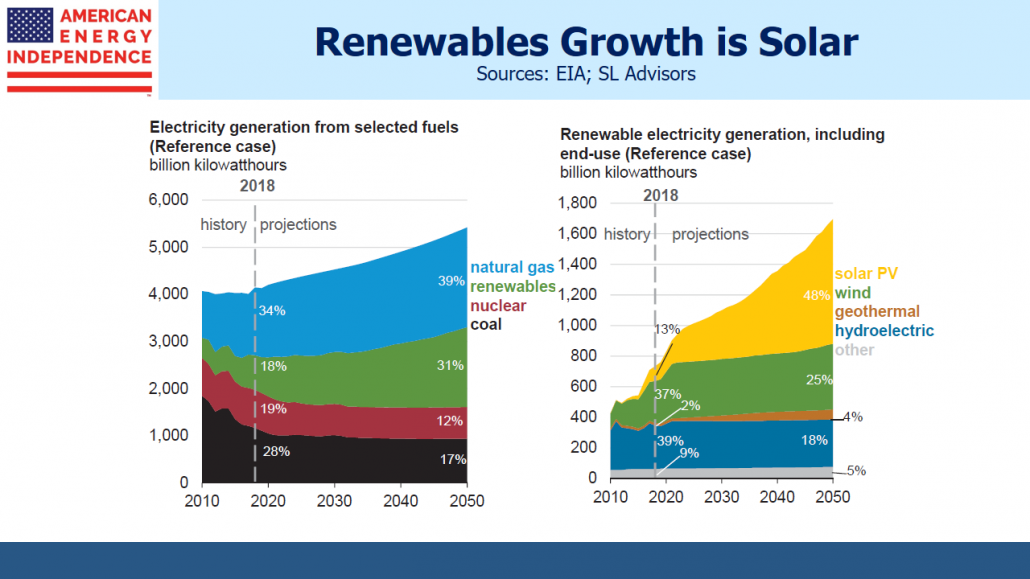

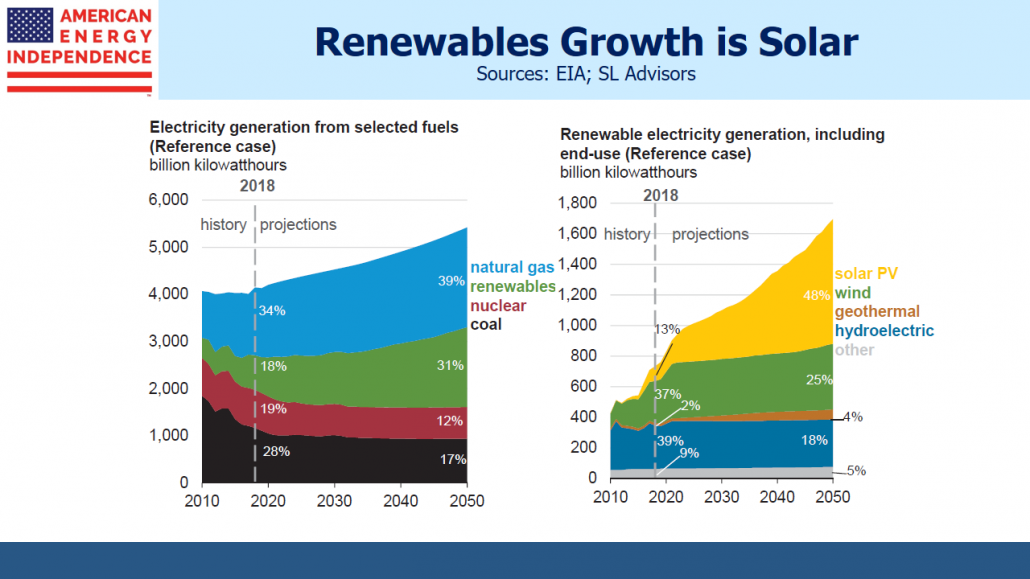

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers

Read More

Here comes the future — not with robots, but with Solar Panel Installers. That is the fastest-growing job in 8 states...

Here comes the future — not with robots, but with Solar Panel Installers. That is the fastest-growing job in 8 states...

Read More

You never know who’s gonna be the one with the big idea. History has shown it’s not necessarily the person with the most...

Read More

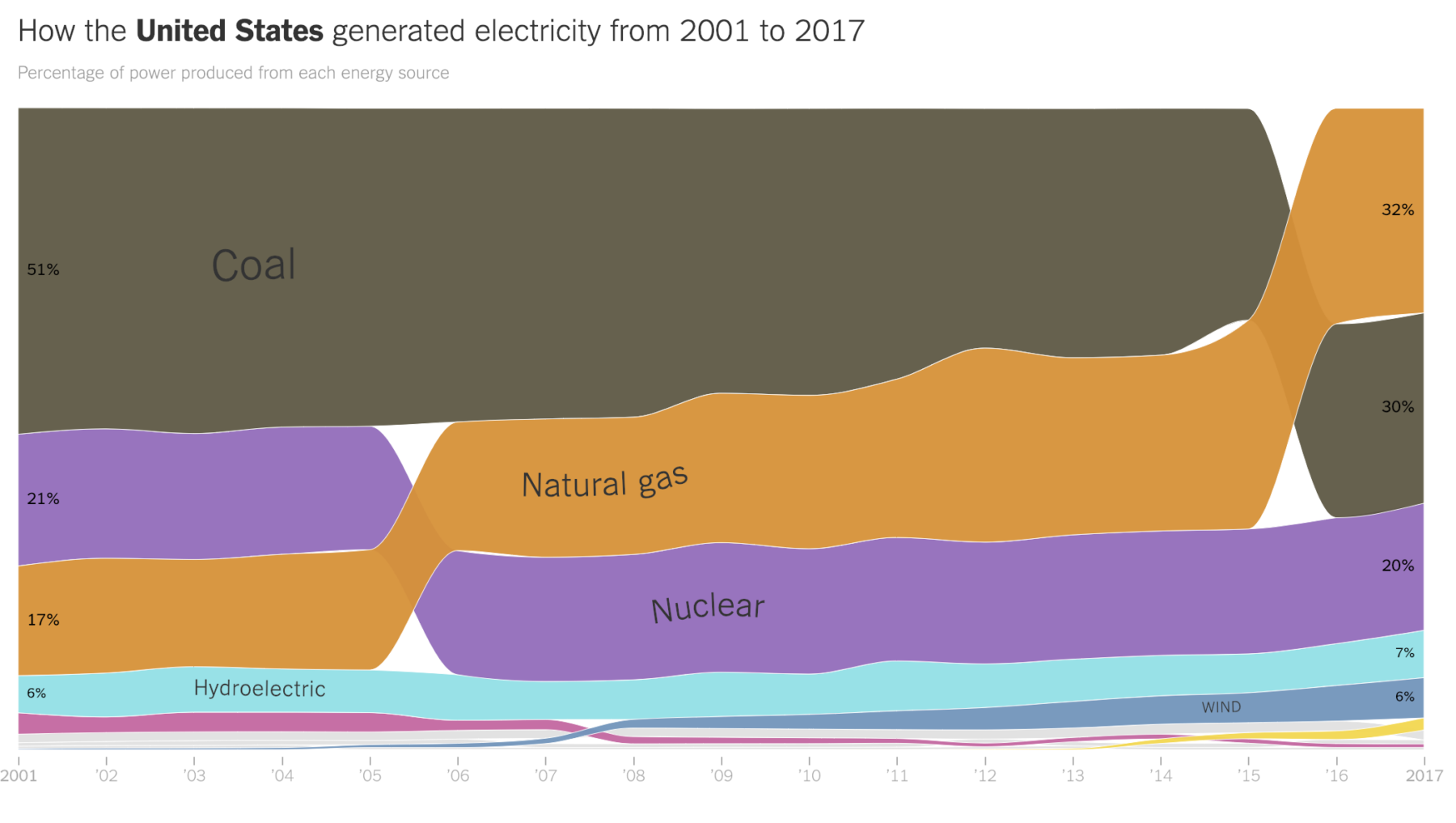

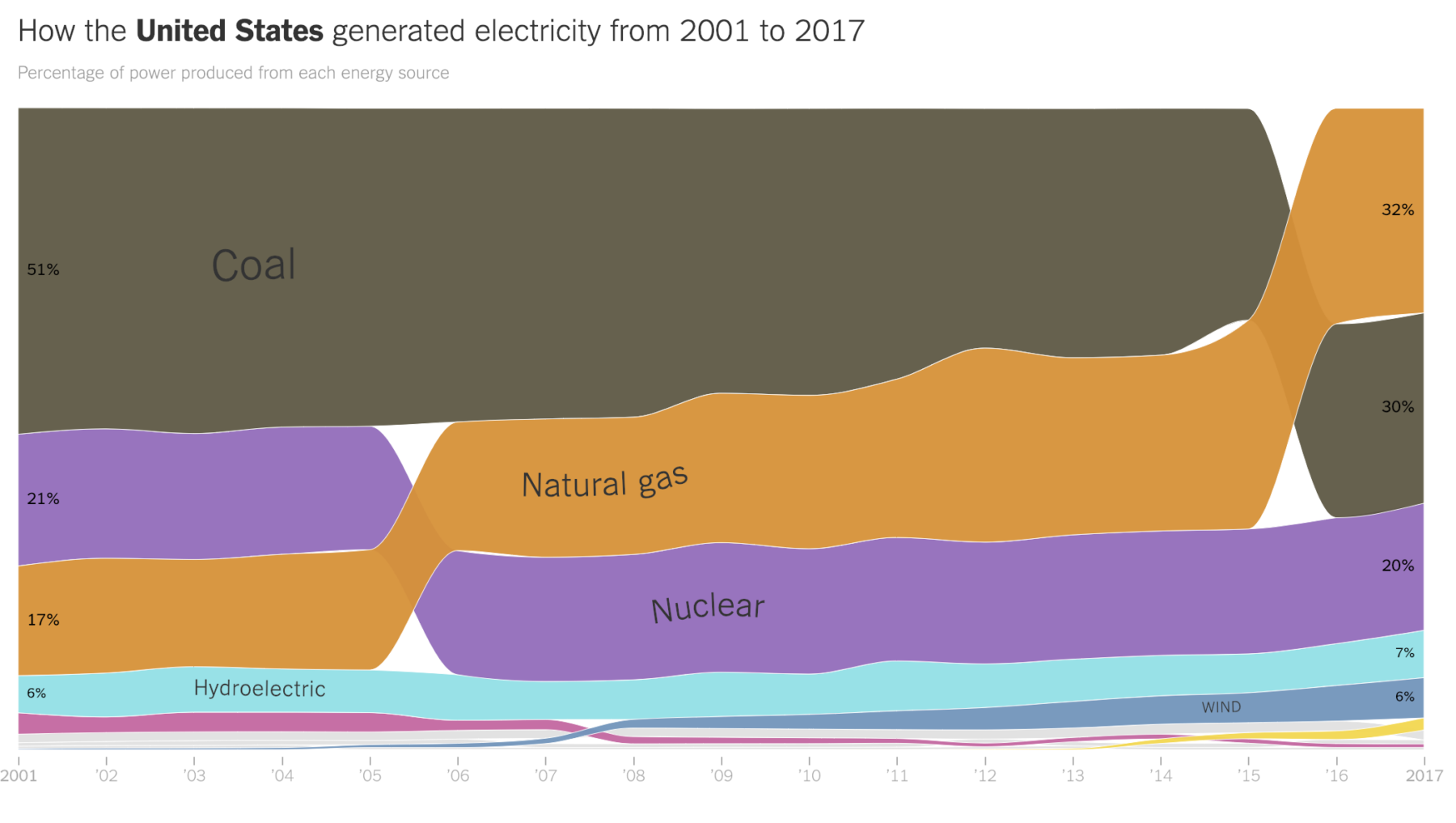

Source: NYT Its hard to argue with the data here: Coal was the major and majority source of energy for electrical generation for...

Source: NYT Its hard to argue with the data here: Coal was the major and majority source of energy for electrical generation for...

Read More

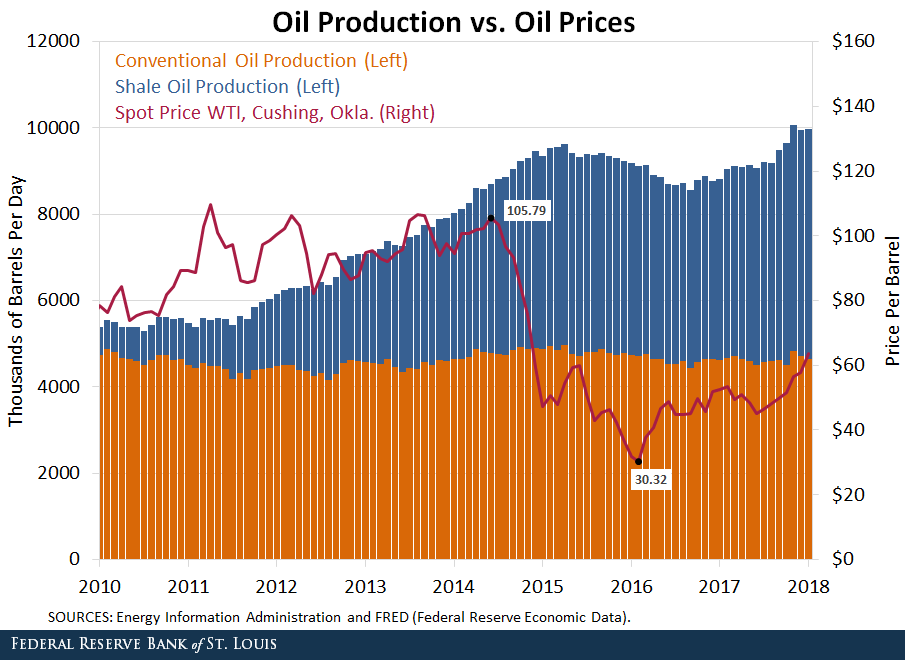

You probably know that the technology of horizontal drilling as one of many innovations associated with the “fracking” energy boom...

Read More

The transcript from this week’s MIB: Bethany McLean, is below. You can stream/download the full conversation, including...

Read More

This week, we speak with Bethany McLean, contributing editor to Vanity Fair, and author of Smartest Guys in the Room:...

Read More

Bloomberg: “The manufacturing analysts who spent 6,600 hours inside a warehouse north of Detroit picking apart a Model 3 have good...

Read More

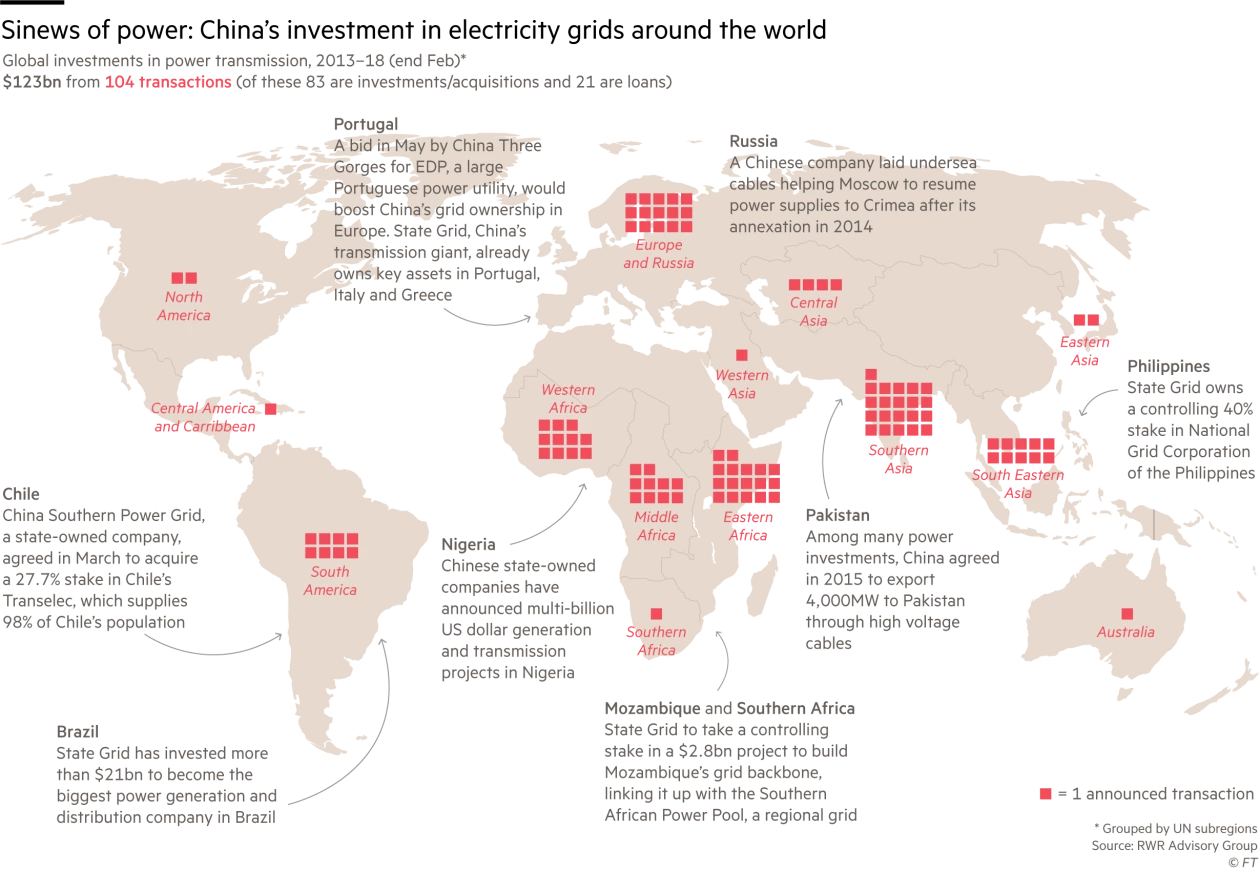

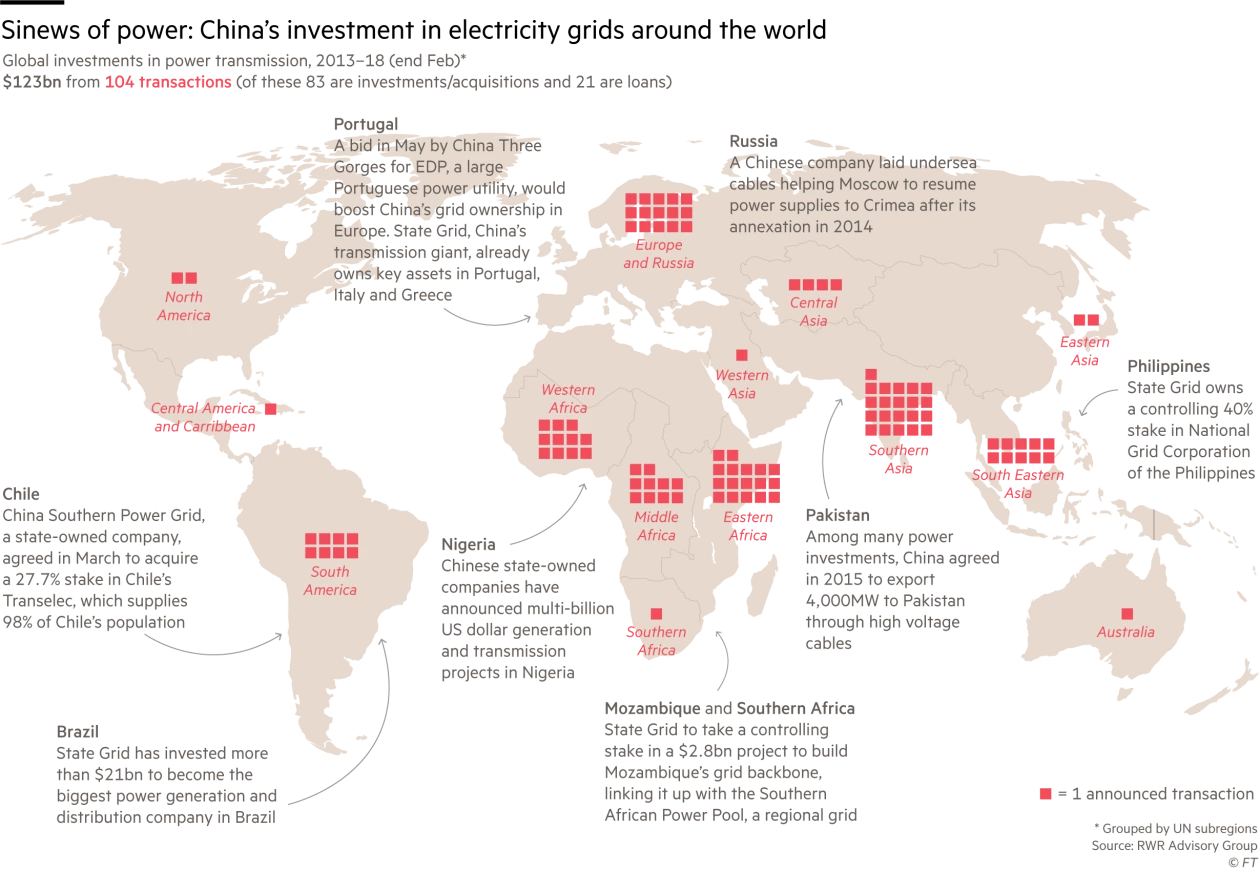

click for ginormous graphic Source: Financial Times FT: “All of this fits in with Beijing’s goals of expansion and being a...

click for ginormous graphic Source: Financial Times FT: “All of this fits in with Beijing’s goals of expansion and being a...

Read More

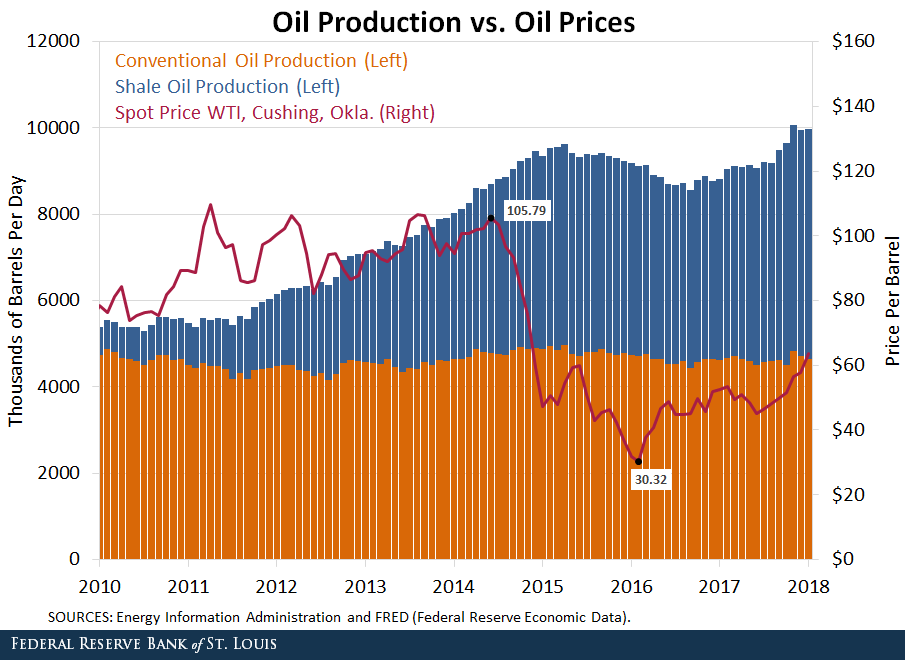

Source: Federal Reserve Bank of St. Louis This is an intriguing energy chart, via the St Louis Fed, showing 3 specific items:...

Source: Federal Reserve Bank of St. Louis This is an intriguing energy chart, via the St Louis Fed, showing 3 specific items:...

Read More

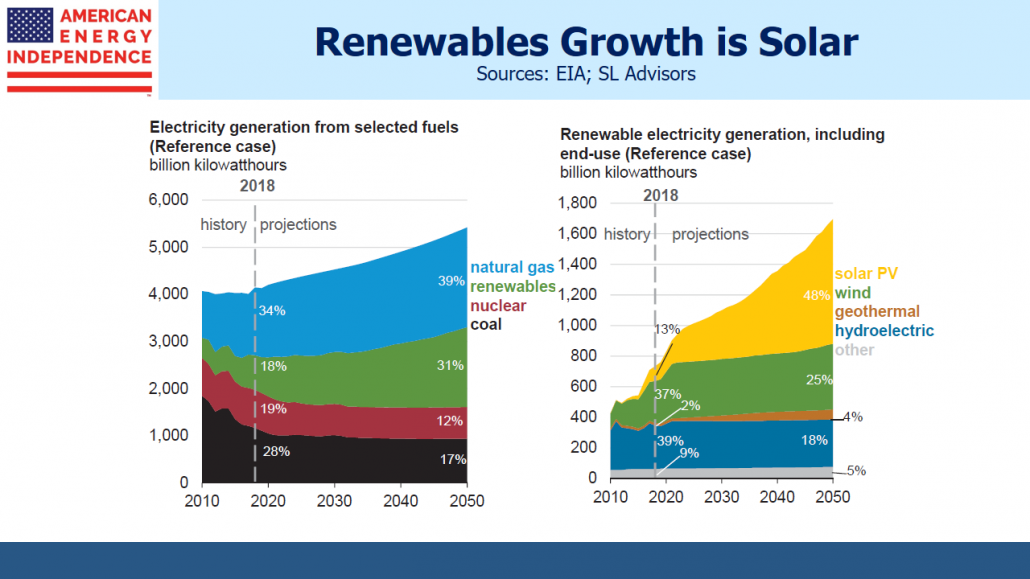

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers

This is really intriguing stuff — a great collection of data and analytics, via SL Advisers: Source: SL Advisers