How Much Shall We Blame the Fed?

I have been having an ongoing debate with a friend who is part of the contingency of people who blame the Fed for many of the evils in...

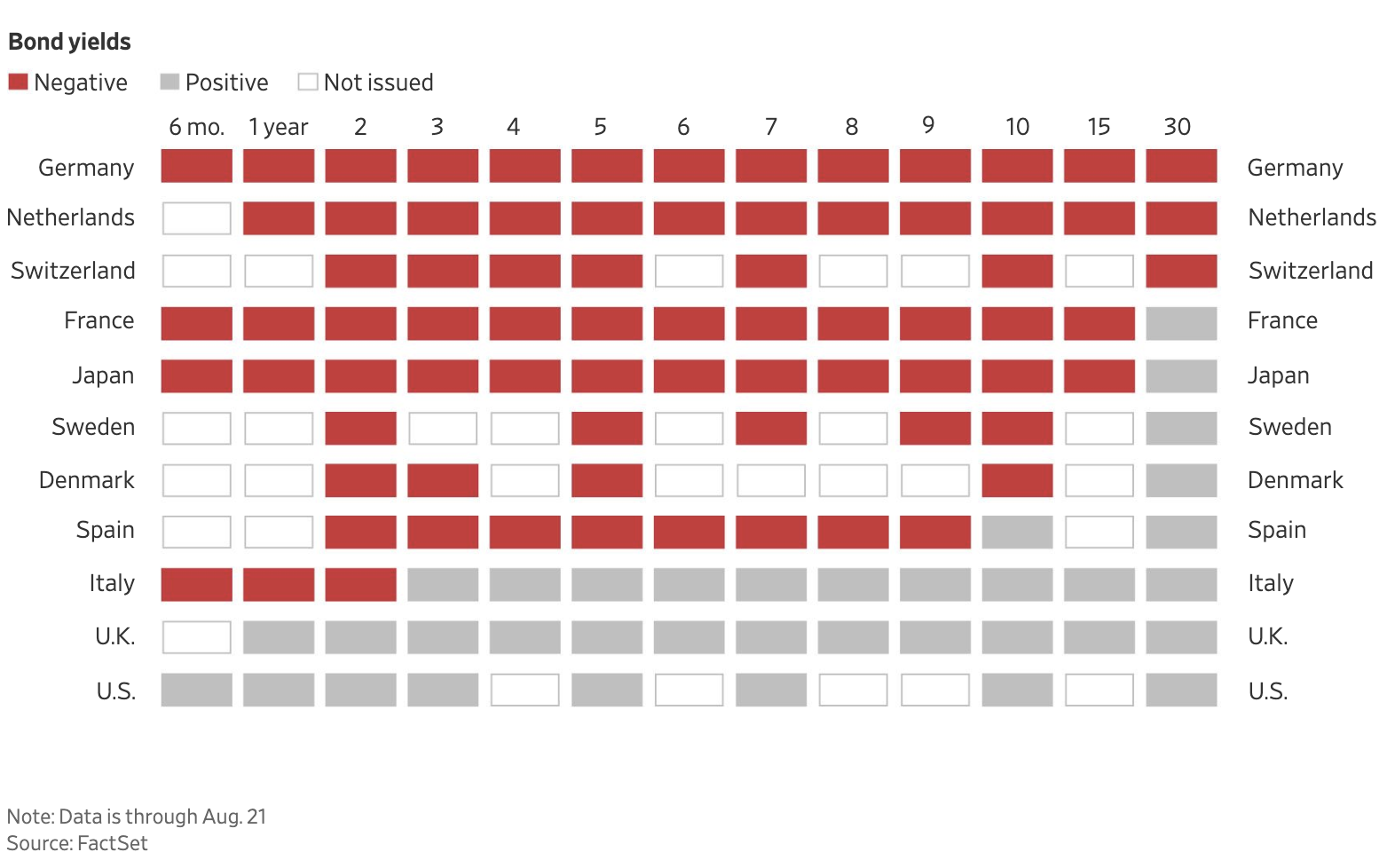

Yields Plumb New Lows, but ‘Century Bonds’ Remain Scarce Source: Wall Street Journal This is fascinating: “Bond...

Yields Plumb New Lows, but ‘Century Bonds’ Remain Scarce Source: Wall Street Journal This is fascinating: “Bond...

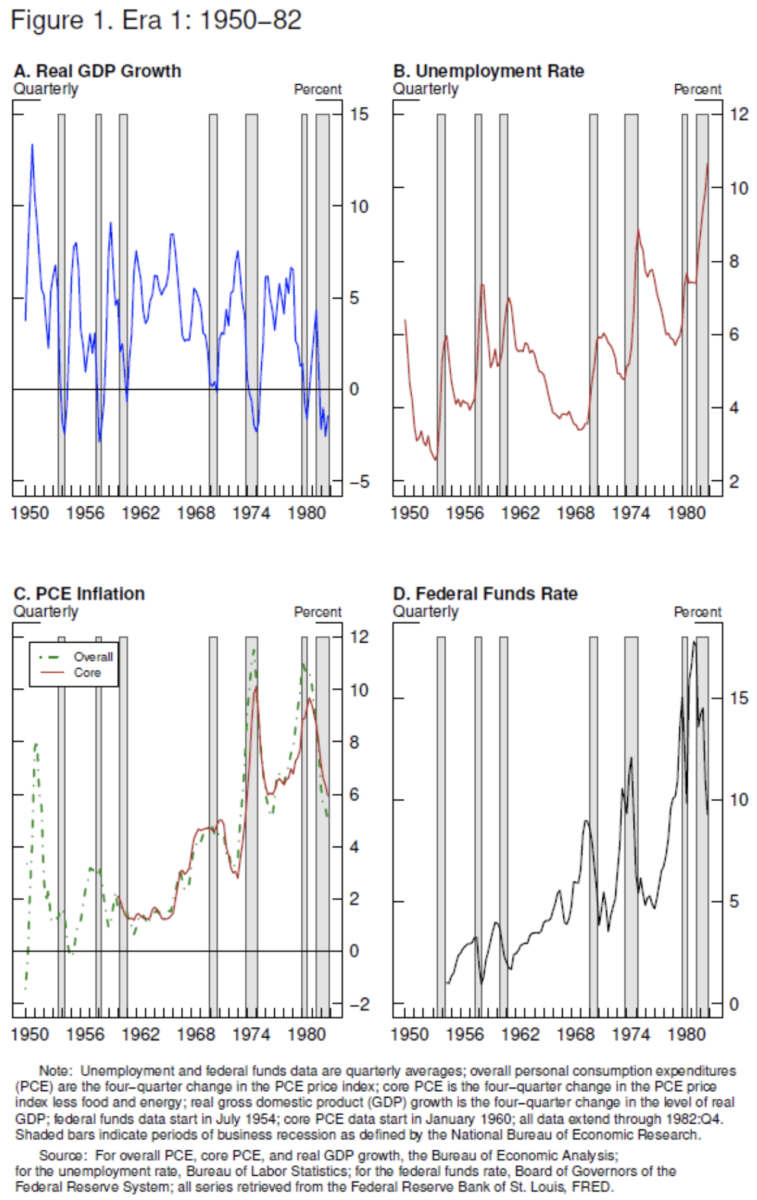

Challenges for Monetary Policy by Chair Jerome H. Powell Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming ...

Challenges for Monetary Policy by Chair Jerome H. Powell Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming ...

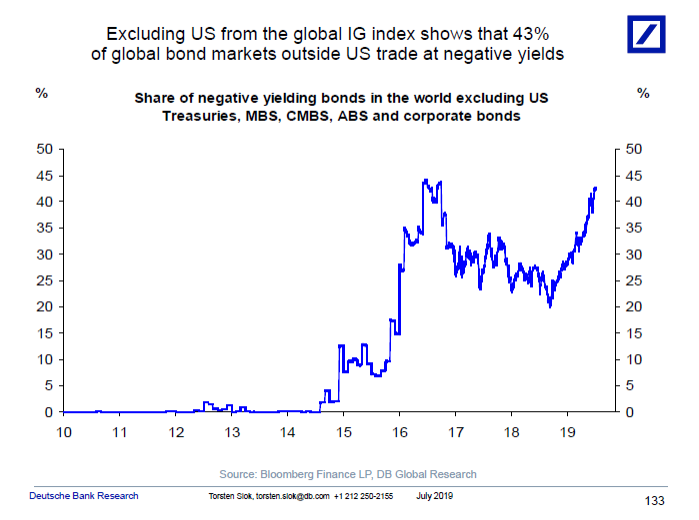

The Federal Open Market Committee is meeting today. There is a lot to unpack here, but let’s get one thing straight: This is a...

The Federal Open Market Committee is meeting today. There is a lot to unpack here, but let’s get one thing straight: This is a...

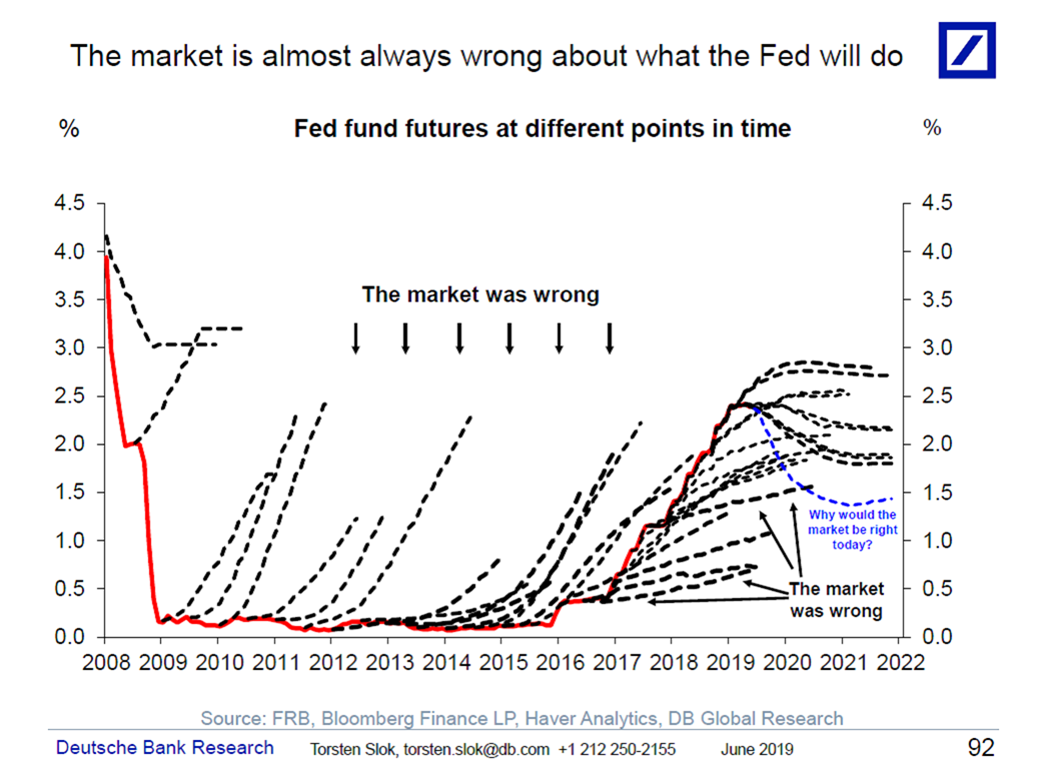

Hold aside the obvious contradiction for a moment — Why does the greatest economy ever necessitate rate cuts? — and consider...

Hold aside the obvious contradiction for a moment — Why does the greatest economy ever necessitate rate cuts? — and consider...

Get subscriber-only insights and news delivered by Barry every two weeks.