When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...

When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...

Read More

Is the best over for the U.S. stock market this year? That’s the question a Bloomberg article asked about the US markets. (This...

Read More

A bonus Friday afternoon guest post via Macro Man — a portfolio manager at a London-based hedge fund, he trades global currencies,...

A bonus Friday afternoon guest post via Macro Man — a portfolio manager at a London-based hedge fund, he trades global currencies,...

Read More

What this country really needs is less tranparency in earnings reports, and more wiggle room for corporate reporting: click for video...

What this country really needs is less tranparency in earnings reports, and more wiggle room for corporate reporting: click for video...

Read More

> "At the start of the year, profits at banks, brokers and insurance companies were projected to rise 22 percent in 2008,...

> "At the start of the year, profits at banks, brokers and insurance companies were projected to rise 22 percent in 2008,...

Read More

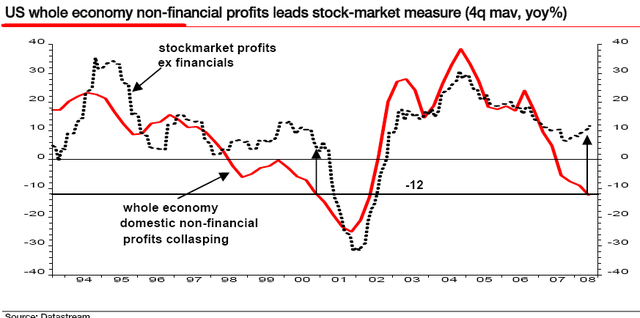

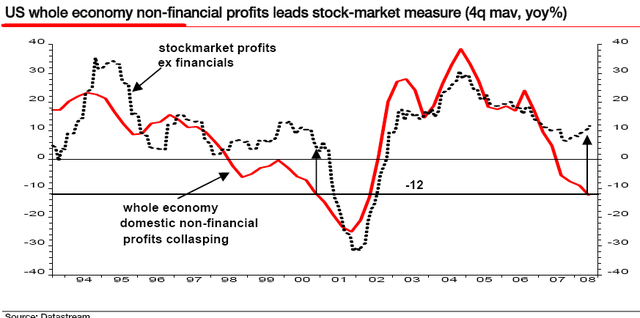

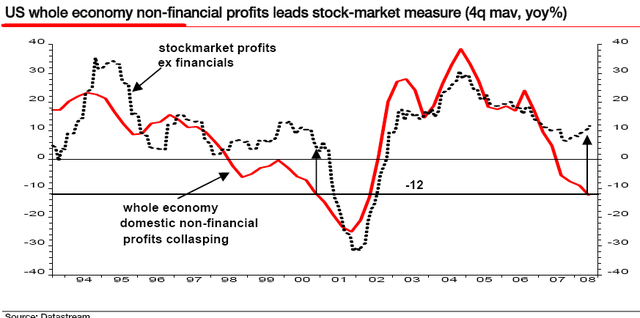

Here’s something you may not have considered: The massive losses taken by Wall Street Banks and Brokers is going to wipe out their...

Here’s something you may not have considered: The massive losses taken by Wall Street Banks and Brokers is going to wipe out their...

Read More

Correct me if I am wrong, but I do believe Robert Steel of Wachovia owes a royalty payment to John Thain of Merrill Lynch. Why? For for...

Read More

Yesterday, I was supposed to do a quick 3 minute spot at Bloomberg, so I headed off to the studio after the close to talk about AIG...

Yesterday, I was supposed to do a quick 3 minute spot at Bloomberg, so I headed off to the studio after the close to talk about AIG...

Read More

Click for Video Thoughts on the future of the economy, with David Rosenberg, Merrill Lynch North American economist Click for Video Final...

Click for Video Thoughts on the future of the economy, with David Rosenberg, Merrill Lynch North American economist Click for Video Final...

Read More

Yesterday’s missive — Rinse. Lather. Repeat — was, apparently, widely circulated. That’s according to a WSJ...

Read More

When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...

When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...

When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...

When people try to figure out what was the cause of today’s 344 point whackage, one of the items they will point to will be...