click for complete graphic

click for complete graphic

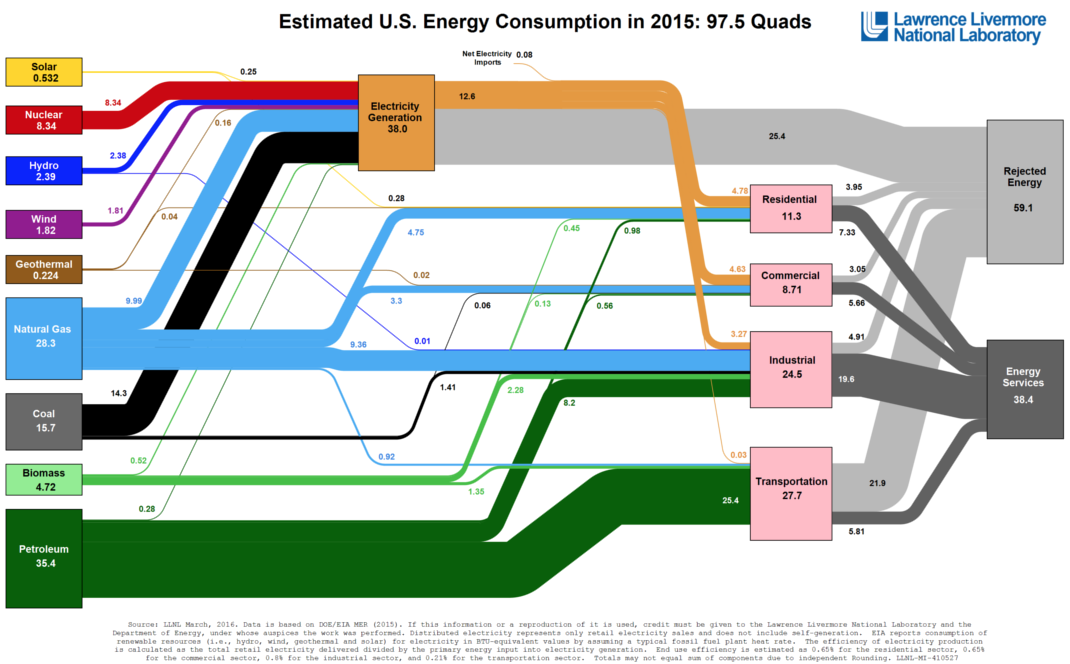

Why is California Over-building Electricity Capacity?

This is an amazing set of graphics, derived from the sad state of California’s electricity capacity and crony capitalism: ...

This is an amazing set of graphics, derived from the sad state of California’s electricity capacity and crony capitalism: ...

Oklahoma is Earthquake Alley

Before 2009, there were, on average, two earthquakes a year in Oklahoma that were magnitude 3 or greater. Last year, there were 907....

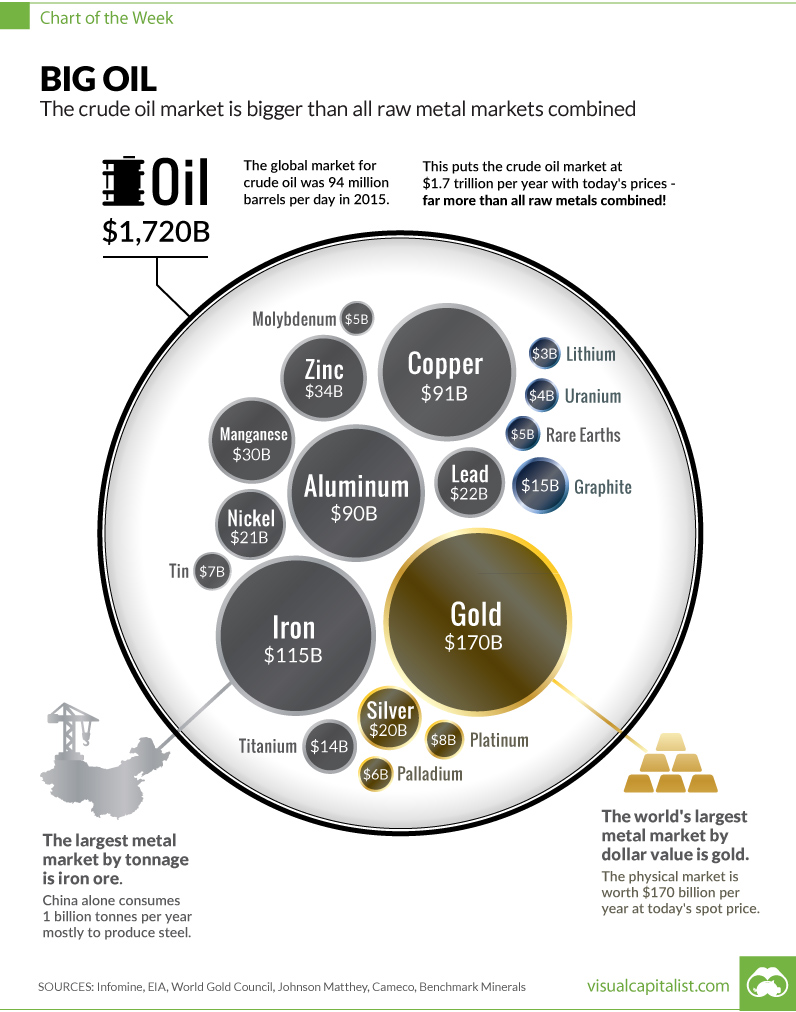

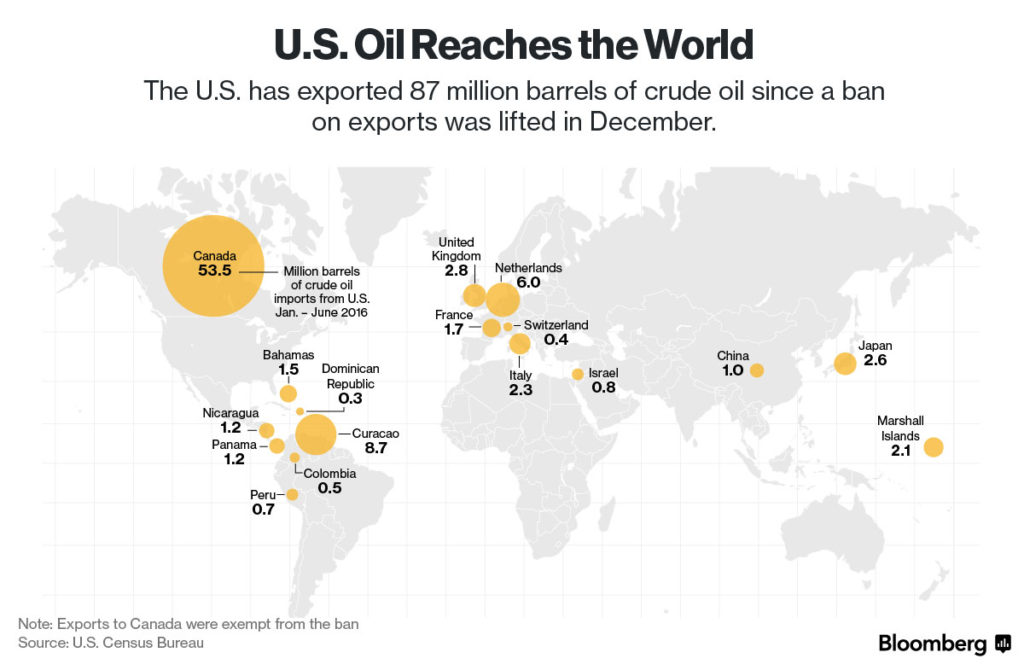

Who’s Buying Up U.S. Oil ?

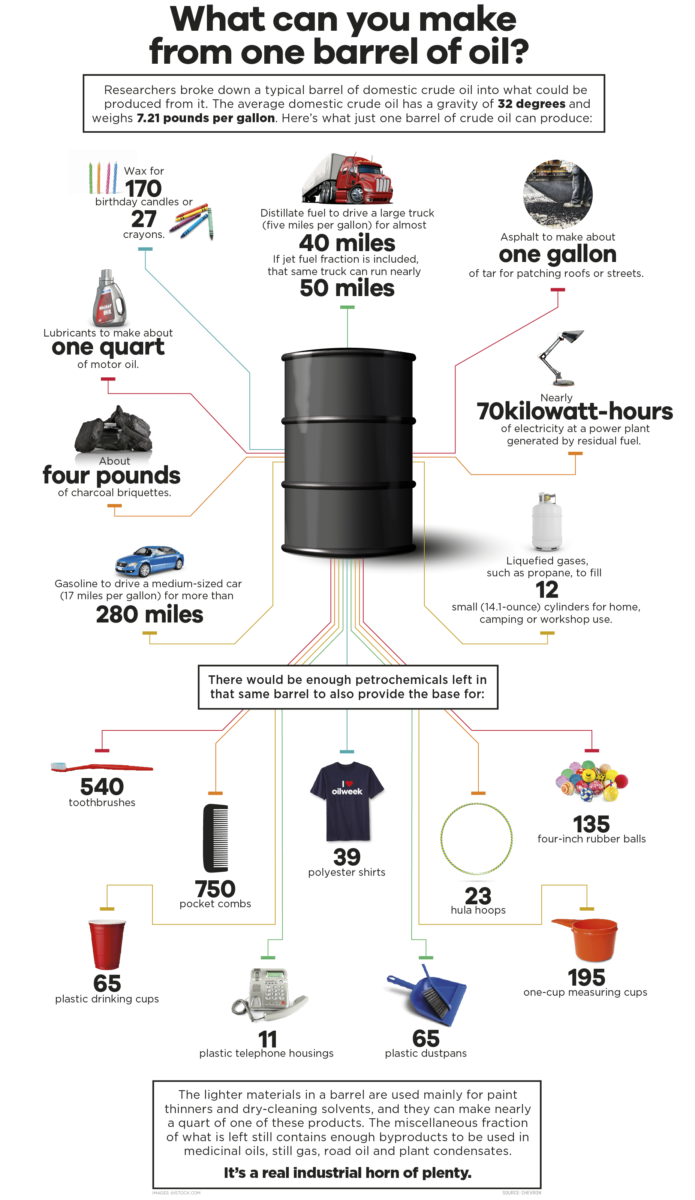

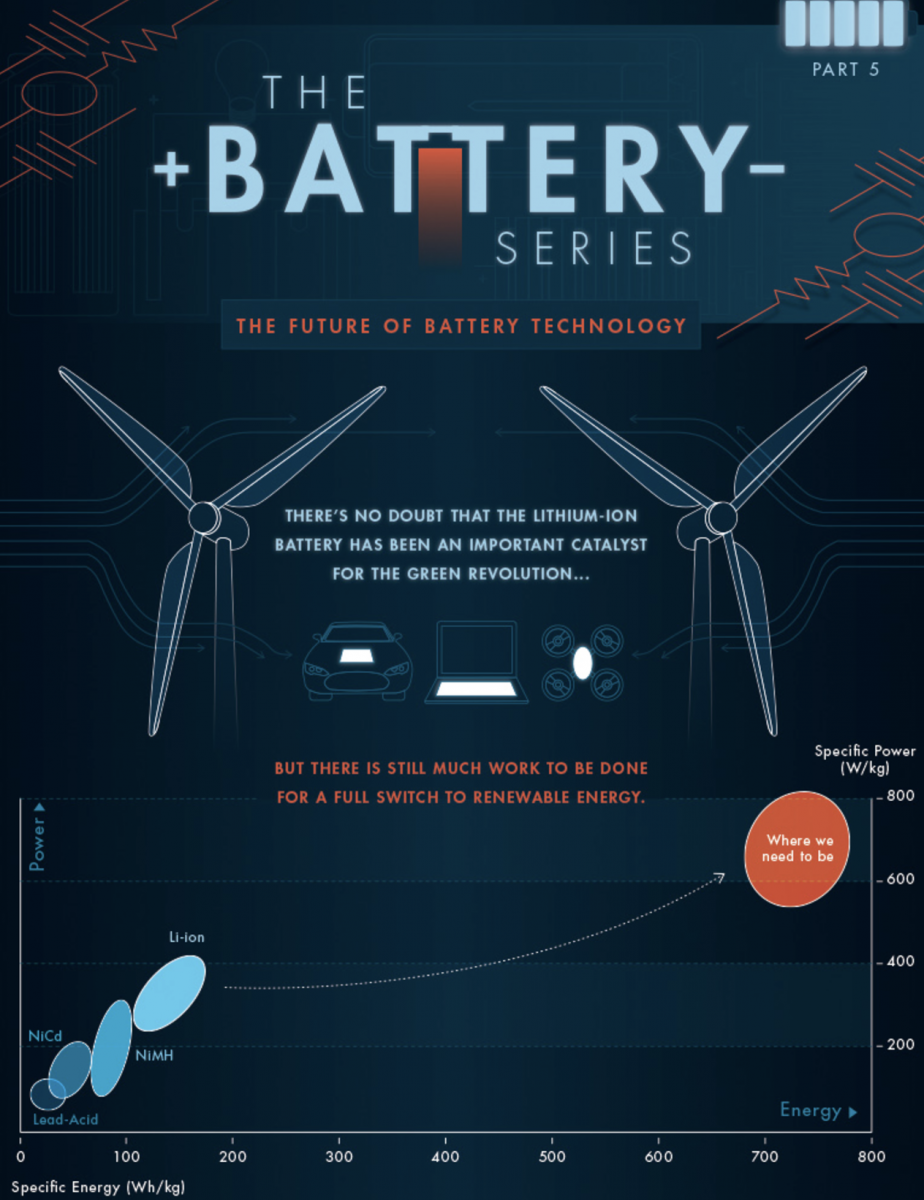

MiB Gianni Kovacevic

In this week’s “Masters in Business” podcast, we chat with Gianni Kovacevic, a venture capital investor and energy...