BBRG: Passive Investors Calmly Bought While Pros Liquidated

Wall Street Pros Panic Over Coronavirus While Mom and Pop Buy Passive investors calmly bought amid the market plunge while the titans...

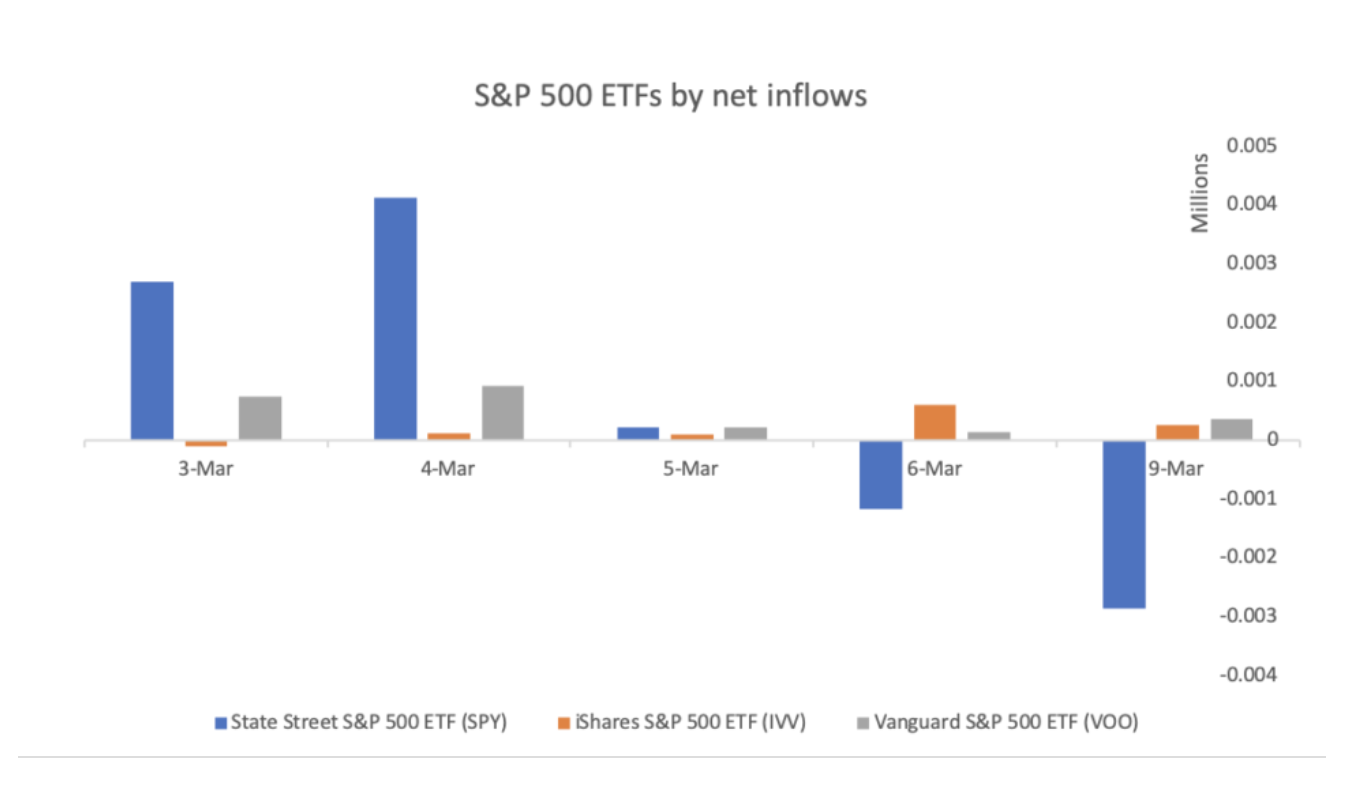

Source: ETF Stream The (March 11) chart above shows three of the largest S&P500 index funds in the world from State...

Source: ETF Stream The (March 11) chart above shows three of the largest S&P500 index funds in the world from State...

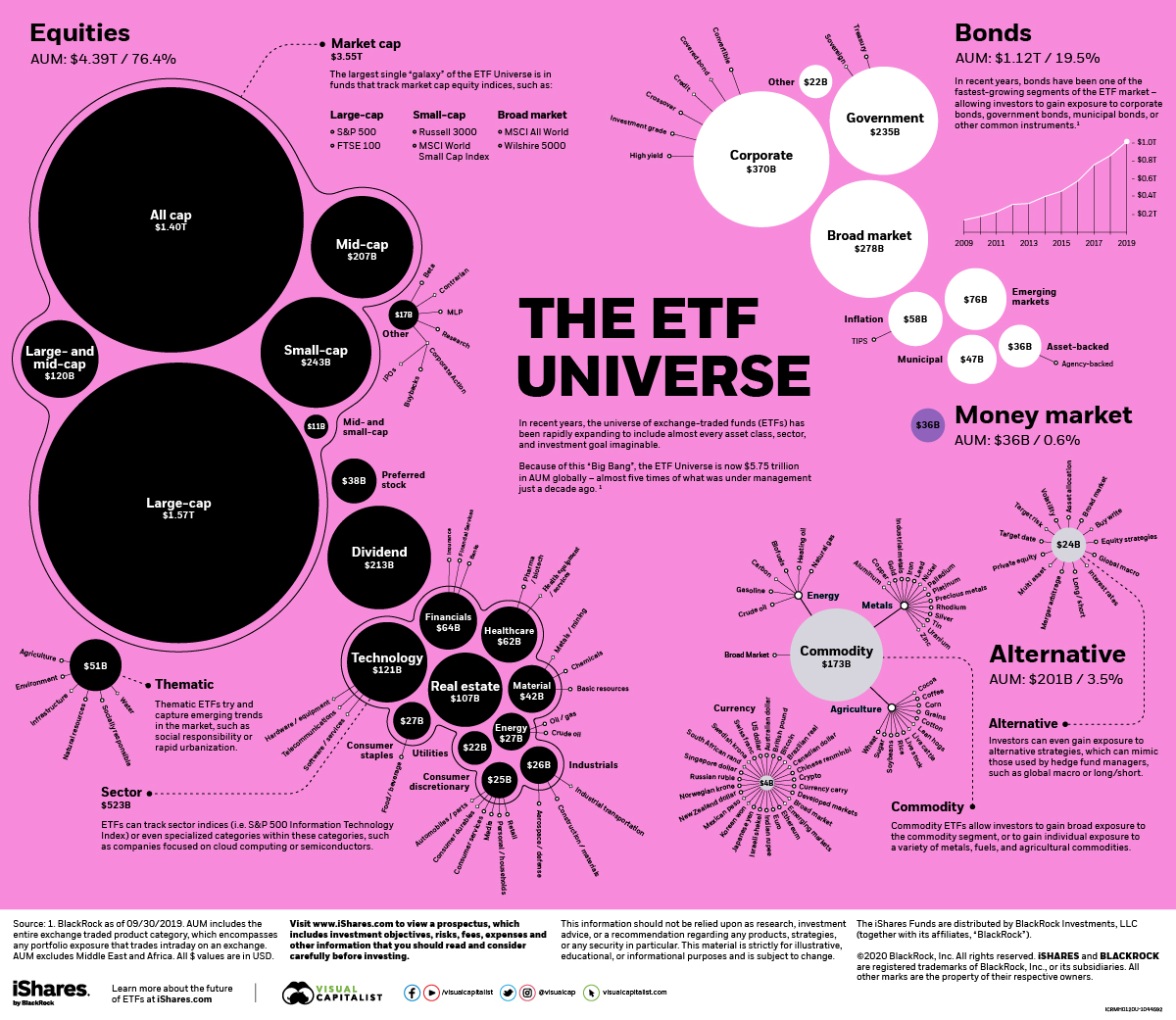

Visualizing the Expanse of the ETF Universe Source: Visual Capitalist It’s the last day of the giant Inside ETFs...

Visualizing the Expanse of the ETF Universe Source: Visual Capitalist It’s the last day of the giant Inside ETFs...

This is one of my favorite conferences each year: Inside ETFs 2020, hosted by Informa (our co-producers on Wealth/Stack). Its...

This is one of my favorite conferences each year: Inside ETFs 2020, hosted by Informa (our co-producers on Wealth/Stack). Its...

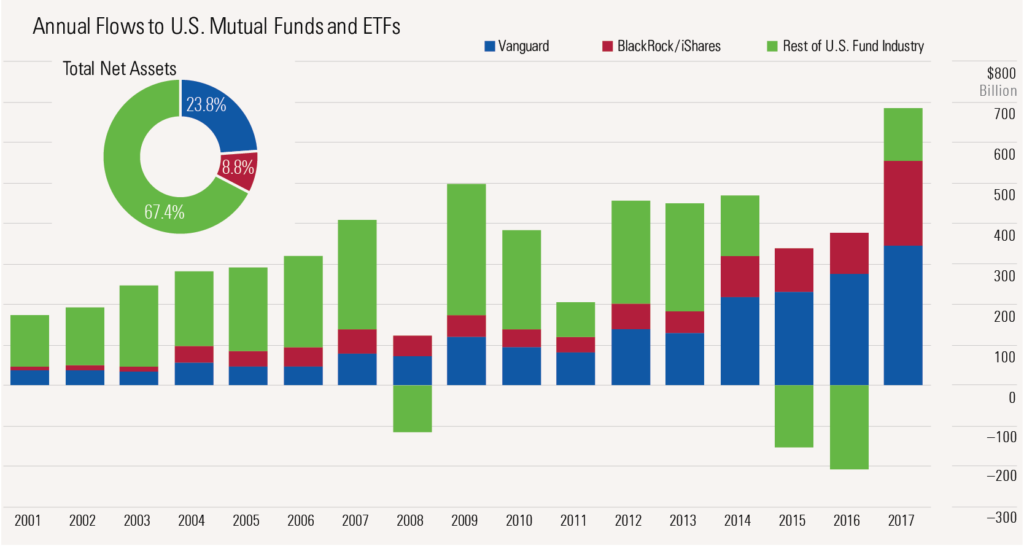

Source: Morningstar The question that I have been getting a lot this year is this: “Why do you spend so much time...

Source: Morningstar The question that I have been getting a lot this year is this: “Why do you spend so much time...

Get subscriber-only insights and news delivered by Barry every two weeks.