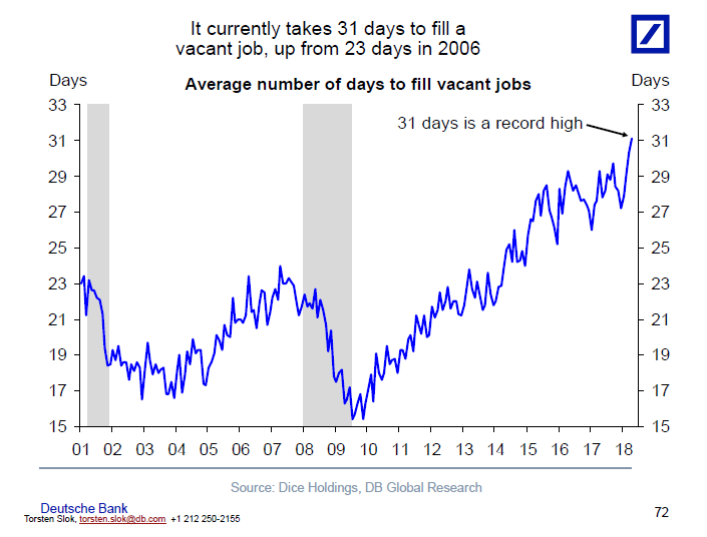

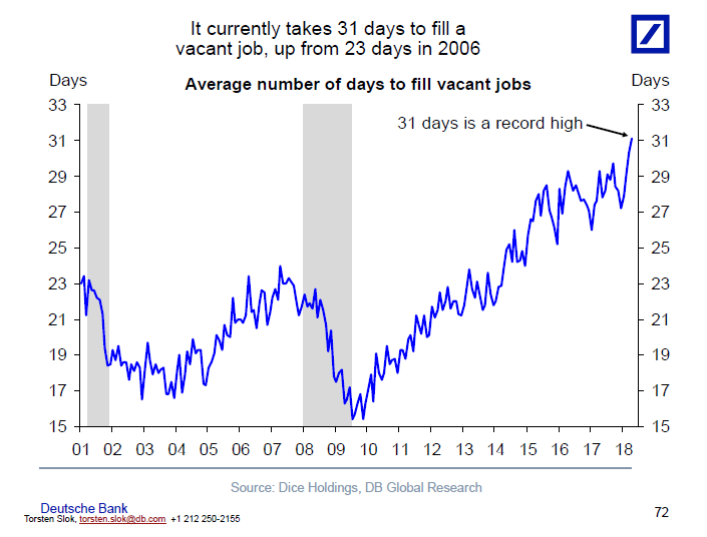

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...

Read More

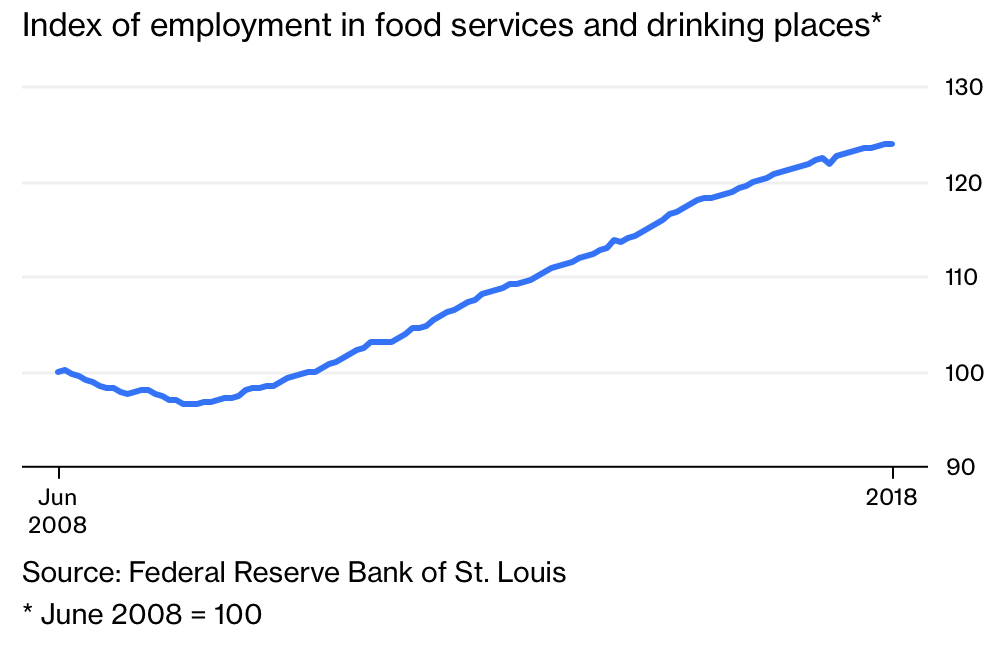

Where’s Your Raise? It Should Be Coming Pressures for bigger pay increases are building, but have yet to show up in the data....

Where’s Your Raise? It Should Be Coming Pressures for bigger pay increases are building, but have yet to show up in the data....

Read More

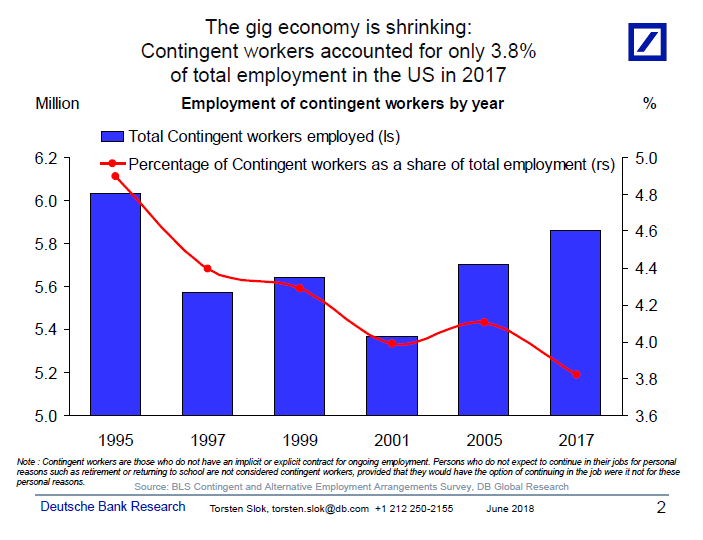

From Torsten Sløk, Ph.D.: Source: Torsten Sløk, Deutsche Bank Research

From Torsten Sløk, Ph.D.: Source: Torsten Sløk, Deutsche Bank Research

Read More

Where’s Your Raise? It Should Be Coming Pressures for bigger pay increases are building, but have yet to show up in the data....

Read More

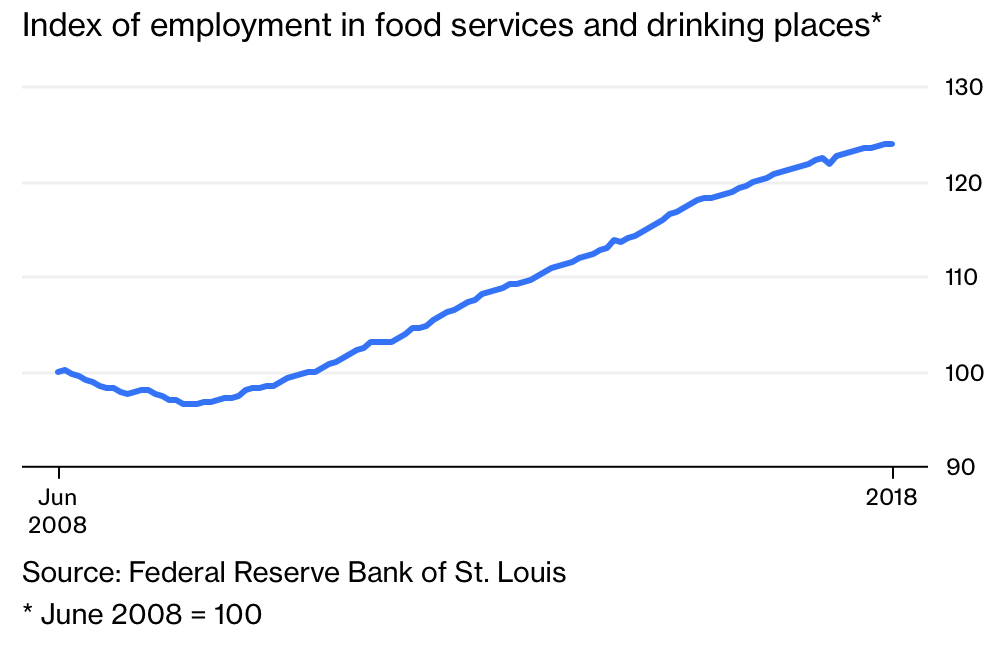

Why to Keep Your Inflation Anxiety in Check Yes, prices are rising faster, but all signs suggest it won’t amount to much. Bloomberg,...

Why to Keep Your Inflation Anxiety in Check Yes, prices are rising faster, but all signs suggest it won’t amount to much. Bloomberg,...

Read More

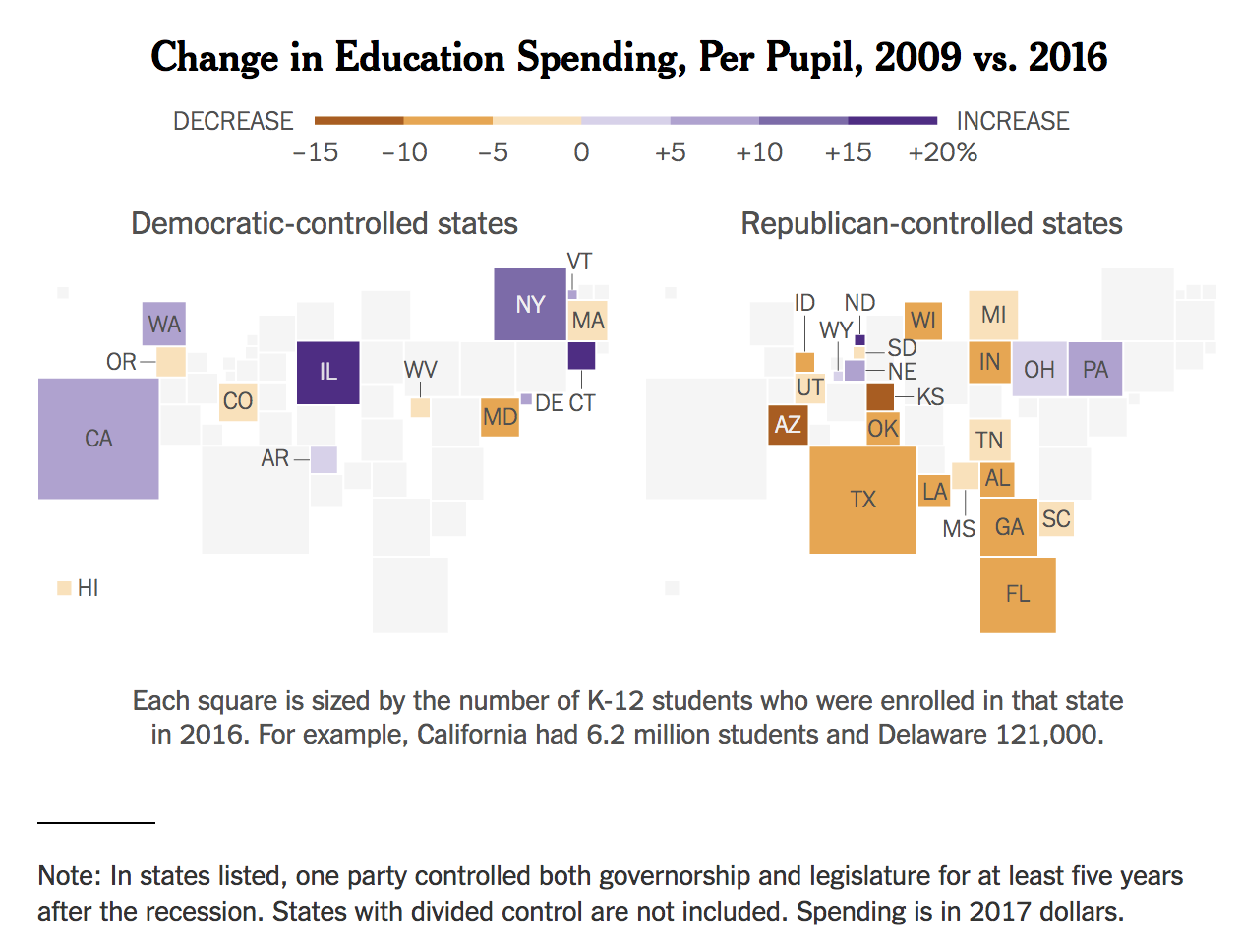

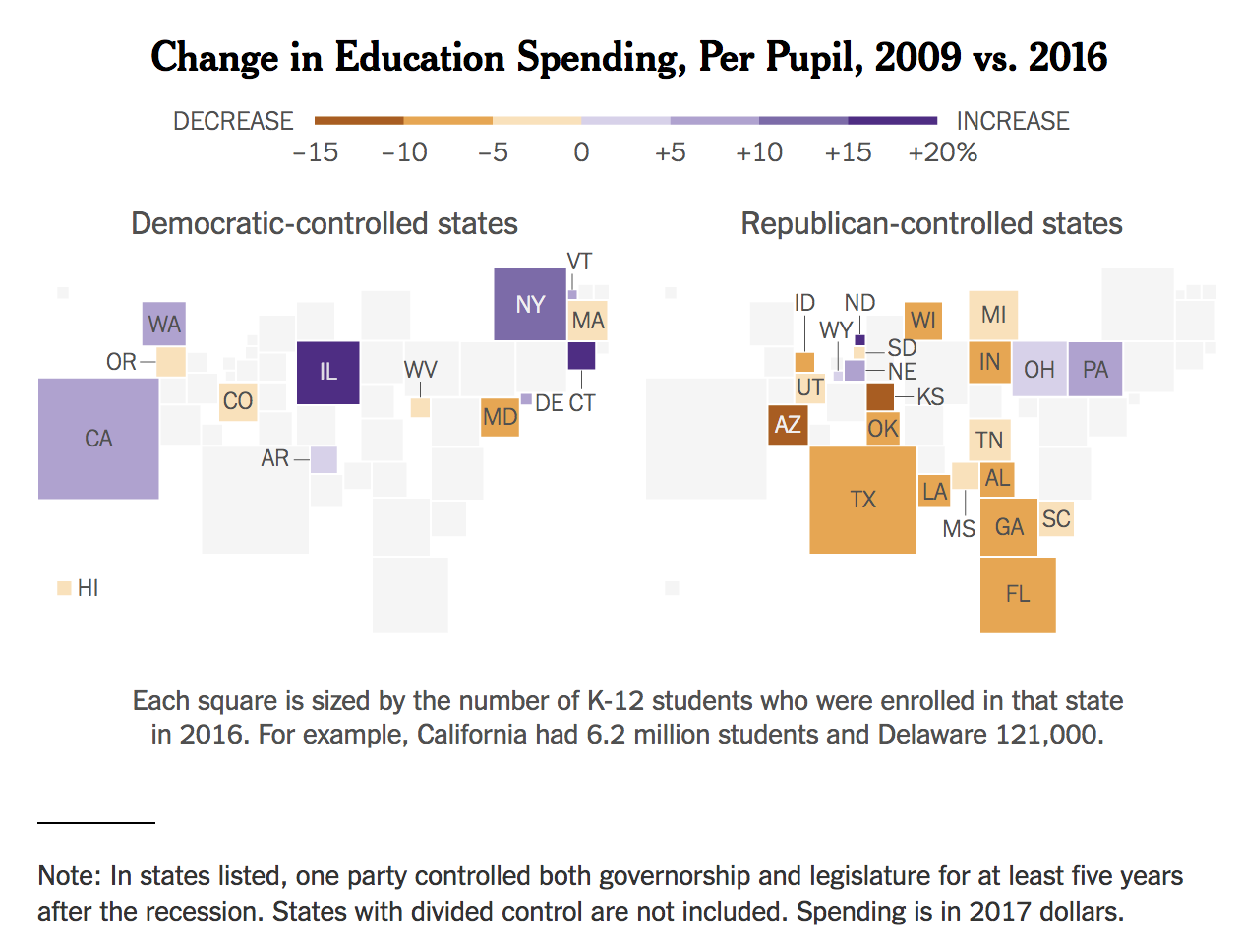

Source: The Upshot From Upshot: the underlying conflict between public school employees and policymakers has roots in decisions...

Source: The Upshot From Upshot: the underlying conflict between public school employees and policymakers has roots in decisions...

Read More

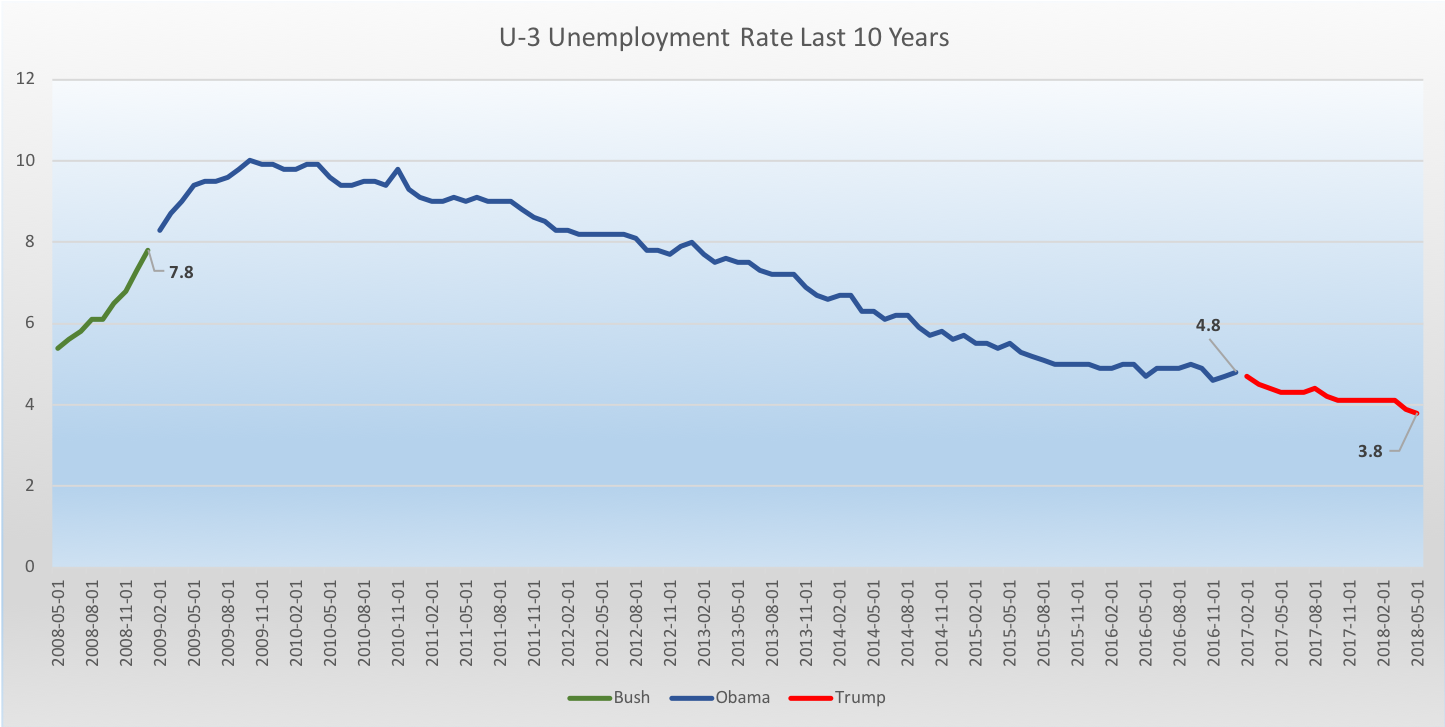

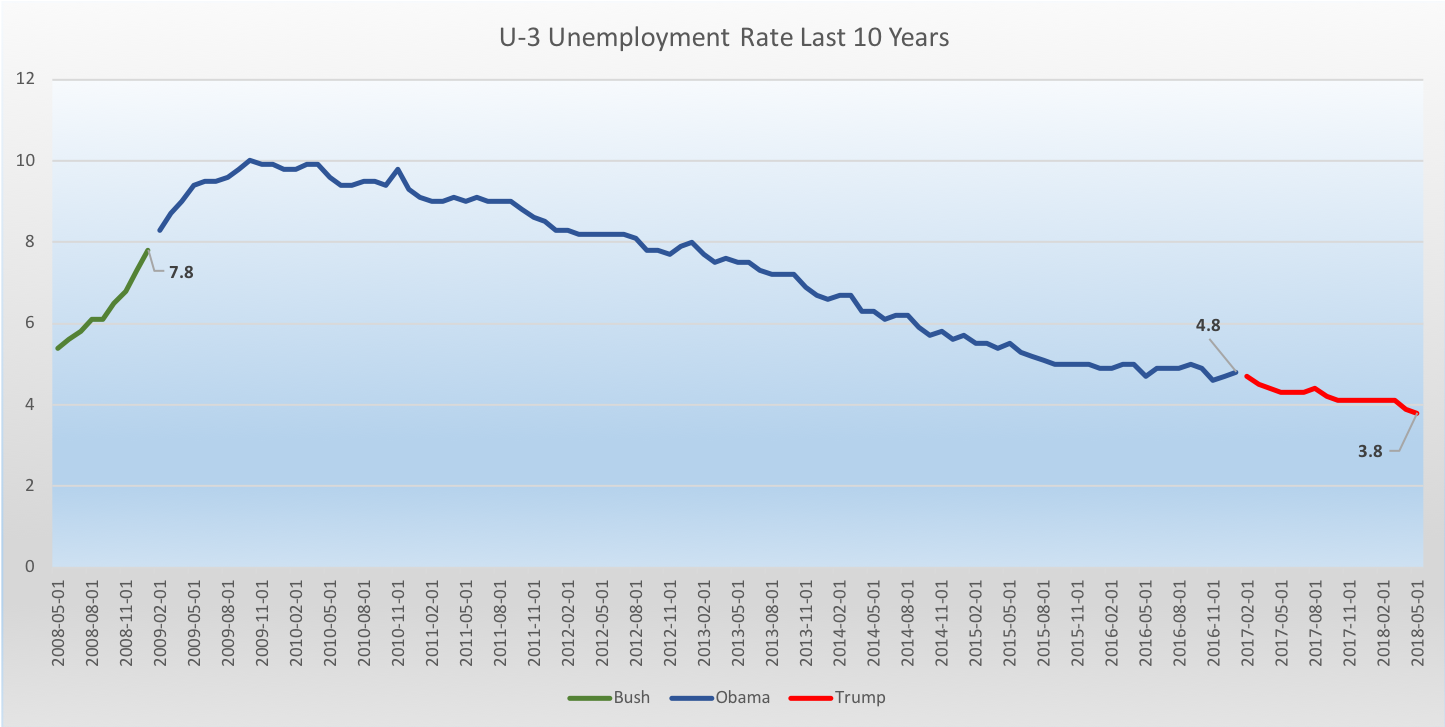

Just a quick note about today’s NFP data. (I will leave any discussion about the inappropriate telegraph by the low...

Just a quick note about today’s NFP data. (I will leave any discussion about the inappropriate telegraph by the low...

Read More

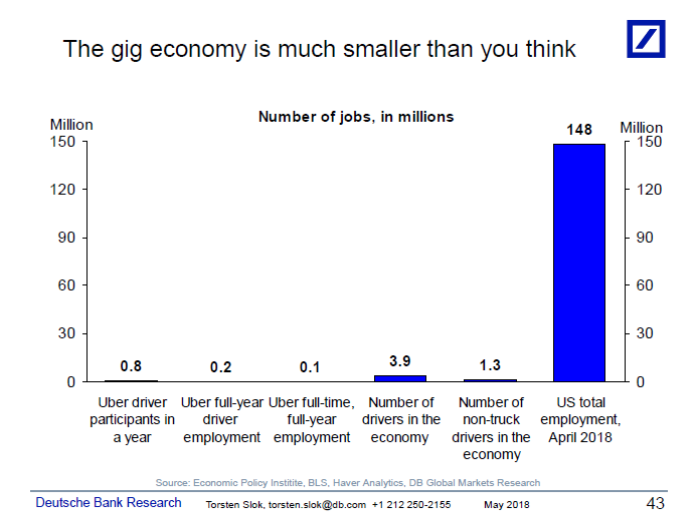

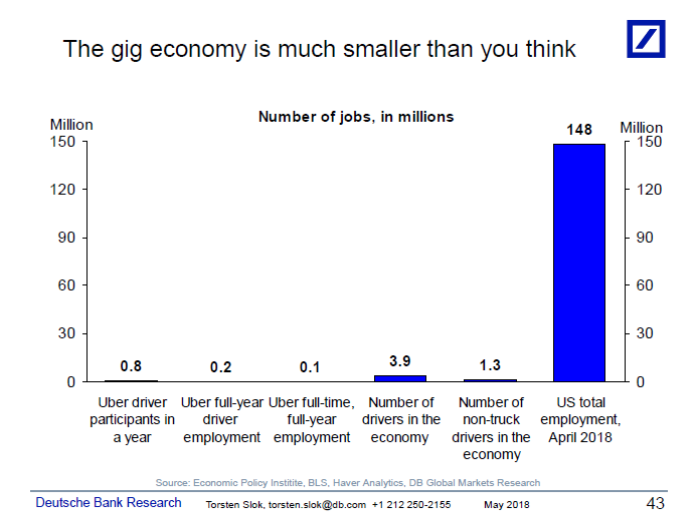

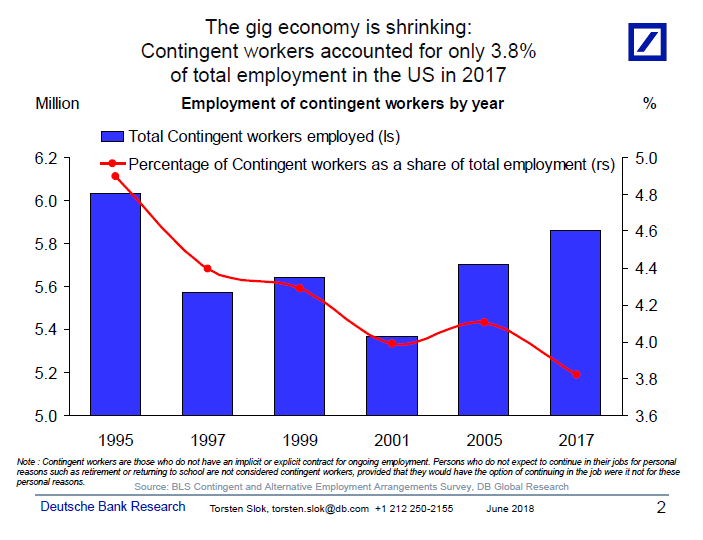

This is fascinating, vua From Deutsche Bank Research: A Fed report this week found that gig work is a very small share of family income....

This is fascinating, vua From Deutsche Bank Research: A Fed report this week found that gig work is a very small share of family income....

Read More

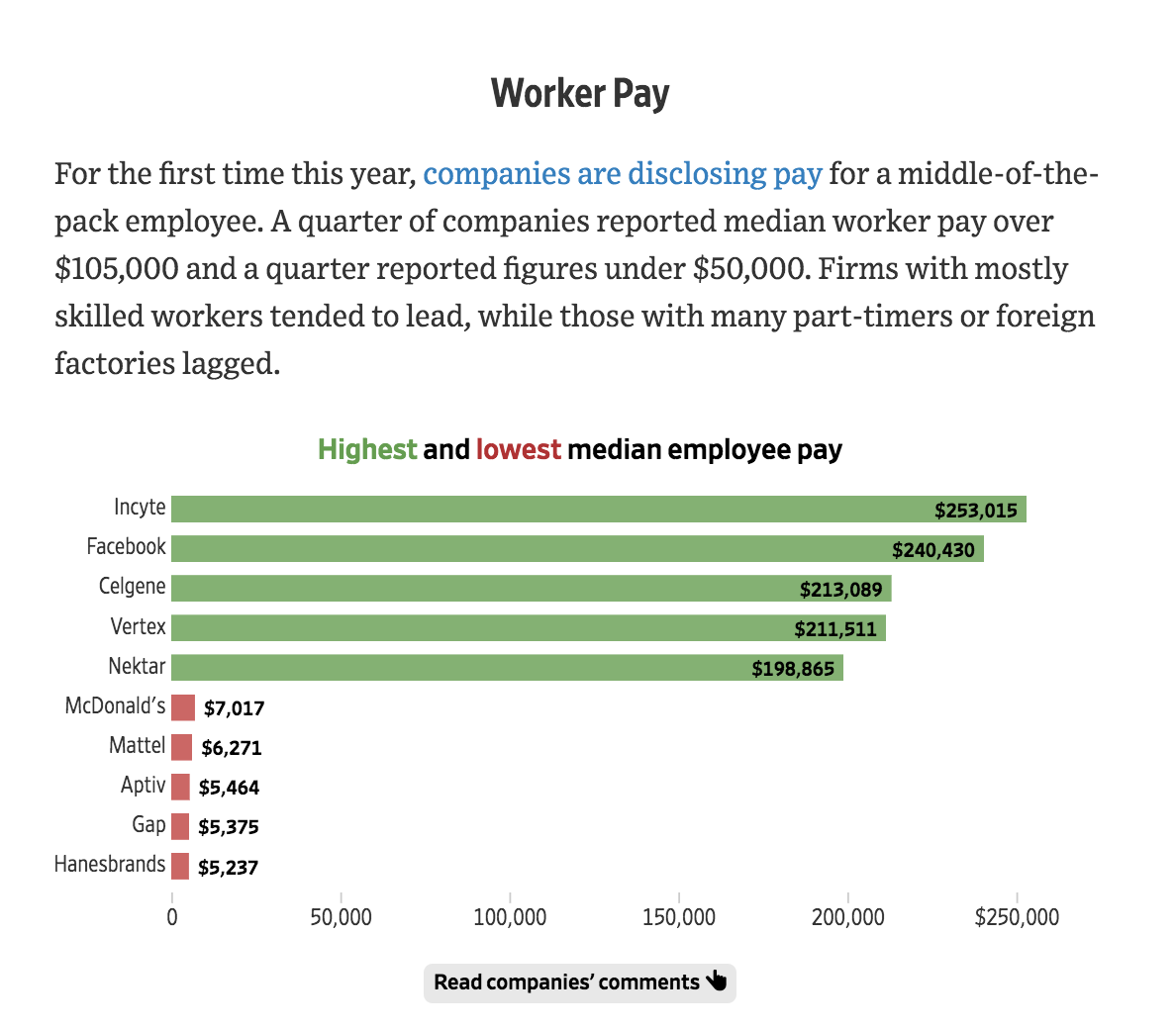

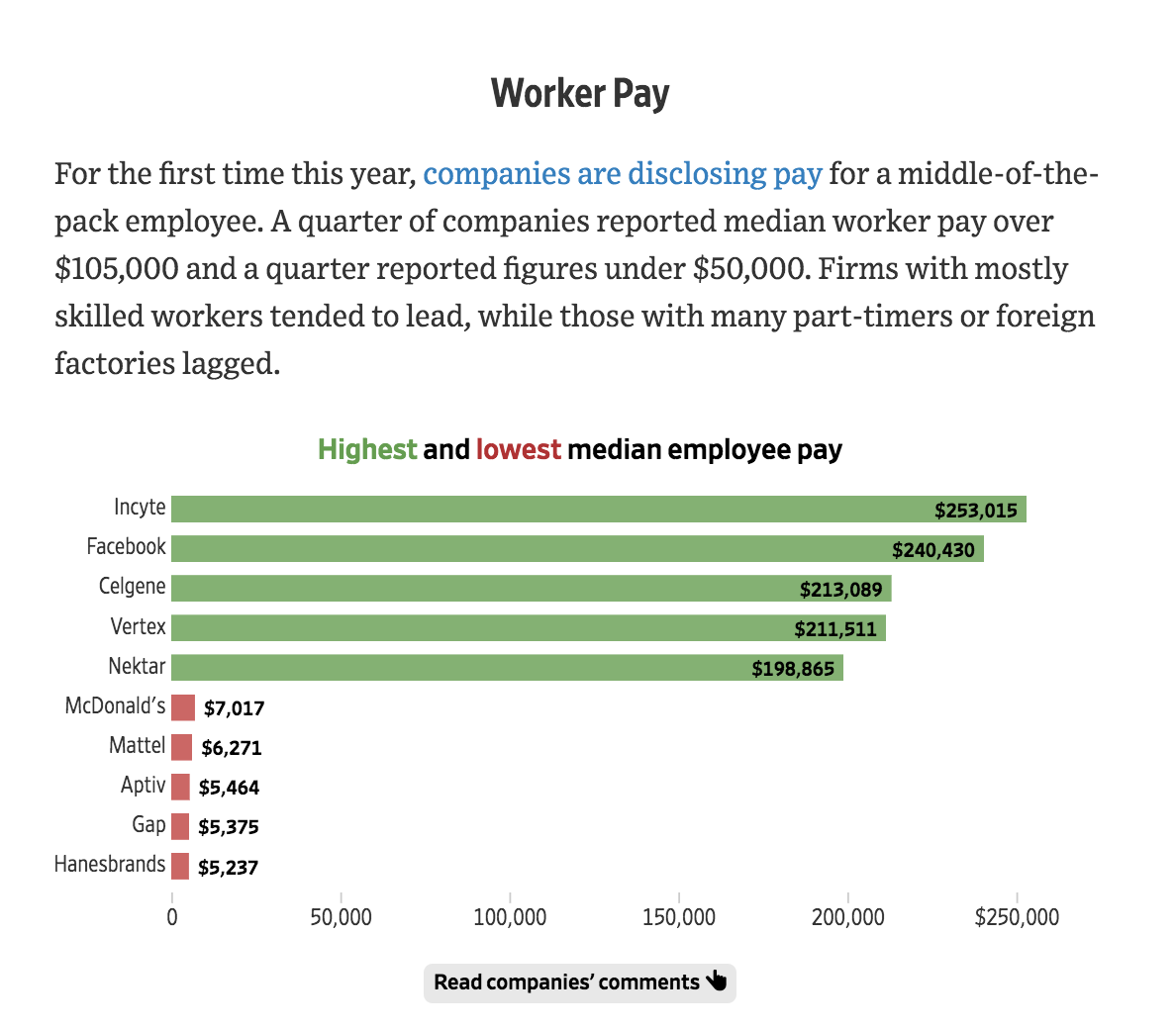

Very interesting assembly of data art the WSJ looking at CEOs and Employee pay, and other related data. The Journal analyzes the most...

Very interesting assembly of data art the WSJ looking at CEOs and Employee pay, and other related data. The Journal analyzes the most...

Read More

Woman run human resources, compliance, and accounting in corporate America today. Its time they take control of the...

Read More

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...

Torsten Sløk was our MIB guest this week; here is a recent chart of his worth sharing: Source: Torsten Sløk, Ph.D., Deutsche Bank...