I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...

I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...

Read More

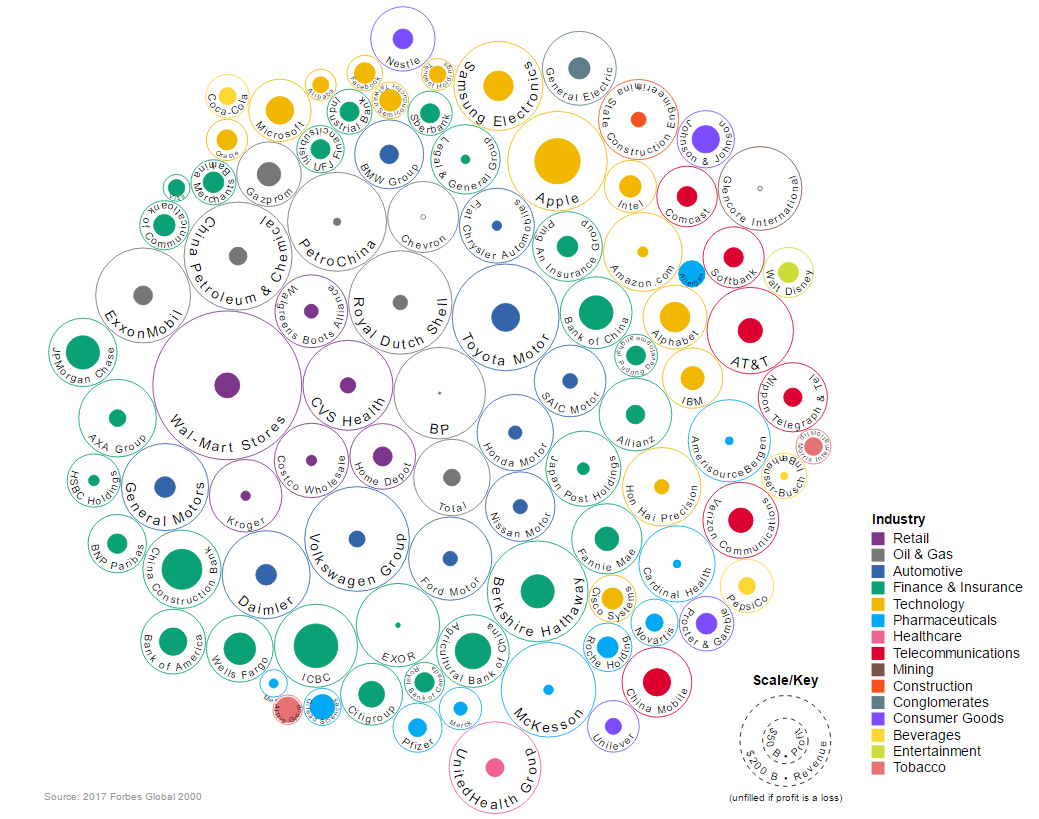

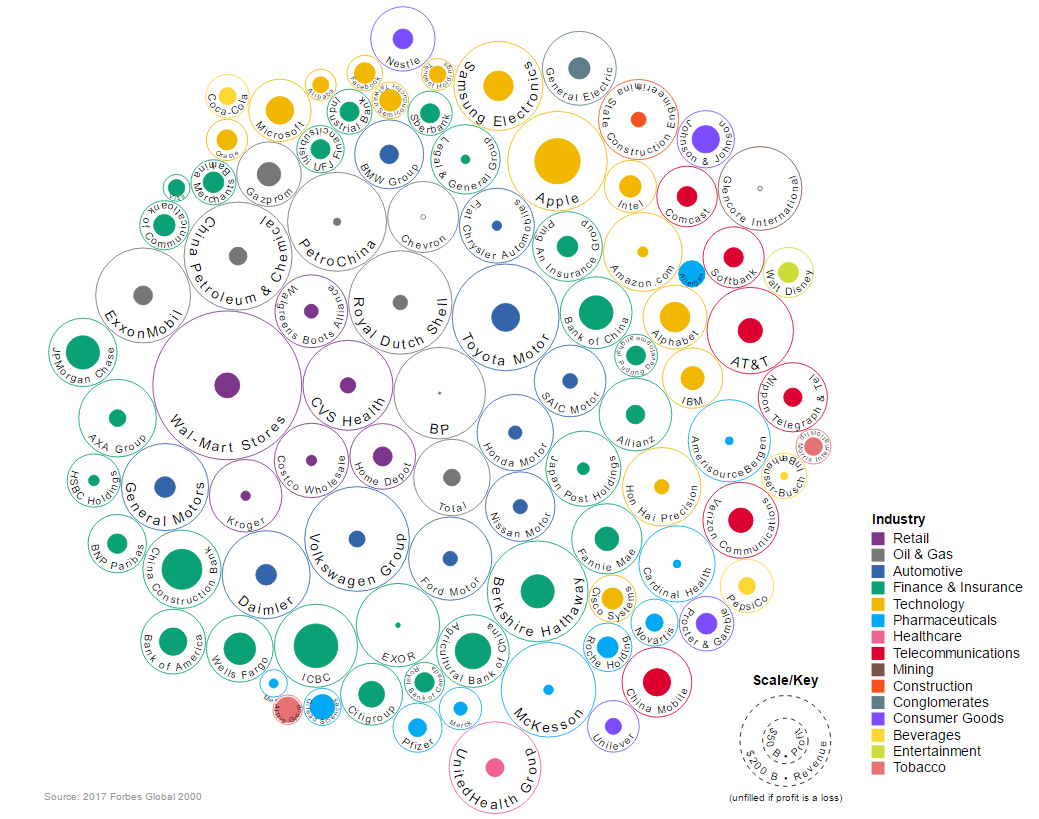

Another funky graphic: Source: Visual Capitalist

Another funky graphic: Source: Visual Capitalist

Read More

Fascinating: click for ginormous inforgraphic Source: Visual Capitalist

Fascinating: click for ginormous inforgraphic Source: Visual Capitalist

Read More

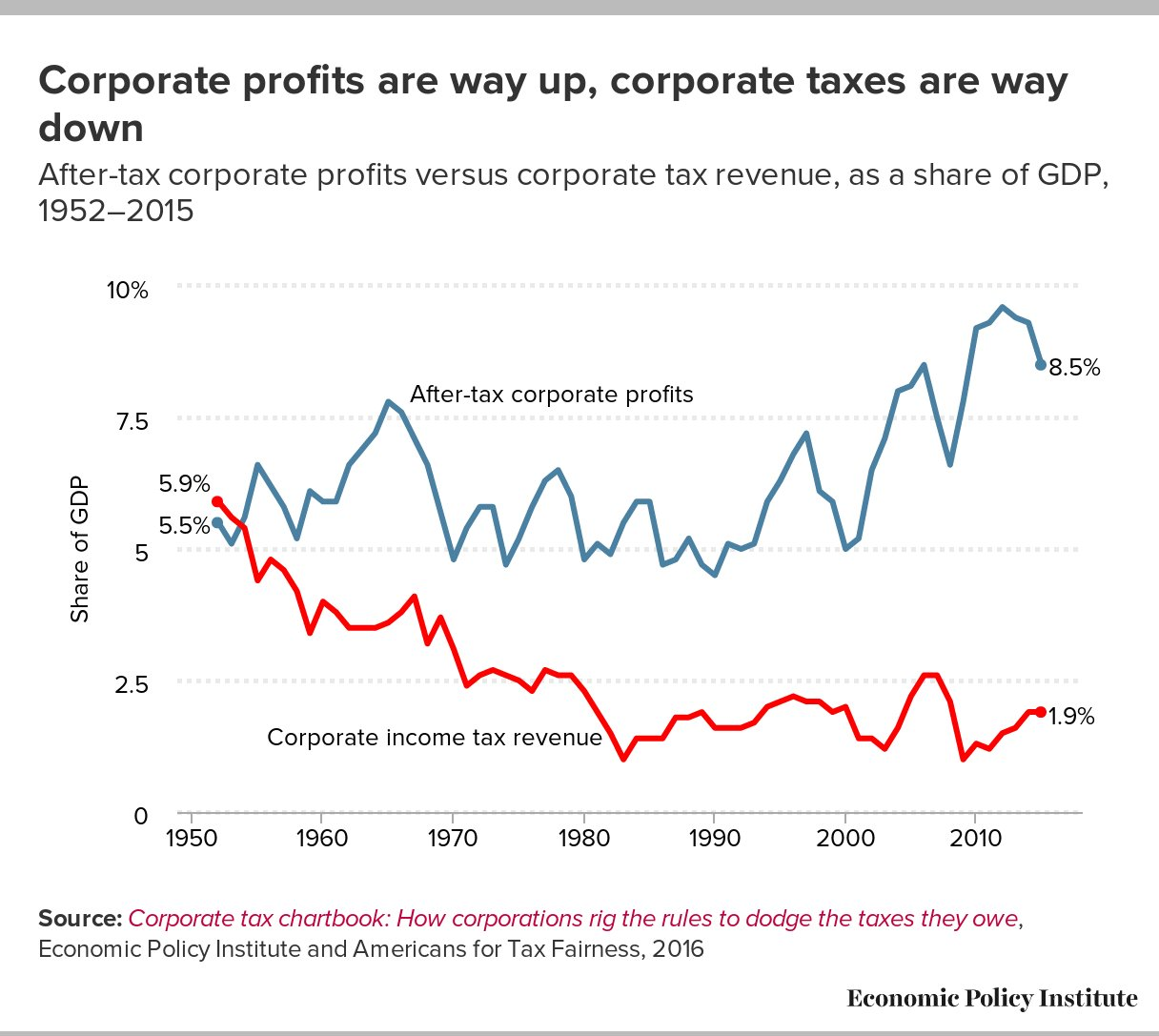

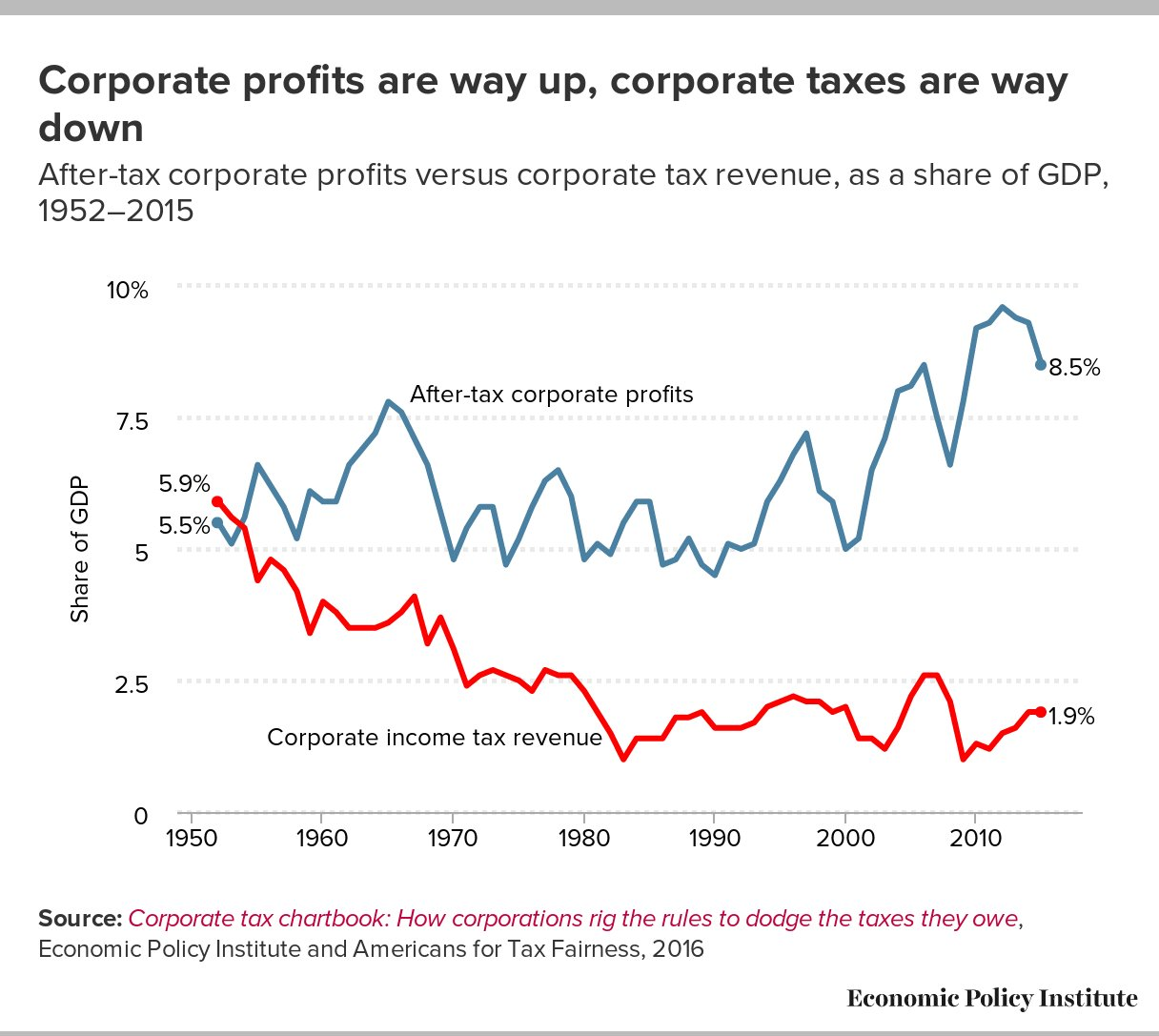

Given the latest tax proposal out if D.C., I thought this was quite relevant: Source: Economic Policy Institute

Given the latest tax proposal out if D.C., I thought this was quite relevant: Source: Economic Policy Institute

Read More

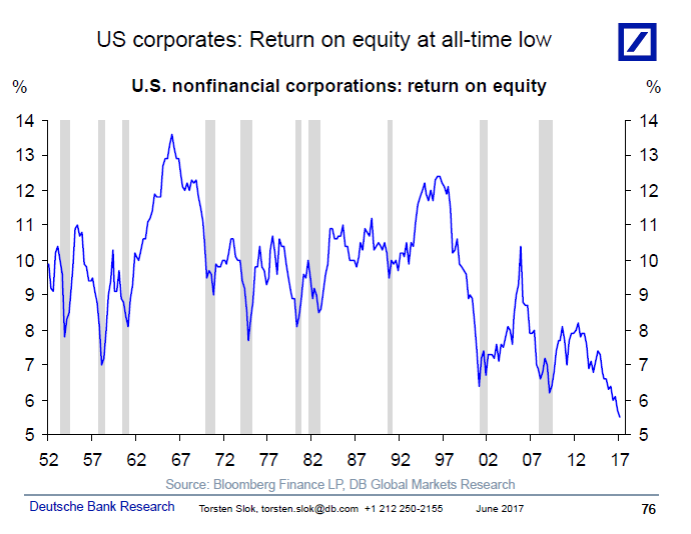

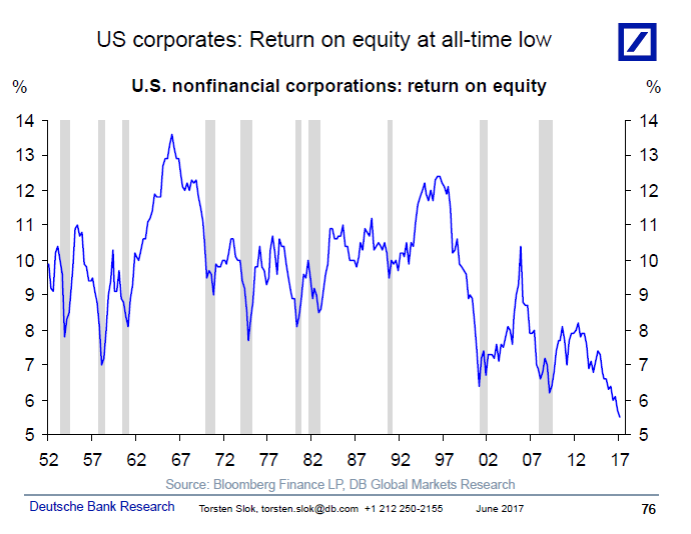

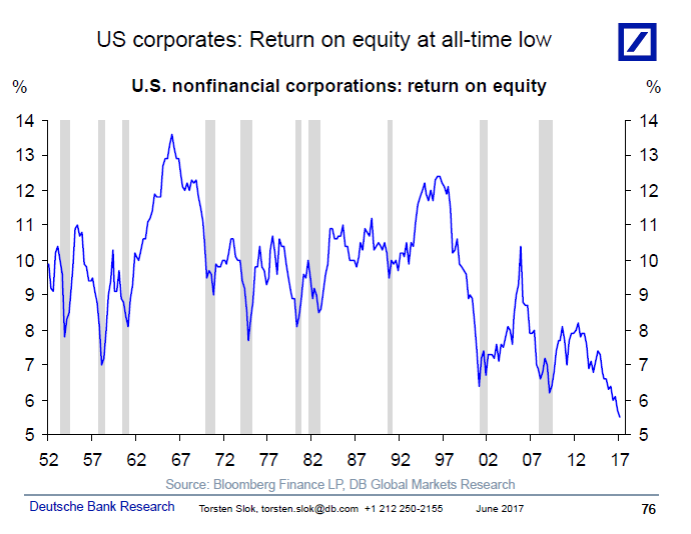

From David Wilson, Bloomberg News: Double-digit earnings growth is back for the S&P 500. The index’s companies are headed for a...

From David Wilson, Bloomberg News: Double-digit earnings growth is back for the S&P 500. The index’s companies are headed for a...

Read More

James Bianco is president of Bianco Research, an institutional research and analytics firm. Since November 1990, he has been...

James Bianco is president of Bianco Research, an institutional research and analytics firm. Since November 1990, he has been...

Read More

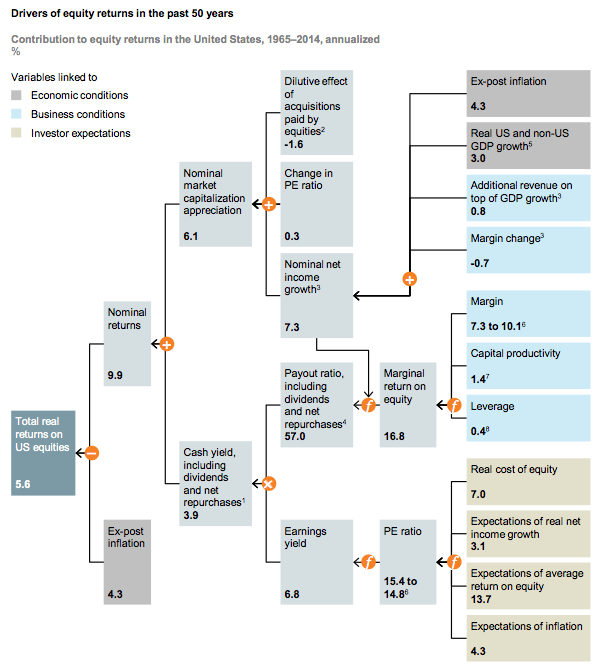

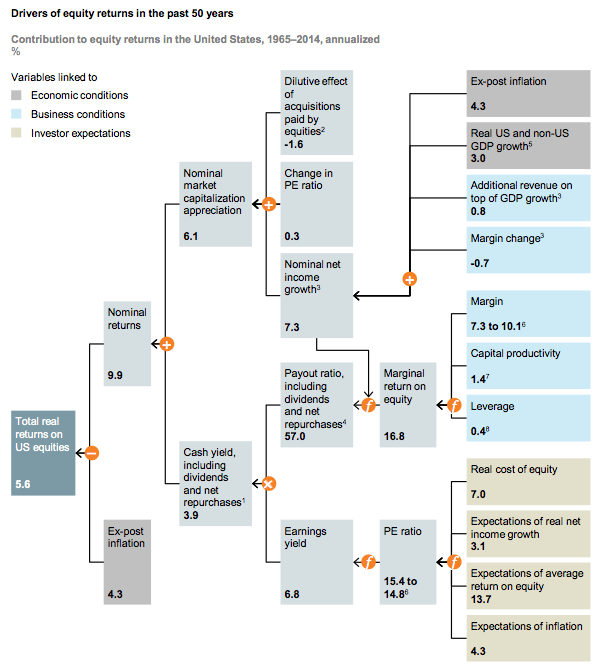

This is from the McKinsey report I referenced yesterday — I have to take a closer look at it, as it strikes me as an odd structure...

This is from the McKinsey report I referenced yesterday — I have to take a closer look at it, as it strikes me as an odd structure...

Read More

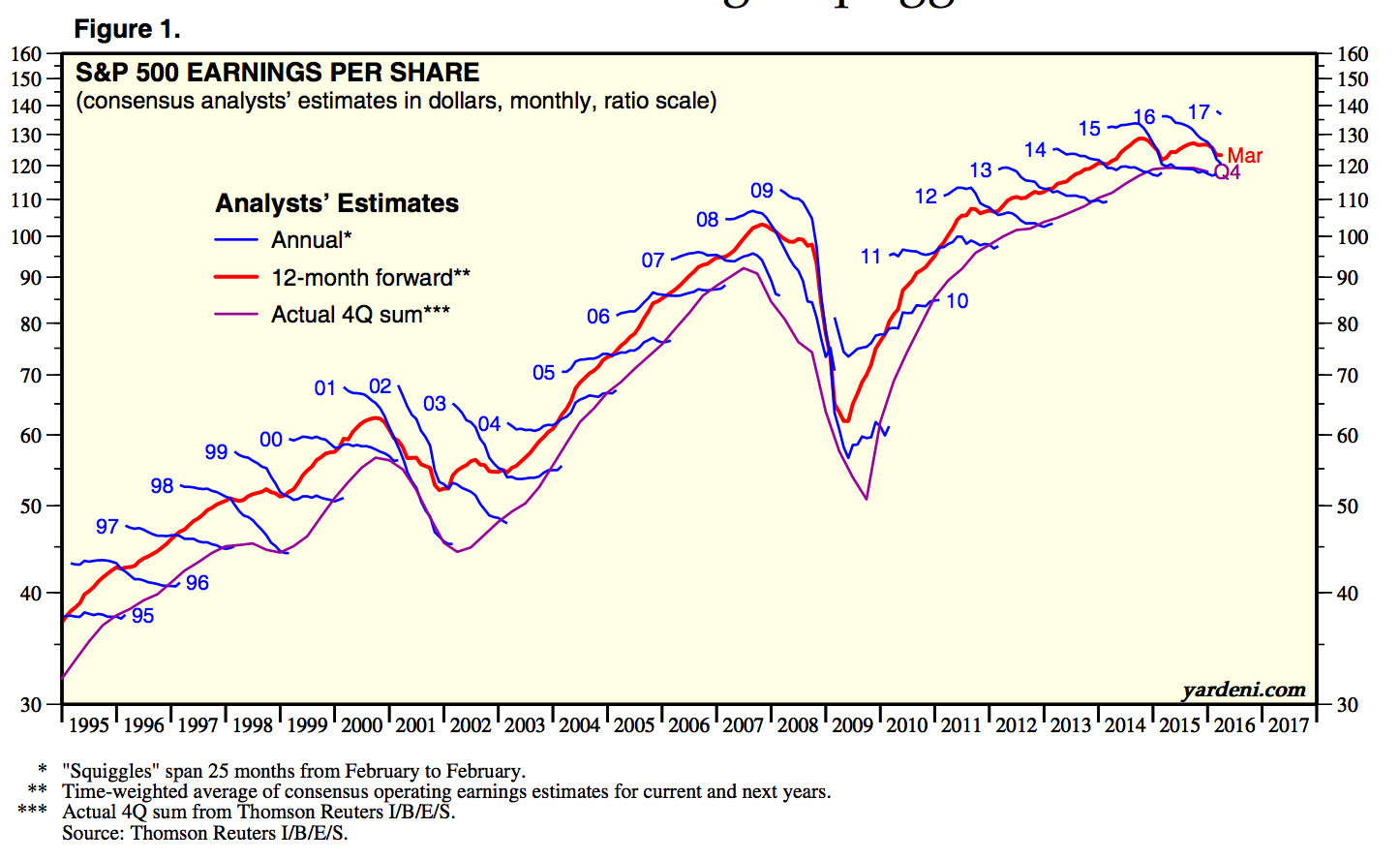

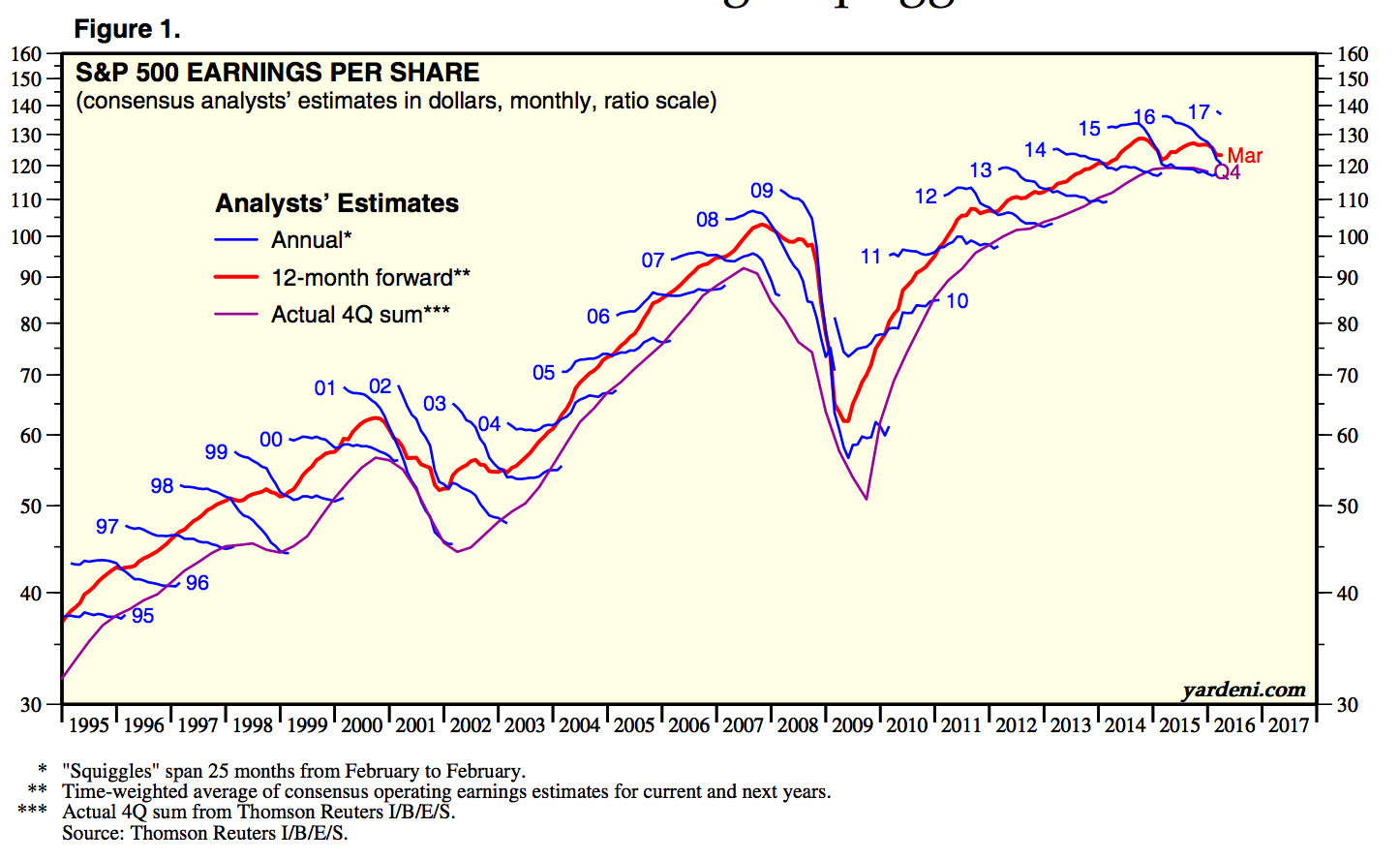

Fascinating look at the tendency for analysts to overestimate earnings, except at market lows, when they under-estimate them: ...

Fascinating look at the tendency for analysts to overestimate earnings, except at market lows, when they under-estimate them: ...

Read More

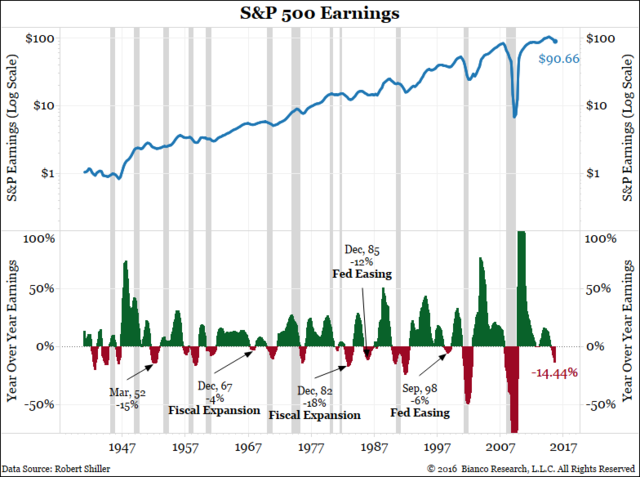

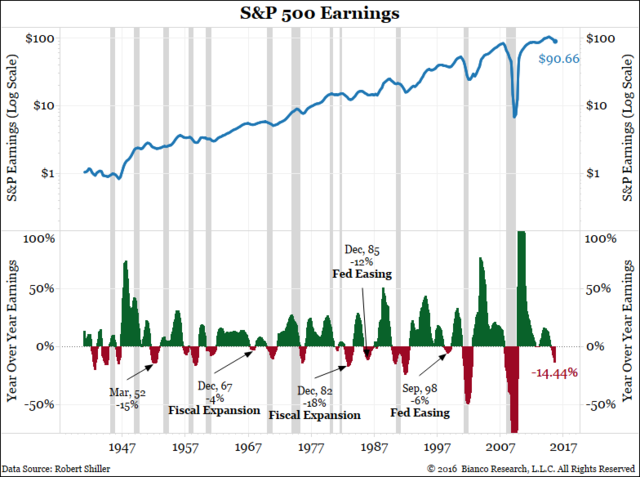

One of the big concerns for investors is the health of corporate profits, which have declined in the three of the past four...

One of the big concerns for investors is the health of corporate profits, which have declined in the three of the past four...

Read More

I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...

I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...

I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...

I have been bullish pretty much this entire market run — from March 2009 to today. But that doesn’t mean I don’t want...