A Q&A with Barry Ritholtz: ETF Perspectives Vanguard, June 11, 2019. I did a Q&A about ETFs last month with the team at...

Read More

Don’t let the rise of passive investing obscure the fundamental advantages of diversification. In our Masters in Business interview,...

Read More

The transcript from this week’s MIB: Sharon French, Oppenheimer Funds is below. You can stream/download the full conversation,...

Read More

This week we speak with Sharon French, who at the time of our interview was Director of Beta Solutions at Oppenheimer Funds, and ran the...

Read More

Vanguard Fund Investors Get Control of Paying Taxes The big money manager found a way to defer taxes on mutual-fund capital gains via...

Read More

Vanguard Fund Investors Get Control of Paying Taxes The big money manager found a way to defer taxes on mutual-fund capital gains via...

Read More

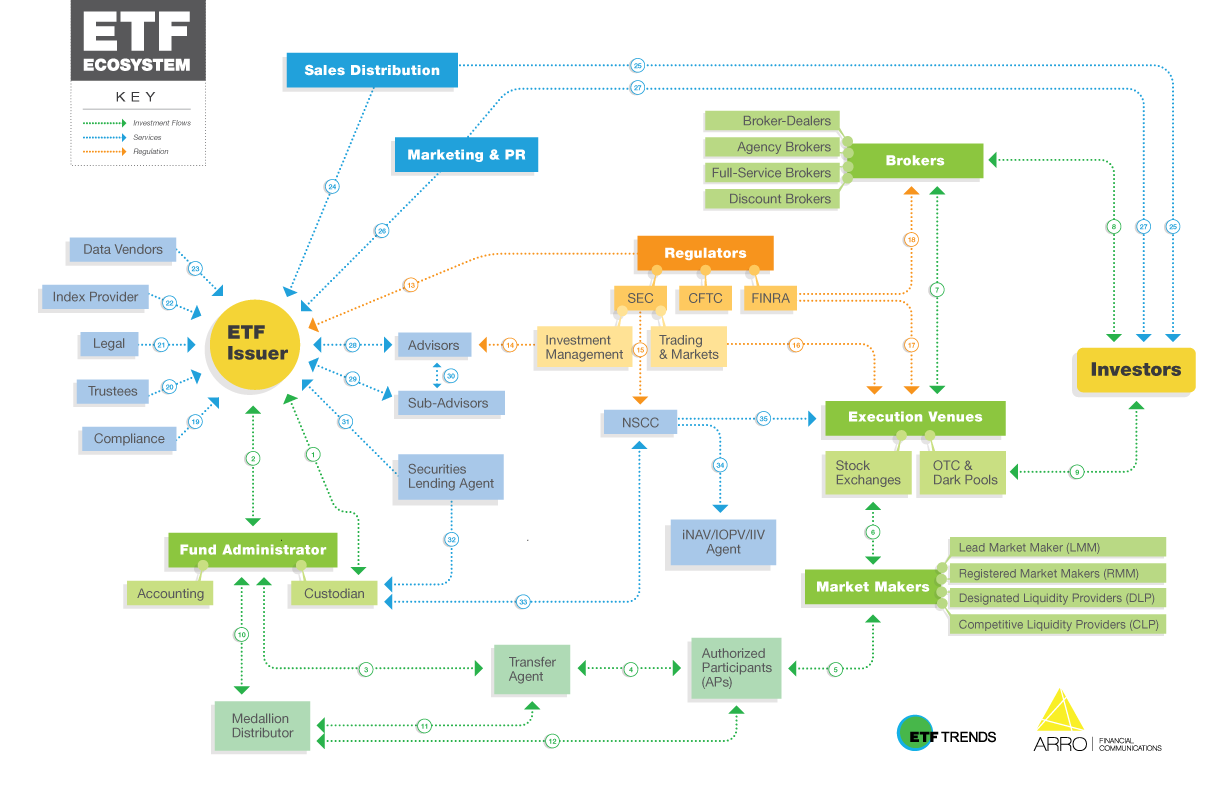

I had no idea ETFs were this complicated to assemble: Source: ETF Trends

I had no idea ETFs were this complicated to assemble: Source: ETF Trends

Read More

Index Funds Sure Don’t Seem Like Libor Arguments that they lack transparency or may be subject to manipulation are largely off base....

Read More

Wall Street Learns That Giving Stuff Away Is Boring Financial firms introduced a slew of products that didn’t charge fees last year....

Read More

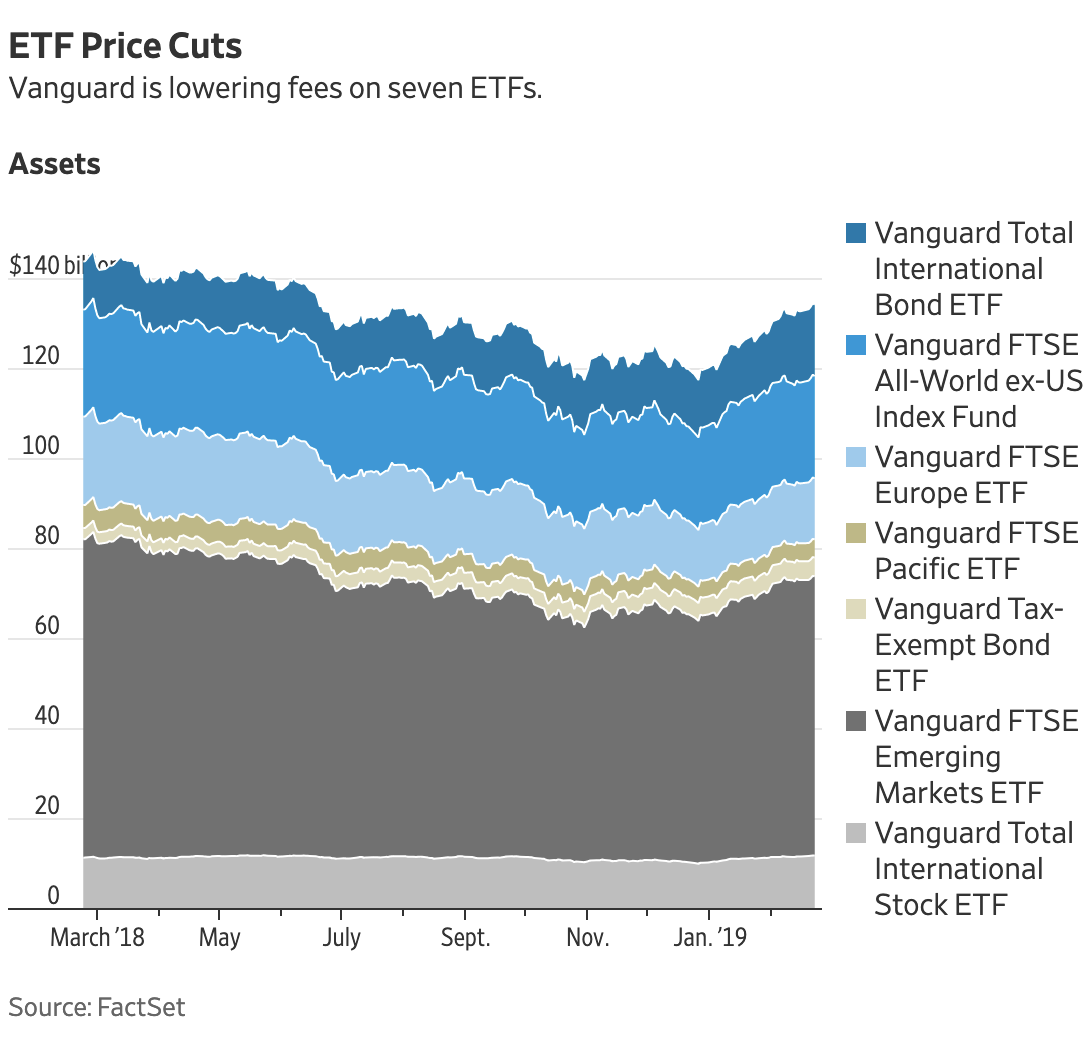

Fees are coming down on 10 Vanguard ETFs $(175 billion aum) Source: Wall Street Journal My friend Asjylyn notes the fee wars...

Fees are coming down on 10 Vanguard ETFs $(175 billion aum) Source: Wall Street Journal My friend Asjylyn notes the fee wars...

Read More

Fees are coming down on 10 Vanguard ETFs $(175 billion aum) Source: Wall Street Journal My friend Asjylyn notes the fee wars...

Fees are coming down on 10 Vanguard ETFs $(175 billion aum) Source: Wall Street Journal My friend Asjylyn notes the fee wars...