I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...

I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...

Read More

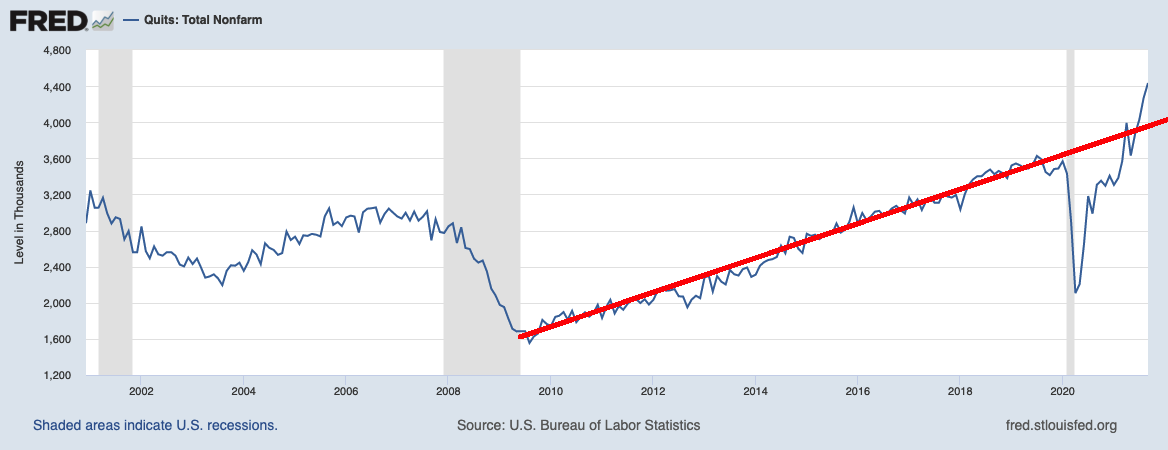

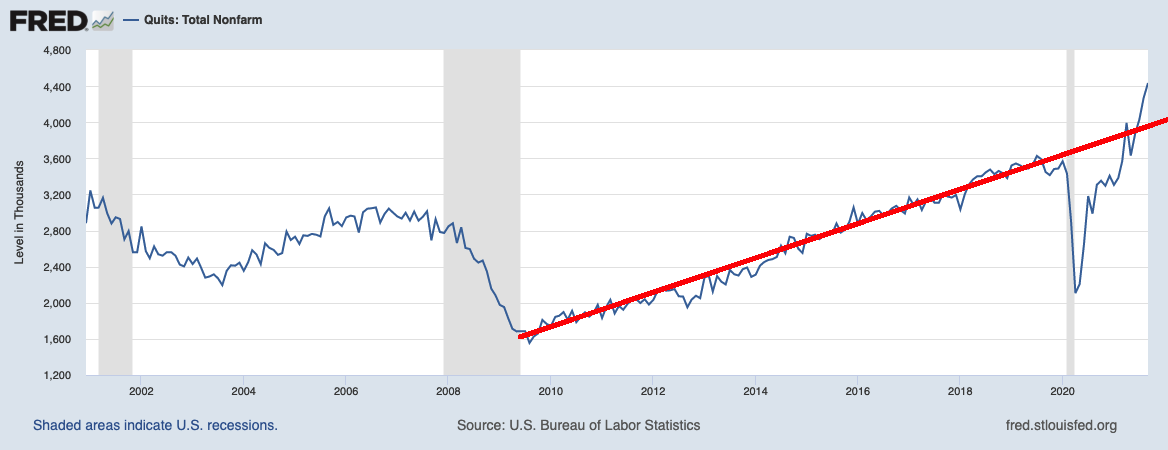

Quits: Total NonFarm Payrolls Quits: Professional & Business Services To hear an audio spoken word version of this...

Quits: Total NonFarm Payrolls Quits: Professional & Business Services To hear an audio spoken word version of this...

Read More

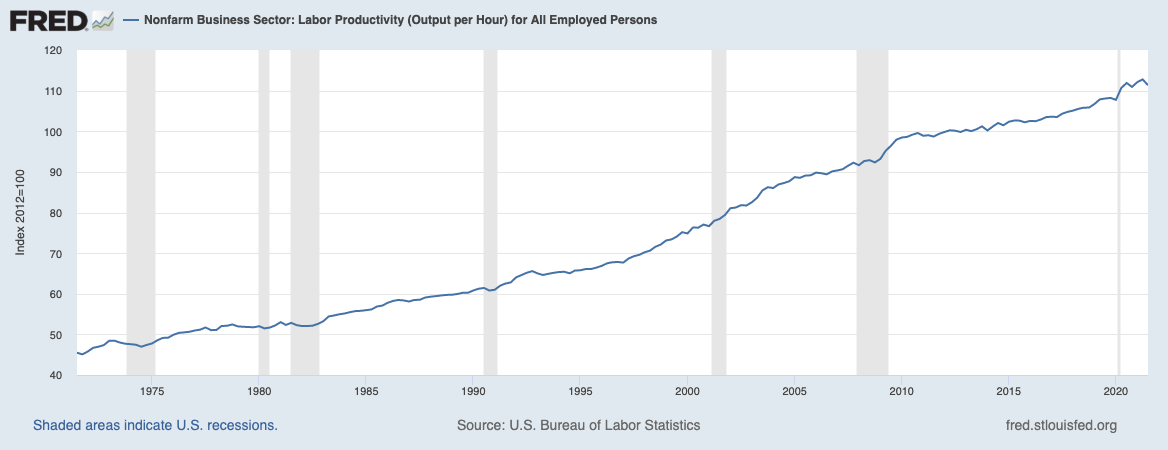

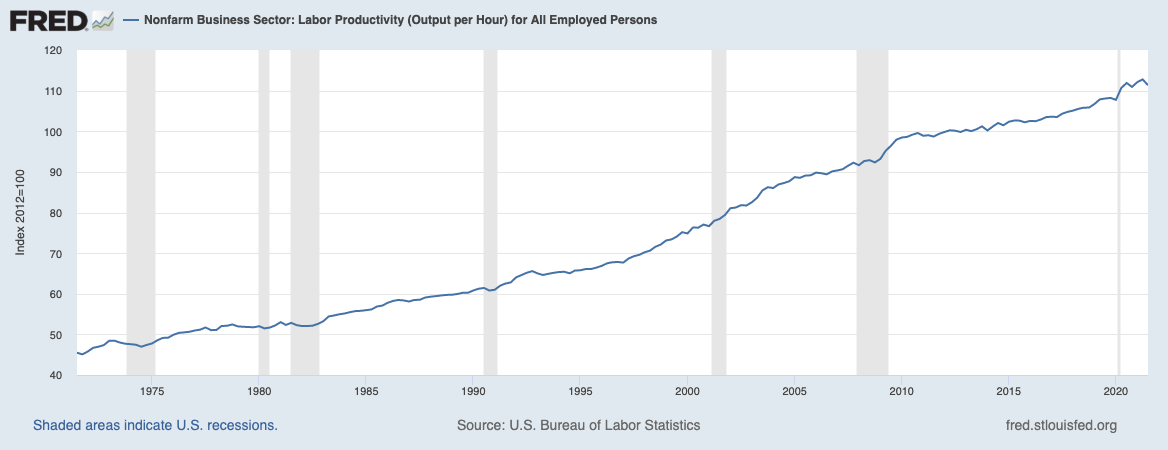

50 Years of Productivity Gains To hear an audio spoken word version of this post, click here. There has been lots...

50 Years of Productivity Gains To hear an audio spoken word version of this post, click here. There has been lots...

Read More

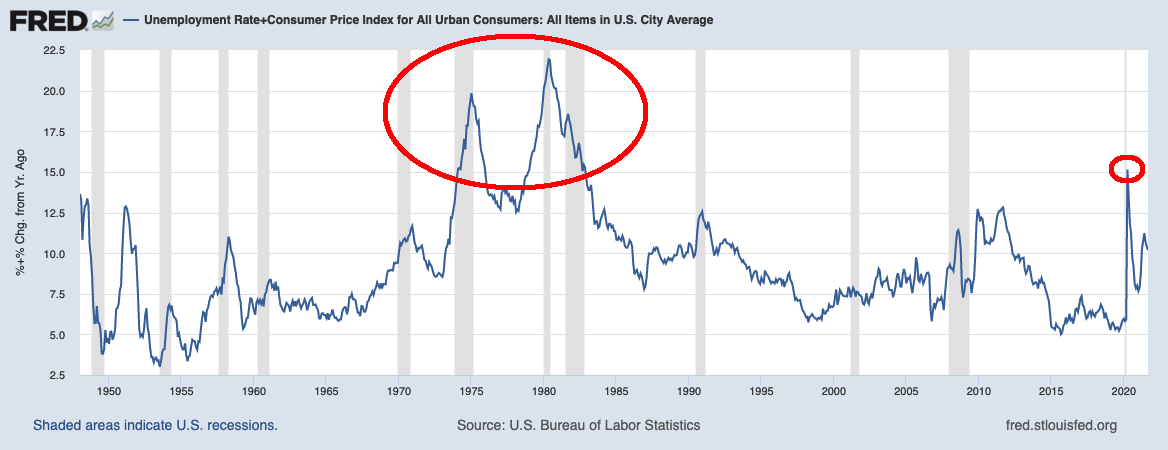

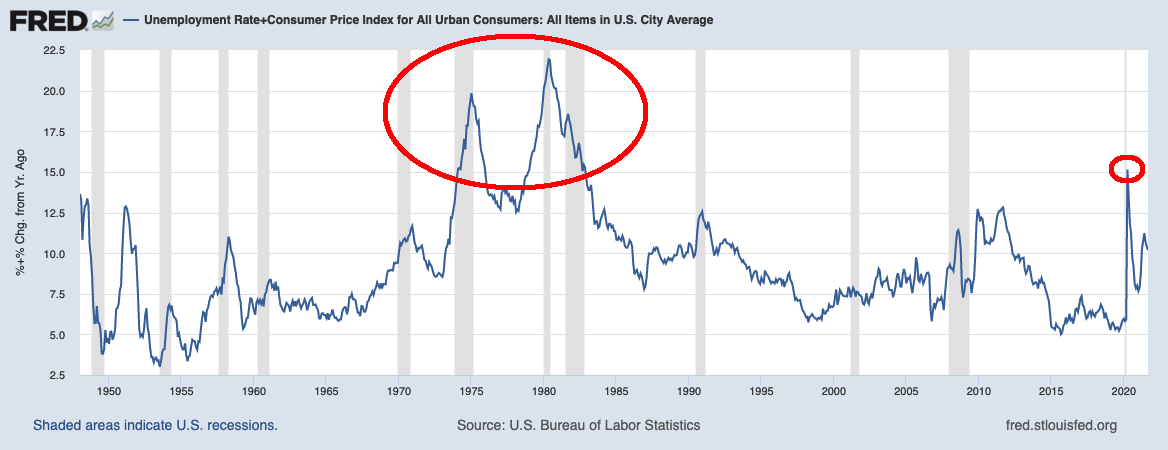

To hear an audio spoken word version of this post, click here. “Stagflation Is All Anyone in Markets...

To hear an audio spoken word version of this post, click here. “Stagflation Is All Anyone in Markets...

Read More

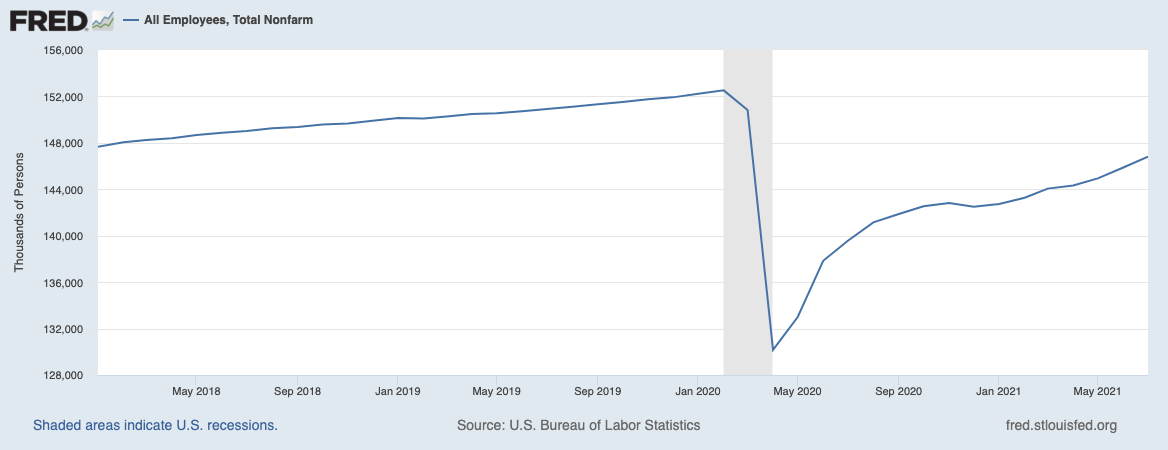

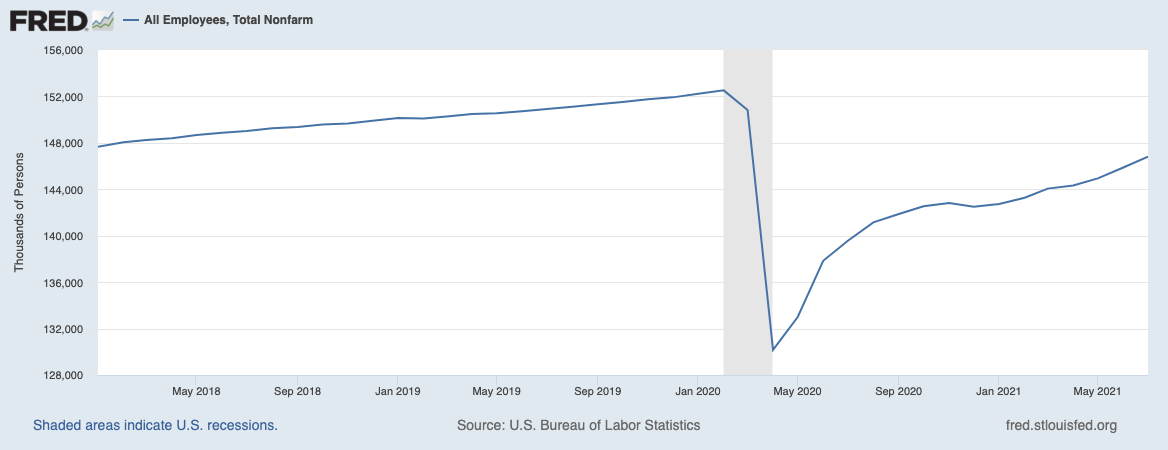

To hear an audio spoken word version of this post, click here. “If economists get this month’s NFP number...

To hear an audio spoken word version of this post, click here. “If economists get this month’s NFP number...

Read More

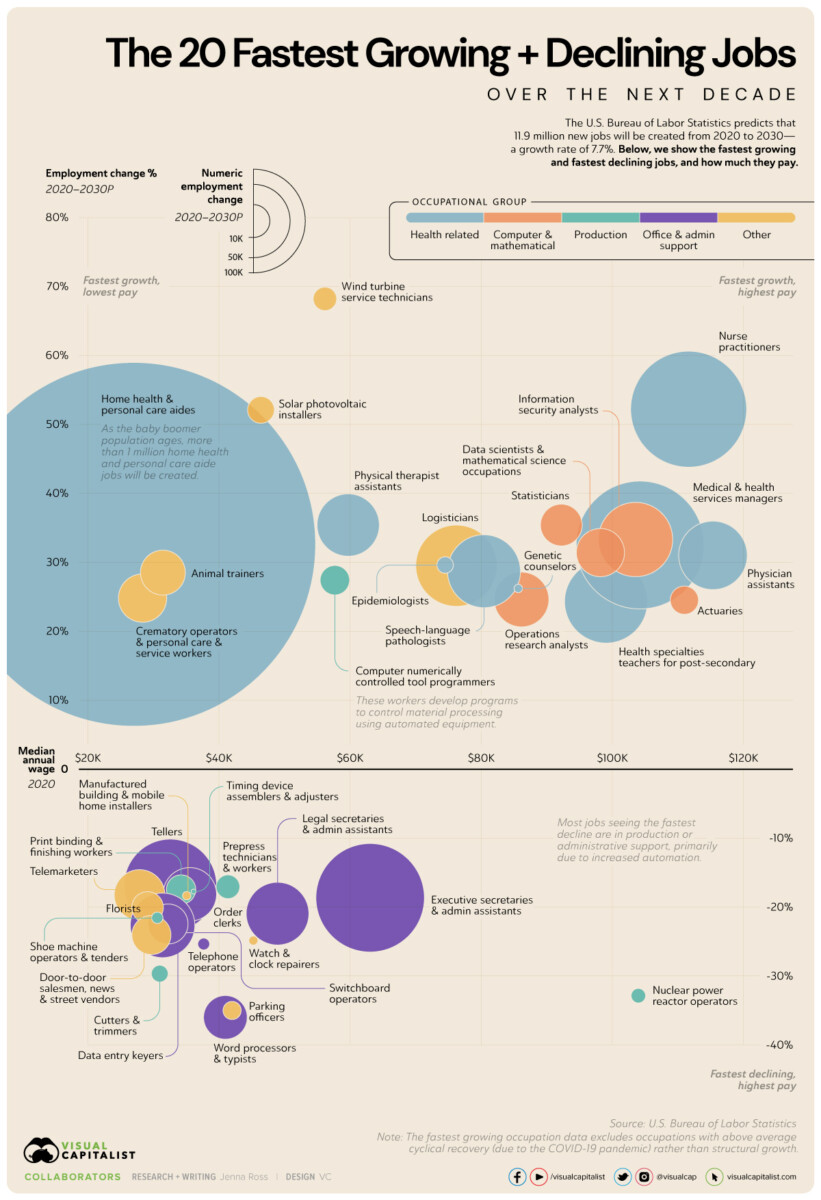

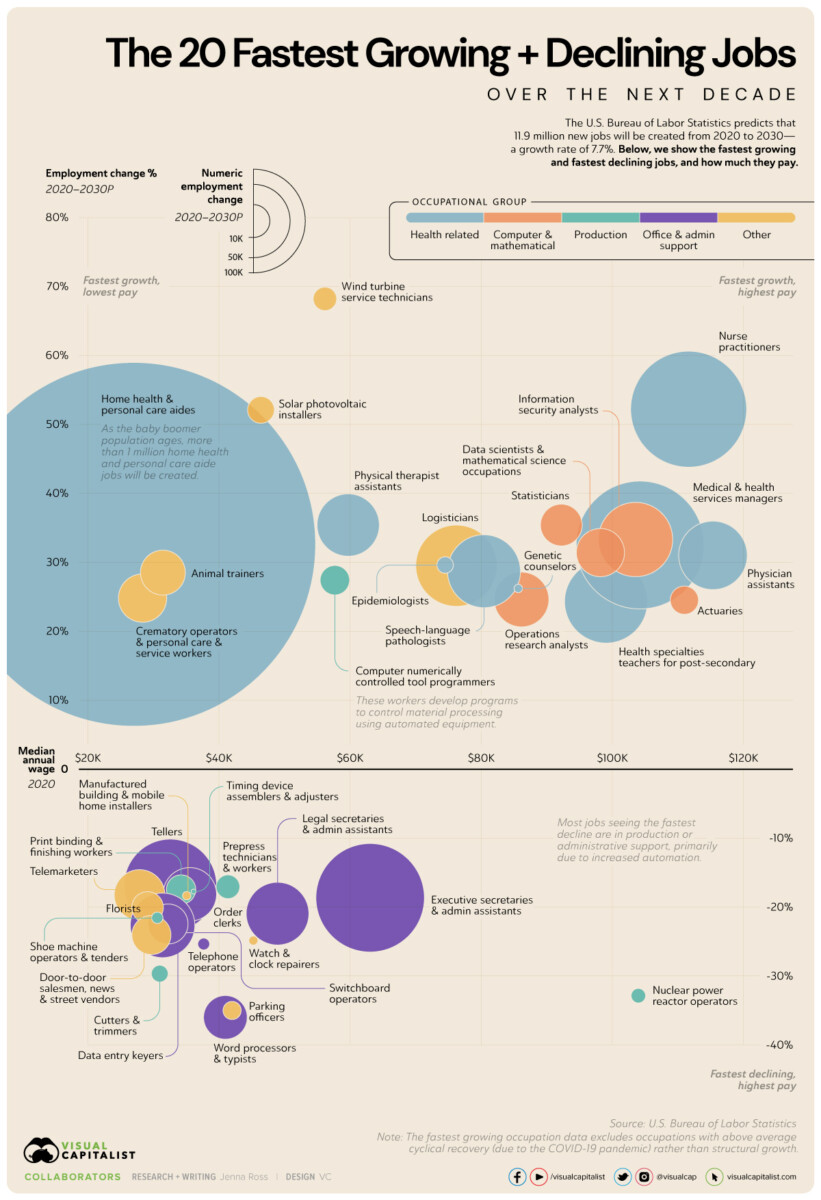

Source: Visual Capitalist What are the jobs projected to grow the fastest from 2020 to 2030? A combination of clean energy,...

Source: Visual Capitalist What are the jobs projected to grow the fastest from 2020 to 2030? A combination of clean energy,...

Read More

In response to employee shortages and hiring difficulties, 25 states in America ended enhanced unemployment insurance...

In response to employee shortages and hiring difficulties, 25 states in America ended enhanced unemployment insurance...

Read More

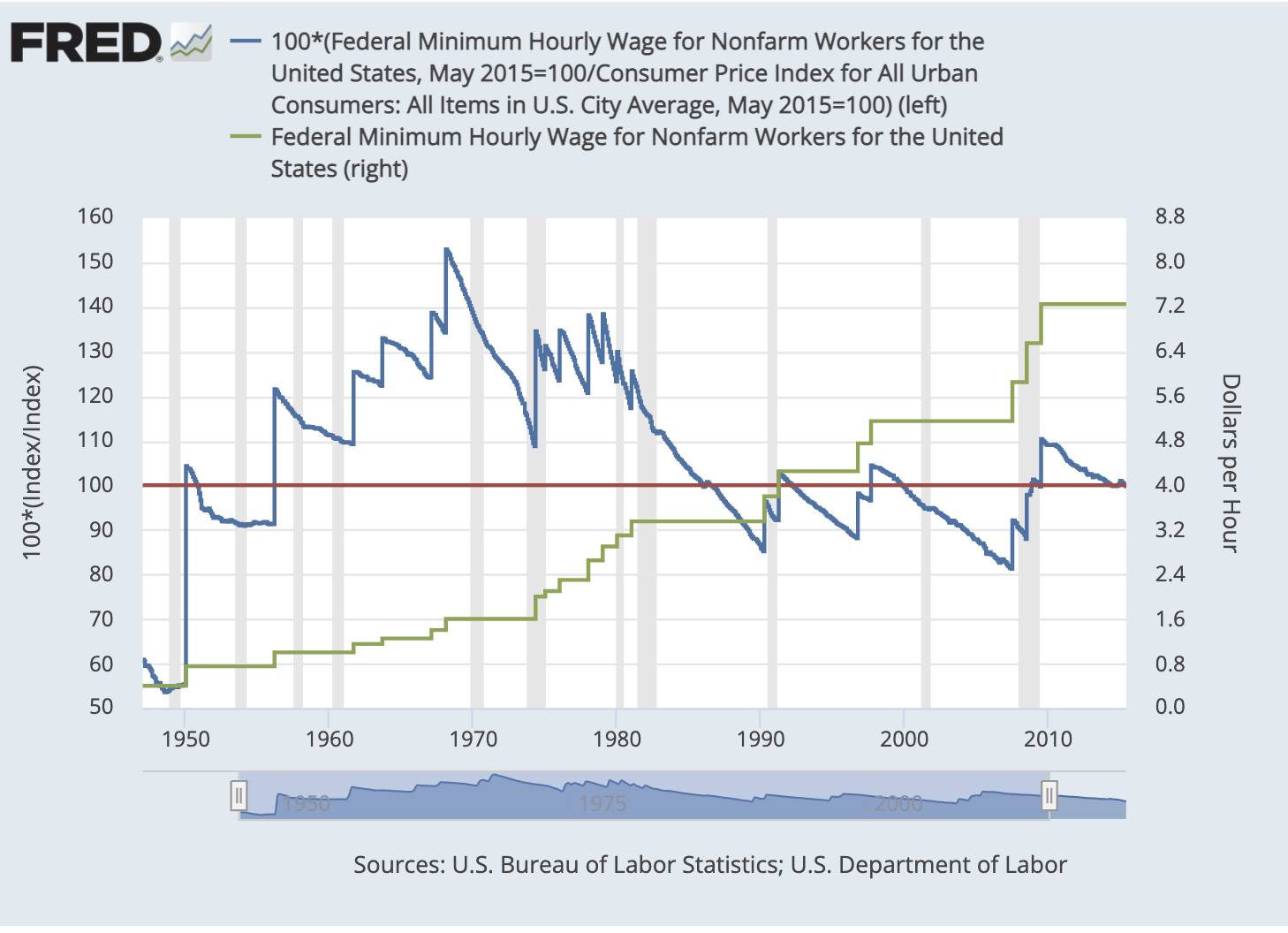

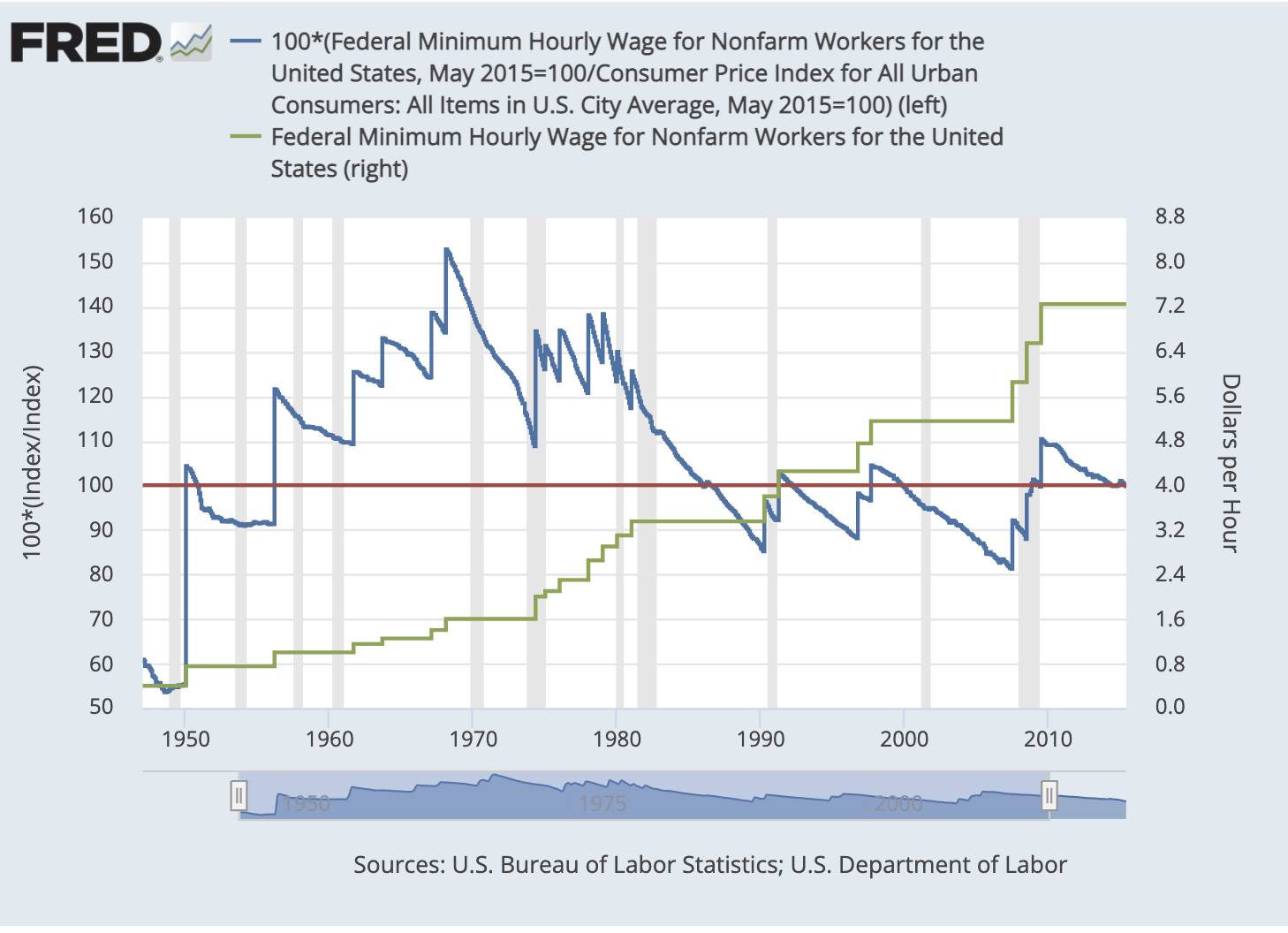

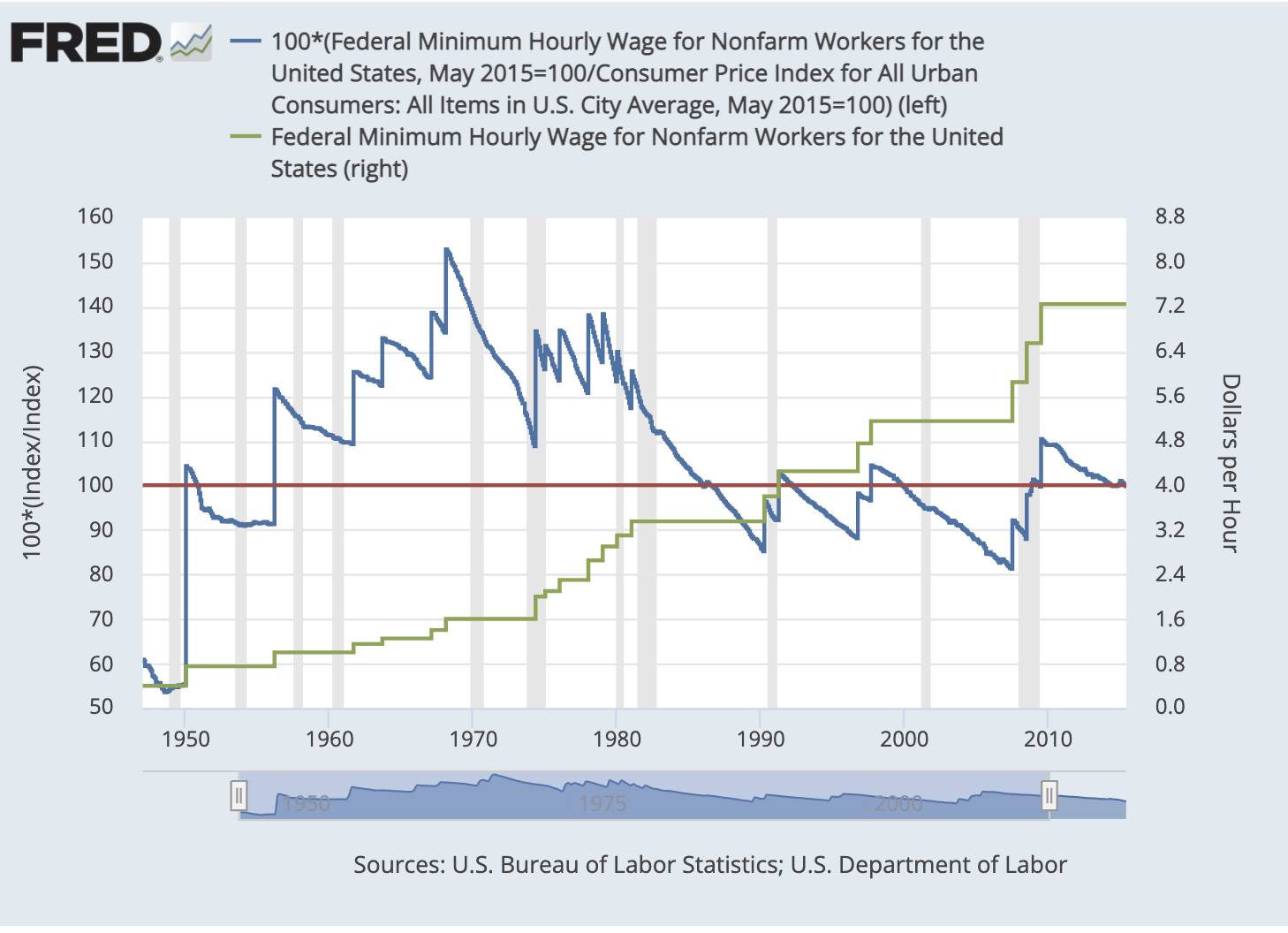

Last week, I discussed part of the reasons many low paying jobs were going unfilled: many people in those industries used the lock down...

Read More

An endless series of articles have been discussing America’s Labor shortages, especially in foodservice and...

An endless series of articles have been discussing America’s Labor shortages, especially in foodservice and...

Read More

Fun conversation with “Marketplace” host Kai Ryssdal on the shifting balance of power between employers and employees. ...

Read More

I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...

I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...

I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...

I kinda buried the lede last week in my Structural or Transitory? post; we looked at a few inflation elements, including...