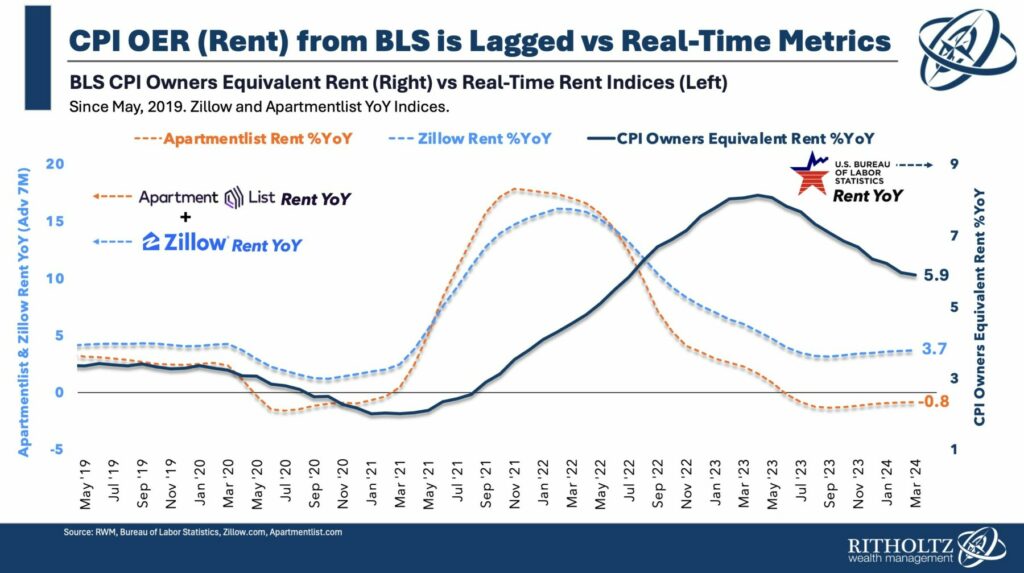

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

Read More

At the Money: How To Know When The Fed Will Cut with Jim Bianco (March 13, 2024) Markets have been waiting for the Federal...

Read More

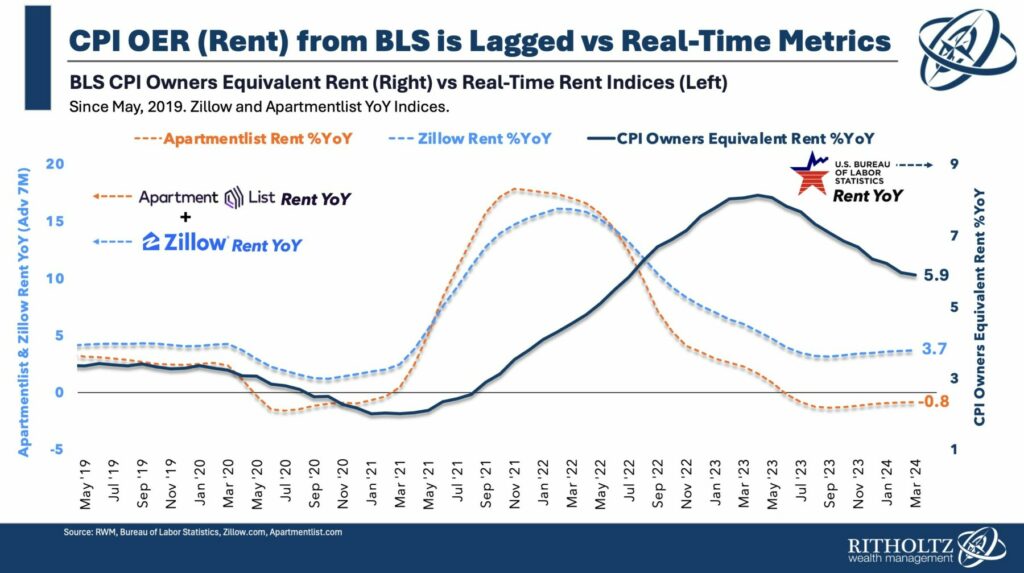

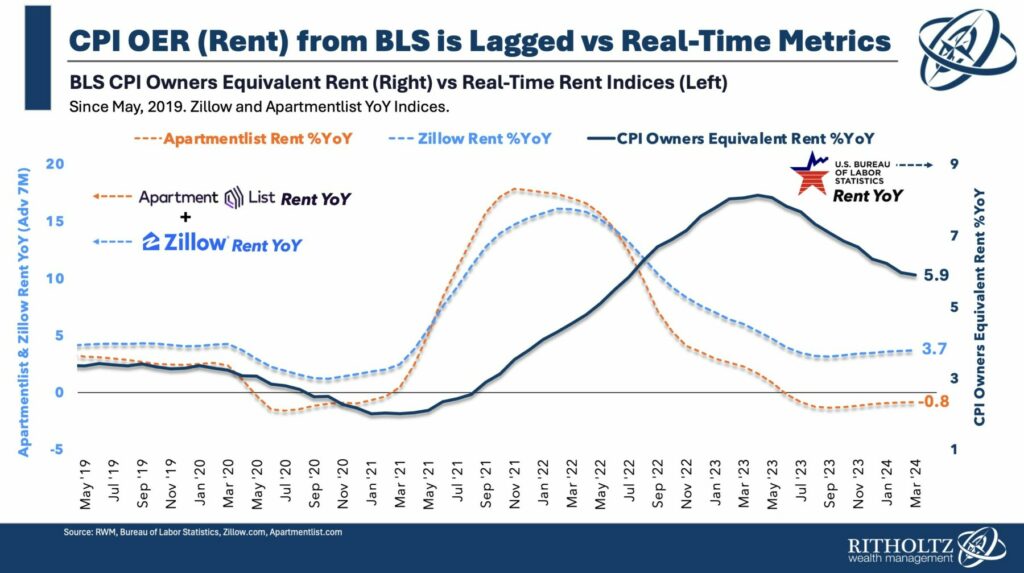

At the Money: Knowing When You’ve Whipped Inflation. (March 6, 2024) Investors hate inflation. How can they evaluate...

Read More

The transcript from this week’s, MiB: Bill Dudley, NY Fed Chief, is below. You can stream and download our full...

Read More

This week, we speak with Bill Dudley, former president and chief executive officer of the Federal Reserve Bank of...

Read More

Hey, I am heading up to Boston today for the annual MIT Sloan Investment Conference. Its’ always a fascinating time (I...

Hey, I am heading up to Boston today for the annual MIT Sloan Investment Conference. Its’ always a fascinating time (I...

Read More

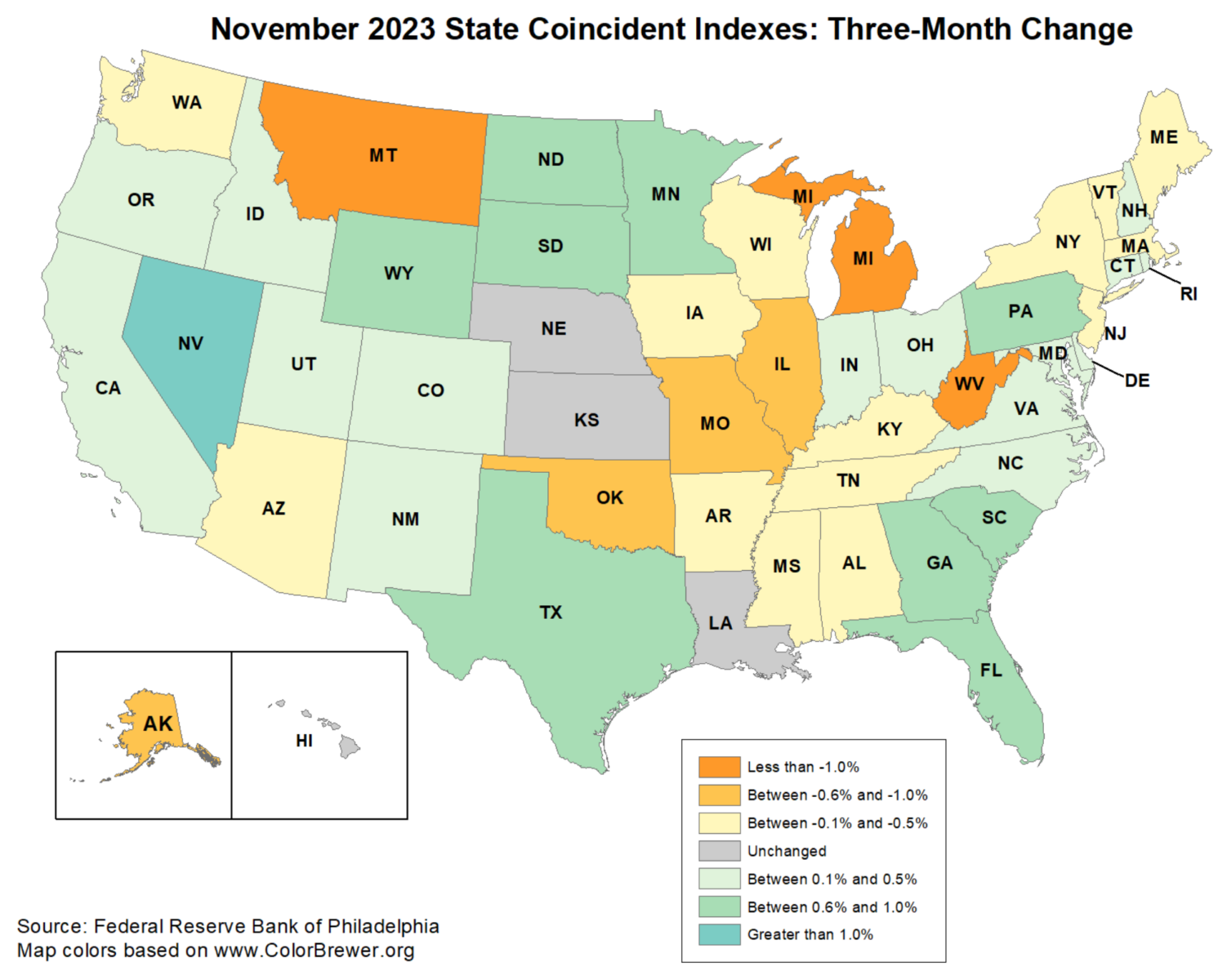

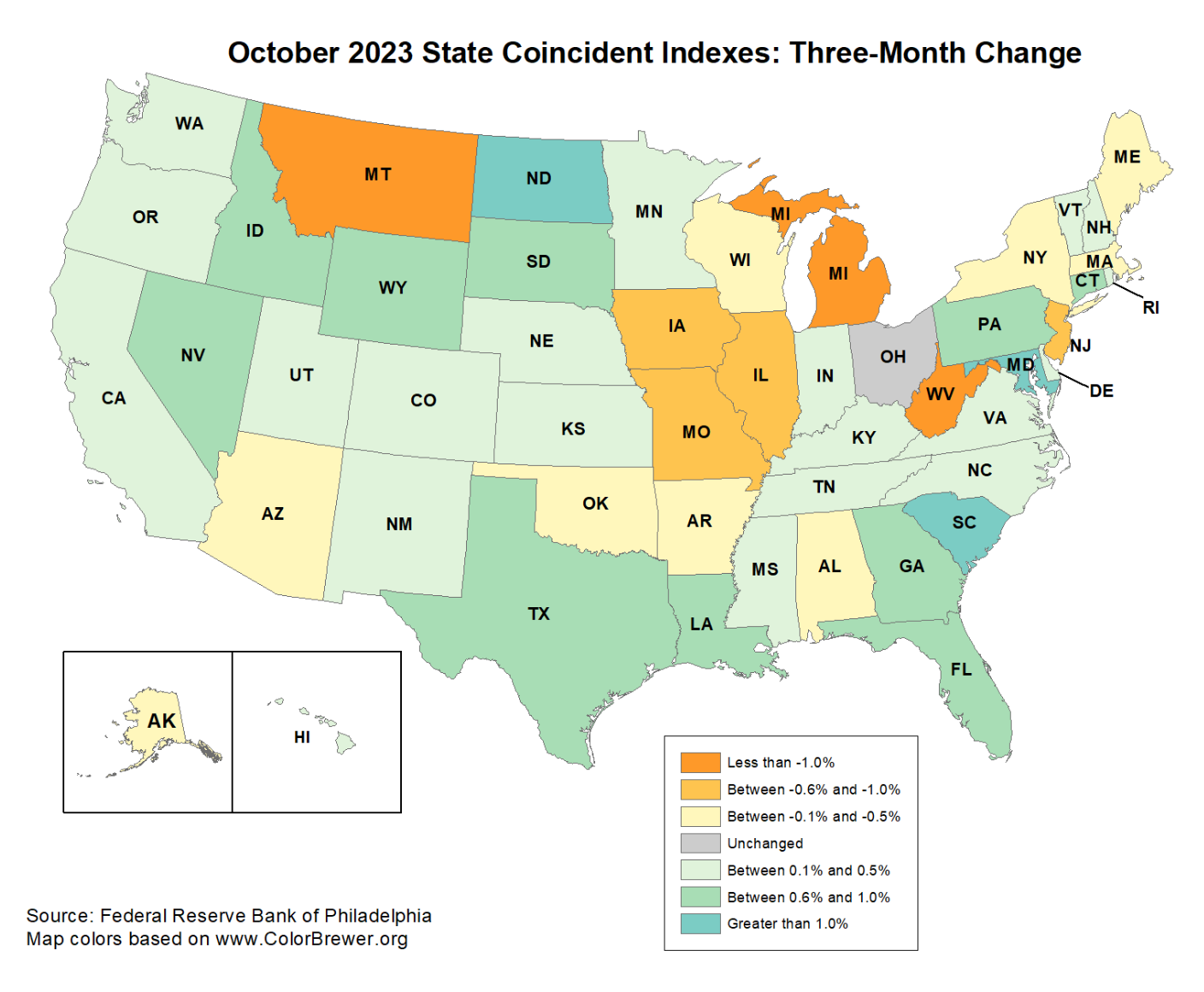

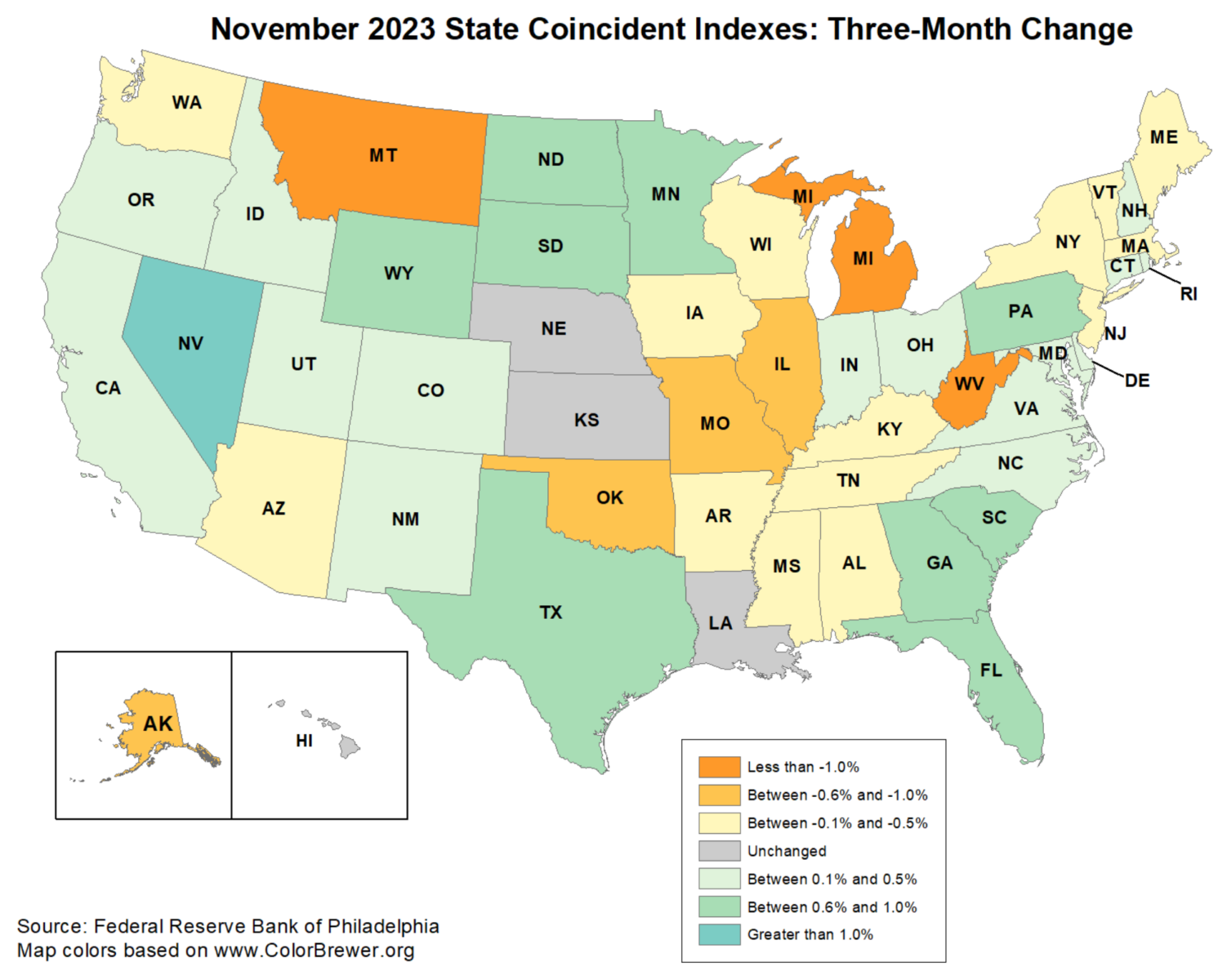

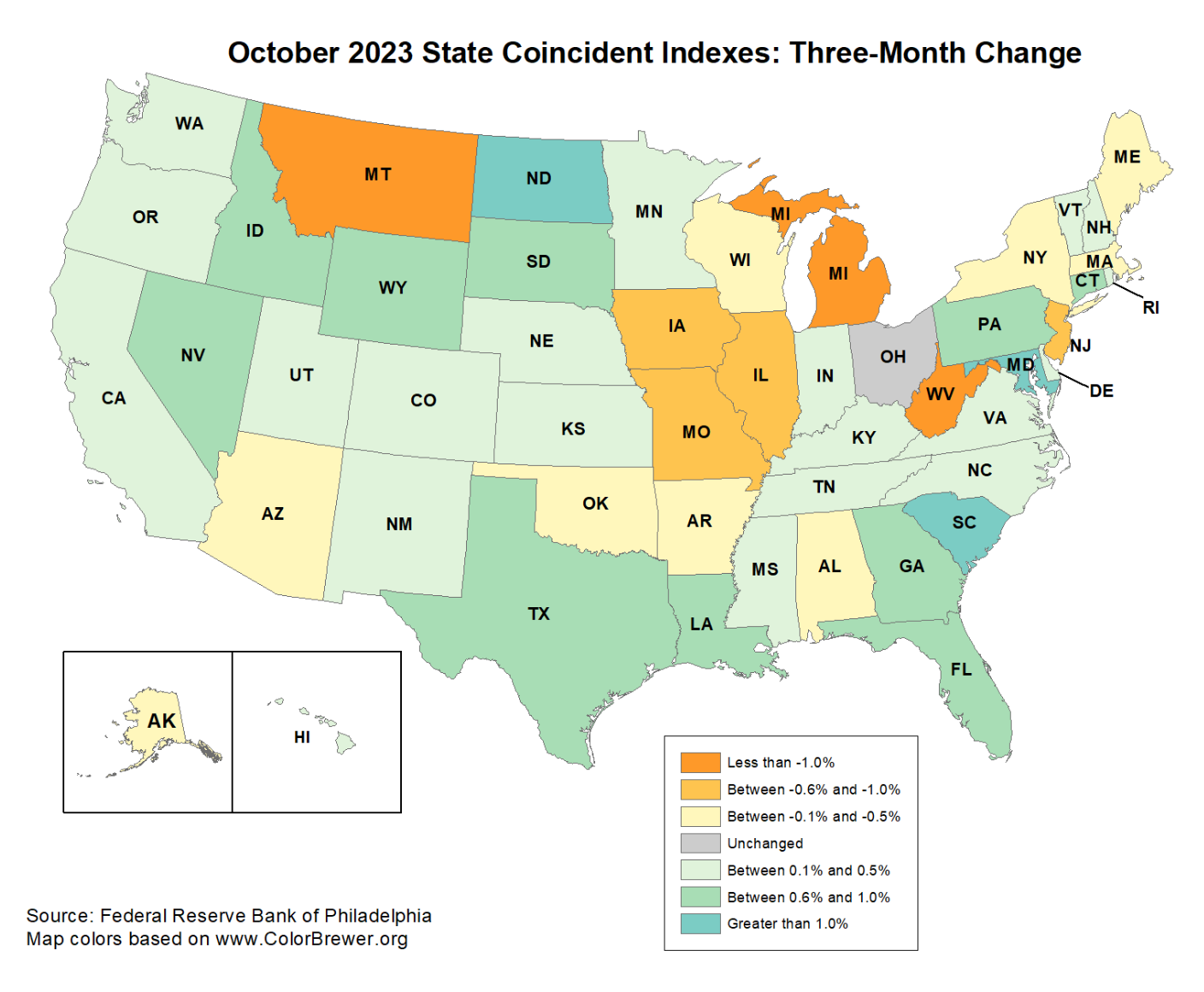

I am popping out of book leave to share this single data point that snuck out over the holidays: The Federal Reserve Bank...

I am popping out of book leave to share this single data point that snuck out over the holidays: The Federal Reserve Bank...

Read More

We spend way too much time trying to predict the future (especially this time of year). Rather than engage in futility, let’s...

We spend way too much time trying to predict the future (especially this time of year). Rather than engage in futility, let’s...

Read More

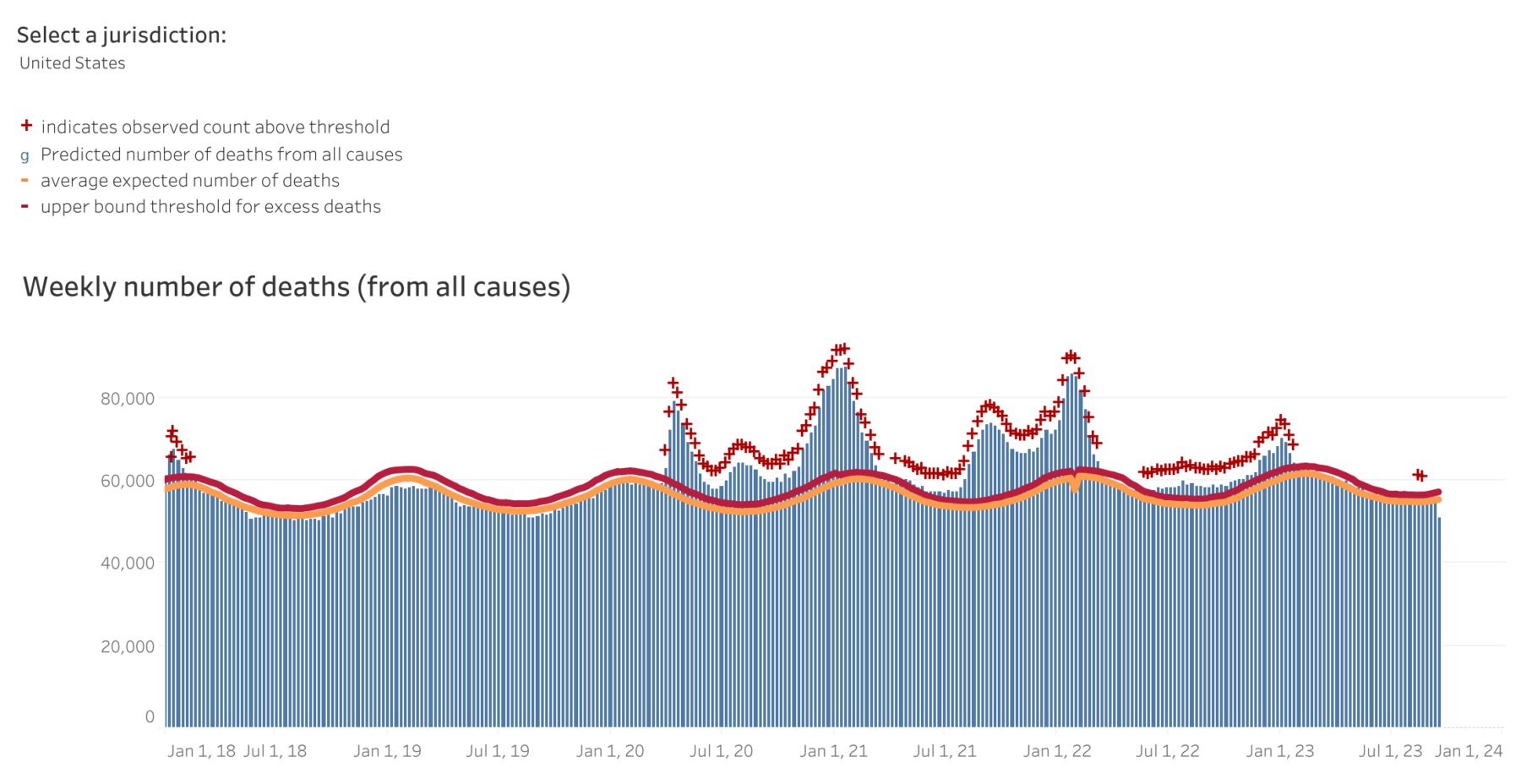

Today, Jerome Powell is making the opening remarks at the 24th Jacques Polak Annual Research Conference in DC. I’ll be on...

Today, Jerome Powell is making the opening remarks at the 24th Jacques Polak Annual Research Conference in DC. I’ll be on...

Read More

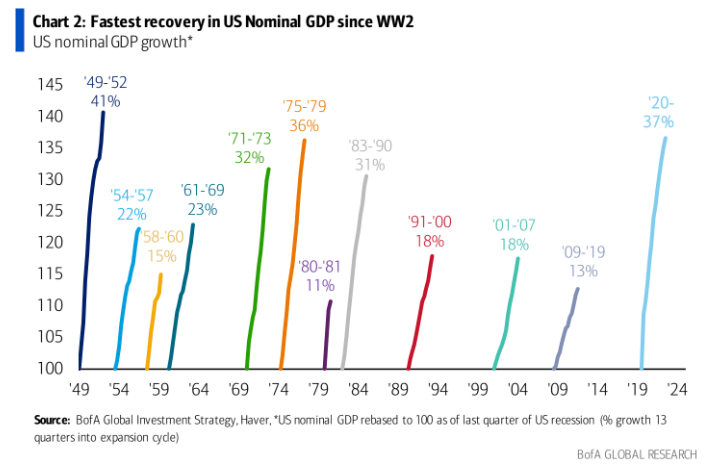

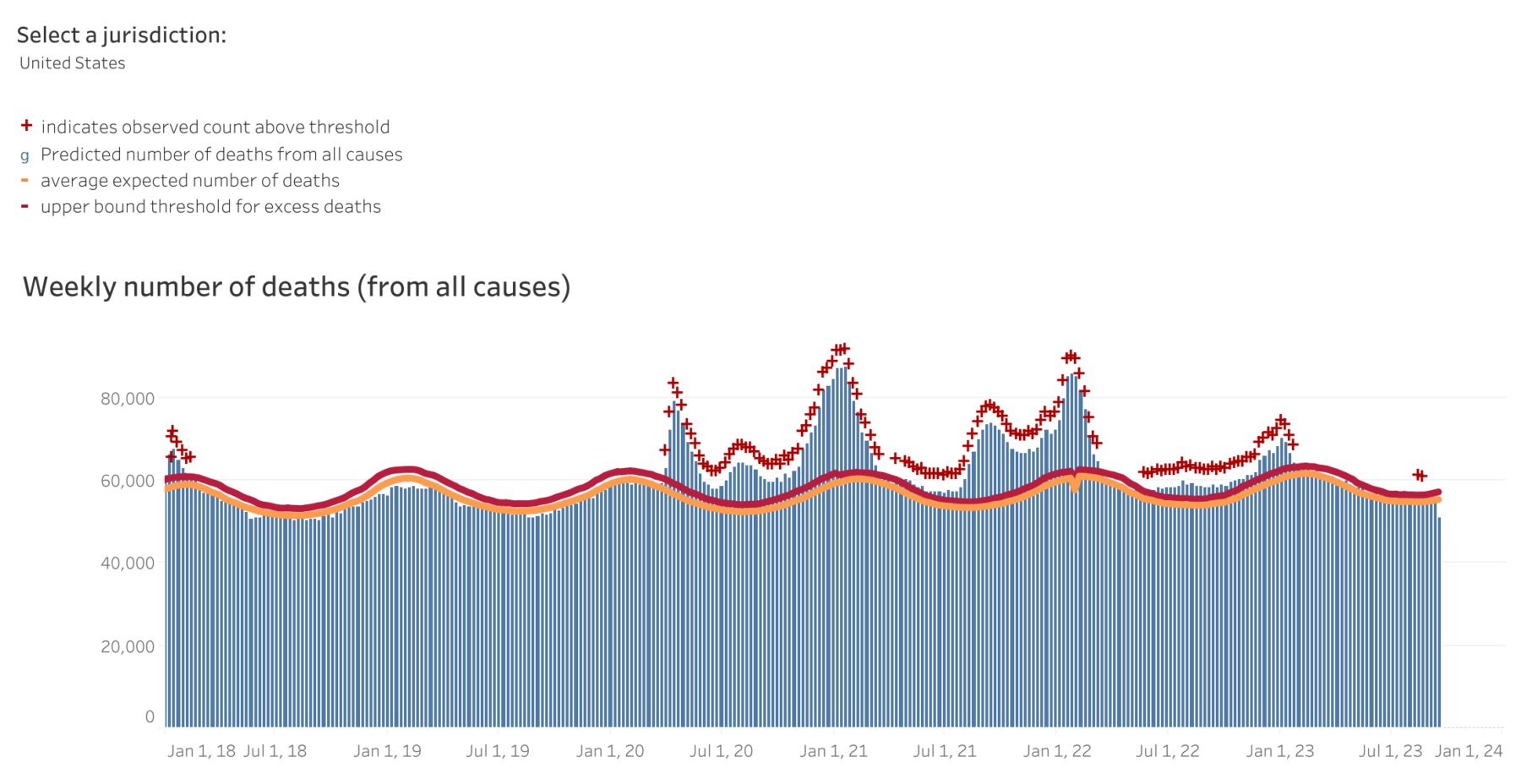

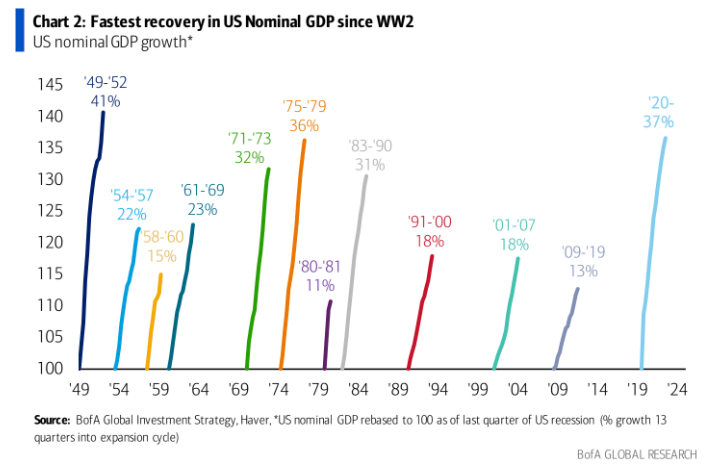

We just experienced the strongest economic recovery since the end of World War II Source: Irrelevant Investor Light posting as...

We just experienced the strongest economic recovery since the end of World War II Source: Irrelevant Investor Light posting as...

Read More

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...