Perfect Business Week cover for Valentines Day: Source: Bloomberg

Perfect Business Week cover for Valentines Day: Source: Bloomberg

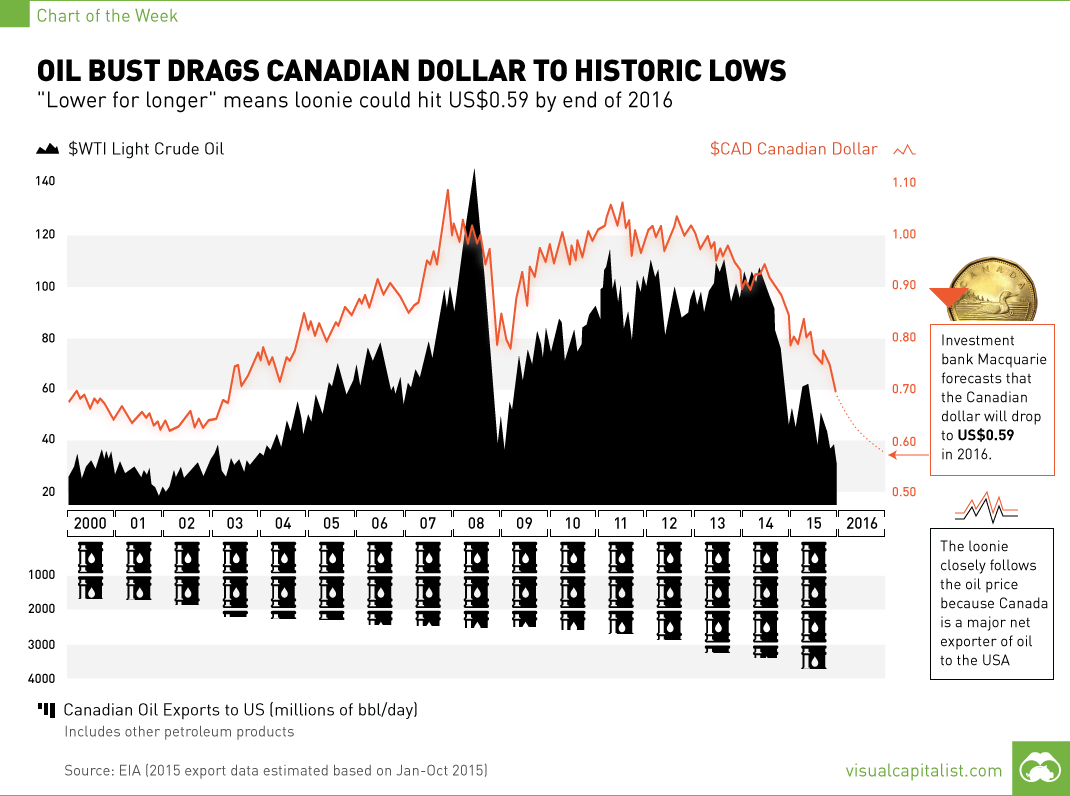

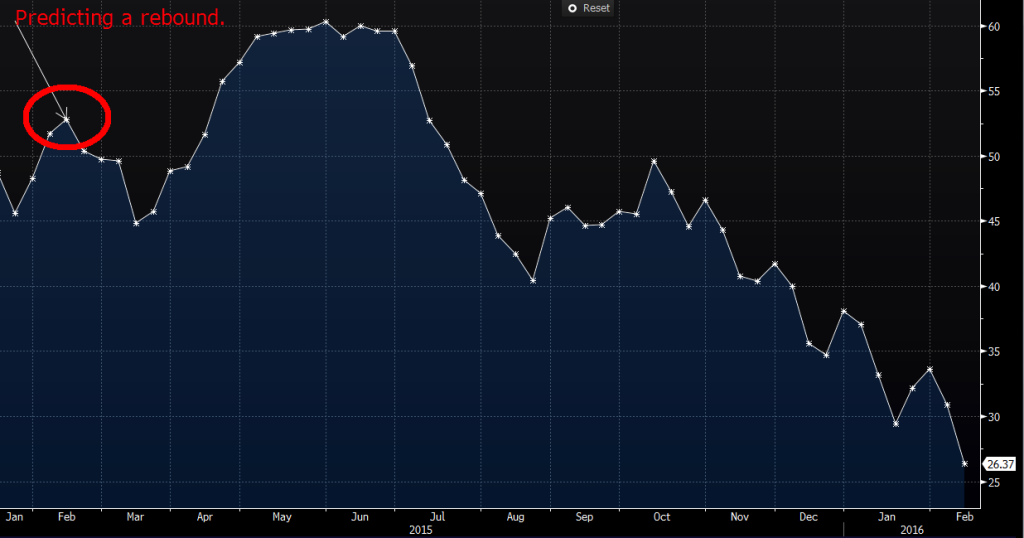

More Evidence of the Folly of Forecasting

Oil’s Rebound and Other Wrong-Way Forecasts People keep making predictions, though they’re almost always incorrect....

Oil’s Rebound and Other Wrong-Way Forecasts People keep making predictions, though they’re almost always incorrect....

Its Time to Kill Ethanol Once and For All

Enough With Ethanol Turning corn into fuel is a huge waste that needs to stop. Bloomberg, February 3, 2016 With the...

Oil and U.S. Stock Market

Oil and U.S. Stock Market David R. Kotok Cumberland Advisors, January 25 1016 Hartford Funds has published an analysis of...