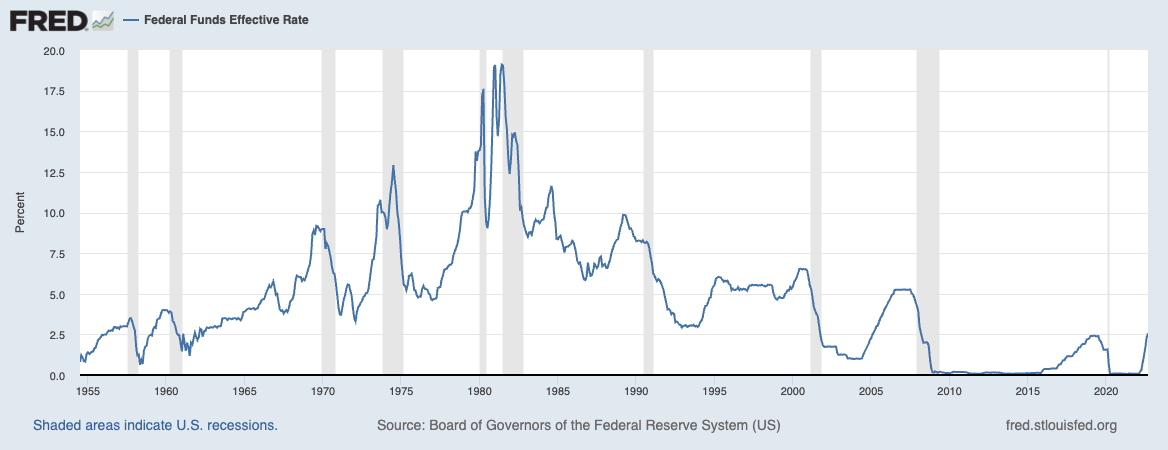

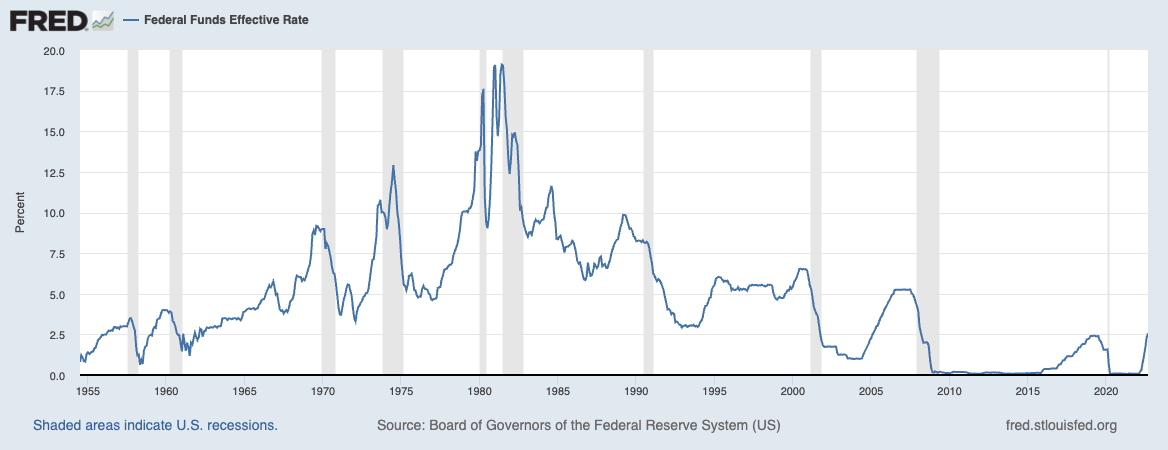

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Read More

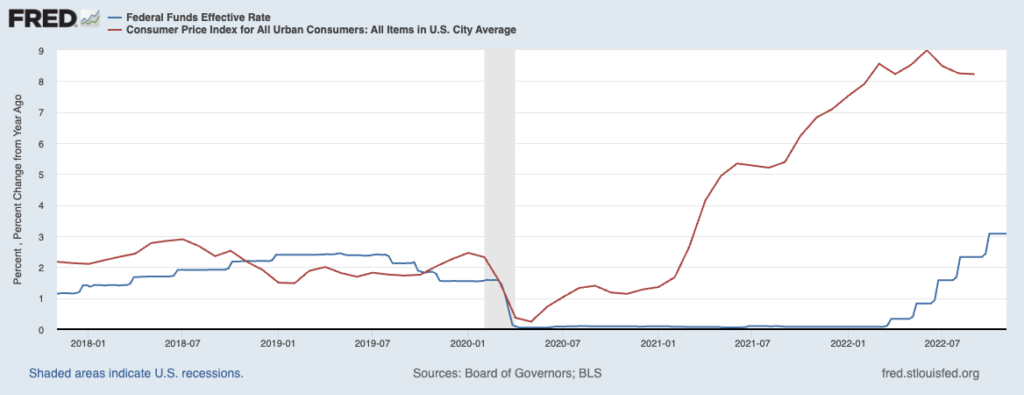

Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we...

Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we...

Read More

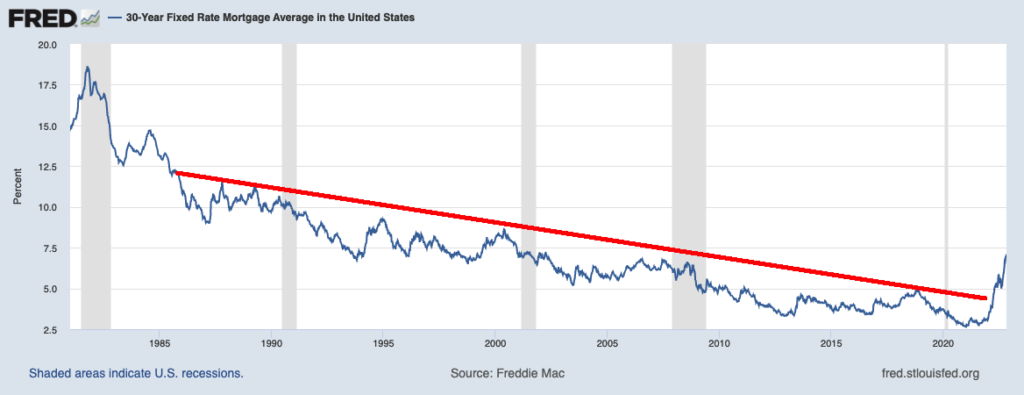

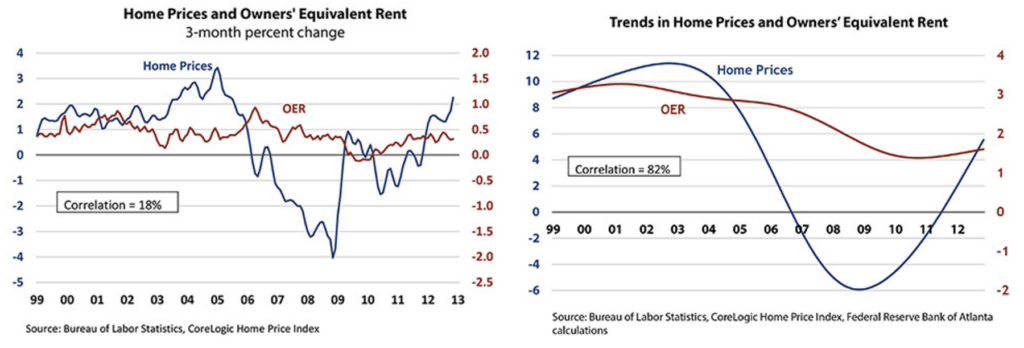

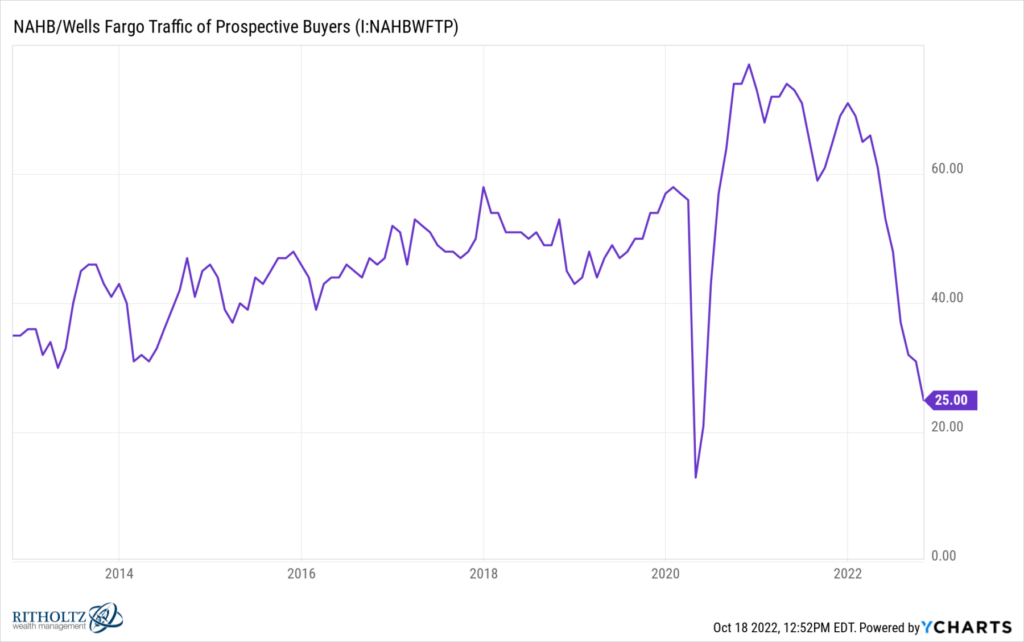

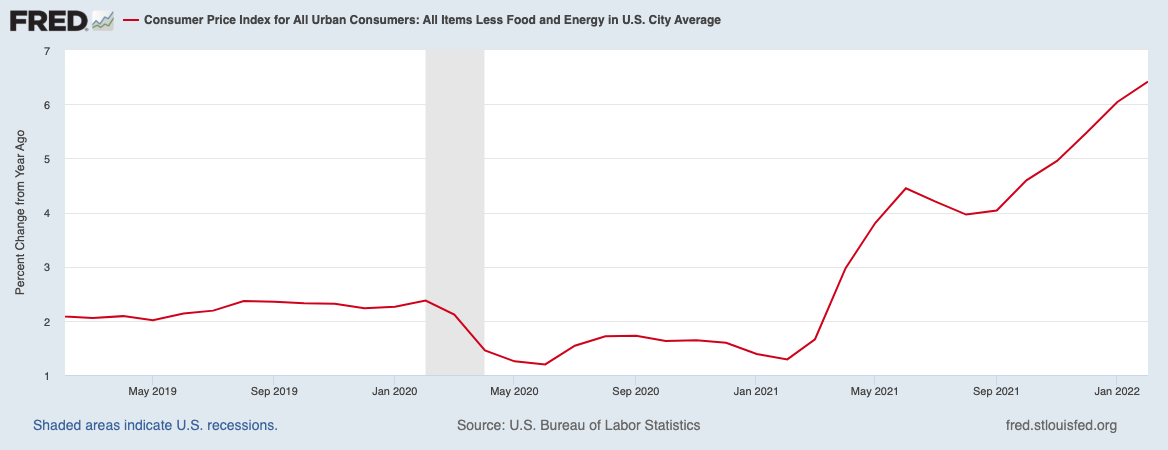

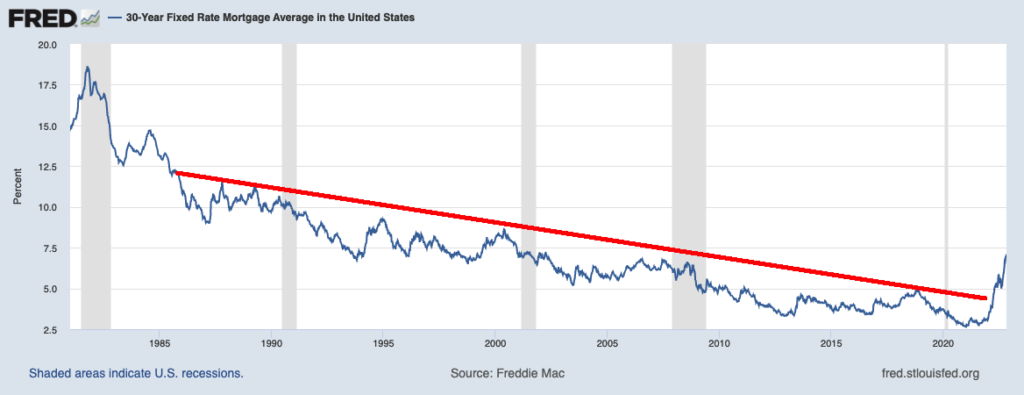

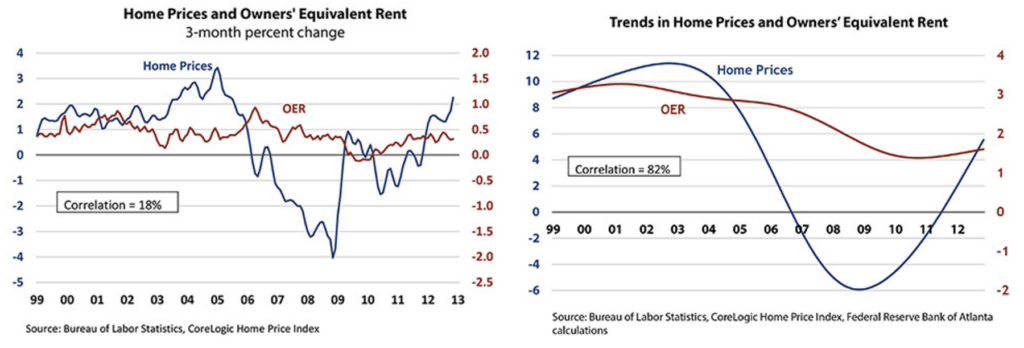

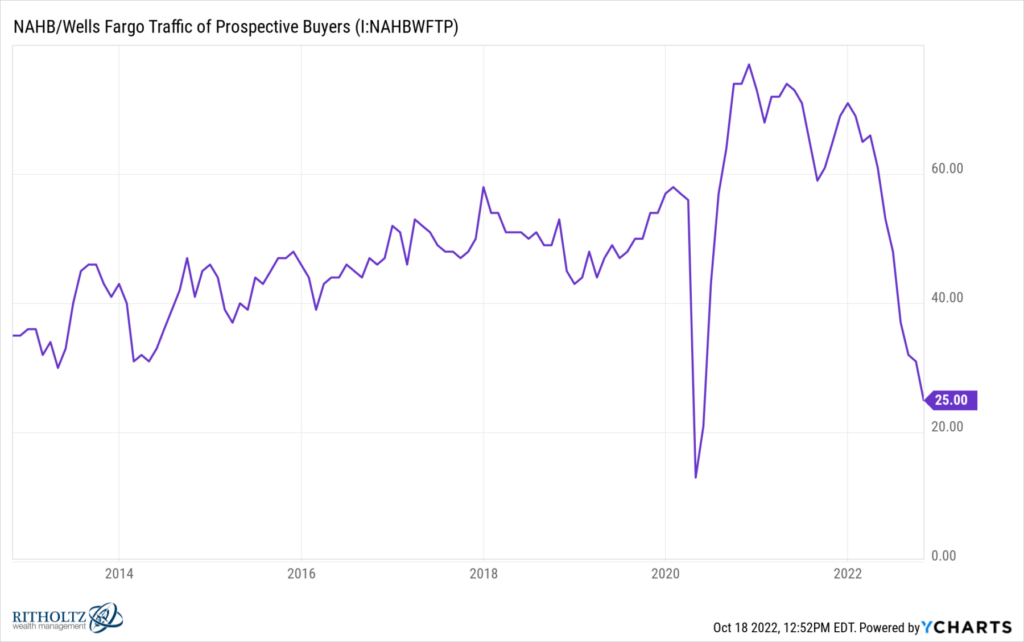

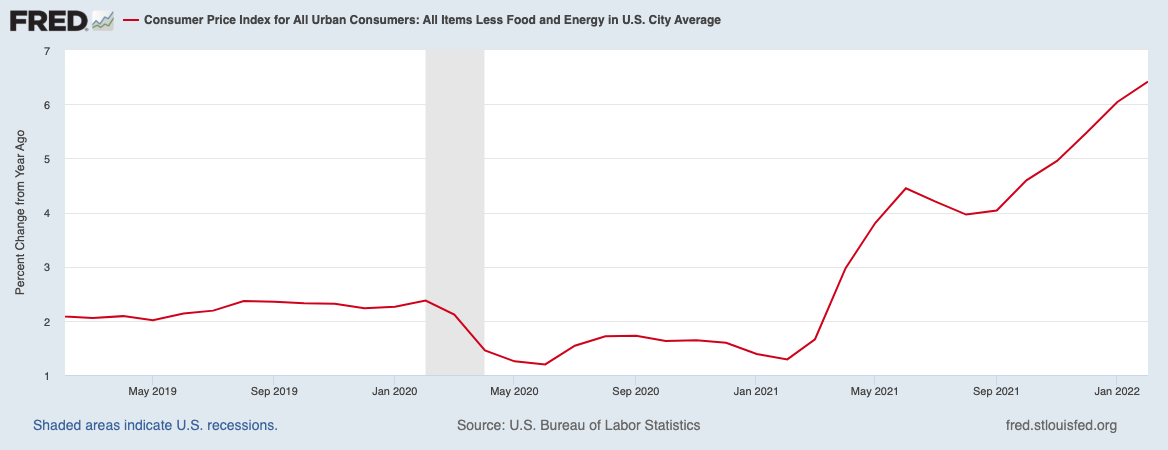

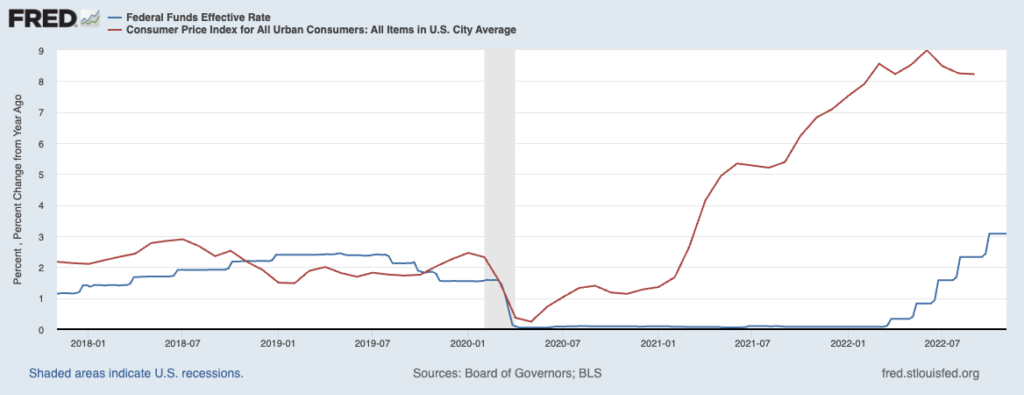

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

Read More

At the beginning of each quarter, I prepare a short but in-depth conference call for RWM clients. The team & I put...

At the beginning of each quarter, I prepare a short but in-depth conference call for RWM clients. The team & I put...

Read More

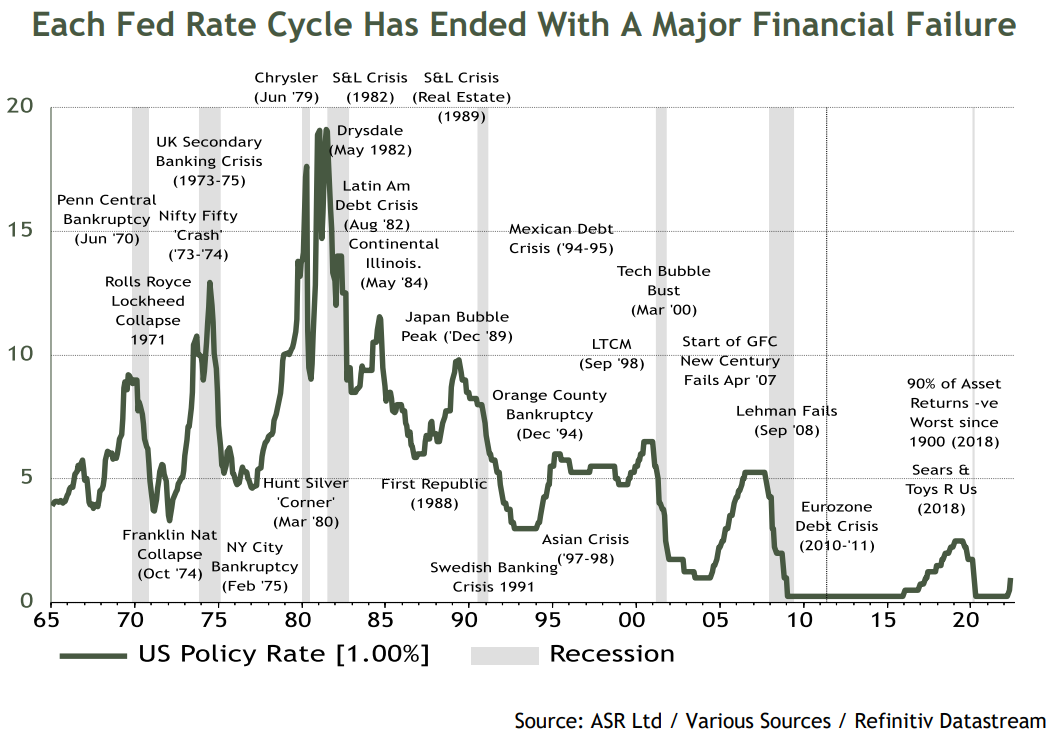

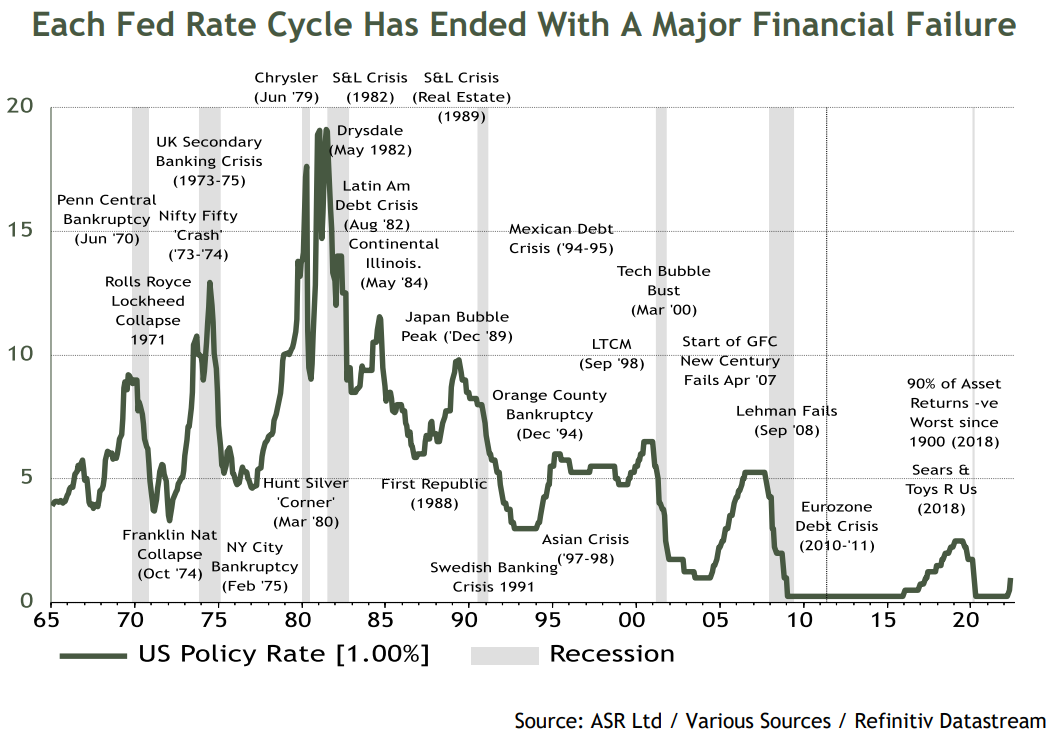

One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s...

One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s...

Read More

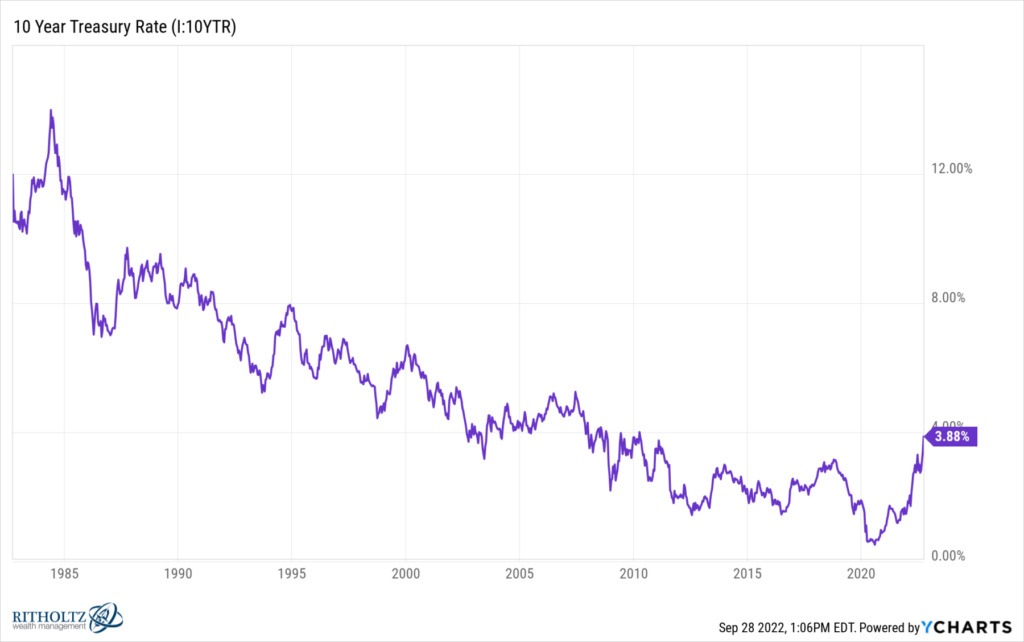

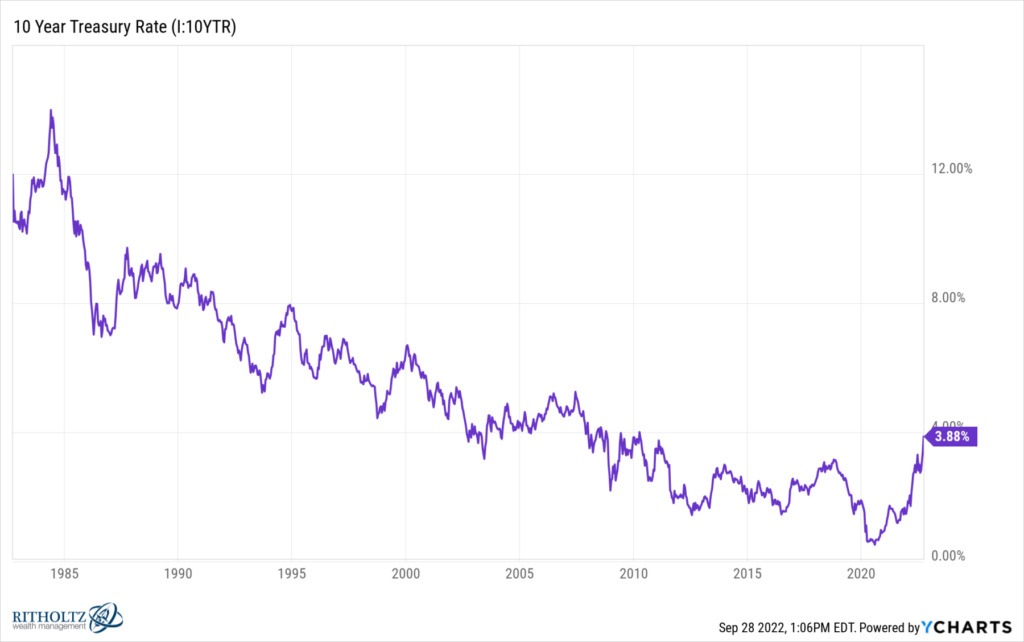

For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash...

For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash...

Read More

“It’s the Fed’s fault!” That has been the rallying cry for so many misguided analyses and criticisms going back...

“It’s the Fed’s fault!” That has been the rallying cry for so many misguided analyses and criticisms going back...

Read More

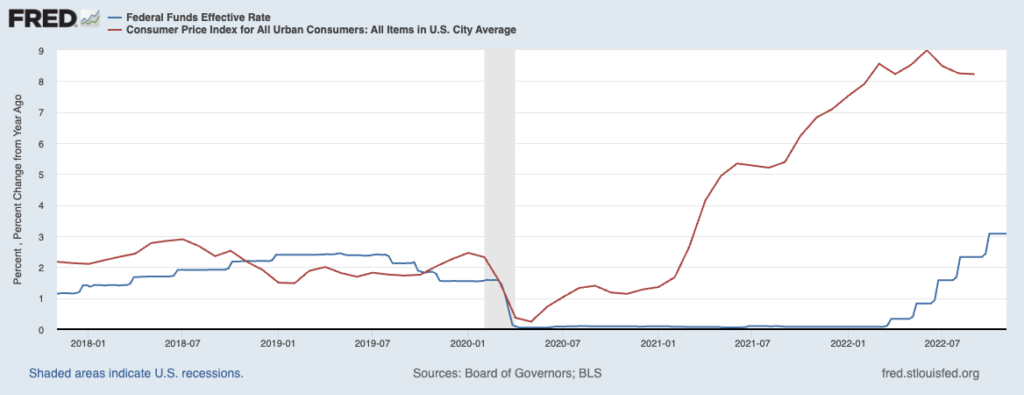

Last week, we compared monetary vs fiscal stimulus. Understanding the differences in how each manifests in the economy is...

Last week, we compared monetary vs fiscal stimulus. Understanding the differences in how each manifests in the economy is...

Read More

How different are the impact of fiscal stimulus and monetary policy? That is a question that Adam S. Posen, president of the Peterson...

Read More

This week, we speak with Adam S. Posen, president of the Peterson Institute for International Economics. Over the course of his career,...

Read More

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...