Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Read More

Of all the ill-advised, misguided nonsense Congress peddles on a daily basis, I cannot identify any more foolish than their...

Of all the ill-advised, misguided nonsense Congress peddles on a daily basis, I cannot identify any more foolish than their...

Read More

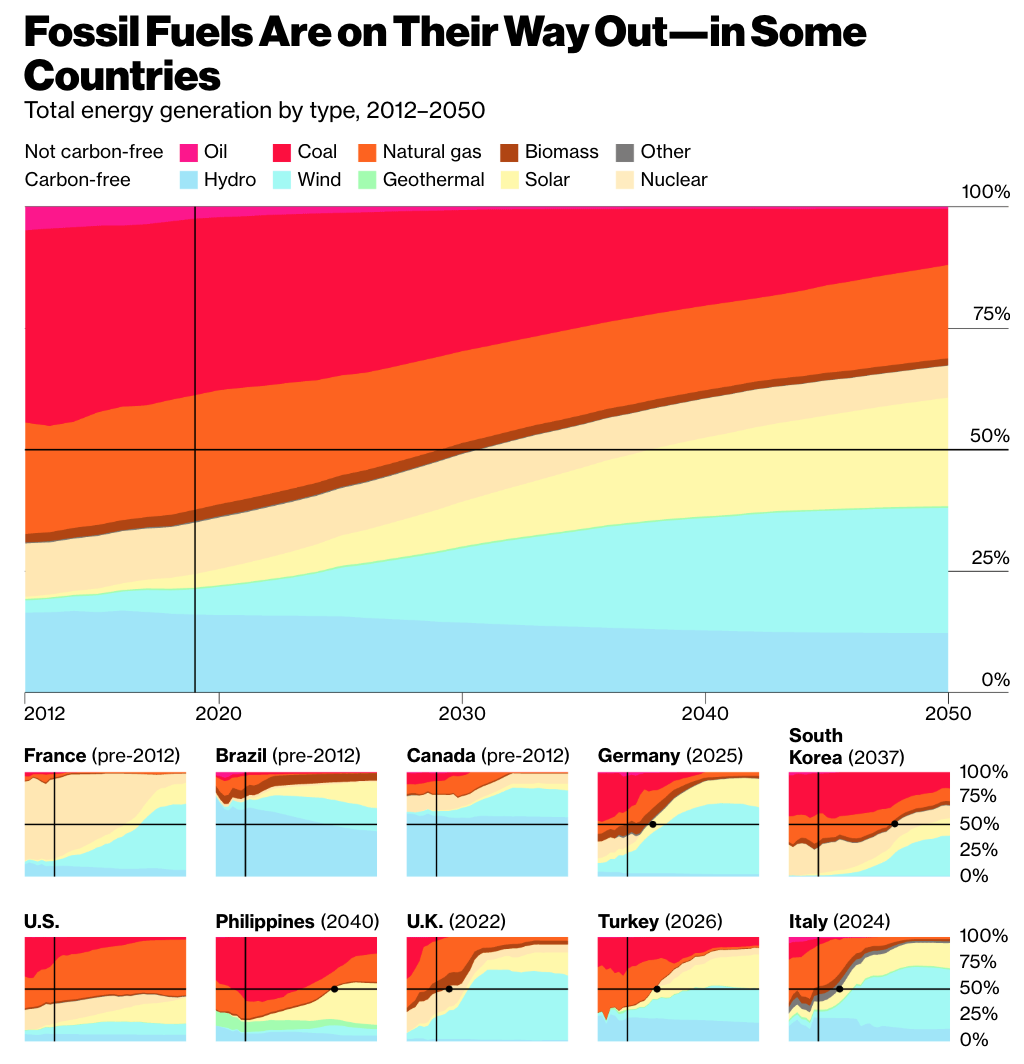

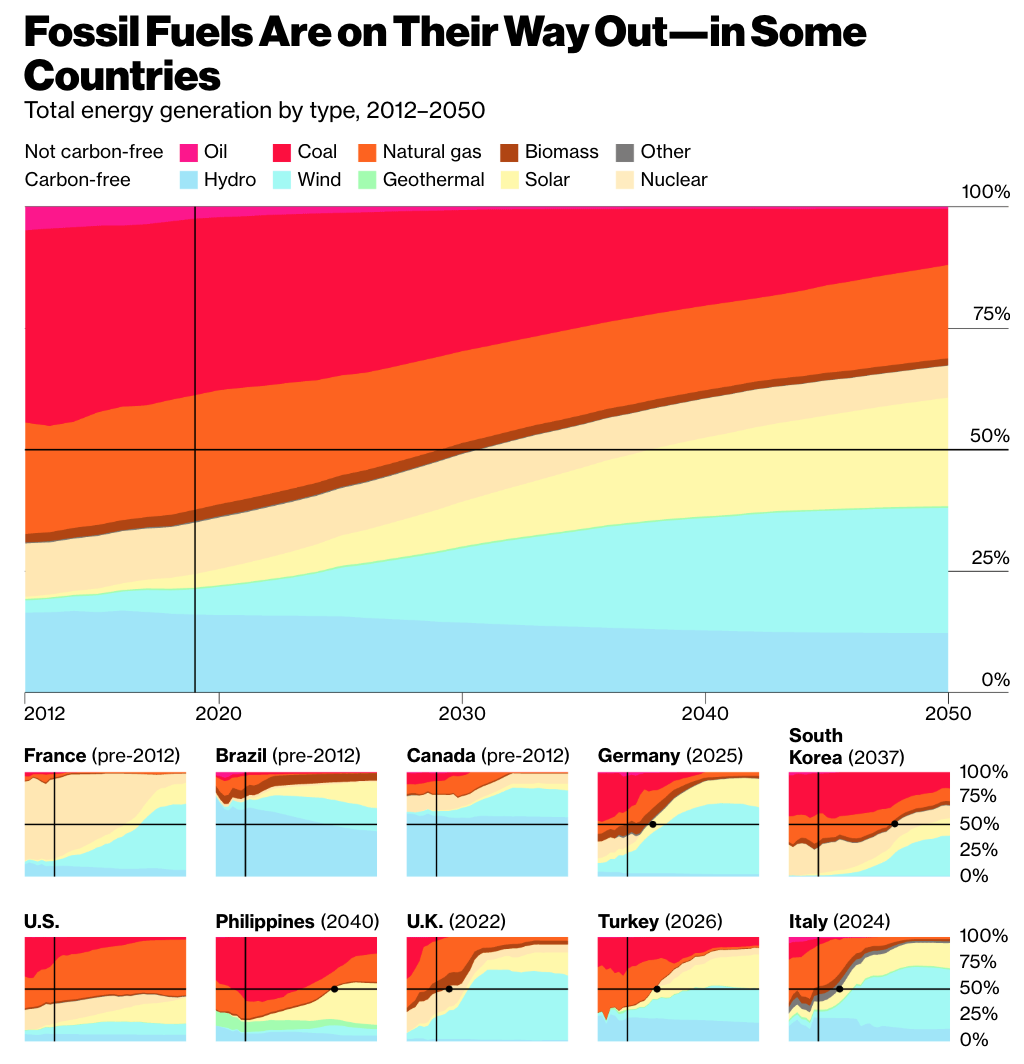

Source: Bloomberg Green Thirty years ago, more than half of all power generation came from coal and natural gas. Thirty...

Source: Bloomberg Green Thirty years ago, more than half of all power generation came from coal and natural gas. Thirty...

Read More

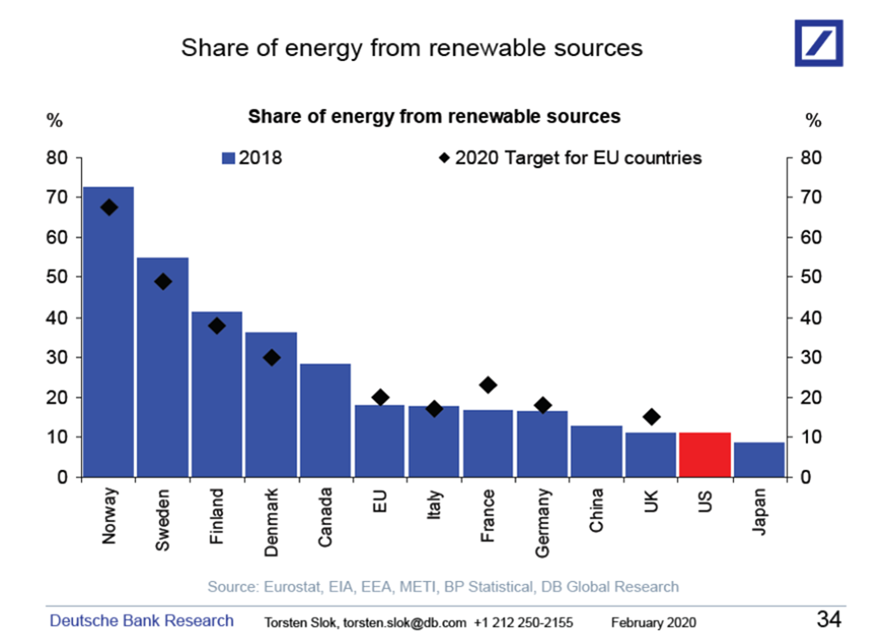

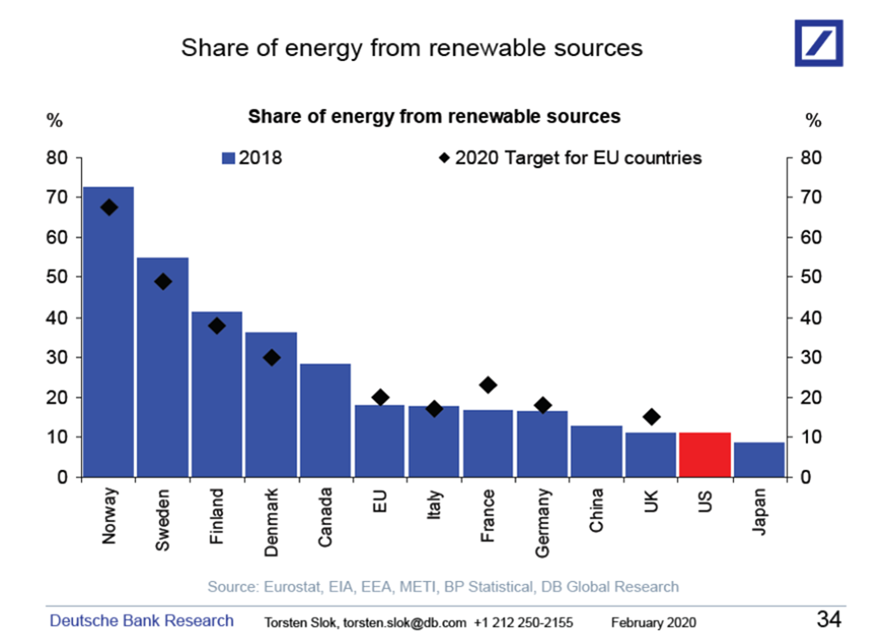

The share of energy from renewable sources in the US is around 10% Source: Torsten Sløk, Deutsche Bank Research

The share of energy from renewable sources in the US is around 10% Source: Torsten Sløk, Deutsche Bank Research

Read More

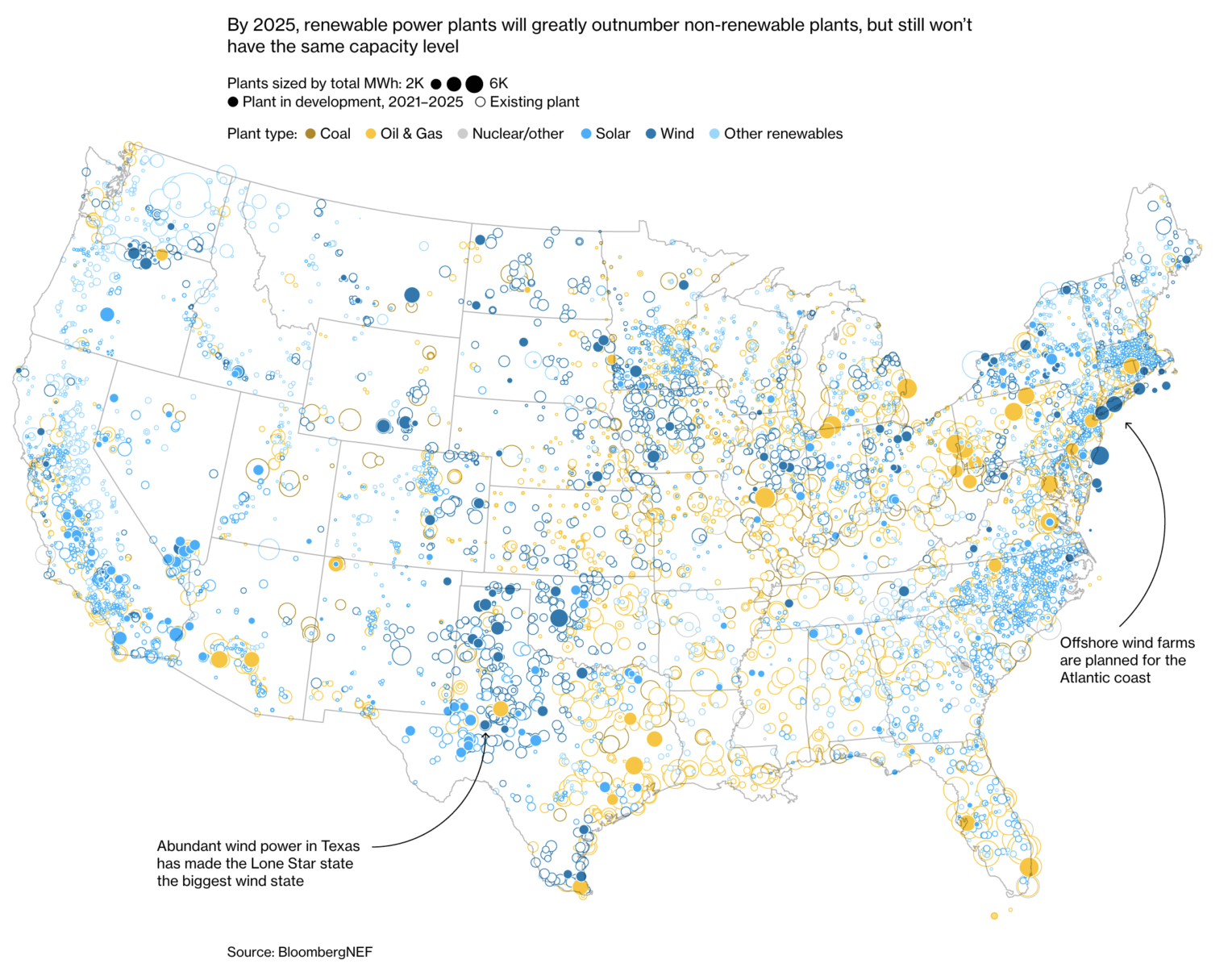

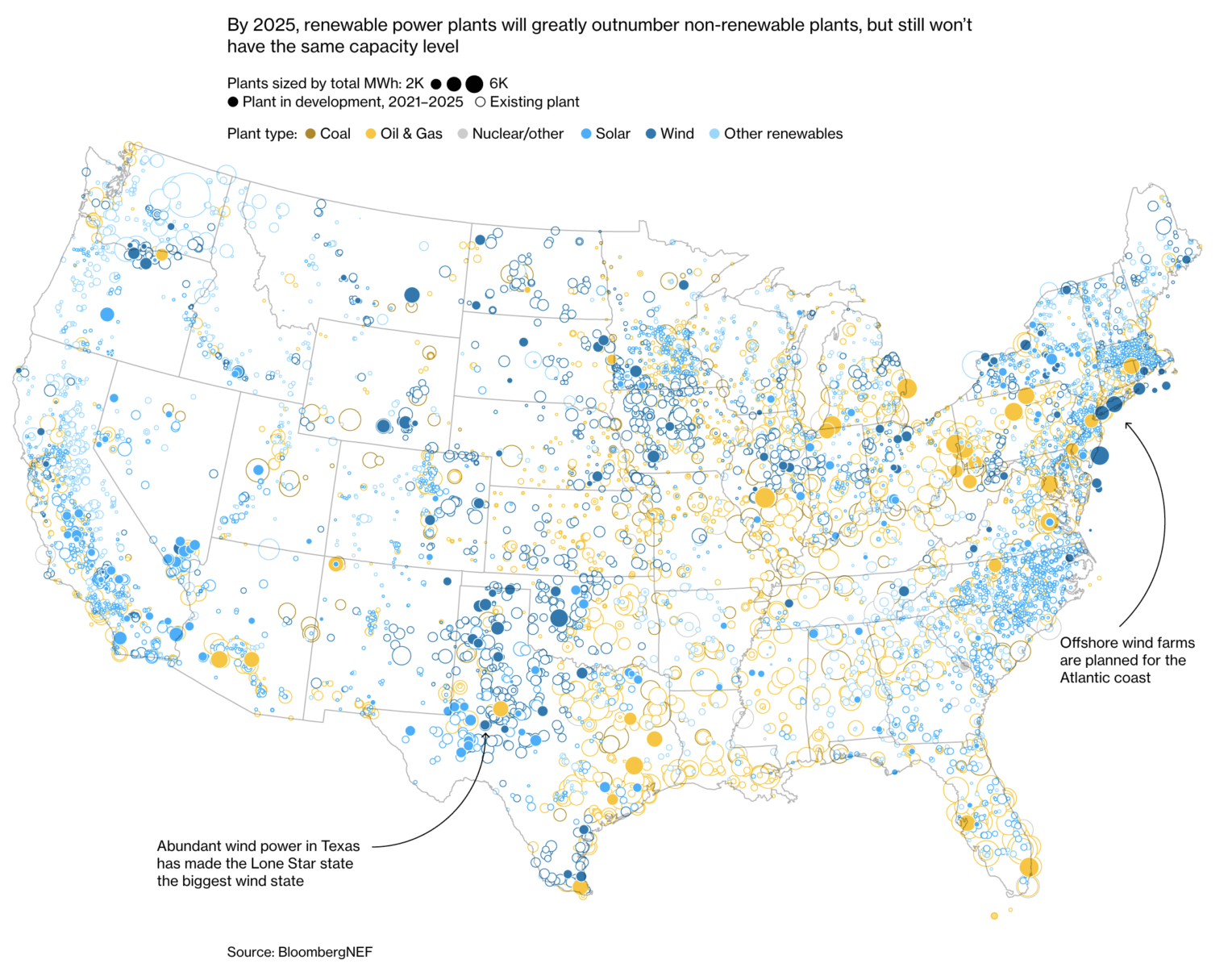

Source: Bloomberg Capitalism is driving renewables over coal: “The market triumph of renewable energy marks the...

Source: Bloomberg Capitalism is driving renewables over coal: “The market triumph of renewable energy marks the...

Read More

The transcript from this week’s MIB: Lord John Browne, CEO of BP, is below. You can stream/download the full...

Read More

This week, we speak with Sir John Browne, executive chairman of L1 Energy and chairman of the supervisory board of Wintershall DEA. As...

Read More

French startup Glowee is rethinking lighting by harnessing ‘bioluminescence’ – light produced by living organisms, like...

Read More

Failure to Increase the Gas Tax Signals American Decline The country’s roads and bridges are in dismal shape. Finding the money to fix...

Read More

One of the biggest things preventing Elon Musk from releasing a mass market electric vehicle comes down to the vehicle’s blessing...

Read More

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...

Physics and material sciences are awesome. I have no doubt that by the end of this century decade (if not sooner), we will...