The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...

The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...

Read More

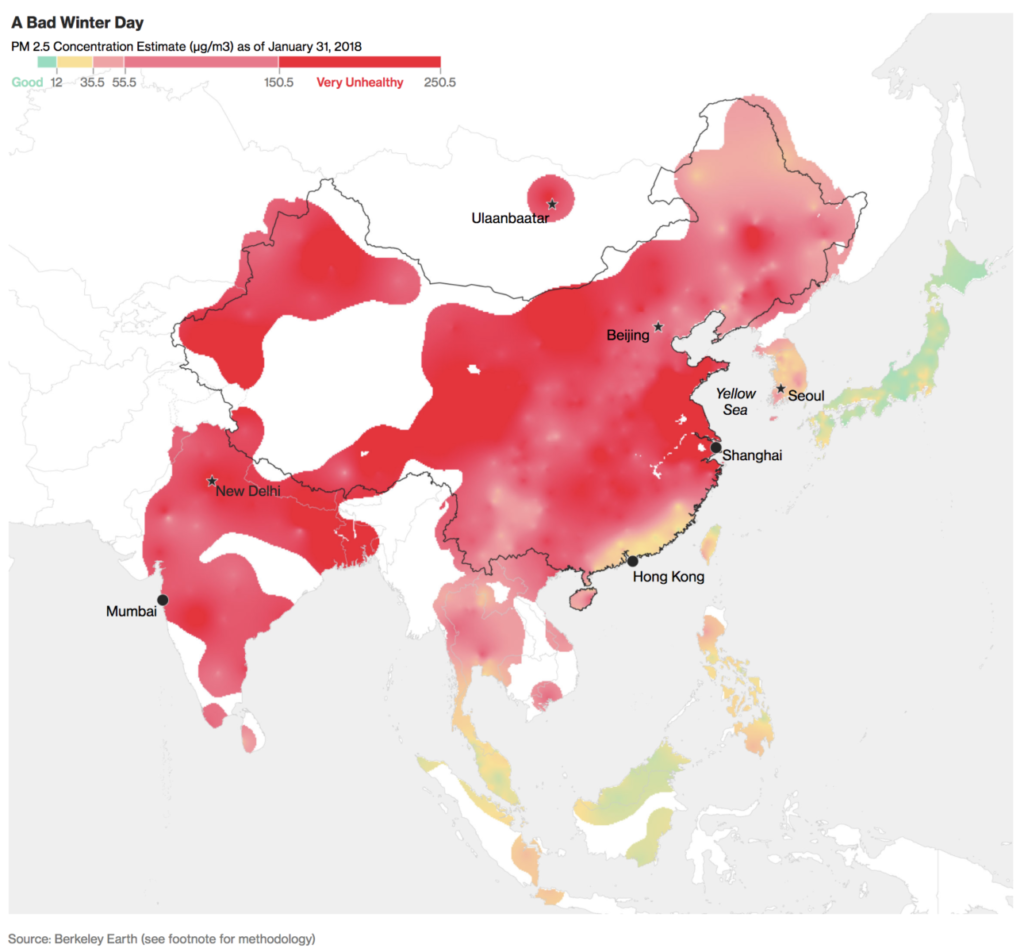

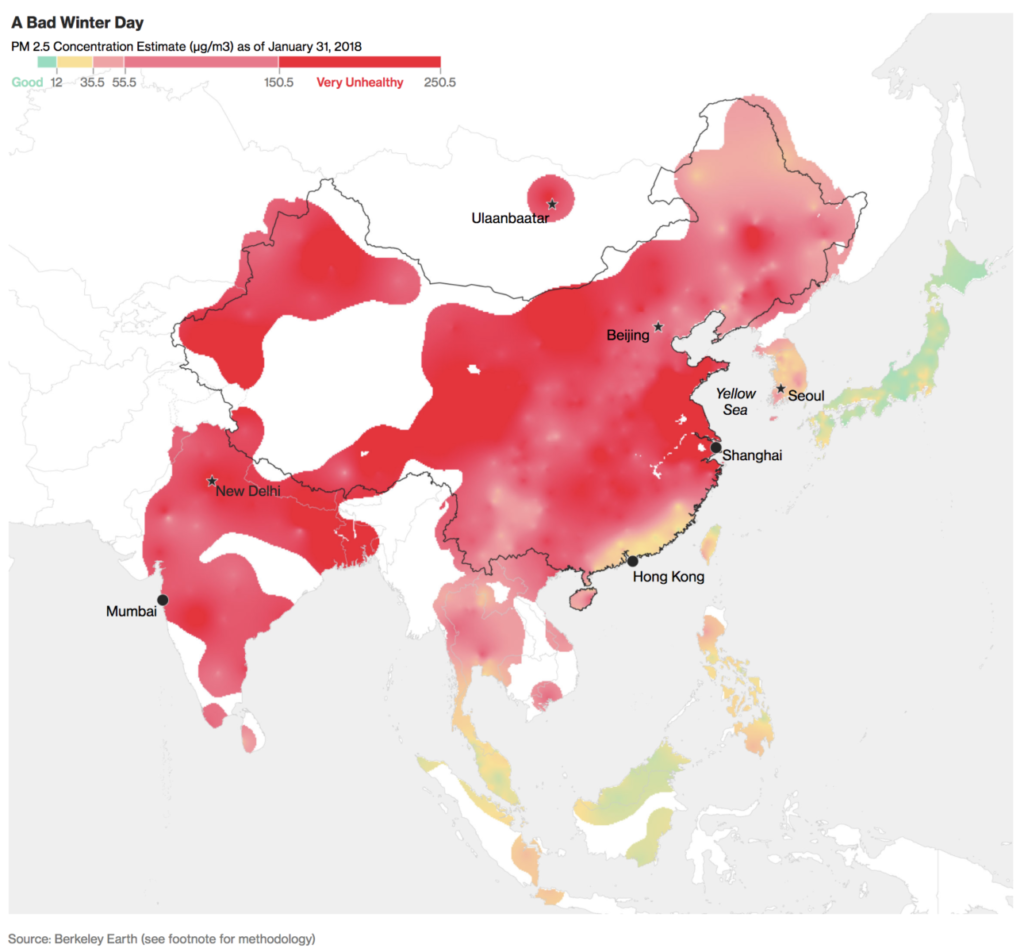

China’s War on Pollution Will Change the World. click for full graphic Source: Bloomberg This is quite fascinating: Four decades...

China’s War on Pollution Will Change the World. click for full graphic Source: Bloomberg This is quite fascinating: Four decades...

Read More

Coal Declining Due to Economics, Not Regulation St. Louis Fed On the Economy December 7, 2017 Cheaper alternative...

Coal Declining Due to Economics, Not Regulation St. Louis Fed On the Economy December 7, 2017 Cheaper alternative...

Read More

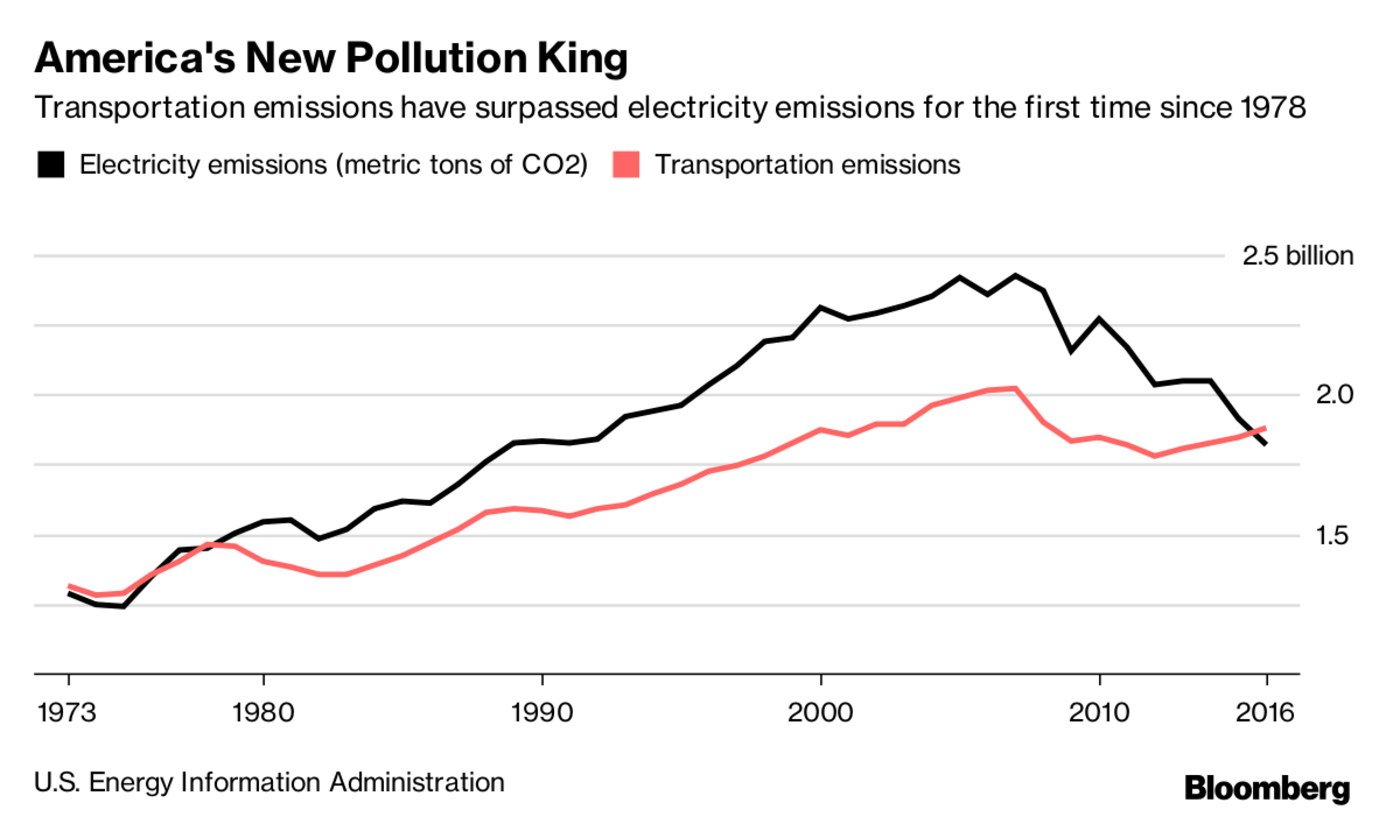

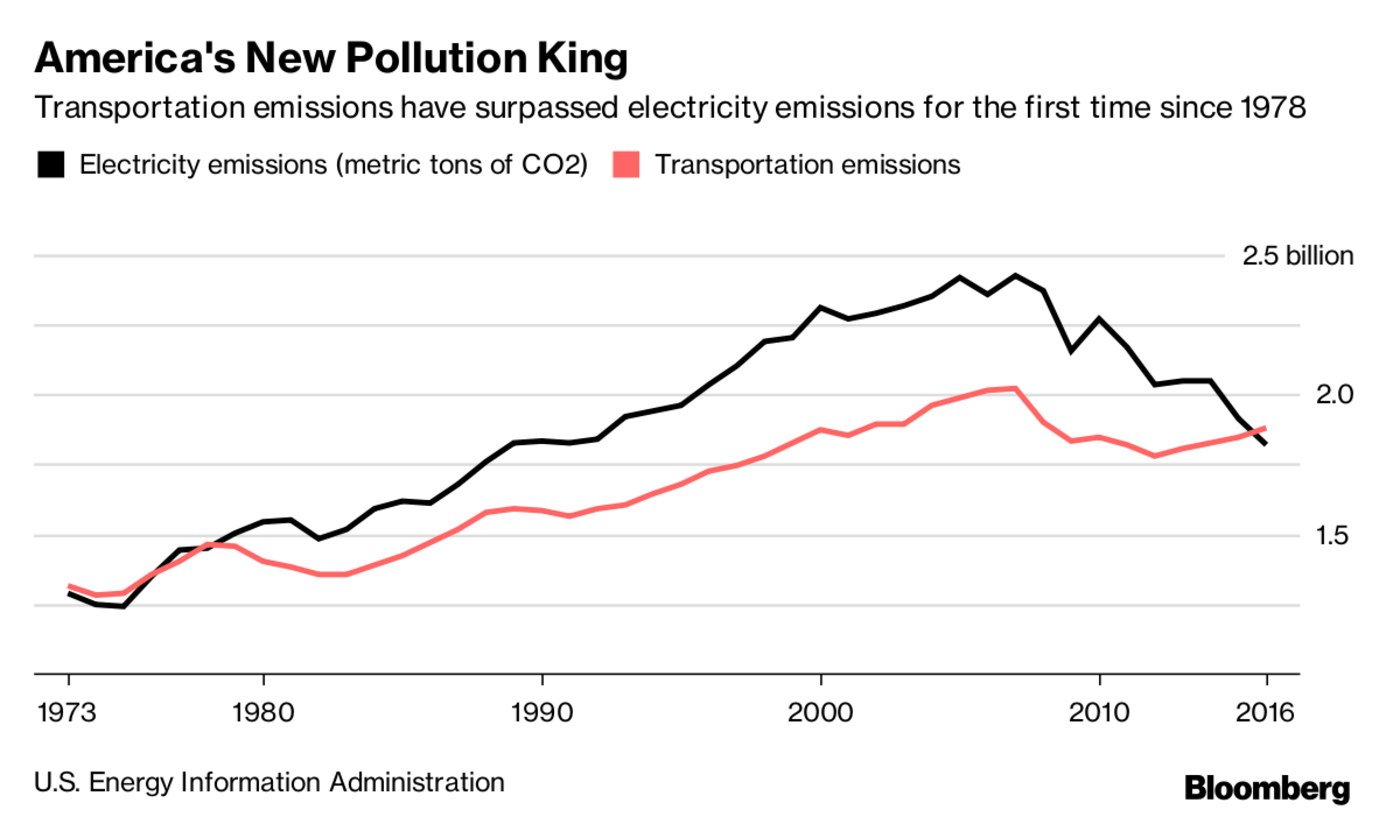

This is fascinating: over the past decade, the rise of Natural Gas and the fall of Coal has helped drive electricity production as a...

This is fascinating: over the past decade, the rise of Natural Gas and the fall of Coal has helped drive electricity production as a...

Read More

Nothing Trump Does Can Save Coal Don’t blame liberals and regulations; blame capitalism and technology. Bloomberg, November 15,...

Read More

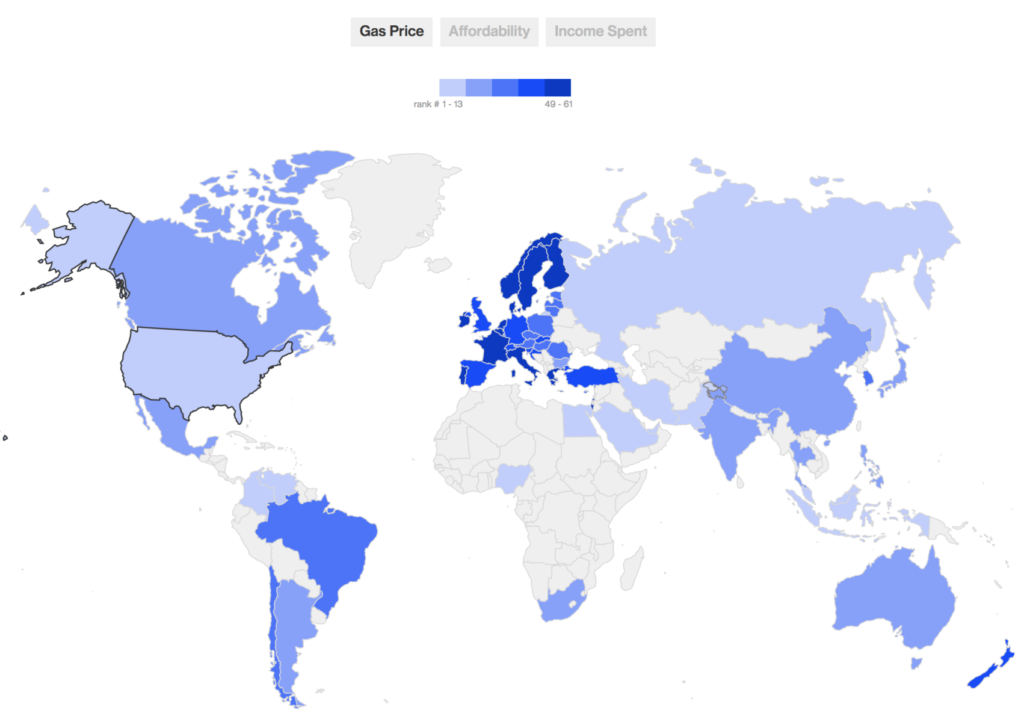

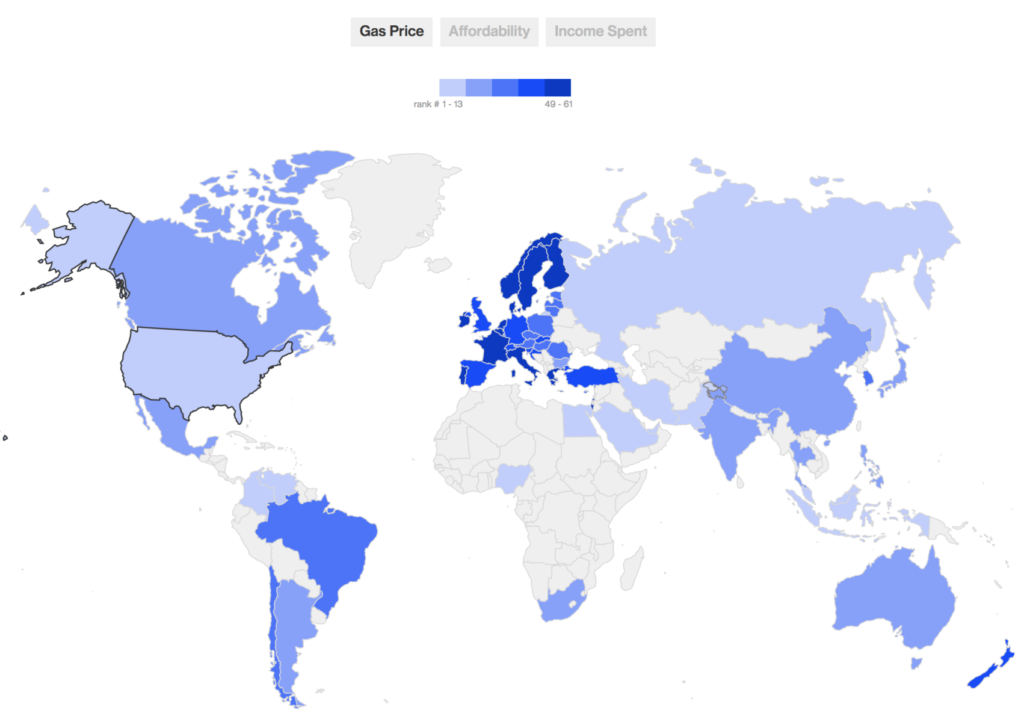

Interesting interactive graphic on gasoline prices around the world: Gasoline Prices Around the World: The Real Cost of Filling Up...

Interesting interactive graphic on gasoline prices around the world: Gasoline Prices Around the World: The Real Cost of Filling Up...

Read More

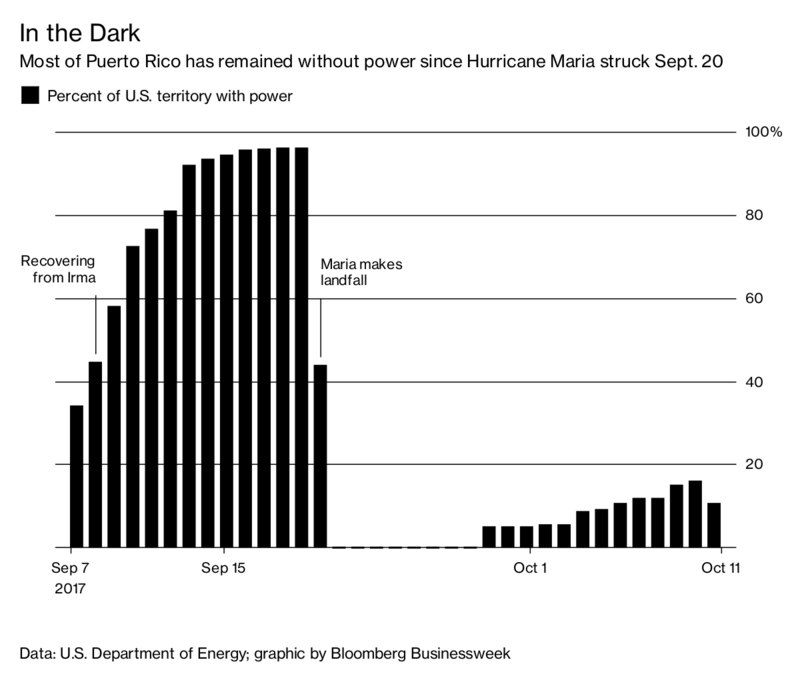

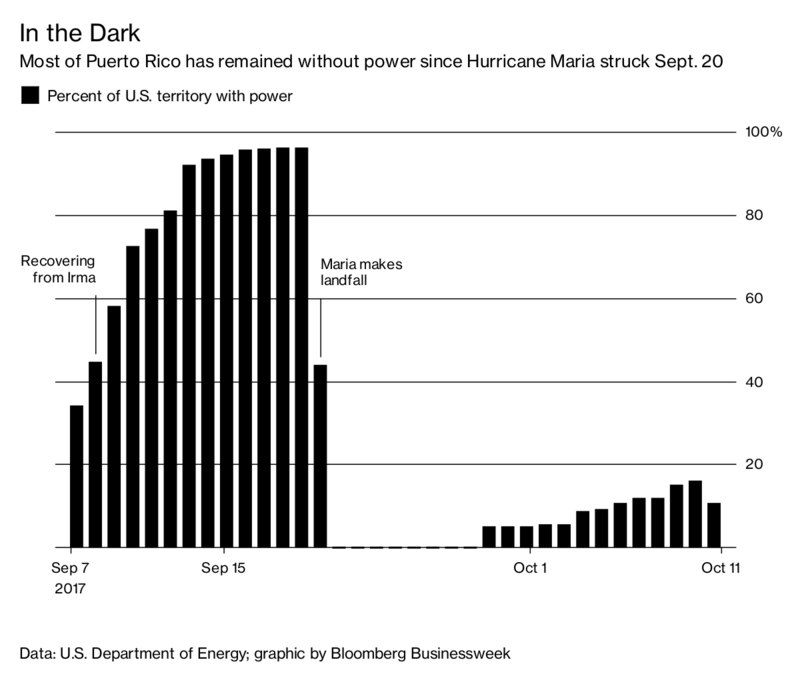

Brownie, you’re doing a heck of a job: Source: Bloomberg Businessweek

Brownie, you’re doing a heck of a job: Source: Bloomberg Businessweek

Read More

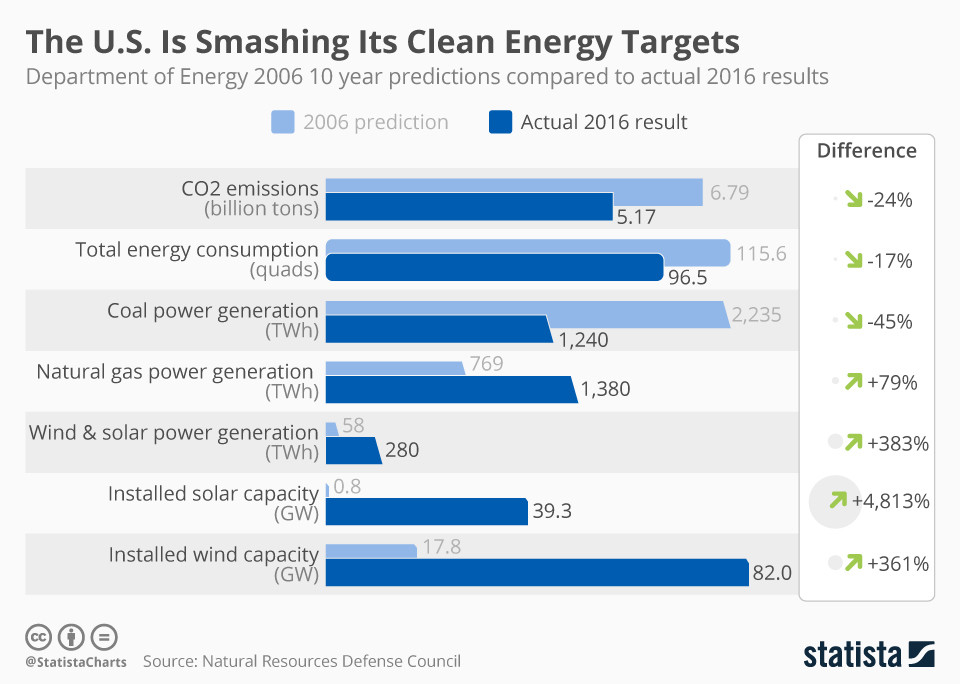

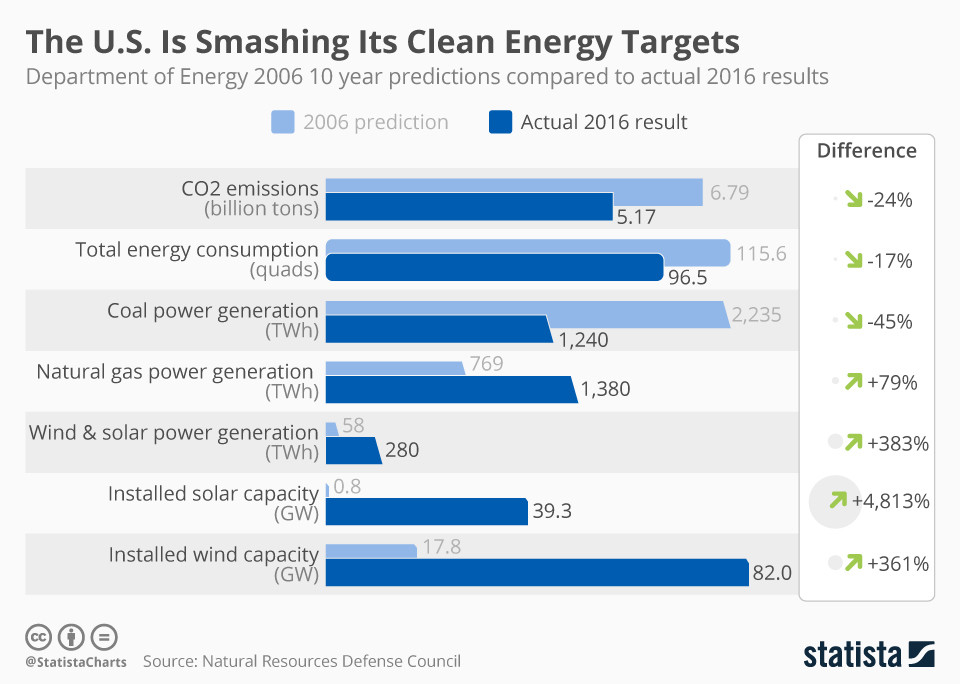

Renewable energy infrastructure is expanding at a much faster rate than was thought possible ten years ago. Predictions made in 2006 for...

Renewable energy infrastructure is expanding at a much faster rate than was thought possible ten years ago. Predictions made in 2006 for...

Read More

Despite tremendous advances over the last decade, electric cars have yet to go mainstream. Even once Tesla ramps up production of its...

Read More

The age of batteries is just getting started. In the latest episode of our animated series, Sooner Than You Think, Bloomberg’s Tom...

The age of batteries is just getting started. In the latest episode of our animated series, Sooner Than You Think, Bloomberg’s Tom...

Read More

The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...

The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...

The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...

The Rise of Shale Oil Michael T. Owyang and Hannah G. Shell St Louis Fed, Tuesday, May 15, 2018. ...