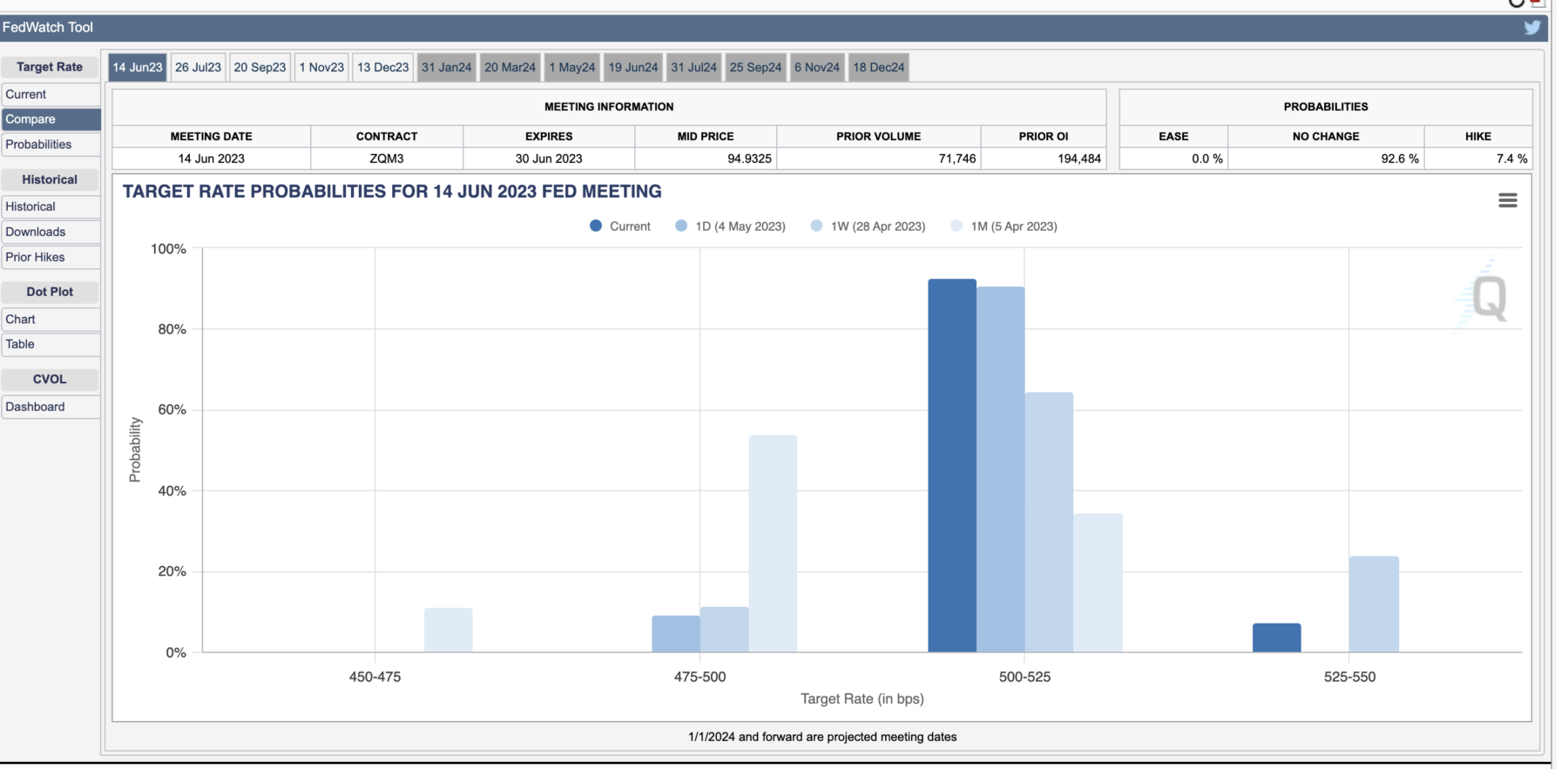

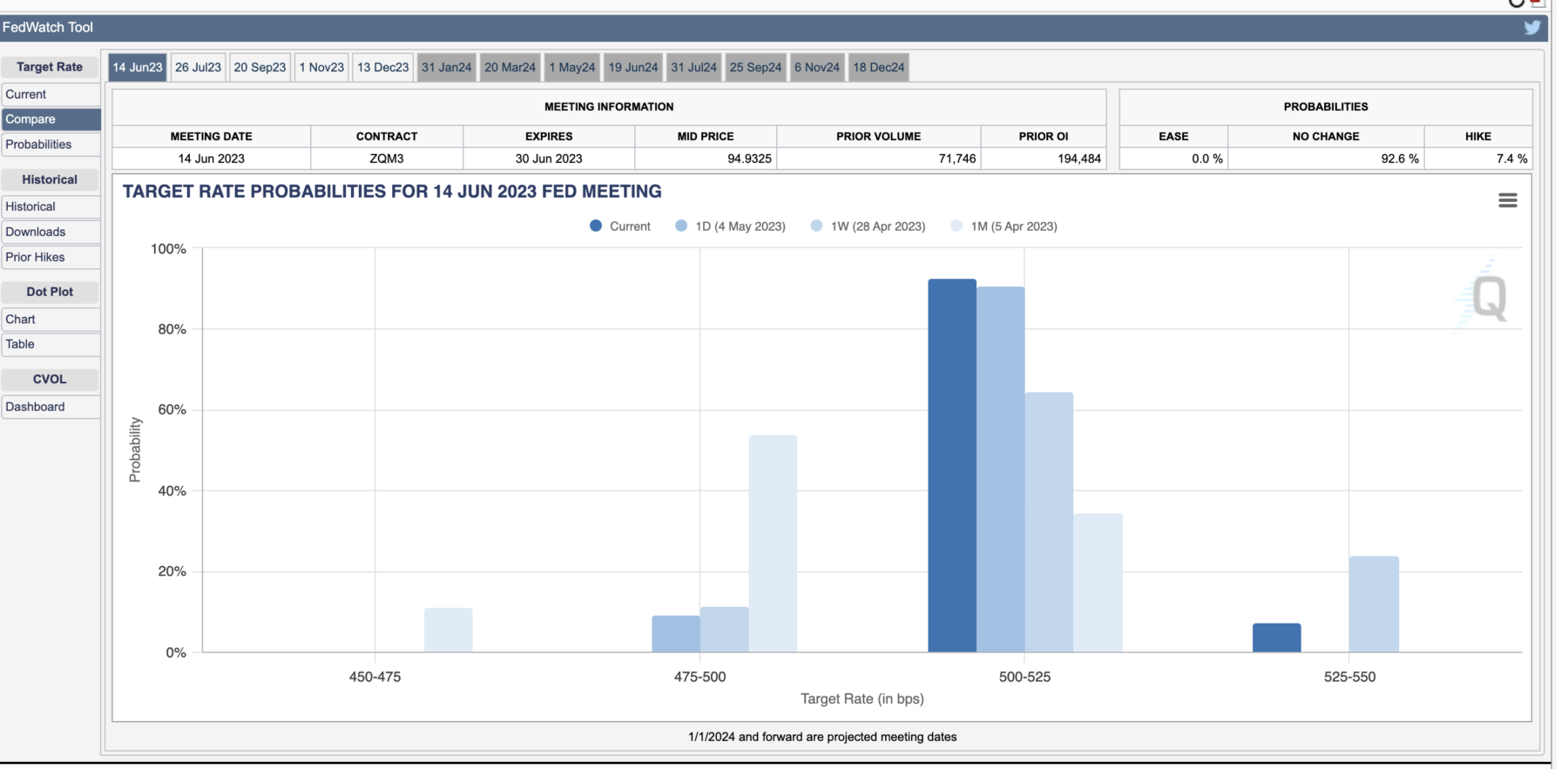

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Read More

The September Federal Reserve meeting is behind us we still have November and December ahead of us. Markets are nervous expecting...

The September Federal Reserve meeting is behind us we still have November and December ahead of us. Markets are nervous expecting...

Read More

I have a new column out in Businessweek, just in time for the Federal Reserve meeting in Jackson Hole. It is a...

I have a new column out in Businessweek, just in time for the Federal Reserve meeting in Jackson Hole. It is a...

Read More

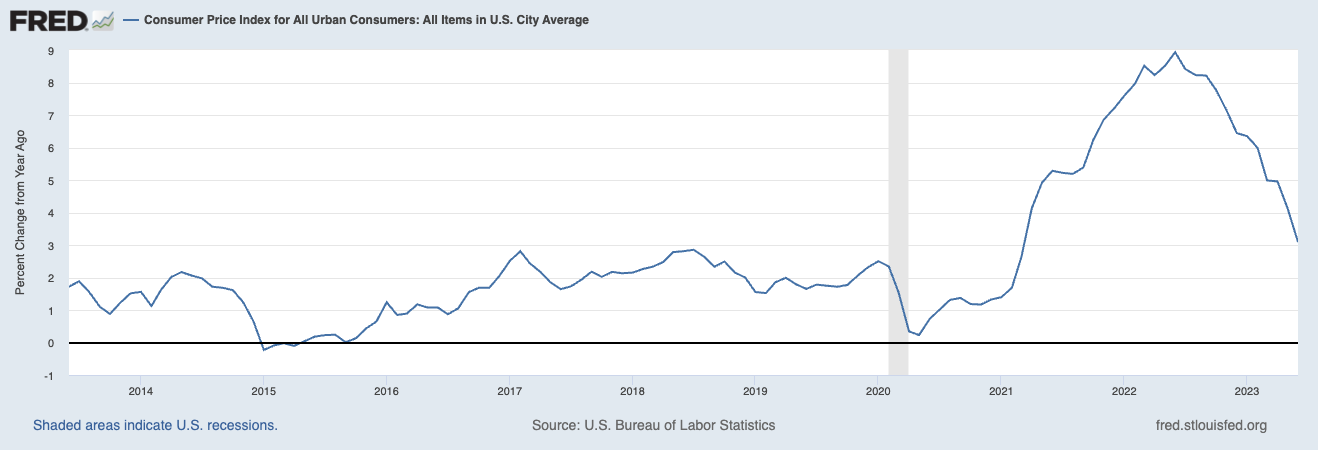

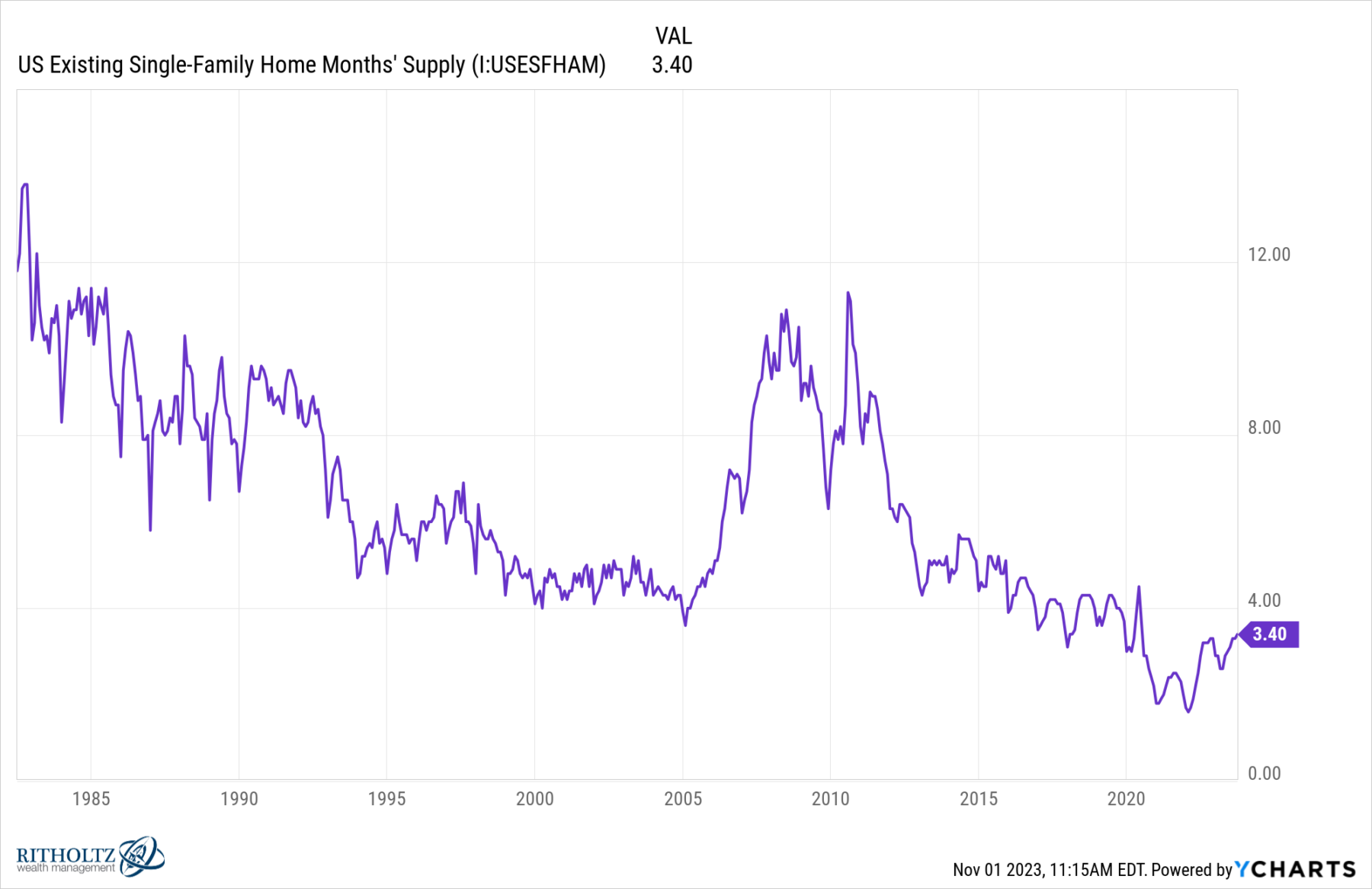

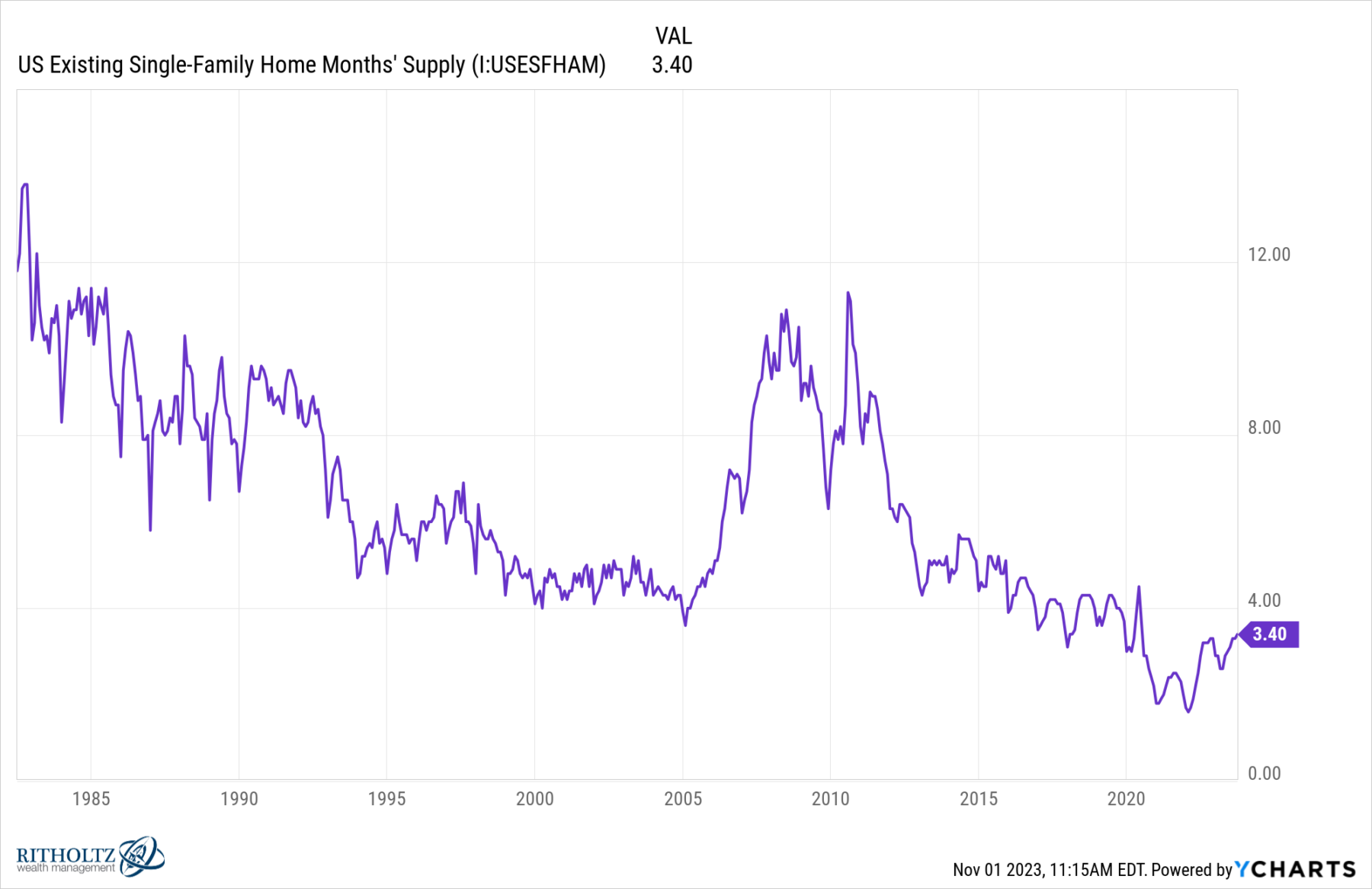

One of the more foolish arguments1 that seem to be emanating from the Fed about their intention to raise rates another quarter...

One of the more foolish arguments1 that seem to be emanating from the Fed about their intention to raise rates another quarter...

Read More

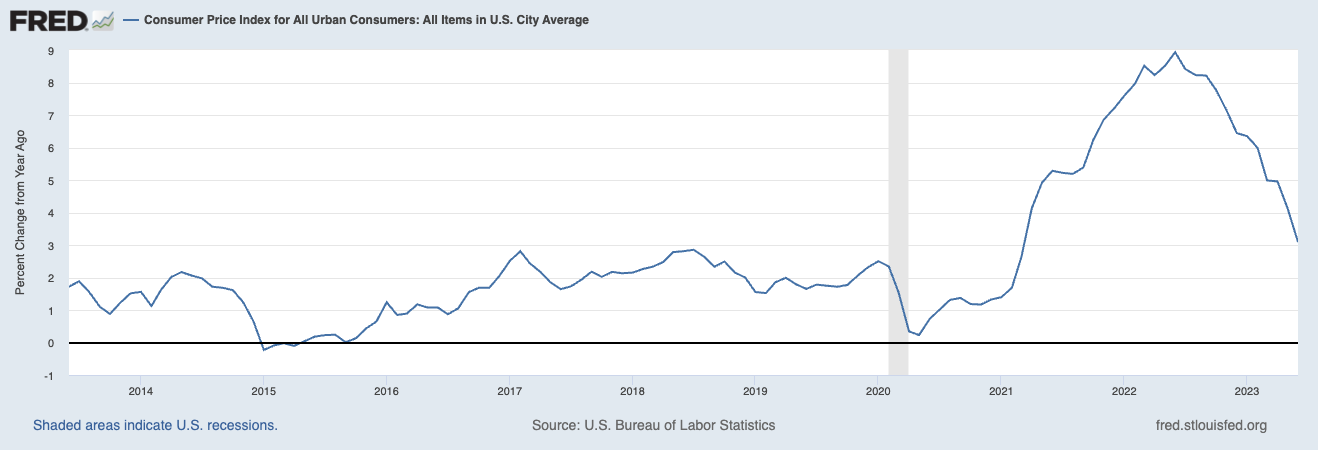

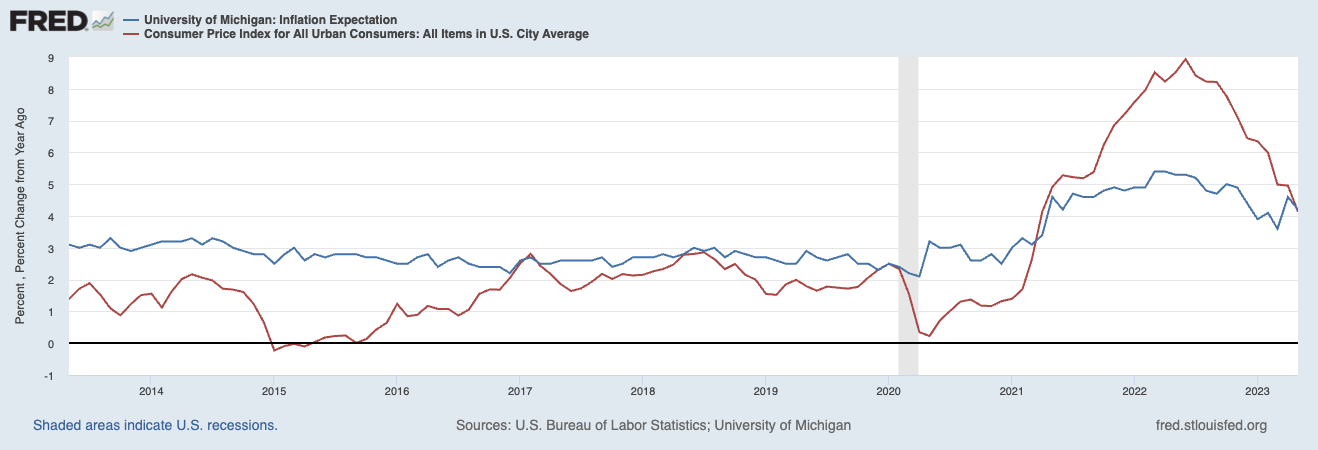

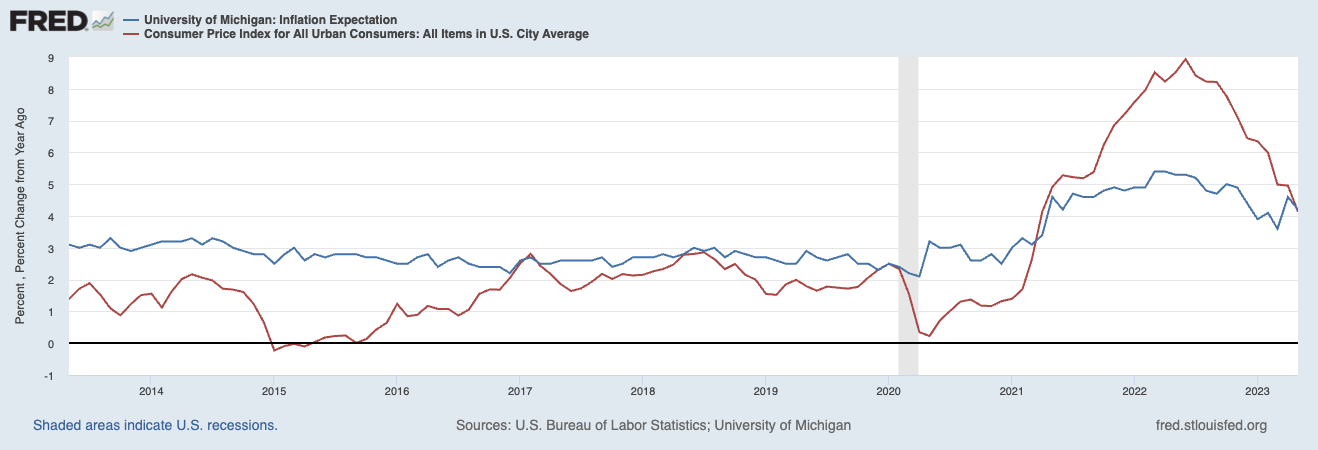

This morning, the WSJ reported that “Consumers expect to see 4.1% inflation a year from now, the lowest such reading in two...

This morning, the WSJ reported that “Consumers expect to see 4.1% inflation a year from now, the lowest such reading in two...

Read More

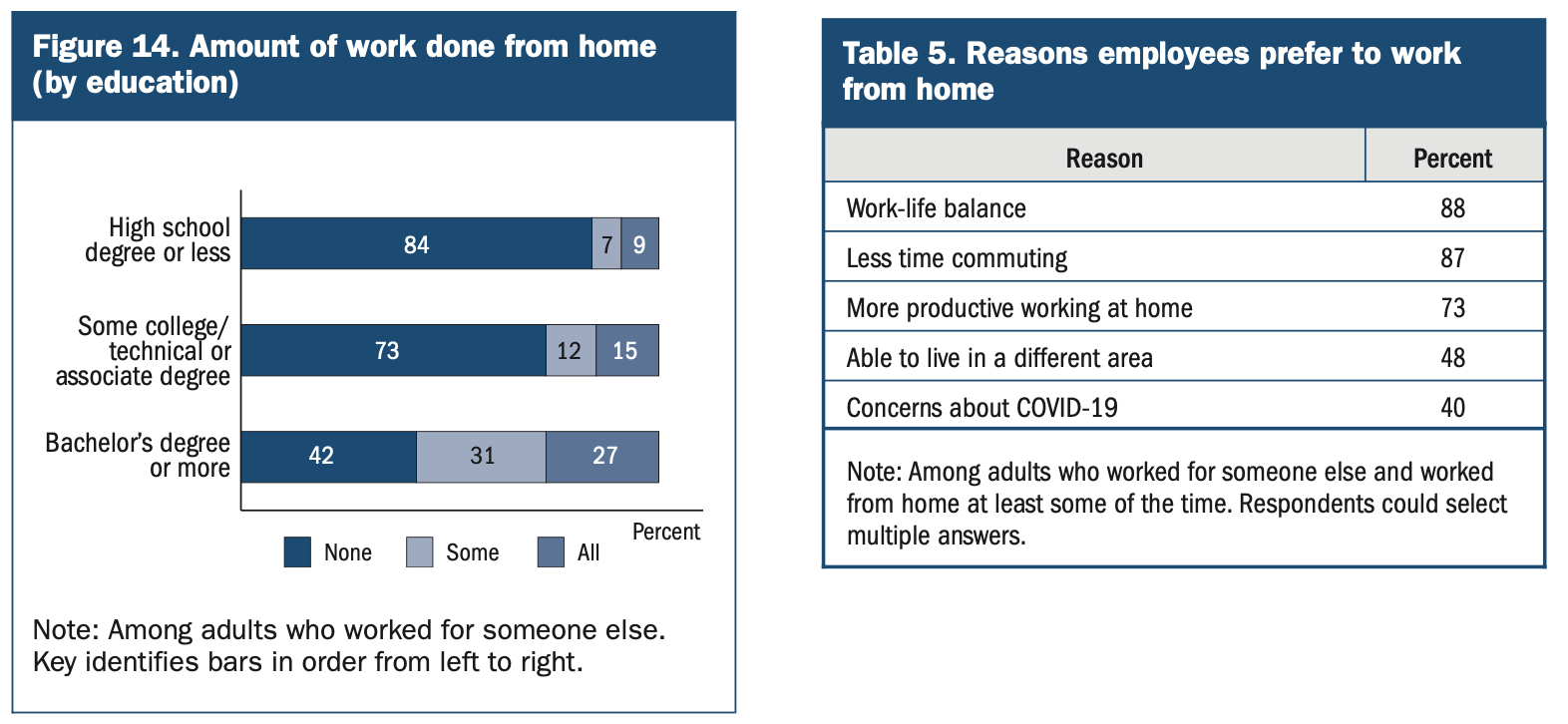

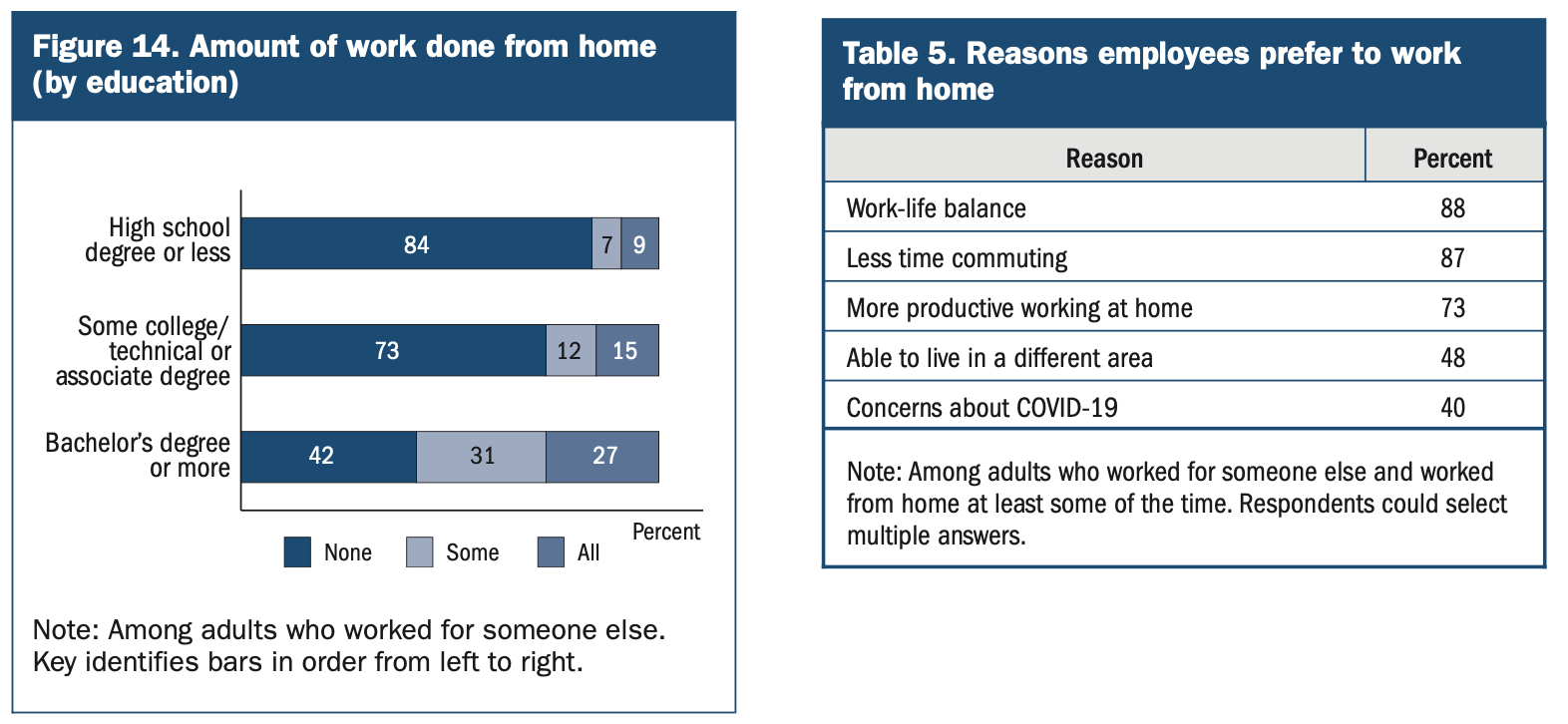

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

Read More

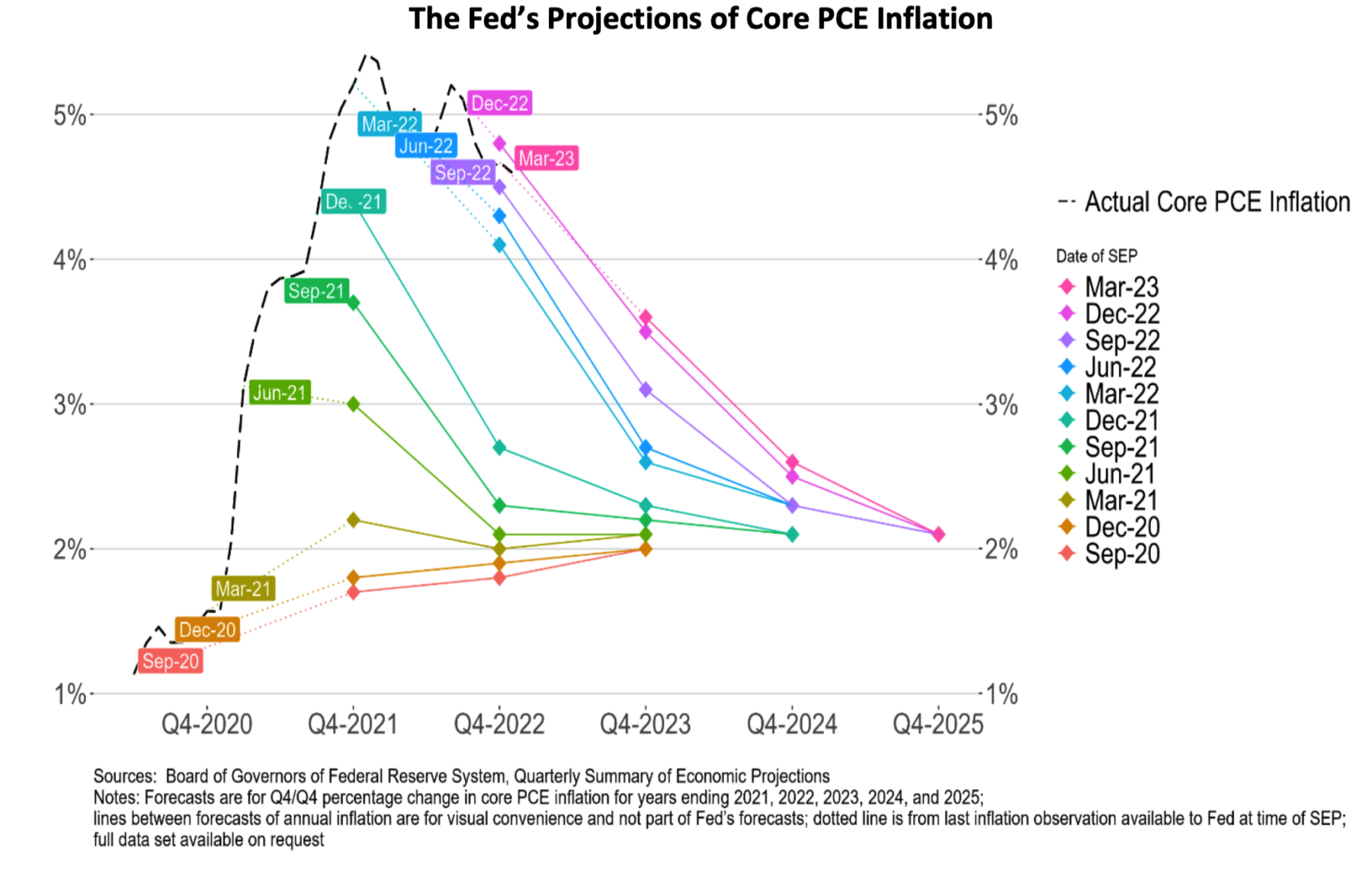

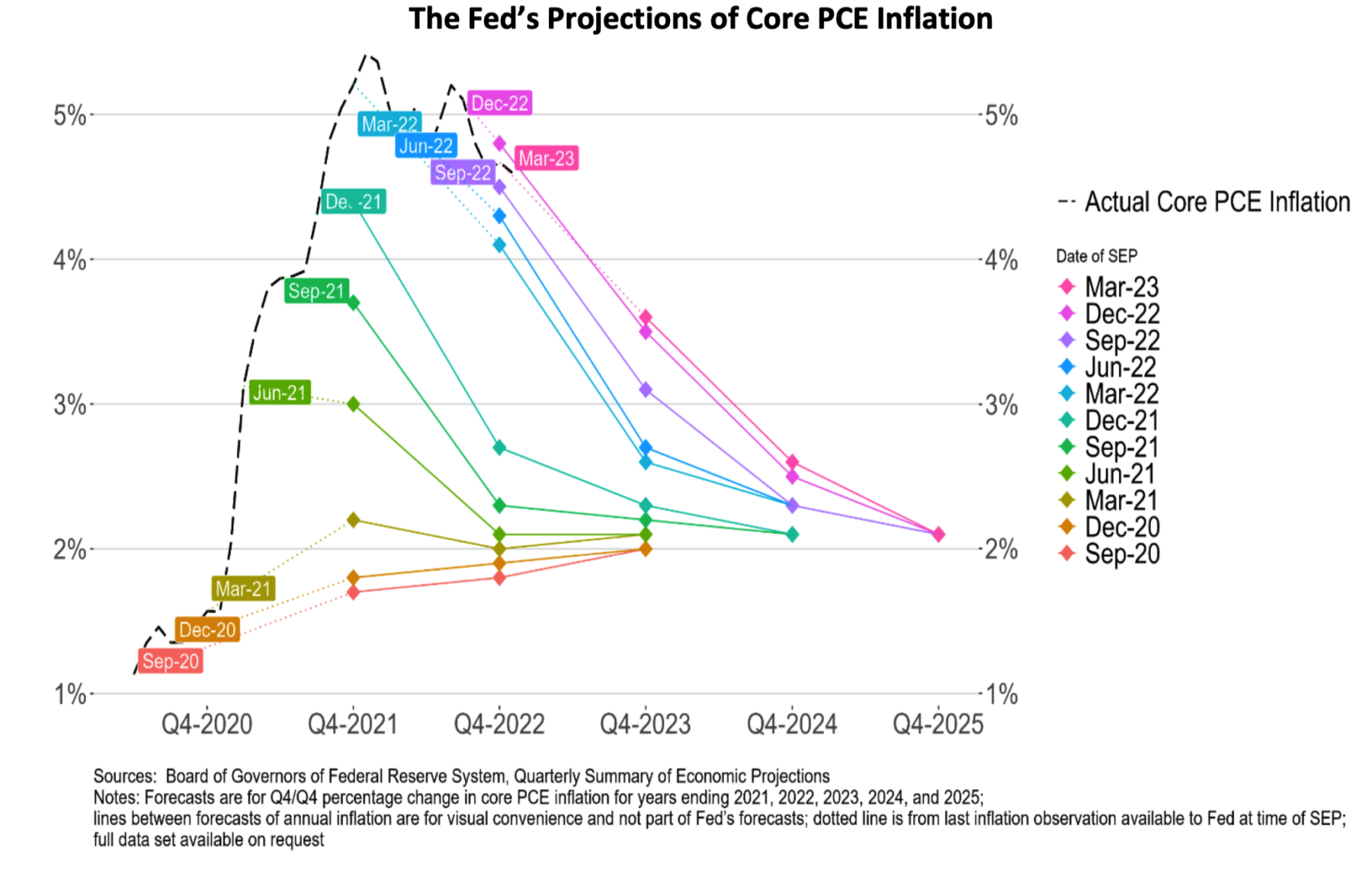

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Read More

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

Read More

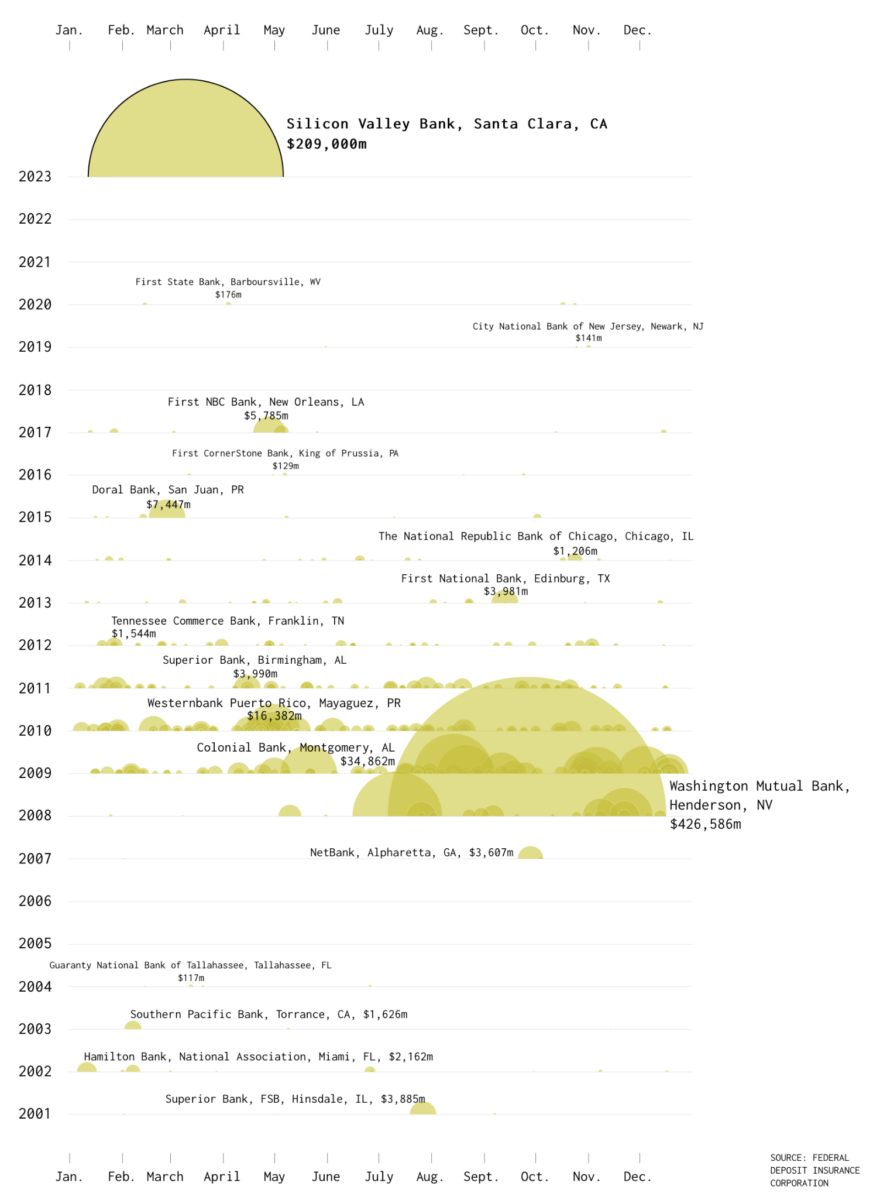

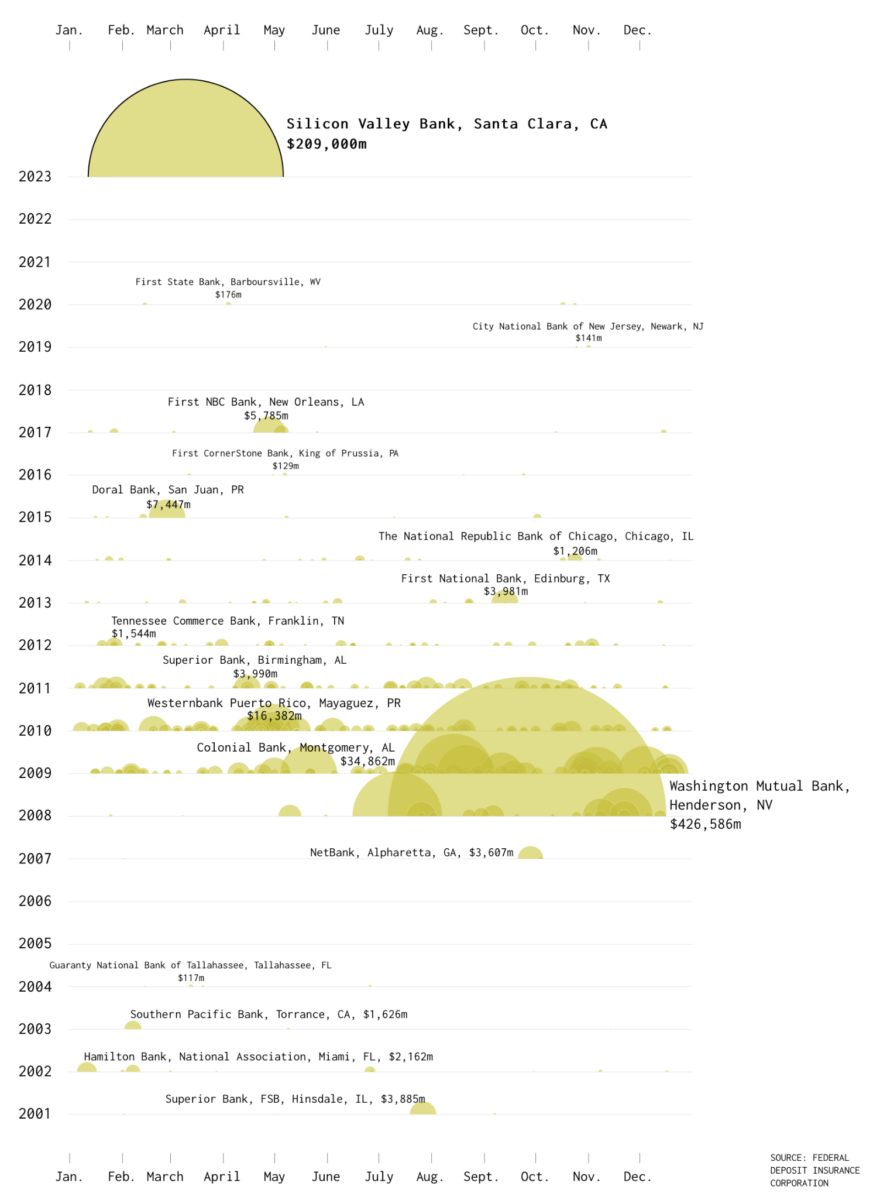

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data, puts recent...

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data, puts recent...

Read More

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole...

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole...

Read More

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...