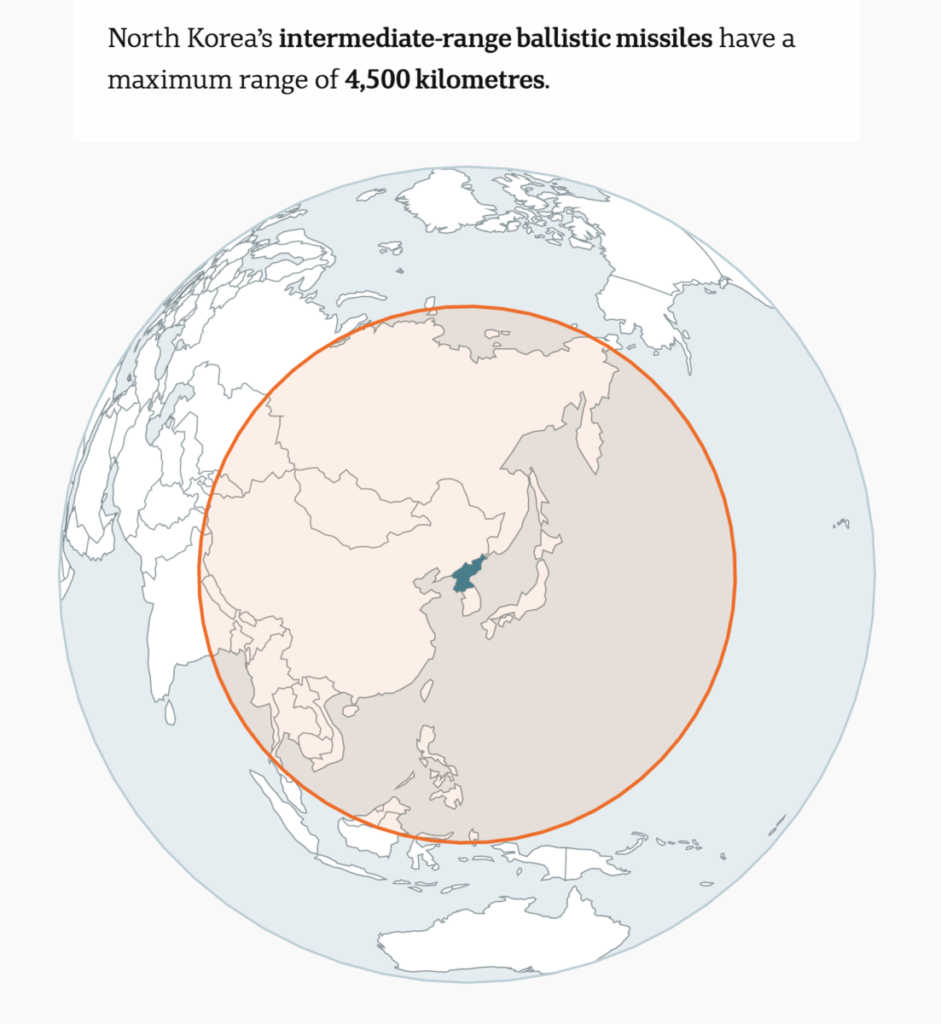

Very interesting — and more than a little frightening — explanatory of the ranges of various North Korean missiles: ...

Very interesting — and more than a little frightening — explanatory of the ranges of various North Korean missiles: ...

Read More

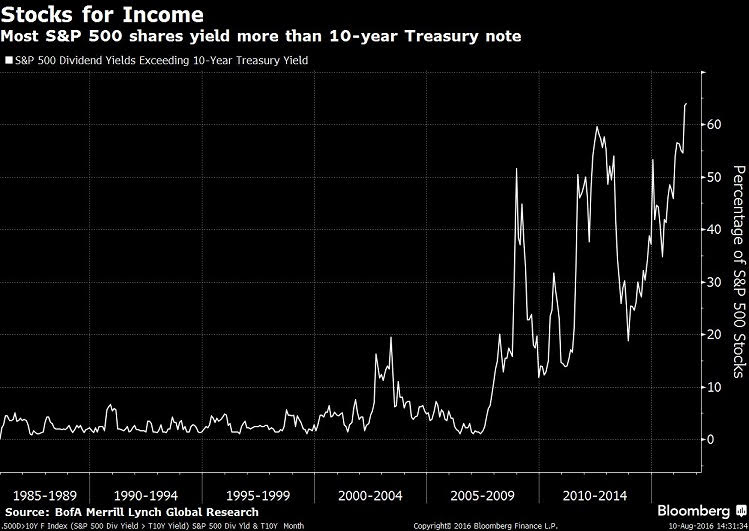

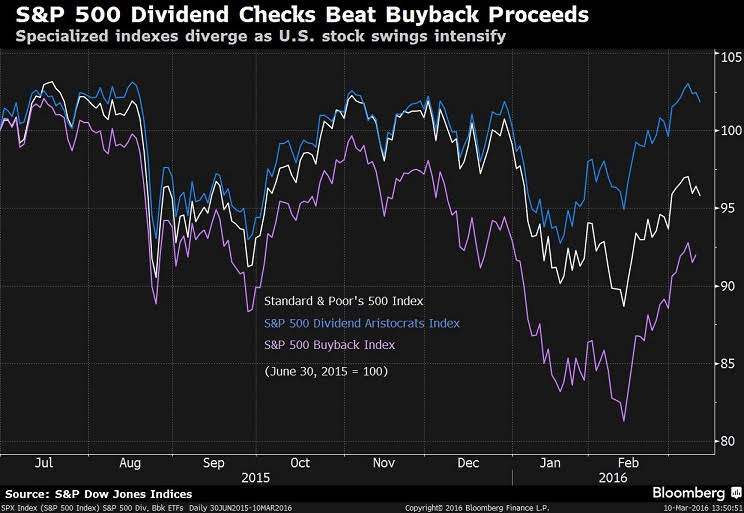

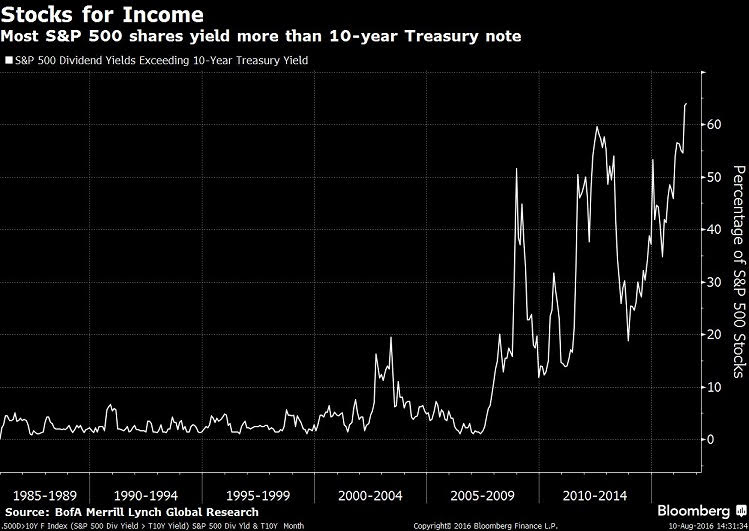

Source: Bloomberg From David Wilson: “Investors ought to look at some stocks as sources of income,” strategists at Bank...

Source: Bloomberg From David Wilson: “Investors ought to look at some stocks as sources of income,” strategists at Bank...

Read More

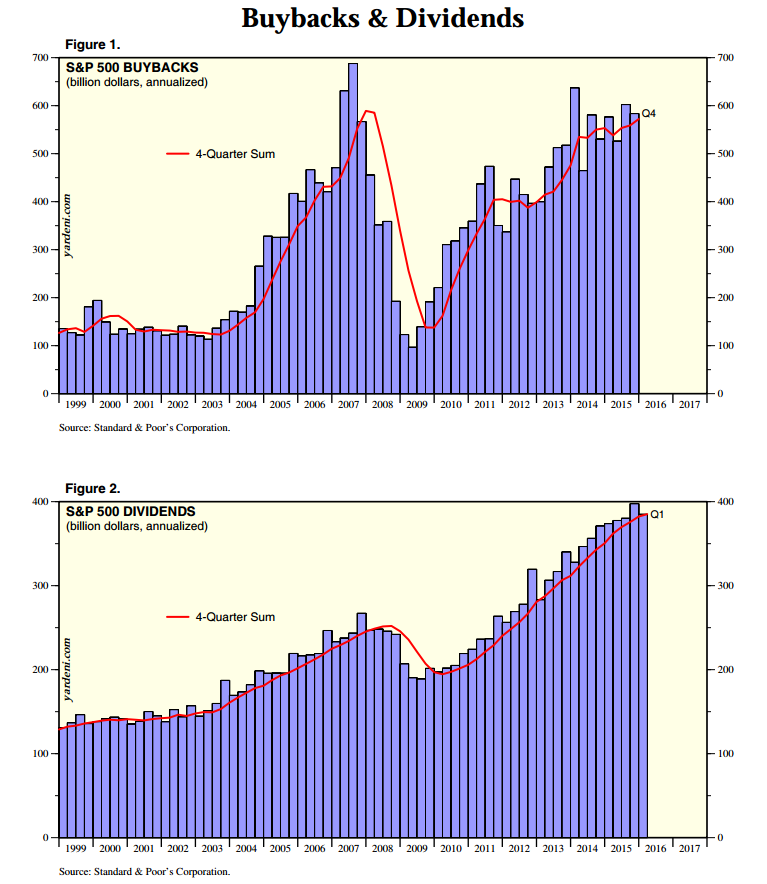

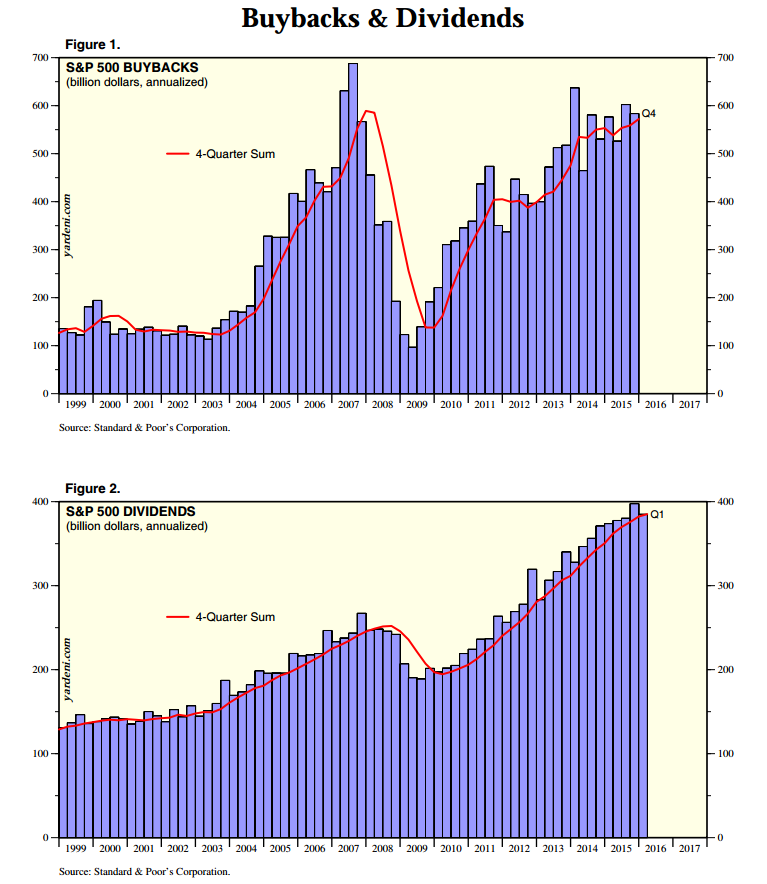

Take Dividends Over Buybacks One puts cash in the hands of investors; the other assumes management is a great market timer. Bloomberg,...

Take Dividends Over Buybacks One puts cash in the hands of investors; the other assumes management is a great market timer. Bloomberg,...

Read More

Hat tip: David Wilson, Bloomberg Here’s Dave Wilson, citing Liz Ann Sonders of Schwab & Co: Dividend-paying stocks in...

Hat tip: David Wilson, Bloomberg Here’s Dave Wilson, citing Liz Ann Sonders of Schwab & Co: Dividend-paying stocks in...

Read More

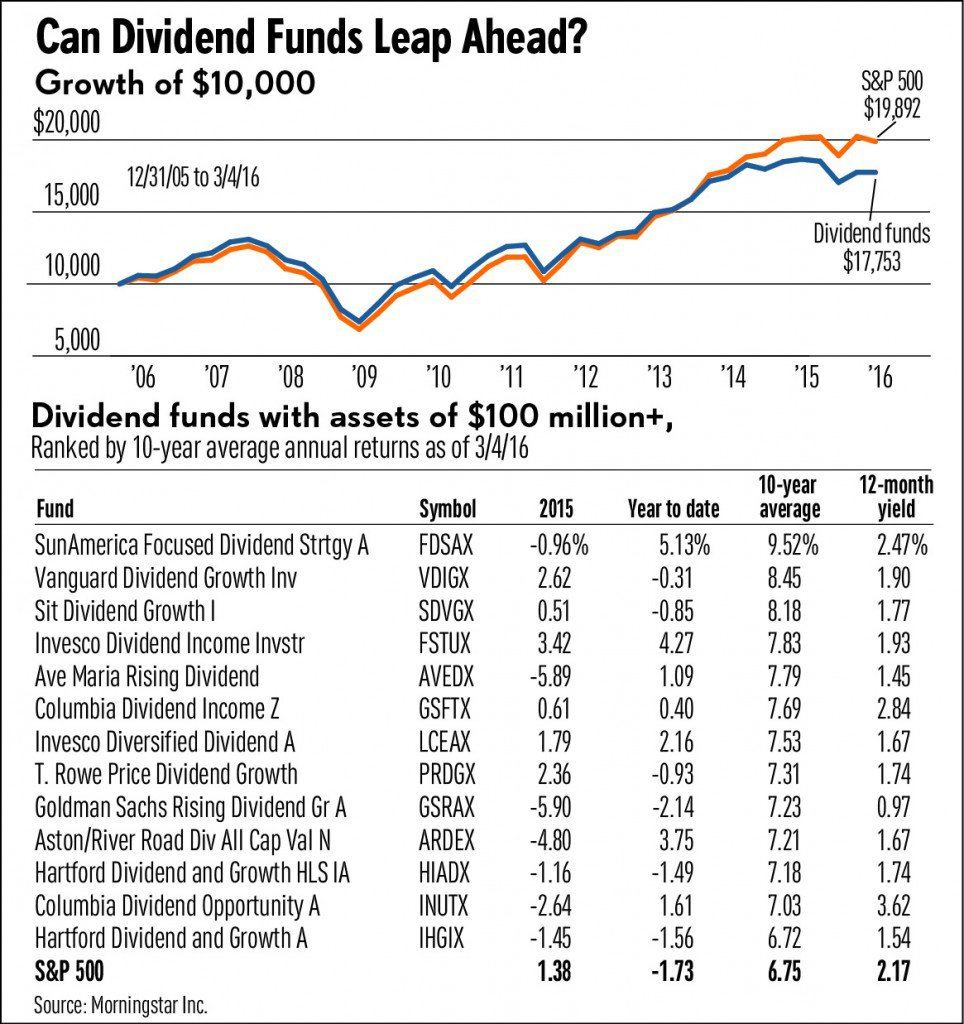

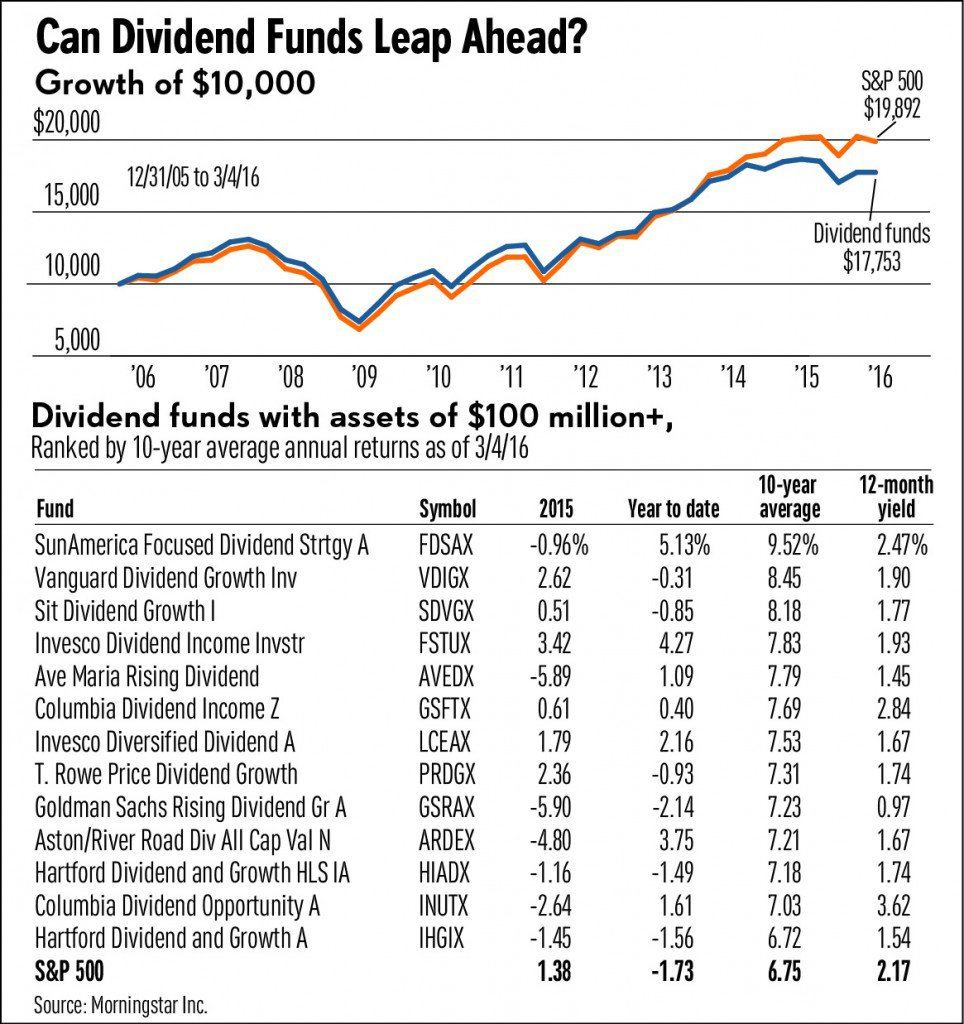

Interesting discussion from IBD about dividend funds lagging the SPX. Short answer: Not if you are overweight energy . . . ...

Interesting discussion from IBD about dividend funds lagging the SPX. Short answer: Not if you are overweight energy . . . ...

Read More

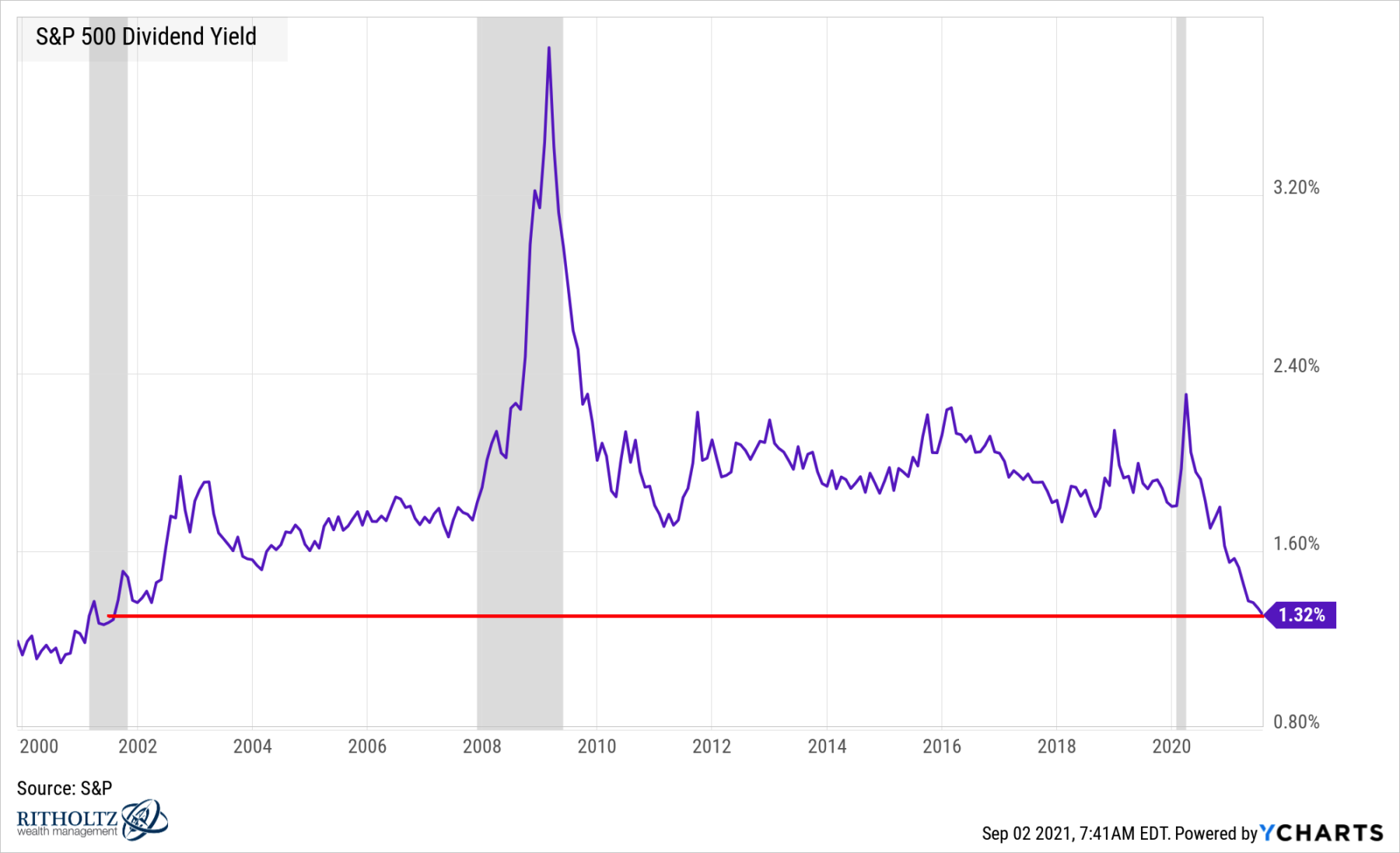

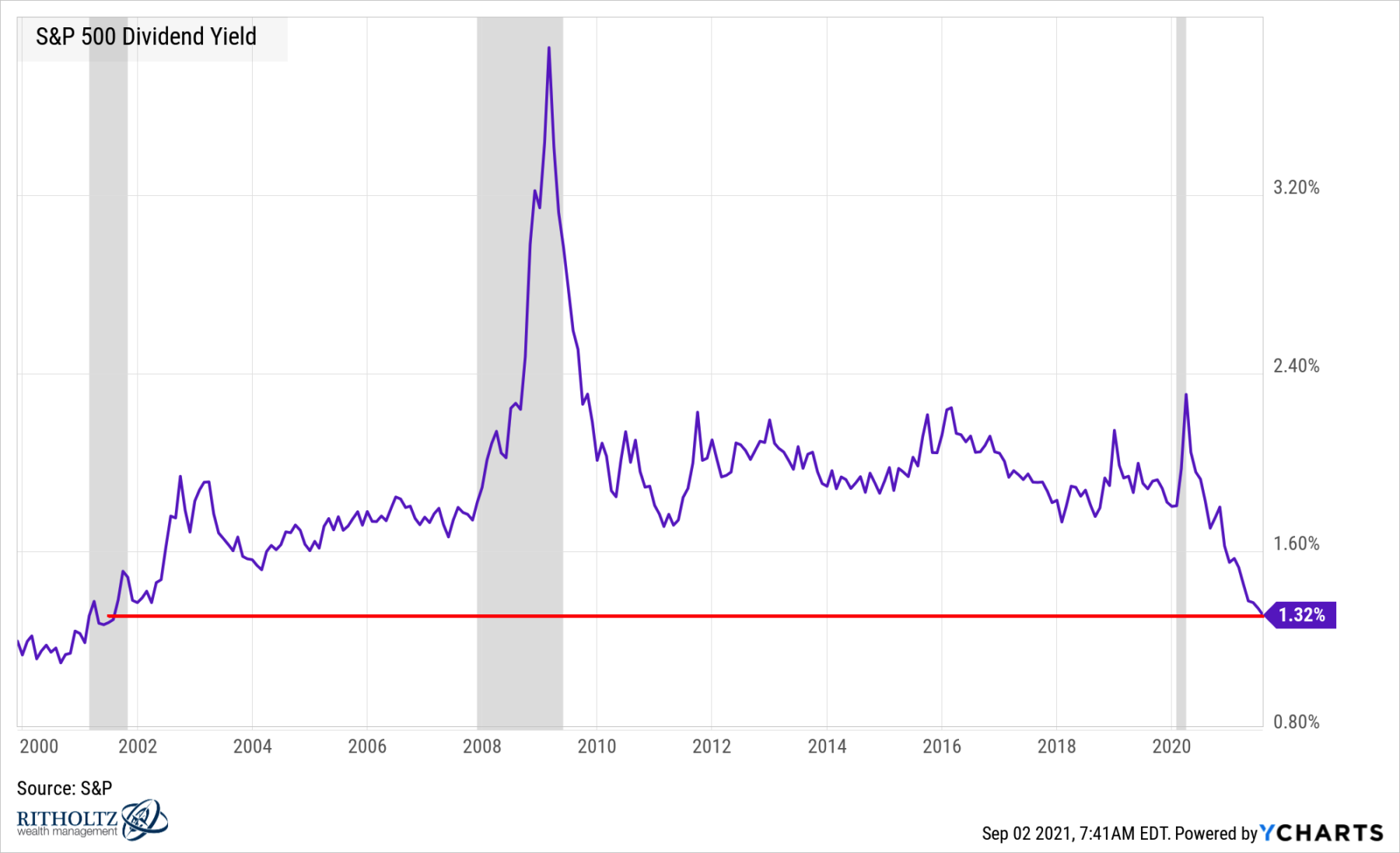

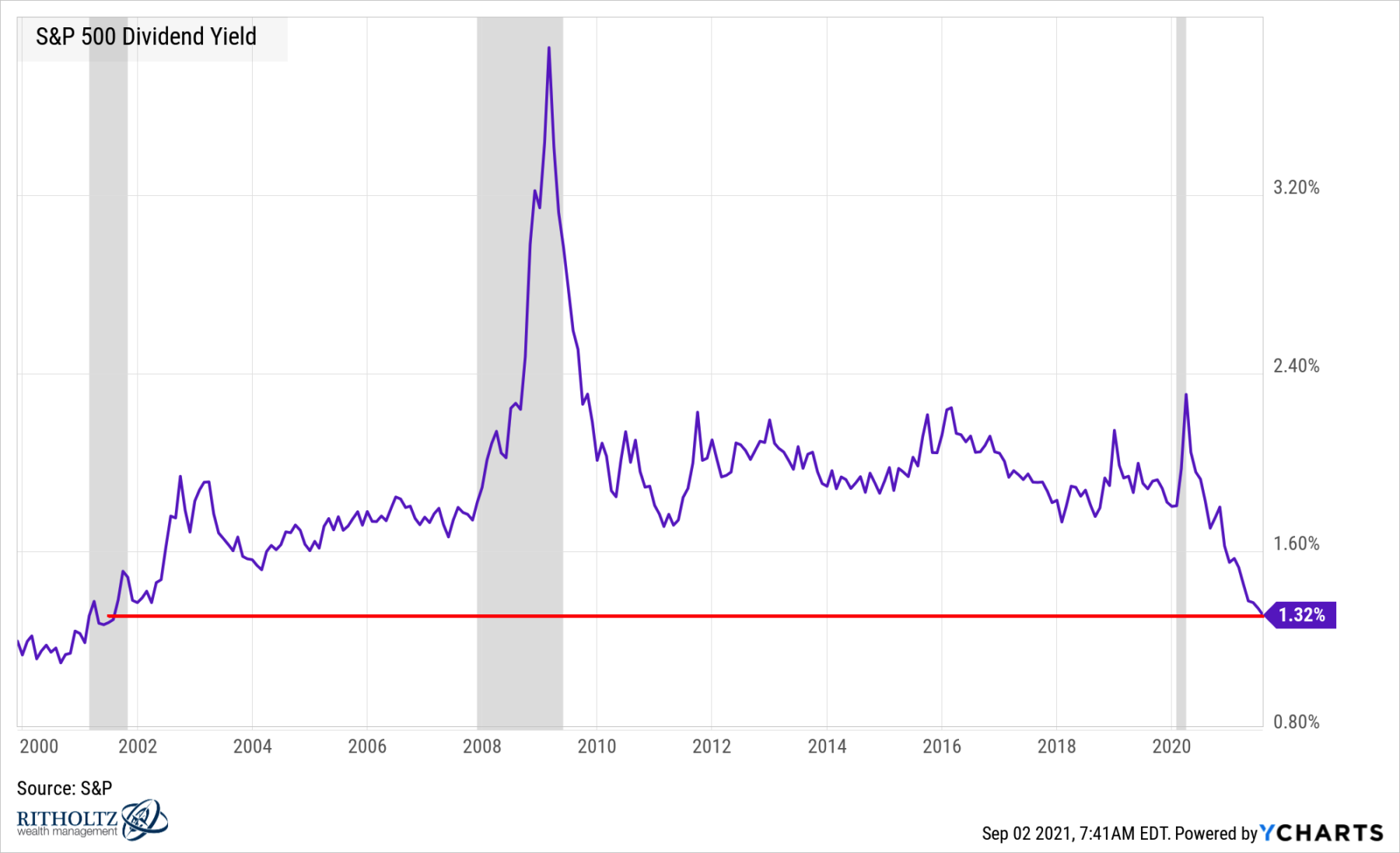

Longtime readers of mine — going back to the email days 10 years ago — will note that at various times I have been bullish or...

Longtime readers of mine — going back to the email days 10 years ago — will note that at various times I have been bullish or...

Read More

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...