Source: Priceonomics

Source: Priceonomics

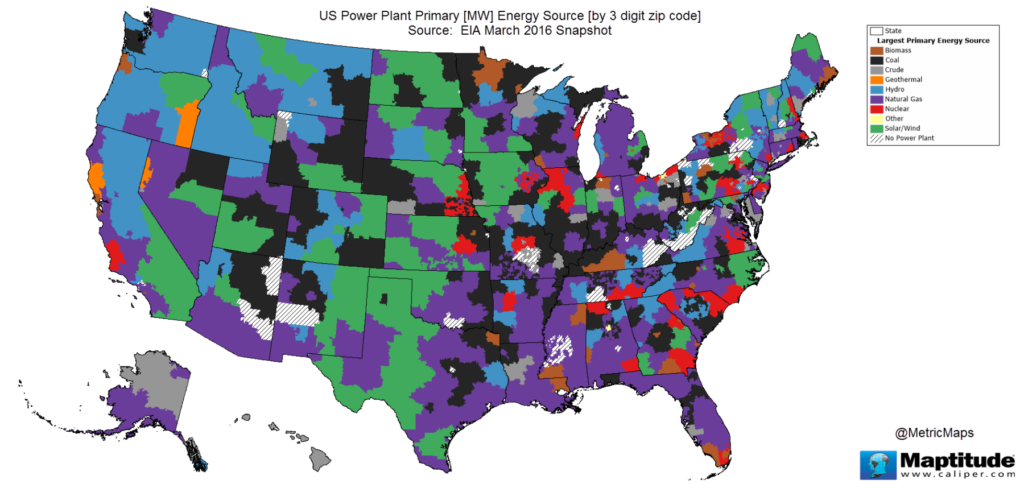

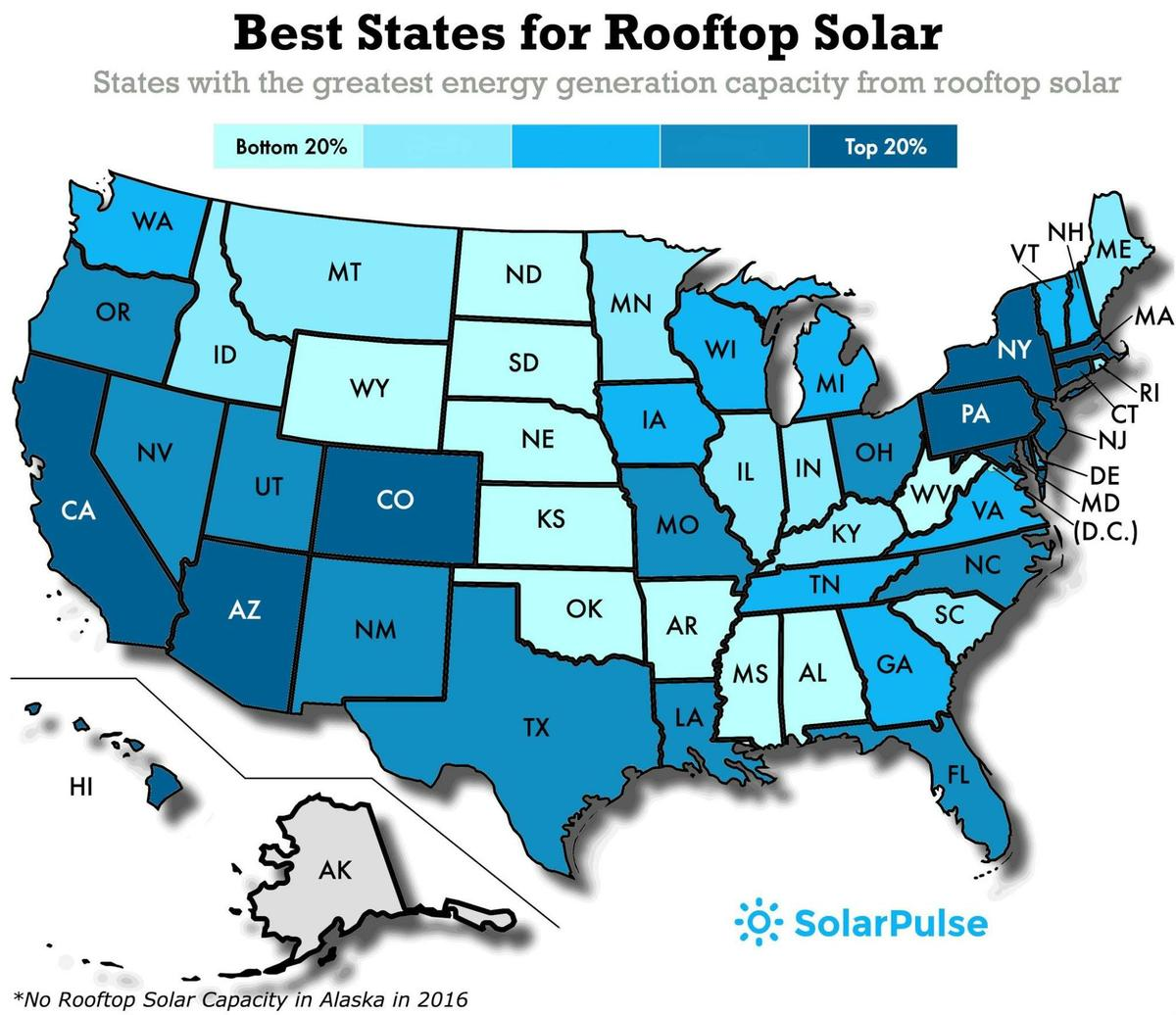

What is your Primary Power Source

2016 Climate Change Letter to Congress

As a reminder, the GOP is the only major political party in the entire world that does not believe global warming is real or caused by...

What Caused the Demise of the US Coal Industry?

Coal Isn’t Dying Because There’s a War on It Regulation is often blamed for the industry’s woes. There’s more to...

Building Our Energy Future, From the Ground Up

This is totally fascinating: Watch a team put up a huge wind turbine in a time lapse that covers weeks in just 5 minutes: From the...

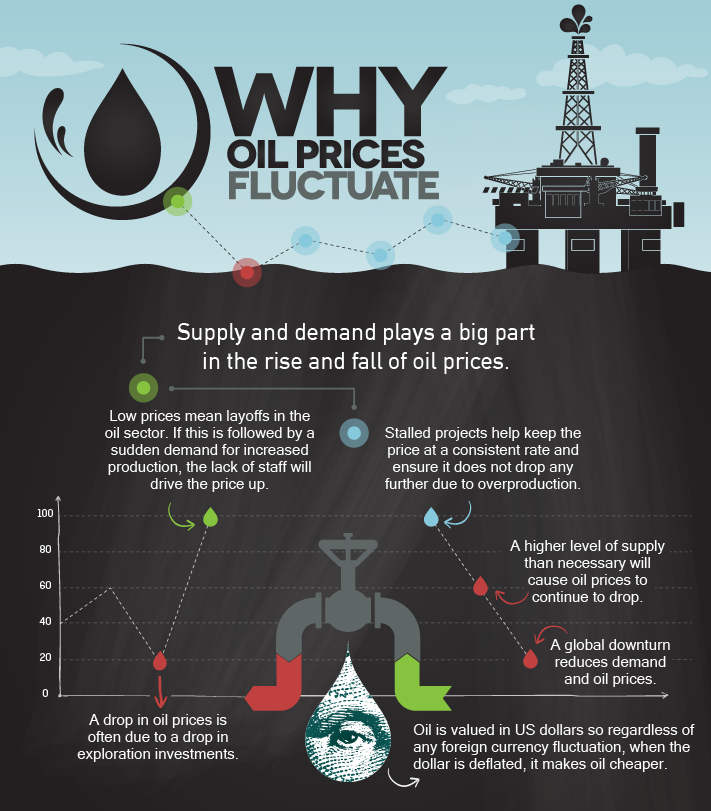

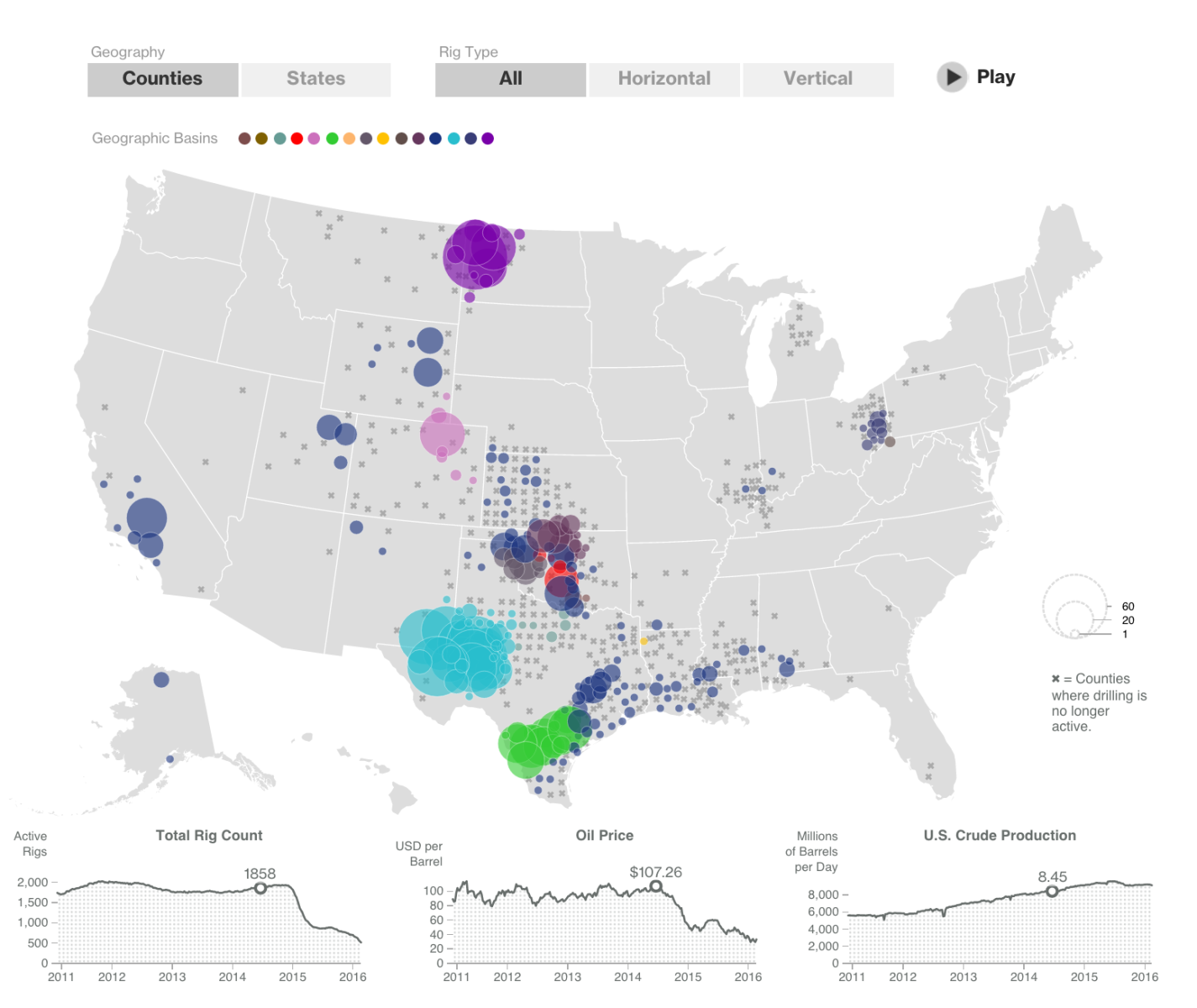

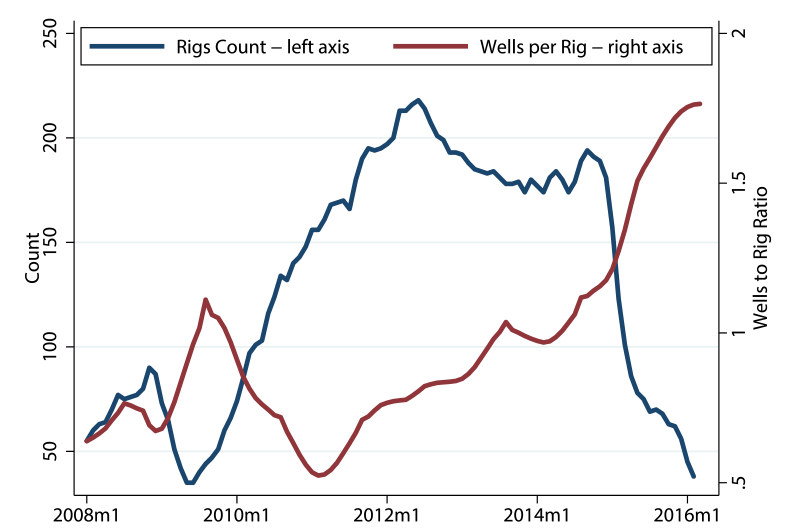

Unraveling the Oil Conundrum: Productivity Improvements and...

Unraveling the Oil Conundrum: Productivity Improvements and Cost Declines in the U.S. Shale Oil Industry Ryan Decker, Aaron Flaaen, and...

Unraveling the Oil Conundrum: Productivity Improvements and Cost Declines in the U.S. Shale Oil Industry Ryan Decker, Aaron Flaaen, and...