The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

Read More

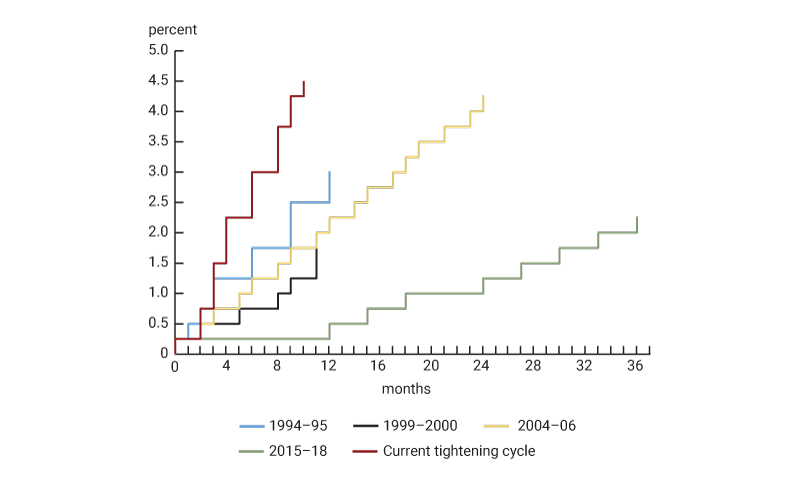

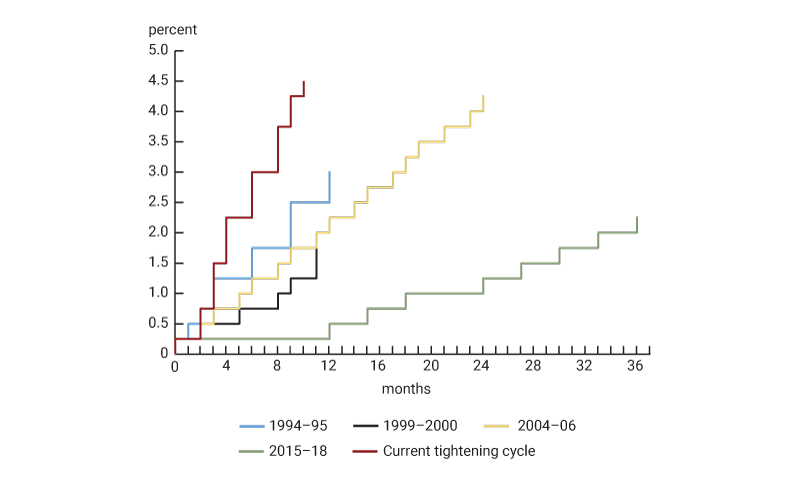

Armchair quarterbacking the decisions of the Federal Reserve long ago became a blood sport. With the benefit of hindsight, we all...

Armchair quarterbacking the decisions of the Federal Reserve long ago became a blood sport. With the benefit of hindsight, we all...

Read More

This week, we get to hear from Federal Reserve Chairman Jerome Powell twice – tomorrow in the Semiannual Monetary Policy...

This week, we get to hear from Federal Reserve Chairman Jerome Powell twice – tomorrow in the Semiannual Monetary Policy...

Read More

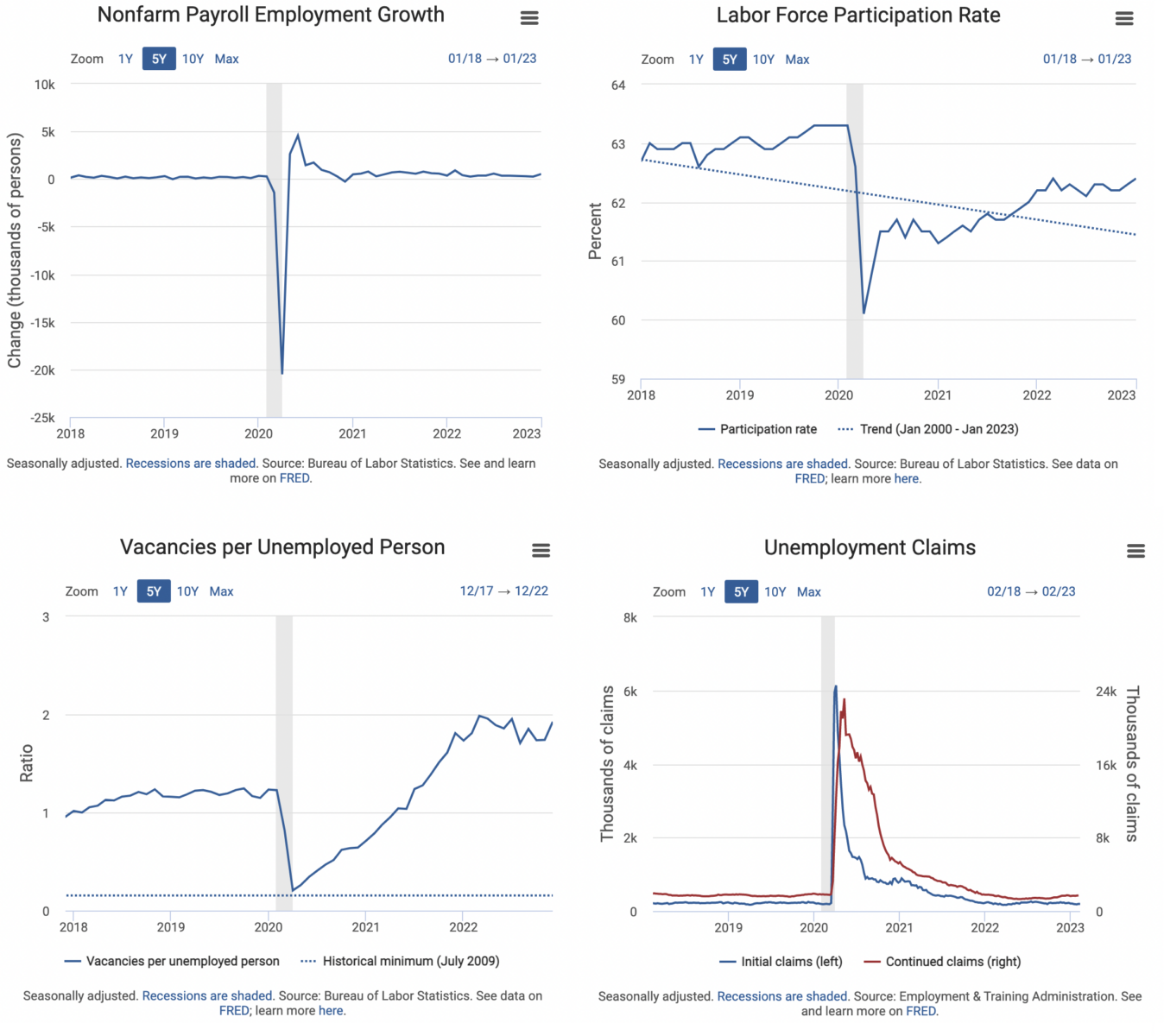

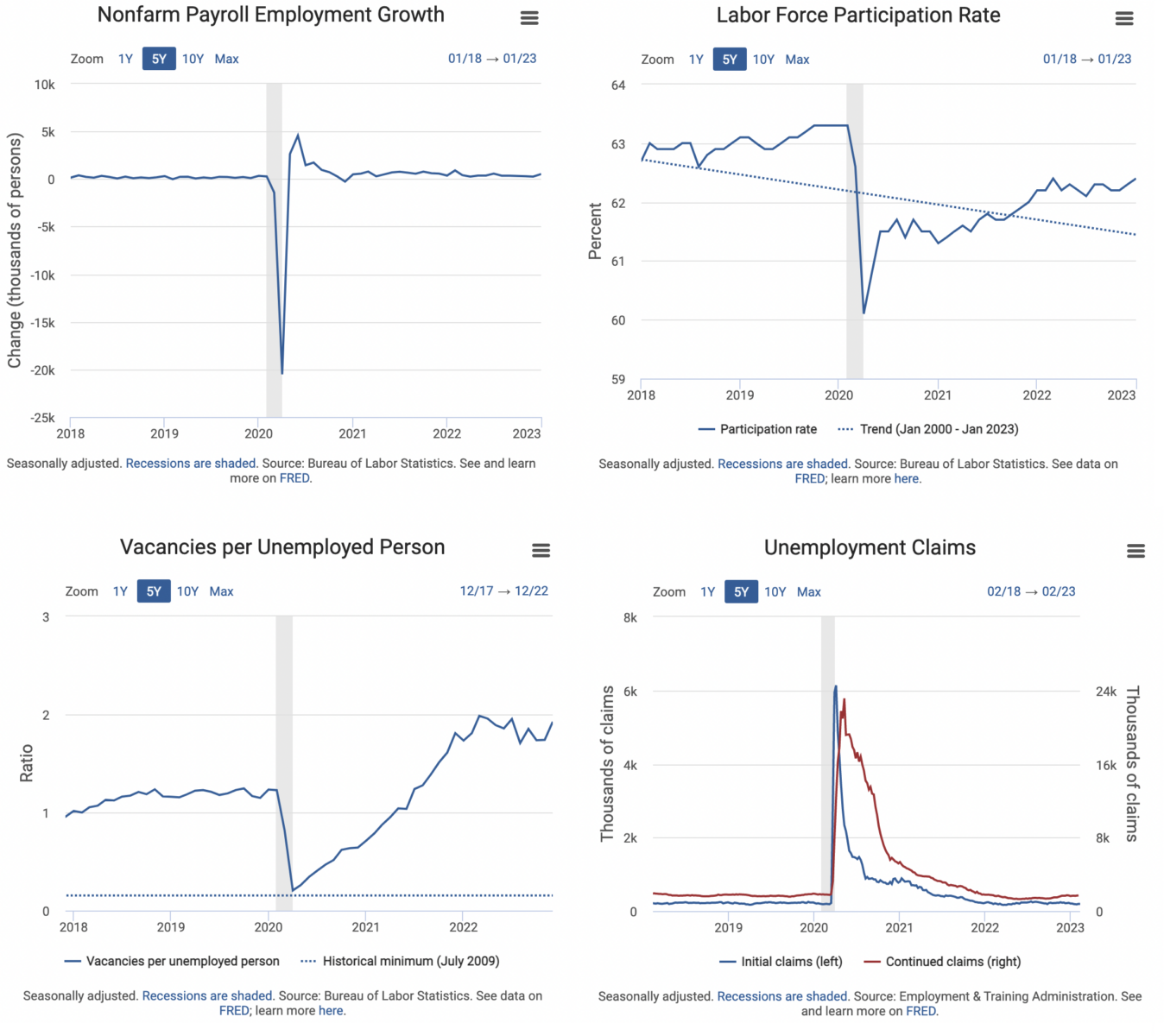

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Read More

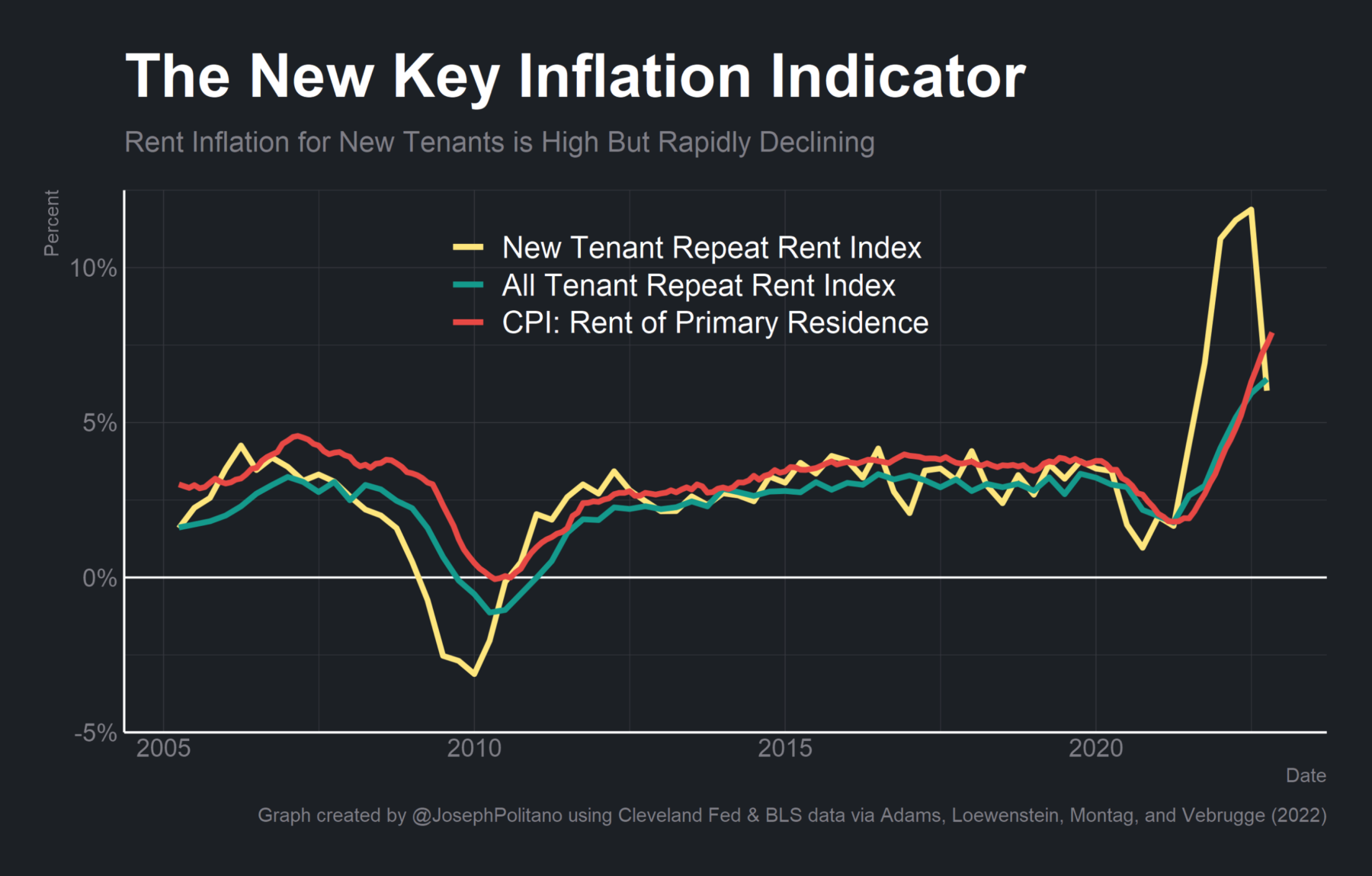

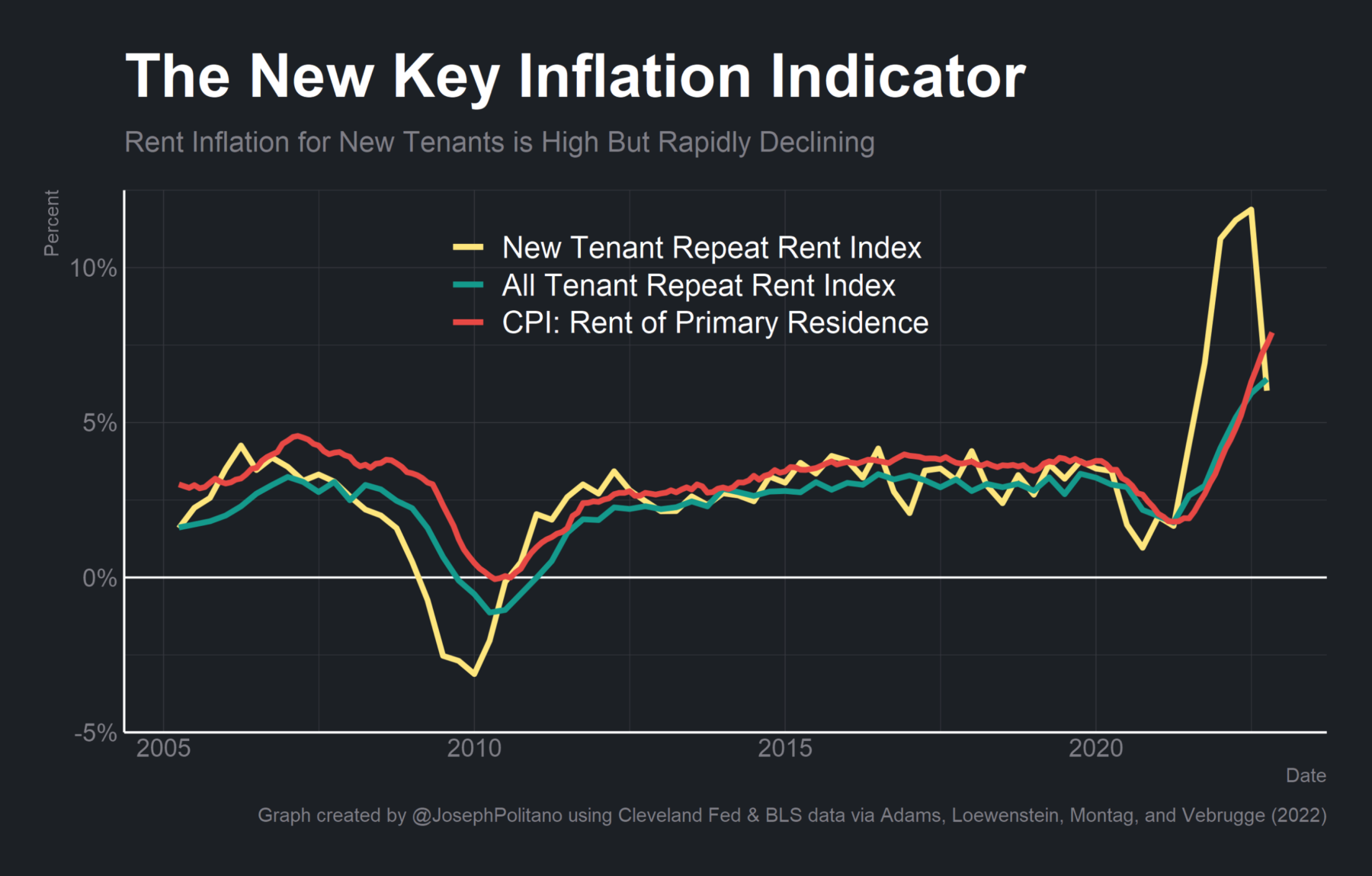

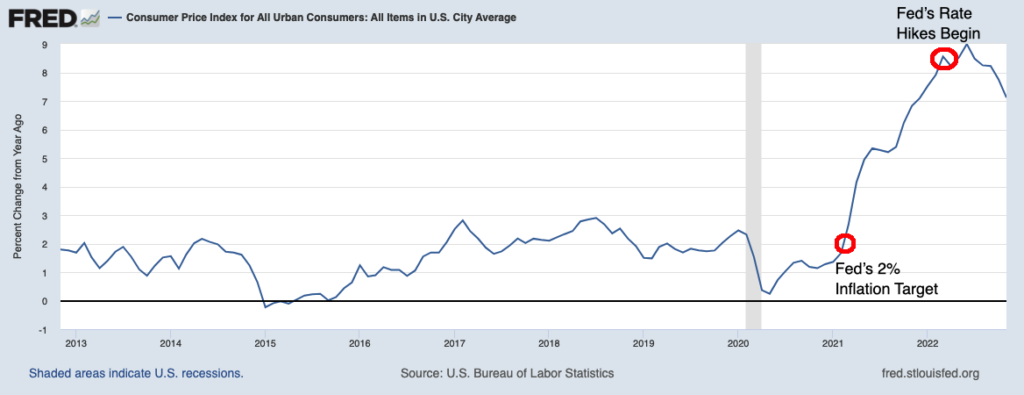

Last week, I discussed the December CPI print; it showed further evidence that inflation is coming down substantially. But...

Last week, I discussed the December CPI print; it showed further evidence that inflation is coming down substantially. But...

Read More

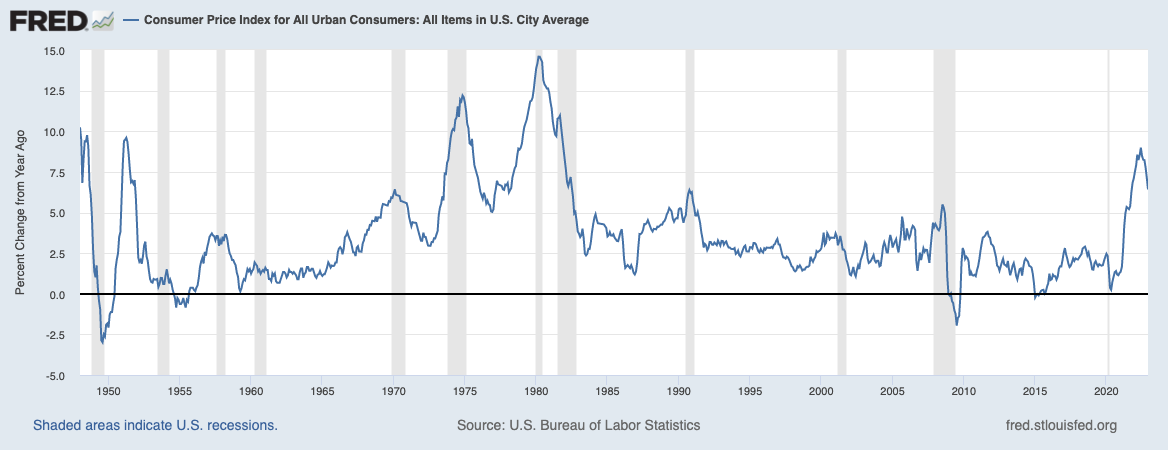

CPI for December 2021 came in as expected, showing a decrease in core inflation is driven primarily by falling gasoline prices....

CPI for December 2021 came in as expected, showing a decrease in core inflation is driven primarily by falling gasoline prices....

Read More

Barry Ritholtz, Ritholtz Wealth Management Chairman & CIO and “Masters in Business” Bloomberg Radio & Podcast Host,...

Read More

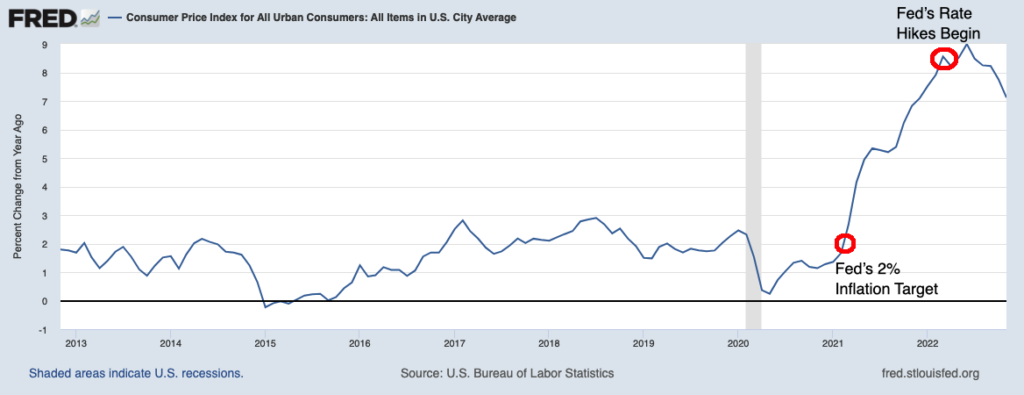

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve...

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve...

Read More

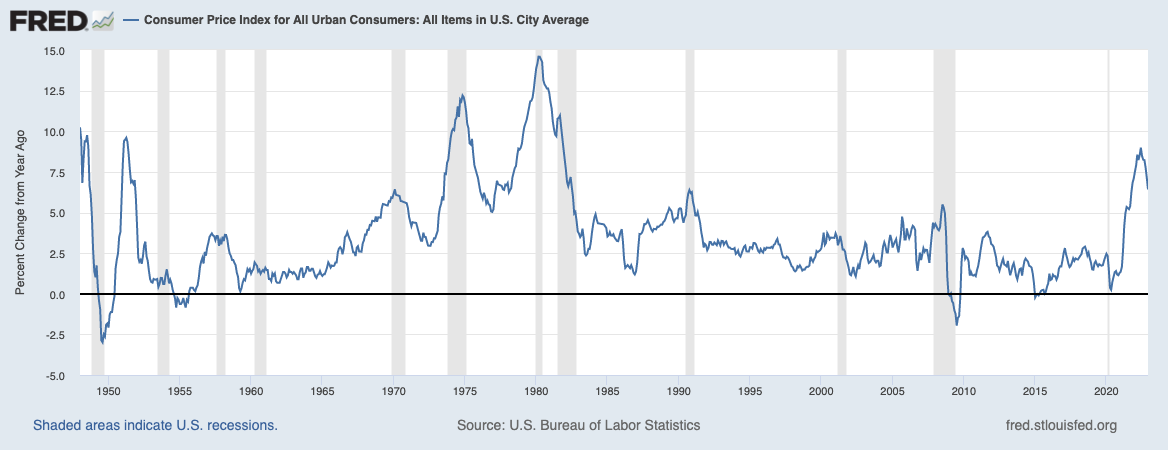

My views on inflation continue to evolve: I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s...

My views on inflation continue to evolve: I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s...

Read More

Since it is late on a Friday, I thought I might share some quick thoughts about the week. I have been wondering, more than usual,...

Since it is late on a Friday, I thought I might share some quick thoughts about the week. I have been wondering, more than usual,...

Read More

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...